Sirios Announces Closing of the First Tranche of a Private Placement of $269,250

28 March 2024 - 8:05AM

SIRIOS RESOURCES INC. (TSX-V: SOI)

(the “

Corporation”) is pleased to announce

that it has closed the first tranche of a non-brokered private

placement, for aggregate gross proceeds of $269,250 (the

“

Offering”). A total of 4,142,306 common

shares of the share capital of the Corporation (the

“Shares”), at a price of $0.065 per Share,

were issued. The Share are “flow-through shares” pursuant to

section 66(15) of the Income Tax Act (Canada) and section 359.1 of

the Taxation Act (Québec).

The gross proceeds of the Offering will be

mainly used to finance the exploration work on its Cheechoo gold

project.

In connection with the Offering, finder’ fees

totaling $12,000 will be paid to a non-arm’s length finder, Mine

Equities Ltd., through the issuance of 184,615 Shares at a price of

0$.065 per Share. The Shares issued pursuant to this Offering are

subject to a restricted hold period of four months and one day,

ending on July 28, 2024, under applicable Canadian laws. The

Offering and issuance of Shares as finder’ fees remain subject to

the final approval of the the TSX Venture Exchange

(the “Exchange”).

Under the Offering, an insider of the

Corporation subscribed for a total of 200,000 Shares for a total

consideration of $13,000, which constitutes a “related party

transaction” within the meaning of Regulation 61-101 respecting

Protection of Minority Security Holders in Special

Transactions (“Regulation 61-101”) and the

Exchange Policy 5.9. However, the directors of the Corporation who

voted in favour of the Offering have determined that the exemptions

from formal valuation and minority approval requirements provided

for respectively under subsections 5.5(a) and 5.7(1)(a) of

Regulation 61-101 can be relied on as neither the fair market value

of the Shares issued to the insider nor the fair market value of

the consideration paid exceeded 25% of the Corporation’s market

capitalization. None of the Corporation’s directors have expressed

any contrary views or disagreements with respect to the foregoing.

A material change report in respect of this related party

transaction will be filed by the Corporation but could not be filed

earlier than 21 days prior to the closing of the Offering due to

the fact that the terms of the participation of each of the

non-related parties and the related parties in the Offering were

not confirmed.

Stock Option AmendmentsThe

Corporation also announces that at the annual and special meeting

of its shareholders on December 18, 2023 (the

“Meeting”), shareholders approved the renewal of

the Corporation stock option plan (the “Option

Plan”), as amended. Pursuant to the policies of the

Exchange, the Option Plan is a “10% rolling” plan. The maximum

aggregate number of Shares that may be reserved for issuance under

the Option Plan is equal to 10% of the outstanding Shares. In order

to comply with the new requirements of policy 4.4 of the Exchange,

amendments have been made to the Option Plan to ensure that:

|

|

(i) |

all certificates representing options issued to directors,

officers, and consultants shall bear a legend as described in the

Option Plan; |

| |

(ii) |

in the event of the death of an

option holder who is an employee, director, officer, consultant, or

investor relations service provider, the options granted to them,

or the remainder thereof, may be exercised by their heirs in

accordance with the terms of their last will and testament or by

their estate representative. Options must be exercised no later

than either (i) the expiration date of the options or (ii) the

expiration of a 12-month period following the date of the option

holder's death, whichever occurs first; |

| |

(iii) |

in the event of an adjustment of

options, where the event (as defined in the Option Plan) is not a

share consolidation or share split, the adjustment of options

remains subject to prior approval from the Exchange; |

| |

(iv) |

the administration of the Option

Plan shall be the responsibility of the board of directors. The

board may establish, amend, and terminate, at any time and from

time to time, subject to Exchange approval as applicable, such

rules as it considers necessary or desirable for the proper

administration and operation of the Option Plan, and such rules

shall be deemed part of the Option Plan. The board may delegate to

a director, officer, or employee of the company such administrative

functions and powers as it considers appropriate; and |

| |

(v) |

the application of section 6.2

shall be subject to prior approval from the Exchange for options

held by option holders who are investor relations service

providers, as defined by the Exchange's policies. |

| |

|

|

The full text of the Option Plan can be found in

Schedule A of the Corporation's management and information

circular, a copy of which can be found on the Corporation's SEDAR+

profile at www.sedarplus.ca and on the Corporation’s web

site:

https://sirios.com/wp-content/uploads/2023/11/LMAU-SOI-circulaire-2023-vANG-FINAL.docx.pdf.

The Option Plan remains subject to the final approval of the

Exchange.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

in the United States. The securities have not been and will not be

registered under the United States Securities Act of 1933, as

amended (the “U.S. Securities Act”) or any state

securities laws and may not be offered or sold within the United

States or to U.S. Persons unless registered under the U.S.

Securities Act and applicable state securities laws or an exemption

from such registration is available.

About Sirios

ResourcesRessources Sirios is a mining exploration

company based in Québec, focused on developing its

portfolio of high-potential gold properties in the

Eeyou Istchee James Bay, Canada.

Forward-Looking Statements All

statements, other than statements of historical fact, contained in

this press release including, but not limited to, those relating to

the intended use of proceeds of the Offering, the final approval of

the in connection with the Offering, the final approval of the

Exchange in connection with the Option Plan, and, generally, the

above “About Sirios Resources Inc.” paragraph which essentially

describes the Corporation’s outlook, constitute “forward-looking

information” or “forward-looking statements” within the meaning of

applicable securities laws, and are based on expectations,

estimates and projections as of the time of this press release.

Forward-looking statements are necessarily based upon a number of

estimates and assumptions that, while considered reasonable by the

Corporation as of the time of such statements, are inherently

subject to significant business, economic and competitive

uncertainties and contingencies. These estimates and assumptions

may prove to be incorrect. Many of these uncertainties and

contingencies can directly or indirectly affect, and could cause,

actual results to differ materially from those expressed or implied

in any forward-looking statements and future events, could differ

materially from those anticipated in such statements. A description

of assumptions used to develop such forward-looking information and

a description of risk factors that may cause actual results to

differ materially from forward-looking information can be found in

the Corporation’s disclosure documents on the SEDAR+ website at

www.sedarplus.ca.

By their very nature, forward-looking statements

involve inherent risks and uncertainties, both general and

specific, and risks exist that estimates, forecasts, projections

and other forward-looking statements will not be achieved or that

assumptions do not reflect future experience. Forward-looking

statements are provided for the purpose of providing information

about management’s endeavors to develop the Cheechoo, Aquilon and

Maskwa projects and, more generally, its expectations and plans

relating to the future. Readers are cautioned not to place undue

reliance on these forward-looking statements as a number of

important risk factors and future events could cause the actual

outcomes to differ materially from the beliefs, plans, objectives,

expectations, anticipations, estimates, assumptions and intentions

expressed in such forward-looking statements. All of the

forward-looking statements made in this press release are qualified

by these cautionary statements and those made in our other filings

with the securities regulators of Canada. The Corporation disclaims

any intention or obligation to update or revise any forward-looking

statements or to explain any material difference between subsequent

actual events and such forward-looking statements, except to the

extent required by applicable law.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Contact: Dominique Doucet, Eng.,

PresidentTel :514-918-2867 info@sirios.comWeb Site :

www.sirios.com

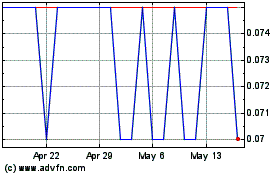

Sirios Resources (TSXV:SOI)

Historical Stock Chart

From Oct 2024 to Nov 2024

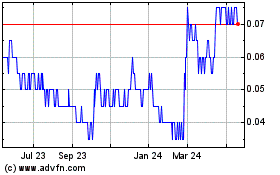

Sirios Resources (TSXV:SOI)

Historical Stock Chart

From Nov 2023 to Nov 2024