false

0000047307

0000047307

2024-11-06

2024-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 6, 2024

Crawford United Corporation

(Exact Name of Registrant as Specified in Charter)

|

Ohio

|

|

000-00147

|

|

34-0288470

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

10514 Dupont Avenue

Cleveland, Ohio

|

|

44108

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(216) 243-2614

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act: None.

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02

|

Results of Operations and FinancialCondition.

|

On November 6, 2024, Crawford United Corporation, (the “Company”) issued a news release announcing its results for the third quarter of 2024. The news release is furnished herewith as Exhibit 99.1.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

Exhibit No.

|

Description of Exhibit

|

| |

|

|

99.1

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CRAWFORD UNITED CORPORATION

|

| |

|

|

Date: November 6, 2024

|

/s/ Jeffrey J. Salay

|

| |

Name: Jeffrey J. Salay

|

| |

Title: Chief Financial Officer

|

Exhibit Index

|

Exhibit No.

|

Description of Exhibit

|

| |

|

|

99.1

|

News release dated November 6, 2024.

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

Exhibit 99.1

Contact:

Brian E. Powers, President and Chief Executive Officer

CRAWFORD UNITED CORPORATION

10514 Dupont Avenue, Suite 200

Cleveland, Ohio 44108

216-243-2449

|

November 6, 2024

|

|

FOR IMMEDIATE RELEASE

|

Crawford United Corporation Announces Third Quarter 2024 Results

| |

●

|

Earnings per share of $0.95 for the quarter and $2.72 year-to-date |

| |

● |

Sales of $112.8 million for the year, 2.5% ahead of last year's record pace |

| |

●

|

Improved sales, operating income, net income and EBITDA As Defined1 compared to Q3 2023 |

| |

●

|

Completed acquisition of Advanced Industrial Coatings

|

CLEVELAND, OHIO, November 6, 2024 – Crawford United Corporation (OTC: CRAWA), a growth-oriented holding company serving diverse markets, today reported results for the quarter ended

September 30, 2024.

For the quarter ended September 30, 2024, sales were $36.7 million compared with $33.6 million in the same period in 2023, an increase of 9.2%. In the quarter, the Company recorded operating income of $5.3 million compared with operating income of $4.3 million in the same quarter of the prior year, an increase of 22.4%. Net income was $3.4 million or $0.95 per fully diluted share, compared to $2.8 million or $0.80 per fully diluted share, in the third quarter of 2023, an increase of 19.7%. EBITDA As Defined was $6.8 million in the quarter compared to $6.1 million in the same quarter of the prior year, an increase of 10.1%.

For the year-to-date period ended September 30, 2024, sales were $112.8 million compared with $110.1 million in the same period in 2023, an increase of 2.5%. For the year-to-date period, the Company recorded operating income of $14.9 million compared with operating income of $14.6 million in the same period of the prior year, an increase of 2.6%. Net income was $9.6 million or $2.72 per fully diluted share, compared to $10.1 million or $2.86 per fully diluted share, in the same period of 2023, a decrease of 4.1%. EBITDA As Defined1 was $20.1 million in the year-to-date period compared to $20.5 million in the same period of the prior year, a decrease of 1.8%.

Brian Powers, President and CEO, stated “We are pleased with the ongoing success of our business model and remain confident in our ability to achieve long-term strategic priorities. So far in 2024, we have completed two acquisitions to strengthen our presence in the aerospace and defense market. Crawford United is well positioned to pursue opportunities for increased revenue and profitability, always with an eye towards additional acquisitions.”

About Crawford United Corporation.

Crawford United Corporation is a growth-oriented holding company providing specialty industrial products to diverse markets, including healthcare, education, aerospace, defense, and transportation. The company currently operates two business segments. The Commercial Air Handling Equipment segment is a leader in designing, manufacturing, and installing highly customized, large-scale commercial, institutional, and industrial air handling solutions, primarily for hospitals and universities. The Industrial & Transportation Products segment provides highly complex precision components and coatings to customers in the aerospace and defense industries, as well as a full line of branded metal, silicone, plastic, rubber, hydraulic, marine and fuel hose products. For more information, go to www.crawfordunited.com.

Information about Forward Looking Statements.

This press release contains forward-looking statements within the meaning of the “Safe Harbor” provisions of the Private Securities Litigation Reform Act of 1995, including statements made regarding the company’s future results. Generally, these statements can be identified by the use of words such as “guidance,” “outlook,” “believes,” “estimates,” “anticipates,” “expects,” “forecasts,” “seeks,” “projects,” “intends,” “plans,” “may,” “will,” “should,” “could,” “would” and similar expressions intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements, or other statements made by the Company, are made based on management's expectations and beliefs concerning future events impacting the Company and are subject to uncertainties and factors (including, but not limited to, those specified below) which are difficult to predict and, in many instances, are beyond the control of the Company. As a result, actual results of the Company could differ materially from those expressed in or implied by any such forward-looking statements. These uncertainties and factors include (a) shortages in supply or increased costs of necessary products, components or raw materials from the Company’s suppliers; (b) availability shortages or increased costs of freight and labor for the Company and/or its suppliers; (c) actions that governments, businesses and individuals take in response to public health crises, including mandatory business closures and restrictions on onsite commercial interactions; (d) conditions in the global and regional economies and economic activity, including slow economic growth or recession, inflation, currency and credit market volatility, reduced capital expenditures and changes in government trade, fiscal, tax and monetary policies; (e) adverse effects from evolving geopolitical conditions, such as the military conflicts in Ukraine and Israel; (f) the Company's ability to effectively integrate acquisitions, and manage the larger operations of the combined businesses, (g) the Company's dependence upon a limited number of customers and the aerospace industry, (h) the highly competitive industries in which the Company operates, which includes several competitors with greater financial resources and larger sales organizations, (i) the Company's ability to capitalize on market opportunities in certain sectors, (j) the Company's ability to obtain cost effective financing and (k) the Company's ability to satisfy obligations under its financing arrangements, and the other risks described in “Item 1A. Risk Factors” in our Annual Report Form 10-K and the Company’s subsequent filings with the SEC.

Brian E. Powers

President & CEO

216-243-2449

bpowers@crawfordunited.com

“Crawford United has a great future behind it.”

1 EBITDA As Defined is a Non-GAAP financial measure. Please refer to the definition and table at the end of this release for a reconciliation of EBITDA As Defined to net income.

CRAWFORD UNITED CORPORATION

Consolidated Income Statement (Unaudited)

| |

Three Months Ended

|

|

|

|

|

|

Nine Months Ended

|

|

| |

September 30,

|

|

|

|

|

|

September 30,

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

2024

|

|

|

|

|

|

2023

|

|

|

|

|

|

|

2024

|

|

|

|

|

|

2023

|

|

|

|

Sales

|

$ |

36,736,228 |

100 |

% |

|

|

|

$ |

33,641,513 |

100 |

% |

|

|

|

|

$ |

112,811,955 |

100 |

% |

|

|

|

$ |

110,058,884 |

100 |

% |

|

Cost of sales

|

|

26,048,576 |

71 |

% |

|

|

|

|

24,732,181 |

74 |

% |

|

|

|

|

|

81,467,956 |

72 |

% |

|

|

|

|

80,158,123 |

73 |

% |

|

Gross Profit

|

|

10,687,652 |

29 |

% |

|

|

|

|

8,909,332 |

26 |

% |

|

|

|

|

|

31,343,999 |

28 |

% |

|

|

|

|

29,900,761 |

27 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses

|

|

5,429,209 |

14 |

% |

|

|

|

|

4,612,364 |

14 |

% |

|

|

|

|

|

16,395,286 |

15 |

% |

|

|

|

|

15,332,161 |

14 |

% |

|

Operating Income

|

|

5,258,443 |

15 |

% |

|

|

|

|

4,296,968 |

12 |

% |

|

|

|

|

|

14,948,713 |

13 |

% |

|

|

|

|

14,568,600 |

13 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Expense and (Income):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest charges

|

|

262,130 |

1 |

% |

|

|

|

|

294,825 |

1 |

% |

|

|

|

|

|

804,028 |

1 |

% |

|

|

|

|

1,030,729 |

1 |

% |

|

(Gain) loss on investments

|

|

(12,059) |

0 |

% |

|

|

|

|

135,522 |

0 |

% |

|

|

|

|

|

367,407 |

0 |

% |

|

|

|

|

17,040 |

0 |

% |

|

Other expense (income), net

|

|

303,013 |

1 |

% |

|

|

|

|

(599) |

0 |

% |

|

|

|

|

|

369,718 |

0 |

% |

|

|

|

|

(345,569) |

0 |

% |

|

Total Other Expense and (Income)

|

|

553,084 |

2 |

% |

|

|

|

|

429,748 |

1 |

% |

|

|

|

|

|

1,541,153 |

1 |

% |

|

|

|

|

702,200 |

1 |

% |

|

Income before Income Taxes

|

|

4,705,359 |

13 |

% |

|

|

|

|

3,867,220 |

11 |

% |

|

|

|

|

|

13,407,560 |

12 |

% |

|

|

|

|

13,866,400 |

12 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax expense

|

|

1,336,148 |

4 |

% |

|

|

|

|

1,052,484 |

3 |

% |

|

|

|

|

|

3,758,008 |

3 |

% |

|

|

|

|

3,808,850 |

3 |

% |

|

Net Income

|

$ |

3,369,211 |

9 |

% |

|

|

|

$ |

2,814,736 |

8 |

% |

|

|

|

|

$ |

9,649,552 |

9 |

% |

|

|

|

$ |

10,057,550 |

9 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per common share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

$ |

0.95 |

|

|

|

|

|

$ |

0.80 |

|

|

|

|

|

|

$ |

2.73 |

|

|

|

|

|

$ |

2.87 |

|

|

|

Diluted

|

$ |

0.95 |

|

|

|

|

|

$ |

0.80 |

|

|

|

|

|

|

$ |

2.72 |

|

|

|

|

|

$ |

2.86 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

3,540,746 |

|

|

|

|

|

|

3,510,740 |

|

|

|

|

|

|

|

3,538,148 |

|

|

|

|

|

|

3,506,920 |

|

|

|

Diluted

|

|

3,557,881 |

|

|

|

|

|

|

3,536,697 |

|

|

|

|

|

|

|

3,549,552 |

|

|

|

|

|

|

3,519,672 |

|

|

CRAWFORD UNITED CORPORATION

Supplemental Non-GAAP Financial Measures (Unaudited)

EBITDA As Defined is a non-GAAP financial measure that reflects net income before interest expense, income taxes, depreciation and amortization, and also excludes certain charges and corporate-level expenses as defined in the Company's current revolving credit facility. The Company presents this non-GAAP financial measure because management uses EBITDA As Defined to assess the Company's performance and believes that EBITDA As Defined is useful to investors as an indication of the Company's compliance with its financial covenants in its revolving credit facility. Additionally, EBITDA As Defined is a measure used under the Company's revolving credit facility to determine whether the Company may incur additional debt under such facility. EBITDA As Defined is not a measure of performance under GAAP and should not be considered in isolation from, or as a substitute for, net income or cash flow information calculated in accordance with GAAP. EBITDA As Defined herein may not be comparable to similarly titled measures of other companies. The following table reconciles net income to EBITDA As Defined:

| |

|

Three Months Ended

|

|

Nine Months Ended

|

| |

|

September 30,

|

|

September 30,

|

| |

|

|

|

|

|

|

|

|

| |

|

2024

|

|

2023

|

|

2024

|

|

2023

|

|

Net Income

|

|

$ 3,369,211

|

|

$ 2,814,736

|

|

$ 9,649,552

|

|

$ 10,057,550

|

|

Addback:

|

|

|

|

|

|

|

|

|

|

Interest charges

|

|

262,130

|

|

294,825

|

|

804,028

|

|

1,030,729

|

|

Income tax expense

|

|

1,336,148

|

|

1,052,484

|

|

3,758,008

|

|

3,808,850

|

|

Depreciation and amortization

|

|

1,034,301

|

|

1,132,262

|

|

3,039,681

|

|

3,156,558

|

|

Non-cash stock-based compensation expense

|

|

232,225

|

|

224,317

|

|

1,076,804

|

|

1,153,105

|

|

Amortization of right of use assets

|

|

299,893

|

|

474,978

|

|

1,081,245

|

|

1,267,360

|

|

(Gain) loss on investments in equity securities

|

|

(12,059)

|

|

135,522

|

|

367,407

|

|

17,040

|

|

Non-recurring transaction charges

|

|

228,771

|

|

-

|

|

341,422

|

|

-

|

| |

|

|

|

|

|

|

|

|

|

EBITDA As Defined

|

|

$ 6,750,620

|

|

$ 6,129,124

|

|

$ 20,118,147

|

|

$ 20,491,192

|

v3.24.3

Document And Entity Information

|

Nov. 06, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Crawford United Corporation

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 06, 2024

|

| Entity, Incorporation, State or Country Code |

OH

|

| Entity, File Number |

000-00147

|

| Entity, Tax Identification Number |

34-0288470

|

| Entity, Address, Address Line One |

10514 Dupont Avenue

|

| Entity, Address, City or Town |

Cleveland

|

| Entity, Address, State or Province |

OH

|

| Entity, Address, Postal Zip Code |

44108

|

| City Area Code |

216

|

| Local Phone Number |

243-2614

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000047307

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

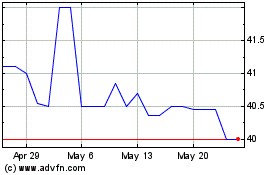

Crawford United (PK) (USOTC:CRAWA)

Historical Stock Chart

From Jan 2025 to Feb 2025

Crawford United (PK) (USOTC:CRAWA)

Historical Stock Chart

From Feb 2024 to Feb 2025