0001560385

false

0001560385

2023-09-26

2023-09-26

0001560385

lmca:LibertySiriusXmGroupCommonClassAMember

2023-09-26

2023-09-26

0001560385

lmca:LibertySiriusXmGroupCommonClassBMember

2023-09-26

2023-09-26

0001560385

lmca:LibertySiriusXmGroupCommonClassCMember

2023-09-26

2023-09-26

0001560385

lmca:LibertyFormulaOneGroupCommonClassAMember

2023-09-26

2023-09-26

0001560385

lmca:LibertyFormulaOneGroupCommonClassCMember

2023-09-26

2023-09-26

0001560385

lmca:LibertyLiveGroupCommonClassAMember

2023-09-26

2023-09-26

0001560385

lmca:LibertyLiveGroupCommonClassCMember

2023-09-26

2023-09-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d)

of the Securities

Exchange Act of 1934

Date of Report (date of earliest event reported): September 26, 2023

LIBERTY

MEDIA CORPORATION

(Exact name of registrant

as specified in its charter)

| Delaware | |

001-35707 | |

37-1699499 |

(State or other jurisdiction of

incorporation or organization) | |

(Commission

File Number) | |

(I.R.S. Employer

Identification No.) |

12300

Liberty Blvd.

Englewood,

Colorado 80112

(Address of principal executive offices and zip

code)

Registrant's telephone number, including area

code: (720) 875-5400

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol |

Name

of each exchange on which registered |

| Series

A Liberty SiriusXM Common Stock |

LSXMA |

The

Nasdaq Stock Market LLC |

| Series

B Liberty SiriusXM Common Stock |

LSXMB |

The

Nasdaq Stock Market LLC |

| Series

C Liberty SiriusXM Common Stock |

LSXMK |

The

Nasdaq Stock Market LLC |

| Series

A Liberty Formula One Common Stock |

FWONA |

The

Nasdaq Stock Market LLC |

| Series

C Liberty Formula One Common Stock |

FWONK |

The

Nasdaq Stock Market LLC |

| Series

A Liberty Live Common Stock |

LLYVA |

The

Nasdaq Stock Market LLC |

| Series

C Liberty Live Common Stock |

LLYVK |

The

Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01. Regulation FD Disclosure.

On September 26, 2023, Liberty Media Corporation

issued a press release announcing that it has made a proposal to the Special Committee of the Board of Directors of Sirius XM Holdings

Inc. (“SiriusXM”), outlining the terms of a proposed combination of the Liberty SiriusXM tracking stock group with SiriusXM

to form a new, consolidated public company. A copy of the press release is attached as Exhibit 99.1 to this report and is incorporated

by reference herein.

This Current Report on Form 8-K and the press

release attached hereto as Exhibit 99.1 are being furnished to the Securities and Exchange Commission under Item 7.01 of Form 8-K

in satisfaction of the public disclosure requirements of Regulation FD and shall not be deemed "filed" for any purpose.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

Date: September 26, 2023

| |

LIBERTY MEDIA CORPORATION |

| |

|

| |

By: |

/s/ Brittany A. Uthoff |

| |

|

Name: Brittany A. Uthoff |

| |

|

Title: Vice President and Assistant Secretary |

Exhibit 99.1

September 26, 2023

Liberty Media Corporation Proposes Combination with Sirius XM Holdings

Inc.

ENGLEWOOD, Colo. — (BUSINESS WIRE) — Liberty Media Corporation

(“Liberty”) (Nasdaq: LSXMA, LSXMB, LSXMK, FWONA, FWONK, LLYVA, LLYVK) announced today that it communicated a proposal to the

Special Committee of the Board of Directors (the “Special Committee”) of Sirius XM Holdings Inc. (Nasdaq: SIRI) (“SiriusXM”),

which outlined the terms of a proposed combination of the Liberty SiriusXM tracking stock group (“LSXM”) with SiriusXM to

form a new, consolidated public company (“New SiriusXM”).

In the proposed transaction, Liberty would separate LSXM by means

of a redemptive split-off of a newly formed subsidiary of Liberty (“SplitCo”), which would own all of the assets and

liabilities attributed to LSXM. In the split-off, holders of each series of LSXM common stock would receive a number of shares of a

single series of common stock of SplitCo calculated based upon each underlying share of SiriusXM common stock held by SplitCo being

exchanged for 1.05 shares of common stock of New SiriusXM. SplitCo would then combine with SiriusXM to form New SiriusXM, with the

minority shareholders of SiriusXM receiving shares in New SiriusXM on a one-for-one basis. In addition, the minority shareholders of

SiriusXM would receive a pro rata cash payment calculated based on the amount of the outstanding net debt of LSXM effectively

assumed by New SiriusXM in the proposed transaction. New SiriusXM would have a single outstanding series of common stock, with each

share entitling the holder thereof to one vote per share. By way of example, based on recent outstanding share counts, holders of

LSXM common stock would receive 10.3 shares of New SiriusXM common stock for each share of LSXM common stock held at closing, and,

based on the projected outstanding principal amount of LSXM net debt at year end, the minority shareholders of SiriusXM would

receive 1 share of New SiriusXM common stock plus $0.55 in cash for each share of SiriusXM common stock held at closing. The

minority shareholders of SiriusXM would collectively own approximately 16% of New SiriusXM, and the former holders of LSXM common

stock would collectively own approximately 84% of New SiriusXM.

“Liberty’s proposal rationalizes the dual corporate structure

between LSXM and SiriusXM and provides value to all shareholders with a more flexible and attractive currency in New SiriusXM,”

said Greg Maffei, Liberty President & CEO. “SiriusXM minority shareholders will also benefit from enhanced trading dynamics,

including increased liquidity and likelihood of future index inclusion. We are excited about the prospects for New SiriusXM and look forward

to remaining meaningfully invested in the business. This simplified structure will also allow management to better focus on its strategic

priorities, drive the company’s continued growth and simplify the investor relations story.”

The proposed transaction is intended to be tax-free (except with respect

to any cash received) and would be subject to, among other things, the negotiation and execution of mutually acceptable definitive transaction

documents and applicable board approvals, including the approval of a Special Committee. No further updates on the proposed transaction

will be provided unless and until definitive documents are executed or discussions between the parties terminate.

The proposed transaction would not result in any changes to the Liberty

Formula One tracking stock group or the Liberty Live tracking stock group.

Forward-Looking Statements

This press release includes certain forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995, including certain statements relating to the completion of the proposed

transaction, proposed trading of New SiriusXM common stock and other matters related to such proposed transaction. All statements other

than statements of historical fact are “forward-looking statements” for purposes of federal and state securities laws. These

forward-looking statements generally can be identified by phrases such as “possible,” “potential,” “intends”

or “expects” or other words or phrases of similar import or future or conditional verbs such as “will,” “may,”

“might,” “should,” “would,” “could,” or similar variations. These forward-looking statements

involve many risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements,

including, without limitation, the satisfaction of all other conditions to the proposed transaction. These forward-looking statements

speak only as of the date of this press release, and Liberty expressly disclaims any obligation or undertaking to disseminate any updates

or revisions to any forward-looking statement contained herein to reflect any change in Liberty’s expectations with regard thereto

or any change in events, conditions or circumstances on which any such statement is based. Please refer to the publicly filed documents

of Liberty, including its most recent Forms 10-K and 10-Q, as such risk factors may be amended, supplemented or superseded from time to

time by other reports Liberty subsequently files with the SEC, for additional information about Liberty and about the risks and uncertainties

related to Liberty’s business which may affect the statements made in this press release.

Additional Information

Nothing in this press release shall constitute a solicitation to buy

or an offer to sell shares of common stock of Liberty, SiriusXM, SplitCo, or New SiriusXM. The proposed offer and issuance of shares of

common stock of SplitCo and of the shares of New SiriusXM common stock, as applicable, in the proposed split-off and the proposed combination

will be made only pursuant to an effective registration statement. Liberty and SiriusXM stockholders and other investors are urged to

read the registration statement when it is available, together with all relevant SEC filings regarding the proposed transaction, and any

other relevant documents filed as exhibits therewith, as well as any amendments or supplements to those documents, because they will contain

important information about the proposed transaction. Copies of these SEC filings will be available free of charge at the SEC’s

website (http://www.sec.gov). Copies of the filings together with the materials incorporated by reference therein will also be available,

without charge, by directing a request to Liberty Media Corporation, 12300 Liberty Boulevard, Englewood, Colorado 80112, Attention: Investor

Relations, Telephone: (877) 772-1518.

Participants in a Solicitation

Liberty and SiriusXM and their respective directors and executive officers

and other persons may be deemed to be participants in a solicitation in respect of any proposals relating to the proposed transaction.

Information regarding the directors and executive officers of Liberty and any participants in a solicitation and a description of their

respective direct and indirect interests, by security holdings or otherwise, will be available in relevant SEC filings regarding the proposed

transaction to be filed with the SEC. Investors should read relevant SEC filings regarding the proposed transaction carefully before making

any voting or investment decisions. Free copies of these materials from Liberty may be obtained as indicated above.

About Liberty Media Corporation

Liberty Media Corporation operates and owns interests in a broad range

of media, communications and entertainment businesses. Those businesses are attributed to three tracking stock groups: the Liberty SiriusXM

Group, the Formula One Group and the Liberty Live Group. The businesses and assets attributed to the Liberty SiriusXM Group (NASDAQ: LSXMA,

LSXMB, LSXMK) include Liberty’s interest in SiriusXM. The businesses and assets attributed to the Formula One Group (NASDAQ: FWONA,

FWONK) include Liberty’s subsidiary Formula 1 and other minority investments. The businesses and assets attributed to the Liberty

Live Group (NASDAQ: LLYVA, LLYVK) include Liberty’s interest in Live Nation and other minority investments.

Liberty Media Corporation

Shane Kleinstein, 720-875-5432

Source: Liberty Media Corporation

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=lmca_LibertySiriusXmGroupCommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=lmca_LibertySiriusXmGroupCommonClassBMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=lmca_LibertySiriusXmGroupCommonClassCMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=lmca_LibertyLiveGroupCommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=lmca_LibertyLiveGroupCommonClassCMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

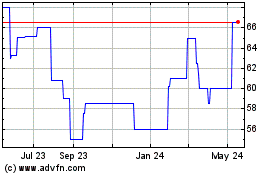

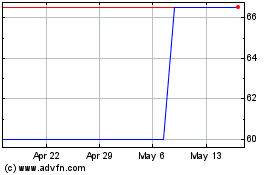

Liberty Media (QB) (USOTC:FWONB)

Historical Stock Chart

From Apr 2024 to May 2024

Liberty Media (QB) (USOTC:FWONB)

Historical Stock Chart

From May 2023 to May 2024