0001131903

false

0001131903

2024-09-10

2024-09-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 10, 2024

SPECTRAL CAPITAL CORPORATION

(Exact name of registrant as specified in its charter)

Nevada

| 000-50274

| 51-0520296

|

(State or other jurisdiction of

incorporation)

| (Commission File Number)

| (IRS Employer Identification No.)

|

4500 9th Avenue NE, Seattle, WA

|

| 98105

|

(Address of principal executive offices)

|

| (Zip Code)

|

|

|

|

Registrant’s telephone number, including area code:

|

| (206) 385-6490

|

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act: None

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Current Report contains forward-looking statements, including, without limitation, in the sections captioned “Description of Business,” “Risk Factors,” and and elsewhere. Any and all statements contained in this Report that are not statements of historical fact may be deemed forward-looking statements. Terms such as “may,” “might,” “would,” “should,” “could,” “project,” “estimate,” “pro-forma,” “predict,” “potential,” “strategy,” “anticipate,” “attempt,” “develop,” “plan,” “help,” “believe,” “continue,” “intend,” “expect,” “future,” and terms of similar import (including the negative of any of the foregoing) may be intended to identify forward-looking statements. However, not all forward-looking statements may contain one or more of these identifying terms. Forward-looking statements in this Report may include, without limitation, statements regarding (i) the plans and objectives of management for development and commercialization of our planned technologies (ii) our limited financial resources, and (iii) need for additional capital to fund our operations.

The forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances and may not be realized because they are based upon our current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences, many of which we have no control over. Actual results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements as a result of these risks and uncertainties. Factors that may influence or contribute to the inaccuracy of the forward-looking statements or cause actual results to differ materially from expected or desired results may include, without limitation, our inability to obtain adequate financing, lack of revenue and/or future insufficient cash flows and resulting illiquidity, our inability to develop our business, significant government regulation, or inability to protect our intellectual property, existing or increased competition, penny stock risks, stock volatility and illiquidity, and our failure to implement our business plans or strategies. A description of some of the risks and uncertainties that could cause our actual results to differ materially from those described by the forward-looking statements in this Report appears in the section captioned “Risk Factors” and elsewhere in this Report.

Readers are cautioned not to place undue reliance on forward-looking statements because of the risks and uncertainties related to them and to the risk factors. We disclaim any obligation to update the forward-looking statements contained in this Report to reflect any new information or future events or circumstances or otherwise.

Readers should read this Report in conjunction with the discussion under the caption “Risk Factors,” our financial statements and the related notes thereto in this Report, and other documents which we may file from time to time with the SEC.

2

EXPLANATORY NOTE

Special Capital Corporation, a Nevada Corporation, is referred to herein as “we”, “our”, “us”, or the “Company”.

This Current Report responds to the following Items in Form 8-K:

Item 1.01. Entry into a Material Definitive Agreement.

On September 10, 2024, the Company entered into an Acquisition Agreement to exchange shares (the “Exchange Agreement”) with Crowdpoint Technologies, Inc., a Texas corporation (“Seller”), a company controlled by Sean Michael Brehm, also known as Sean Michael Obrien, the Chairman of our Board of Directors, and its wholly owned subsidiary, Crwdunit Inc., a Delaware corporation (“Target”), whereby the Company agreed to acquire from the Seller, and Seller agreed to sell to the Company, 100% of the Target’s outstanding shares in exchange for 3,750,000 newly issued shares (the “Exchange Shares”) of the Company’s common stock, $.0001 par value (the “Common Stock”).

The Company will acquire 100% of the issued and outstanding shares of the Target for a total purchase price of $15,000,000, paid through the issuance of the Exchange Shares. The closing of the transaction (the “Closing”) is expected to occur by December 10, 2024, subject to the satisfaction of the following conditions:

§Approval by the boards of directors of the Company and Target

§All necessary regulatory approvals and compliance with applicable securities and commercial laws.

§Completion of satisfactory due diligence by both parties, including financial, legal, technical, and operational audits.

§Execution of all necessary legal agreements, including those governing the transfer of the Crwdunit Utility and Quantization Mechanism intellectual property.

§Confirmation that all Target shareholders have been duly notified and rights have been protected according to this term sheet.

Item 2.01. Completion of Acquisition or Disposition of Assets.

The information contained in 1.01 above is incorporated into this Item 2.01.

Item 3.02. Unregistered Sales of Equity Securities.

As explained in Item 1.01 above, we entered into the Exchange Agreement which obligates us to issue 3,750,000 shares of the Common Stock to the Seller. The issuance of the shares will be exempt from registration under Section 4(2) of the Securities Act as transactions by an issuer not involving any public offering. The shares of Common Stock will not be sold through an underwriter and, accordingly, there were no underwriting discounts or commissions involved.

Item 7.01 Regulation FD Disclosure.

On September 11, 2024, the Company issued a press release announcing the Exchange Agreement. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference. The information included in this Item 7.01 of this Current Report on Form 8-K, including the attached Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

The foregoing descriptions of the Exchange Agreement and does not purport to be complete, and is qualified in their entirety by reference to the full text of the Exchange Agreement, a copy of which is attached as Exhibit 10.1 to this Current Report on Form 8-K. The closing of the transaction contemplated by the Exchange Agreement is subject to the closing conditions specified in the Exchange Agreement.

3

Item 9.01. Financial Statements and Exhibits.

(d) exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: September 17, 2024

|

|

|

|

|

SPECTRAL CAPITAL CORPORATION

|

|

|

|

|

By:

| /s/Jenifer Osterwalder

|

|

Name: Jenifer Osterwalder

|

|

Title: Chief Executive Officer

|

|

4

SPECTRAL CAPITAL ACQUISITON OF CRWDUNIT INC ACQUISITION AGREEMENT

Date: 10 September 2024

Parties:

·Spectral Capital Corporation. (“Purchaser”), a corporation incorporated under the laws of Washington with its principal place of business in Seattle, Washington.

·CrowdPoint Technologies Inc. (“Seller” or “Parent”), a corporation incorporated under the laws of Texas with its principal place of business in Austin, Texas.

·Crwdunit Inc. ("Target"), a wholly owned subsidiary of CrowdPoint Technologies Inc.

1. Transaction Overview

Spectral Capital Corp. will acquire 100% of the issued and outstanding shares of Crwdunit Inc., a subsidiary of CrowdPoint Technologies Inc., for a total purchase price of $15,000,000 USD, paid entirely through the issuance of Spectral Capital Corp. stock.

Additionally, Spectral Capital Corp. will acquire the Crwdunit Utility for the Quantization Mechanism, a proprietary worth measurement system that includes six coefficients used for measuring resources and ensuring performance metrics, as outlined below in Section 3.

2. Consideration

Purchase Price: The purchase price of $15,000,000 USD will be paid through the issuance of 3,750,000 shares of Spectral Capital Corp. common stock at a value of $4.00 USD per share.

Crwdunit Holders’ Rights: Current Crwdunit holders will retain their Crwdunit holdings post-acquisition and will also receive Quantum Value Units (QVUs) on a one-to-one basis with their Crwdunit holdings.

Issuance Responsibility and Timeline: CrowdPoint Technologies Inc. will be responsible for the issuance of both the Crwdunits and the QVUs to the current Crwdunit holders. The issuance of QVUs will occur within 14 days of the execution of the definitive acquisition agreement. In the event of delays, CrowdPoint Technologies Inc. will notify the holders within five (5) business days, and an additional grace period of 14 days will be granted before penalties or compensation for holders will apply.

The issuance of shares and QVUs has defined timelines, but in the event of delays, CrowdPoint Technologies Inc. will notify Spectral Capital Corp. within five (5) business days, and an additional grace period of up to 14 days will be granted. Should the deadlines continue to be unmet, CrowdPoint Technologies Inc. may extend the grace period by an additional 30 days upon further notice to Spectral Capital Corp. before penalties or compensation for holders will apply.

3. Crwdunit Utility & Quantization Mechanism

Spectral Capital Corp. will acquire exclusive rights to the Crwdunit Utility’s Quantization Mechanism, which includes the following six key performance metrics, all measured and reported monthly:

1.Quantization: Objective measurement of workload efficiency, calculated by system throughput (number of tasks processed) against system capacity.

2.CPU: Measurement of computational power usage as a percentage of available capacity, calculated by actual CPU time used per task.

3.Memory: Measurement of memory consumption, expressed as a percentage of total memory available, calculated hourly.

4.Storage: Measurement of storage usage, expressed as the percentage of allocated storage space, reviewed weekly for data consistency and efficiency.

5.Bandwidth: Measurement of data transfer rates, calculated by monitoring peak and average usage during 24-hour intervals.

6.Uptime: Measurement of server uptime, ensuring a target of 99.999% uptime. Calculation will be based on system logs and includes maintenance windows agreed upon by both parties. Uptime results will be reported quarterly.

Regular reporting (monthly or quarterly depending on the metric) is critical. CrowdPoint Technologies Inc. will assist Spectral Capital Corp. in ensuring adequate systems are in place for tracking, monitoring, and ensuring compliance with these metrics. This will be achieved by leveraging the AI Actuary technology from CrowdPoint Technologies to enhance the tracking, monitoring, and compliance processes for each of the six key performance metrics outlined in this agreement.

4. Quantum Value Units (QVUs)

The Quantum Value Unit (QVU) will act as a utility tracking system for 48 reporting commodities, measuring the amount of specific commodities currently in transit and under the custodianship of the Management of IBA, a San Marino company and wholly owned subsidiary of Spectral Capital Corp. The accurate measurement and transparent reporting of QVUs will comply with all applicable securities laws.

QVUs will be issued to Crwdunit holders within 14 days of the definitive agreement, with a 14-day grace period if there are unavoidable delays. Spectral Capital Corp. will be responsible for ensuring accurate measurement and transparent reporting of QVUs under applicable securities laws.

5. Conditions Precedent

The following conditions must be met prior to the closing of the transaction:

1.Approval by the boards of directors of Spectral Capital Corp. and CrowdPoint Technologies Inc.

2.All necessary regulatory approvals and compliance with applicable securities and commercial laws.

3.Completion of satisfactory due diligence by both parties, including financial, legal, technical, and operational audits.

4.Execution of all necessary legal agreements, including those governing the transfer of the Crwdunit Utility and Quantization Mechanism intellectual property.

5.Confirmation that all Crwdunit holders have been duly notified and rights have been protected according to this term sheet.

6. Closing Date

The closing of the transaction is expected to occur within 60 days of signing this term sheet, subject to the satisfaction of all conditions precedent. A delay of up to 30 days may be permitted in case of regulatory hurdles, after which either party may choose to terminate the agreement under the provisions in Section 11.

7. Representations and Warranties

Both Spectral Capital Corp. and CrowdPoint Technologies Inc. will provide the following representations and warranties, among others:

1.Each party has the requisite power and authority to enter into and perform the terms of this agreement.

2.The shares to be issued by Spectral Capital Corp. will be duly authorized, validly issued, fully paid, and non-assessable and will be delivered under Rule 144 with a two-year restriction period, compliant with applicable securities laws. Shares will be released in increments every six (6) months.

3.The Quantization Mechanism, including any intellectual property, will be transferred free of any encumbrances, liens, or claims by third parties.

4.Intellectual property rights, including those related to the Quantization Mechanism, must be transferred free of any encumbrances, liens, or third-party claims. Both Spectral Capital Corp. and CrowdPoint Technologies Inc. agree to conduct a full review of any existing intellectual property claims, liens, or pending litigation before the transfer of such rights to ensure a clean and unencumbered transition of ownership.

8. Indemnification

Each party agrees to indemnify, defend, and hold the other harmless from and against any and all liabilities, losses, damages, or expenses (including reasonable attorneys' fees) arising from:

1.Any breach of representation, warranty, or covenant made in this agreement.

2.Any claims related to intellectual property infringement or legal challenges arising from the use or transfer of the Quantization Mechanism.

Indemnifications will survive for three (3) years post-closing, except for intellectual property claims, which will survive for five (5) years.

9. Governing Law and Dispute Resolution

This agreement shall be governed by and construed in accordance with the laws of the State of Washington, without regard to its conflict of laws principles.

Any disputes arising under this term sheet will be resolved through arbitration under the rules of the American Arbitration Association (AAA), with the venue in Seattle, Washington. Each party will bear its own costs for arbitration.

10. Confidentiality

Both parties agree to maintain the confidentiality of this term sheet and the details of the proposed transaction, except as may be required by law or as mutually agreed upon in writing.

11. Termination

This term sheet may be terminated by either party upon written notice to the other, prior to the execution of a definitive agreement, without liability.

If either party fails to meet the conditions precedent or a material breach occurs during the negotiation period, the other party may terminate the agreement without further obligation, subject to any costs or expenses incurred in reliance on this term sheet.

12. Post-Acquisition Transition Plan

The CrowdPoint Management team will oversee the transition period, ensuring the seamless integration of Crwdunit Inc. and the Quantization Mechanism into Spectral Capital's operations.

This process will occur in accordance with a detailed timeline that includes technology transfer and service continuity milestones. Key tasks must be completed within 120 days post-closing, and regular reports will be provided to both management teams.

13. Non-Binding Agreement

Except for the sections on confidentiality, indemnification, and governing law, this term sheet is non-binding and serves as a framework for the preparation of a definitive acquisition agreement.

14. Other Considerations

There are no regulatory considerations beyond those that are normal and ordinary for this type of transaction. No fees or penalties will apply for termination of this agreement prior to the execution of a definitive acquisition agreement.

IN WITNESS WHEREOF, the Parties hereto have executed this Agreement as of the Effective Date.

Spectral Capital

|

| CrowdPoint Technologies Inc

|

|

|

|

|

|

By

|

|

| By

|

|

Name

| Sean Michael Brehm

|

| Name

| Nadab U Akhtar

|

Title

| Chairman

|

| Title

| President

|

Date

| 10 September 2024

|

| Date

| 10 September 2024

|

Spectral Capital Enters Agreement to Acquire Crwdunit Inc., A Strategic Move Aligned with Its Quantum Bridge Initiative

SEATTLE, September 11, 2024 – Spectral Capital Corporation (OTCQB: FCCN), a pioneer in Quantum as a Service (QaaS) computing and decentralized cloud infrastructure, is pleased to announce that it has entered into a definitive agreement to acquire Crwdunit Inc., a wholly-owned subsidiary of CrowdPoint Technologies. The agreement provides for the issuance of Spectral Capital stock, with a comprehensive due diligence period currently underway.

Crwdunit Inc. is the creator of a proprietary Quantization Mechanism used to measure performance across multiple dimensions, including workload efficiency, CPU, memory, storage, bandwidth, and server uptime. This technology is pivotal in enhancing resource optimization for decentralized cloud infrastructures. Spectral Capital’s acquisition will include exclusive rights to this innovative quantization system, further bolstering its cutting-edge Quantum Bridge initiative.

"We are excited about the potential this acquisition brings to Spectral Capital’s portfolio," said Jenifer Osterwalder, CEO of Spectral Capital. "Crwdunit’s Quantization Mechanism is perfectly aligned with our Quantum Bridge strategy, providing advanced measurement tools that enhance resource allocation and system performance across decentralized cloud networks. This technology will be integrated with the technology from our recently acquired Quantomo technology and serve as a critical component in optimizing and scaling our Vogon Cloud decentralized edge and hybrid cloud platform."

The acquisition was spurred by IBA of San Marino, Spectral Capital’s subsidiary, which recently licensed the technology from Crwdunit Inc. This successful licensing deal highlighted the significant potential of Crwdunit’s offerings and led to the broader strategic decision to acquire the company fully. The integration of Crwdunit’s technology into Spectral’s Quantum Bridge will enhance its ability to provide decentralized cloud services and distributed computing power across a wide range of industries.

About Spectral Capital’s Quantum Bridge Initiative

Spectral Capital’s Quantum Bridge initiative aims to revolutionize the integration of classical and quantum computing by creating a decentralized, quantum-ready cloud infrastructure. The acquisition of Crwdunit Inc. aligns with this initiative by providing enhanced quantization tools that allow for more precise resource management and performance metrics, essential for efficient quantum computing.

Spectral Capital continues to pioneer the future of decentralized cloud services, positioning itself at the forefront of next-generation data processing and quantum computing technologies. With the integration of Crwdunit Inc., the company is set to drive the future of collective intelligence and scalable, energy-efficient cloud infrastructures.

About Spectral Capital Corporation: Founded in 2000 and based in Seattle, Washington, Spectral Capital (OTCQB:FCCN) is a technology startup accelerator and quantum incubator. We specialize in Quantum as a Service (QaaS), leveraging our proprietary Distributed Quantum Ledger Database technology (DQ-LDB) to offer secure, advanced storage and computing solutions.

Forward-Looking Statements

This press release contains forward-looking statements (as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended) concerning future events and FCCN's growth and business strategy. Words such as "expects," "will," "intends," "plans," "believes," "anticipates," "hopes," "estimates," and variations on such words and similar expressions are intended to identify forward-looking statements. Although FCCN believes that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to have been correct. These statements involve known and unknown risks and are based upon a number of assumptions and estimates that are inherently subject to significant uncertainties and contingencies, many of which are beyond the control of FCCN. Actual results may differ materially from those expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to, changes in FCCN's business; competitive factors in the market(s) in which FCCN operates; risks associated with operations outside the United States; and other factors listed from time to time in FCCN's filings with the Securities and Exchange Commission. FCCN expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in FCCN's expectations with respect thereto or any change in events, conditions or circumstances on which any statement is based.

For more information, please visit www.spectralcapital.com.

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

us-gaap_TextBlockAbstract |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

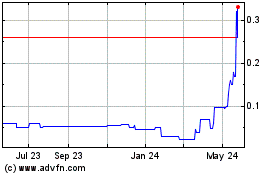

Spectral Capital (QB) (USOTC:FCCN)

Historical Stock Chart

From Oct 2024 to Nov 2024

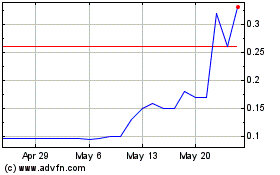

Spectral Capital (QB) (USOTC:FCCN)

Historical Stock Chart

From Nov 2023 to Nov 2024