December 10, 2020 -- InvestorsHub NewsWire -- via Insider Financial

-- In this article, Insider Financial takes a look at penny

stocks on the move: SFOR and WSGF.

We are doing this to update our regular readers on what is

happening in the land of penny stocks. We are not focused on the

bagholders, but rather the penny stocks that are moving and

why.

As we have stressed repeatedly to our subscribers, the key to

trading penny stocks is finding momentum BEFORE it happens. We got

our subscribers in early on TSNP,

which you can read our latest here, ENZC,

which you can read about here,

and recently CBDD, which you can

read here.

Now, when we say that we find momentum BEFORE it happens, we are

swing traders looking to position our subscribers BEFORE the move

happens. This is where the big money is made and why so many of our

subscribers are sitting on gains of over 7400% in ENZC and over

26,150% in TSNP. If you want to day trade, this is not the place

for you. If you want to make a few hundred bucks and then lose a

thousand the next, we hear Tim Sykes has plenty of openings.

We always alert our subscribers first before we publish for our

regular readers. This is the value of having a subscription to

Insider Financial, which you can sign up for here. We

alert our subscribers with our best ideas before our regular

readers.

Now that we got that out the way, here are 2 penny stocks on the

move: SFOR and WSGF.

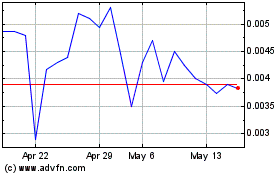

SFOR

We last wrote about SFOR on October 27th when the stock was

trading at just $.0044 a share, which you can read here. We

said at the time:

Now that the company has signaled that it has come up with more

attractive financing, we can see SFOR stock run. In this article,

we take a look at SFOR stock and make the bull case why there’s

more room to run.

In just six weeks, readers and subscribers are now up over

1200%. As we say, the key is finding good penny stocks and then

having the patience to let them pay off. Some take longer than

others to run, but when they do, they really run!

SFOR Chart

For those not familiar with SFOR, StrikeForce Technologies helps

to prevent Cyber theft and data security breaches for consumers,

corporations, and government agencies. It provides powerful

two-factor, “Out-of-Band” authentication and keystroke encryption

along with mobile solutions.

The news driving SFOR this week is the announcement that its

SafeVchat secure video conferencing platform goes live on December

18 and that the company has distribution partners in six countries

already set up.

The fact is that the SFOR is the new ZOOM and that’s why it’s

running. SFOR has created the industry’s most secure video

conferencing platform which includes: authenticated access,

encrypted video, encrypted audio, keystroke protection as well as

protection for your camera, microphone & speakers.

Additionally, Strikeforce Technologies’ solution will protect

your computer and confidential data even when you are offline and

not on a video conference. No other video conferencing service on

the market such as Zoom, Webex, LogMeIn, MS Teams, or, BlueJeans

can do that.

SFOR expects to see major top-line revenue growth from its new

videoconferencing solution starting in Q1 of 2021.

WSGF

This is the first time Insider Financial is covering WSGF. WSGF

caught our attention on December 8th when the stock registered its

first big green day in over a month. We love first day runners as

they usually turn into multi-day plays. The key is the stock must

trade above the previous day’s high.

In the case of WSGF, the stock needed to trade above $.0242 a

share. WSGF opened the next day above there at $.028 and proceeded

to deliver 285% gains. Add in a fresh press release and you had all

the makings of a triple-digit runner.

WSGF Chart

For those of you not familiar with WSGF, the company known as

World Series of Golf Inc is in the process of changing its name to

Vaycaychella. WSGF acquired Vaycaychella, a sharing economy

technology company with a P2P App to connect entrepreneurs seeking

to acquire short-term rental vacation properties with investors to

back them, earlier this year in January. Vaycaychella is the new

focus of the company.

Vaycaychella is a three-year-old operation that has built a

business model focused on financing short-term vacation rental

properties outside of conventional financing channels.

Vaycaychella’s mission is to empower entrepreneurs looking to get

into the short-term vacation property rental business marketed

through sharing technology apps such as Airbnb, Booking.com, and

Vrbo.

Vaycaychella has established a proven model through developing a

portfolio of properties that includes 10 Caribbean beachfront

vacation homes, a boutique hotel, and a recently acquired 3 unit

building in Puerto Rico with an overall estimated

cumulative value of $12 million. The company is now scaling

that model with the introduction of a peer-to-peer (P2P)

application (App) designed to connect new and existing short-term

vacation property rental operators with prospective investors.

SFOR AND WSGF BOTTOM LINE

SFOR is the more compelling play, in our opinion. The COVID-19

pandemic benefits stay-at-home plays like SFOR and Zoom. With a

market cap of just $13 million, there are 220 million shares

outstanding. When you look at the market cap of TSNP at $1 billion,

SFOR could easily command a $1 share price or a $220 million market

cap.

WSGF is more of a COVID-19 vaccine recovery play. If more people

start traveling, that will drive top and bottom growth for

WSGF.

Furthermore, with its P2P App, WSGF is also a derivative play on

AirBnB and its upcoming IPO. Whenever a hot deal hits the tape,

investors start scouring the OTC for similar plays. WSGF could be a

beneficiary of that.

Either way, the OTC is the place to be right now for penny stock

investors. Stocks running 1000% or more are common and investors

should jump in while it lasts because it never does. Markets

change, but times now favor penny stocks on the OTC.

As always, good luck to all (except the shorts)!

SOURCE: Insider

Financial

Enzolytics (PK) (USOTC:ENZC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Enzolytics (PK) (USOTC:ENZC)

Historical Stock Chart

From Nov 2023 to Nov 2024