false

0001560385

0001560385

2023-12-11

2023-12-11

0001560385

lmca:LibertySiriusXmGroupCommonClassAMember

2023-12-11

2023-12-11

0001560385

lmca:LibertySiriusXmGroupCommonClassBMember

2023-12-11

2023-12-11

0001560385

lmca:LibertySiriusXmGroupCommonClassCMember

2023-12-11

2023-12-11

0001560385

lmca:LibertyFormulaOneGroupCommonClassAMember

2023-12-11

2023-12-11

0001560385

lmca:LibertyFormulaOneGroupCommonClassCMember

2023-12-11

2023-12-11

0001560385

lmca:LibertyLiveGroupCommonClassAMember

2023-12-11

2023-12-11

0001560385

lmca:LibertyLiveGroupCommonClassCMember

2023-12-11

2023-12-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d)

of the Securities

Exchange Act of 1934

Date of Report (date of earliest event reported): December 11, 2023

LIBERTY

MEDIA CORPORATION

(Exact name of registrant

as specified in its charter)

| Delaware | |

001-35707 | |

37-1699499 |

(State or other jurisdiction of

incorporation or organization) | |

(Commission

File Number) | |

(I.R.S. Employer

Identification No.) |

12300

Liberty Blvd.

Englewood,

Colorado 80112

(Address of principal executive offices and zip

code)

Registrant's telephone number, including area

code: (720) 875-5400

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

x

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol |

Name

of each exchange on which

registered |

| Series

A Liberty SiriusXM Common Stock |

LSXMA |

The

Nasdaq Stock Market LLC |

| Series

B Liberty SiriusXM Common Stock |

LSXMB |

The

Nasdaq Stock Market LLC |

| Series

C Liberty SiriusXM Common Stock |

LSXMK |

The

Nasdaq Stock Market LLC |

| Series

A Liberty Formula One Common Stock |

FWONA |

The

Nasdaq Stock Market LLC |

| Series

C Liberty Formula One Common Stock |

FWONK |

The

Nasdaq Stock Market LLC |

| Series

A Liberty Live Common Stock |

LLYVA |

The

Nasdaq Stock Market LLC |

| Series

C Liberty Live Common Stock |

LLYVK |

The

Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 8.01 Other Events

On December 12, 2023, Liberty

Media Corporation, a Delaware corporation (“Liberty Media”), and Sirius XM Holdings Inc., a Delaware corporation (“SiriusXM”),

issued a joint press release, a copy of which is filed herewith as Exhibit 99.1 and incorporated herein by reference, announcing the execution

of (i) a Reorganization Agreement, dated December 11, 2023, by and among Liberty Media, SiriusXM and Liberty Sirius XM Holdings Inc.,

a Delaware corporation and a wholly owned subsidiary of Liberty Media (“SplitCo”), pursuant to which, upon the terms

and subject to the conditions set forth therein, Liberty Media will cause SplitCo to be split-off from Liberty Media, and (ii) an Agreement

and Plan of Merger, dated December 11, 2023, by and among Liberty Media, SiriusXM, SplitCo and Radio Merger Sub, LLC, a Delaware limited

liability company and a wholly owned subsidiary of SplitCo (“Merger Sub”), pursuant to which, upon the terms and subject

to the conditions set forth therein, Merger Sub will merge with and into SiriusXM, with SiriusXM surviving as a wholly owned subsidiary

of SplitCo.

Also on December 12, 2023,

Liberty Media made available on its website a slide show presentation regarding the transactions described herein and in the press release

and further regarding the Liberty SiriusXM Group and SiriusXM businesses in connection with a joint investor conference call to be held

with investors at 8:30 a.m., Eastern Time, on December 12, 2023. Information on how to participate in the call can be found in the press

release. A copy of the presentation is filed herewith as Exhibit 99.2 and incorporated herein by reference.

The press release and investor

presentation are being filed herewith as Exhibit 99.1 and Exhibit 99.2, respectively, to this Current Report on Form 8-K in compliance

with Rule 425 of the Securities Act of 1933, as amended, and Rule 14a-12 under the Securities Exchange Act of 1934, as amended, and are

hereby incorporated by reference into this Item 8.01.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form

8-K includes certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including

certain statements relating to the completion of the proposed transaction, proposed trading of SplitCo common stock and other matters

related to such proposed transaction. All statements other than statements of historical fact are “forward-looking statements”

for purposes of federal and state securities laws. These forward-looking statements generally can be identified by phrases such as “possible,”

“potential,” “intends” or “expects” or other words or phrases of similar import or future or conditional

verbs such as “will,” “may,” “might,” “should,” “would,” “could,”

or similar variations. These forward-looking statements involve many risks and uncertainties that could cause actual results and the timing

of events to differ materially from those expressed or implied by such statements, including, but not limited to: historical financial

information may not be representative of future results; there may be significant transaction costs and integration costs in connection

with the proposed transaction (including significant tax liability); the parties may not realize the potential benefits of the proposed

transaction in the near term or at all; an active trading market for SplitCo common stock may not develop; the uncertainty of the market

value of the SplitCo common stock; the satisfaction of all conditions to the proposed transaction; the proposed transaction may not be

consummated; Liberty Media and SiriusXM may need to use resources that are needed in other parts of its business to do so; there may be

liabilities that are not known, probable or estimable at this time; the proposed transaction may result in the diversion of management’s

time and attention to issues relating to the proposed transaction and integration; unfavorable outcome of legal proceedings that may be

instituted against Liberty Media and/or SiriusXM following the announcement of the proposed transaction; risks related to disruption of

management time from ongoing business operations due to the proposed transaction; risks inherent to the business may result in additional

strategic and operational risks, which may impact Liberty Media, SplitCo and/or SiriusXM’s risk profiles, which each company may

not be able to mitigate effectively; and other risks and uncertainties detailed in periodic reports that Liberty Media and SiriusXM file

with the SEC. These forward-looking statements speak only as of the date of this Current Report on Form 8-K, and Liberty Media and SiriusXM

expressly disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein

to reflect any change in Liberty Media’s or SiriusXM’s expectations with regard thereto or any change in events, conditions

or circumstances on which any such statement is based. Please refer to the publicly filed documents of Liberty Media and SiriusXM, including

their most recent Forms 10-K and 10-Q, as such risk factors may be amended, supplemented or superseded from time to time by other reports

Liberty Media or SiriusXM subsequently file with the Securities and Exchange Commission (“SEC”), for additional information about Liberty Media and SiriusXM and about the risks

and uncertainties related to Liberty Media’s and SiriusXM’s businesses which may affect the statements made in this Current

Report on Form 8-K.

Additional Information

Nothing in this Current Report

on Form 8-K shall constitute a solicitation to buy or an offer to sell shares of common stock of Liberty Media, SiriusXM or SplitCo. The

proposed offer and issuance of shares of SplitCo common stock in the proposed transactions will be made only pursuant to an effective

registration statement on Form S-4, including a proxy statement of Liberty Media, prospectus of SplitCo, and information statement of

SiriusXM. LIBERTY MEDIA AND SIRIUSXM STOCKHOLDERS AND OTHER INVESTORS ARE URGED TO READ THE REGISTRATION STATEMENT WHEN IT IS AVAILABLE,

TOGETHER WITH ALL RELEVANT SEC FILINGS REGARDING THE PROPOSED TRANSACTION, AND ANY OTHER RELEVANT DOCUMENTS FILED AS EXHIBITS THEREWITH,

AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

After the registration statement is declared effective, the proxy statement/prospectus/information statement and other relevant materials

for the proposed transaction will be mailed to all Liberty Media and SiriusXM stockholders. Copies of these SEC filings will be available,

free of charge, at the SEC’s website (http://www.sec.gov). Copies of the filings together with the materials incorporated by reference

therein will also be available, without charge, by directing a request to Liberty Media Corporation, 12300 Liberty Boulevard, Englewood,

Colorado 80112, Attention: Investor Relations, Telephone: (877) 772-1518 or Sirius XM Holdings Inc., 1221 Avenue of the Americas, 35th

Floor, New York, New York 10021, Attention: Investor Relations, (212) 584-5100.

Participants in a Solicitation

Liberty

Media anticipates that the following individuals will be participants (the “Liberty Media

Participants”) in the solicitation of proxies from holders of Liberty Media’s LSXMA and LSXMB common stock in connection

with the proposed transaction: John C. Malone, Chairman of the Board of Directors of Liberty Media, Robert R. Bennett, Derek Chang, Brian

M. Deevy, M. Ian G. Gilchrist, Evan D. Malone, Larry E. Romrell, and Andrea L. Wong, all of whom are members of the Board of Directors

of Liberty Media, Gregory B. Maffei, Liberty Media’s President, Chief Executive Officer and Director, and Brian J. Wendling, Liberty

Media’s Chief Accounting Officer and Principal Financial Officer. Information regarding the Liberty Media Participants, including

a description of their direct or indirect interests, by security holdings or otherwise, can be found under the caption “Security

Ownership of Certain Beneficial Owners and Management—Pro Forma Security Ownership of Management of Liberty Media Following the

Reclassification” contained in Liberty Media’s registration statement on Form S-4 (the “S-4”),

which was filed with the SEC on June 8, 2023 and is available at: https://www.sec.gov/Archives/edgar/data/1560385/000110465923069028/tm2232384-33_s4a.htm.

To the extent that certain Liberty Media Participants or their affiliates have acquired or disposed of security holdings since the “as

of” date disclosed in the S-4, such transactions have been or will be reflected on Statements of Change in Ownership on Form 4

or amendments to beneficial ownership reports on Schedules 13D filed with the SEC, which are available at: https://www.sec.gov/edgar/browse/?CIK=1560385&owner=exclude.

Additional information regarding the Liberty Media Participants in the proxy solicitation and a description of their interests will be

contained in the proxy statement for Liberty Media’s special meeting of stockholders and other relevant materials to be filed with

the SEC in respect of the contemplated transactions when they become available. These documents can be obtained free of charge from the

sources indicated above.

SiriusXM anticipates that

the following individuals will be participants (the “SiriusXM Participants”) in the solicitation of proxies from holders

of Liberty Media’s LSXMA and LSXMB common stock in connection with the proposed transaction Gregory B. Maffei, Chairman of the

SiriusXM Board of Directors, David A. Blau, Eddy W. Hartenstein, Robin P. Hickenlooper, James P. Holden, Evan D. Malone, James E. Meyer,

Jonelle Procope, Michael Rapino, Kristina M. Salen, Carl E. Vogel and David Zaslav, all of whom are members of SiriusXM’s Board

of Directors, Jennifer Witz, SiriusXM’s Chief Executive Officer and Director and Thomas D. Barry, SiriusXM’s Chief Financial

Officer. Information regarding the SiriusXM Participants, including a description of their direct or indirect interests, by security

holdings or otherwise, can be found under the caption “Stock Ownership” contained in Sirius XM’s definitive proxy statement

for its 2023 annual meeting of stockholders (the “2023 Proxy Statement”), which was filed with the SEC on April 21,

2023 and is available at: https://www.sec.gov/ix?doc=/Archives/edgar/data/908937/000093041323001281/c105679_def14a-ixbrl.htm.

To the extent that certain SiriusXM Participants or their affiliates have acquired or disposed of security holdings since the “as

of” date disclosed in the 2023 Proxy Statement, such transactions have been or will be reflected on Statements of Change in Ownership

on Form 4, which are available at: https://www.sec.gov/edgar/browse/?CIK=908937&owner=exclude. Additional information regarding certain

of the SiriusXM Participants in the proxy solicitation and a description of their interests will be contained in the information statement

and other relevant materials to be filed with the SEC in respect of the contemplated transactions when they become available. These documents

can be obtained free of charge from the sources indicated above.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

Date: December

12, 2023

| |

LIBERTY MEDIA CORPORATION |

| |

|

|

| |

By: |

/s/ Brittany A. Uthoff |

| |

|

Name: Brittany A. Uthoff |

| |

|

Title: Vice President and Assistant Secretary |

Exhibit 99.1

Liberty Media and SiriusXM Announce Transaction

to Simplify Ownership Structure of SiriusXM

Liberty SiriusXM Tracking Stock Group Will

Combine with SiriusXM and Form a New Public Company

Transaction Builds on SiriusXM’s Durable

Foundation and Positions Company to Drive Growth

and Create Stockholder Value

Liberty and SiriusXM to Host Conference Call

Today at 8:30 AM ET

ENGLEWOOD,

Colo. and NEW YORK -- December 12, 2023 -- Liberty Media Corporation (“Liberty Media” or “Liberty”)

(NASDAQ: LSXMA, LSXMB, LSXMK, FWONA, FWONK, LLYVA, LLYVK) and Sirius XM Holdings Inc. (NASDAQ: SIRI) (“SiriusXM” or the “Company”),

the leading audio entertainment company in North America, today announced that they have entered into definitive agreements whereby Liberty

Media’s Liberty SiriusXM tracking stock group (NASDAQ: LSXMA, LSXMB and LSXMK) (collectively “LSXM”), will be combined

with SiriusXM to create a new public company (“New SiriusXM”), which will continue to operate under the SiriusXM name and

brand. New SiriusXM will have a single outstanding series of common stock and is expected to continue to be traded on the Nasdaq Global

Select Market under the ticker symbol “SIRI”.

“We have reached an important milestone in Liberty’s ownership

of SiriusXM. This combination will create value for all stockholders by eliminating the tracking stock structure, enhancing liquidity

and allowing former LSXM stockholders to participate directly in the ongoing performance of SiriusXM,” said Greg Maffei, Liberty

President & CEO. “SiriusXM commands the largest paid share-of-ear in the car and has proven itself as an incredibly successful

and profitable business. We are confident SiriusXM will continue to create value by building on its resilient business model to execute

its strategic initiatives. We look forward to remaining meaningfully involved in the business and significant stockholders.”

“We are pleased that the Special Committee of our Board of Directors

has reached this agreement with Liberty Media, which will allow SiriusXM to enter its next phase of value creation,” said Jennifer

Witz, Chief Executive Officer of SiriusXM. “In a highly fragmented audio entertainment industry, SiriusXM has differentiated itself

as the leading audio entertainment provider by creating an experience centered on our high-quality, premium, human curated radio that

is more relevant than ever. In doing so, we have built a profitable business that is poised for continued success. With our strong foundation

and as we roll out our next generation platform, we are transforming SiriusXM to drive long-term growth and stockholder value creation.”

“The Special Committee of the SiriusXM Board of Directors, along

with our independent advisors, has carefully and diligently evaluated Liberty Media’s proposal and negotiated this transaction.

We believe that the agreement we reached with Liberty Media is in the best interests of the Company and its stockholders,” said

Eddy Hartenstein, member of the Special Committee and Lead Independent Director of the SiriusXM Board. “With this transaction,

SiriusXM will be well positioned to continue creating value for stockholders.”

Transaction Benefits

The transaction will result in New SiriusXM being an independent public

company, with no majority stockholder, a single class of shares and a board comprising a majority of independent directors.

New SiriusXM will have a simplified ownership structure and benefit

from greater strategic flexibility and independence. It also provides New SiriusXM with access to a broader investor base and expanded

opportunities for index inclusion. The additional float provided by the transaction is also expected to improve trading liquidity for

New SiriusXM stockholders.

The transaction offers all stockholders the opportunity to participate

directly in the long-term potential of the leading audio-entertainment company in North America.

Transaction Details

Under the terms of the transaction, Liberty will separate LSXM by

means of a redemptive split-off of a new subsidiary of Liberty (“SplitCo”), which will hold its shares of SiriusXM and approximately

$1.7 billion of estimated attributed net liabilities. Such net liabilities include LSXM’s net debt (3.75% LSXMA convertible notes

due 2028, 2.75% SIRI exchangeable bonds due 2049 and SIRI margin loan, net of corporate cash)1, as well as other liabilities

for transaction fees and expenses, financing fees, litigation related liabilities and other corporate adjustments. In the split-off,

holders of each series of LSXM common stock will receive a number of shares of SplitCo stock equal to the Exchange Ratio, calculated

as described below, such that LSXM stockholders receive 1 share of New SiriusXM for each share of SiriusXM previously held at LSXM, adjusted

for LSXM net liabilities. A wholly owned subsidiary of SplitCo will then merge with SiriusXM, and existing SiriusXM stockholders (other

than Liberty Media) will receive 1:1 shares of SplitCo, which will become New SiriusXM. The transaction is intended to be tax-free to

LSXM stockholders (except with respect to any cash received in lieu of fractional shares) and SiriusXM stockholders.

The Exchange Ratio will be calculated based on (i) the number of shares

of SiriusXM held by Liberty, reduced by a net liabilities share adjustment (the “Net Liabilities Share Adjustment”), divided

by (ii) the number of adjusted fully diluted shares of LSXM.

Liberty Media currently holds 3,205.8 million shares of SiriusXM attributed

to LSXM. The Net Liabilities Share Adjustment to the Exchange Ratio will be determined as the amount of assumed LSXM net debt (excluding

the 3.75% LSXMA convertible notes due 2028), with additional adjustments for transaction fees and expenses, financing fees, litigation

related liabilities and other corporate adjustments, divided by the SiriusXM share price of $4.23, which represents the average of the

SiriusXM daily volume-weighted average prices over the 20 consecutive trading days ending September 25, 2023, the day before Liberty

filed a 13D relating to a transaction.

1 Estimated as of June 30, 2024. Based

on figures as of September 30, 2023, adjusted for retirement of remaining $199 million principal amount of 1.375% cash convertible notes

in October 2023, settlement of BATRK stake monetized in debt-for-equity exchange in November 2023, estimated dividends to be received

from SiriusXM and estimated interest payments on remaining debt.

The adjusted fully diluted shares of LSXM will be calculated based

on outstanding LSXM shares at closing, including the dilutive impact of shares underlying the 3.75% LSXMA convertible notes due 2028

and the dilutive impact of equity awards.

If the Net Liabilities Share Adjustment and the adjusted fully diluted

shares of LSXM were calculated as of June 30, 2024, the Exchange Ratio is estimated to be approximately 8.4 shares in New SiriusXM for

each share of LSXM held.

Pro forma for the transaction, and assuming the adjustment described

above, at June 30, 2024, there will be approximately 3,392 million basic shares outstanding of New SiriusXM, of which former LSXM stockholders

will own approximately 81% of New SiriusXM, with the SiriusXM minority stockholders owning the remaining 19%.

New SiriusXM will remain committed to the business’ long-term

target leverage ratio of low-to-mid 3x adjusted EBITDA.

SiriusXM has secured committed financing with availability of $1.1

billion from Morgan Stanley, Bank of America and J.P. Morgan, the net proceeds of which may be used to refinance Liberty Media’s

2.75% Exchangeable Notes due 2049 and the existing Liberty Media margin loan secured by SiriusXM’s common stock.

The transaction has been unanimously approved by Liberty’s Board,

the SiriusXM Special Committee and SiriusXM’s Board of Directors. Greg Maffei is expected to be Chairman of the Board of New SiriusXM.

The transaction is expected to be completed early in the third quarter of 2024, subject to approval by a majority of the aggregate voting

power of the shares of Liberty SiriusXM common stock present, whether in-person or by proxy, at a stockholder meeting, the receipt by

Liberty Media and New SiriusXM of tax opinions from their respective tax counsel, as well as the receipt of required regulatory approvals

and the satisfaction of other customary closing conditions. Certain trusts affiliated with John Malone, the Chairman of Liberty Media,

have entered into a voting agreement pursuant to which they have committed to vote their shares of LSXM in favor of the transaction.

A subsidiary of Liberty Media owning a majority of the outstanding shares of SiriusXM has delivered a written consent approving the transaction

on behalf of SiriusXM stockholders. The transaction will not result in any changes to the Liberty Formula One tracking stock group or

the Liberty Live tracking stock group.

Shaping the Future of Audio

New SiriusXM is poised to drive growth and create value:

| ● | Leaning

into the Company’s live, human curated audio experiences: SiriusXM is an innovative

content company and leader in providing a differentiated blend of live, human curated and

artist-hosted radio, exclusive talk programming, podcasts and news, sports and more. |

| ● | Leading

subscription business positioned for the future: SiriusXM has more than 155 million SiriusXM-enabled

vehicles on the road, 34 million paid subscribers with near record low churn and continues

to roll out its 360L platform and expand its electric vehicle footprint. In addition, with

the launch of its next generation platform, the Company is focused on delivering a unified,

personalized experience in- and out-of-vehicle by creating seamless listening experiences,

with greater personalization and content discovery for consumers anywhere they choose to

listen. |

| ● | Tapping

into new audiences to grow with its next generation platform: SiriusXM is doubling-down

on its differentiated content, while enhancing its value proposition with a modernized brand,

new app experience, and an attractive new price point for streaming-only subscribers. Through

its new next generation platform, SiriusXM is poised to retain its loyal core audience of

listeners and capture demand from new growth audiences that are younger, more diverse and

willing to pay for multiple services. |

| ● | Capturing

opportunities in ad-based platforms: SiriusXM commands a significant audience, reaching

over 150 million monthly listeners across SiriusXM, Pandora and its broader podcast and off-platform

ad network. The Company generates over $1.8 billion in advertising revenue and continues

to invest in advertising capabilities, creating a unique value proposition for advertisers

to reach its scaled and diverse listener base. |

| ● | Consistently

delivering strong results and capital returns: SiriusXM continues to generate high EBITDA

margins and steady free cash flow that support the Company’s ability to invest in long-term

growth and rapidly de-lever, while also returning capital to stockholders. The Company does

not expect any change to its existing dividend policy while de-emphasizing repurchases until

it reaches its long standing leverage target of low-to-mid 3x adjusted EBITDA. Over the last

three years, SiriusXM has returned approximately $4.4 billion to stockholders through a combination

of dividends, special dividends and share repurchases. The Company has no bond maturities

until 2026 and expects to end 2023 with approximately $2 billion of available liquidity,

plus committed financing of another $1.1 billion in support of this transaction. |

Joint Investor Call

Liberty Media and SiriusXM will hold a joint investor conference call

and webcast at 8:30 AM ET to discuss the details of the transaction. To participate via telephone, please dial 877.407.4019 (Toll-free)

or +1.201.689.8337 (Local) 10 minutes prior to the start of the call and ask to be connected to the SiriusXM conference call. A webcast

of the presentation will be available on the Investor Relations section of the SiriusXM website at siriusxm.com/investorrelations.

A replay of the call will be accessible on each company's Investor Relations webpage within 24 hours of the conclusion after any necessary

filings have been made with the SEC.

Advisors

J.P. Morgan is acting as financial advisor to Liberty Media, and O’Melveny

& Myers LLP is acting as legal counsel. Morgan Stanley & Co. LLC is acting as financial advisor to SiriusXM, and Simpson Thacher

& Bartlett LLP is acting as legal counsel. Solomon Partners is acting as financial advisor to the SiriusXM Special Committee and

Debevoise & Plimpton LLP is acting as legal counsel.

Cautionary Note Regarding Forward-Looking Statements

This press release includes certain forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995, including certain statements relating to the completion

of the proposed transaction, proposed trading of SplitCo common stock and other matters related to such proposed transaction. All statements

other than statements of historical fact are “forward-looking statements” for purposes of federal and state securities laws.

These forward-looking statements generally can be identified by phrases such as “possible,” “potential,” “intends”

or “expects” or other words or phrases of similar import or future or conditional verbs such as “will,” “may,”

“might,” “should,” “would,” “could,” or similar variations. These forward-looking statements

involve many risks and uncertainties that could cause actual results and the timing of events to differ materially from those expressed

or implied by such statements, including, but not limited to: historical financial information may not be representative of future results;

there may be significant transaction costs and integration costs in connection with the proposed transaction (including significant tax

liability); the parties may not realize the potential benefits of the proposed transaction in the near term or at all; an active trading

market for SplitCo common stock may not develop; the uncertainty of the market value of the SplitCo common stock; the satisfaction of

all conditions to the proposed transaction; the proposed transaction may not be consummated; Liberty Media and SiriusXM may need to use

resources that are needed in other parts of its business to do so; there may be liabilities that are not known, probable or estimable

at this time; the proposed transaction may result in the diversion of management’s time and attention to issues relating to the

proposed transaction and integration; unfavorable outcome of legal proceedings that may be instituted against Liberty Media and/or SiriusXM

following the announcement of the proposed transaction; risks related to disruption of management time from ongoing business operations

due to the proposed transaction; risks inherent to the business may result in additional strategic and operational risks, which may impact

Liberty Media, SplitCo and/or SiriusXM’s risk profiles, which each company may not be able to mitigate effectively; and other risks

and uncertainties detailed in periodic reports that Liberty Media and SiriusXM file with the SEC. These forward-looking statements speak

only as of the date of this press release, and Liberty Media and SiriusXM expressly disclaim any obligation or undertaking to disseminate

any updates or revisions to any forward-looking statement contained herein to reflect any change in Liberty Media’s or SiriusXM’s

expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Please refer

to the publicly filed documents of Liberty Media and SiriusXM, including their most recent Forms 10-K and 10-Q, as such risk factors

may be amended, supplemented or superseded from time to time by other reports Liberty Media or SiriusXM subsequently file with the SEC,

for additional information about Liberty Media and SiriusXM and about the risks and uncertainties related to Liberty Media’s and

SiriusXM’s businesses which may affect the statements made in this press release.

Additional Information

Nothing in this press release shall constitute a

solicitation to buy or an offer to sell shares of common stock of Liberty Media, SiriusXM or SplitCo. The proposed offer and issuance

of shares of SplitCo common stock in the proposed transactions will be made only pursuant to an effective registration statement on Form

S-4, including a proxy statement of Liberty Media, prospectus of SplitCo, and information statement of SiriusXM. LIBERTY MEDIA AND SIRIUSXM

STOCKHOLDERS AND OTHER INVESTORS ARE URGED TO READ THE REGISTRATION STATEMENT WHEN IT IS AVAILABLE, TOGETHER WITH ALL RELEVANT SEC FILINGS

REGARDING THE PROPOSED TRANSACTION, AND ANY OTHER RELEVANT DOCUMENTS FILED AS EXHIBITS THEREWITH, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS

TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. After the registration statement

is declared effective, the proxy statement/prospectus/ information statement and other relevant materials for the proposed transaction

will be mailed to all Liberty Media and SiriusXM stockholders. Copies of these SEC filings will be available, free of charge, at the

SEC’s website (http://www.sec.gov). Copies of the filings together with the materials incorporated by reference therein

will also be available, without charge, by directing a request to Liberty Media Corporation, 12300 Liberty Boulevard, Englewood, Colorado

80112, Attention: Investor Relations, Telephone: (877) 772-1518 or Sirius XM Holdings Inc., 1221 Avenue of the Americas, 35th Floor,

New York, New York 10021, Attention: Investor Relations, (212) 584-5100.

Participants in a Solicitation

Liberty Media anticipates that the following individuals will be participants

(the “Liberty Media Participants”) in the solicitation of proxies from holders of Liberty Media’s LSXMA and LSXMB common

stock in connection with the proposed transaction: John C. Malone, Chairman of the Liberty Media Board of Directors, Robert R. Bennett,

Derek Chang, Brian M. Deevy, M. Ian G. Gilchrist, Evan D. Malone, Larry E. Romrell, and Andrea L. Wong, all of whom are members of the

Liberty Media Board of Directors, Gregory B. Maffei, Liberty Media’s President, Chief Executive Officer and Director, and Brian

J. Wendling, Liberty Media’s Chief Accounting Officer and Principal Financial Officer. Information regarding the Liberty Media

Participants, including a description of their direct or indirect interests, by security holdings or otherwise, can be found under the

caption “Security Ownership of Certain Beneficial Owners and Management—Pro Forma Security Ownership of Management of Liberty

Media Following the Reclassification” contained in Liberty Media’s registration statement on Form S-4 (the “S-4”),

which was filed with the SEC on June 8, 2023 and is available at: https://www.sec.gov/Archives/edgar/data/1560385/000110465923069028/tm2232384-33_s4a.htm.

To the extent that certain Liberty Media Participants or their affiliates have acquired or disposed of security holdings since the “as

of” date disclosed in the S-4, such transactions have been or will be reflected on Statements of Change in Ownership on Form 4

or amendments to beneficial ownership reports on Schedules 13D filed with the SEC, which are available at: https://www.sec.gov/edgar/browse/?CIK=1560385&owner=exclude.

Additional information regarding the Liberty Media Participants in the proxy solicitation and a description of their interests will be

contained in the proxy statement for Liberty Media’s special meeting of stockholders and other relevant materials to be filed with

the SEC in respect of the contemplated transactions when they become available. These documents can be obtained free of charge from the

sources indicated above.

SiriusXM anticipates that the following individuals

will be participants (the “SiriusXM Participants”) in the solicitation of proxies from holders of Liberty Media’s LSXMA

and LSXMB common stock in connection with the proposed transaction Gregory B. Maffei, Chairman of the SiriusXM Board of Directors, David

A. Blau, Eddy W. Hartenstein, Robin P. Hickenlooper, James P. Holden, Evan D. Malone, James E. Meyer, Jonelle Procope, Michael Rapino,

Kristina M. Salen, Carl E. Vogel and David Zaslav, all of whom are members of SiriusXM’s Board of Directors, Jennifer Witz, SiriusXM’s

Chief Executive Officer and Director and Thomas D. Barry, SiriusXM’s Chief Financial Officer. Information regarding the SiriusXM

Participants, including a description of their direct or indirect interests, by security holdings or otherwise, can be found under the

caption “Stock Ownership” contained in Sirius XM’s definitive proxy statement for its 2023 annual meeting of stockholders

(the “2023 Proxy Statement”), which was filed with the SEC on April 21, 2023 and is available at: https://www.sec.gov/ix?doc=/Archives/edgar/data/908937/000093041323001281/c105679_def14a-ixbrl.htm.

To the extent that certain SiriusXM Participants or their affiliates have acquired or disposed of security holdings since the “as

of” date disclosed in the 2023 Proxy Statement, such transactions have been or will be reflected on Statements of Change in Ownership

on Form 4, which are available at: https://www.sec.gov/edgar/browse/?CIK=908937&owner=exclude. Additional information regarding

certain of the SiriusXM Participants in the proxy solicitation and a description of their interests will be contained in the information

statement and other relevant materials to be filed with the SEC in respect of the contemplated transactions when they become available.

These documents can be obtained free of charge from the sources indicated above.

About Liberty Media Corporation

Liberty Media Corporation operates and owns interests in a broad range

of media, communications and entertainment businesses. Those businesses are attributed to three tracking stock groups: the Liberty SiriusXM

Group, the Formula One Group and the Liberty Live Group. The businesses and assets attributed to the Liberty SiriusXM Group (NASDAQ:

LSXMA, LSXMB, LSXMK) include Liberty Media’s interest in SiriusXM. The businesses and assets attributed to the Formula One Group

(NASDAQ: FWONA, FWONK) include Liberty Media’s subsidiary Formula 1 and other minority investments. The businesses and assets attributed

to the Liberty Live Group (NASDAQ: LLYVA, LLYVK) include Liberty Media’s interest in Live Nation and other minority investments.

About Sirius XM Holdings Inc.

SiriusXM is the leading audio entertainment company in North America

with a portfolio of audio businesses including its flagship subscription entertainment service SiriusXM; the ad-supported and premium

music streaming services of Pandora; an expansive podcast network; and a suite of business and advertising solutions. Reaching a combined

monthly audience of approximately 150 million listeners, SiriusXM offers a broad range of content for listeners everywhere they tune

in with a diverse mix of live, on-demand, and curated programming across music, talk, news, and sports. For more about SiriusXM, please

go to: www.siriusxm.com.

Contacts

Liberty Media

Shane Kleinstein

(720) 875-5432

SiriusXM

Investor

contacts:

Hooper Stevens

212-901-6718

hooper.stevens@siriusxm.com

Natalie Candela

212-901-6672

natalie.candela@siriusxm.com

Media

contact:

Jessica Casano-Antonellis

Jessica.casano@siriusxm.com

Exhibit 99.2

Investor Presentation December 2023

2 Cautionary Note Regarding Forward Looking Statements This communication includes certain forward - looking statements within the meaning of the Private Securities Litigation Reform Ac t of 1995, including certain statements relating to the completion of the proposed transaction, proposed trading of common stock of Liberty Sirius XM Holdings Inc. (“SplitCo”) and other matter s r elated to such proposed transaction. All statements other than statements of historical fact are “forward - looking statements” for purposes of federal and state securities laws. These forward - looking statements generally can be identified by phrases such as “possible,” “potential,” “intends” or “expects” or other words or phrases of similar import or future or conditional verbs su ch as “will,” “may,” “might,” “should,” “would,” “could,” or similar variations. These forward - looking statements involve many risks and uncertainties that could cause actual results and the timing of events t o differ materially from those expressed or implied by such statements, including, but not limited to: historical financial information may not be representative of future results; ther e m ay be significant transaction costs and integration costs in connection with the proposed transaction (including significant tax liability); the parties may not realize the potential benefits of th e p roposed transaction in the near term or at all; an active trading market for SplitCo common stock may not develop; the uncertainty of the market value of the SplitCo common stock; the satisfaction of al l c onditions to the proposed transaction; the proposed transaction may not be consummated; Liberty Media and SiriusXM may need to use resources that are needed in other parts of its business t o d o so; there may be liabilities that are not known, probable or estimable at this time; the proposed transaction may result in the diversion of management’s time and attention to issues rel ati ng to the proposed transaction and integration; unfavorable outcome of legal proceedings that may be instituted against Liberty Media and/or SiriusXM following the announcement of the proposed tra nsaction; risks related to disruption of management time from ongoing business operations due to the proposed transaction; risks inherent to the business may result in additional strategi c a nd operational risks, which may impact Liberty Media, SplitCo and/or SiriusXM’s risk profiles, which each company may not be able to mitigate effectively; and other risks and uncertainties detai led in periodic reports that Liberty Media and SiriusXM file with the SEC. These forward - looking statements speak only as of the date of this communication, and Liberty Media and SiriusXM expressly discl aim any obligation or undertaking to disseminate any updates or revisions to any forward - looking statement contained herein to reflect any change in Liberty Media’s or SiriusXM’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Please refer to the publicly filed documents of Liberty Media and SiriusX M, including their most recent Forms 10 - K and 10 - Q, as such risk factors may be amended, supplemented or superseded from time to time by other reports Liberty Media or SiriusXM subsequently fil e with the SEC, for additional information about Liberty Media and SiriusXM and about the risks and uncertainties related to Liberty Media’s and SiriusXM’s businesses which may affect the sta tements made in this communication.

3 Legal Disclaimer Additional Information Nothing in this communication shall constitute a solicitation to buy or an offer to sell shares of common stock of Liberty Me dia , SiriusXM or SplitCo. The proposed offer and issuance of shares of SplitCo common stock in the proposed transactions will be made only pursuant to an effective registration statement on Form S - 4, includ ing a proxy statement of Liberty Media, prospectus of SplitCo, and information statement of SiriusXM. LIBERTY MEDIA AND SIRIUSXM STOCKHOLDERS AND OTHER INVESTORS ARE URGED TO READ TH E REGISTRATION STATEMENT WHEN IT IS AVAILABLE, TOGETHER WITH ALL RELEVANT SEC FILINGS REGARDING THE PROPOSED TRANSACTION, AND ANY OTHER RELEVANT DOCUMENTS FILED AS EXHIBITS TH EREWITH, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. After the reg istration statement is declared effective, the proxy statement/prospectus/information statement and other relevant materials for the proposed transaction will be mailed to all Liberty Media and SiriusXM stockholders. Copies of these SEC filings will be available, free of charge, at the SEC’s website (http://www.sec.gov). Copies of the filings together with the ma terials incorporated by reference therein will also be available, without charge, by directing a request to Liberty Media Corporation, 12300 Liberty Boulevard, Englewood, Colorado 80112, Attention: I nve stor Relations, Telephone: (877) 772 - 1518 or Sirius XM Holdings Inc., 1221 Avenue of the Americas, 35th Floor, New York, New York 10021, Attention: Investor Relations, (212) 584 - 5100. Participants in a Solicitation SiriusXM anticipates that the following individuals will be participants (the “SiriusXM Participants”) in the solicitation of pr oxies from holders of Liberty Media’s LSXMA and LSXMB common stock in connection with the proposed transaction Gregory B. Maffei, Chairman of the SiriusXM Board of Directors, David A. Blau , Eddy W. Hartenstein, Robin P. Hickenlooper, James P. Holden, Evan D. Malone, James E. Meyer, Jonelle Procope , Michael Rapino , Kristina M. Salen , Carl E. Vogel and David Zaslav, all of whom are members of SiriusXM’s Board of Directors, Jennifer Witz, SiriusXM’s Chief E xec utive Officer and Director and Thomas D. Barry, SiriusXM’s Chief Financial Officer. Information regarding the SiriusXM Participants , i ncluding a description of their direct or indirect interests, by security holdings or otherwise, can be found under the caption “Stock Ownership” contained in SiriusXM’s definitive proxy statement fo r i ts 2023 annual meeting of stockholders (the “2023 Proxy Statement”), which was filed with the SEC on April 21, 2023 and is available at: https://www.sec.gov/ix?doc=/Archives/edgar/d ata /908937/000093041323001281/c105679_def14a - ixbrl.htm. To the extent that certain SiriusXM Participants or their affiliates have acquired or disposed of security holdings since the “as of ” d ate disclosed in the 2023 Proxy Statement, such transactions have been or will be reflected on Statements of Change in Ownership on Form 4, which are available at: https://www.sec.gov/edgar/browse /?C IK=908937&owner=exclude. Additional information regarding certain of the SiriusXM Participants in the proxy solicitation and a description of their interests will be contained in the inf ormation statement and other relevant materials to be filed with the SEC in respect of the contemplated transactions when they become available. These documents can be obtained free of charge from the sou rces indicated above. Liberty Media anticipates that the following individuals will be participants (the “Liberty Media Participants”) in the solic ita tion of proxies from holders of Liberty Media’s LSXMA and LSXMB common stock in connection with the proposed transaction: John C. Malone, Chairman of the Liberty Media Board of Directors, Robert R . B ennett, Derek Chang, Brian M. Deevy , M. Ian G. Gilchrist, Evan D. Malone, Larry E. Romrell , and Andrea L. Wong, all of whom are members of the Liberty Media Board of Directors, Gregory B. Maffei, Liberty Media’s Pre sid ent, Chief Executive Officer and Director, and Brian J. Wendling, Liberty Media’s Chief Accounting Officer and Principal Financial Officer. Information regarding the Libert y M edia Participants, including a description of their direct or indirect interests, by security holdings or otherwise, can be found under the caption “Security Ownership of Certain Beneficial Owners an d Management — Pro Forma Security Ownership of Management of Liberty Media Following the Reclassification” contained in Liberty Media’s registration statement on Form S - 4 (the “S - 4”), which was filed with the SEC on June 8, 2023 and is available at: https://www.sec.gov/Archives/edgar/data/1560385/000110465923069028/tm2232384 - 33_s4a.htm. To the extent that certain Liberty Medi a Participants or their affiliates have acquired or disposed of security holdings since the “as of” date disclosed in the S - 4, such transactions have been or will be reflected on S tatements of Change in Ownership on Form 4 or amendments to beneficial ownership reports on Schedules 13D filed with the SEC, which are available at: https://www.sec.gov/edgar/browse/?C IK= 1560385&owner=exclude. Additional information regarding the Liberty Media Participants in the proxy solicitation and a description of their interests will be contained in the proxy stat eme nt for Liberty Media’s special meeting of stockholders and other relevant materials to be filed with the SEC in respect of the contemplated transactions when they become available. These doc ume nts can be obtained free of charge from the sources indicated above.

4 4 Today’s Speakers Jennifer Witz CEO of SiriusXM Greg Maffei President & CEO of Liberty Media, Chairman of SiriusXM

5 $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 $8.00 $9.00 $10.00 Feb-09 Feb-10 Feb-11 Feb-12 Feb-13 Feb-14 Feb-15 Feb-16 Feb-17 Feb-18 Feb-19 Feb-20 Feb-21 Feb-22 Feb-23 Significant Value Creation for All Investors ($) February 13, 2009 – December 11, 2023 February 2009: Initial Liberty Investment SiriusXM Total Shareholder Returns (1) Note: Rebased to SiriusXM share price of $0.10 as of February 13, 2009 (1) Assumes dividends are reinvested as received at the prevailing market price

6 Compelling Transaction Benefits □ Simplifies equity structure □ Enhances trading liquidity and float – Broadens potential investor base – Eliminates multi - class structure □ Greater strategic flexibility with majority independent Board □ Expands potential index inclusion □ Addresses discount to net asset value at LSXM Transaction offers all stockholders the opportunity to participate in the long - term upside potential of the leading audio - entertainment company

7 Transaction Overview □ Liberty separates Liberty SiriusXM Group (“LSXM”) through redemptive split - off to form SplitCo holding all LSXM assets and liabilities □ Immediately following split - off, SplitCo acquires SiriusXM in all stock transaction to form New SiriusXM with one class of common stock □ LSXM shareholders receive 1 share of New SiriusXM for each share of SiriusXM previously held at LSXM, adjusted for LSXM net liabilities – Results in estimated Exchange Ratio of 8.4 (1) shares of New SiriusXM per share of LSXM held □ SiriusXM minority shareholders receive 1 share of New SiriusXM for each share of SiriusXM held □ Subject to required approvals, including majority vote of LSXM shareholders, receipt of tax opinions, required regulatory approvals and customary closing conditions □ Expected to close early Q3’24 Note: Refer to Appendix pages 13 - 15 for additional transaction detail (1) Exchange Ratio based on estimated net liabilities at LSXM as of June 30, 2024 and estimated other liabilities for transaction fe es and expenses, financing fees, litigation related liabilities and other corporate adjustments; subject to final adjustments at close

8 Streamlined Ownership Structure Post Merger Structure Current Structure LSXMA Shares LSXMB Shares LSXMK Shares SiriusXM Public Shareholders SiriusXM Current Shares: 3,839MM (1) 16% 84% Former Liberty SiriusXM Shareholders Former SiriusXM Public Shareholders “New SiriusXM” Pro Forma Shares: 3,392MM (2) 19% 81% (1) Current SIRI share count as of October 27, 2023, per latest 10 - Q. Excludes impact of potentially dilutive securities, including existing SiriusXM equity awards (2) Pro forma share count based on current SIRI share count, LSXM share count as of December 8, 2023, and estimated Exchange Rati o o f 8.4. Excludes impact of potentially dilutive securities, including existing SiriusXM equity awards, LSXM equity awards, and the market value above principal of the 3.75% LSX M convertible notes Liberty SiriusXM Group Liberty Media Corporation

9 SiriusXM: Shaping the Future of Audio Transforming SiriusXM for Long - Term Growth Innovative content company and leader in live, human curated audio experiences Leading subscription business positioned for the future Tapping into new audiences to grow with next gen platform Capturing opportunities in ad - based platforms Consistently delivering strong results and capital returns 34MM Subscribers 150MM Reach $20Bn Capital Returns 2.2% Dividend Yield Industry Leading Margins

10 3.3x 3.2x 3.9x Low to Mid 3s 9/30/23 (Status Quo) 12/31/23E (Status Quo) 6/30/24E (Pro Forma) Target Leverage $1.66 $1.83 $1.55 $1.15 2020A 2021A 2022A 2023E Free Cash Flow (1) $Bn Strong Free Cash Flow to Support Rapid Deleveraging Leverage Net Debt / LTM EBITDA No expected change to existing dividend policy Expect deprioritized buybacks until reaching target leverage Near - term focus on debt reduction (1) Company - defined FCF includes cash provided by operations plus insurance recoveries on satellites, net of additions to property a nd equipment, and restricted and other investment activity (2) 2021 free cash flow includes $225 million of satellite insurance recoveries Strong FCF generation (2)

11 Summary Long - Term Value Creation □ Highly beneficial transaction for all shareholders □ Meaningful opportunity ahead at SiriusXM with differentiated content and next gen tech platform □ Delivering financial results and investing for the future □ Strong free cash flow generation to maintain existing dividend policy and reduce debt

Appendix

13 Transaction Detail Structure • Liberty separates Liberty SiriusXM Group (“LSXM”) through redemptive split - off to form SplitCo holding all LSXM assets and liabi lities • Immediately following split - off, SplitCo acquires SiriusXM in all stock transaction to form New SiriusXM with one class of commo n stock • Transaction is intended to be tax - free to LSXM and SiriusXM shareholders, except with respect to cash received in lieu of fracti onal shares Consideration • Existing LSXM shareholders (LSXMA, LSXMB, LSXMK) will receive 8.4 shares in “New SiriusXM” for every LSXM share held (1) ‒ Exchange Ratio will be calculated based on (i) the number of shares of SiriusXM held by Liberty, reduced by a net liabilities sh are adjustment, divided by (ii) the number of adjusted fully diluted shares of LSXM i. The net liabilities share adjustment to the Exchange Ratio will be determined as the amount of assumed LSXM net debt (excludi ng the 3.75% LSXMA convertible notes due 2028), with additional adjustments for transaction fees and expenses, litigation related li abi lities and other corporate adjustments, divided by $4.23 (2) ii. The adjusted fully diluted shares of LSXM will be calculated based on outstanding LSXM shares at closing, including the dilut ive impact of shares underlying the 3.75% LSXMA convertible notes due 2028 and the dilutive impact of equity awards ‒ Final Exchange Ratio will be determined at closing • SiriusXM minority shareholders will receive 1 share in “New SiriusXM” for every SiriusXM share held Financing • Pro forma net leverage is anticipated to be 3.9x at close (3) • No change to low - to - mid 3x target leverage • New SiriusXM has secured financing commitments of up to $1.1Bn to fund the potential refinancing of LSXM’s existing Margin Loan and 2.75% Exchangeable at or following close Transaction Approval and Timing • Transaction has been approved by Liberty’s Board, the SiriusXM Special Committee and SiriusXM’s Board • Transaction is subject to approval by a majority of the aggregate voting power of the Liberty SiriusXM common stock, receipt of tax opinions, receipt of required regulatory approvals and customary closing conditions (1) Exchange Ratio based on estimated net liabilities at LSXM as of June 30, 2024 and estimated other liabilities for transaction fe es and expenses, financing fees, litigation related liabilities and other corporate adjustments; subject to final adjustments at close (2) Represents the average of the SIRI daily VWAP over the 20 consecutive trading days ending September 25, 2023, the day before Lib erty filed a 13D relating to a transaction (3) Transaction expected to close early Q3’24

14 Transaction Structure • Liberty separates Liberty SiriusXM Group through redemptive split - off to form “SplitCo” holding all LSXM assets and liabilities Exchange Ratio = Adjusted LSXM - Owned SIRI Shares Adjusted Fully - Diluted LSXM Shares = = 3,205.8MM shares – LSXM Net Liabilities (1) / SIRI Share Price of $4.23 Basic shares of LSXMA+LSXMB+LSXMK + Dilutive Impact of LSXMA convertible notes and equity awards 8.4 (2) • SplitCo acquires SiriusXM in stock - for - stock transaction to create New SiriusXM − Each share of SplitCo becomes 1 share of New SiriusXM − Each share of SiriusXM held by minority shareholders receives 1 share of New SiriusXM (1) LSXM Net Liabilities include SIRI Margin Loan and 2.75% SIRI Exchangeable Bonds due 2049, net of estimated corporate cash. Ex clu des LSXMA convertible notes. Also includes estimated other liabilities for transaction fees and expenses, financing fees, litigation related liabilities and other corpo rat e adjustments (2) Exchange Ratio based on estimated LSXM Net Liabilities as of June 30, 2024, subject to final adjustments at close =

15 Illustrative Transaction Exchange Ratio (in millions except SIRI Reference Price) Q2‘24E Net Liabilities (1) $1,118 ( ÷ ) SIRI Reference Price $4.23 LSXM Net Liabilities Share Adjustment (Effective SIRI Share Reduction) 264.2 Fully Diluted LSXM Shares (2) 326.8 (+) Shares to settle LSXMA Convertible (3) 21.6 Adjusted Fully Diluted LSXM Shares 348.4 Liberty Owned SIRI shares 3,205.8 ( - ) LSXM Net Liabilities Share Adjustment (264.2) Pro Forma Liberty Owned SIRI Shares 2,941.6 ( ÷ ) Adjusted Fully Diluted LSXM Shares 348.4 Exchange Ratio 8.4 Note: Illustrative based on market information as of December 11, 2023. Actual values to be calculated at Measurement Date, w hic h is to be 7 business days before closing, subject to certain conditions (1) Includes SIRI Margin Loan and 2.75% SIRI Exchangeable Bonds due 2049, net of estimated corporate cash. Excludes LSXMA convert ibl e notes per below. Also includes estimated other liabilities for transaction fees and expenses, financing fees, litigation related liabilities and other corpo rat e adjustments (2) Includes LSXMA, LSXMB and LSXMK basic shares outstanding, accelerated RSU / RSA / PSUs net of tax withholding, and options outstanding at signing using treasury stock method; Based on LSXMK share price as of December 11, 2023 for illustrative purposes (3) Maximum of shares underlying LSXMA convertible and par value divided by the LSXMA share price as of December 11, 2023 for ill ust rative purposes

THANK YOU

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=lmca_LibertySiriusXmGroupCommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=lmca_LibertySiriusXmGroupCommonClassBMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=lmca_LibertySiriusXmGroupCommonClassCMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=lmca_LibertyLiveGroupCommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=lmca_LibertyLiveGroupCommonClassCMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

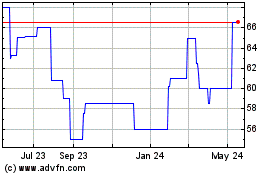

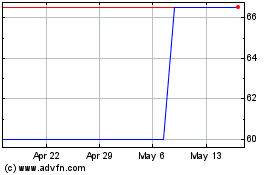

Liberty Media (QB) (USOTC:FWONB)

Historical Stock Chart

From Apr 2024 to May 2024

Liberty Media (QB) (USOTC:FWONB)

Historical Stock Chart

From May 2023 to May 2024