Reconnaissance Energy Africa Ltd. (the “

Company”

or “

ReconAfrica”) (TSXV: RECO) (OTCQX: RECAF)

(Frankfurt: 0XD) announces that, in connection with its previously

announced overnight marketed public offering (the

“

Offering”) of units of the Company (the

“

Units”), it has entered into an underwriting

agreement with Research Capital Corporation as the lead underwriter

and sole bookrunner, on behalf of a syndicate of underwriters,

including Canaccord Genuity Corp. and Haywood Securities Inc.

(collectively, the “

Underwriters”), pursuant to

which the Underwriters will agree to purchase 28,000,000 Units for

aggregate gross proceeds of C$35 million.

BW Energy Limited (“BW Energy”)

has agreed to a strategic equity investment in the Company for

US$16 million (approximately C$22 million), pursuant to the

Offering in connection with the strategic partnership with the

Company.

Each Unit will be comprised of one common share

of the Company (a “Common Share”), and one Common

Share purchase warrant of the Company (a

“Warrant”). Each Warrant will entitle the holder

thereof to purchase one Common Share at an exercise price of C$1.75

at any time up to 24 months from closing of the Offering, subject

to an acceleration provision as detailed further below. In the

event that, at any time four months and one day after the date of

issuance and prior to the expiry date of the Warrants, the moving

volume weighted average trading price of the Common Shares on the

TSX Venture Exchange (“Exchange”), or other

principal exchange on which the Common Shares are listed, is equal

to or greater than C$3.70 for any 20 consecutive trading days, the

Company may, within 10 business days of the occurrence of such

event, deliver a notice to the holders of Warrants accelerating the

expiry date of the Warrants to the date that is 30 days following

the date of such notice (the “Accelerated Exercise

Period”). Any unexercised Warrants shall automatically

expire at the end of the Accelerated Exercise Period.

The net proceeds from the Offering will be used

for exploration activities, working capital and general corporate

purposes.

The Company has granted to the Underwriters an

option (the “Over-Allotment Option”), exercisable,

in whole or in part, in the sole discretion of the Underwriters, to

purchase up to an additional number of Units, and/or the components

thereof, that in aggregate would be equal to 15% of the total

number of Units to be issued under the Offering, to cover

over-allotments, if any, and for market stabilization purposes,

exercisable at any time and from time to time up to 30 days

following the closing of the Offering.

All Units purchased by BW Energy will be subject

to a six-month lock-up agreement.

The closing of the Offering is expected to occur

on or about July 31, 2024 (the “Closing”), or such

other earlier or later date as the Underwriters may determine.

Closing is subject to the Company receiving all necessary

regulatory approvals, including the approval of the Exchange to

list, on the date of Closing, the Common Shares, and the Common

Shares issuable upon exercise of the Warrants and the Underwriters’

broker warrants, on the Exchange. In addition, the Company will use

commercial reasonable efforts to obtain the necessary approvals to

list the Warrants on the Exchange.

In connection with the Offering, the Company

intends to file a prospectus supplement within two business days,

to the Company’s short form base shelf prospectus dated February

29, 2024, with the securities regulatory authorities in each of the

provinces of Canada (except Québec). Copies of the base shelf

prospectus and any supplement thereto to be filed in connection

with the Offering, are and will be available under the Company’s

profile on SEDAR+ at www.sedarplus.ca. The Units are being offered

in each of the provinces of Canada (except Québec) and may be

offered in the United States on a private placement basis pursuant

to an appropriate exemption from the registration requirements

under applicable U.S. law, and outside of Canada and the United

States on a private placement or equivalent basis.

This press release is not an offer to sell or

the solicitation of an offer to buy the securities in the United

States or in any jurisdiction in which such offer, solicitation or

sale would be unlawful prior to qualification or registration under

the securities laws of such jurisdiction. The securities being

offered have not been, nor will they be, registered under the

United States Securities Act of 1933, as amended, and such

securities may not be offered or sold within the United States or

to, or for the account or benefit of, U.S. persons absent

registration or an applicable exemption from U.S. registration

requirements and applicable U.S. state securities laws.

About BW Energy Limited

BW Energy is a growth E&P company with a

differentiated strategy targeting proven offshore oil and gas

reservoirs through low risk phased developments. The Company has

access to existing production facilities to reduce time to first

oil and cashflow with lower investments than traditional offshore

developments. The Company's assets are 73.5% of the producing

Dussafu Marine licence offshore Gabon, 100% interest in the

Golfinho and Camarupim fields, a 76.5% interest in the BM-ES-23

block in, a 95% interest in the Maromba field in Brazil and a 95%

interest in the Kudu field in Namibia, all operated by BW

Energy.

BW Energy, 74% owned by BW Group Ltd., was

created as the E&P arm of Oslo listed BW Offshore, a company

with more than four decades of experience in operating advanced

offshore production solutions and executing complex projects. Since

its origin, BW Offshore has executed 40 FPSO and FSO projects.

About ReconAfrica

ReconAfrica is a Canadian oil and gas company

engaged in the opening of the newly discovered Kavango Sedimentary

Basin in the Kalahari Desert of northeastern Namibia and

northwestern Botswana, where the Company holds petroleum licences

comprising ~8 million contiguous acres. In all aspects of its

operations ReconAfrica is committed to minimal disturbance of

habitat in line with international standards and will implement

environmental and social best practices in all of its project

areas.

Neither the TSXV nor its Regulation Services

Provider (as that term is defined in policies of the TSXV) accepts

responsibility for the adequacy or accuracy of this release.

For further information

contact:

Brian Reinsborough, President and Chief

Executive Officer | Tel: +1-877-631-1160Grayson Andersen, Vice

President Investor Relations | Tel: +1-877-631-1160

Email:

admin@reconafrica.comIR Inquiries Email:

investors@reconafrica.comMedia Inquiries Email:

media@reconafrica.com

Cautionary

Note Regarding

Forward-Looking

Statements:Certain statements contained in this

press release constitute forward-looking information under

applicable Canadian, United States and other applicable securities

laws, rules and regulations, including, without limitation,

statements with respect to the completion of the strategic joint

venture transaction, the timing and amount of cash payments

relating to the joint venture transaction, the timing and amount of

any bonus payments, the timing and amount of production milestone

payments, entering into a definitive agreement, the drilling of

four exploration wells, the undertaking of additional seismic

acquisition, statements with respect to prospective resources of

oil and natural gas, the financing of exploration, development and

production related costs, the expected use of proceeds from the

Offering, the expected closing date of the Offering, the completion

of the Offering being subject to the receipt of all necessary

regulatory approvals, including acceptance of the TSXV, any

potential acceleration of the expiry date of the Warrants, the

listing of the Warrants, and the Company’s commitment to minimal

disturbance of habitat, in line with best international standards

and its implementation of environmental and social best practices

in all of its project areas. These statements relate to future

events or future performance. The use of any of the words "could",

"intend", "expect", "believe", "will", "projected", "estimated" and

similar expressions and statements relating to matters that are not

historical facts are intended to identify forward-looking

information and are based on ReconAfrica's current belief or

assumptions as to the outcome and timing of such future events.

There can be no assurance that such statements will prove to be

accurate, as the Company's actual results and future events could

differ materially from those anticipated in these forward-looking

statements as a result of the factors discussed in the "Risk

Factors" section in the Company's annual information form dated

December 4, 2023, available under the Company's profile at

www.sedarplus.ca. Actual future results may differ materially.

Various assumptions or factors are typically applied in drawing

conclusions or making the forecasts or projections set out in

forward-looking information. Those assumptions and factors are

based on information currently available to ReconAfrica. The

forward-looking information contained in this release is made as of

the date hereof and ReconAfrica undertakes no obligation to update

or revise any forward-looking information, whether as a result of

new information, future events or otherwise, except as required by

applicable securities laws. Because of the risks, uncertainties and

assumptions contained herein, investors should not place undue

reliance on forward-looking information. The foregoing statements

expressly qualify any forward-looking information contained

herein.

Disclosure of Oil and Gas

Information:

The report of Netherland, Sewell &

Associates, Inc. (“NSAI”) entitled “Estimates of Prospective

Resources to the Reconnaissance Energy Africa Ltd. Interests in

Certain Opportunities Located in Damara Fold and Thrust Belt Play

Area in Petroleum Exploration Licence 73, Kavango Basin, Namibia as

of February 29, 2024” (the “NSAI Report”) and the prospective

resource estimates contained therein and in this press release were

prepared by NSAI, an independent qualified reserves evaluator, with

an effective date of February 29, 2024. The NSAI Report was

prepared in accordance with the definitions and guidelines of the

Canadian Oil and Gas Evaluation Handbook prepared jointly by the

Society of Petroleum and Engineers (Calgary Chapter) (the “COGE

Handbook”) and the Canadian Institute of Mining, Metallurgy &

Petroleum and National Instrument 51-101 – Standards of Disclosure

for Oil and Gas Activities (“NI 51-101”). For additional

information concerning the risks and the level of uncertainty

associated with recovery of the prospective resources detailed

herein and in the NSAI Report, the significant positive and

negative factors relevant to the prospective resources estimates

detailed herein and in the NSAI Report and a description of the

project to which the prospective resources estimates detailed

herein and in the NSAI Report applies are contained within the NSAI

Report, a copy of which has been filed with the Canadian Securities

Administrators and is available under the Company’s issued profile

on SEDAR+ at www.sedarplus.ca.

The prospective resources shown in the NSAI

Report have been estimated using probabilistic methods and are

dependent on a petroleum discovery being made. If a discovery is

made and development is undertaken, the probability that the

recoverable volumes will equal or exceed the unrisked estimated

amounts is 90 percent for the low estimate, 50 percent for the best

estimate, and 10 percent for the high estimate. Low estimate and

high estimate prospective resources have not been included in the

NSAI Report. For the purposes of the NSAI Report, the volumes and

parameters associated with the best estimate scenario of

prospective resources are referred to as 2U. The 2U prospective

resources have been aggregated beyond the prospect and lead level

by arithmetic summation; therefore, these totals do not include the

portfolio effect that might result from statistical aggregation.

Statistical principles indicate that the arithmetic sums of

multiple estimates may be misleading as to the volumes that may

actually be recovered.

RECONNAISSANCE ENERGY AFRICA

LTD.Tel: 1-877-631-1160 | www.reconafrica.com

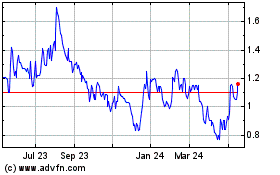

Reconnaissance Energy Af... (TSXV:RECO)

Historical Stock Chart

From Dec 2024 to Jan 2025

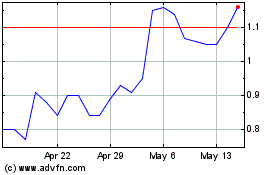

Reconnaissance Energy Af... (TSXV:RECO)

Historical Stock Chart

From Jan 2024 to Jan 2025