This prospectus relates to

the offering and resale by the selling stockholders identified herein (the “Selling Stockholders”) of up to 306,528,740 shares

of the common stock, par value $0.001 (the “common stock”) of Innovative Payment Solutions, Inc., a Nevada corporation, (“IPSI,”

the “Company,” “we,” “our,” or “us”), which includes:

The warrants referred to

in (ii) and (iii) above are collectively referred to in this prospectus as the “Warrants” and the shares common stock as

described in (i), (ii) and (iii are referred to in this prospectus as the “Shares”.

We are registering the Shares

pursuant to various registration rights obligations we have with the Selling Stockholders. See the section of this prospectus entitled

“The Private Placements” for a further description of the various private placements transaction described above, and the

section of this prospectus entitled “Selling Stockholders” for additional information regarding the Selling Stockholders.

We are not selling any Shares

in this offering. We, therefore, will not receive any proceeds from the sale of the Shares by the Selling Stockholders. However, we may

receive gross proceeds upon the exercise of the Warrants if exercised for cash.

The Selling Stockholders

may sell the Shares described in this prospectus in a number of different ways and at varying prices. The prices at which the Selling

Stockholders may sell the Shares in this offering will be determined by the prevailing market price for the shares of our common stock

or in negotiated transactions. See “Plan of Distribution” for more information about how the Selling Stockholders may sell

the Shares being registered pursuant to this prospectus. The Selling Stockholders each may be deemed an “underwriter” within

the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended. The Selling Stockholders have informed us that they do not

currently have any agreement or understanding, directly or indirectly, with any person to distribute the Shares.

The number of shares available

for re-sale under this prospectus on the date hereof may have changed since the Securities and Exchange Commission declared this Registration

Statement. See “Selling Stockholders” beginning on page 65 for a listing of the Shares that are available for sale under

this prospectus as of the date of this prospectus to the extent that the Company is aware of any such changes.

We have agreed to pay the

expenses of the registration of the Shares offered and sold under the registration statement of which this prospectus forms a part by

the Selling Stockholders. The Selling Stockholders will pay any underwriting discounts, commissions and transfer taxes applicable to

the Shares sold by them.

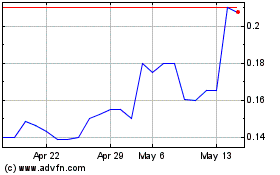

Our common stock issued is

traded on the OTCQB Market under the symbol “IPSI.” On February 6, 2023, the last reported sale price of our common stock

on the OTCQB was $0.0095 per share.

PROSPECTUS SUMMARY

Overview

We are fintech provider of digital payment solutions

and services to businesses and consumers, focusing on the needs of unbanked and underserved communities, particularly migrant communities

in the United States. We are focused on operating and developing “e-wallet” mobile applications that enable consumers to

deposit cash, convert it into a digital form, and remit the funds to Mexico and other countries quickly and securely.

Our initial two initial

e-wallet applications are Beyond Wallet and IPSIPay®. While Beyond Wallet is currently operational

and is an institutional business-to-business product, we consider IPSIPay to be our flagship retail customer product and is the product

we are presently dedicating most of our resources to developing and commercializing. IPSIPay was first “soft” launched in

December 2021, and in September 2022, we announced completion of the key integration of IPSIPay and its back-end payment processing infrastructure

through our commercial partners. This major achievement allows IPSIPay users the ability to easily transfer money and make payments through

the IPSIPay app throughout five continents for receipt at more than 215,000 payment locations.

Our primary sources

of revenue are commissions and fees from the download and use of our digital suite of products without physical custody of customer funds.

December 2022 Note

Amendment Transaction

On February 16, 2021, we entered into separate

Securities Purchase Agreements (the “SPAs”), with each of Cavalry Fund I LP (“Cavalry”) and Mercer Street Global

Opportunity Fund, LLC (“Mercer”), pursuant to which we received $500,500 and $500,500 from Cavalry and Mercer, respectively,

in exchange for the issuance of: (i) Original Issue Discount 12.5% Convertible Notes (the “Notes” and each a “Note”)

in the principal amount of $572,000 to each of Cavalry and Mercer; and (ii) five-year warrants (the “Original Warrants”)

issued to each of Cavalry and Mercer to purchase 2,486,957 shares of the Company’s common stock (the “Common Stock”)

at an exercise price of $0.24 per share. Cavalry and Mercer are Selling Stockholders listed in this prospectus.

We have twice extended our indebtedness to each

Cavalry and Mercer. On February 3, 2022, we agreed to extend the maturity date of the Notes to August 16, 2022. Additionally, on August

30, 2022we entered agreements for an additional maturity date extension to November 16, 2022. In consideration for the second extension,

we agreed to (i) increase the principal amount outstanding and due to Cavalry and Mercer under their respective Notes by twenty percent

(20%) and (ii) issue to each of Cavalry and Mercer a new five-year warrant (each, an “Extension Warrant”) to purchase an

additional 3,000,000 shares of common stock at an exercise price of $0.15 per share. The Extension Warrant contains the same terms and

provisions in all material respects as the Original Warrants, except for difference in exercise price.

On December 30, 2022, we again extended the maturity

dates of each of the Notes to December 30, 2023. Each of Cavalry and Mercer entered into Note Amendment Letter Agreement with the Company

(the “Note Amendment”) pursuant to which the parties agreed to the following:

| (1) | The conversion

price of the Notes was reduced from $0.15 to $0.0115 per share (such reduced conversion price

being the current conversion price of the Notes give the passage of the November 16, 2022

maturity date of the Notes). As a result of this change in conversion price, under the existing

terms of the Notes, the 3,000,000 shares of common stock underlying the Extension Warrants

was increased to 39,130,435 shares (and such shares are registered for resale pursuant to

the registration statement of which this prospectus forms a part); |

| (2) | The Original Warrants

issued on February 16, 2021 were irrevocably exchanged for 12-month non-convertible promissory

notes in the amount of $482,000 (the “Exchange Notes”). This exchange caused

the cancellation of the Extension Warrants for all purposes. The Exchange Notes have a maturity

date of December 30, 2023 and carry an interest rate of ten percent (10%). We shall have

the right, but not the obligation, in lieu of a cash payment upon maturity of the Exchange

Notes, to issue 51,901,711 shares of common stock, as adjusted for any stock splits, dividends

or other similar corporate events, in full satisfaction of its obligations under each of

the Exchange Notes (or any pro rata portion of such number of shares in partial satisfaction

of such obligations). We are under no legal obligation to reserve such number of shares for

future issuance; |

| (3) | Each of Cavalry

and Mercer agreed (i) not to convert all or any portion of the Notes until after March 30,

2023 and (ii) waive any events of default under the Notes and the SPAs; |

| (4) | Certain other

warrants held by Cavalry and Mercer which contain a mandatory exercise provision allowing

us to force exercise of such warrants if the price of the common stock is $0.06 per share

or above were amended effective December 30, 2022 to reduce such forced exercise price to

$0.04 per share; and |

| (5) | We are obligated

to register the shares of common stock underlying the Notes and the shares underlying all

warrants held by Cavalry and Mercer for resale with the Securities and Exchange Commission

and we have filed the registration statement of which this prospectus forms a part to satisfy

such registration obligation. |

The parties also acknowledged that the principal

and accrued interest under the Notes as of December 28, 2022 is equal to an aggregate of $2,264,784, or $1,132,392 for each of Cavalry

and Mercer. In addition, as a result of the reduction in the conversion price of the Notes, certain other warrants held by third parties

will have the exercise price of such warrants reduced to $0.0115 per share. All of the shares of our common stock underlying the Notes

as amended and all warrants held by Cavalry and Mercer as adjusted are registered for resale pursuant to the registration statement of

which this prospectus forms a part.

Recent Developments

During 2022, we have

continued our efforts to both improve the features and functionality of IPSIPay while also augmenting our marketing efforts aimed at

generating downloads and use of IPSIPay. In particular:

| ● | In April 2022, we announced

the approval from VISA® for use of its debit card services as part of

IPSIPay. This achievement provides IPSIPay users the ability to withdraw cash with minimal

fees from their digital wallet using the VISA debit card in ATM machines. The IPSIPay VISA

debit card also gives customers access to their money from a large merchant network around

the world, providing the ability to make everyday purchases anywhere that accepts VISA cards.

Simultaneously, the cards provide users with a bank account via Metropolitan Bank, thereby

enabling a path for users to potentially establish or enhance their credit; |

| ● | In July 2022, we announced

an exclusive endorsement agreement with television personality Mario Lopez to increase awareness

regarding our products. The goal of this collaboration is to highlight the challenges faced

by the unbanked and underserved communities in the United States and Latin America emphasizing

how our products can help address these challenges; |

| ● | In August 2022, we announced

a commercial relationship with DRUID, a leader in conversational artificial intelligence

(“AI”), to provide various conversational AI technology to be integrated into

IPSIPay. This collaboration will enable IPSIPay app users to conduct transactions and utilize

other functions through voice command in addition to traditional touch screen interaction; |

| |

● |

In October

2022, we announced the availability of Walmart Health Virtual Care (formerly known as MeMD) on IPSIPay, providing a comprehensive

telemedicine offering to IPSIPay users; |

| ● | In October 2022, we announced

that since the initiation of our new marketing campaign in August 2022, we had achieved 10,000

downloads of our IPSIPay® app. Of the 10,000 downloads, 1,200 were converted

to active users with wallets, meaning the users have initiated at least one transaction via

IPSIPay®; and |

| ● | In

January 2023, we announced that (i) we have initiated e-commerce collaborations that will

grant IPSIPay users with access to providers like Best Buy and Groupon and (ii) we are working

with our technology partners on IPSIPay 2.0. This new and upgraded

app with the latest technological advances should be released in the second quarter of of

2023. We also expect to announce during 2023 the addition of check capture, allowing IPSIPay

users the ability to take a picture of their paycheck and have it immediately deposited into

their IPSIPay wallet. |

We are also creating

an ecosystem that enables our business-to-business and business-to-consumer customers to move money, retain customers, and offer the

cost savings, convenience and instant settlement that is associated with digital payments. In another new development, during the first

quarter of 2023, we expect to file an application with the Government of Mexico for our Mexican MTO (money transmitting organization)

which, if approved, will allow us to capture exchange rates, issue Visa and Mastercard debit cards and provide our services as an agent

to companies in the U.S. looking to reach millions of customers in Mexico. Our Mexican MTO will also have the ability to move money in

Mexico for Mexicans sending money to family and friends within the country. We believe our Mexican MTO will give us tremendous leverage

in pricing our remittances to Mexico and better margins in sending money to Mexico.

In June 2021, we acquired a 10% strategic interest

in Frictionless Financial Technologies, Inc. (“Frictionless”). Frictionless has been a key collaborator in the development

of IPSIPay and we contract for key services related to IPSIPay, including hosting and payment transaction execution, through Frictionless

and other third parties. We have an irrevocable right to acquire up to an additional 41% of the outstanding common stock of Frictionless

at a purchase price of $300,000 for each 1% acquired.

In August 2021, we formed a new majority owned

subsidiary, Beyond Fintech, in which we own a 51% stake, with Frictionless owning the remaining 49%. Beyond Fintech acquired an exclusive

license to our Beyond Wallet offering to further its objective of providing virtual payment services allowing U.S. persons to transfer

funds to Mexico and other countries.

Our Strategy and Market

We offer simple digital e-wallet and digital

payment solutions. As a California-based fintech company, our initial launch efforts for IPSIPay and Beyond Wallet has been focused on

the Central Valley region in California, which is the largest agricultural belt in the U.S. Our applications (which can be used both

business-to-business and business-to-consumer) will facilitate the transfer of funds in digital form to other countries, initially Mexico

but also, India and the Philippines, primarily from hand-held devices as well as on desktop or laptop computers. Our launch plan for

IPSIPay and Beyond Wallet is to target lower income, migrant communities in California (notably in the agriculture industry), and expanding

to other states with large migrant populations such as Texas and Florida.

We believe

the money remittance business is changing after 50 years of an industry controlled by a very small number of large corporations. According

to publicly available data from Statista, total global remittance payments are estimated to reach over $750 billion in 2023, and for

the first time digital payments are estimated to exceed non-digital payments in 2023. We believe we are positioned to take advantage

of this sea change with our applications while also emphasizing our humanitarian theme by focusing on the unbanked and underserved. Our

ability to capture even a fraction of this massive global market represents our largest value proposition.

Our Apps and Business Model

Our primary sources of revenue are commissions

and fees from the use of our digital suite of products without physical custody of customer funds. Our fully functional apps include

the ability to use an e-wallet, Visa debit cards, bill payment platform, e-commerce and the ability to buy gold and silver. Our novel

platforms allow us to incorporate stringent compliance features (including KYC (know your customer)

and AML (anti-money laundering)) for onboarding of customers. This has enabled us to partner during 2022 with key third parties that

drive the core functionality of our apps and has also allowed us to begin to expand our product offerings beyond money remittance into

exciting other verticals. We expanded the functionality of IPSIPay in October 2022 when we announced the availability of Walmart

Health Virtual Care (formerly known as MeMD), a comprehensive telemedicine offering, on IPSIPay. We believe we have the ability and technology

to add micro-loans as well as payroll services to our apps in the future.

We are

also committed to exploring the use of the KYC and AML-focused technology at the core of our apps to be used in other verticals such

as the large and growing mobile gaming industry.

In addition to these

revenue generators, we intend on releasing our BeyondAgro software to enable growers to improve business management

and management of contract employees, particularly migrant workers. This will be offered as a monthly fee-based SaaS platform.

Our revenue will include

fees derived from the use of debit cards, ATM fees, merchant processing fees, money transfer fees, commissions on international bill

payments and, in the future micro-loans.

Marketing

We intend to initially focus on the unbanked

and underserved labor markets, initially focusing on the Californian agriculture industry to acquire customers for our IPSIPay and Beyond

Wallet apps. We will use direct social media marketing strategies to the business to consumer market. We will also employ our paid marketing

campaign with television personality Mario Lopez.

Competition

The payment service

business is highly competitive and continued growth depends on our ability to compete effectively. Companies like Western Union, Money

Gram, Paypal, and Venmo, dominate the money remittance business, and most of our competitors have far greater sources of financing, greater

name recognition and have been engaged in the industry longer than we have. We believe, however that the differentiator with the IPSIPay

and Beyond Wallet apps is our ability to provide the unbanked and under-served the ability to transact without the use of a traditional

bank account, with greater convenience, lower costs and instant settlement, and with free wallet-to-wallet transfers, and the ability

to upload funds onto Visa debit cards across borders. We believe the design of our apps will be highly attractive to our initial target

communities, thus allowing our product to compete effectively.

Intellectual Property

We rely on a combination

of contractual rights, copyright, trademark and trade secret laws to establish and protect our technology and the technology that we

license and/or that we develop in the future. We presently have three trademark applications on file and under review, and our 51% subsidiary

Beyond Fintech has an additional three trademark applications on file and under review.

Government and Environmental Regulation

and Laws

We act as a facilitator

between consumers and finance product providers, and therefore operate in a highly regulated industry. While we do not believe that our

core business as a facilitator presently is subject to significant government regulation our finance product providers are subject to

a variety of regulations aimed at preventing money laundering and financing criminal activity and terrorism, financial services regulations,

payment services regulations, consumer protection laws, currency control regulations, advertising laws and privacy and data protection

laws and therefore may expect to experience periodic investigations by various regulatory authorities in connection with the same, which

may sometimes result in monetary or other sanctions being imposed upon them. Many of these laws and regulations are constantly evolving

and are often unclear and inconsistent with other applicable laws and regulations, making compliance challenging, and may indirectly

increase our operating costs and legal risks (or directly should it be determined that our business model is or becomes subject to more

extensive regulation). Any violations of any of the foregoing or similar laws, rules or regulations could adversely affect our ability

to maintain IPSIPay and Beyond Wallet, which could have a material adverse effect on our operations and financial condition.

Corporate Information and Background

Our principal offices are located at 56B 5th

Street, Lot 1, #AT, Carmel by the Sea, CA, 93921, and our telephone number at that office is (866) 477-4729. Our website address

is www.ipsipay.com. Information contained in our website does not form part of this prospectus and is intended for informational purposes

only.

Our company was formed in 2013, but we only commenced

our current business model in late 2019. For information on our corporate history, see “Business–Our Corporate History and

Background.”

Available Information

We have included our website address as a factual

reference and do not intend it to be an active link to our website. We make available on our website, www.ipsipay.com., our Annual Reports

on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant

to Section 13(a) or 15(d) of the Exchange Act. These reports are available free of charge through the investor relations page of our

internet website as soon as reasonably practicable after those reports are filed with the SEC.

Summary Risk Factors

Our business faces significant risks and uncertainties

of which investors should be aware before making a decision to invest in our common stock. If any of the following or similar risks are

realized, our business, financial condition and results of operations could be materially and adversely affected. The following is a

summary of the more significant risks relating to the Company. A more detailed description of our risk factors set forth under the caption

“Risk Factors” in this prospectus.

| ● | We

have had very limited operations to date with our current business model. |

| ● | We

have generated and we will likely continue to generate, operating losses and experience negative

cash flows, and it is uncertain whether we will achieve profitability. |

| ● | We

have a present need for additional funding, which raises questions about our ability to continue

as a going concern. We may be unable to raise capital when needed, which would force us to

delay, reduce or eliminate our product development programs or commercialization efforts. |

| ● | We

have not generated sufficient revenue or cash flow to pay our convertible notes, and conversion

of such debt into shares of common stock, which could cause significant dilution. |

| ● | We

previously identified material weaknesses in our internal controls, and we cannot provide

assurances that these weaknesses will be effectively remediated or that additional material

weaknesses will not occur in the future. |

| ● | We

are dependent on Frictionless and other back-end providers for our technology development

and infrastructure. |

| ● | The

payment services industry is highly competitive, and many of our competitors are larger and

have greater financial and other resources. |

| ● | There

is uncertainty as to market acceptance of our technology, products and services. |

| ● | We

may be unable to scale usage of our digital payment products. |

| ● | We

may be unable to integrate complimentary services or features into IPSIPay, which could cause

IPSIPay to decrease in popularity or customer usage. |

| ● | We

are dependent on technology networks and systems to process, transmit and securely store

electronic information and we could be subject to liability if our technology systems fail

to be secure. |

| ● | Our

focus on migrant communities generally, and significant changes or disruption in U.S.-Mexico

migration patterns, could adversely affect our business, financial condition and results

of operations. |

| ● | We

are subject to economic risks that could impact the overall level of consumer spending. |

| ● | Our

business will initially be geographically concentrated and could be significantly affected

by any adverse change in the region in which we operate. |

| ● | We

expect to be subject to extensive government regulation if we are deemed to be engaged in

a regulated business or if we implement our cryptocurrency operations, and we are faced with

the risk that new regulations applicable to our business will be enacted. |

| ● | The

laws and regulations indirectly affecting our industry is constantly evolving and failure

to comply could adversely impact our business. |

| ● | We

may have difficulty managing our growth, which may divert resources and limit our ability

to successfully expand our operations. |

| ● | We

may not be able to complete or integrate successfully any potential future acquisitions,

partnerships or joint ventures. |

| ● | Major

bank failure or sustained financial market illiquidity, or illiquidity at our clearing, cash

management and custodial financial institutions, could adversely affect our business, financial

condition and results of operations. |

| ● | If

we cannot keep pace with rapid developments and change in our industry and provide new services

to our clients, the use of our services could decline, reducing our revenues. |

| ● | Our

systems and our third party providers’ systems may fail due to factors beyond our control,

which could interrupt our service, cause us to lose business and increase our costs. |

| ● | Unauthorized

disclosure of data, whether through cybersecurity breaches, computer viruses or otherwise,

could expose us to liability, protracted and costly litigation and damage our reputation. |

| ● | Customer

complaints or negative publicity about our customer service could affect attractiveness of

our services adversely and, as a result, could have an adverse effect on our business, financial

condition and results of operations. |

| ● | Our

payment system might be used for fraudulent, illegal or improper purposes, which could expose

us to additional liability and harm our business. |

| ● | We

may not be able to successfully protect the intellectual property we license or own and may

be subject to infringement claims. |

| ● | We

rely on certain key personnel and in a dynamic industry like ours, the ability to attract,

recruit, retain and develop qualified personnel is critical to our success and growth. |

| ● | There

is currently a limited public trading market for our common stock and one may never develop. |

| ● | Because

our common stock may be a “penny stock,” it may be more difficult for investors

to sell shares of our common stock, and the market price of our common stock may be adversely

affected. |

| ● | Our

stock price has been subject to significant volatility, and future volatility may result

in our investors incurring substantial losses. |

| ● | Because

we became public by means of a reverse merger, we and our shareholders may be faced with

regulatory constraints, and we may not be able to attract the attention of brokerage firms. |

| ● | Our

investors’ ownership will likely be diluted in the future. |

| ● | We

do not have an independent compensation committee, which presents the risk that compensation

and benefits paid to those executive officers who are board members and other officers may

not be commensurate with its financial performance. |

THE OFFERING

| Issuer: |

|

Innovative

Payment Solutions, Inc., a Nevada corporation |

| |

|

|

| Securities offered by the Selling Stockholders |

|

306,528,740 shares of our

common stock, including (i) 196,937,678 shares of common stock issuable upon conversion of the Notes, and (iii) 109,591,062 shares

of common stock issuable upon exercise of the Warrants. |

| |

|

|

| Total Common Stock outstanding after this offering |

|

683,430,419 shares of common

stock; assuming all of the Shares offered in this offering are issued including Shares issuable upon conversion of the Notes and

exercise of the Warrants. |

| |

|

|

| Use of Proceeds |

|

We will not receive any

proceeds from the sale of the Shares covered by this prospectus. However, we may receive gross proceeds upon the exercise of the

Warrants if exercised for cash. See “Use of Proceeds.” |

| |

|

|

| Risk Factors |

|

Investing in our

common stock is highly speculative and involves a high degree of risk. For a discussion of factors to consider before deciding

to invest in our securities, you should carefully review and consider the “Risk Factors” section of this prospectus beginning

on page 8 of this prospectus. |

RISK FACTORS

Investing in our common stock is highly

speculative and involves a high degree of risk. Therefore, you should be able to bear the complete loss of your investment.

You should carefully consider the risks described below, the other information in this prospectus and the documents incorporated by reference

herein when evaluating our company and our business. If any of the following risks actually occur, our business could be harmed. In such

case, the trading price of our common stock could decline and investors could lose all or a part of the money paid to buy our common

stock

Risks Relating to our Company

We have had very limited operations

to date with our current business model.

We only began developing our current business

December 2019, when we sold our Mexican subsidiaries and began to focus solely on application-based payment solutions, as opposed to

our prior business plan which was based on payments via physical kiosks. Moreover, COVID-19 resulted in significant delays in the development

and commercial launch of IPSIPay and Beyond Wallet, and we only achieved full commercial availability of our flagship offering IPSIPay

in September 2022. As such, we have a very limited operating history in our current business model, which makes it difficult to evaluate

both our operating history and our future potential. We have yet to demonstrate our ability to overcome the risks frequently encountered

in “start-up” companies, including in the payment services industry in the United States, and are still subject to many of

the risks common to early stage companies, including the uncertainty as to our ability to implement our business plan, market acceptance

of our proposed business and services, under-capitalization, cash shortages, limitations with respect to personnel, financing and other

resources and uncertainty of our ability to generate revenues. There is therefore a significant risk that our activities will not result

in any material revenues or profit, and the likelihood of our business viability and long term prospects must be considered in light

of the stage of our development. There can be no assurance that we will be able to fulfill our stated business strategy and plans, or

that financial, technological, market, or other limitations may force us to modify, alter, significantly delay, or significantly impede

the implementation of such plans. We have insufficient results of operations in our current business model for investors to use to identify

historical trends. Investors should consider our prospects considering the risk, expenses and difficulties we will encounter as an early-stage

company. Our revenue and income potential is unproven and our business model is continually evolving. We are subject to the risks inherent

to the operation of a new business enterprise and cannot assure you that we will be able to address these risks, and our inability to

address these risks could lead to the failure of our business..

We have generated

and we will likely continue to generate, operating losses and experience negative cash flows, and it is uncertain whether we will achieve

profitability.

For the year ended December

31, 2021 and the nine months ended September 30, 2022, we incurred a net loss of $14,494,915 and $6,208,074, respectively. We have an

accumulated deficit of $48,290,394 through September 30, 2022. We expect to continue to incur operating losses until such time, if ever,

as we are able to achieve sufficient levels of revenue from operations. There can be no assurance that we will ever generate significant

sales or achieve profitability. Accordingly, the extent of future losses and the time required to achieve profitability, if ever, cannot

be predicted.

We also expect to experience

negative cash flows for the foreseeable future as we fund our operating losses. Although we believe our existing cash and cash equivalents

will be sufficient for the near term, if in the long term we do not generate significant revenues or raise additional financing in order

to achieve and maintain profitability. We may not be able to generate these revenues or achieve profitability in the future. Our failure

to achieve or maintain profitability would likely negatively impact the value of our securities and financing activities.

We have a present

need for additional funding, which raises questions about our ability to continue as a going concern. We may be unable to raise capital

when needed, which would force us to delay, reduce or eliminate our product development programs or commercialization efforts.

As of September 30,

2022, we had cash and cash equivalents of $1,352,983. We believe that based on our current operating plan, our existing cash and cash

equivalents will only be sufficient to enable us to fund our operations and our debt and other obligations for a very limited period.

See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources”

below. This raises questions about our ability to continue as a going concern. Moreover, we have significant indebtedness due in December

2023, and thus we will need significant additional funds to repay our debt, fund our working capital, and fully implement our business

plan as we seek to achieve revenues, positive cash flow and profitability. There is a material risk that we will be unable to generate

sufficient revenues to pay our expenses, and if our existing sources of cash and cash flows are insufficient to fund our activities,

we will need to raise additional funds. Additional equity or debt financing may not be available on acceptable terms, if at all, particularly

in the current economic environment. If adequate funds are not available, we may be required to delay, reduce the scope of or eliminate

one or more of our new products in development.

Until such time, if

ever, as we can generate substantial product revenues, we will be required to finance our cash needs through public or private equity

offerings, debt financings and corporate collaboration and licensing arrangements. If we raise additional funds by issuing equity securities,

our stockholders may experience dilution. Debt financing, if available, may involve agreements that include covenants limiting or restricting

our ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends. Any debt

financing or additional equity that we may raise may contain terms, such as liquidation and other preferences, that are not favorable

to us or our stockholders. If we raise additional funds through collaboration and licensing arrangements with third parties, it may be

necessary to relinquish valuable rights to our technologies, research programs or product candidates or grant licenses on terms that

may not be favorable to us.

If we are unable to generate cash flow positive

operations or achieve profitability, and if we are unable to raise additional funds on commercially reasonable terms or at all, we may

be required to significantly reduce or cease our operations, or our business could fail, which could result in the loss to investors

of their investment in our securities.

We have not generated

sufficient revenue or cash flow to pay our convertible notes, and conversion of such debt into shares of common stock, which would cause

significant dilution.

As of December 28, 2022, we had outstanding convertible

notes owed to Cavalry and Mercer in the aggregate principal amount of approximately $2.26 million which has a currently maturity date

of December 30, 2023. To date, we have not generated sufficient revenue or cash flows to pay the balances owed under these notes and

provide sufficient working capital to run our business. The outstanding principal amount of the notes is convertible at any time into

shares of our common stock at $0.0115 per share. In addition, upon the occurrence and during the continuation of an Event of Default

(as defined in the notes), the notes each will become immediately due and payable and we have agreed to pay additional default interest

rates. We may not have sufficient cash resources or access to funding to repay such notes. Moreover, upon conversion of these notes,

our current shareholders will suffer dilution, which given the current conversion price of the notes would be significant.

Servicing our

debt requires a significant amount of cash. Our ability to generate sufficient cash to service our debt depends on many factors beyond

our control.

Our ability to make payments on and to refinance

our debt, to fund planned capital expenditures and to maintain sufficient working capital depends on our ability to generate cash in

the future. This, to a certain extent, is subject to general economic, financial, competitive, legislative, regulatory and other factors

that are beyond our control. We cannot assure you that our business will generate sufficient cash flow from operations or from other

sources in an amount sufficient to enable us to service our debt or to fund our other liquidity needs. If our cash flow and capital resources

are insufficient to allow us to make scheduled payments on our debt, we may need to seek additional capital or restructure or refinance

all or a portion of our debt on or before the maturity thereof, any of which could have a material adverse effect on our business, financial

condition or results of operations. We cannot assure you that we will be able to refinance any of our debt on commercially reasonable

terms or at all, or that the terms of that debt will allow any of the above alternative measures or that these measures would satisfy

our scheduled debt service obligations. If we are unable to generate sufficient cash flow to repay or refinance our debt on favorable

terms, it could significantly adversely affect our financial condition and the value of our outstanding debt. Our ability to restructure

or refinance our debt will depend on the condition of the capital markets and our financial condition. Any refinancing of our debt could

be at higher interest rates and may require us to comply with more onerous covenants, which could further restrict our business operations.

There can be no assurance that we will be able to obtain any financing when needed.

Covenant restrictions

under our indebtedness may limit our ability to operate our business.

Our outstanding convertible

notes contain, and our future indebtedness agreements may contain covenants that restrict our ability to finance future operations or

capital needs or to engage in other business activities. The Notes restrict our ability to:

| ● | incur,

assume or guarantee or suffer to exist any indebtedness for borrowed money of any kind, including,

but not limited to, a guarantee, on or with respect to any of its property or assets now

owned or hereafter acquired or any interest therein or any income or profits therefrom other

than Permitted Indebtedness (as defined in the notes); |

| ● | repurchase

capital stock; |

| ● | repay

any Indebtedness (as defined in the notes) other than certain secured notes which are no

longer outstanding or Permitted Indebtedness or make other restricted payments including,

without limitation, paying dividends and making investments; |

| ● | sell

or otherwise dispose of assets; and |

| ● | enter

into transactions with affiliates. |

In addition, the notes

contain price protection anti-dilution provisions that will discourage financing at prices below the conversion price of the notes and

will result in a decrease in the conversion price of the notes if we should issue securities below such price.

We previously

identified material weaknesses in our internal controls, and we cannot provide assurances that these weaknesses will be effectively remediated

or that additional material weaknesses will not occur in the future.

Our management is responsible for establishing

and maintaining adequate internal control over our financial reporting, as defined in Rule 13a- 15(f) under the Exchange Act. In connection

with our audited financial statements for the year ended December 31, 2021, we identified material weaknesses in our internal controls

which included (i) insufficient segregation of duties and oversight of work performed in our accounting and finance function due to limited

personnel with the appropriate skill sets and (ii) lack of written policies and procedures to address all material transactions and developments

impacting our financial statements. Our management believes that these material weaknesses have since been remedied. However, given the

small size of our company and the current state of our business, we are faced with the risk that we may not always be able to detect

errors or omissions in our financial reporting and we face internal control weaknesses in the future. If we fail to comply with the rules

under Sarbanes-Oxley related to disclosure controls and procedures in the future, or, if we experience material weaknesses and other

deficiencies in our internal control and accounting procedures and disclosure controls and procedures, our stock price could decline

significantly and raising capital could be more difficult. If new material weaknesses or significant deficiencies are discovered or if

we otherwise fail to address the adequacy of our internal control and disclosure controls and procedures from time to time, our business

may be harmed. Moreover, effective internal controls are necessary for us to produce reliable financial reports and are important to

helping prevent financial fraud. If we cannot provide reliable financial reports or prevent fraud, our business and operating results

could be harmed, investors could lose confidence in our reported financial information, and the trading price of our securities could

drop significantly.

Risks Related to Our Business

We are dependent on Frictionless and other

back-end providers for our technology development and infrastructure.

In June 2021, we entered into an investment and

services collaboration with Frictionless under which Frictionless agreed to deliver to us a live, fully compliant financial payment software

as a service solution for use by us as a digital payment platform (which became IPSIPay) that enables payments within the United States

and abroad, including Mexico, together with a full suite of product services to facilitate our anticipated product offerings. Frictionless

was and remains critical in the development of IPSIPay, and currently, we remain dependent on Frictionless and its contracted back-end

providers for the execution of the technological aspects of IPSIPay. If Frictionless or such other technology providers are unable to

perform the important functions they manage for us, or if we were to lose our commercial relationship Frictionless or such other technology

collaborators, our ability to offer IPSIPay, and thus our business and results of operations, would suffer greatly.

The payment services

industry is highly competitive, and many of our competitors are larger and have greater financial and other resources.

The payment services industry is highly competitive,

and our continued growth depends on our ability to compete effectively with both traditional and non-traditional payment service providers.

We currently expect to face competition from a variety of financial and non-financial business groups which include retail banks, non-traditional

payment service providers which provide mobile top-up services, and mobile network operators, traditional kiosk and terminal operators,

electronic payment system operators, as well as other companies that provide various forms of payment services, including electronic

payment and payment processing services. Competitors in our industry seek to differentiate themselves by features and functionalities

such as speed, convenience, network size, accessibility, hours of operation, reliability and price. A significant number of these competitors

have greater financial, technological and marketing resources than we have, and operate robust networks and are highly regarded by consumers.

There is uncertainty

as to market acceptance of our technology, products and services.

We have conducted our

own research into the markets for our technology, products and services; however, because we are a new entrant into the market, there

is a risk that the market will not accept our technology, products and services. Further, we have limited information on which to estimate

our anticipated level of sales. Our products and services require consumers and service providers to adopt our technology. Our industry

is susceptible to rapid technological developments and there can be no assurance that we will be able to match any new technological

advances. If we are unable to match the technological changes in the needs of our customers, the demand for our products will be reduced

and our ability to generate revenue could be adversely impacted.

We may be unable to scale usage of

our digital payment products.

We have developed and

launched digital payment products, including, IPSIPay and Beyond Wallet. It was only recently (in September 2022) that we completed the

key integration of our IPSIPay mobile application and back-end payment processing infrastructure through its commercial partners, and

our efforts are now focused on increasing the number of IPSIPay downloads. No assurance can be given that we will be able to achieve

commercial success these products as and when planned. Moreover, the growth of the digital payments industry in general is subject to

a high degree of uncertainty, and the slowing or stopping of the development or acceptance of developing protocols may occur unpredictably.

This would have a material adverse impact on our results of operations and the viability of our current business model.

We may be unable

to integrate complimentary services or features into IPSIPay, which could cause IPSIPay to decrease in popularity or customer usage.

As part of our development of IPSIPay, we are

endeavoring to integrate into IPSIPay new services and capabilities, such as conversational AI technology through Druid and the Walmart

Virtual Healthcare telemedicine service. We may be unable to technologically establish or maintain the capabilities of these offerings,

and even if we are able to do so, these offerings may not increase customer interest in IPSIPay, which could harm our business, our ability

to generate revenues and results of operations.

We are dependent

on technology networks and systems to process, transmit and securely store electronic information and we could be subject to liability

if our technology systems fail to be secure.

We could be held liable

for damages or our reputation could suffer from security breaches or disclosure of confidential information or personal data. Through

Frictionless and other service providers, we are dependent on technology networks and systems to process, transmit and securely store

electronic information and to communicate with our kiosks, with our partners and with our customers. Security breaches of this infrastructure

could lead to shutdowns or disruptions of our systems and potential loss or unauthorized disclosure of confidential information or data,

including personal data. The theft and/or unauthorized use or publication of our, or our customers’, confidential information or

other proprietary business information as a result of such an incident could adversely affect our competitive position and reduce marketplace

acceptance of our services. Any failure in the networks or computer systems used by us or our customers could result in a claim for substantial

damages against us and significant reputational harm, regardless of our responsibility for the failure. In addition, through Frictionless

and other service providers, we have access to or are required to manage, utilize, collect and store sensitive or confidential customer

or employee data, including personal data. As a result, we are subject to numerous U.S. and non-U.S. laws and regulations designed to

protect this information, such as various U.S. federal and state laws governing the protection of personal data. If any person, including

any of our employees, negligently disregards or intentionally breaches controls or procedures with which we are responsible for complying

with respect to such data, or otherwise mismanages or misappropriates that data, or if unauthorized access to or disclosure of data in

our possession or control occurs, we could be subject to liability and penalties in connection with any violation of applicable privacy

laws and/or criminal prosecution, as well as significant liability to our customers or our customers’ clients’ for breaching

contractual confidentiality and security provisions or privacy laws. The loss or unauthorized disclosure of sensitive or confidential

customer or employee data, including personal data, whether through breach of computer systems, systems failure, employee negligence,

fraud or misappropriation, or otherwise, could damage our reputation and cause us to lose customers. Similarly, unauthorized access to

or through our information systems and networks or those we develop or manage for our customers, whether by our employees or third parties,

could result in negative publicity, legal liability and damage to our reputation, which could in turn harm our business, results of operations,

or financial condition.

Our focus on migrant

communities generally, and significant changes or disruption in U.S.-Mexico migration patterns, could adversely affect our business,

financial condition and results of operations.

We are targeting the unbanked and underserved

migrant communities as initial users of IPSIPay. Our money transfer business therefore relies to a large extent on international migration

patterns, particularly between the U.S. and Mexico, as individuals move from their native countries to countries with greater economic

opportunities or a more stable political environment. A significant portion of money transfer transactions are initiated by immigrants

or refugees sending money back to their native countries, particularly Mexico. Immigration has become a very contentious political topic

in recent years, and changes in immigration laws or policies that discourage migration and political or other events (such as war, trade

wars, terrorism or health emergencies including but not limited to the COVID-19 pandemic) that make it more difficult for individuals

to migrate to or work in the U.S. could adversely affect our money transfer remittance volume or growth rate. Additionally, sustained

weakness in global economic conditions could reduce economic opportunities for migrant workers and result in reduced or disrupted international

migration patterns. Reduced or disrupted international migration patterns, particularly in the U.S. or Europe, are likely to reduce money

transfer transaction volumes and therefore have an adverse effect on our business. Finally, since we are targeting migrant communities,

and since immigration has become such a contentious topic, our reputation in the marketplace (including the financial markets) could

be harmed, which could adversely effect our business.

We are subject

to economic risks that could impact the overall level of consumer spending.

The payment services

industry depends heavily on the overall level of consumer spending. We are exposed to general economic conditions that affect consumer

confidence, consumer spending, consumer discretionary income or changes in consumer purchasing habits. Economic factors such as employment

levels, business conditions, energy and fuel costs, interest rates, and inflation rate could reduce consumer spending or change consumer

purchasing habits. A reduction in the amount of consumer spending could result in a decrease in our prospects for revenue and profits.

If users of our products and services spend or remit less money per transaction, we will have fewer transactions to process at lower

amounts, resulting in lower revenue. As we are targeting the migrant communities in the United States, weakening in the Mexican economy

could have a negative impact on users of IPSIPay which could, in turn, negatively impact our business, financial condition and results

of operations, particularly if the recessionary environment disproportionately affects some of the market segments that represent a larger

portion of our payment processing volume.

If consumer confidence

in our business deteriorates, our business, financial condition and results of operations could be adversely affected.

Our business is built

on consumers’ confidence in our brands, as well as our ability to provide fast, reliable payment services. As a consumer business,

the strength of our brand and reputation are of paramount importance to us. Several factors could adversely affect consumer confidence

in our brand, many of which are beyond our control, and could have an adverse impact on our results of operations. These factors include:

| ● | any

regulatory action or investigation against us; |

| ● | any

significant interruption to our systems and operations; and |

| ● | any

breach of our security systems or any compromises of consumer data. |

Our business will

initially be geographically concentrated and could be significantly affected by any adverse change in the region in which we operate.

Initially our business will be concentrated in

states such as California and later Texas and Florida, which have high migrant populations. We plan to derive a large portion of our

revenues in the coming years from these migrant states and customers in these migrant states. Therefore, our business is exposed to adverse

regulatory and competitive changes, economic downturns and changes in political conditions in these migrant states. For example, in 2022,

the governors of Florida and Texas have begun transporting persons who allegedly engaged in illegal immigration to other states, and

policies such as these have increased the national focus on immigration, in many instances negatively. Such activities could discourage

migration, which could cause our products and services to be less desirable. Moreover, due to the concentration of our businesses in

migrant states, our business is less diversified and, accordingly, is subject to regional risks, including inclement weather, power outages,

labor shortages, and state and local laws, rules and regulations.

We expect to be

subject to extensive government regulation if we are deemed to be engaged in a regulated business or if we implement our cryptocurrency

operations, and we are faced with the risk that new regulations applicable to our business will be enacted.

Currently, we are indirectly

impacted by government regulation, however, we may be directly subject to a variety of regulations aimed at preventing money laundering

and financing criminal activity and terrorism, financial services regulations, payment services regulations, consumer protection laws,

currency control regulations, advertising laws and privacy and data protection laws which may sometimes result in monetary or other sanctions

being imposed on our financial service providers or us. Many of these laws and regulations are constantly evolving and are often unclear

and inconsistent with other applicable laws and regulations, making compliance challenging and could directly or indirectly increase

our related operating costs and legal risks. In particular, there has been increased public attention and heightened legislation and

regulations regarding money laundering and terrorist financing. Our financial service providers or us may be required make significant

judgment calls in applying anti-money laundering legislation and risk being found in non-compliance with such laws, which could have

an adverse impact on our business.

The regulatory

regime governing digital assets and offerings of digital assets is evolving and uncertain, and new regulations or policies may materially

adversely affect our development.

The regulatory regime

governing digital assets and offerings of digital assets is uncertain, and new regulations or policies may materially adversely affect

the development and the value of the Company. Regulation of digital assets is currently undeveloped and likely to rapidly evolve as government

agencies take greater interest in them. Regulation also varies significantly among international, federal, state and local jurisdictions

and is subject to significant uncertainty. Various legislative and executive bodies in the United States and in other countries may in

the future adopt laws, regulations, or guidance, or take other actions, which may severely impact the digital assets market. In addition,

any violations of laws and regulations relating to the safeguarding of private information in connection with e-Wallets could subject

us to fines, penalties or other regulatory actions, as well as to civil actions by affected parties. Any such violations could adversely

affect the ability of the Company to maintain e-Wallets, which could have a material adverse effect on our operations and financial condition.

Failure by us to comply with any laws, rules and regulations, some of which may not exist yet or are subject to interpretation and may

be subject to change, could result in a variety of adverse consequences, including civil penalties and fines.

The laws and regulations

indirectly affecting our industry are constantly evolving and failure to comply adversely impact our business.

Our business is indirectly

subject to a wide range and increasing number of laws and regulations, as described below. Liabilities or loss of business resulting

from a failure by us, our agents or their subagents to comply with laws and regulations and regulatory or judicial interpretations thereof,

including laws and regulations designed to protect consumers, or detect and prevent money laundering, terrorist financing, fraud and

other illicit activity, and increased costs or loss of business associated with compliance with those laws and regulations has had and

we expect will continue to have an adverse effect on our business, financial condition, results of operations, and cash flows. Our services

are subject to increasingly strict legal and regulatory requirements, including those intended to help detect and prevent money laundering,

terrorist financing, fraud, and other illicit activity. The interpretation of those requirements by judges, regulatory bodies and enforcement

agencies may change quickly and with little notice. Additionally, these requirements or their interpretations in one jurisdiction may

conflict with those of another jurisdiction. As United States federal and state as well as foreign legislative and regulatory scrutiny

and enforcement action in these areas increase, we expect that our costs of complying with these requirements could continue to increase,

perhaps substantially, and may make it more difficult or less desirable for consumers and others to use our services or for us to contract

with certain intermediaries, either of which would have an adverse effect on our revenue and operating income. For example, we have made

additional investments in our compliance programs based on the rapidly evolving and increasingly complex global regulatory and enforcement

environment and our internal reviews. These additional investments relate to enhancing our compliance capabilities, including our consumer

protection efforts. Further, failure by us or partners and service providers to comply with any of these requirements or their interpretation

could result in the suspension or revocation of a license or registration required to provide money transfer, payment or foreign exchange

services, the limitation, suspension or termination of services, changes to our business model, loss of consumer confidence, the seizure

of our assets, and/or the imposition of civil and criminal penalties, including fines and restrictions on our ability to offer services.

We are subject to numerous regulations such as those imposed by the Foreign Corrupt Practices Act (the “FCPA”) in the United

States and similar laws in other countries, which generally prohibit companies and those acting on their behalf from making improper

payments to foreign government officials for the purpose of obtaining or retaining business. Some of these laws, such as the Bribery

Act, also prohibit improper payments between commercial enterprises. Because our services are offered in other countries, we face significant

risks associated with our obligations under the FCPA and other national anti-corruption laws. Any determination that we have violated

these laws could have an adverse effect on our business, financial condition, results of operations, and cash flows. Our United States

business is subject to reporting, recordkeeping and anti-money laundering provisions of the BSA and could be subject to regulatory oversight

and enforcement by FinCEN.

The remittance and digital

payments industry has come under increasing scrutiny from government regulators and others in connection with its ability to prevent

its services from being abused by people seeking to defraud others. Our failure to continue to help prevent frauds and increased costs

related to the implementation of enhanced anti-fraud measures, or a change in fraud prevention laws or their interpretation or the manner

in which they are enforced has had and could in the future have an adverse effect on our business, financial condition, results of operations,

and cash flows.

Further, any determination

that our partners have violated laws and regulations could seriously damage our reputation and brands, resulting in diminished revenue

and profit and increased operating costs. In some cases, we could be liable for the failure of our partners to comply with laws which

also could have an adverse effect on our business, financial condition, results of operations, and cash flows. The regulations implementing

the remittance provisions of the Dodd-Frank Act also impose responsibility on us for any related compliance failures of our partners.

The requirements under

the U.S. Dodd-Frank Act, the European Revised Payment Services Directive and similar legislation enacted or proposed in other countries

have resulted and will likely continue to result in increased compliance costs, and in the event we or our agents are unable to comply,

could have an adverse impact on our business, financial condition, results of operations, and cash flows. Additional countries may adopt

similar legislation.

We may have difficulty

managing our growth, which may divert resources and limit our ability to successfully expand our operations.

Our implementation of our business plan and current

or future strategic initiatives will place significant demands on our operations and management. Our future success will depend on the

ability of our officers and other key employees to continue to implement and improve our operational, credit, financial, management and

other internal risk controls and processes, along with our reporting systems and procedures, as the number and geographical scope of

our customer and vendor relationships continue to expand. We may be unable to implement improvements to our management information and

control systems and control procedures and processes in an efficient or timely manner, and we may discover additional deficiencies in

existing systems and controls. In particular, our controls and procedures must be able to accommodate our expected increase in revenue.

Our growth strategy may require us to incur additional expenditures to expand our administrative and operational infrastructure. If we

are unable to manage future expansion in our operations, we may experience compliance and operational problems, have to slow the pace

of growth or have to incur additional expenditures beyond current projections to support such growth, any one of which could adversely

affect our business and results of operations. We may be unable to increase the volume of sales at acceptable risk levels, expand our

customer base and manage the costs and implementation risks associated with our growth strategy. We also cannot provide you with any

assurance that our further expansion will be profitable, that we will be able to maintain any specific level of growth, if any, that

we will be able to maintain capital sufficient to support our continued growth or that we will be able to adequately and profitably manage

that growth.

We may not be

able to complete or integrate successfully any potential future acquisitions, partnerships or joint ventures.

We have implemented joint ventures and commercial

partnerships as part of our business, and from time-to-time, we may evaluate possible acquisition transactions, partnerships or joint

ventures, some of which may be material. Potential future acquisitions, partnerships and joint ventures may pose significant risks to

our existing operations if they cannot be successfully integrated. These projects would place additional demands on our managerial, operational,

financial and other resources, create operational complexity requiring additional personnel and other resources and require enhanced

control procedures. In addition, we may not be able to successfully finance or integrate any businesses, services or technologies that

we acquire or with which we form a partnership or joint venture. Furthermore, the integration of any acquisition may divert management’s

time and resources from our core business and disrupt our operations. Moreover, even if we were successful in integrating newly acquired

assets, expected synergies or cost savings may not materialize, resulting in lower than expected benefits to us from such transactions.

We may spend time and money on projects that do not increase our revenue. Additionally, when making acquisitions it may not be possible

for us to conduct a detailed investigation of the nature of the assets being acquired due to, for instance, time constraints in making

the decision and other factors. We may become responsible for additional liabilities or obligations not foreseen at the time of an acquisition.

In addition, in connection with any acquisitions, we must comply with various antitrust requirements. It is possible that perceived or

actual violations of these requirements could give rise to regulatory enforcement action or result in us not receiving all necessary

approvals in order to complete a desired acquisition. To the extent we pay the purchase price of any acquisition in cash, it would reduce

our cash reserves, and to the extent the purchase price is paid with our stock, it could be dilutive to our stockholders. To the extent

we pay the purchase price with proceeds from the incurrence of debt, it would increase our level of indebtedness and could negatively

affect our liquidity and restrict our operations. All of the above risks could have a material adverse effect on our business, results

of operations, financial condition, and prospects.

We are subject

to the discretion of administrative enforcement agencies.

In certain cases, regulations

may provide administrative discretion regarding enforcement, and regulations may be applied inconsistently across the industry, resulting

in increased costs for the Company that may not be incurred by competitors. Changes in laws, regulations or other industry practices

and standards, or interpretations of legal or regulatory requirements, may reduce the market for or value of our products or services

or render our products or services less profitable or obsolete. For example, policymakers may impose heightened customer due diligence

requirements or other restrictions, fees or taxes on remittances. Changes in the laws affecting the kinds of entities that are permitted

to act as money transfer agents (such as changes in requirements for capitalization or ownership) could adversely affect our ability

to distribute certain services and the costs of providing those services.

Major bank failure

or sustained financial market illiquidity, or illiquidity at our clearing, cash management and custodial financial institutions, could

adversely affect our business, financial condition and results of operations.

We face certain risks in the event of a sustained

deterioration of financial market liquidity, as well as in the event of sustained deterioration in the liquidity, or failure, of

our clearing, cash management and custodial financial institutions. In particular, in the event of a major bank or credit card failure,

we could be unable to process transactions via our mobile applications: In such a case, or if financial liquidity deteriorates for other

reasons, our ability to operate our business and our financial condition and results of operations could be significantly harmed.

As our business

develops, we will need to implement enhanced compliance processes, procedures and controls with respect to the rules and regulations

that apply to our business.

Our success requires significant public confidence

in our ability to handle large and growing payment volumes and amounts of consumer funds, as well as comply with applicable regulatory

requirements. Any failure to manage consumer funds or to comply with applicable regulatory requirements could result in the imposition

of fines, harm our reputation and significantly diminish use of our products. In addition, if we are not in compliance with anti-corruption

laws and other laws governing the conduct of business with government entities and/or officials (including local laws), we may be subject

to criminal and civil penalties and other remedial measures, which could have an adverse impact on our business, financial condition,

results of operations and prospects.

If we cannot keep

pace with rapid developments and change in our industry and provide new services to our clients, the use of our services could decline,

reducing our revenues.

The payment services

industry in which we operate is characterized by rapid technological change, new product and service introductions, evolving industry

standards, changing customer needs and the entrance of more established market players seeking to expand into these businesses. In order

to remain competitive, we continually seek to expand the services we offer and to develop new projects, including, for example, the electronic

wallet. These projects carry risks, such as delays in delivery, performance problems and lack of customer acceptance. In our industry,

these risks are acute. Any delay in the delivery of new services or the failure to differentiate our services or to accurately predict

and address market demand could render our services less desirable, or even obsolete, to consumers. In addition, if alternative payment

mechanisms become widely available, substituting our current products and services, and we do not develop and offer similar alternative

payment mechanisms successfully and on a timely basis, our business and prospects could be adversely affected. Furthermore, we may be

unable to recover the costs we have incurred in developing new services. Our development efforts could result in increased costs and

we could also experience a loss in business that could reduce our earnings or could cause a loss of revenue if promised new services

are not timely delivered to our clients, we are not able to compete effectively with our competitors’ or do not perform as anticipated.

If we are unable to develop, adapt to or access technological changes or evolving industry standards on a timely and cost effective basis,

our business, financial condition and results of operations could be materially adversely affected.

Our systems and

our third party providers’ systems may fail due to factors beyond our control, which could interrupt our service, cause us to lose

business and increase our costs.

We depend on the efficient and uninterrupted

operation of numerous systems, including our computer systems, software and telecommunications networks, as well as the data centers

that we lease from third parties, including Frictionless. Our systems and operations, or those of our third party providers like Frictionless,

could be exposed to damage or interruption from, among other things, fire, flood, natural disaster, power loss, telecommunications failure,

vendor failure, unauthorized entry, improper operation and computer viruses. Substantial property and equipment loss, and disruption

in operations, as well as any defects in our systems or those of third parties or other difficulties could expose us to liability and

materially adversely impact our business, financial condition and results of operations. In addition, any outage or disruptive efforts

to our data center would result in the failure of our computers and kiosks to operate and would, if for an extensive period, adversely

impact our reputation, brand and future prospects.

Unauthorized disclosure

of data, whether through cybersecurity breaches, computer viruses or otherwise, could expose us to liability, protracted and costly litigation

and damage our reputation.

We store and/or transmit sensitive data, such

as mobile phone numbers, and we have ultimate liability to our consumers for our failure to protect this data. If breaches occur our

encryption of data and other protective measures may not prevent unauthorized disclosure of data. Unauthorized disclosure of data or

a cybersecurity breach could harm our reputation and deter clients from using electronic payments generally, our kiosks and our products

and services specifically, increase our operating expenses in order to correct the breaches or failures, expose us to uninsured liability,

increase our risk of regulatory scrutiny, subject us to lawsuits, result in the imposition of material penalties and fines by state authorities

and otherwise materially adversely affect our business, financial condition and results of operations.

Customer complaints

or negative publicity about our customer service could affect attractiveness of our services adversely and, as a result, could have an

adverse effect on our business, financial condition and results of operations.

Customer complaints or negative publicity about

our customer service could diminish consumer confidence in, and the attractiveness of, our services. Breaches of our consumers’

privacy and our security systems could have the same effect. We sometimes take measures to combat risks of fraud and breaches of privacy

and security, such as freezing consumer funds, which could damage relations with our consumers. These measures heighten the need for

prompt and attentive customer service to resolve irregularities and disputes. Effective customer service requires significant personnel