|

OMB APPROVAL

|

OMB Number: 3235-0288 Expires: April 30, 2015 Estimated average burden hours per response..2645.52

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

o REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2015

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

o SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Event requiring this shell company report _____________

For the transition period from ___________________ to ______________________

Commission file number: 000-51848

VANC Pharmaceuticals Inc.

(Exact name of Registrant as specified in its charter)

Not applicable

(Translation of Company’s name into English)

Province of British Columbia, Canada

(Jurisdiction of incorporation or organization)

615 – 800 West Pender Street, Vancouver, BC, V6C 2V6 CANADA

Contact person: Eugene Beukman, Phone: 604-687-2038 Email ebeukman@pendergroup.ca

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

Title of each class

Name of each exchange on which registered

Not Applicable

Not Applicable

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Common Shares Without Par Value - Toronto Venture Stock Exchange

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. June 30, 2015 55,219,116

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Yes o No x

Indicate by check mark whether the Company (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Company was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act (check one): Large accelerated filer o Accelerated filer o Non-Accelerated filerx

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP o International Financial Reporting Standards as issued Other o

by the International Accounting Standards Board x

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Indicate by check mark which financial statement item the Company has elected to follow. Item 17 x Item 18 o

If this is an annual report, indicate by checkmark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

(APPLICABLE ONLY TO ISSUES INVOLVED IN BANKRUPTCY PROCEEDING DURING THE PAST FIVE YEARS)

Indicate by check mark whether the Company has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes o No o

The information set forth in this Annual Report on Form 20-F is as at June 30, 2015 unless an earlier or later date is indicated.

SEC 1852 (01-12) Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

i

FORM 20-F ANNUAL REPORT

TABLE OF CONTENTS

PART I

4

ITEM 1. IDENTITY OF DIRECTORS SENIOR MANAGEMENT AND ADVISERS

4

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

5

ITEM 3. KEY INFORMATION

5

ITEM 4. INFORMATION ON THE COMPANY

15

ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS

19

ITEM 6. DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES

23

ITEM 7. MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS

31

ITEM 8. FINANCIAL INFORMATION

32

ITEM 9. THE OFFER AND LISTING

33

ITEM 10. ADDITIONAL INFORMATION

35

ITEM 11. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

43

ITEM 12. DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES

43

PART II

44

ITEM 13. DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES

44

ITEM 14. MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS

44

ITEM 15. CONTROLS AND PROCEDURES

44

ITEM 16. RESERVED

44

PART III

46

ITEM 17. FINANCIAL STATEMENTS

46

ITEM 18. FINANCIAL STATEMENTS

46

ITEM 19. EXHIBITS

46

SIGNATURES

74

ii

INTRODUCTION

The Company was incorporated by registration of its Memorandum and Articles under the BC Companies Act on May 30, 2000 under the name “Duft Biotech Capital Ltd.”

On November 13, 2003, the Company acquired the assets of ALDA Pharmaceuticals Inc. (“API”), a private company founded in 1996.

On November 26, 2003 the Company changed its name to ALDA Pharmaceuticals Corp. (“the Company”) The Company is still a British Columbia, Canada, company.

Effective August 19, 2005, the authorized share capital of the Company was increased to an unlimited number of common shares without par value. There are no Indentures or Agreements limiting the payment of dividends and there are no conversion rights, special liquidation rights, pre-emptive rights or subscription rights.

On July 24, 2013 the Company changed its name to NUVA Pharmaceuticals Inc. (“the Company”) The Company is still a British Columbia, Canada, company.

On July 28, 2014 the Company changed its name to VANC Pharmaceuticals Inc. (“the Company”) The Company is still a British Columbia, Canada, company.

BUSINESS OF VANC PHARMACEUTICALS INC.

The Company is now focused on the manufacture and distribution of generic and over-the-counter (“OTC”) pharmaceuticals.

FINANCIAL AND OTHER INFORMATION

The Company’s reporting currency and domestic currency is Canadian Dollars. In this Annual Report, unless otherwise specified, all dollar amounts are expressed in Canadian Dollars (“CDN$” or “$”). The Government of Canada permits a floating exchange rate to determine the value of the Canadian Dollar against the U.S. Dollar (US$). Comparisons of historic exchange rates between the US$ and the CDN$ are contained in Section 3.A.3.

OPERATING AND FINANCIAL REVIEW AND PROSPECTS

This Annual Report on Form 20-F contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, principally in ITEM #4, “Information on the Company” and ITEM #5, “Operating and Financial Review of Prospects”. These statements may be identified by the use of words like “plan,” “expect,” “aim,” “believe,” “project,” “anticipate,” “intend,” “estimate,” “will,” “should,” “could” and similar expressions in connection with any discussion, expectation, or projection of future operating or financial performance, events or trends. In particular, these include statements about the Company’s strategy for growth, future performance or results of current sales and production, interest rates, foreign exchange rates, and the outcome of contingencies, such as acquisitions and/or legal proceedings and intellectual property issues.

Forward-looking statements are based on certain assumptions and expectations of future events that are subject to risks and uncertainties. Actual future results and trends may differ materially from historical results or those projected in any such forward-looking statements depending on a variety of factors, including, among other things, the factors discussed in this Annual Report under ITEM #3, “Key Information, Risk Factors” and factors described in documents that the Company may furnish from time to time to the Securities and Exchange Commission. The Company undertakes no obligation to update publicly or revise any forward-looking statements because of new information.

MEASUREMENT INFORMATION

Canada uses the metric measurement system and all of the measures used by the Company adhere to the standards of the metric system.

3

PART I

ITEM 1. IDENTITY OF DIRECTORS SENIOR MANAGEMENT AND ADVISERS

1.A.1. Directors and senior management

Table No. 1 lists as of June 30, 2015 the names of the Directors of the Company.

Table No. 1

Directors

| | |

Name and Residential Address

| Age

| Date First Elected or Appointed

|

Amandeep Parmar (1)

4848 Killarney St.

Vancouver BC, V5R3V5

| 28

| December 3, 2014

|

Eugene Beukman (1)

615 – 800 West Pender St.

Vancouver, BC V6C 2V6, Canada

| 55

| November 14, 2012

|

Bob Rai

2257 128St. Surrey BC V4A 3V8, Canada

| 45

| June 4, 2015

|

Sina Pirooz(1)

2685 W. Broadway, Vancouver, BC V6K 2G2

| 45

| October 25, 2013

|

(1) Member of Audit Committee

1.A.2. Senior Management

Table No. 2 lists the names of the Senior Management of the Company. The Senior Management serves at the pleasure of the Board of Directors.

Table No. 2

Senior Management

| | |

Name and Position

| Age

| Date of First Appointment

|

Arun Nayyar, CEO

| 57

| November 12, 2013

|

Amandeep Parmar, CFO

| 28

| December 3, 2014

|

Eugene Beukman, Secretary

| 55

| November 14, 2012

|

.

Mr. Nayyar’s business functions, as CEO of the Company, included overall supervision of all officers and consultants, as well as management of research and development, strategic planning, business development, operations, liaison with auditors, accountants, lawyers, regulatory authorities, the financial community and shareholders and reporting to the Board of Directors.

Mr. Parmar’s business functions, as CFO, include financial statement preparation, accounting, liaising with auditors, accountants, lawyers and regulatory authorities and preparation, payment and organization of the expenses, taxes, and other financial activities of the Company and reporting to the Board of Directors

Mr. Beukman’s business functions, as Corporate Secretary, include attending and being the secretary of all meetings of the Board, shareholders and committees of the Board and entering, or causing to be entered in records kept for that purpose, minutes of all proceedings thereat; gives or causes to be given, as and when instructed, all notices to shareholders, Directors, officers, auditors and members of committees of the Board; is the custodian of the stamp or mechanical device generally used for affixing the corporate seal of the Company and of all books, records and instruments belonging to the Company.

4

1.B. Legal Advisors

The legal advisors for the Company are Harder & Company, 2760 – 200 Granville St., Vancouver, BC, V6C 1S4 Phone 604-682 - 4466 Fax 604 682 - 4467. As of October 2, 2007, the Company retained Stanislaw Ashbaugh LLP, 4400 - 701 Fifth Avenue, Seattle, WA 98104 to provide assistance with matters concerning securities laws in the United States. The firm does not provide other legal services to the Company.

The Company’s Bank is the: Bank of Montreal. Its business address and telephone number are 595 Burrard St. Vancouver, British Columbia Canada V7X 1L7. Tel: (604) 665-7374.

1.C. Auditors

Smythe LLP performed the year end audit in 2015.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

No disclosure necessary.

ITEM 3. KEY INFORMATION

3.A.1. Selected Financial Data

The selected financial data should be read in conjunction with the financial statements and other financial information included elsewhere in the Annual Report.

The Company has not declared any dividends since incorporation and does not anticipate that it will do so in the foreseeable future. The present policy of the Company is to retain all available funds for use in its operations and the expansion of its business.

Table No. 3 is derived from the audited financial statements of the Company, which have been prepared in accordance with IFRS, as issued by the International Accounting Standards Board (“IASB”) and Interpretations of the International Financial Reporting Interpretations Committee (“IFRIC”). IFRS represents standards and interpretations approved by the International Accounting Standards Board (“IASB”), and are comprised of IFRS, International Accounting Standards (“IASs”), and interpretations issued by the International Financial Reporting Interpretations Committee (“IFRICs”) or the former Standing Interpretations Committee (“SICs”) and effective for the Company’s reporting period ended June 30,

2015.

5

Table No. 3

Selected Financial Data

(CDN$)

| | | | | |

| Year

Ended

2015

| Year

Ended

2014

| Year

Ended

2013

| Year

Ended

2012

| Year

Ended

2011

|

IFRS

| | | | | |

Revenue

| 5,713

| 0

| 0

| 83,361

| 305,592

|

Net Income (Loss) for the Year

| (2,200,648)

| (733,946)

| 283,432

| (306,565)

| (1,875,565)

|

Basic Income (Loss) Per Share

| (0.05)

| (0.03)

| 0.02

| (0.03)

| (0.03)

|

Dividends Per Share

| 0

| 0

| 0

| 0

| 0

|

Wtg. Avg. Shares (1)

| 47,272,866

| 26,107,760

| 18,821,177

| 6,451,760

| 6,231,468

|

Period-end Shares (1)

| 55,219,116

| 36,767,074

| 21,617,075

| 6,959,680

| 6,399,680

|

| | | | | |

Working Capital

| 3,305,603

| 156,185

| 296,132

| (1,320,984)

| (1,068,383)

|

Sponsorship Liability

| 0

| 0

| 0

| 875,000

| 0

|

Long-Term Debt

| 0

| 0

| 29,444

| 0

| 0

|

Capital Stock

| 15,262,357

| 10,995,282

| 7,943,874

| 7,933,288

| 7,921,708

|

Shareholders’ Equity (Deficit)

| 3,353,461

| 663,097

| (436,688)

| (1,321,164)

| (1,066,502)

|

Total Assets

| 3,540,585

| 820,418

| 800,991

| 19,751

| 190,494

|

| | | | | |

US GAAP

| | | | | |

Net Loss

| (2,200,648)

| (733,946)

| 283,432

| (306,565)

| (1,875,565)

|

Income/(Loss) Per Share

| (0.05)

| (0.03)

| 0.02

| (0.03)

| (0.03)

|

Shareholders’ Equity (Deficit)

| 3,353,461

| 663,097

| (436,688)

| (1,321,164)

| (1,066,502)

|

Total Assets

| 3,540,585

| 820,418

| 800,991

| 19,751

| 190,494

|

(1) At June 30, 2015 there were 55,219,116 shares issued and outstanding.

3.A.3. Exchange Rates

In this Annual Report, unless otherwise specified, all dollar amounts are expressed in Canadian Dollars (CDN$). The Government of Canada permits a floating exchange rate to determine the value of the Canadian Dollar against the U.S. Dollar (US$).

Table No. 4 sets forth the exchange rates for the Canadian Dollar at the end of four most recent fiscal years ended June 30, 2015, the average rates for the period and the range of high and low rates for the period. The data for each month during the most recent six months is also provided.

For purposes of this table, the rate of exchange means the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York.

The table sets forth the number of US Dollars required under that formula to buy one Canadian Dollar. For example, where the number “0.8704” is quoted in the upper left hand number in the table, it means that it took on average in December 2012, 98.95 cents US to purchase one Canadian dollar. For most periods presented, the Canadian dollar has been worth less than one US dollar.

6

Table No. 4

U.S. Dollar/Canadian Dollar

| | | | |

Period

| Average

| Low

| High

| Close

|

April 2015

| 0.8252

| 0.8241

| 0.8333

| 0.8289

|

May 2015

| 0.8022

| 0.7983

| 0.8046

| 0.8041

|

June 2015

| 0.8017

| 0.8002

| 0.8089

| 0.8006

|

July 2015

| 0.7665

| 0.7634

| 0.7728

| 0.7645

|

August 2015

| 0.7563

| 0.7504

| 0.7603

| 0.7601

|

September 2015

| 0.7466

| 0.7449

| 0.7496

| 0.7493

|

| | | | |

Three Months Ended September 30, 2015

| 0.7463

| 0.7449

| 0.7496

| 0.7491

|

Three Months Ended June 30, 2015

| 0.8007

| 0.8002

| 0.8089

| 0.8006

|

| | | | |

Fiscal Year Ended June 30, 2015

| 0.8010

| 0.8002

| 0.8089

| 0.8006

|

Fiscal Year Ended June 30, 2014

| 0.9328

| 0.8866

| 0.9803

| 0.9343

|

Fiscal Year Ended June 30, 2013

| 0.9593

| 0.9694

| 0.9694

| 0.9694

|

Fiscal Year Ended June 30, 2012

| 1.0019

| 1.0002

| 1.0221

| 1.0019

|

| | | | |

(Source: http://www.bankofcanada.ca/rates/exchange/10-year-converter/)

3.B. Capitalization and Indebtedness

Table No. 5 sets forth the capitalization and indebtedness of the Company as of June 30, 2015.

Private Placements:

i)

On December 10, 2014, the Company closed a non-brokered private placement of 7,607,332 units at a price of $0.15 per unit for gross proceeds of $1,141,100. Each unit consists of one common share and one-half of one transferrable share purchase warrant. Each warrant entitles the holder thereof to purchase one additional common share on or before December 10, 2015 at a price of $0.25. Finder’s fees of $91,287 cash were paid in addition to the issuance of 608,586 warrants. The fair value of the warrants issued to agents was estimated using the Black-Scholes option pricing model and amounted to $67,553.

Securities are subject to a four month hold period that expired April 11, 2015. Proceeds from the offering will be used by the Company for commercialization of the generic and OTC products and for general ongoing corporate and working capital purposes.

Additional share issue costs totaling $203,490 were incurred relating to options and warrants exercised for the year.

ii)

On April 08, 2014 the Company closed a non-brokered Private Placement of 1,750,000 units of the Company at a price of $0.10 per unit for gross proceeds of $175,000.

Each Unit consists of one (1) common share and one (1) transferrable share purchase warrant. Each Warrant will entitle the holder thereof to purchase one (1) additional Common Share for a period of twelve (12) months from the Closing Date of the Offering at a price of CDN$0.30 per Common Share.

The Warrants will be subject to an accelerated exercise provision in the event the shares trade more than $0.10 above the exercise price for ten (10) consecutive days.

In addition, on April 08, 2014 the Company closed a non-brokered Private Placement of 2,000,000 units of the Company at a price of $0.10 per unit for gross proceeds of $200,000.

7

Each Unit consists of one (1) common share and one (1) transferrable share purchase warrant. Each warrant will entitle the holder thereof to purchase one (1) additional Common Share for a period of twenty four (24) months from the Closing Date of the Offering at a price of CDN$0.13 per Common Share.

In accordance with the Private Placements, Finder’s fees of $12,000 cash were paid in addition to the issuance of 300,000 agent warrants. 120,000 warrants have a life of two years and are exercisable at $0.13. The remaining 180,000 warrants have a life of one year and are exercisable at $0.30. The fair value of these warrants was measured at $47,567. Total share issue cost was $59,567.

Proceeds from the Offering will be used by the Company for general ongoing corporate and working capital purposes.

iii)

On June 12, 2013 the Company closed a non-brokered private placement of 8,000,000 units of the Company’s common shares at a price of $0.10 per unit, for proceeds of $800,000. Each Unit will be exchangeable for one common share of the Company and one share purchase warrant.

Each warrant will entitle the holder to purchase one additional common share of the Company for a period of 36 months at a price of $0.30 per common share in the first year, $0.40 in the second year and $0.50 in the third year. The Units cannot be exchanged for shares and warrants during the first year unless the holder either simultaneously exercises or forgoes the warrants.

The warrants will be subject to an accelerated exercise provision in the event that the shares trade more than $0.10 above the exercise price for ten consecutive trading days.

The private placement was subject to a TSX-V hold period expiring on October 12, 2013. As of June 30, 2013, the private placement was classified as Share Subscriptions. Legal fees of $850 and finders’ fees of $57,600 were charged against share capital in connection with the private placement. The fair value of the warrants issued as part of the private placement is $663,834

Options:

The changes in share options including those granted to directors, offers and consultants during the years ended June 30, 2015 and 2014 are summarized as follows

| | | | |

| June 30, 2015

| June 30, 2014

|

| | Weighted

| | Weighted

|

| | Average

| | Average

|

| Number

| Exercise

| Number

| Exercise

|

| of Shares

| Price

| of Shares

| Price

|

Beginning Balance

| 2,250,000

| $0.11

| -

| -

|

Options granted

| 4,255,000

| $0.31

| 3,200,000

| $0.11

|

Expired/Cancelled

| -

| | (950,000)

| $0.10

|

Exercised

| (1,625,000)

| $0.16

| -

| |

Ending Balance

| 4,880,000

| $0.27

| 2,250,000

| $0.11

|

Exercisable

| 3,097,500

| $0.19

| 1,650,000

| $0.10

|

8

The following table summarizes information about share options outstanding at June 30, 2015 and 2014:

| | | | |

| | Outstanding

|

| | Exercise

| June 30,

| June 30,

|

Expiry date

| | Price

| 2015

| 2014

|

| | | | |

19-Feb-17

| | $0.20

| 450,000

| -

|

15-Apr-17

| | $0.55

| 230,000

| -

|

05-Jun-17

| | $0.55

| 300,000

| -

|

05-Sep-18

| | $0.10

| -

| 450,000

|

21-Feb-19

| | $0.10

| 1,000,000

| 1,000,000

|

08-May-19

| | $0.13

| 500,000

| 800,000

|

25-Jul-19

| | $0.10

| 200,000

| -

|

14-Nov-19

| | $0.15

| 150,000

| -

|

18-Dec-19

| | $0.20

| 800,000

| -

|

08-Jan-20

| | $0.20

| 150,000

| -

|

15-May-20

| | $0.45

| 200,000

| -

|

05-Jun-20

| | $0.45

| 400,000

| -

|

05-Jun-20

| | $0.55

| 500,000

| -

|

Granted

| | | 4,880,000

| 2,250,000

|

Exercisable

| | | 3,097,500

| 1,650,000

|

The weighted average remaining contractual life of options outstanding and exercisable is 3.78 and 3.81 years, respectively.

Warrants:

The Company has issued warrants entitling the holders to acquire common shares of the Company. A summary of changes in warrants is presented below:

| | | | |

| June 30, 2015

| June 30, 2014

|

| | Weighted

| | Weighted

|

| | Average

| | Average

|

| Number

| Exercise

| Number

| Exercise

|

| of Warrants

| Price

| of Warrants

| Price

|

Beginning balance

| 11,800,000

| $0.33

| 8,000,000

| $0.30

|

Warrants granted

| 4,412,252

| $0.25

| 4,050,000

| $0.21

|

Expired/Cancelled

| -

| | (250,000)

| $0.30

|

Exercised

| (9,219,710)

| $0.31

| -

| |

Issued and exercisable

| 6,992,542

| $0.31

| 11,800,000

| $0.33

|

| | | | |

| | Outstanding

|

| | Exercise

| June 30,

| June 30,

|

Expiry date

| | Price

| 2015

| 2014

|

| | | | |

April 8, 2015

| | $0.30

| -

| 1,890,000

|

December 11, 2015

| | $0.25

| 1,787,542

| -

|

April 8, 2016

| | $0.13

| 1,300,000

| 2,160,000

|

June 12, 2016

| | **$0.40

| 3,905,000

| 7,750,000

|

Issued and exercisable

| | | 6,992,542

| 11,800,000

|

*These warrants are exercisable at a price of $0.30 per warrant until June 12, 2014, $0.40 until June 12, 2015 and $0.50 until June 12, 2016.

9

Table No. 5

Capitalization and Indebtedness

As of June 30, 2015

| |

SHAREHOLDERS’ EQUITY

| |

Common shares issued and outstanding

|

55,219,116

|

Share Capital

| $15,262,357

|

Subscriptions Receivables

| 0

|

Reserve-Warrants

| 69,058

|

Reserve – Options

| 2,572,620

|

Deficit

| (14,550,574)

|

Net Shareholders’ Equity

| 3,353,461

|

TOTAL CAPITALIZATION

| |

Stock Options Outstanding:

| 4,880,000

|

Warrants Outstanding (1):

| 6,992,542

|

Capital Leases:

| None

|

Guaranteed Debt

| None

|

Secured Debt:

| None

|

(1) See Table 12 for exercise prices and terms of these warrants.

3.C. Reasons for the Offer and Use of Proceeds

General working capital, pay down liabilities and applications for registrations with Health Canada.

3.D. Risk Factors

Risks pertaining to the Company:

The Company's limited operating history makes it difficult to evaluate the Company’s current business and forecast future results.

The Company was started as a Capital Pool Company, has been operating its current business since November, 2003 and has had limited revenues during this time. Since its inception, the Company has experienced significant operating losses each year. These losses are due to substantial expenditures on intellectual property protection, product development and product testing of commercial and consumer infection control products. The Company has also been engaged in a program of pre-clinical testing for registration of a number of therapeutic products with Health Canada and the FDA. This testing is costly and time consuming and the Company does not have sufficient funds to undertake all of the testing that is required to satisfy the requirements of these regulatory agencies. Accordingly, the Company requires outside funding to complete these tests. As funds are raised, they will be invested in the testing and the Company will continue to accumulate losses that are proportional to the funds raised and spent on testing. In addition, the Company launched a number of consumer and commercial products, described above, and established new sales and distribution agreements. Although sales of T36® Antiseptic Hand Sanitizer products were substantial during the last quarter of 2009, sales subsequently dropped to nearly zero for reasons discussed below in the commentary on the financial statements. As a result, future sales of the Company’s products are virtually impossible to predict.

The Company has no significant source of operating cash flow and failure to generate revenues in the future could cause the Company to go out of business.

Based upon current plans to introduce its products into the Canadian market, the company should be able to generate sufficient cash flows to funds its growing operations. At the time of reporting, the Company has sufficient cash to fund its operations and do not anticipate undertaking additional financings.

10

If the Company raises further funds through equity issuances, the price of its securities could decrease due to the dilution caused by the sale of additional shares.

Additional funds raised by the Company through the issuance of equity or convertible debt securities will cause the Company’s current shareholders to experience dilution and possibly lower the trading price of its shares. Such securities may grant rights, preferences or privileges senior to those of the Company’s common shareholders. The Company is not profitable and will not be profitable for the foreseeable future under its current development plan. The Company plans to issue further equity to raise funds as necessary to continue operations and fund its program of research and development, patent protection and regulatory approvals. As a result, an indeterminate amount of dilution of the Company’s capital stock will occur.

The Company has issued a limited number of shares out of its authorized capital of an unlimited number of common shares, which could be dilutive and negatively affect the share price.

Having an unlimited number of authorized but unissued common shares could allow the Company’s Directors and Officers to issue a large number of shares without shareholder approval, leading to significant dilution of current shareholders and possible lowering of the share price.

The Company could enter into debt obligations and not have the funds to repay these obligations.

The Company does not have any contractual restrictions on its ability to incur debt and, accordingly, the Company could incur significant amounts of indebtedness to finance its operations. Any such indebtedness could contain covenants, which would restrict the Company’s operations. The Company might not be able to repay indebtedness.

The Company could enter into contractual obligations and not have the funds to pay for these obligations.

The Company does not have any contractual restrictions on its ability to enter into binding agreements and, accordingly, the Company could incur significant obligations to third parties including financial obligations. Any such obligations could restrict the Company’s operations and the Company might not be able to pay for its commitments. If the Company cannot meet its commitments, legal action could be taken against the Company. Any such actions could further restrict the Company’s ability to conduct its business or could cause the Company to go out of business.

The Company has a history of generating limited revenues and the continuing failure to generate further revenues could cause the Company to cease operations.

The Company has no history of pre-tax profit and in the previous three years has had only limited annual revenues for each of the years it has been operating. The Company sustained operating losses for each of its fiscal years and has sustained significant accumulated operating losses. The continued operation of the Company will be dependent upon its ability to generate operating revenues and to procure additional financing. The Company may not be successful in generating revenues or raising capital in the future. Failure to generate revenues or raise capital could cause the Company to cease operations.

As the Company is a Canadian company, it may be difficult for U.S. shareholders of the Company to effect service on the Company or to realize on judgments obtained in the United States.

The Company is a Canadian corporation. A majority of its directors and officers are residents of Canada and a significant part of its assets are, or will be, located outside of the United States. As a result, it may be difficult for shareholders resident in the United States to effect service within the United States upon the Company, directors, officers or experts who are not residents of the United States, or to realize in the United States judgments of courts of the United States predicated upon civil liability of any of the Company, directors or officers under the United States federal securities laws. If a judgment is obtained in the U.S. courts based on civil liability provisions of the U.S. federal securities laws against the Company or its directors or officers, it will be difficult to enforce the judgment in the Canadian courts against the Company and any of the Company’s non-U.S. resident executive officers or directors. Accordingly, United States shareholders may be forced to bring actions against the Company and its respective directors and officers under Canadian law and in Canadian courts in order to enforce any claims that they may have against the Company or its directors and officers. Nevertheless, it may be difficult for United States shareholders to bring an original action in the Canadian courts to enforce liabilities based on the U.S. federal securities laws against the Company and any of the Company’s non-U.S. resident executive officers or directors.

11

The Company’s future performance is dependent on key personnel. The loss of the services of any of the Company’s executives or Board of Directors could have a material adverse effect on the Company.

The Company’s performance is substantially dependent on the performance and continued efforts of the Company’s executives and its Board of Directors. Aman Parmar is the Chief Financial Office and a Director. Eugene Beukman and Bob Rai are independent Directors and members of the Audit Committee. The loss of the services of any of the Company’s executives or Board of Directors could have a material adverse effect on the Company’s business, results of operations and financial condition. There is no assurance that key personnel can be replaced with people with similar qualifications within a reasonable period of time. The Company currently does not carry any key person insurance on any of the executives or members of the board of directors. The only contracts in place with any of the employees, officers or directors of the Company are with the CEO Arun Nayyar and the CFO Aman Parmar.

The Company has not declared any dividends since its inception in 2000 and has no present intention of paying any cash dividends on its common shares in the foreseeable future.

The Company has not declared any dividends since its inception in 2000, and has no present intention of paying any cash dividends on its common shares in the foreseeable future. The payment by the Company of dividends, if any, in the future, rests in the discretion of the Company's Board of Directors and will depend, among other things, upon the Company's earnings, its capital requirements and financial condition, as well as other relevant factors.

The Company’s future performance is dependent on key suppliers and manufacturers and a loss of any suppliers or manufacturers could have a material adverse effect on the Company by reducing or eliminating the ability of the Company to manufacture or sell its products.

The Company does not have agreements in place with any of its key suppliers for raw materials, other supplies or manufacturing. If any of the Company’s suppliers or manufacturers were to go out of business or were unable to procure the raw materials or other supplies required by the Company to manufacture its products, the Company would have to find other suppliers or manufacturers. There is no guarantee that the Company would be able to find other suppliers or manufacturers. If the Company could not find other suppliers or manufacturers, production of the Company’s products would be delayed for an indefinite period of time and such delays would lead to delayed revenues or reduced revenues or both.

If the Company is unable to manufacture its products, there is a risk that customers will be lost and that the Company will be unable to regain these customer.

The company has been able to secure manufacturing for its products and has secured long term partners to ensure sufficient inventory levels.

To meet its financial obligations, the Company may be required to divest itself of certain assets

At the date of reporting the Company does not anticipate any issues in meeting its financial obligations.

There is no assurance that the patent applications filed for the T36® technology or for other products will be approved, and failure to obtain such approvals could leave the Company with no further protection for its intellectual property and reduced sales.

The Company has obtained patent approval for its T36 product which it has rebranded under the label VANC Cortivera. The Company has written off its Ferro-heme and Pediasafe products as management is no longer pursuing these products.

There is no assurance that the Company will be able to secure the funds needed for future development, and failure to secure such funds could lead to a lack of opportunities for growth.

Many of the Company’s products require very costly laboratory testing to establish toxicity, efficacy and analytical methods and clinical trials to establish effectiveness and safety on human subjects. This testing is required in order to obtain required regulatory approvals from Health Canada, the EPA and FDA in the US and the EMA in the EU. A lack of funds would impair the ability of the Company to complete such tests. A lack of funds would also impair the Company’s ability to establish marketing and sales plans once the products have been approved for sale. If adequate financing is not available when required, the Company may be required to delay, scale back or eliminate various activities and may be unable to continue in operation. The Company may seek such additional financing through debt or equity offerings, but there can be no assurance that such financing will be available on terms acceptable to the Company or at all. Any equity offering will result in dilution to the ownership interests of the Company’s shareholders and may result in dilution to the value of such interests.

12

There is no assurance that research and development being conducted by the Company to create new products will be successful.

The Company is conducting research and development on new products, but the outcomes of research and development are never certain. For example, there is no assurance that any new products will be developed or that any new products that do result will have a competitive advantage or market acceptance, will not be superseded by the new products of competitors, will not infringe on the patents of other companies or that other companies will not develop products that infringe on patents obtained by the Company for its new products. The Company has completed the formulations for new products but still needs to conduct the toxicity and efficacy tests and establish the analytical methods required to obtain regulatory approvals from Health Canada, the EPA and FDA in the US and the EMA in the EU.

The Company and the Company’s products have limited brand awareness which limits the ability of the Company to gain credibility from prospective customers and to sell its products into new markets.

Market knowledge of the Company’s name is limited. The Company will need to devote considerable resources to educate new markets about the products the Company offers. In establishing new markets, the Company will be competing with companies that are potentially already entrenched in such markets or may be better funded than the Company. The ability of the Company to raise brand awareness will depend on its ability to raise the money required to undertake such an intensive marketing effort. As noted elsewhere, there is no assurance that the Company can raise funds required for such an investment in marketing.

The Company has limited sales and marketing experience and can provide no assurance that the Company can keep its current customers or gain new ones.

The Company has limited experience in marketing and selling its products and the Company has no sales or marketing staff. The Company will have to expend substantial funds to promote and develop its products. The Company’s success in this regard will depend on the quality of its products and its ability to develop and implement an effective sales and marketing strategy. Failure to achieve the marketing objectives will have a material adverse effect on the Company and on its results of operations and financial condition.

Conflicts of interest may exist for Directors and Officers which may inhibit their ability to act in the best interests of the Company and its shareholders leading to possible impairment of the Company’s ability to achieve its business objectives.

The directors and officers of the Company will not be devoting all of their time to the affairs of the Company. The directors and officers of the Company are directors and officers of other companies. The directors and officers of the Company will be required by law to act in the best interests of the Company. They will have the same obligations to the other companies in respect of which they act as directors and officers. Discharge by the directors and officers of their obligations to the Company may result in a breach of their obligations to the other companies and, in certain circumstances, this could expose the Company to liability to those companies. Similarly, discharge by the directors and officers of their obligations to the other companies could result in a breach of their obligation to act in the best interests of the Company. Such conflicting legal obligations may expose the Company to liability to others and impair its ability to achieve its business objectives. Aman Parmar is not a Director or Officer of any companies that compete with or provide services that are similar to those of the Company.

Management of the Company can, through their stock ownership in the Company, influence all matters requiring approval by the Company’s shareholders.

Management of the Company at the time of this report, collectively own approximately 5% of the Company's issued and outstanding common shares at that date. These shareholders, if acting together, could significantly influence all matters requiring approval by the Company's shareholders, including the election of directors and the approval of mergers or other business combination transactions. Management may not make decisions that will maximize shareholder value and may make decisions that will contribute to or cause the entrenchment of management.

The value and transferability of the Company shares may be adversely impacted by the limited trading market for the Company’s common shares.

No assurance can be given that a market for the Company’s common shares will be quoted on an exchange in the U.S. or on the NASD's Over the Counter Bulletin Board. The Company’s common shares may be subject to illiquidity and investors may not be able to sell their shares in a timely manner.

13

The value and transferability of the Company shares may be adversely impacted by the penny stock rules.

The sale or transfer of the Company common shares by shareholders in the United States may be subject to the so-called "penny stock rules." Under Rule 15g-9 of the Exchange Act, a broker or dealer may not sell a "penny stock" (as defined in Rule 3a51-1) or effect the purchase of a penny stock by any person unless:

(a)

Such sale or purchase is exempt from Rule 15g-9;

(b)

Prior to the transaction the broker or dealer has (1) approved the person's account for transaction in penny stocks in accordance with Rule 15g-9, and (2) received from the person a written agreement to the transaction setting forth the identity and quantity of the penny stock to be purchased; and

(c)

The purchaser has been provided an appropriate disclosure statement as to penny stock investment.

The SEC adopted regulations generally define a penny stock to be any equity security other than a security excluded from such definition by Rule 3a51-1. Such exemptions include, but are not limited to (1) an equity security issued by an issuer that has (i) net tangible assets of at least $2,000,000, if such issuer has been in continuous operations for at least three years, (ii) net tangible assets of at least $5,000,000, if such issuer has been in continuous operation for less than three years, or (iii) average revenue of at least $6,000,000 for the preceding three years; (2) except for purposes of Section 7(b) of the Exchange Act and Rule 419, any security that has a price of $5.00 or more; and (3) a security that is authorized or approved for authorization upon notice of issuance for quotation on the NASDAQ Stock Market, Inc.'s Automated Quotation System. It is likely that the Company’s common shares, assuming a market were to develop in the US, will be subject to the regulations on penny stocks. Consequently, the market liquidity for the common shares may be adversely affected by such regulations limiting the ability of broker/dealers to sell the Company’s common shares and the ability of shareholders to sell their securities in the secondary market in the US Moreover, the Company shares may only be sold or transferred by the Company shareholders in those jurisdictions in the US in which an exemption for such "secondary trading" exists or in which the shares may have been registered.

There is no guarantee that there is a market for the Company’s common shares in the United States.

Although the Company’s common shares were added to the OTC Bulletin Board System on April 20, 2009 under the symbol “APCSF”, trading of the company’s shares is very limited. The Company cannot guarantee that there will be a market for the Company’s common shares in the United States or that there will any significant amount trading in the company’s shares for the foreseeable future The Company cannot guarantee that it will continue to maintain a listing in the United States or that it will not be found in default of existing regulations or new regulations and be suspended from trading or delisted.

Risks Pertaining to the Industry

Registration of products may not occur in a timely manner which could lead to delays in product introductions, reduced revenue expectations and extra costs to conduct further tests to satisfy regulatory agencies.

Government agencies, such as the EPA and the Food and Drug Administration (“FDA”) in the United States and Health Products and Food Branch in Canada, need to provide approvals of the Company’s products prior to any sales of these products. To obtain such approvals, the Company must submit extensive amounts of information on the efficacy, toxicology, carcinogenicity, mutagenecity and other testing of the products that it is trying to register. After all of the information is provided, the agencies can request supplemental information and further testing. Once all of the requirements for documentation are satisfied, the agencies can take an indeterminate amount of time to provide approvals for the Company to market its products. Significant delays could lead to slower revenue growth than anticipated. In addition, regulatory delays can allow time for competitors to devise strategies to prevent or reduce market penetration. There is no assurance that government agencies will accept for registration any of the Company’s products.

The Company is very dependent on the registration and sale of its commercial, retail and therapeutic products.

If the Company is not successful in achieving regulatory approval of its products, its ability to generate revenues will be impaired. Even if registrations are successful, there is no guarantee that the Company will be able to maintain the registrations or be able to pass inspections by the regulatory authorities that permit the sale of the Company’s products. In the event of a failed inspection, it is possible that the Company may be ordered to stop the sale of its products or undertake a recall of products that the regulatory authorities deem to be non-compliant with existing regulations. If the Company is ordered to recall or stop the sale of any of its products, the ability of the Company to generate revenues will be impaired. If such a recall or suspension of sales occurs, there is no guarantee that the Company will, at any future date, be able to resume the sale of the suspended or recalled products.

14

There is a risk that the Company’s intellectual property infringes upon the rights of other companies, which could lead to reduced revenues, reduced margins due to sanctions against the Company, outright withdrawal or prohibition of products or trademarks from the market and significant costs for legal defense against infringement claims, re-branding of products and revised marketing materials.

The Company is unaware of any infringement claims being made against the Company or its products or processes at the time of writing. In the future, there can be no assurances that third parties will not assert infringement claims in the future or require the Company to obtain a license for the intellectual property rights of such third parties. There can be no assurance that such a license, if required, will be available on reasonable terms or at all. If the Company does not obtain such a license, it could encounter delays in the introduction of products or could find that the development, manufacture or sale of products requiring such a license could be prohibited.

There is a risk that earlier inventions may exist that invalidate the Company’s patent applications so that the Company may not be able to sell any infringing products.

Since patent applications are maintained in secrecy for a period of time after filing, and since publication of discoveries in the scientific or patent literature often lags behind actual discoveries, the Company cannot be certain that it was the first creator of inventions covered by pending patent applications, or that it was the first to file patent applications for such inventions. The Company might have to participate in interference proceedings in U.S., Canadian or patent offices in other jurisdictions to determine priority of invention, at substantial cost, particularly if such actions are required overseas. There can be no assurance that the Company’s patents, if issued, would be held valid or enforceable by a court. The Company has patents issued in the United States, China and Australia and patent applications filed in the European Union and Canada. These patent applications seek intellectual property protection for the basic formulation of the T36® formulation, the method for making it and certain therapeutic uses of the formulation.

There may be limited ability to defend the patents if and when they are issued, leading to loss of sales that might otherwise be realized if the Company was in a position to defend its patents.

Litigation among pharmaceutical companies can be intense and costly. The Company might not have the financial ability to defend its patents, if issued, against larger industry players. Litigation may be necessary to enforce patents issued or assigned to the Company, or to determine the scope and validity of a third party's proprietary rights. Additionally, there can be no assurances that the Company would prevail in any such action. An adverse outcome in litigation or as part of an interference or other proceeding in a court or patent office could subject the Company to significant liabilities, require disputed rights to be licensed from other parties or require the Company to cease using certain technology or products, any of which could have a material adverse effect on the Company’s business.

ITEM 4. INFORMATION ON THE COMPANY

4.A. History and Development of the Company

Capital Pool Company

The Company was incorporated by registration of its Memorandum and Articles under the BC Companies Act on May 30, 2000 under the name “Duft Biotech Capital Ltd.” and was classified as a Capital Pool Company (“CPC”) on the TSX Venture Exchange. Under the policies of the TSX Venture Exchange, the principal business of a CPC is to identify and evaluate opportunities for acquisition. The completion of such an acquisition is referred to as a Qualifying Transaction. A CPC does not carry on any business other than the identification and evaluation of assets or businesses in connection with potential Qualifying Transactions, does not have business operations or assets other than seed capital and has no written or oral agreements for the acquisition of an asset or business at the time of formation.

A “Qualifying Transaction”, pursuant to the policies of the TSX Venture Exchange, is a transaction whereby a capital pool company:

(a)

Issues or proposes to issue, in consideration for the acquisition of significant assets or businesses, common shares or securities convertible, exchangeable or exercisable into common shares, which, if fully converted, exchanged or exercised would represent more than 25 percent of its common shares issued and outstanding immediately prior to the issuance;

(b)

Enters into an arrangement, amalgamation, merger or reorganization with another issuer with significant assets, whereby the ratio of securities which are distributed to the security holders of the capital pool company and the other issuer results in the security holders of the other issuer acquiring control of the resulting entity; or

(c)

Otherwise acquires significant assets other than cash.

15

Financings

The Company has financed its operations since inception through funds raised in a series of private placements of common shares:

| | | |

Fiscal Year

| Nature of Share Issuance

| Number of Shares

| Amount ($)

|

Fiscal 2001

| Private Placement @ $0.085

| 1,176,475

| $100,000

|

| | | |

Fiscal 2002

| Canadian Prospectus Offering (IPO) @$0.17

| 1,200,000

| $204,000

|

Fiscal 2003

| Broker’s Warrant Shares on Canadian Prospectus Offering (IPO) @ $0.17

| 150,000

| $25,500

|

| | | |

Fiscal 2004

| Private Placement @ $0.15

| 346,666

| $52,000

|

| Private Placement @ $0.20

| 6,200,000

| $1,240,000

|

| | | |

Fiscal 2005

| Private Placement @ $0.10

| 3,000,000

| $300,000

|

| | | |

Fiscal 2006

| Private Placement @$0.05

| 3,916,000

| $195,800

|

| | | |

| Private placement @ $0.05

| 1,100,000

| $55,000

|

| | | |

Fiscal 2007

| Private placement @ $0.05

| 1,430,000

| $ 71,500

|

| Private placement @ $0.10

| 8,000,000

| $800,000

|

| | | |

Fiscal 2008

| Private placement @ $0.12

| 2,000,000

| $240,000

|

| Private placement @ $0.15

| 3,500,000

| $525,000

|

| | | |

Fiscal 2009

| N/A

| N/A

| N/A

|

| | | |

Fiscal 2010

| Private placement @ $0.25

| 6,000,000

| $1,500,000

|

| | | |

Fiscal 2011

| Private placement @ $0.10

| 3,275,000

| $327,500

|

| Private placement @ $0.10

| 2,000,000

| $200,000

|

| | | |

Fiscal 2012

| Private placement @ $0.10

| 560,000

| $56,000

|

| | | |

Fiscal 2013

| Private placement @ $0.10

| 8,000,000

| $800,000

|

| | | |

Fiscal 2014

| Private placement @ $0.10

| 3,750,000

| $375,000

|

Fiscal 2015

|

Private placement @ $0.15

|

7,607,332

|

$1,141,100

|

| | | |

4.B. Business Overview

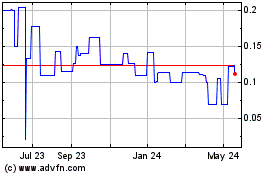

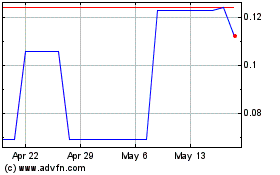

On August 12, 2013, Vanc Pharmaceuticals Inc. trades on the TSX Venture Exchange in Canada under the symbol “NPH” and on February 23, 2014 on the OTCQB under the symbol “NUVPF”.

In 2003, VANC developed a patented infection control formulation, referred to as T36®, a mixture of ethanol containing the anti-microbial ingredients o-phenyl phenol (“OPP”), benzalkonium chloride (“BZK”), chlorhexidine gluconate (“CHG”) and Nonoxynol-9 (”N-9”). All of these component chemicals are bio-degradable.

The Company is continuing to maintain patents for the T3/6 product in Canada and China.

The Company is now focused on the manufacturing and distribution of generic and over-the-counter (“OTC”) pharmaceuticals.

On April 16, 2014 – the Company announced that it has signed Cross Referencing Agreements (“CRA”) for prescription generic products for Canadian markets. These agreements cover 48 prescription generic products and are for acute and chronic diseases.

16

Sales

Sales during the year ended June 30, 2015 were $5,713 (June 30, 2014 - $nil).

Manufacturing

On April 16, 2014 the Company announced that it had signed CRAs with three large pharmaceutical companies for multiple products in the prescription generic drug lines. The suppliers will manufacture and VANC will market and sell these new product lines under its own label.

As at June 30, 2015, management has decided to discontinue efforts related to the Pedia-Safe Polyvitamin Drops and FerroHeme Iron supplements for the foreseeable future, as there have been significant changes in the competitive landscape for these products in Canada. The Company is continuing to focus on the manufacture and distribution of generic and OTC pharmaceuticals. Accordingly, the Company fully impaired the carrying value of intangible assets to $nil.

Patents

The Company has abandoned T3/6 patent renewals in Europe, the USA and Australia. It is maintaining the Chinese patent and the Canadian patent, which was assigned in a debt settlement agreement with a former Director.

China

On February 6, 2008, the Company announced that Certificate of Invention Patent Number ZL02829642.7 had been issued by the State Intellectual Property Office of the People’s Republic of China. The patent provides protection for the composition and production methods for T36® formulation until August 20, 2022. On November 25, 2010 the Company was advised that the above patent became vulnerable to an application for a compulsory license on October 17, 2010. Under Chinese patent practice, it is possible for a third party to apply for the grant of a compulsory license should the invention not have been “worked” or otherwise been impeded from being worked, three years from the grant of a Patent. This may take into account circumstances where the conditions attached to the licensing of the invention are unreasonable, or the demand for the invention is not reasonably being met. The government body responsible for considering applications for a compulsory license will consider a multitude of factors before granting such a license and there may be mechanisms available for patentees to respond, or comment, on such applications.

Amendments to the original patent application were also drafted by the Company. As in the case of the amendments prepared for CIPO, the proposed amendments to the original Chinese patent application expanded the original claims to include a number of therapeutic applications of the T36® formulation, including its use in cosmetics and in a microbicidal gel to prevent the transmission of sexually transmitted infections (“STI’s”). On October 10, 2007, the Company was advised that the amended claims had been submitted to the Chinese Patent Office. On January 30, 2008 the Chinese Patent office assigned Chinese Divisional Patent Application No. 200710142798.3 to the new application which was published in the Chinese Patent Gazette, under Publication No. CN101112624A. On April 13, 2010, the Company received an Office Action from the Chinese Patent Office and a response was filed by the Company prior to the deadline of June 11, 2010. A second Office Action was received on September 23, 2010 and a response was filed prior to the deadline of October 16, 2010. A third Office Action was received by the Company on February 1, 2011. The Company chose not to respond to this Office Action.

Canada

On April 6, 2011, the Company announced in a news release that the Canadian patent had been allowed. The Company allowed the patent to become temporarily abandoned and had it reinstated on October 3, 2012. The company settled debts with a former Officer and Director with the transfer of the T3/6 patent for Canada. Part of the agreement was that the Company would maintain the patent renewals.

17

Trademarks

“T36®”

The Company successfully trademarked “T36®” and the design of the T36® logo in Canada on April 22, 2004 (Registration No. TMA608308) for “pharmaceuticals, namely a disinfectant agent”.

“Hema-fer”

In 2015 the Company made application to have the above-mentioned trade-mark registered.

Products Registered in Canada

The following table summarizes the NPN’s that have been received from Health Canada.

NPN’s - Products to be marketed by the Company.

| | |

80061817

| May 26/15

| Hema-fer

|

Risk Factors

Limited Operating History

There is no assurance that Vanc will earn profits in the future, or that profitability, if achieved, will be sustained. Operating in the pharmaceutical and biotechnology industry and the pharmaceutical contract manufacturing industry requires financial resources, and there is no assurance that future revenues will be sufficient to generate the funds required to continue Vanc business development and marketing activities. If Vanc does not have sufficient capital to fund its operations, we may be required to reduce our sales and marketing efforts or forego certain business opportunities.

Development of Technological Capabilities

The market for Vanc’s products is characterized by changing technology and continuing process development. The future success of Vanc’s business will depend in large part upon our ability to maintain and enhance the Company’s technological capabilities, develop and market products and services which meet changing customer needs and successfully anticipate or respond to technological changes on a cost effective and timely basis. Although we believe that Vanc’s operations provide the products and services currently required by our customers, there can be no assurance that Vanc’s process development efforts will be successful or that the emergence of new technologies, industry standards or customer requirements will not render Vanc’s products or services uncompetitive. If Vanc needs new technologies and equipment to remain competitive, the development, acquisition and implementation of those technologies and equipment may require us to make significant capital investments. Vanc may not be able to raise the required capital on terms satisfactory to Vanc or at all.

4.C. Organization structure

The Company is not part of a group and has the following wholly owned subsidiaries, VANC Marine Pharmaceuticals Inc. and Vise Healthcare Inc., the Companies are incorporated in British Columbia. They are currently inactive.

4.D. Property, Plant and Equipment

The Company has no facilities.

The Company uses outside manufacturers for its production needs.

Item 4A Unresolved Staff Comments

No disclosure necessary.

18

ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS

This discussion should be read in conjunction with the audited consolidated financial statements of the Company and related notes included therein.

5. A. Operating Results of the Company

Overview

During the 2015 fiscal year, the Company was able to commence commercialization of its generic portfolio. The Company will continue to grow its generic portfolio as well as commence commercialization of its Over-the-counter products.

1.4

RESULTS OF OPERATIONS

Sales

The Company recorded sales of $5,713 in 2015 compared to $nil in 2014.

Cost of Goods Sold

For the year ended June 30, 2015 was $2,491 and $nil for 2014.

Gross Profit

For the year ended June 30, 2015 was $3,222 and $nil for 2014.

Consulting & Management

Consulting and management fees for the year ended June 30, 2015 were $362,727 compared to $254,337 for the year ended June 30, 2014. The increase is due to an increase in Executive compensation as well as the addition of a full time CFO.

Filing and Transfer Agent Fees

Fees amounted to $53,714 for the year ended June 30, 2015 compared to $39,567 for the same period ended June 30, 2014. This was due to significant increase in public news releases and capital transactions which resulted in filing fees with the TSX Exchange.

Legal and Audit Fees

Legal and accounting fees were $37,806 for the year ended June 30, 2015 compared to $48,862 for the year ended June 30, 2014. This decrease was due to legal fees which were charged in 2014 for due diligence on products the Company was in-licensing.

Product Registration and Development Costs

Total costs incurred in this category for the year ended June 30, 2015 were $56,143 compared to $5,156 for the year ended June 30, 2014. Costs incurred in this category consist primarily of fees paid to maintain the Company’s trademarks as well as the costs incurred to file products with Health Canada.

Share Based Payments

Stock based Compensation expenses were $915,211 for the year ended June 30, 2015, compared to $291,355 for the year ended June 30, 2014. This increase was expected due to the significant amount of share based transaction in the third quarter of 2015.

Comprehensive (Gain)/Loss from Operations

The Comprehensive (loss) from operations was $(2,200,648) for the year ended June 30, 2015 compared to a loss of $(733,946) during the same period ended June 30, 2014. This significant increase was due to non-cash transactions.

19

5. B. Liquidity and capital resources

Liquidity

As at June 30, 2015, the Company had working capital of $3,305,603 ($156,185 – June 30, 2014).

| | |

| June 30, 2015

| June 30, 2014

|

| $

| $

|

Current Assets

| 3,492,727

| 313,506

|

Current Liabilities

| (187,124)

| (157,321)

|

Working Capital

| 3,305,603

| 156,185

|

Management has raised sufficient cash from warrant and option exercises in the third and fourth quarter to fund the current business operations. Management does not anticipate any additional financings or capital requirements to fund the current operations.

Capital resources

During the year ended June 30, 2015 and 2014, the following were changes in share options

| | | | |

| June 30, 2015

| June 30, 2014

|

| | Weighted

| | Weighted

|

| | Average

| | Average

|

| Number

| Exercise

| Number

| Exercise

|

| of Shares

| Price

| of Shares

| Price

|

Beginning Balance

| 2,250,000

| $0.11

| -

| -

|

Options granted

| 4,255,000

| $0.31

| 3,200,000

| $0.11

|

Expired/Cancelled

| -

| | (950,000)

| $0.10

|

Exercised

| (1,625,000)

| $0.16

| -

| |

Ending Balance

| 4,880,000

| $0.27

| 2,250,000

| $0.11

|

Exercisable

| 3,097,500

| $0.19

| 1,650,000

| $0.10

|

The following table summarizes information about share options outstanding at June 30, 2015 and 2014:

| | | | |

| | Outstanding

|

| | Exercise

| June 30,

| June 30,

|

Expiry date

| | Price

| 2015

| 2014

|

| | | | |

19-Feb-17

| | $0.20

| 450,000

| -

|

15-Apr-17

| | $0.55

| 230,000

| -

|

05-Jun-17

| | $0.55

| 300,000

| -

|

05-Sep-18

| | $0.10

| -

| 450,000

|

21-Feb-19

| | $0.10

| 1,000,000

| 1,000,000

|

08-May-19

| | $0.13

| 500,000

| 800,000

|

25-Jul-19

| | $0.10

| 200,000

| -

|

15-Sep-19

| | $0.10

| -

| -

|

14-Nov-19

| | $0.15

| 150,000

| -

|

18-Dec-19

| | $0.20

| 800,000

| -

|

08-Jan-20

| | $0.20

| 150,000

| -

|

15-May-20

| | $0.45

| 200,000

| -

|

05-Jun-20

| | $0.45

| 400,000

| -

|

05-Jun-20

| | $0.55

| 500,000

| -

|

Granted

| | | 4,880,000

| 2,250,000

|

Exercisable

| | | 3,097,500

| 1,650,000

|

At the time of this report, the Company has sufficient working capital to pursue its current business plan.

Critical Accounting Policies

The consolidated financial statements of the Company comply with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and interpretations of the International Financial Reporting Interpretations Committee (“IFRIC”).

The preparation of the consolidated financial statements in conformity with IFRS requires management to make estimates and assumptions that affect the amounts reported of assets and liabilities, the disclosure of contingent assets and liabilities at the date of consolidated financial statements and the amounts of revenues and expenses for the reporting period. The areas of estimation are the stock-based compensation, estimated useful lives of depreciable assets, and intellectual property. The Company believes that the estimates and assumptions upon which it relies are reasonable and are based on information available to the Company at the time that estimates and assumptions are made. Actual results could differ from those estimates.

Changes in Significant Accounting Policies

The Company has applied the following standards in these consolidated financial statements, which were effective for the Company beginning July 1, 2014:

Offsetting Financial Assets and Financial Liabilities (Amendments to IAS 32)

Amends IAS 32 Financial Instrument: Presentation to clarify certain aspects because of diversity in application of the requirements on offsetting, focused on four main areas:

·

The meaning of “currently has a legally enforceable right of set-off”

·

The application of simultaneous realization and settlement

·

The offsetting of collateral amounts

·

The unit of account for applying the offsetting requirements

Recoverable Amount Disclosures for Non-Financial Assets (Amendments to IAS 36)

Amends IAS 36 Impairment of Assets to reduce the circumstances in which the recoverable amount of assets or cash-generating units is required to be disclosed, clarify the disclosures required, and to introduce an explicit requirement to disclose the discount rate used in determining impairment (or reversals) where recoverable amount (based on fair value less costs of disposal) is determined using a present value technique. The application of this standard did not have a significant impact on the Company’s consolidated financial statements.

Change in accounting policy

During the year ended June 30, 2015, the Company changed its accounting policy over the allocation of fair value of the proceeds of units in accordance with IAS 32 Financial Instruments: Presentation. The Company uses the residual method and now, under this method, proceeds are allocated first to share capital based on the fair value of the common shares at the time the units are priced and any residual value is allocated to the warrants reserve. Previously, the Company had first measured the fair value of the warrants using the Black-Scholes option pricing model with the difference between the fair value of the warrants and the proceeds received being allocated to the common shares.

This change has been applied retrospectively. An adjustment to remove any previously recorded fair value allocated to warrants has been recorded as a reduction to the warrant reserve and recorded as additional share capital on the consolidated statements of financial position (Note 19).

Future accounting policy change issued, but not yet effective

IFRS 9 Financial Instruments

21

IFRS 9 was issued by the IASB in October 2010. It incorporates revised requirements for the classification and measurement of financial liabilities and carrying over the existing derecognition requirements from IAS 39 Financial Instruments: Recognition and measurement. The revised financial liability provisions maintain the existing amortized cost measurement basis for more liabilities. New requirements apply where an entity chooses to measure a liability at fair value through profit or loss; in these cases, the portion of the change in fair value related to changes in the entity’s own credit risk is presented in other comprehensive income rather than within profit or loss. IFRS 9 is effective for annual periods beginning on or after July 1, 2018. The impact of IFRS 9 on the Company’s consolidated financial statements has not yet been determined.

5.C. Research and development, patents and licenses etc.

The Company won’t be devoting resources to research, development and patents going forward. The Company is now focused on the manufacture and distribution of generic and over-the-counter (“OTC”) pharmaceuticals.

5.D. Trend information

There are significant market swings away from branded pharmaceuticals towards low cost generics. The Company will attempt to integrate itself into this shift.

5.E. Off-balance sheet arrangements

The Company does not have any off-balance sheet arrangements.

5.F. Tabular disclosure of contractual obligations

The Company does not have any long-term debt obligations, purchase obligations or other long-term liabilities reflected on the Company’s statement of financial position.

The Company has entered into contracts for leased premises, which expire in 2018. Total future minimum lease payments (net of sub-lease arrangement) under these contracts are as follows:

| | |

Within 1 year

| $

| 34,763

|

2 years

| | 37,354

|

3 years

| | 22,671

|

| $

| 94,788

|

5.G. Safe Harbor

This Annual Report on Form 20-F contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, principally in ITEM #4, “Information on the Company” and ITEM #5, “Operating and Financial Review and Prospects”. These statements may be identified by the use of words like “plan,” “expect,” “aim,” “believe,” “project,” “anticipate,” “intend,” “estimate,” “will,” “should,” “could” and similar expressions in connection with any discussion, expectation, or projection of future operating or financial performance, events or trends. In particular, these include statements about the Company’s strategy for growth, future performance or results of current sales and production, interest rates, foreign exchange rates, and the outcome of contingencies, such as acquisitions and/or legal proceedings and intellectual property issues.

Forward-looking statements are based on certain assumptions and expectations of future events that are subject to risks and uncertainties. Actual future results and trends may differ materially from historical results or those projected in any such forward-looking statements depending on a variety of factors, including, among other things, the factors discussed in this Annual Report under ITEM #3, “Key Information, Risk Factors” and factors described in documents that the Company may furnish from time to time to the Securities and Exchange Commission. The Company undertakes no obligation to update publicly or revise any forward-looking statements because of new information.

22

ITEM 6. DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES

A. Directors and Senior Management

The following table sets forth certain information as of June 30, 2015 about the Company’s current directors and senior management. There have been no subsequent changes to the Company’s current directors and senior management, except as footnoted below:

Table No. 6:

Directors and Senior Management:

| | | | |

Name

| Age

| Position

| Other Reporting Companies in Canada

or the United States

|

Company

| Position

|

Arun Nayyar

| 57

| CEO

| n/a

| n/a

|