false

FY

0001355736

A1

0001355736

2023-01-01

2023-12-31

0001355736

dei:BusinessContactMember

2023-01-01

2023-12-31

0001355736

2023-12-31

0001355736

2022-12-31

0001355736

2022-01-01

2022-12-31

0001355736

2021-01-01

2021-12-31

0001355736

ifrs-full:IssuedCapitalMember

2020-12-31

0001355736

ifrs-full:WarrantReserveMember

2020-12-31

0001355736

AVCR:OptionReserveMember

2020-12-31

0001355736

ifrs-full:RetainedEarningsMember

2020-12-31

0001355736

2020-12-31

0001355736

ifrs-full:IssuedCapitalMember

2021-12-31

0001355736

ifrs-full:WarrantReserveMember

2021-12-31

0001355736

AVCR:OptionReserveMember

2021-12-31

0001355736

ifrs-full:RetainedEarningsMember

2021-12-31

0001355736

2021-12-31

0001355736

ifrs-full:IssuedCapitalMember

2022-12-31

0001355736

ifrs-full:WarrantReserveMember

2022-12-31

0001355736

AVCR:OptionReserveMember

2022-12-31

0001355736

ifrs-full:RetainedEarningsMember

2022-12-31

0001355736

ifrs-full:IssuedCapitalMember

2021-01-01

2021-12-31

0001355736

ifrs-full:WarrantReserveMember

2021-01-01

2021-12-31

0001355736

AVCR:OptionReserveMember

2021-01-01

2021-12-31

0001355736

ifrs-full:RetainedEarningsMember

2021-01-01

2021-12-31

0001355736

ifrs-full:IssuedCapitalMember

2022-01-01

2022-12-31

0001355736

ifrs-full:WarrantReserveMember

2022-01-01

2022-12-31

0001355736

AVCR:OptionReserveMember

2022-01-01

2022-12-31

0001355736

ifrs-full:RetainedEarningsMember

2022-01-01

2022-12-31

0001355736

ifrs-full:IssuedCapitalMember

2023-01-01

2023-12-31

0001355736

ifrs-full:WarrantReserveMember

2023-01-01

2023-12-31

0001355736

AVCR:OptionReserveMember

2023-01-01

2023-12-31

0001355736

ifrs-full:RetainedEarningsMember

2023-01-01

2023-12-31

0001355736

ifrs-full:IssuedCapitalMember

2023-12-31

0001355736

ifrs-full:WarrantReserveMember

2023-12-31

0001355736

AVCR:OptionReserveMember

2023-12-31

0001355736

ifrs-full:RetainedEarningsMember

2023-12-31

0001355736

AVCR:SystemhardwareMember

2023-01-01

2023-12-31

0001355736

AVCR:SystemAnalyzersAndSoftwareMember

2023-01-01

2023-12-31

0001355736

ifrs-full:AtCostMember

2021-12-31

0001355736

ifrs-full:AtCostMember

2022-01-01

2022-12-31

0001355736

ifrs-full:AtCostMember

2022-12-31

0001355736

ifrs-full:AtCostMember

2023-01-01

2023-12-31

0001355736

ifrs-full:AtCostMember

2023-12-31

0001355736

ifrs-full:AccumulatedDepreciationAndAmortisationMember

2021-12-31

0001355736

ifrs-full:AccumulatedDepreciationAndAmortisationMember

2022-01-01

2022-12-31

0001355736

ifrs-full:AccumulatedDepreciationAndAmortisationMember

2022-12-31

0001355736

ifrs-full:AccumulatedDepreciationAndAmortisationMember

2023-01-01

2023-12-31

0001355736

ifrs-full:AccumulatedDepreciationAndAmortisationMember

2023-12-31

0001355736

ifrs-full:ComputerSoftwareMember

2021-12-31

0001355736

AVCR:HealthTabMember

2021-12-31

0001355736

AVCR:CorozonMember

2021-12-31

0001355736

AVCR:EmeraldMember

2021-12-31

0001355736

ifrs-full:ComputerSoftwareMember

2022-01-01

2022-12-31

0001355736

AVCR:HealthTabMember

2022-01-01

2022-12-31

0001355736

AVCR:CorozonMember

2022-01-01

2022-12-31

0001355736

AVCR:EmeraldMember

2022-01-01

2022-12-31

0001355736

ifrs-full:ComputerSoftwareMember

2022-12-31

0001355736

AVCR:HealthTabMember

2022-12-31

0001355736

AVCR:CorozonMember

2022-12-31

0001355736

AVCR:EmeraldMember

2022-12-31

0001355736

ifrs-full:ComputerSoftwareMember

2023-01-01

2023-12-31

0001355736

AVCR:HealthTabMember

2023-01-01

2023-12-31

0001355736

AVCR:CorozonMember

2023-01-01

2023-12-31

0001355736

AVCR:EmeraldMember

2023-01-01

2023-12-31

0001355736

ifrs-full:ComputerSoftwareMember

2023-12-31

0001355736

AVCR:HealthTabMember

2023-12-31

0001355736

AVCR:CorozonMember

2023-12-31

0001355736

AVCR:EmeraldMember

2023-12-31

0001355736

AVCR:DecemberThirtyOneTwoThousandTwentyFiveMember

2020-01-01

2020-12-31

0001355736

AVCR:DecemberThirtyOneTwoThousandTwentyFiveMember

2020-12-31

0001355736

AVCR:IssuedShareCaptialMember

2023-12-31

0001355736

AVCR:IssuedShareCaptialMember

2023-01-01

2023-12-31

0001355736

AVCR:IssuedShareCaptialOneMember

2022-12-31

0001355736

AVCR:IssuedShareCaptialOneMember

2022-01-01

2022-12-31

0001355736

AVCR:IssuedShareCaptialTwoMember

2022-12-31

0001355736

AVCR:IssuedShareCaptialTwoMember

2022-01-01

2022-12-31

0001355736

AVCR:IssuedShareCaptialFourMember

2021-02-12

0001355736

AVCR:IssuedShareCaptialFourMember

2021-02-12

2021-02-12

0001355736

AVCR:IssuedShareCaptialFourMember

ifrs-full:OrdinarySharesMember

2021-02-12

0001355736

AVCR:IssuedShareCaptialFiveMember

2021-01-28

0001355736

AVCR:IssuedShareCaptialFiveMember

2021-01-28

2021-01-28

0001355736

AVCR:IssuedShareCaptialFiveMember

ifrs-full:OrdinarySharesMember

2021-01-28

0001355736

AVCR:IncentiveSharePurchaseOptionPlanMember

2023-01-01

2023-12-31

0001355736

AVCR:IncentiveSharePurchaseOptionPlanMember

ifrs-full:TopOfRangeMember

2023-01-01

2023-12-31

0001355736

AVCR:OptionOneMember

2023-12-31

0001355736

AVCR:OptionOneMember

2023-01-01

2023-12-31

0001355736

AVCR:OptionTwoMember

2023-12-31

0001355736

AVCR:OptionTwoMember

2023-01-01

2023-12-31

0001355736

AVCR:OptionThreeMember

2023-12-31

0001355736

AVCR:OptionThreeMember

2023-01-01

2023-12-31

0001355736

AVCR:OptionFourMember

2023-12-31

0001355736

AVCR:OptionFourMember

2023-01-01

2023-12-31

0001355736

AVCR:OptionFiveMember

2023-12-31

0001355736

AVCR:OptionFiveMember

2023-01-01

2023-12-31

0001355736

AVCR:OptionSixMember

2023-12-31

0001355736

AVCR:OptionSixMember

2023-01-01

2023-12-31

0001355736

AVCR:OptionSevenMember

2023-12-31

0001355736

AVCR:OptionSevenMember

2023-01-01

2023-12-31

0001355736

AVCR:OptionEightMember

2023-12-31

0001355736

AVCR:OptionEightMember

2023-01-01

2023-12-31

0001355736

AVCR:OptionNineMember

2023-12-31

0001355736

AVCR:OptionNineMember

2023-01-01

2023-12-31

0001355736

AVCR:OptionTenMember

2023-12-31

0001355736

AVCR:OptionTenMember

2023-01-01

2023-12-31

0001355736

AVCR:OptionElevenMember

2023-12-31

0001355736

AVCR:OptionElevenMember

2023-01-01

2023-12-31

0001355736

AVCR:OptionTwelveMember

2023-12-31

0001355736

AVCR:OptionTwelveMember

2023-01-01

2023-12-31

0001355736

AVCR:OptionThirteenMember

2023-12-31

0001355736

AVCR:OptionThirteenMember

2023-01-01

2023-12-31

0001355736

ifrs-full:BottomOfRangeMember

2022-01-01

2022-12-31

0001355736

ifrs-full:TopOfRangeMember

2022-01-01

2022-12-31

0001355736

ifrs-full:BottomOfRangeMember

2021-01-01

2021-12-31

0001355736

ifrs-full:TopOfRangeMember

2021-01-01

2021-12-31

0001355736

ifrs-full:BottomOfRangeMember

2023-01-01

2023-12-31

0001355736

ifrs-full:TopOfRangeMember

2023-01-01

2023-12-31

0001355736

AVCR:ChiefTechnologyOfficerMember

2023-01-01

2023-12-31

0001355736

AVCR:ChiefTechnologyOfficerMember

2022-01-01

2022-12-31

0001355736

AVCR:ChiefTechnologyOfficerMember

2021-01-01

2021-12-31

0001355736

AVCR:ChiefFinancialOfficersMember

2023-01-01

2023-12-31

0001355736

AVCR:ChiefFinancialOfficersMember

2022-01-01

2022-12-31

0001355736

AVCR:ChiefFinancialOfficersMember

2021-01-01

2021-12-31

0001355736

AVCR:DirectorsAndOtherMembersMember

2023-01-01

2023-12-31

0001355736

AVCR:DirectorsAndOtherMembersMember

2022-01-01

2022-12-31

0001355736

AVCR:DirectorsAndOtherMembersMember

2021-01-01

2021-12-31

0001355736

ifrs-full:TradeReceivablesMember

ifrs-full:CreditRiskMember

AVCR:OneCustomerMember

2023-01-01

2023-12-31

0001355736

ifrs-full:TradeReceivablesMember

ifrs-full:CreditRiskMember

AVCR:OneCustomerMember

2022-01-01

2022-12-31

0001355736

AVCR:ContractualCashFlowsMember

2023-12-31

0001355736

ifrs-full:NotLaterThanOneYearMember

2023-12-31

0001355736

ifrs-full:LaterThanOneYearAndNotLaterThanFiveYearsMember

2023-12-31

0001355736

AVCR:LeaseAndServiceMember

2023-01-01

2023-12-31

0001355736

AVCR:LeaseAndServiceMember

2022-01-01

2022-12-31

0001355736

AVCR:LeaseAndServiceMember

2021-01-01

2021-12-31

0001355736

AVCR:SaleOfProductsMember

2023-01-01

2023-12-31

0001355736

AVCR:SaleOfProductsMember

2022-01-01

2022-12-31

0001355736

AVCR:SaleOfProductsMember

2021-01-01

2021-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

iso4217:CAD

xbrli:shares

iso4217:CAD

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

20-F

(Mark

One)

| |

☐ |

REGISTRATION STATEMENT

PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| |

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13

OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the fiscal year ended December 31, 2023

OR

| |

☐ |

TRANSITION REPORT PURSUANT TO SECTION

13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

☐ |

SHELL COMPANY REPORT PURSUANT TO SECTION

13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date

of Event requiring this shell company report _____________

For

the transition period from ___________________ to ______________________

Commission

file number:000-51848

AVRICORE

HEALTH INC.

(Exact

name of Registrant as specified in its charter)

Not

applicable

(Translation

of Company’s name into English)

British

Columbia, Canada

(Jurisdiction

of incorporation or organization)

1120

– 789 West Pender Street, Vancouver British Columbia, V6C1H2

Contact

person: Hector Bremner, Phone: (604) 773-8943 Email hector.bremner@avricorehealth.com

(Address

of principal executive offices)

Securities

registered or to be registered pursuant to Section 12(b) of the Act.

| Title

of each class |

Name

of each exchange on which registered |

| Not

Applicable |

Not

Applicable |

Securities

registered or to be registered pursuant to Section 12(g) of the Act.

Common

Shares Without Par Value

(Title

of Class)

Securities

for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title

of Class)

Indicate

the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered

by the annual report. December 31, 2023 - 99,644,664.

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No

☒

If

this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934 Yes ☐ No ☒

Indicate

by check mark whether the Company (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act

of 1934 during the preceding 12 months (or for such shorter period that the Company was required to file such reports), and (2) has been

subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 2 of 105 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or an emerging growth

company. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act (check one):

Large

accelerated filer ☐ Accelerated filer ☐ Non-Accelerated filer ☒ Emerging growth company ☐

If

an emerging growth company that prepares its financial statements in accordance with U.S.GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 USC. 7262(b)) by the registered public

accounting firm that prepared or issued its audit report. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive- based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S.

GAAP ☐ |

International Financial Reporting Standards as issued |

Other

☐ |

| |

by

the International Accounting Standards Board ☒ |

|

If

“Other” has been checked in response to the previous question, indicate by check mark which financial statement item the

registrant has elected to follow.

Item

17 ☐ Item 18 ☐

If

this is an annual report, indicate by checkmark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

(APPLICABLE

ONLY TO ISSUES INVOLVED IN BANKRUPTCY PROCEEDING DURING THE PAST FIVE YEARS)

Indicate

by check mark whether the Company has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities

Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☐ No ☐

The

information set forth in this Annual Report on Form 20-F is as at December 31, 2023 unless an earlier or later date is indicated.

FORM

20-F ANNUAL REPORT

TABLE

OF CONTENTS

INTRODUCTION

Nomenclature

In

this Annual Report on Form 20-F, which we refer to as the “Annual Report”, except as otherwise indicated or as the context

otherwise requires, the terms “Company”, “Avricore”, “we”, “our” or “us”

refers to Avricore Health Inc. and its subsidiaries.

You

should rely only on the information contained in this Annual Report. We have not authorized anyone to provide you with information that

is different. The information in this Annual Report may only be accurate on the date of this Annual Report or on or as at any other date

provided with respect to specific information.

The

Company was incorporated by registration of its Memorandum and Articles under the BC Companies Act on May 30, 2000 under the name “Duft

Biotech Capital Ltd.”

On

November 13, 2003, the Company acquired the assets of ALDA Pharmaceuticals Inc. (“API”), a private company founded in 1996.

On

November 26, 2003 the Company changed its name to ALDA Pharmaceuticals Corp. (“the Company”). The Company is still a British

Columbia, Canada, company.

Effective

August 19, 2005, the authorized share capital of the Company was increased to an unlimited number of common shares without par value.

There are no Indentures or Agreements limiting the payment of dividends and there are no conversion rights, special liquidation rights,

pre-emptive rights or subscription rights.

On

July 24, 2013 the Company changed its name to NUVA Pharmaceuticals Inc. (“the Company”). The Company is still a British Columbia,

Canada, company.

On

July 28, 2014 the Company changed its name to VANC Pharmaceuticals Inc. (“the Company”). The Company is still a British Columbia,

Canada, company.

On

December 28, 2017, the Company completed the acquisition of all the common shares of HealthTab Inc. (“HealthTab”), a private

company. HealthTab’s primary asset is intellectual property and certain trademarks and web domains related to the design of the

HealthTabTM system, being a lab-accurate, point of care testing platform.

On

November 5, 2018 the Company changed its name to Avricore Health Inc. (the “Company”). The Company is still a British Columbia,

Canada, company.

BUSINESS

OF AVRICORE HEALTH INC.

Avricore

Health Inc. (TSXV: AVCR) is a pharmacy service innovator focused on acquiring and developing early-stage technologies aimed at moving

pharmacy forward. Through its flagship offering HealthTab™ (a wholly owned subsidiary), it provides a turnkey point-of-care testing

platform, creating value for stakeholders and better outcomes for patients.

FINANCIAL

AND OTHER INFORMATION

The

Company’s reporting currency and domestic currency is Canadian Dollars. In this Annual Report, unless otherwise specified, all

dollar amounts are expressed in Canadian Dollars (“CDN$” or “$”). The Government of Canada permits a floating

exchange rate to determine the value of the Canadian Dollar against the U.S. Dollar (US$).

OPERATING

AND FINANCIAL REVIEW AND PROSPECTS

This

Annual Report on Form 20-F contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of

1995, principally in ITEM #4, “Information on the Company” and ITEM #5, “Operating and Financial Review of Prospects”.

These statements may be identified by the use of words like “plan,” “expect,” “aim,” “believe,”

“project,” “anticipate,” “intend,” “estimate,” “will,” “should,”

“could” and similar expressions in connection with any discussion, expectation, or projection of future operating or financial

performance, events or trends. In particular, these include statements about the Company’s strategy for growth, future performance

or results of current sales and production, interest rates, foreign exchange rates, and the outcome of contingencies, such as acquisitions

and/or legal proceedings and intellectual property issues.

Forward-looking

statements are based on certain assumptions and expectations of future events that are subject to risks and uncertainties. Actual future

results and trends may differ materially from historical results or those projected in any such forward-looking statements depending

on a variety of factors, including, among other things, the factors discussed in this Annual Report under ITEM #3, “Key Information,

Risk Factors” and factors described in documents that the Company may furnish from time to time to the Securities and Exchange

Commission. The Company undertakes no obligation to update publicly or revise any forward-looking statements because of new information.

Although

we believe that the expectations conveyed by the forward-looking statements are reasonable based on information available to us on the

date such forward-looking statements were made, no assurances can be given as to future results, levels of activity, achievements or

financial condition.

MEASUREMENT

INFORMATION

Canada

uses the metric measurement system and all of the measures used by the Company adhere to the standards of the metric system.

PART

I

ITEM

1. IDENTITY OF DIRECTORS SENIOR MANAGEMENT AND ADVISERS

Not

applicable.

ITEM

2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not

applicable.

ITEM

3. KEY INFORMATION

3.A.1.

[Reserved]

3.B.

Capitalization and Indebtedness

Not

applicable.

3.C.

Reasons for the Offer and Use of Proceeds

Not

applicable.

3.D.

Risk Factors

Risks

pertaining to the Company:

The

Company’s limited operating history makes it difficult to evaluate the Company’s current business and forecast future results.

Since

its inception, the Company has had limited revenues and has experienced significant operating losses each year. These losses are due

to substantial expenditures on intellectual property protection, product development and product testing of commercial and consumer infection

control product and pre-clinical testing for registration of a number of therapeutic products and over-the-counter (OTC) pharmaceutical

products with Health Canada and the FDA. Sales of T36® Antiseptic Hand Sanitizer products were discontinued

in the year ended December 31, 2012. During the year ended December 31, 2019, the Company discontinued its over-the-counter (OTC) pharmaceutical

products business. The Company has changed its direction, and its current operations consist of developing and implementing its HealthTab™

point-of-care technology (POCT). Currently the Company is engaged in the rollout of the HealthTab™ point-of-care testing platform

to 776 Shoppers Drug Mart and affiliated Loblaws locations nation-wide. As a result, future sales of the Company’s products are

difficult to predict.

The

Company has commenced generating operating cash flow, however failure to generate sufficient revenues and cash flow in the future could

cause the Company to go out of business.

The

Company has no history of pre-tax profit and in the previous four years has had only limited annual revenues for most of the years it

has been operating. The Company sustained operating losses for each of its fiscal years and has sustained significant accumulated operating

losses. The continued operation of the Company will be dependent upon its ability to generate operating revenues and to procure additional

financing. Based upon current plans to introduce HealthTab™ into new markets in Canada and internationally, maintain the Company’s

public listing on the TSX-Venture Exchange (the “Exchange”) and support the continued registration of its securities in the

US, the Company may incur operating losses in future periods. These losses will occur because there are continuing expenses associated

with the roll out of the Company’s HealthTab™ network, legal and accounting fees, the maintenance of its public listing and

other expenses associated with running an operating business. Even if the Company becomes operationally profitable, the Company will

need to raise significant amounts of new funding to expand these activities. Also, the Company may not be successful in generating significant

revenues in the future. At the time of this report, the Company has sufficient funds to continue the roll out of its HealthTab™

network but it may be unable to do so without securing further financing. The Company may not be successful in generating revenues or

raising capital in the future. Failure to generate revenues or raise capital could cause the Company to cease operations,

If

the Company raises further funds through equity issuances, the price of its securities could decrease due to the dilution caused by the

sale of additional shares.

Additional

funds raised by the Company through the issuance of equity or convertible debt securities will cause the Company’s current shareholders

to experience dilution and possibly lower the trading price of its shares. Such securities may grant rights, preferences or privileges

senior to those of the Company’s common shareholders.

The

Company has issued a limited number of shares out of its authorized capital of an unlimited number of common shares, which could be dilutive

and negatively affect the share price.

Having

an unlimited number of authorized but unissued common shares could allow the Company’s Directors and Officers to issue a large

number of shares without shareholder approval, leading to significant dilution of current shareholders and possible lowering of the share

price.

The

Company could enter into debt obligations and not have the funds to repay these obligations.

The

Company does not have any contractual restrictions on its ability to incur debt and, accordingly, the Company could incur significant

amounts of indebtedness to finance its operations. Any such indebtedness could contain covenants, which would restrict the Company’s

operations. The Company might not be able to repay indebtedness.

The

Company could enter into contractual obligations and not have the funds to pay for these obligations.

The

Company does not have any contractual restrictions on its ability to enter into binding agreements and, accordingly, the Company could

incur significant obligations to third parties including financial obligations. Any such obligations could restrict the Company’s

operations and the Company might not be able to pay for its commitments. If the Company cannot meet its commitments, legal action could

be taken against the Company. Any such actions could further restrict the Company’s ability to conduct its business or could cause

the Company to go out of business.

The

Company’s information technology systems are susceptible to certain risks, including cyber security breaches, which could adversely

impact the Company’s operations and financial condition.

The

Company’s operations involve information technology systems that process, transmit and store information about our suppliers, customers,

employees, and financial information. These systems face threats including telecommunication failures, natural disasters, and cyber security

threats, including computer viruses, unauthorized access to our systems, and other security issues. While the Company has implemented

security measures to protect these systems, such threats change and evolve almost daily. There is no guarantee these actions will secure

the information systems against all threats and vulnerabilities. The compromise or failure of these information systems could have a

negative effect on the Company’s operations and financial condition.

As

the Company is a Canadian company, it may be difficult for U.S. shareholders of the Company to effect service on the Company or to realize

on judgments obtained in the United States.

The

Company is a Canadian corporation. All of its directors and officers are residents of Canada and a significant part of its assets are,

or will be, located outside of the United States. As a result, it may be difficult for shareholders resident in the United States to

effect service within the United States upon the Company, directors, officers or experts who are not residents of the United States,

or to realize in the United States judgments of courts of the United States predicated upon civil liability of any of the Company, directors

or officers under the United States federal securities laws. If a judgment is obtained in the U.S. courts based on civil liability provisions

of the U.S. federal securities laws against the Company or its directors or officers, it will be difficult to enforce the judgment in

the Canadian courts against the Company and any of the Company’s non-U.S. resident executive officers or directors. Accordingly,

United States shareholders may be forced to bring actions against the Company and its respective directors and officers under Canadian

law and in Canadian courts in order to enforce any claims that they may have against the Company or its directors and officers. Nevertheless,

it may be difficult for United States shareholders to bring an original action in the Canadian courts to enforce liabilities based on

the U.S. federal securities laws against the Company and any of the Company’s non-U.S. resident executive officers or directors.

The

Company’s future performance is dependent on key personnel. The loss of the services of any of the Company’s executives or

Board of Directors could have a material adverse effect on the Company.

The

Company’s performance is substantially dependent on the performance and continued efforts of the Company’s executives and

its Board of Directors. The loss of the services of any of the Company’s executives or Board of Directors could have a material

adverse effect on the Company’s business, results of operations and financial condition. There is no assurance that key personnel

can be replaced with people with similar qualifications within a reasonable period of time. If any or all Directors resign, there is

no assurance that new Directors can be found to replace any directors who resign.

The

Company has not declared any dividends since its inception in 2000 and has no present intention of paying any cash dividends on its common

shares in the foreseeable future.

The

Company has not declared any dividends since its inception in 2000 and has no present intention of paying any cash dividends on its common

shares in the foreseeable future. The payment by the Company of dividends, if any, in the future, rests in the discretion of the Company’s

Board of Directors and will depend, among other things, upon the Company’s earnings, its capital requirements and financial condition,

as well as other relevant factors.

There

is no assurance that the Company will be able to secure the funds needed for future development, and failure to secure such funds could

lead to a lack of opportunities for growth.

A

lack of funds would also impair the Company’s ability to roll out the HealthTab™ network. If adequate financing is not available

when required, the Company may be required to delay, scale back or eliminate various activities and may be unable to continue in operation.

The Company may seek such additional financing through debt or equity offerings, but there can be no assurance that such financing will

be available on terms acceptable to the Company or at all. Any equity offering will result in dilution to the ownership interests of

the Company’s shareholders and may result in dilution to the value of such interests.

Conflicts

of interest may exist for Directors and Officers which may inhibit their ability to act in the best interests of the Company and its

shareholders leading to possible impairment of the Company’s ability to achieve its business objectives.

The

directors and officers of the Company will not be devoting all of their time to the affairs of the Company. Some of the directors and

officers of the Company are directors and officers of other companies. The directors and officers of the Company will be required by

law to act in the best interests of the Company. They will have the same obligations to the other companies in respect of which they

act as directors and officers. Discharge by the directors and officers of their obligations to the Company may result in a breach of

their obligations to the other companies and, in certain circumstances, this could expose the Company to liability to those companies.

Similarly, discharge by the directors and officers of their obligations to the other companies could result in a breach of their obligation

to act in the best interests of the Company. Such conflicting legal obligations may expose the Company to liability to others and impair

its ability to achieve its business objectives.

Management

of the Company can, through their stock ownership in the Company, influence all matters requiring approval by the Company’s shareholders.

Management

of the Company at the time of this report, collectively own approximately 10% of the Company’s issued and outstanding common shares

at that date. These shareholders, if acting together, could significantly influence all matters requiring approval by the Company’s

shareholders, including the election of directors and the approval of mergers or other business combination transactions. Management

may not make decisions that will maximize shareholder value and may make decisions that will contribute to or cause the entrenchment

of management.

The

value and transferability of the Company shares may be adversely impacted by the limited trading market for the Company’s common

shares.

The

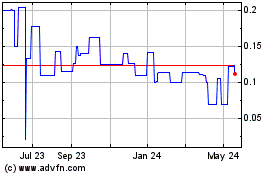

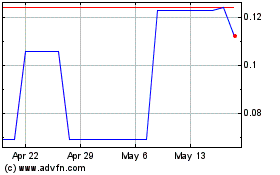

Company’s common shares are currently quoted on the TSX Venture Exchange under the symbol “AVCR” and on the OTCQB under

the symbol “AVCRF”. No assurance can be given that a market for the Company’s common shares will be quoted on an exchange

in the U.S. or on the Over the Counter Bulletin Board. The Company’s common shares may be subject to illiquidity and investors

may not be able to sell their shares in a timely manner.

The

value and transferability of the Company shares may be adversely impacted by the penny stock rules.

The

sale or transfer of the Company common shares by shareholders in the United States may be subject to the so-called “penny stock

rules.” Under Rule 15g-9 of the Exchange Act, a broker or dealer may not sell a “penny stock” (as defined in Rule 3a51-1)

or effect the purchase of a penny stock by any person unless:

| (a) | Such

sale or purchase is exempt from Rule 15g-9; |

| (b) | Prior

to the transaction the broker or dealer has (1) approved the person’s account for transaction

in penny stocks in accordance with Rule 15g-9, and (2) received from the person a written

agreement to the transaction setting forth the identity and quantity of the penny stock to

be purchased; and |

| (c) | The

purchaser has been provided an appropriate disclosure statement as to penny stock investment. |

The

SEC adopted regulations generally define a penny stock to be any equity security other than a security excluded from such definition

by Rule 3a51-1. Such exemptions include, but are not limited to (1) an equity security issued by an issuer that has (i) net tangible

assets of at least $2,000,000, if such issuer has been in continuous operations for at least three years, (ii) net tangible assets of

at least $5,000,000, if such issuer has been in continuous operation for less than three years, or (iii) average revenue of at least

$6,000,000 for the preceding three years; (2) except for purposes of Section 7(b) of the Exchange Act and Rule 419, any security that

has a price of $5.00 or more; and (3) a security that is authorized or approved for authorization upon notice of issuance for quotation

on the NASDAQ Stock Market, Inc.’s Automated Quotation System. It is likely that the Company’s common shares, assuming a

market were to develop in the US, will be subject to the regulations on penny stocks. Consequently, the market liquidity for the common

shares may be adversely affected by such regulations limiting the ability of broker/dealers to sell the Company’s common shares

and the ability of shareholders to sell their securities in the secondary market in the US Moreover, the Company shares may only be sold

or transferred by the Company shareholders in those jurisdictions in the US in which an exemption for such “secondary trading”

exists or in which the shares may have been registered.

There

is no guarantee that there is a market for the Company’s common shares in the United States.

Although

the Company’s common shares were added to the OTC Bulletin Board System on April 20, 2009 under the symbol “APCSF”,

and the Company’s common shares are currently trading on the OTCQB under the symbol “AVCRF”, trading of the Company’s

shares is very limited. The Company cannot guarantee that there will be a market for the Company’s common shares in the United

States or that there will any significant amount trading in the Company’s shares for the foreseeable future. The Company cannot

guarantee that it will continue to maintain a listing in the United States or that it will not be found in default of existing regulations

or new regulations and be suspended from trading or delisted.

Risks

Pertaining to the Industry

There

is a risk of competition from alternative POCT platforms.

Although

competition is currently limited competitors may emerge offering alternative platforms. The Company will be competing with companies

that are potentially already entrenched in some markets or may be better funded than the Company.

There

is a risk that the Company’s intellectual property infringes upon the rights of other companies, which could lead to reduced revenues,

reduced margins due to sanctions against the Company, outright withdrawal or prohibition of products or trademarks from the market and

significant costs for legal defense against infringement claims, re-branding of products and revised marketing materials.

The

Company is unaware of any infringement claims being made against the Company or its products or processes at the time of writing. In

the future, there can be no assurances that third parties will not assert infringement claims in the future or require the Company to

obtain a license for the intellectual property rights of such third parties. There can be no assurance that such a license, if required,

will be available on reasonable terms or at all. If the Company does not obtain such a license, it could encounter delays in the roll

out of the Company’s HealthTab™ network.

ITEM

4. INFORMATION ON THE COMPANY

4.A.

History and Development of the Company

Capital

Pool Company

The

Company was incorporated by registration of its Memorandum and Articles under the BC Companies Act on May 30, 2000 under the name “Duft

Biotech Capital Ltd.” and was classified as a Capital Pool Company (“CPC”) on the TSX Venture Exchange. Under the policies

of the TSX Venture Exchange, the principal business of a CPC is to identify and evaluate opportunities for acquisition. The completion

of such an acquisition is referred to as a Qualifying Transaction. A CPC does not carry on any business other than the identification

and evaluation of assets or businesses in connection with potential Qualifying Transactions, does not have business operations or assets

other than seed capital and has no written or oral agreements for the acquisition of an asset or business at the time of formation.

A

“Qualifying Transaction”, pursuant to the policies of the TSX Venture Exchange, is a transaction whereby a capital pool company:

| (a) | Issues

or proposes to issue, in consideration for the acquisition of significant assets or businesses,

common shares or securities convertible, exchangeable or exercisable into common shares,

which, if fully converted, exchanged or exercised would represent more than 25 percent of

its common shares issued and outstanding immediately prior to the issuance; |

| (b) | Enters

into an arrangement, amalgamation, merger or reorganization with another issuer with significant

assets, whereby the ratio of securities which are distributed to the security holders of

the capital pool company and the other issuer results in the security holders of the other

issuer acquiring control of the resulting entity; or |

| (c) | Otherwise

acquires significant assets other than cash. |

On

November 13, 2003, the Company acquired the assets of ALDA Pharmaceuticals Inc. (“API”), a private company founded in 1996.

Financings

The

Company has financed its operations since inception through funds raised in a series of private placements of common shares:

| Fiscal

Year Ended | |

Nature

of Share Issuance | |

Number

of Shares | |

Amount

($) |

| 30-Jun-2001 | |

Private Placement @ | |

$ | 0.34 | | |

| 294,119 | | |

$ | 100,000 | |

| 30-Jun-2002 | |

Canadian Prospectus Offering (IPO) @ | |

$ | 0.68 | | |

| 300,000 | | |

$ | 204,000 | |

| 30-Jun-2003 | |

Broker’s Warrant Shares on Canadian

Prospectus Offering (IPO) @ | |

$ | 0.68 | | |

| 37,500 | | |

$ | 25,500 | |

| 30-Jun-2004 | |

Private Placement @ | |

$ | 0.60 | | |

| 86,667 | | |

$ | 52,000 | |

| | |

Private Placement @ | |

$ | 0.80 | | |

| 1,550,000 | | |

$ | 1,240,000 | |

| 30-Jun-2005 | |

Private Placement @ | |

$ | 0.40 | | |

| 750,000 | | |

$ | 300,000 | |

| 30-Jun-2006 | |

Private Placement @ | |

$ | 0.20 | | |

| 979,000 | | |

$ | 195,800 | |

| | |

Private Placement @ | |

$ | 0.20 | | |

| 275,000 | | |

$ | 55,000 | |

| 30-Jun-2007 | |

Private Placement @ | |

$ | 0.20 | | |

| 357,500 | | |

$ | 71,500 | |

| | |

Private Placement @ | |

$ | 0.40 | | |

| 2,000,000 | | |

$ | 800,000 | |

| 30-Jun-2008 | |

Private Placement @ | |

$ | 0.48 | | |

| 500,000 | | |

$ | 240,000 | |

| | |

Private Placement @ | |

$ | 0.60 | | |

| 875,000 | | |

$ | 525,000 | |

| 30-Jun-2009 | |

N/A | |

| | | |

| | | |

| N/A | |

| 30-Jun-2010 | |

Private Placement @ | |

$ | 1.00 | | |

| 1,500,000 | | |

$ | 1,500,000 | |

| 30-Jun-2011 | |

Private Placement @ | |

$ | 0.40 | | |

| 818,750 | | |

$ | 327,500 | |

| | |

Private Placement @ | |

$ | 0.40 | | |

| 500,000 | | |

$ | 200,000 | |

| 30-Jun-2012 | |

Private Placement @ | |

$ | 0.40 | | |

| 140,000 | | |

$ | 56,000 | |

| 30-Jun-2013 | |

Private Placement @ | |

$ | 0.40 | | |

| 2,000,000 | | |

$ | 800,000 | |

| 30-Jun-2014 | |

Private Placement @ | |

$ | 0.40 | | |

| 937,500 | | |

$ | 375,000 | |

| 30-Jun-2015 | |

Private Placement @ | |

$ | 0.60 | | |

| 1,901,833 | | |

$ | 1,141,100 | |

| Stub period ended 31-Dec-2015 | |

N/A | |

| | | |

| | | |

| N/A | |

| 31-Dec-2016 | |

N/A | |

| | | |

| | | |

| N/A | |

| 31-Dec-2017 | |

Private Placement @ | |

$ | 0.15 | | |

| 10,585,326 | | |

$ | 1,587,799 | |

| 31-Dec-2018 | |

Private Placement @ | |

$ | 0.15 | | |

| 5,327,335 | | |

$ | 799,100 | |

| 31-Dec-2019 | |

Private Placement @ | |

$ | 0.05 | | |

| 6,852,400 | | |

$ | 342,620 | |

| 31-Dec-2019 | |

Private Placement @ | |

$ | 0.07 | | |

| 4,206,435 | | |

$ | 294,450 | |

| 31-Dec-2020 | |

Private Placement @ | |

$ | 0.10 | | |

| 6,260,000 | | |

$ | 626,000 | |

| 31-Dec-2021 | |

Private Placement @ | |

$ | 0.10 | | |

| 8,740,000 | | |

$ | 874,000 | |

| 31-Dec-2021 | |

Private Placement @ | |

$ | 0.22 | | |

| 7,000,000 | | |

$ | 1,540,000 | |

4.B.

Business Overview

Operations

& Principal Activities

Avricore

Health Inc. is a pharmacy service innovator focused on acquiring and developing early-stage technologies aimed at moving pharmacy forward.

Through its flagship offering HealthTab™ (a wholly owned subsidiary), it provides a turnkey point-of-care testing platform, creating

value for stakeholders and better outcomes for patients.

During

the year ended December 31, 2019, the Company discontinued its over-the-counter (OTC) pharmaceutical products business and ceased production

and sales of all generic and over-the-counter pharmaceuticals.

Avricore

sees the community pharmacy as underutilized and is committed to supporting their ability to deliver innovation to modern healthcare

consumers. Pharmacies face reduced revenues as a result of disruptions to the sector and regulatory changes. As a result, pharmacy owners

are actively looking for innovations in service and value-added services, like HealthTab™, to support their business growth beyond

the traditional dispensing model. Community pharmacy is expected to focus increasingly on cognitive services with attendant point of

care testing in the future.

The

Company hopes to improve health outcomes for patients and lower overall healthcare system costs in this way, bridging traditional healthcare

platforms with disruptive innovations and eventually achieving the healthcare cost savings government and private payors are seeking

to achieve.

This

is all possible thanks to the Company’s HealthTab™ technology, which provides lab-accurate results for specific blood work

within 12 minutes. Installed at the pharmacy and administered by the attending pharmacist, the patient can quickly access up to 27 bio-markers.

The advantage of this innovation is that a consumer can quickly access data on their health with a simple patient assisted finger prick

to share with their physician and healthcare team, track their health overtime, measure the impacts of therapies they are undertaking

and screen for potential health risks.

HealthTab™

allows for these innovations to be accessed in a low barrier manner at the community pharmacy level for a balanced cost. The pharmacist

is also able to benefit from this new revenue stream, build a deeper relationship with clientele and fully realize their ability to deliver

lower cost healthcare support.

693

HealthTab™ systems were operating in Shoppers Drug Mart® and Loblaw family stores including pharmacist walk-in clinics as of

December 31, 2023; 448 in Ontario and 74 in British Columbia, 12 in Nova Scotia, 151 in Alberta, 1 in Prince Edward Island, 2 in Saskatchewan

and 5 in New Brunswick. The Company was honoured to have HealthTab™ placed in the first pharmacist-led primary healthcare clinic

located in Lethbridge, Alberta. Not only was this the first clinic, it was also the first system placed in a Real Canadian Superstore®,

as well as its first Alberta location.

Avricore

is focused on expanding and further deploying HealthTab™ to best meet the current community pharmacy sector’s needs. The

Company is also in late-stage discussions with other Canadian and international major pharmacy chains, and has a strong prospect list

for future expansion.

The

Company promotes a cleaner and greener economy and continues to drive towards sustainability, including regular evaluations of its sourcing

and shipping procedures to ensure they are environmentally friendly.

Key

developments in the later quarters of the year ended December 31, 2023 have included:

Key

developments have included:

| ● | In

the year ended December 31, 2023 revenue increased by 97% year over year to $3,485,147 and

gross profit increased by 163% to $1,203,396. |

| | | |

| ● | In

the three months ended December 31, 2023 revenue increased by 39% year over year to $1,354,403

and gross profit increased by 197% to $501,466. |

| | | |

| ● | Avricore

has partnered with Ascensia Diabetes Care to integrate their blood glucose monitoring systems,

CONTOUR®NEXT GEN and CONTOUR®NEXT ONE, with Avricore’s HealthTab™ platform.

The collaboration aims to improve diabetes management for patients and pharmacists in Canada

by linking daily blood glucose testing data to the patient’s HealthTab™ account.

This integration will provide a more comprehensive health data tool for combating diabetes.

The technical work is expected to be completed by Q3 of this year, with ongoing efforts to

encourage patient engagement. Ascensia Diabetes Care is a global company focused on supporting

people with diabetes and is a subsidiary of PHC Holdings Corporation. |

| | | |

| ● | In

September 2023, the Company announced its first testing location within Rexall’s Pharmacy

Walk-In Clinic in Sherwood Park, Alberta. That location, a first for Rexall as well, offers

both the Afinion 2™ blood-chemistry analyzer as well as the ID Now™ molecular

platform by Abbott Rapid Diagnostics, giving patients quick access to their test results,

and allowing for immediate consultation with their pharmacist. |

| | | |

| ● | Subsequent

to the initial launch, the Company was pleased to announce further expansion of HealthTab™

with Rexall Pharmacy Group ULC (“Rexall”). The Companies have been working closely

to develop the best patient approaches and internal workflows to ensure the most successful

deployment of this powerful point-of-care testing platform. |

| | | |

| ● | The

next steps with Rexall will be to deploy a minimum of another 20 locations spread out between

stores in Alberta and Ontario. After each deployment, the teams will collaborate to assess

deployment workflow, refine processes and identify further deployment opportunities based

on patient and pharmacist feedback. |

| | | |

| ● | Avricore’s

HealthTab™ platform has been selected by a collaborative effort involving Barts Heart

Centre and HEART UK to assess the feasibility of community pharmacists in the UK providing

cholesterol testing alongside blood pressure checks for cardiovascular risk evaluation. The

study aims to build on the success of over 930,000 blood pressure checks conducted in 6,000

pharmacies as part of an NHS initiative. With NHS England allocating £645 million (approx.

$1.1 billion CDN$) to increase access to primary care, HealthTab™ will support pharmacists

in delivering vital support for chronic diseases. |

| | | |

| ● | Signing

a reseller agreement between HealthTab™ Inc. and Abbott Rapid Diagnostics Limited UK

& Ireland. This agreement provides a foundation for HealthTab™ to purchase and

distribute the Afinion™ 2 and associated tests for diabetes and heart disease screening

in community pharmacies in the United Kingdom. |

| | | |

| ● | The

Company has significantly expanded the number of Shoppers Drug Mart pharmacies offering its

HealthTab™ point-of-care testing platform under a renewed Master Service Agreement

(MSA) to 776 locations nation-wide. In addition to Shoppers Drug Mart pharmacies, this new

MSA and corresponding Statement of Work (SOW) provides for affiliated locations under the

Loblaws family of brands, to utilize HealthTab™ upon request. |

Key

developments subsequent to December 31, 2023 have included:

| ● | Subsequent

to December 31, 2023 an additional 83 systems have been deployed for a total of 776 participating

Shoppers Drug Mart® pharmacies and Loblaw family stores offering screening tests to patients

via HealthTab™ systems as of the date of this report. |

| | | |

| ● | In

212 of these locations, the Company has deployed Abbott’s ID Now™, either in combination

with the Afinion 2™ or standalone, to offer confirmed molecular testing for virus detection

in community pharmacies. Last year’s “tripledemic” (Flu, RSV and Covid)

strained the Canadian healthcare system beyond its breaking point. This year scientists are

concerned about a heavily mutated Covid variant. Pharmacy will play a key a role in these

battles and confirmed tests results means faster responses, better treatment and less spread

of these infectious diseases. |

| | | |

| ● | While

flu season strains pharmacies’ capacity for chronic disease screening and management,

having the ID Now™ means HealthTab™ can support pharmacies with confirmed molecular

testing for virus detection during these critical months of the year and diversify the Company’s

revenues. |

| | | |

| ● | The

innovative practice of pharmacist-led primary healthcare clinics is expected to expand, as

provinces struggle to meet the health care needs of their residents and recruit more family

physicians. The program’s primary focus is to screen patients at-risk for diabetes

and cardiovascular disease. In-store signage and print material will let customers know they

are able to request HealthTab™ tests, and existing patients will be made aware through

direct outreach from their Shoppers Drug Mart® or Real Canadian Superstore® pharmacist

based on their health profile. On March 28th, 2023, the Government of Canada tabled its budget

for the year ahead, including a 10-year funding agreement with the Nation’s provinces

to increase healthcare funding. This new funding approach is novel for the fact that each

province will have specific agreements, opposed to the more traditional generalized formula.

This approach is expected to bring substantial innovations related to healthcare data and

new healthcare service delivery, as the provinces agreed to make changes to rules and practices

which have limited data-flow optimization and healthcare access. |

| | | |

| ● | The

Canadian Medical Association expressed support for many of the initiatives on March 30th,

2023, in relation to the healthcare agreement and encouraged government to institute recommendations

from the Addressing Canada’s Health Workforce Crisis report from the Standing

Committee on Health. One of the key items they pointed to was “…optimizing

scopes of practice for health professionals…”. |

| | | |

| ● | Most

provinces have already begun expanding the scope of practice of their pharmacists, with 7

provinces allowing these healthcare professionals to prescribe for minor ailments and 8 provinces

either allowing or will soon allow them to order and interpret lab results. |

| | | |

| ● | As

of July 1st, 2022, the Government of Ontario brought into effect an expanded scope of practice

for community pharmacists in the province, joining Alberta in this growing and increasingly

popular approach. This includes limited prescribing for minor ailments, as well as the ability

to perform certain point-of-care tests to assist patients with managing chronic disease.

Approved tests include glucose, HbA1c and lipids, all of which HealthTab™ currently

offers with the Abbott Afinion 2™. Also announced as part of this plan in Ontario,

is a second stage of scope modifications, which began on January 1, 2023. This stage allows

for limited prescribing for minor ailments and certain prescription renewals, further enhancing

the value of community pharmacy. |

| | | |

| ● | These

changes, and increasing demand, means Canadian pharmacy business is rapidly changing before

our eyes, from being product focused to service focused. At $51.4 billion, the industry already

represents a significant impact on healthcare, and the anticipated increase in funding and

new service offerings, including point-of-care testing, will mean this practice will play

an even more impactful role going forward. |

| | | |

| ● | During

the pilot with Shoppers Drug Mart®, over 15,000 HealthTab™ tests were completed

for more than 6,900 patients. The data collected confirmed that the patients tested had a

high prevalence of previously undiagnosed diabetes, pre-diabetes and heart disease and significant

near-term risk for major health events. Almost 60 per cent of patients needed an intervention

to better manage their chronic disease. On average, 31 percent received a new chronic medication,

28 percent required a change in their current medication, and 235 patients were newly identified

as diabetic. Patients also reported in post surveys that they valued receiving this information

from their pharmacists, and those pharmacists indicated that HealthTab™ enabled an

increase in the value of services they were able to provide to their patients. |

| ● | Developed

a unique quality assurance program with a third-part reference laboratory to offer HealthTab™

pharmacies industry leading validation for point-of-care instruments and test consumables. |

| | | |

| ● | Signing

of a non-exclusive, pilot supplier distribution agreement in Canada between HealthTab™

Inc., and Abbott, with respect to the handheld blood chemistry analyzer, i-STAT Alinity.

The agreement allows HealthTab™ to distribute Abbott’s point-of-care i-STAT Alinity

and its associated tests for creatinine in Canadian pharmacies to better support patients

with important information about their renal function. |

| | | |

| ● | Amendment

to the Distribution Agreement adds Abbott’s popular ID NOW™ molecular testing

device which will add onsite testing and reporting capabilities for SARS-CoV-2 as well as

Respiratory Syncytial Virus (RSV), Influenza A & B and Streptococcus – a powerful

combination for detecting infections before they spread. |

| | | |

| ● | Developing

new pilot programs with national pharmacy chains, |

| | | |

| ● | Continuing

to negotiate new POC diagnostic device integrations to expand the HealthTab™ testing

menu. |

| | | |

| ● | Refining

HealthTab™’s de-centralized clinical trials capabilities to monetize de-identified

data associated with high-value Real-World Evaluation (RWE). |

| | | |

| ● | Moving

forward with negotiations across several target demographics, domestically and internationally,

with pharmacies, life-science companies, host-locations, and Clinical Research Organizations

(CRO). |

Industry

Trends

HealthTab™

is a cloud-based network technology that enables the world’s first harmonized, real-time response system where consumers receive

a finger-stick blood test at their local pharmacy via a web-enabled clinical grade blood chemistry analyzer. These results are available

in 12 minutes. Consumers’ bio-markers, which include key results related to heart, liver and kidney function, are received via

secure login which they can then use to better understand their health performance and share with their healthcare team for evidence-based

decision making. This one-of-a-kind real-time reporting system opens the door to improved preventative healthcare in public and private

health systems.

De-identified

data collected, with consumer consent across the HealthTab™ network of analyzers, can be shared with life-science companies and

other research entities including the clinical research industry. The traditional clinical trial approach can be limited in the scope

of time, demographical outreach, and other inherent exclusionary attributes. HealthTab™ presents a revolutionary model for utilizing

the system’s unique ability to offer real-time evaluations of treated populations and real-world evaluation clinical trials.

Between

January and February 2020, the Deloitte Center for Health Solutions surveyed multiple leaders from 17 pharmaceutical companies on their

organizations’ RWE capabilities. Survey questions revolved around current and future applications for RWE, areas of investment,

strategic partnerships, and use of Real World Data (RWD) and RWE in R&D.

| ● | Ninety-four

percent of survey respondents believe using RWE in R&D will become important or very

important to their organizations by 2022. |

| | | |

| ● | Almost

all companies expect to increase investments in talent, technology, and external partnerships

to strengthen their RWE capabilities. |

| | | |

| ● | Reduced

clinical trial costs and trial failure rates using RWE in R&D |

| | | |

| ● | Entered

strategic partnerships to access new sources of RWD (in fact, all have taken this step) |

The

Company believes it is very well positioned as a strategic partner and lead in this exciting growth sector. In addition, HealthTab™

is ideally situated to provide Real Time Real World Data (RTRWD). This is an important distinction from RWD because HealthTab™’s

anonymized data can be transmitted in real time versus the lag that is accompanied with RWD that is gathered from clinical reporting

systems, insurance claims and adverse event reporting systems.

Currently,

HealthTab™ is available in certain Shoppers Drug Marts in several Canadian provinces. The Company has secured commitments with

other pharmacies in Canada to place additional HealthTab™ systems and is in negotiations with corporate chains. Furthermore, the

Company expanded a partnership agreement with the Ontario Pharmacists Association (OPA) to endorse HealthTab™ to pharmacies conducting

COVID-19 testing and government for real-time reporting of test results. The OPA is the largest pharmacists’ association in the

country, with over 10,000 members and over 4,600 community pharmacy locations.

HealthTab™

is being embraced as it is the most credible way to deploy point-of-care testing in the pharmacy and community setting where it offers

the reliability, accuracy and flexibility the sector needs. Avricore has enjoyed a robust response from a variety of key industry players

including, CROs, labs, pharmacies and researchers and has been engaging in a variety of technical discussions which are anticipated to

lead to business.

As

conversations progress, the Company will be making announcements in due course.

Fully

Integrated Patient Health Records

The

Company has been in technical discussions on the integration of HealthTab™ into the electronic medical records and pharmacy management

systems with a Canadian market leader in the provision of these systems.

HealthTab™’s

API integration capabilities make it ideal to achieve an industry first, where a consumer’s test results can be directly linked

to an electronic medical record as well as a patient’s personal health record, for real-time responses and smooth integration across

the multiple platforms a health provider will use.

Connected

Medical Devices

With

greater utilization of integrated devices in almost all other sectors of daily life, the seamless connection of medical devices has been

slow to catch up. That is changing, as Electronic Health Records (EHS) are becoming increasingly important to patients, providers, and

researchers. Having quick, reliable access to critical information means better healthcare outcomes and by the end of 2024, the connected

medical device market is expected to reach over $23 billion US and achieving $133 billion US by 2029. This sector includes near-to-patient

devices like wearables, screening and diagnostic tools and even hospital-based systems.

Community

Pharmacy Sector

In

an era of rapid change in health care delivery, community pharmacy practice models and community pharmacy business models are both experiencing

significant evolution in focus and daunting challenges to be met. We strongly believe that Avricore is a game-changing catalyst for community

pharmacy to meet their practice and business challenges and increasingly focus on patient-centred cognitive services with attendant point-of-care

testing in the future. Avricore is focused on expanding and further deploying its HealthTab™ and to best meet the current community

pharmacy sector’s needs.

HealthTab

Market Fast Facts

| ● | Point

of Care Testing Market to reach $93.21 Billion USD in 2030 (Source) |

| ● | Nearly

13.6 Million Canadians expected to be diabetic or prediabetic by 2030, with many undiagnosed

(Source) |

| ● | Over

1 in 3 Americans, approximately 88 million people, have pre-diabetes (Source) |

| ● | Close

to 160,000 Canadians 20 years and older are diagnosed with heart disease each year, often

it’s only after a heart attack they are diagnosed (Source) |

| ● | There

are more than 10,000 pharmacies in Canada, 88,000 pharmacies in the US, nearly 12,000 in

the UK. |

According

to PWC Canada’s most recent consumer survey, Canadians consumers have been utilizing technology to take better control of

their health and 75% of them have as many as three health related apps installed on their mobile device.

They

also state: “Many Canadians are willing to share their personal information to facilitate ease of access to personal health

information through digital channels. Think of accessing lab or diagnostic test results online days after getting the test, instead of

having to wait for results and visiting the doctor, or waiting for a phone call.”

The

internet of things has hit healthcare consumer trends in a large way and consumers are benefitting from faster, lower cost analysis direct

to their device. The Global Consumer Insights Survey (GCIS) demonstrated the rapid shift with more than two-thirds of those surveyed

stating they trusted tech companies - not known to be in healthcare, but in hardware, software and online shopping - to access healthcare

services.

67%

of consumers stated they were either “somewhat comfortable or very comfortable” with accessing healthcare products and services

from a company with all their information collated in one place. This means companies offering health insurance, over-the-counter medications,

or digital diagnostics.

Healthcare

data, its capture, analysis and delivery to the consumer is a top market priority as consumers are looking to take greater control, however;

those same consumers are looking to companies to manage the security of that data well and use it ethically.

The

MIT Technology Review has looked at consumer pay genomic services, largely offered online, and have found that 26 Million people

have taken one of these tests. “You may discover unexpected facts about yourself or your family when using our services,”

warns the most popular company’s privacy statement. “Once discoveries are made, we can’t undo them.”

In

addition to the shift in direct access healthcare technology is offering, policy changes toward healthcare policy is also creating dynamics

within the market.

The

Ontario Pharmacy Evidence Network’s most recent paper looked at a wide ranging of policy changes affecting Ontario alone.

They found an industry going through “significant changes” thanks to the Patients First Action Plan and the Proposal

to Strengthen Patient-Centered Health Care in Ontario are driving a more date-driven and patient centered approach.

It

has also meant that pharmacy has had to contend with offering greater service innovation with less revenues, as controls placed on generic

drug pricing and limits on certain revenue streams, like manufacture rebates, have come into effect.

“As

pharmacies develop their own technology,” the authors state “the integration of health care provider records and the emergence

of patient-controlled or viewable health records are important areas of health care transformation.”

This

means consumers want better data control about their health and the market will need to deliver.

Manufacturing

- The Company has discontinued the manufacturing of OTC and generic drugs.

4.C.

Organization structure

The

Company is not part of a group and has one wholly-owned subsidiary, HealthTab Inc., which is incorporated in British Columbia.

4.D.

Equipment

The

Company’s property, plant and equipment is HealthTabTM systems deployed at pharmacy locations, comprised of system analyzers,

system computer hardware and systems software.

Item

4A Unresolved Staff Comments

Not

applicable.

ITEM

5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS

The

following discussion and analysis of the financial condition and operational performance should be read in conjunction with the audited

consolidated financial statements of the Company and the notes thereto prepared in accordance with IFRS.

5.

A. Operating Results of the Company

Overview

In

the last several years, the Company’s primary focus was on expanding its HealthTab™ point-of-care testing platform in pharmacies

across Canada and beyond and begin to generate more substantial revenues. The pilot project announced with Shoppers Drug Mart® was

successfully executed, despite operating under the extraordinary impacts of the COVID-19 pandemic. Currently the Company has completed

the rollout of 776 HealthTab™ point-of-care testing platform Shoppers Drug Mart and affiliated Loblaws locations nation-wide.

The

Company is in discussions with multiple pharmacy groups to expand the Canadian and international HealthTab™ network.

The

most recent financials demonstrated that fiscal 2023 saw a year-over-year 97% increase in revenues and the Company has maintained strong

fiscal discipline, maintaining a moderate operating cost model, conserving cash, and limiting exposure to further equity dilution while

executing on the build out of HealthTab™.

Management’s

focus is on expansion of the business to new markets, locations and jurisdictions; cost control and positive cash flows to ensure sustainable

operations of the Company.

Results

of Operations for the years ended December 31, 2023, 2022 and 2021

Revenue

from the continuing operations was $3,485,147 for the year ended December 31, 2023 (2022 - $1,768,374; 2021 - $122,808). This represents

the revenue earned by the POTC HealthTab™ business acquired in 2018.

Marketing

and Communication expenses

| | |

Year

ended December 31, 2023 | | |

Year

ended December 31, 2022 | | |

Year

ended December 31, 2021 | |

| | |

| $ | | |

| $ | | |

| $ | |

| Marketing | |

| - | | |

| - | | |

| - | |

| Shareholder

communications | |

| 112,234 | | |

| 173,035 | | |

| 329,342 | |

| | |

| 112,234 | | |

| 173,035 | | |

| 329,342 | |

General

and Administrative expenses

| | |

Year ended | | |

Year ended | | |

Year ended | |

| | |

December

31, 2023 | | |

December

31, 2022 | | |

December

31, 2021 | |

| | |

| $ | | |

| $ | | |

| $ | |

| Bank service charges | |

| 6,008 | | |

| 5,421 | | |

| 6,806 | |

| Filing and registration fees | |

| 61,569 | | |

| 40,563 | | |

| 59,635 | |

| Insurance | |

| 92,812 | | |

| 60,251 | | |

| 44,784 | |

| Investor relations | |

| - | | |

| - | | |

| 5,312 | |

| Office maintenance | |

| 44,545 | | |

| 31,888 | | |

| 30,738 | |

| Payroll | |

| 70,495 | | |

| 34,813 | | |

| - | |

| Regulatory fees | |

| 7,373 | | |

| 5,238 | | |

| 8,380 | |

| Rent | |

| 18,000 | | |

| 16,800 | | |

| 12,810 | |

| Travel | |

| 35,317 | | |

| 55,170 | | |

| 14,382 | |

| Warranty expense | |

| 3,250 | | |

| - | | |

| - | |

| | |

| 339,369 | | |

| 250,144 | | |

| 182,847 | |

Share-based

compensation

Share-based

compensation for the year ended December 31, 2023 of $703,612 (2022: $331,522; 2021: $495,791) is a non-cash item that represents the

allocation of the fair value of options over the vesting period.

5.

B. Liquidity and capital resources

Liquidity

The

Company’s operations have been financed through the issuance of common shares. Management anticipates that additional financings

or capital requirements to fund the current commercial operations and working capital will be required to grow the business to the sustainable

level.

Cash

flows

Sources

and Uses of Cash:

| | |

Year ended | | |

Year ended | | |

Year ended | |

| | |

December

31, 2023 | | |

December

31, 2022 | | |

December

31, 2021 | |

| | |

| $ | | |

| $ | | |

| $ | |

| Cash used in operating activities | |

| 660,403 | | |

| (437,832 | ) | |

| (1,234,154 | ) |

| Cash used in investing activities | |

| (1,046,859 | ) | |

| (1,208,516 | ) | |

| (140,364 | ) |

| Cash provided by financing activities | |

| 42,500 | | |

| 253,880 | | |

| 3,084,798 | |

| Net change in cash and cash equivalents | |

| (343,956 | ) | |

| (1,392,468 | ) | |

| 1,710,280 | |

| Cash and Cash Equivalents | |

| 276,571 | | |

| 620,527 | | |

| 2,012,995 | |

Capital

resources

Management

devotes financial resources to the Company’s operations, sales and commercialization efforts, and business development. The Company

will require cash to support working capital.

At

December 31, 2023, the Company had a working capital of $244,343, compared to $826,238 at December 31, 2022. The Company believes that

its cash on hand, the expected future cash inflows from the sale of its products, net proceeds from the closing of private placements

and proceeds from loans, stock options and warrants exercised, if any, will be sufficient to finance the Company’s working capital

and operational needs for at least the next 6 months. If the Company’s existing cash resources together with the cash the Company

generates from the sales of its products are insufficient to fund its working capital and operational needs, the Company may need to

sell additional equity or debt securities or seek additional financing through other arrangements.

During

the year ended year December 31, 2020, the Company entered into a loan agreement with a third party for a secured loan in the amount

of $1,000,000. The Loan was for a term of one year from the date of receipt of the funds, bore interest at a rate of 10% per annum and

was secured with all of the present and after-acquired property of the Company. In 2021, the Company repaid the $1,000,000 loan at its

maturity. The Company does not have any off-balance sheet arrangements.

5.C.

Research and development, patents and licenses etc.

The