false

0001054102

0001054102

2025-01-14

2025-01-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): January 14, 2025

INTERPACE

BIOSCIENCES, INC.

(Exact

name of Registrant as specified in its charter)

| delaware |

|

0-24249 |

|

22-2919486 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

Waterview

Plaza, Suite 310

2001

Route 46,

Parsippany,

NJ 07054

(Address,

including zip code, of Principal Executive Offices)

(855)

776-6419

Registrant’s

telephone number, including area code

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| None |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐

Emerging growth company

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

January 17, 2025, Interpace Biosciences, Inc. (the “Company”) and its subsidiaries entered into the Fourth Amendment

(the “Fourth Amendment”) to the Loan and Security Agreement with BroadOak Fund V, L.P. (“BroadOak”)

dated May 5, 2022 (the “Credit Agreement”), pursuant to which, among other things, the Company and BroadOak agreed

to: (i) the payment by the Company commencing on February 1, 2025 and continuing until and including June 1, 2025 of $500,000 of principal

together with unpaid and accrued interest owed pursuant to the Credit Agreement on the first day of each month, (ii) commending on July

1, 2025 and continuing until and including December 1, 2025, the payment by the Company of accrued and unpaid interest owed pursuant

to the Credit Agreement on the first day of each month, (iii) the payment by the Company on December 31, 2025 of all remaining outstanding

principal and accrued and unpaid interest owed pursuant to the Credit Agreement, and (iv) the payment by the Company on January 17, 2025

of an amount equal to 1% of the then outstanding amount of the Term Loan Advance under the Credit Agreement.

The

foregoing description of the Fourth Amendment is qualified in its entirety by reference to the full text of such agreement, a copy of

which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference in its entirety.

Item

2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

information set forth in Item 1.01 above is incorporated by reference into this Item 2.03.

Item

2.05 Costs Associated with Exit or Disposal Activities.

On

January 14, 2025, the Board of Directors of the Company approved a restructuring

plan (the “Restructuring Plan”) and cost-savings to reduce operating costs and better align its workforce with the

loss of PancraGEN® coverage by Centers for Medicare & Medicaid Services

(“CMS”), which was previously announced on January 9, 2025. The Company

expects the implementation of the Restructuring Plan to be substantially completed by the end of the second quarter of 2025.

Under

the Restructuring Plan, the Company is reducing its workforce and impacted employees will be eligible to receive severance benefits.

The Company expects to incur severance costs in the range of $0.8 million to $1.0 million which will be recorded primarily in the first

quarter of 2025. The substantial majority of the severance payments are expected to be made by the end of the second quarter of

2025.

The Company expects that the loss

of PancraGEN® and related restructuring activities will reduce its annual

cost of revenue and operating expenses by approximately $12.5 million to $14.5 million which is expected to substantially offset the expected

loss of approximately one-third of its revenues. The cost that the Company expects to incur in connection with the Restructuring Plan

is subject to several assumptions, and actual results may differ materially. The Company may also incur additional costs not currently

contemplated due to events that may occur as a result of, or that are associated with, the Restructuring Plan.

The

following exhibits are being filed herewith:

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Interpace

Biosciences, Inc. |

| |

|

|

| |

By: |

/s/

Thomas W. Burnell |

| |

Name: |

Thomas

W. Burnell |

| |

Title: |

President

and Chief Executive Officer |

Date:

January 21, 2025

Exhibit

10.1

FOURTH

AMENDMENT TO LOAN AND SECURITY AGREEMENT

This

Fourth Amendment to Loan and Security Agreement (this “Amendment”) is entered into as of January 17, 2025 between

INTERPACE BIOSCIENCES, INC., a Delaware corporation (“Parent”), INTERPACE DIAGNOSTICS CORPORATION, a

Delaware corporation (“Diagnostics Corporation”), and INTERPACE DIAGNOSTICS, LLC, a Delaware limited liability

company (“Diagnostics”) (Parent, Diagnostics Corporation and Diagnostics, collectively referred to as the “Borrowers”

and each individually a “Borrower”) and BROADOAK FUND V, L.P. (“Lender”).

RECITALS

Borrowers

and Lender are parties to that certain Loan and Security Agreement, dated as of October 29, 2021, as amended, restated or otherwise modified

from time to time (the “Agreement”). The parties desire to amend the Agreement in accordance with the terms of this

Amendment.

NOW,

THEREFORE, the parties agree as follows:

1. Amendments to Agreement.

(a)

Section 2.1.1(b) of the Agreement is hereby amended and restated in its entirety to read as follows:

“Repayment.

Beginning on February 1, 2025 and continuing on each Payment Date thereafter up to and including June 1, 2025, Borrower shall repay the

outstanding principal on the Term Loan Advance in an amount equal to $500,000 together with interest due and payable in accordance with

Section 2.2(c) hereof. From July 1, 2025 up to and including December 1, 2025, on each Payment Date Borrower shall not make any principal

payment but shall pay all accrued and unpaid interest with respect to the Term Loan Advance in accordance with Section 2.2(c) hereof.

The remaining principal balance of the Term Loan Advance, including all outstanding principal and accrued and unpaid interest with respect

to the Term Loan Advance and all other outstanding Obligations under the Term Loan Advance, shall be due and payable on the Term Loan

Maturity Date. After repayment or prepayment, the Term Loan Advance may not be reborrowed.”

(b)

The definition of “Term Loan Maturity Date” set forth in Section 13.1 of the Agreement is hereby amended and restated in

its entirety to read as follows:

““Term

Loan Maturity Date” is the earlier to occur of (a) December 31, 2025 and (b) a Change in Control.”

(c) A new subsection (d) is hereby added to Section 2.3 of the Agreement as follows:

“(d)

Restructuring Fee. Upon signing of this Amendment,, the Borrower shall pay a restructuring fee to Lender in an amount equal to

1% of the then outstanding amount of the Term Loan Advance.”

2.

No course of dealing on the part of Lender or its officers, nor any failure or delay in the exercise of any right by Lender, shall

operate as a waiver thereof, and any single or partial exercise of any such right shall not preclude any later exercise of any such

right. Lender’s failure at any time to require strict performance by Borrower of any provision shall not affect any right of

Lender thereafter to demand strict compliance and performance. Any suspension or waiver of a right must be in writing signed by an

officer of Lender.

3.

Unless otherwise defined, all initially capitalized terms in this Amendment shall be as defined in the Agreement. The Agreement, as

amended hereby, shall be and remains in full force and effect in accordance with its terms and hereby is ratified and confirmed in

all respects. Except as expressly set forth herein, the execution, delivery, and performance of this Amendment shall not operate as

a waiver of, or as an amendment of, any right, power, or remedy of Lender under the Agreement, as in effect prior to the date

hereof.

4.

As a condition to the effectiveness of this Amendment, Lender shall have received this Amendment, duly executed by each

Borrower.

5.

This Amendment may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together

shall constitute one instrument.

[Signature

page follows.]

IN

WITNESS WHEREOF, the undersigned have executed this Amendment as of the first date above written.

| |

INTERPACE

BIOSCIENCES, INC. |

| |

|

|

| |

By: |

/s/

Thomas W. Burnell |

| |

Name: |

Thomas

W. Burnell |

| |

Title: |

Chief

Executive Officer |

| |

|

|

| |

INTERPACE

DIAGNOSTICS CORPORATION |

| |

|

|

| |

By: |

/s/

Thomas W. Burnell |

| |

Name: |

Thomas

W. Burnell |

| |

Title: |

Chief

Executive Officer |

| |

|

|

| |

INTERPACE

DIAGNOSTICS, LLC |

| |

|

|

| |

By: |

/s/

Thomas W. Burnell |

| |

Name: |

Thomas

W. Burnell |

| |

Title: |

Chief

Executive Officer |

| |

|

|

| |

BROADOAK

FUND V, L.P. |

| |

|

|

| |

By: |

/s/

William Snider |

| |

Name: |

William

Snider |

| |

Title: |

Manager |

[Signature

Page to Fourth Amendment to Loan and Security Agreement]

v3.24.4

Cover

|

Jan. 14, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 14, 2025

|

| Entity File Number |

0-24249

|

| Entity Registrant Name |

INTERPACE

BIOSCIENCES, INC.

|

| Entity Central Index Key |

0001054102

|

| Entity Tax Identification Number |

22-2919486

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

Waterview

Plaza

|

| Entity Address, Address Line Two |

Suite 310

|

| Entity Address, Address Line Three |

2001

Route 46

|

| Entity Address, City or Town |

Parsippany

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

07054

|

| City Area Code |

(855)

|

| Local Phone Number |

776-6419

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

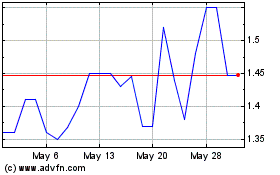

Interpace Biosciences (QX) (USOTC:IDXG)

Historical Stock Chart

From Jan 2025 to Feb 2025

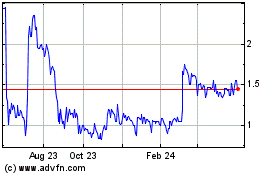

Interpace Biosciences (QX) (USOTC:IDXG)

Historical Stock Chart

From Feb 2024 to Feb 2025