Amended Statement of Beneficial Ownership (sc 13d/a)

05 September 2018 - 5:09AM

Edgar (US Regulatory)

Equitable Financial (PK) (USOTC:EQFN)

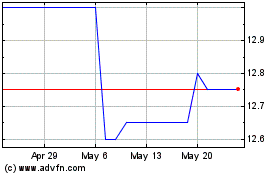

Historical Stock Chart

From Nov 2024 to Dec 2024

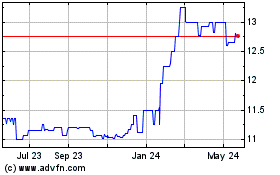

Equitable Financial (PK) (USOTC:EQFN)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about Equitable Financial Corporation (PK) (OTCMarkets): 0 recent articles

More Equitable Financial Corp. News Articles