UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934

(Amendment

No. 5 )*

INTERPACE

BIOSCIENCES, INC.

(Name

of Issuer)

Common

Stock, $0.01 par value

(Title

of Class of Securities)

46062X

303

(CUSIP

Number)

1315

Capital II, L.P.

1315

Capital Management II, LLC

2929

Walnut Street, Suite 1240

Philadelphia,

PA 19104

Telephone:

(215) 662-1315

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications)

October

11, 2024

(Date

of Event Which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of § 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ☐.

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule

13d-7 for other parties to whom copies are to be sent.

| * |

The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover

page. |

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act

but shall be subject to all other provisions of the Act (however, see the Notes).

SCHEDULE

13D

| CUSIP

No. 46062X 303 |

|

|

|

Page

2 of 7 Pages |

| 1 |

|

NAME

OF REPORTING PERSONS

1315

Capital II, L.P. |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a)

☐ (b) ☐ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE

OF FUNDS (See Instructions)

OO |

| 5 |

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

|

7

|

|

SOLE

VOTING POWER

0 |

| |

8 |

|

SHARED

VOTING POWER

9,405,940

(1) |

| |

9 |

|

SOLE

DISPOSITIVE POWER

0 |

| |

10 |

|

SHARED

DISPOSITIVE POWER

9,405,940

(1) |

| 11 |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

9,405,940

(1) |

| 12 |

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

☐ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

68%

(2) |

| 14 |

|

TYPE

OF REPORTING PERSON (See Instructions)

PN |

| (1) |

Evidenced

by 19,000 shares of Series C Convertible Preferred Stock, par value $0.01 per share (the “Series C”), of Interpace

Biosciences, Inc. (the “Issuer”). The Series C is convertible from time to time, at the option of the holder thereof,

into a number of shares of common stock, par value $0.01 per share, of the Issuer (the “Common Stock”), equal

to the initial stated value per Series C share of $1,000 divided by an initial conversion price of $2.02 per share and then multiplied

by the number of shares of Series C to be converted. |

| (2) |

This

percentage (a) is calculated based upon 4,394,312 shares of Common Stock outstanding as of August 2, 2024, as disclosed in the Quarterly

Report on Form 10-Q for the quarterly period ended June 30, 2024 filed by the Issuer on August 8, 2024 and (b) assumes the conversion

of all 19,000 outstanding shares of Series C owned by 1315 Capital into an aggregate 9,405,940 shares of Common Stock. However, if

all 47,000 outstanding shares of Series C were converted into an aggregate of 23,267,326 shares of Common Stock, 1315 Capital would

own 34%. |

SCHEDULE

13D

| CUSIP

No. 46062X 303 |

|

|

|

Page

3 of 7 Pages |

| 1 |

|

NAME

OF REPORTING PERSONS

1315

Capital Management II, LLC |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a)

☐ (b) ☐ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE

OF FUNDS (See Instructions)

OO |

| 5 |

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

|

7 |

|

SOLE

VOTING POWER

0 |

| |

8 |

|

SHARED

VOTING POWER

9,405,940

(1) |

| |

9 |

|

SOLE

DISPOSITIVE POWER

0 |

| |

10 |

|

SHARED

DISPOSITIVE POWER

9,405,940

(1) |

| 11 |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

9,405,940

(1) |

| 12 |

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

☐ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

68

% (2) |

| 14 |

|

TYPE

OF REPORTING PERSON (See Instructions)

OO |

| (1) |

Evidenced

by 19,000 shares of Series C. The shares of Series C are convertible from time to time, at the option of the holder thereof, into

a number of shares of Common Stock equal to the initial stated value per Series C share of $1,000 divided by an initial conversion

price of $2.02 per share and then multiplied by the number of shares of Series C to be converted. |

| (2) |

This

percentage (a) is calculated based upon 4,394,312 shares of Common Stock outstanding as of August 2, 2024, as disclosed in the Quarterly

Report on Form 10-Q for the quarterly period ended June 30, 2024 filed by the Issuer on August 8, 2024 and (b) assumes the conversion

of all 19,000 outstanding shares of Series C owned by 1315 Capital into an aggregate 9,405,940 shares of Common Stock. However, if

all 47,000 outstanding shares of Series C were converted into an aggregate of 23,267,326 shares of Common Stock, 1315 Capital would

own 34%. |

| Item

1. |

Security

and Issuer |

This

Amendment No. 5 to Schedule 13D (this “Amendment No. 5”) supplements and amends the Schedule 13D originally filed with the

Securities and Exchange Commission (the “SEC”) on January 23, 2020, as amended by Amendment No. 1 thereto filed with the

SEC on April 30, 2020, Amendment No. 2 thereto filed with the SEC on January 21, 2021, Amendment No. 3 thereto filed with the SEC on

May 20, 2021 and Amendment No. 4 thereto filed with the SEC on November 12, 2021 (as so amended, the “Prior Statement” and,

as supplemented and amended by this Amendment No. 5, the “Statement”). Capitalized terms used but not otherwise defined herein

have the meanings set forth in the Prior Statement. Except as specifically supplemented and amended by this Amendment No. 5, items in

the Prior Statement remain unchanged. The Statement relates to the common stock, par value $0.01 per share (the “Common Stock”),

of Interpace Biosciences, Inc., a Delaware corporation (the “Issuer”), with its principal offices located at Waterview Plaza,

Suite 310, 2001 Route 46, Parsippany, NJ 07504. The Common Stock is listed on the Nasdaq Capital Market under the ticker symbol “IDXG.”

This

Amendment No. 4 is being filed to report that, on October 10, 2024, Issuer entered into an Exchange Agreement, dated October 10, 2024

(the “Exchange Agreement”), by and among the Issuer, 1315 Capital, and Ampersand , pursuant to which, on October 11, 2024,

the Issuer exchanged all 19,000 existing shares of Series B Convertible Preferred Stock, par value $0.01 per share (the “Series

B”), held by 1315 Capital, for 19,000 newly created shares of Series C Convertible Preferred Stock, par value $0.01 per share (the

“Series C” and such transaction, the “Exchange”).

| Item

2. |

Identity

and Background |

(a)

This Statement is being filed by 1315 Capital and 1315 Capital Management II, LLC, a limited liability company organized under the laws

of Delaware and the general partner of 1315 Capital (“1315 Capital Management” and, together with 1315 Capital, the

“Reporting Persons”). The principal business of the Reporting Persons is investing in commercial-stage medical technology,

healthcare service and specialty therapeutic companies.

(b)

- (c) Each of the Reporting Persons has their principal offices at 2929 Walnut Street, Suite 1240, Philadelphia, PA 19104.

(d)

- (e) During the last five years, none of the Reporting Persons has been (i) convicted in a criminal proceeding (excluding traffic violations

or similar misdemeanors) or (ii) a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as

a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or

mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

| Item

3. |

Source

and Amount of Funds or Other Consideration |

On

October 11, 2024, the Issuer exchanged all 19,000 existing shares of Series B held by 1315 Capital for 19,000 newly created shares of

Series C.

| Item

4. |

Purpose

of Transaction |

The

Issuer entered into the Exchange Agreement with 1315 Capital pursuant to which the Exchange was consummated as further discussed below

under Item 6. The Reporting Persons caused 1315 Capital to acquire the shares of Series C for the purpose of making an investment in

the Issuer and not with the intention of acquiring control of the Issuer’s business on behalf of the Reporting Persons. The information

set forth or incorporated in Items 1, 5 and 6 of this Statement is incorporated by reference in its entirety into this Item 4.

Except

as set forth in this Statement, the Reporting Persons have not formulated any plans or proposals which relate to or would result in:

(a) the acquisition by any person of additional securities of the Issuer or the disposition of securities of the Issuer; (b) an extraordinary

corporate transaction, such as a merger, reorganization or liquidation, involving the Issuer or any of its subsidiaries; (c) a sale or

transfer of a material amount of the assets of the Issuer or any of its subsidiaries; (d) any change in the present board of directors

(the “Board”) or management of the Issuer, including any plans or proposals to change the number or term of directors

or to fill any existing vacancies on the Board; (e) any material change in the Issuer’s capitalization or dividend policy of the

Issuer; (f) any other material change in the Issuer’s business or corporate structure; (g) any change in the Issuer’s charter

or bylaws or other instrument corresponding thereto or other action which may impede the acquisition of control of the Issuer by any

person; (h) causing a class of the Issuer’s securities to be deregistered or delisted from a national securities exchange or to

cease to be authorized to be quoted in an inter-dealer quotation system of a registered national securities association; (i) a class

of equity securities of the Issuer becoming eligible for termination of registration pursuant to Section 12(g)(4) of the Act; or (j)

any action similar to any of those enumerated above.

| Item

5. |

Interest

in Securities of the Issuer |

(a)

- (b) As of the date of this filing, as discussed in Item 1 of this Statement, which is hereby incorporated by reference in its entirety

into this Item 5, the Reporting Persons may be deemed, for purposes of Rule 13d-3 of the Act, directly or indirectly, including by reason

of their mutual affiliation, to be the beneficial owners of 9,405,940 shares of Common Stock issuable upon conversion of the shares of

Series C that may be attributable to the Reporting Persons. Based upon information disclosed in connection with the Securities Purchase

and Exchange Agreement, such shares of Common Stock deemed to be indirectly beneficially owned by the Reporting Persons constitute approximately

68% of the outstanding shares of Common Stock as of August 2, 2024, assuming the conversion of all 19,000 outstanding shares of Series

C owned by 1315 Capital into an aggregate 9,405,940 shares of Common Stock. 1315 Capital Management, as the general partner of 1315 Capital,

may be deemed to also indirectly beneficially own the shares of Series C held by 1315 Capital. As a result, 1315 Capital Management shares

the power to direct the vote and to direct the disposition of the Series C shares held by 1315 Capital. Each of the Reporting Persons

disclaims beneficial ownership in all shares of Series C and Common Stock reported herein, except to the extent of such Reporting Person’s

respective pecuniary interest therein.

| Item

6. |

Contracts,

Arrangements, Understandings or Relationship with Respect to Securities of the Issuer |

Item

6 of the Prior Statement is hereby amended and supplemented to include the following:

Exchange

Agreement

On

October 10, 2024, the Issuer entered into the Exchange Agreement with 1315 Capital and Ampersand, pursuant to which the Exchange was

consummated on October 11, 2024. The shares of Series C issued in the Exchange were offered and sold pursuant to an exemption from registration

under Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”) and Rule 506 of Regulation

D promulgated thereunder.

Series

C Certificate of Designation

In

connection with the consummation of the Exchange on October 11, 2024 (the “Exchange Closing”), the Issuer filed a

Certificate of Designation of Preferences, Rights and Limitations of Series C Convertible Preferred Stock (the “Series C Certificate

of Designation”) with the Secretary of State of the State of Delaware to designate 52,000 shares as Series C.

Voting

On

any matter presented to the stockholders of the Issuer for their action or consideration at any meeting of stockholders of the Issuer

(or by written consent of stockholders in lieu of meeting), each holder of outstanding shares of Series C will be entitled to cast the

number of votes equal to the number of whole shares of Common Stock into which the shares of Series C held by such holder are convertible

as of the record date for determining stockholders entitled to vote on such matter. Except as provided by law or by the Series C Certificate

of Designation, holders of Series C will vote together with the holders of Common Stock as a single class and on an as-converted to Common

Stock basis.

Conversion

The

Series C Certificate of Designation provides that from and after the Series C Issuance Date and subject to the terms of the Series C

Certificate of Designation, each share of Series C is convertible, at any time and from time to time, at the option of the holder into

a number of shares of Common Stock equal to dividing the amount equal to the greater of the initial stated value per share of $1,000

of such Series C, plus any dividends declared but unpaid thereon, or such amount per share as would have been payable had each such share

been converted into Common Stock immediately prior to a liquidation, by $2.02 (subject to further adjustment in the event of any stock

dividend, stock split, combination, or other similar recapitalization affecting such shares).

Mandatory

Conversion

Immediately

prior to the listing of the Common Stock on The Nasdaq Stock Market, all outstanding shares of Series C owned by each holder will automatically

convert into a number of shares of Common Stock equal to the product of the Series C Conversion Ratio (as defined in the Series C Certificate

of Designation) and the number of shares of Series C owned by such holder.

Dividends

The

Series C Certificate of Designation does not provide for mandatory dividends on the Series C shares. Dividends may be declared and paid

on the Series C shares from funds lawfully available and as determined by the Board.

Protective

Provisions

For

so long as any shares of the Series C remain outstanding, the following actions may only be taken by the Issuer or any of its direct

or indirect subsidiaries with the written consent of each holder of the outstanding shares of Series C: (i) amend, waive, alter or repeal

the preferences, rights, privileges or powers of the holders of the shares of Series C,; (ii) amend, alter or repeal any provision of

the Series C Certificate of Designation in a manner that is adverse to the holders of the shares of Series C; or (iii) authorize, create

or issue any equity securities senior to or pari passu with the Series C.

Liquidation

In

the event of any voluntary or involuntary liquidation, dissolution or winding up of the Issuer, the holders of shares of Series C then

outstanding on an as-converted basis will be entitled to be paid out of the assets of the Issuer available for distribution to its stockholders

on a pari passu basis with the holders the shares of the Common Stock.

Amended

and Restated Investor Rights Agreement

On

October 10, 2024, the Issuer and the Investors entered into an amended and restated investor rights agreement (the “Second Amended

and Restated Investor Rights Agreement”), which amended and restated that certain Amended and Restated Investor Rights Agreement,

dated as of January 15, 2020, between the Issuer and the Investors. Pursuant to the Second Amended and Restated Investor Rights Agreement,

the Issuer and the Investors established certain terms and conditions concerning the rights of and restrictions on the Investors with

respect to the ownership of the shares of Series C.

Demand

Piggy-Back and Shelf Registration Rights

The

Second Amended and Restated Investor Rights Agreement provides the Investors with (1) demand registration rights exercisable beginning

on the Exchange Closing and subject to certain limitations described therein, (2) piggy-back registration rights at any time the Issuer

proposes to file a registration statement under the Securities Act with respect to an offering of equity securities, or securities or

other obligations exercisable or exchangeable for, or convertible into, equity securities, subject to certain exceptions described therein,

and (3) shelf registration rights, exercisable on or prior the first anniversary of the Exchange Closing upon the written demand of an

Investor or group of Investors and subject to certain limitations described therein.

Termination

of Support Agreement

In

connection with the Exchange, the Issuer and 1315 Capital entered into a Termination of Support Agreement, dated October 14, 2024 (the

“Support Termination Agreement”), pursuant to which the parties agreed that the Support Agreement, dated April 7, 2020, by

and between 1315 Capital and Issuer would immediately terminate and be of no further force and effect as of the date of the Support Termination

Agreement.

Qualified

By the Documents

The

foregoing description of the Exchange Agreement, Series C Certificate of Designation and Second Amended and Restated Investor Rights

Agreement (collectively, the “Exchange Documents”) is qualified in its entirety by reference to the full text of the

Exchange Documents, which are filed as Exhibits 2, 3 and 4, respectively, to this Statement and incorporated herein by reference in their

entirety.

Other

than as described in this Statement, to the best of the Reporting Persons’ knowledge, there are no other contracts, arrangements,

understandings or relationships (legal or otherwise) among the persons named in Item 2 and between such persons and any person with respect

to any securities of the Issuer.

| Item 7. |

Materials to Be Filed as Exhibits

|

| Exhibit |

|

Description |

| |

|

|

| 1. |

|

Joint Filing Agreement among 1315 Capital and 1315 Capital Management (incorporated by reference to Exhibit 1 to the Schedule 13D filed by 1315 Capital II, L.P. on January 23, 2020). |

| |

|

|

| 2. |

|

Exchange Agreement, dated October 10, 2024, by and among Interpace Biosciences, Inc., 1315 Capital II, L.P. and Ampersand 2018 Limited Partnership (incorporated by reference to Exhibit 10.1 to the Form 8-K filed by Interpace Biosciences, Inc. on October 15, 2024). |

| |

|

|

| 3. |

|

Certificate of Designation of Preferences, Rights and Limitations of Series C Convertible Preferred Stock (incorporated by reference to Exhibit 3.1 to the Form 8-K filed by Interpace Biosciences, Inc. on October 15, 2024). |

| |

|

|

| 4. |

|

Amended and Restated Investor Rights Agreement, dated October 10, 2024, by and among Interpace Biosciences, Inc., 1315 Capital II, L.P. and Ampersand 2018 Limited Partnership (incorporated by reference to Exhibit 10.2 to the Form 8-K filed by Interpace Biosciences, Inc. on October 15, 2024). |

| |

|

|

| 5. |

|

Termination of Support Agreement, dated October 10, 2024, by and among Interpace Biosciences, Inc. and 1315 Capital II, L.P. (incorporated by reference to Exhibit 10.3 to the Form 8-K filed by Interpace Biosciences, Inc. on October 15, 2024). |

SIGNATURE

After

reasonable inquiry and to the best of each of the undersigned’s knowledge and belief, each of the undersigned certifies that the

information set forth in this statement is true, complete and correct.

Dated:

October 16, 2024

| |

1315 CAPITAL II, L.P. |

| |

|

|

| |

By: |

1315 Capital Management

II, LLC, its General Partner |

| |

|

|

| |

By: |

/s/

Adele C. Oliva |

| |

Name: |

Adele C. Oliva |

| |

Title: |

Managing Member |

| |

|

|

| |

1315 CAPITAL MANAGEMENT II, LLC |

| |

|

|

| |

By: |

/s/

Adele C. Oliva |

| |

Name: |

Adele C. Oliva |

| |

Title: |

Managing Member |

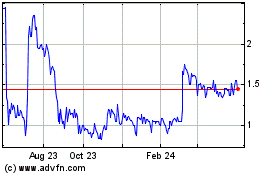

Interpace Biosciences (QX) (USOTC:IDXG)

Historical Stock Chart

From Jan 2025 to Feb 2025

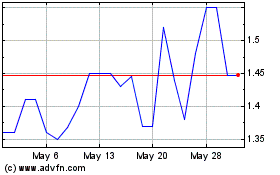

Interpace Biosciences (QX) (USOTC:IDXG)

Historical Stock Chart

From Feb 2024 to Feb 2025