Hydreight Technologies Inc. (“

Hydreight” or

the

“Company”) ( TSXV:

NURS )( OTCQB: HYDTF )( FSE: SO6 ), a

fast-growing mobile clinical network and medical platform which

enables flexible at-home medical services across 50 states in the

United States, is pleased to announce its financial results for the

first quarter ended June 30, 2024. All financial information is

presented in Canadian dollars unless otherwise indicated.

Summary of Q2, 2024 Financial

Highlights:

- Q2, 2024 GAAP revenue was

$4.10 million an increase of 52% compared to Q2,

2023.

- Q2, 2024 topline¹ record

revenue of $5.59 million, an increase of 27% compared to Q2,

2023.

- Q2, 2024 Adjusted EBITDA¹

was $218K compared to ($456K) in the comparative

quarter.

- Q2, 2024 gross margin

of $1.56 million compared to $1.08 million in Q2,

2023.

- Hydreight has secured

national medical spa partners with collectively almost 700

locations sold and 140 opened across the United

States.

- The total number of

pharmacy orders through Hydreight platform year to date has

increased by about 74% in comparison to the same period last

year.

- The company has never

raised or borrowed any additional capital since the original going

public transaction in December 2022.

- The Company’s cash position

at June 30, 2024 is $1.40 million.

- Hydreight announced a

partnership with DSV Global and VS Digital Health called VSDHOne, a

telemedicine solution that helps companies launch a direct to

consumer (“D2C”) healthcare brand in all 50 States. The purpose of

launching VSDHOne is to make it easy for any existing brick and

mortar or individual to launch a D2C healthcare brand in a few days

without worrying about compliance, doctor network, telemedicine and

ecommerce technology, medical direction and oversight, pharmacy

network, and medical legal framework covering all 50 States. With

the marriage of virtual and at facility healthcare features,

companies can expand beyond their current Brick and Mortar

solution.

-

Investor webinar, Tuesday, September 3, 2024, at 11:00am

PT/ 2:00pm ET

Shane Madden, CEO of Hydreight commented, “We

had an outstanding quarter with record revenue, Adjusted EBITDA¹

and Adjusted Revenue¹. Our investment in our technology and

infrastructure in 2023 helped us to become the mobile medicine

solutions for nurses, bricks and mortar and D2C businesses. We are

very excited for our “VSDHONE” products expansion and cashflow in

the next 12 months.”

The Company believes the following Non-GAAP1

financial measures provide meaningful insight to aid in the

understanding of the Company’s performance and may assist in the

evaluation of the Company’s business relative to that of its

peers:

|

|

Three months ended June 30, |

|

Six months ended June 30, |

|

|

|

2024 |

2023 |

% change |

2024 |

2023 |

% change |

|

|

|

|

|

|

|

|

|

Adjusted Revenue |

$ |

5,589,481 |

$ |

4,416,103 |

27% |

$ |

10,456,485 |

$ |

8,083,524 |

29% |

|

Deduct - deferred business partner contract revenue |

(186,935) |

190,934 |

|

(303,913) |

171,886 |

|

|

Deduct - business partner payouts on app service gross revenue |

1,676,204 |

1,525,501 |

|

3,282,580 |

2,863,554 |

|

|

GAAP Revenue |

$ |

4,100,212 |

$ |

2,699,668 |

52% |

$ |

7,477,818 |

$ |

5,048,084 |

48% |

|

|

|

|

|

|

|

|

| Adjusted

Gross Margin |

$ |

1,372,862 |

$ |

1,270,762 |

8% |

$ |

2,487,218 |

$ |

2,294,147 |

8% |

|

Deduct - deferred business partner contract revenue |

(186,935) |

190,934 |

|

(303,913) |

171,886 |

|

|

GAAP Gross Margin |

$ |

1,559,797 |

$ |

1,079,828 |

44% |

$ |

2,791,131 |

$ |

2,122,261 |

32% |

|

|

|

|

|

|

|

|

| Adjusted

EBITDA |

$ |

217,708 |

$ |

(455,580) |

148% |

$ |

171,835 |

$ |

(561,936) |

131% |

|

Deduct - amortization and depreciation |

24,636 |

$ |

16,310 |

|

71,189 |

32,258 |

|

|

Deduct - share-based payments |

220,159 |

$ |

- |

|

436,454 |

- |

|

|

GAAP Net Loss |

$ |

(27,087) |

$ |

(471,890) |

94% |

$ |

(335,808) |

$ |

(594,194) |

43% |

|

|

1 Refer to Use of Non-GAAP Financial

Measures

The table below sets out a summary of certain

financial results of the Company over the past eight quarters and

is derived from the audited annual consolidated financial

statements and unaudited quarterly consolidated financial

statements of the Company.

|

|

|

Net Loss AfterTaxes |

ComprehensiveLoss |

Basic and DilutedLoss Per Share |

|

Fiscal Quarter Ended |

Revenue |

|

June 30, 2024 |

4,100,212 |

(27,087) |

(48,184) |

(0.00) |

|

March 31, 2024 |

3,377,606 |

(308,721) |

(370,559) |

(0.01) |

|

December 31, 2023 |

3,373,193 |

(898,561) |

(865,068) |

(0.02) |

|

September 30, 2023 |

3,088,219 |

(466,973) |

(548,954) |

(0.01) |

|

June 30, 2023 |

2,699,668 |

(471,890) |

(405,638) |

(0.01) |

|

March 31, 2023 |

2,348,416 |

(122,304) |

(121,502) |

(0.00) |

|

December 31, 2022 |

1,695,134 |

(5,060,755) |

(5,062,144) |

(1.44) |

|

September 30, 2022 |

1,136,510 |

(240,360) |

(298,367) |

(0.07) |

|

|

|

|

|

|

The Company has experienced dramatic user growth

over the past two years as can be seen by the consistent revenue

growth over the past eight quarters.

The Company continues to deliver on its mission

of building the largest mobile clinical network in the United

States. Through its medical network, pharmacy network and

proprietary technology platform that adheres to the complex

healthcare legislation across 50 states, Hydreight has provided a

fully integrated solution for healthcare providers to become

independent contractors.

Hydreight remains focused on its strategic

priorities of (1) Profitability (2) adding more product and service

offerings for its customers, (3) introducing Hydreight story with

more potential shareholders (4) driving white label partnerships

and Nurses to the platform and (5) looking for strategic tuck in

M&A opportunities to scale and grow the business quickly and

efficiently. Hydreight will continue to invest into its technology

to ensure continuous improvements, advancements and updates

adhering to changes within the healthcare industry.

Please see SEDAR+ for the Company's

condensed interim consolidated unaudited financial statements and

MD&A for the three and six months ended June 30, 2024 and 2023

and for the Company’s audited annual consolidated financial

statements and MD&A for the year ended December 31, 2023 and

2022.

Investor Webinar:

The Company’s management team will be hosting a

webinar to discuss the financials and provide corporate

updates:

Date/Time: Tuesday, Sept. 3, 2024, at 11am PT /

2pm ET

Registration link:

https://hydreight.zoom.us/webinar/register/WN_6V91HNW2QlCJ0x-UUIo-rA

About Hydreight Technologies

Inc.

Hydreight Technologies Inc. is building the

largest mobile clinic network in the United States. Its

proprietary, fully integrated platform hosts a network of over 2500

nurses, over 100 doctors and a pharmacy network across 50 states.

The platform includes a built-in, easy-to-use suite of fully

integrated tools for accounting, documentation, sales, inventory,

booking, and managing patient data, which enables licensed

healthcare professionals to provide services directly to patients

at home, office or hotel. Hydreight is bridging the gap between

provider compliance and patient convenience, empowering nurses, med

spa technicians, and other licensed healthcare professionals. The

Hydreight platform allows healthcare professionals to deliver

services independently, on their own terms, or to add mobile

services to existing location-based operations. Hydreight has a

503B pharmacy network servicing all 50 states and is closely

affiliated with a U.S. certified e-script and telemedicine provider

network.

On behalf of the Board of DirectorsShane MaddenDirector and

Chief Executive OfficerHydreight Technologies Inc.

Contact

Email: ir@hydreight.com; Telephone:

(480) 790 6886

This press release does not constitute an offer

of securities for sale in the United States. The securities being

offered have not been, nor will they be, registered under the

United States Securities Act of 1933, as amended, and such

securities may not be offered or sold within the United States

absent U.S. registration or an applicable exemption from U.S.

registration requirements.

Use of Non-GAAP Financial

Measures:

This release contains references to non-GAAP

financial measures Adjusted Revenue, Adjusted Gross Margin, and

Adjusted EBITDA. The Company defines Adjusted Revenue as gross cash

income before adjustment for the deferred portion of business

partner contract revenue and gross receipts from Hydreight App

service sales. The Company defines Adjusted Gross Margin as GAAP

gross margin plus inventory impairment plus the deferred portion of

business partner contract revenue. The Company defines Adjusted

EBITDA as net income (loss) before interest, taxes, depreciation

and amortization and before (i) transaction, restructuring, and

integration costs and share-based payments expense, and (iii)

gains/losses that are not reflective of ongoing operating

performance. The Company believes that the measures provide

information useful to its shareholders and investors in

understanding the Company’s operating cash flow growth, user

growth, and cash generating potential for funding working capital

requirements, service future interest and principal debt repayments

and fund future growth initiatives. These non-GAAP measures may

assist in the evaluation of the Company’s business relative to that

of its peers more accurately than GAAP financial measures alone.

This data is furnished to provide additional information and does

not have any standardized meaning prescribed by GAAP. Accordingly,

it should not be considered in isolation or as a substitute for

measures of performance prepared in accordance with GAAP and is not

necessarily indicative of other metrics presented in accordance

with GAAP.

Neither TSXV nor its Regulation Services

Provider (as that term is defined in policies of the TSXV) accepts

responsibility for the adequacy or accuracy of this release. This

press release does not constitute an offer of securities for sale

in the United States. The securities being offered have not been,

nor will they be, registered under the United States Securities Act

of 1933, as amended, and such securities may not be offered or sold

within the United States absent U.S. registration or an applicable

exemption from U.S. registration requirements.

Cautionary Note Regarding

Forward-Looking Information

This press release contains statements which

constitute “forward-looking information” within the meaning of

applicable securities laws, including statements regarding the

plans, path to profitability, intentions, beliefs and current

expectations of the Company with respect to future business

activities and operating performance. Forward-looking information

is often identified by the words “may”, “would”, “could”, “should”,

“will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”,

“expect” or similar expressions and includes information regarding

expectations for the Company's growth and profitability in

2024.

Investors are cautioned that forward-looking

information is not based on historical facts but instead reflects

the Company’s management’s expectations, estimates or projections

concerning future results or events based on the opinions,

assumptions and estimates of management considered reasonable at

the date the statements are made. Although the Company believes

that the expectations reflected in such forward-looking information

are reasonable, such information involves risks and uncertainties,

and undue reliance should not be placed on such information, as

unknown or unpredictable factors could have material adverse

effects on future results, performance or achievements of the

Company. Among the key factors that could cause actual results to

differ materially from those projected in the forward-looking

information are the following: the ability to obtain requisite

regulatory and other approvals with respect to the business

operated by the Company and/or the potential impact of the listing

of the Company’s shares on the TSXV on relationships, including

with regulatory bodies, employees, suppliers, customers and

competitors; changes in general economic, business and political

conditions, including changes in the financial markets; changes in

applicable laws; compliance with extensive government regulation;

and the diversion of management time as a result of being a

publicly listed entity. This forward-looking information may be

affected by risks and uncertainties in the business of the Company

and market conditions.

Should one or more of these risks or

uncertainties materialize, or should assumptions underlying the

forward-looking information prove incorrect, actual results may

vary materially from those described herein as intended, planned,

anticipated, believed, estimated or expected. Although the Company

has attempted to identify important risks, uncertainties and

factors which could cause actual results to differ materially,

there may be others that cause results not to be as anticipated,

estimated or intended. The Company does not intend, and does not

assume any obligation, to update this forward-looking information

except as otherwise required by applicable law.

¹See Use of Non-GAAP Financial Measures

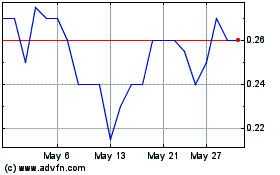

Hydreight Technologies (TSXV:NURS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Hydreight Technologies (TSXV:NURS)

Historical Stock Chart

From Jan 2024 to Jan 2025