London's blue-chip index closed the trading day 0.16% lower on

Monday at 7,452.76 points. "Today's initial gains have been

tempered somewhat by caution that the rally in Asia might be

largely a knee jerk response to a narrow rebound in housing sales

in two Chinese cities, with the bigger test set to come tomorrow

with the return of U.S. markets," CMC Markets UK's Michael Hewson

wrote in a market comment. Chinese-sensitive mining company

Glencore was among the index's top performers, with International

Consolidated Airlines Group also performing strongly boosted by

solid updates from peers Ryanair and Wizz Air.

COMPANIES NEWS:

CMC Markets Appoints Albert Soleiman as CFO

CMC Markets has appointed Albert Soleiman as chief financial

officer with effect from Sept. 1, it said Monday.

---

Ergomed Agrees to GBP703.1 Mln Permira Takeover

Ergomed has agreed to a 703.1 million-pound ($885.3 million)

takeover by Eden Acquisitionco, a new company controlled and owned

by funds advised by Permira Advisers.

---

Advanced Medical Solutions Warns of Performance Impact Due to

Royalty Stream Issues

Advanced Medical Solutions Group warned that its financial

performance for 2023 will be affected due to the uncertainty around

royalty stream and the higher destocking of its LiquiBand product

in the U.S.

---

Franchise Brands Changes Board Structure

Franchise Brands said that it will change the board structure

given the significant growth of the group following the acquisition

of Filta and Pirtek Europe.

---

Belvoir Confident in Meeting Full-Year Expectations After 1H

Profit, Revenue Rose

Belvoir said its pretax profit and revenue both rose despite

challenging market conditions, that it is confident in meeting its

full-year expectations, and hiked its dividend.

---

Mosman Oil & Gas Chair John Barr Steps Down

Mosman Oil & Gas said that Chair John Barr has decided to

step down from the board with effect from Sept. 30, without

disclosing further details.

---

Primary Health Properties Appoints New CEO

Primary Health Properties said it has appointed Mark Davies as

chief executive officer with effect from the conclusion of the

company's annual general meeting on April 24, 2024.

---

Datalex Appoints Jonathan Rockett as New CEO

Datalex has appointed Jonathan Rockett as chief executive

officer to replace Sean Corkery who announced his plan to step down

in July.

---

Ashtead Technology Pretax Profit, Revenue Rose on High

Demand

Ashtead Technology Holdings first-half pretax profit and revenue

rose, driven by continued high demand in both offshore renewables

and oil and, the subsea equipment-rental provider said Monday.

---

Zenith Energy Pulls Out From $21.6 Mln Deal for OMV Yemen

Zenith Energy said that it has terminated a deal to buy the

outstanding shares of OMV Yemen as conditions to complete the

agreement weren't satisfied.

---

Physiomics Names Peter Sargent as New COO

Physiomics said it has appointed Peter Sargent as chief

operating officer, effective immediately.

---

Centralnic to Rebrand as Team Internet Group

Centralnic Group said it will rebrand itself as Team Internet

Group and that from Tuesday its shares will trade under the ticker

TIG.

---

Serinus Energy Names Vlad Ryabov as CFO of Serinus Group

Serinus Energy said it has appointed Vlad Ryabov as chief

financial officer of the Serinus Group of companies.

MARKET TALK:

European Stocks Rise After Asia Rally; Tech Shares Gain

1321 GMT - European stocks rise after upbeat trading in Asia,

with tech stocks among the biggest risers. The Stoxx Europe 600 and

FTSE 100 advance 0.3% and the CAC 40 and DAX climb 0.2%, with the

likes of ams-Osram, Infineon Technologies and BE Semiconductor

Industries gaining most. Brent crude trades flat at $88.57 a

barrel. Asia stocks rose, with markets in mainland China and Hong

Kong rallying more than 1% and 2%, respectively. "Hopes of more

China stimulus lifted the Hang Seng and other Asia markets," IG

analysts write. "In Japan, corporate profits hit a record in the

second quarter, putting new strength into Japanese indices. U.S.

markets are closed for Labor Day, leaving European investors facing

a quiet session." (philip.waller@wsj.com)

---

Ergomed Investors Should Wait and See on Takeover Bid

1144 GMT - Ergomed shares surge 28% to 1342 pence after the

pharma-industry services provider agreed to a 703.1 million-pound

($885.3 million) takeover by an arm of private-equity firm Permira

Advisers. The 1350p recommended offer from Permira looks good, but

investors should hold on and see if a competing bid emerges,

Liberum Capital says. "We think there's plenty of scope for trade

interest and that a trade player could afford to pay between 1400p

and 1500p, after taking into account synergies and cost savings,"

Liberum analysts write, downgrading the stock to hold from buy, but

increasing their price target to 1350p. "We note that only one

investor has signed a non-binding letter of intent, suggesting

investors don't view this as a knock-out price either."

(philip.waller@wsj.com)

---

Trident Royalties Lithium Acquisition Offsets Recent

Downgrade

1127 GMT - Trident Royalties's addition of the Paradox Basin

lithium project to its portfolio is well-timed, as recent share

weakness posits a good buying opportunity, Liberum analysts write

in a research note. The acquisition offsets Liberum's recent

valuation downgrade following the news that Mexico was cancelling

lithium concessions in a mine that includes Trident's asset Sonora,

the analysts say. Shares fell 2.4% Friday on the news, which the

analysts see as "an over-reaction, driven by retail selling," they

say. Additionally, Trident could see a rapid expansion of operating

free cash flow, if the Paradox Basin project is anywhere near as

profitable as hoped, they say. Liberum rates the stock buy and

raises its price target to 81 pence from 76 pence.

(christian.moess@wsj.com)

---

Standard Chartered Seen Dented by Slower China Recovery

0959 GMT - A more balanced approach to Standard Chartered is

warranted in the near term given the stresses in the Chinese

real-estate sector, Keefe, Bruyette & Woods says in a note. "It

is now clear that elements of Chinese recovery are more fragile

than might have been expected," analysts Perlie Mong and Edward

Firth write, noting that peer HSBC has limited direct exposure, but

that a slower recovery in the country would likely reduce their

Asia growth prospects. KBW remains confident on StanChart's

medium-term outlook but cuts the stock to underperform from market

perform citing share price outperformance against HSBC, higher

exposure to Asia and emerging markets, risks to underlying

profitability given higher reliance on markets trading income and

higher interest rate sensitivity. (elena.vardon@wsj.com)

---

Diversified UK Asset Managers Are Better Placed, JPM Says

0932 GMT - U.K. asset managers that have a diversified business

model are better placed than those relying on the recovery of

investor demand for emerging markets, JPMorgan Cazenove says in a

note. Schroders is the crown jewel for its conscious repositioning

toward asset classes that offer growth and client longevity, which

will allow it to benefit from strong net flow and asset under

management growth, analysts say, reinstating its overweight rating.

Ashmore--restarted at underweight--is exposed to the challenging

near-term outlook for emerging markets and has limited scope for

further cost efficiencies, they say. Ninety One's higher

diversification gives it the flexibility to offset some emerging

market headwinds and any prolonged revenue slump, they add on the

neutral-rated stock. (elena.vardon@wsj.com)

---

FTSE 100 Rises on Improved Sentiment in Asia

0924 GMT - The FTSE 100 rises 0.8% to 7520 points on improved

sentiment in Asia after Chinese officials lowered downpayment

requirements for first and second-time home buyers, supporting

greater economic growth in China, AJ Bell investment director Russ

Mould says in a note. In addition, creditors agreed to restructure

bond repayments for struggling developer Country Garden, adding to

the positive sentiment. "The FTSE 100 started Monday 0.5% higher at

7,503, led by miners, housebuilders and packaging firms - all

economically-sensitive sectors," Mould says. Chinese-sensitive

mining companies Glencore, Anglo American, and Rio Tinto are the

biggest gainers up 2.7%, 2.4% and 2.2% respectively.

(miriam.mukuru@wsj.com)

Contact: London NewsPlus, Dow Jones Newswires;

(END) Dow Jones Newswires

September 04, 2023 12:30 ET (16:30 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

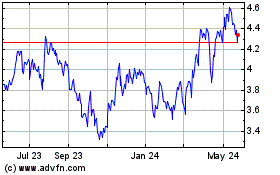

International Consolidat... (PK) (USOTC:ICAGY)

Historical Stock Chart

From Dec 2024 to Jan 2025

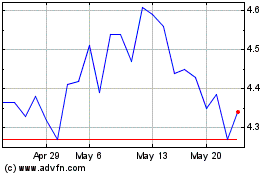

International Consolidat... (PK) (USOTC:ICAGY)

Historical Stock Chart

From Jan 2024 to Jan 2025