Montero Mining and Exploration Ltd. (TSX-V: MON)

(“

Montero” or the “

Company”) is

pleased to report a US$27,000,000 settlement has been reached with

the United Republic of Tanzania (“

Tanzania”) in

the dispute arising out of the expropriation of Montero’s Wigu Hill

rare earth element project (“

Wigu Hill”).

The settlement sum of US$27,000,000

(approximately CDN $38,000,000) due to Montero is payable in just

over 3 months, with payments scheduled as follows:

- US$12,000,000– payable by 20

November 2024 –PAYMENT RECEIVED

- US$8,000,000– on or before 31

January 2025

- US$7,000,000– on or before 28

February 2025

The settlement sum represents ~39% of the

US$70,000,000 initially claimed by Montero. This settlement

obviates the need for a costly and time-consuming hearing, the risk

of an adverse award, enforcement efforts, and finally concludes a

near 7-year dispute.

Dr Tony Harwood, President and CEO of Montero

commented: “I am pleased Montero was able to reach an amicable

settlement with the government of Tanzania to bring a mutually

beneficial end to this dispute. This resolution allows both parties

to move forward, and we wish Tanzania every success in attracting

new mining investment. I would like to thank our shareholders,

board, management, and our legal and technical teams, for their

valuable contribution to this outcome.”

ICSID Arbitration

Montero and Tanzania have sent a joint request

to the arbitral tribunal to suspend the ICSID arbitration

proceedings, as the first payment has been received by Montero.

Subsequent payments are to be made by the specified dates provided.

Provided the final payment has been received by Montero, the

parties will request the arbitral tribunal discontinue the ICSID

arbitration altogether.

Distribution of Funds

Montero and its litigation funding partner, Omni

Bridgeway (Canada) will receive a distribution of the first

payment. The second instalment will be distributed to Omni

Bridgeway (Canada) and to Montero, and will also cover Montero's

operational needs and legal expenses, including payments to Boies

Schiller Flexner UK LLP and Jeantet AARPI. Montero will entirely

retain the final instalment.

Montero is planning a return of capital to

shareholders where no amount has yet been determined and is subject

to accounting review and board approval. In addition, Montero will

retain funds to cover legal, taxation, and administrative expenses,

including potential costs for arbitral proceedings, or enforcement

actions if the second or third instalments are delayed or unpaid.

The net amount of the award after repayment to the funder and legal

expenses cannot be estimated with certainty and no assurances can

be made. Further announcements will be made in due course.

Acknowledgments

The Board would like to especially thank Dr.

Tony Harwood for reaching this settlement. Without his

perseverance and significant efforts to not only develop Wigu

Hill initially, but to then safeguard and recover Montero’s

investment speaks to his dedication and commitment to the Company

and shareholders. Special thanks also to directors, the balance of

management, our loyal shareholders, legal advisers and accounting

team for their steadfast support and dedication throughout nearly

seven years of efforts to secure compensation for the Company’s

investment in the Wigu Hill Rare Earth Project. Montero’s legal

team includes Timothy Foden of Boies Schiller Flexner (UK) LLP and

Martin Tavaut of Jeantet AARPI. Quantum and technical expertise

provided by Dr. Neal Rigby of SRK Consulting (USA) Inc. with full

dispute funding secured from Omni Bridgeway, a leading global

dispute funder. This unwavering commitment enabled the Board to

achieve a favourable outcome for the benefit of shareholders.

Disclaimer

The conclusion of the ICSID arbitration and

payment of the remaining instalments is conditional on Tanzania’s

compliance with the settlement agreement. The agreement does not

provide for any security for the benefit of Montero in case

Tanzania would not pay any instalment, in which case Montero can

either resume the ICSID arbitration or seek enforcement of the

settlement agreement.

About Montero

Montero has agreed to a US$27,000,000 settlement

amount to end its dispute with the United Republic of Tanzania for

the expropriation of the Wigu Hill rare earth element project.

Montero will continue to seek a joint venture partner to advance

its Avispa copper-molybdenum project in Chile. Montero’s board of

directors and management have an impressive track record of

successfully discovering and advancing precious metal and copper

projects. Montero trades on the TSX Venture Exchange under the

symbol MON and has 50,122,975 shares outstanding.

For more information,

contact:Montero Mining and Exploration

Ltd. Dr. Tony Harwood, President, and

Chief Executive OfficerE-mail: ir@monteromining.comTel: +1 604 428

7050www.monteromining.com

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

INFORMATION: This news release includes certain "forward-looking

information" within the meaning of applicable Canadian securities

laws. Forward looking information includes, but is not limited to,

statements, projections and estimates with respect to the receipt

of the settlement sum of US$27,000,000 and the timing thereof and

with respect to the distribution of the settlement funds.

Generally, forward-looking information can be identified by the use

of forward-looking terminology such as “plans”, “expects” or “does

not expect”, “is expected”, “budget”, “scheduled”, “estimates”,

“forecasts”, “intends”, “anticipates” or “does not anticipate”, or

“believes”, or variations of such words and phrases or state that

certain actions, events or results “may”, “could”, “would”, “might”

or “will be taken”, “occur” or “be achieved”. Such information is

based on information currently available to Montero and Montero

provides no assurance that actual results will meet management's

expectations. Forward-looking information by its very nature

involves inherent risks and uncertainties that may cause the actual

results, level of activity, performance, or achievements of Montero

to be materially different from those expressed or implied by such

forward-looking information. Actual results relating to, among

other things, completion of the required instalments pursuant to

the settlement agreement with Tanzania, satisfactory arrangements

for the payment of the arbitration funder and legal expenses, the

ability of the Company to find suitable exploration projects,

results of exploration, project development, reclamation and

capital costs of Montero’s mineral properties, and financial

condition and prospects, all of which could differ materially from

those currently anticipated in such statements for many reasons

such as: an inability to obtain payment of the remaining instalment

amounts from Tanzania on the terms as announced or at all;

unanticipated expenses associated with the settlement; changes in

general economic conditions and conditions in the financial

markets; changes in demand and prices for minerals; litigation,

legislative, environmental and other judicial, regulatory,

political and competitive developments; technological and

operational difficulties encountered in connection with Montero’s

activities; and other matters discussed in this news release and in

filings made with securities regulators. This list is not

exhaustive of the factors that may affect any of Montero’s

forward-looking statements. These and other factors should be

considered carefully and accordingly, readers should not place

undue reliance on forward-looking information. Montero does not

undertake to update any forward-looking information, except in

accordance with applicable securities laws.

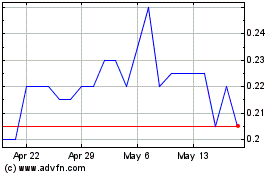

Montero Mining and Explo... (TSXV:MON)

Historical Stock Chart

From Dec 2024 to Jan 2025

Montero Mining and Explo... (TSXV:MON)

Historical Stock Chart

From Jan 2024 to Jan 2025