false0000880641NONE00008806412024-10-252024-10-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): October 25, 2024 |

EAGLE FINANCIAL SERVICES, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Virginia |

0-20146 |

54-1601306 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

2 East Main Street |

|

Berryville, Virginia |

|

22611 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (540) 955-2510 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

None |

|

N/A |

|

N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On October 25, 2024, the Registrant issued a press release announcing the results for the quarter ended September 30, 2024.

A copy of the Company’s press release with respect to the results for the quarter ended September 30, 2024 is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

|

|

|

Exhibit No. |

|

Description |

|

|

99.1 104 |

|

Press release, dated October 25, 2024 Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: October 25, 2024

|

|

|

|

|

|

Eagle Financial Services, Inc. |

|

|

By: |

|

/s/ KATHLEEN J. CHAPPELL |

|

|

Kathleen J. Chappell |

|

|

Executive Vice President and CFO |

Exhibit 99.1

EAGLE FINANCIAL SERVICES, INC. ANNOUNCES

2024 THIRD QUARTER FINANCIAL RESULTS AND QUARTERLY DIVIDEND

|

|

|

Contact: |

Kathleen J. Chappell, Executive Vice President and CFO |

540-955-2510 |

|

|

kchappell@bankofclarke.com |

BERRYVILLE, VIRGINIA (October 25, 2024) – Eagle Financial Services, Inc. (OTCQX: EFSI), the holding company for Bank of Clarke, whose divisions include Bank of Clarke Wealth Management, announced its third quarter 2024 results. On October 23, 2024, the Board of Directors announced a quarterly common stock cash dividend of $0.31 per common share, payable on November 15, 2024, to shareholders of record on November 8, 2024. Net income was $3.4 million for the third quarter of 2024 compared to $3.2 million for the second quarter of 2024. The following table presents selected financial performance highlights for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

September 30, |

|

|

June 30, |

|

|

September 30, |

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

(in thousands) |

|

Consolidated net income |

$ |

3,424 |

|

|

$ |

3,185 |

|

|

$ |

2,319 |

|

|

|

|

|

|

|

|

|

|

Earnings per share - basic and diluted |

$ |

0.97 |

|

|

$ |

0.89 |

|

|

$ |

0.66 |

|

|

|

|

|

|

|

|

|

|

Annualized return on average equity |

|

11.99 |

% |

|

|

11.76 |

% |

|

|

8.87 |

% |

|

|

|

|

|

|

|

|

|

Annualized return on average assets |

|

0.75 |

% |

|

|

0.72 |

% |

|

|

0.51 |

% |

|

|

|

|

|

|

|

|

|

Net interest margin |

|

2.88 |

% |

|

|

2.80 |

% |

|

|

2.93 |

% |

Brandon Lorey, President and CEO, stated, "The success of the third quarter of 2024 reflects the continued execution of the 2024 strategic plan, coupled with a focus on deepening both existing and new relationships. The Bank of Clarke delivered exceptional results for Eagle Financial Services, Inc., highlighted by continued improvements in efficiency, earnings per share (EPS), and capital. Additionally, we have strengthened our loan-to-deposit ratio, with net deposit growth doubling that of loan growth. I would like to personally extend my gratitude to our phenomenal staff, who consistently place our customers at the center of everything we do. We remain steadfast in our commitment to our clients and communities."

Key highlights for the third quarter of 2024 are as follows:

•Noninterest income increased $946 thousand or 22.0% during the quarter.

•Net interest margin increased eight basis points during the quarter.

•Deposit growth of $57.4 million or 3.9% during the quarter.

•Sales of $14.9 million and $4.3 million in mortgage and SBA loans, respectively, with a gain on sales of $626 thousand recognized during the quarter.

•Earnings per share increased by $0.08 for the quarter to $0.97.

Income Statement Review

Net income for the quarter ended September 30, 2024 was $3.4 million reflecting an increase of 7.5% from the quarter ended June 30, 2024 and an increase of 47.6% from the quarter ended September 30, 2023. The increase from the quarters ended June 30, 2024 and September 30, 2023 was due mainly to increases in total noninterest income. Total noninterest income increased primarily due to a $671 thousand bank owned life insurance (BOLI) payout during the third quarter of 2024. The increase of total noninterest income was also due to more sales activity in loans held for sale resulting in a $627 thousand gain on sale of loans held for sale for the quarter ended September 30, 2024 compared to $492 thousand and $265 thousand for the quarters ended June 30, 2024 and September 30, 2023, respectively. In addition, income from the Bank's holdings of Small Business Investment Company (SBIC) increased to $496 thousand for the three months ended September 30, 2024 from $259 thousand and $151 thousand for the three months ended June 30, 2024 and September 30, 2023, respectively. Net income was $3.2 million for the three-month period ended June 30, 2024 and $2.3 million for the quarter ended September 30, 2023.

Total loan interest income was $21.1 million and $19.5 million for the quarters ended September 30, 2024 and June 30, 2024, respectively. Total loan interest income was $20.2 million for the quarter ended September 30, 2023. Total loan interest income increased $964 thousand or 4.8% from the quarter ended September 30, 2023 to the quarter ended September 30, 2024. The increase in loan interest income during the third quarter of 2024 compared to the second quarter of 2024 is mainly due to the increase in loan volume during the third quarter. Average loans increased from $1.44 billion for the quarter ended June 30, 2024 to $1.47 billion for the quarter ended September 30, 2024. Year over year quarterly average loans remained stable at $1.47 billion for the quarters ended September 30, 2024 and September 30, 2023. The tax equivalent yield on average loans for the quarter ended September 30, 2024 was 5.71%, an increase of 27 basis points from the 5.44% average yield for the same time period in 2023. The increase in yield was due mainly to loans paying off and being replaced at higher rates due to the current market environment.

Interest and dividend income from the investment portfolio was $873 thousand for the quarter ended September 30, 2024 compared to $897 thousand for the quarter ended June 30, 2024. Interest income and dividend income from the investment portfolio was $931 thousand for the quarter ended September 30, 2023. The tax equivalent yield on average investments for the quarter ended September 30, 2024 was 2.53%, down nine basis points from 2.62% for the quarter ended June 30, 2024 and up five basis points from 2.48% for the quarter ended September 30, 2023.

Total interest expense was $10.5 million for the three months ended September 30, 2024 and $9.6 million and $9.3 million for three months ended June 30, 2024 and September 30, 2023, respectively. The increase in interest expense between the quarter ended September 30, 2024 and both quarters ended June 30, 2024 and September 30, 2023 was due to the growth in interest-bearing deposit accounts. The average cost of interest-bearing liabilities increased 15 and 37 basis points when comparing the quarter ended September 30, 2024 to the quarters ended June 30, 2024 and September 30, 2023, respectively. The average balance of interest-bearing liabilities increased $52.8 million from the quarter ended June 30, 2024 to the quarter ended September 30, 2024. The average balance of interest-bearing liabilities increased $61.8 million from the quarter ended September 30, 2023 to the same period in 2024. In addition to the growth in interest-bearing liabilities, there has been a shift in the mix of interest-bearing deposits towards higher interest-bearing deposits.

Net interest income for the quarter ended September 30, 2024 was $13.2 million reflecting an increase of 8.2% from the quarter ended June 30, 2024 and an increase of 1.9% from the quarter ended September 30, 2023. Net interest income was $12.2 million and $12.9 million, respectively, for the quarters ended June 30, 2024 and September 30, 2023.

The net interest margin was 2.88% for the quarter ended September 30, 2024. For the quarters ended June 30, 2024 and September 30, 2023, the net interest margin was 2.80% and 2.93%, respectively. The net interest margin for the quarter ended June 30, 2024 was negatively impacted by recognizing additional deferred fees due to early loan payoffs, mainly in the Marine portfolio, which is what caused the increase to 2.88% during the third quarter of 2024, when these deferred fees were not as significant. The Company’s net interest margin is not a measurement under accounting principles generally accepted in the United States, but it is a common measure used by the financial services industry to determine how profitably earning assets are funded. The Company’s net interest margin is calculated by dividing tax equivalent net interest income by total average earning assets. Tax equivalent net interest income is calculated by grossing up interest income for the amounts that are non-taxable (i.e., municipal income) then subtracting interest expense. The tax rate utilized is 21%.

Noninterest income was $5.3 million for the quarter ended September 30, 2024, which represented an increase of $946 thousand or 22.0% from $4.3 million for the three months ended June 30, 2024. Noninterest income for the quarter ended September 30, 2023 was $4.2 million. Total noninterest income increased primarily due to a $671 thousand BOLI payout during the third quarter of 2024. The increase of total noninterest income was also due to increased sales activity in loans held for sale resulting in a $627 thousand gain on sale of loans held for sale for the quarter ended September 30, 2024 compared to $492 thousand and $265 for the quarters ended June 30, 2024 and September 30, 2023, respectively. In addition, SBIC income increased to $496 thousand for the three months ended September 30, 2024 from $259 thousand and $151 thousand for the three months ended June 30, 2024 and September 30, 2023, respectively.

Noninterest expense increased $380 thousand, or 3.0%, to $12.9 million for the quarter ended September 30, 2024 from $12.5 million for the quarter ended June 30, 2024. Noninterest expense was $14.1 million for the quarter ended September 30, 2023, representing a decrease of $1.2 million or 8.8% when comparing the quarter ended September 30, 2024 to the quarter ended September 30, 2023. A $195 thousand or 2.7% increase in salaries and benefits expenses was noted between September 30, 2024 and June 30, 2024. This is mainly due to larger incentive accruals as employees reached certain goals. In addition, a $204 thousand loss of sale of repossessed assets occurred during the quarter ended September 30, 2024. The decrease from the quarter ended September 30, 2023 to the quarter ended September 30, 2024 was due mainly to the sale of the marine finance line of business during the third quarter of 2023. While there was some reduction in overhead costs by having the marine finance line of business in operation only through August 2023, there was approximately $1.5 million in additional expense recognized during the quarter due to its sale. These costs included a change in control agreement, accelerated deferred compensation expenses, legal costs and advisory firm expenses.

Asset Quality and Provision for Credit Losses

Nonperforming assets consist of nonaccrual loans, loans 90 days or more past due and still accruing, other real estate owned (foreclosed properties), and repossessed assets. Nonperforming assets decreased from $3.3 million or 0.18% of total assets at June 30, 2024 to $2.5 million or 0.13% of total assets at September 30, 2024. Nonperforming assets were $6.0 million or 0.33% of total assets at September 30, 2023. Total nonaccrual loans were $2.3 million at September 30, 2024 and $2.7 million at June 30, 2024. Nonaccrual loans were $5.7 million at September 30, 2023. Nonperforming assets decreased between June 30, 2024 and September 30, 2024 mainly due to one large relationship totaling $591 thousand paying off. Nonaccrual loans, and in turn nonperforming assets, decreased between September 30, 2023 and September 30, 2024 due to three large relationships totaling $3.3 million paying off. The majority of all nonaccrual loans are secured by real estate and management evaluates the financial condition of these borrowers and the value of any collateral on these loans. The results of these evaluations are used to estimate the amount of losses which may be realized on the disposition of these nonaccrual loans. Other real estate owned was zero at September 30, 2024, June 30, 2024 and September 30, 2023.

The Company realized $1.2 million in net charge-offs for the quarter ended September 30, 2024 compared to $252 thousand in net recoveries for the three months ended June 30, 2024. During the three months ended September 30, 2023, $156 thousand in net charge-offs were recognized. The majority of the charge-offs recognized during the third quarter of 2024 were related to a clean-up of the marine portfolio and does not reflect a systemic performance issue within the portfolio.

The amount of provision for credit losses reflects the results of the Bank’s analysis used to determine the adequacy of the allowance for credit losses. The Company recorded $1.5 million in provision for credit loss for the quarter ended September 30, 2024. The Company recognized provision for credit losses of $181 thousand and $216 thousand for the quarters ended June 30, 2024 and September 30, 2023, respectively. The provision for the quarter ended September 30, 2024 was mainly needed due to the larger net charge-offs during the quarter coupled with $34.6 million in total loan growth. The provision for the quarters ended June 30, 2024 and September 30, 2023 was mainly needed to keep pace with loan growth during the quarter.

The ratio of allowance for credit losses to total loans was 1.03% and 1.04% at September 30, 2024 and June 30, 2024, respectively. The ratio of allowance for credit losses to total loans was 1.01% at September 30, 2023. The ratio of allowance for credit losses to total nonaccrual loans was 652.86% and 555.46% at September 30, 2024 and June 30, 2024, respectively. The ratio of allowance for credit losses to total nonaccrual loans was 255.80% at September 30, 2023. The lower ratio of allowance for credit losses to nonaccrual loans was lower at September 30, 2023 due to a higher amount of nonaccrual loans. Several large nonaccrual loan relationship have paid off since September 30, 2023. Management’s judgment in determining the level of the allowance is based on evaluations of the collectability of loans while taking into consideration such factors as trends in delinquencies and charge-offs, changes in the nature and volume of the loan portfolio, current economic conditions that may affect a borrower’s ability to repay and the value of collateral, overall portfolio quality and review of specific potential losses. The Company is committed to maintaining an allowance at a level that adequately reflects the risk inherent in the loan portfolio.

Balance Sheet

Total consolidated assets of the Company at September 30, 2024 were $1.88 billion, which represented an increase of $91.3 million or 5.10% from total assets of $1.79 billion at June 30, 2024. At September 30, 2023, total consolidated assets were $1.80 billion. Total asset growth was mainly due to loan growth during the quarter ended September 30, 2024.

Total net loans increased $34.1 million from $1.43 billion at June 30, 2024 to $1.47 billion at September 30, 2024. These increases were mainly in the commercial owner occupied and construction & farmland loans during the third quarter of 2024. During the quarter ended September 30, 2024, through the normal course of business, $14.9 million in mortgage loans were sold on the secondary market. These loan sales resulted in net gains of $257 thousand. During the quarter ended June 30, 2024, $14.6 million in mortgage loans were sold on the secondary market. These loan sales resulted in net gains of $255 thousand.

On August 23, 2023, the Company completed the sale of its marine finance business, operating under the name LaVictoire Finance, to Axos Bank. Under the Asset Purchase Agreement, Axos Bank agreed to assume the servicing of Bank of Clarke’s retail marine loans and those of third parties, each of which were previously being serviced by Bank of Clarke. All LaVictoire Finance employees became employees of Axos Bank. Pursuant to the Loan Purchase Agreement, Axos Bank acquired all the marine vessel dealer floor plans loans currently held by Bank of Clarke at par value. The acquired loans had an aggregate principal balance of approximately $52.8 million as of the date of the Loan Purchase Agreement. All marine finance loans, with a balance of $225.9 million as of September 30, 2024, are still assets of Bank of Clarke.

Total deposits increased to $1.55 billion as of September 30, 2024 when compared to June 30, 2024 deposits of $1.49 billion. At September 30, 2023 total deposits were $1.50 billion. During the third quarter of 2024, total deposits increased $57.4 million. The majority of this increase was due to time deposit balances increasing by $50.5 million. Time deposits as a percentage of total deposits have increased from 28.6% at September 30, 2023 to 30.8% at September 30, 2024. Time deposits as a percentage of total deposits increased from 27.4% at December 31, 2023. The increase in deposits between September 30, 2023 and September 30, 2024 was mainly due to the growth of certificates of deposits over $250 thousand. At September 30, 2024, over 75% of deposits were fully FDIC insured.

Liquidity

The objective of the Company’s liquidity management is to ensure the continuous availability of funds to satisfy the credit needs of our customers and the demands of our depositors, creditors and investors. Uninsured deposits represent an estimate of amounts above the Federal Deposit Insurance Corporation (FDIC) insurance coverage limit of $250,000. As of September 30, 2024, the Company’s uninsured deposits were approximately $180.0 million, or 11.6% of total deposits.

The Company’s liquid assets, which include cash and due from banks, interest-bearing deposits at other banks, loans with a maturity less than one year and nonpledged securities available for sale, were $310.7 million and borrowing availability was $352.5 million as of September 30, 2024, which in total exceed uninsured deposits, excluding intercompany cash holdings and secured municipal deposits, by $483.2 million as of September 30, 2024. Liquid assets have declined by $29.4 million during the third quarter due mainly to pledging of the mortgage-backed securities pool with the Federal Reserve Bank discount window and was offset by increases in interest bearing deposits in banks. In addition to deposits, the Company utilizes short-term and long-term borrowings as sources of funds. Short-term borrowings from the Federal Reserve Bank and the Federal Home loan Bank of Atlanta (FHLB) as well as federal funds purchased from Community Bankers Bank may be used to fund the Company’s day-to-day operations. Long-term borrowings include FHLB advances as well as subordinated debt. Total borrowings increased to $199.7 million at September 30, 2024 from $184.8 million at December 31, 2023 due primarily to higher borrowings from the FHLB. Borrowings increased $25.3 million from $174.4 million at September 30, 2023.

Additional sources of liquidity available to the Company include cash flows from operations, loan payments and payoffs, deposit growth, maturities, calls and sales of securities and the issuance of brokered certificates of deposit.

Capital and Dividends

On October 23, 2024, the Board of Directors announced a quarterly common stock cash dividend of $0.31 per common share, payable on November 15, 2024, to shareholders of record on November 8, 2024.The Board of Directors of the Company continually reviews the amount of cash dividends per share and the resulting dividend payout ratio in light of changes in economic conditions, current and future capital requirements, and expected future earnings.

Total consolidated equity increased $10.1 million at September 30, 2024, compared to December 31, 2023, due primarily to net income and unrealized gains on securities available for sale, partially offset by dividends paid on the Company’s common stock. The Company’s securities available for sale are fixed income debt securities and their unrealized loss position is a result of increased market interest rates since they were purchased. The Company expects to recover its investments in debt securities through scheduled payments of principal and interest and unrealized losses are not expected to affect the earnings or regulatory capital of the Company. The accumulated other comprehensive loss related to the Company’s securities available for sale decreased to $14.4 million at September 30, 2024 compared to $18.8 million at December 31, 2023 due primarily to fluctuations in debt security market interest rates.

As of September 30, 2024, the most recent notification from the FDIC categorized the Bank of Clarke as well capitalized under the regulatory framework for prompt corrective action. To be categorized as well capitalized under regulations applicable at September 30, 2024, Bank of Clarke was required to maintain minimum total risk-based, Tier 1 risk-based, CET1 risk-based and Tier 1 leverage ratios. In addition to the regulatory risk-based capital requirements, Bank of Clarke must maintain a capital conservation buffer of additional capital of 2.5 percent of risk-weighted assets as required by the Basel III capital rules. The Company and Bank of Clarke exceeded these ratios at September 30, 2024.

Cautionary Note Regarding Forward-Looking Statements

Certain information contained in this discussion may include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements relate to the Company’s future operations and are generally identified by phrases such as “the Company expects,” “the Company believes” or words of similar import. Although the Company believes that its expectations with respect to the forward-looking statements are based upon reliable assumptions within the bounds of its knowledge of its business and operations, there can be no assurance that actual results, performance or achievements of the Company will not differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements.

Factors that could have a material adverse effect on the operations and future prospects of the Company include, but are not limited to: changes in interest rates and general economic conditions; the legislative and regulatory climate; monetary and fiscal policies of the U.S. Government, including policies of the U.S. Treasury and Federal Reserve; the quality or composition of the Company’s loan or investment portfolios; demand for loan products; deposit flows; competition; demand for financial services in the Company's market area; acquisitions and dispositions; the Company’s ability to keep pace with new technologies; a failure in or breach of the Company’s operational or security systems or infrastructure, or those of third-party vendors or other service providers, including as a result of cyberattacks; the Company’s capital and liquidity; changes in tax and accounting rules, principles, policies and guidelines; and other factors included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 and other filings with the Securities and Exchange Commission.

EAGLE FINANCIAL SERVICES, INC.

KEY STATISTICS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

|

|

|

3Q24 |

|

|

2Q24 |

|

|

1Q24 |

|

|

4Q23 |

|

|

3Q23 |

|

Net Income (dollars in thousands) |

|

$ |

3,424 |

|

|

$ |

3,185 |

|

|

$ |

2,548 |

|

|

$ |

2,395 |

|

|

$ |

2,319 |

|

Earnings per share, basic |

|

$ |

0.97 |

|

|

$ |

0.89 |

|

|

$ |

0.72 |

|

|

$ |

0.69 |

|

|

$ |

0.66 |

|

Earnings per share, diluted |

|

$ |

0.97 |

|

|

$ |

0.89 |

|

|

$ |

0.72 |

|

|

$ |

0.69 |

|

|

$ |

0.66 |

|

Return on average total assets |

|

|

0.75 |

% |

|

|

0.72 |

% |

|

|

0.58 |

% |

|

|

0.53 |

% |

|

|

0.51 |

% |

Return on average total equity |

|

|

11.99 |

% |

|

|

11.76 |

% |

|

|

9.43 |

% |

|

|

9.33 |

% |

|

|

8.87 |

% |

Dividend payout ratio |

|

|

30.93 |

% |

|

|

33.71 |

% |

|

|

41.67 |

% |

|

|

43.48 |

% |

|

|

45.45 |

% |

Fee revenue as a percent of total revenue |

|

|

17.11 |

% |

|

|

17.57 |

% |

|

|

18.11 |

% |

|

|

17.32 |

% |

|

|

16.95 |

% |

Net interest margin(1) |

|

|

2.88 |

% |

|

|

2.81 |

% |

|

|

2.91 |

% |

|

|

2.85 |

% |

|

|

2.93 |

% |

Yield on average earning assets |

|

|

5.17 |

% |

|

|

5.01 |

% |

|

|

5.13 |

% |

|

|

5.10 |

% |

|

|

5.03 |

% |

Rate on average interest-bearing liabilities |

|

|

3.27 |

% |

|

|

3.14 |

% |

|

|

3.10 |

% |

|

|

3.09 |

% |

|

|

2.98 |

% |

Net interest spread |

|

|

1.91 |

% |

|

|

1.87 |

% |

|

|

2.03 |

% |

|

|

2.01 |

% |

|

|

2.05 |

% |

Tax equivalent adjustment to net interest income (dollars in thousands) |

|

$ |

28 |

|

|

$ |

29 |

|

|

$ |

29 |

|

|

$ |

29 |

|

|

$ |

28 |

|

Non-interest income to average assets |

|

|

1.15 |

% |

|

|

0.97 |

% |

|

|

0.78 |

% |

|

|

0.80 |

% |

|

|

0.93 |

% |

Non-interest expense to average assets |

|

|

2.81 |

% |

|

|

2.82 |

% |

|

|

2.80 |

% |

|

|

2.92 |

% |

|

|

3.13 |

% |

Efficiency ratio(2) |

|

|

71.34 |

% |

|

|

77.00 |

% |

|

|

77.73 |

% |

|

|

83.01 |

% |

|

|

84.71 |

% |

(1) The net interest margin is calculated by dividing tax equivalent net interest income by total average earning assets. Tax equivalent interest income is calculated by grossing up interest income for the amounts that are non-taxable (i.e., municipal income) then subtracting interest expense. The rate utilized is 21%. See the table below for the quarterly tax equivalent net interest income and the reconciliation of net interest income to tax equivalent net interest income. The Company’s net interest margin is a common measure used by the financial service industry to determine how profitable earning assets are funded. Because the Company earns a fair amount of nontaxable interest income due to the mix of securities in its investment security portfolio, net interest income for the ratio is calculated on a tax equivalent basis as described above.

(2) The efficiency ratio is not a measurement under accounting principles generally accepted in the United States. It is calculated by dividing non-interest expense by the sum of tax equivalent net interest income and non-interest income excluding gains and losses on the investment portfolio and sales of repossessed assets. The tax rate utilized is 21%. See the table below for the quarterly tax equivalent net interest income and a reconciliation of net interest income to tax equivalent net interest income. The Company calculates this ratio in order to evaluate its overhead structure or how effectively it is operating. An increase in the ratio from period to period indicates the Company is losing a larger percentage of its income to expenses. The Company believes that the efficiency ratio is a reasonable measure of profitability.

EAGLE FINANCIAL SERVICES, INC.

SELECTED FINANCIAL DATA BY QUARTER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3Q24 |

|

|

2Q24 |

|

|

1Q24 |

|

|

4Q23 |

|

|

3Q23 |

|

BALANCE SHEET RATIOS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans to deposits |

|

|

95.95 |

% |

|

|

97.34 |

% |

|

|

97.63 |

% |

|

|

97.10 |

% |

|

|

96.17 |

% |

Average interest-earning assets to average-interest bearing liabilities |

|

|

142.24 |

% |

|

|

142.64 |

% |

|

|

139.97 |

% |

|

|

137.35 |

% |

|

|

142.07 |

% |

PER SHARE DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends |

|

$ |

0.30 |

|

|

$ |

0.30 |

|

|

$ |

0.30 |

|

|

$ |

0.30 |

|

|

$ |

0.30 |

|

Book value |

|

|

33.20 |

|

|

|

31.24 |

|

|

|

30.28 |

|

|

|

30.78 |

|

|

|

28.74 |

|

Tangible book value |

|

|

33.20 |

|

|

|

31.24 |

|

|

|

30.28 |

|

|

|

30.78 |

|

|

|

28.74 |

|

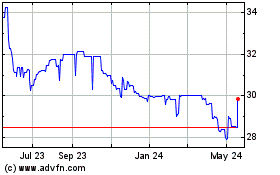

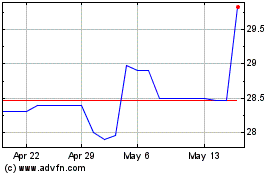

SHARE PRICE DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Closing price |

|

$ |

32.40 |

|

|

$ |

32.99 |

|

|

$ |

29.85 |

|

|

$ |

30.00 |

|

|

$ |

31.90 |

|

Diluted earnings multiple(1) |

|

|

8.35 |

|

|

|

9.27 |

|

|

|

10.36 |

|

|

|

11.03 |

|

|

|

12.08 |

|

Book value multiple(2) |

|

|

0.98 |

|

|

|

1.06 |

|

|

|

0.99 |

|

|

|

0.97 |

|

|

|

1.11 |

|

COMMON STOCK DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Outstanding shares at end of period |

|

|

3,549,581 |

|

|

|

3,556,844 |

|

|

|

3,557,229 |

|

|

|

3,520,894 |

|

|

|

3,520,894 |

|

Weighted average shares outstanding |

|

|

3,552,026 |

|

|

|

3,556,935 |

|

|

|

3,557,203 |

|

|

|

3,520,894 |

|

|

|

3,523,943 |

|

Weighted average shares outstanding, diluted |

|

|

3,552,026 |

|

|

|

3,556,935 |

|

|

|

3,557,203 |

|

|

|

3,520,894 |

|

|

|

3,523,943 |

|

CREDIT QUALITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net charge-offs to average loans |

|

|

0.08 |

% |

|

|

(0.02 |

)% |

|

|

0.04 |

% |

|

|

0.03 |

% |

|

|

0.01 |

% |

Total non-performing loans to total loans |

|

|

0.16 |

% |

|

|

0.20 |

% |

|

|

0.32 |

% |

|

|

0.40 |

% |

|

|

0.40 |

% |

Total non-performing assets to total assets |

|

|

0.13 |

% |

|

|

0.18 |

% |

|

|

0.28 |

% |

|

|

0.34 |

% |

|

|

0.33 |

% |

Non-accrual loans to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

total loans |

|

|

0.16 |

% |

|

|

0.19 |

% |

|

|

0.29 |

% |

|

|

0.39 |

% |

|

|

0.40 |

% |

total assets |

|

|

0.12 |

% |

|

|

0.15 |

% |

|

|

0.23 |

% |

|

|

0.31 |

% |

|

|

0.32 |

% |

Allowance for credit/loan losses to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

total loans |

|

|

1.03 |

% |

|

|

1.04 |

% |

|

|

1.00 |

% |

|

|

0.99 |

% |

|

|

1.01 |

% |

non-performing assets |

|

|

605.82 |

% |

|

|

458.72 |

% |

|

|

290.00 |

% |

|

|

236.43 |

% |

|

|

242.83 |

% |

non-accrual loans |

|

|

652.86 |

% |

|

|

555.46 |

% |

|

|

347.64 |

% |

|

|

256.74 |

% |

|

|

255.80 |

% |

NON-PERFORMING ASSETS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans delinquent over 90 days |

|

$ |

83 |

|

|

$ |

167 |

|

|

$ |

411 |

|

|

$ |

181 |

|

|

$ |

0 |

|

Non-accrual loans |

|

|

2,344 |

|

|

|

2,703 |

|

|

|

4,156 |

|

|

|

5,645 |

|

|

|

5,697 |

|

Other real estate owned and repossessed assets |

|

|

99 |

|

|

|

403 |

|

|

|

415 |

|

|

|

304 |

|

|

|

304 |

|

NET LOAN CHARGE-OFFS (RECOVERIES): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans charged off |

|

$ |

1,382 |

|

|

$ |

172 |

|

|

$ |

705 |

|

|

$ |

427 |

|

|

$ |

187 |

|

(Recoveries) |

|

|

(145 |

) |

|

|

(424 |

) |

|

|

(185 |

) |

|

|

(44 |

) |

|

|

(31 |

) |

Net charge-offs (recoveries) |

|

|

1,237 |

|

|

|

(252 |

) |

|

|

520 |

|

|

|

383 |

|

|

|

156 |

|

PROVISION FOR CREDIT LOSSES (dollars in thousands) |

|

$ |

1,525 |

|

|

$ |

315 |

|

|

$ |

475 |

|

|

$ |

366 |

|

|

$ |

218 |

|

ALLOWANCE FOR CREDIT LOSSES (dollars in thousands) |

|

$ |

15,303 |

|

|

$ |

15,014 |

|

|

$ |

14,448 |

|

|

$ |

14,493 |

|

|

$ |

14,573 |

|

(1) The diluted earnings multiple (or price earnings ratio) is calculated by dividing the period’s closing market price per share by total equity per weighted average shares outstanding, diluted for the period. The diluted earnings multiple is a measure of how much an investor may be willing to pay for $1.00 of the Company’s earnings.

(2) The book value multiple (or price to book ratio) is calculated by dividing the period’s closing market price per share by the period’s book value per share. The book value multiple is a measure used to compare the Company’s market value per share to its book value per share.

EAGLE FINANCIAL SERVICES, INC.

CONSOLIDATED BALANCE SHEETS

(dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unaudited

09/30/2024 |

|

|

Unaudited

06/30/2024 |

|

|

Unaudited

03/31/2024 |

|

|

Audited

12/31/2023 |

|

|

Unaudited

09/30/2023 |

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and due from banks |

|

$ |

177,605 |

|

|

$ |

61,179 |

|

|

$ |

68,280 |

|

|

$ |

112,066 |

|

|

$ |

63,239 |

|

Federal funds sold |

|

|

3,586 |

|

|

|

62,476 |

|

|

|

59,353 |

|

|

|

26,287 |

|

|

|

78,799 |

|

Securities available for sale, at fair value |

|

|

140,018 |

|

|

|

138,269 |

|

|

|

141,106 |

|

|

|

147,011 |

|

|

|

142,559 |

|

Loans held for sale |

|

|

3,657 |

|

|

|

3,058 |

|

|

|

1,593 |

|

|

|

1,661 |

|

|

|

3,564 |

|

Loans, net of allowance for credit losses |

|

|

1,468,025 |

|

|

|

1,433,920 |

|

|

|

1,424,604 |

|

|

|

1,448,193 |

|

|

|

1,426,412 |

|

Bank premises and equipment, net |

|

|

18,101 |

|

|

|

18,114 |

|

|

|

17,954 |

|

|

|

18,108 |

|

|

|

18,421 |

|

Bank owned life insurance |

|

|

30,361 |

|

|

|

30,103 |

|

|

|

29,843 |

|

|

|

29,575 |

|

|

|

24,404 |

|

Other assets |

|

|

40,348 |

|

|

|

43,286 |

|

|

|

40,168 |

|

|

|

42,696 |

|

|

|

44,072 |

|

Total assets |

|

$ |

1,881,701 |

|

|

$ |

1,790,405 |

|

|

$ |

1,782,901 |

|

|

$ |

1,825,597 |

|

|

$ |

1,801,470 |

|

Liabilities and Shareholders' Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest bearing demand deposits |

|

$ |

413,615 |

|

|

$ |

415,017 |

|

|

$ |

424,869 |

|

|

$ |

436,619 |

|

|

$ |

430,910 |

|

Savings and interest bearing demand deposits |

|

|

655,601 |

|

|

|

647,358 |

|

|

|

666,730 |

|

|

|

656,439 |

|

|

|

656,111 |

|

Time deposits |

|

|

476,720 |

|

|

|

426,209 |

|

|

|

382,343 |

|

|

|

413,264 |

|

|

|

411,359 |

|

Total deposits |

|

$ |

1,545,936 |

|

|

$ |

1,488,584 |

|

|

$ |

1,473,942 |

|

|

$ |

1,506,322 |

|

|

$ |

1,498,380 |

|

Federal funds purchased |

|

|

244 |

|

|

|

302 |

|

|

|

347 |

|

|

|

— |

|

|

|

— |

|

Federal Home Loan Bank advances, short-term |

|

|

— |

|

|

|

— |

|

|

|

10,000 |

|

|

|

— |

|

|

|

— |

|

Federal Home Loan Bank advances, long-term |

|

|

170,000 |

|

|

|

145,000 |

|

|

|

145,000 |

|

|

|

165,000 |

|

|

|

145,000 |

|

Subordinated debt |

|

|

29,495 |

|

|

|

29,478 |

|

|

|

29,461 |

|

|

|

29,444 |

|

|

|

29,428 |

|

Other liabilities |

|

|

18,182 |

|

|

|

15,926 |

|

|

|

16,446 |

|

|

|

16,452 |

|

|

|

27,479 |

|

Commitments and contingent liabilities |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Total liabilities |

|

$ |

1,763,857 |

|

|

$ |

1,679,290 |

|

|

$ |

1,675,196 |

|

|

$ |

1,717,218 |

|

|

$ |

1,700,287 |

|

Shareholders' Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock, $10 par value |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Common stock, $2.50 par value |

|

|

8,714 |

|

|

|

8,707 |

|

|

|

8,705 |

|

|

|

8,660 |

|

|

|

8,660 |

|

Surplus |

|

|

14,633 |

|

|

|

14,604 |

|

|

|

14,368 |

|

|

|

14,280 |

|

|

|

13,970 |

|

Retained earnings |

|

|

108,927 |

|

|

|

106,567 |

|

|

|

104,449 |

|

|

|

103,445 |

|

|

|

102,106 |

|

Accumulated other comprehensive (loss) |

|

|

(14,430 |

) |

|

|

(18,763 |

) |

|

|

(19,817 |

) |

|

|

(18,006 |

) |

|

|

(23,553 |

) |

Total shareholders' equity |

|

$ |

117,844 |

|

|

$ |

111,115 |

|

|

$ |

107,705 |

|

|

$ |

108,379 |

|

|

$ |

101,183 |

|

Total liabilities and shareholders' equity |

|

$ |

1,881,701 |

|

|

$ |

1,790,405 |

|

|

$ |

1,782,901 |

|

|

$ |

1,825,597 |

|

|

$ |

1,801,470 |

|

EAGLE FINANCIAL SERVICES, INC.

LOAN DATA

(dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9/30/2024 |

|

|

6/30/2024 |

|

|

3/31/2024 |

|

|

12/31/2023 |

|

|

9/30/2023 |

|

Mortgage real estate loans: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Construction & Secured by Farmland |

|

$ |

97,170 |

|

|

$ |

81,609 |

|

|

$ |

82,692 |

|

|

$ |

84,145 |

|

|

$ |

80,012 |

|

HELOCs |

|

|

50,452 |

|

|

|

46,697 |

|

|

|

46,329 |

|

|

|

47,674 |

|

|

|

44,719 |

|

Residential First Lien - Investment |

|

|

106,323 |

|

|

|

112,790 |

|

|

|

113,813 |

|

|

|

117,431 |

|

|

|

120,547 |

|

Residential First Lien - Owner Occupied |

|

|

198,570 |

|

|

|

187,807 |

|

|

|

181,323 |

|

|

|

178,180 |

|

|

|

162,919 |

|

Residential Junior Liens |

|

|

11,956 |

|

|

|

12,387 |

|

|

|

12,690 |

|

|

|

12,831 |

|

|

|

12,284 |

|

Commercial - Owner Occupied |

|

|

273,249 |

|

|

|

257,675 |

|

|

|

254,744 |

|

|

|

251,456 |

|

|

|

244,088 |

|

Commercial - Non-Owner Occupied & Multifamily |

|

|

357,351 |

|

|

|

352,892 |

|

|

|

344,192 |

|

|

|

348,879 |

|

|

|

355,122 |

|

Commercial and industrial loans: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BHG loans |

|

|

3,810 |

|

|

|

4,284 |

|

|

|

4,740 |

|

|

|

5,105 |

|

|

|

5,419 |

|

SBA PPP loans |

|

|

34 |

|

|

|

39 |

|

|

|

45 |

|

|

|

51 |

|

|

|

57 |

|

Other commercial and industrial loans |

|

|

107,320 |

|

|

|

102,345 |

|

|

|

95,327 |

|

|

|

102,672 |

|

|

|

91,411 |

|

Marine loans |

|

|

225,902 |

|

|

|

236,890 |

|

|

|

247,042 |

|

|

|

251,168 |

|

|

|

260,518 |

|

Triad Loans |

|

|

23,616 |

|

|

|

24,579 |

|

|

|

25,335 |

|

|

|

25,877 |

|

|

|

26,519 |

|

Consumer loans |

|

|

8,447 |

|

|

|

9,497 |

|

|

|

9,194 |

|

|

|

16,542 |

|

|

|

16,019 |

|

Overdrafts |

|

|

215 |

|

|

|

257 |

|

|

|

1,559 |

|

|

|

253 |

|

|

|

207 |

|

Other loans |

|

|

11,932 |

|

|

|

11,951 |

|

|

|

12,466 |

|

|

|

12,895 |

|

|

|

13,089 |

|

Total loans |

|

$ |

1,476,347 |

|

|

$ |

1,441,699 |

|

|

$ |

1,431,491 |

|

|

$ |

1,455,159 |

|

|

$ |

1,432,930 |

|

Net deferred loan costs and premiums |

|

|

6,981 |

|

|

|

7,235 |

|

|

|

7,561 |

|

|

|

7,527 |

|

|

|

8,055 |

|

Allowance for credit/loan losses |

|

|

(15,303 |

) |

|

|

(15,014 |

) |

|

|

(14,448 |

) |

|

|

(14,493 |

) |

|

|

(14,573 |

) |

Net loans |

|

$ |

1,468,025 |

|

|

$ |

1,433,920 |

|

|

$ |

1,424,604 |

|

|

$ |

1,448,193 |

|

|

$ |

1,426,412 |

|

EAGLE FINANCIAL SERVICES, INC.

CONSOLIDATED STATEMENTS OF INCOME

(dollars in thousands)

Unaudited

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9/30/2024 |

|

|

6/30/2024 |

|

|

3/31/2024 |

|

|

12/31/2023 |

|

|

9/30/2023 |

|

Interest and Dividend Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and fees on loans |

|

$ |

21,143 |

|

|

$ |

19,525 |

|

|

$ |

19,963 |

|

|

$ |

19,420 |

|

|

$ |

20,179 |

|

Interest on federal funds sold |

|

|

11 |

|

|

|

68 |

|

|

|

39 |

|

|

|

71 |

|

|

|

51 |

|

Interest and dividends on securities available for sale: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable interest income |

|

|

712 |

|

|

|

739 |

|

|

|

758 |

|

|

|

771 |

|

|

|

781 |

|

Interest income exempt from federal income taxes |

|

|

4 |

|

|

|

3 |

|

|

|

5 |

|

|

|

4 |

|

|

|

3 |

|

Dividends |

|

|

157 |

|

|

|

155 |

|

|

|

156 |

|

|

|

157 |

|

|

|

147 |

|

Interest on deposits in banks |

|

|

1,659 |

|

|

|

1,248 |

|

|

|

982 |

|

|

|

1,583 |

|

|

|

1,021 |

|

Total interest and dividend income |

|

$ |

23,686 |

|

|

$ |

21,738 |

|

|

$ |

21,903 |

|

|

$ |

22,006 |

|

|

$ |

22,182 |

|

Interest Expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest on deposits |

|

$ |

8,419 |

|

|

$ |

7,515 |

|

|

$ |

7,424 |

|

|

$ |

7,658 |

|

|

$ |

6,978 |

|

Interest on federal funds purchased |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Interest on Federal Home Loan Bank advances |

|

|

1,756 |

|

|

|

1,712 |

|

|

|

1,710 |

|

|

|

1,714 |

|

|

|

1,943 |

|

Interest on subordinated debt |

|

|

354 |

|

|

|

355 |

|

|

|

354 |

|

|

|

354 |

|

|

|

354 |

|

Total interest expense |

|

$ |

10,529 |

|

|

$ |

9,582 |

|

|

$ |

9,488 |

|

|

$ |

9,726 |

|

|

$ |

9,275 |

|

Net interest income |

|

$ |

13,157 |

|

|

$ |

12,156 |

|

|

$ |

12,415 |

|

|

$ |

12,280 |

|

|

$ |

12,907 |

|

Provision For Credit Losses |

|

|

1,544 |

|

|

|

181 |

|

|

|

475 |

|

|

|

366 |

|

|

|

216 |

|

Net interest income after provision for credit losses |

|

$ |

11,613 |

|

|

$ |

11,975 |

|

|

$ |

11,940 |

|

|

$ |

11,914 |

|

|

$ |

12,691 |

|

Noninterest Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wealth management fees |

|

$ |

1,515 |

|

|

$ |

1,273 |

|

|

$ |

1,456 |

|

|

$ |

1,315 |

|

|

$ |

1,190 |

|

Service charges on deposit accounts |

|

|

518 |

|

|

|

456 |

|

|

|

454 |

|

|

|

467 |

|

|

|

460 |

|

Other service charges and fees |

|

|

1,117 |

|

|

|

1,164 |

|

|

|

969 |

|

|

|

979 |

|

|

|

1,252 |

|

(Loss) gain on the sale of marine finance business |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(28 |

) |

|

|

463 |

|

(Gain) loss on the sale of bank premises and equipment |

|

|

— |

|

|

|

(11 |

) |

|

|

— |

|

|

|

— |

|

|

|

7 |

|

(Loss) on the sale of AFS securities |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Gain on sale of loans HFS |

|

|

627 |

|

|

|

492 |

|

|

|

161 |

|

|

|

515 |

|

|

|

265 |

|

Small business investment company income |

|

|

496 |

|

|

|

259 |

|

|

|

127 |

|

|

|

35 |

|

|

|

151 |

|

Officer insurance income |

|

|

930 |

|

|

|

269 |

|

|

|

268 |

|

|

|

171 |

|

|

|

184 |

|

Other operating income |

|

|

48 |

|

|

|

403 |

|

|

|

45 |

|

|

|

208 |

|

|

|

246 |

|

Total noninterest income |

|

$ |

5,251 |

|

|

$ |

4,305 |

|

|

$ |

3,480 |

|

|

$ |

3,662 |

|

|

$ |

4,218 |

|

Noninterest Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

$ |

7,548 |

|

|

$ |

7,353 |

|

|

$ |

7,185 |

|

|

$ |

7,849 |

|

|

$ |

7,598 |

|

Occupancy expenses |

|

|

530 |

|

|

|

470 |

|

|

|

569 |

|

|

|

581 |

|

|

|

570 |

|

Equipment expenses |

|

|

427 |

|

|

|

401 |

|

|

|

373 |

|

|

|

320 |

|

|

|

341 |

|

Advertising and marketing expenses |

|

|

247 |

|

|

|

245 |

|

|

|

237 |

|

|

|

291 |

|

|

|

228 |

|

Stationery and supplies |

|

|

35 |

|

|

|

32 |

|

|

|

24 |

|

|

|

44 |

|

|

|

69 |

|

ATM network fees |

|

|

406 |

|

|

|

373 |

|

|

|

380 |

|

|

|

421 |

|

|

|

426 |

|

Loss of sale of reposessed assets |

|

|

204 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

FDIC assessment |

|

|

343 |

|

|

|

351 |

|

|

|

409 |

|

|

|

478 |

|

|

|

495 |

|

Computer software expense |

|

|

226 |

|

|

|

221 |

|

|

|

233 |

|

|

|

373 |

|

|

|

396 |

|

Bank franchise tax |

|

|

342 |

|

|

|

338 |

|

|

|

331 |

|

|

|

339 |

|

|

|

340 |

|

Professional fees |

|

|

408 |

|

|

|

511 |

|

|

|

506 |

|

|

|

577 |

|

|

|

497 |

|

Data processing fees |

|

|

679 |

|

|

|

558 |

|

|

|

565 |

|

|

|

513 |

|

|

|

542 |

|

Other operating expenses |

|

|

1,495 |

|

|

|

1,657 |

|

|

|

1,565 |

|

|

|

1,494 |

|

|

|

2,631 |

|

Total noninterest expenses |

|

$ |

12,890 |

|

|

$ |

12,510 |

|

|

$ |

12,377 |

|

|

$ |

13,280 |

|

|

$ |

14,133 |

|

Income before income taxes |

|

$ |

3,974 |

|

|

$ |

3,770 |

|

|

$ |

3,043 |

|

|

$ |

2,296 |

|

|

$ |

2,776 |

|

Income Tax Expense (Benefit) |

|

|

550 |

|

|

|

585 |

|

|

|

495 |

|

|

|

(99 |

) |

|

|

457 |

|

Net income |

|

$ |

3,424 |

|

|

$ |

3,185 |

|

|

$ |

2,548 |

|

|

$ |

2,395 |

|

|

$ |

2,319 |

|

Earnings Per Share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per common share, basic |

|

$ |

0.97 |

|

|

$ |

0.89 |

|

|

$ |

0.72 |

|

|

$ |

0.68 |

|

|

$ |

0.66 |

|

Net income per common share, diluted |

|

$ |

0.97 |

|

|

$ |

0.89 |

|

|

$ |

0.72 |

|

|

$ |

0.68 |

|

|

$ |

0.66 |

|

EAGLE FINANCIAL SERVICES, INC.

Average Balances, Income and Expenses, Yields and Rates

(dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

September 30, 2024 |

|

|

June 30, 2024 |

|

|

September 30, 2023 |

|

|

|

|

|

|

Interest |

|

|

|

|

|

|

|

|

Interest |

|

|

|

|

|

|

|

|

Interest |

|

|

|

|

|

|

Average |

|

|

Income/ |

|

|

Average |

|

|

Average |

|

|

Income/ |

|

|

Average |

|

|

Average |

|

|

Income/ |

|

|

Average |

|

Assets: |

|

Balance |

|

|

Expense |

|

|

Rate |

|

|

Balance |

|

|

Expense |

|

|

Rate |

|

|

Balance |

|

|

Expense |

|

|

Rate |

|

Securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable |

|

$ |

137,183 |

|

|

$ |

869 |

|

|

|

2.52 |

% |

|

$ |

137,588 |

|

|

$ |

893 |

|

|

|

2.61 |

% |

|

$ |

148,549 |

|

|

$ |

928 |

|

|

|

2.48 |

% |

Tax-Exempt (1) |

|

|

493 |

|

|

|

5 |

|

|

|

4.03 |

% |

|

|

492 |

|

|

|

5 |

|

|

|

4.13 |

% |

|

|

490 |

|

|

|

4 |

|

|

|

4.10 |

% |

Total Securities |

|

$ |

137,676 |

|

|

$ |

874 |

|

|

|

2.53 |

% |

|

$ |

138,080 |

|

|

$ |

898 |

|

|

|

2.62 |

% |

|

$ |

149,039 |

|

|

$ |

932 |

|

|

|

2.48 |

% |

Loans: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable |

|

$ |

1,461,660 |

|

|

$ |

21,041 |

|

|

|

5.73 |

% |

|

$ |

1,424,304 |

|

|

$ |

19,421 |

|

|

|

5.48 |

% |

|

$ |

1,458,347 |

|

|

$ |

20,077 |

|

|

|

5.46 |

% |

Non-accrual |

|

|

2,553 |

|

|

|

— |

|

|

|

— |

% |

|

|

4,600 |

|

|

|

— |

|

|

|

— |

% |

|

|

3,639 |

|

|

|

— |

|

|

|

— |

% |

Tax-Exempt (1) |

|

|

10,162 |

|

|

|

129 |

|

|

|

5.04 |

% |

|

|

10,603 |

|

|

|

132 |

|

|

|

5.01 |

% |

|

|

10,403 |

|

|

|

129 |

|

|

|

4.94 |

% |

Total Loans |

|

$ |

1,474,375 |

|

|

$ |

21,170 |

|

|

|

5.71 |

% |

|

$ |

1,439,507 |

|

|

$ |

19,553 |

|

|

|

5.46 |

% |

|

$ |

1,472,389 |

|

|

$ |

20,206 |

|

|

|

5.44 |

% |

Federal funds sold and interest-bearing deposits in other banks |

|

|

211,888 |

|

|

|

1,670 |

|

|

|

3.14 |

% |

|

|

170,858 |

|

|

|

1,316 |

|

|

|

3.10 |

% |

|

|

132,432 |

|

|

|

1,072 |

|

|

|

3.21 |

% |

Total earning assets |

|

$ |

1,823,939 |

|

|

$ |

23,714 |

|

|

|

5.17 |

% |

|

$ |

1,748,445 |

|

|

$ |

21,767 |

|

|

|

5.01 |

% |

|

$ |

1,753,860 |

|

|

$ |

22,210 |

|

|

|

5.02 |

% |

Allowance for loan losses |

|

|

(14,729 |

) |

|

|

|

|

|

|

|

|

(14,604 |

) |

|

|

|

|

|

|

|

|

(14,642 |

) |

|

|

|

|

|

|

Total non-earning assets |

|

|

14,268 |

|

|

|

|

|

|

|

|

|

33,281 |

|

|

|

|

|

|

|

|

|

52,307 |

|

|

|

|

|

|

|

Total assets |

|

$ |

1,823,478 |

|

|

|

|

|

|

|

|

$ |

1,767,122 |

|

|

|

|

|

|

|

|

$ |

1,791,525 |

|

|

|

|

|

|

|

Liabilities and Shareholders' Equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing deposits: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOW accounts |

|

$ |

254,996 |

|

|

$ |

1,535 |

|

|

|

2.39 |

% |

|

$ |

258,965 |

|

|

$ |

1,538 |

|

|

|

2.39 |

% |

|

$ |

241,033 |

|

|

$ |

1,354 |

|

|

|

2.23 |

% |

Money market accounts |

|

|

261,653 |

|

|

|

1,555 |

|

|

|

2.36 |

% |

|

|

261,557 |

|

|

|

1,463 |

|

|

|

2.25 |

% |

|

|

260,692 |

|

|

|

1,260 |

|

|

|

1.92 |

% |

Savings accounts |

|

|

132,983 |

|

|

|

38 |

|

|

|

0.11 |

% |

|

|

136,370 |

|

|

|

39 |

|

|

|

0.12 |

% |

|

|

145,673 |

|

|

|

44 |

|

|

|

0.12 |

% |

Time deposits: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$250,000 and more |

|

|

159,761 |

|

|

|

1,932 |

|

|

|

4.81 |

% |

|

|

138,531 |

|

|

|

1,652 |

|

|

|

4.80 |

% |

|

|

137,487 |

|

|

|

1,543 |

|

|

|

4.45 |

% |

Less than $250,000 |

|

|

294,579 |

|

|

|

3,359 |

|

|

|

4.54 |

% |

|

|

255,776 |

|

|

|

2,823 |

|

|

|

4.44 |

% |

|

|

257,257 |

|

|

|

2,777 |

|

|

|

4.28 |

% |

Total interest-bearing deposits |

|

$ |

1,103,972 |

|

|

$ |

8,419 |

|

|

|

3.03 |

% |

|

$ |

1,051,199 |

|

|

$ |

7,515 |

|

|

|

2.88 |

% |

|

$ |

1,042,142 |

|

|

$ |

6,978 |

|

|

|

2.66 |

% |

Federal funds purchased |

|

|

12 |

|

|

|

— |

|

|

|

— |

% |

|

|

15 |

|

|

|

— |

|

|

|

— |

% |

|

|

— |

|

|

|

— |

|

|

|

— |

% |

Federal Home Loan Bank advances |

|

|

148,804 |

|

|

|

1,756 |

|

|

|

4.69 |

% |

|

|

145,110 |

|

|

|

1,712 |

|

|

|

4.74 |

% |

|

|

162,935 |

|

|

|