Filed

Pursuant to Rule 424(b)(3)

Registration

No. 333-262631

Registration

No. 333-255041

PROSPECTUS

KRAIG

BIOCRAFT LABORATORIES, INC.

306,124,163

Shares of Class A Common

Stock

Pursuant

to this prospectus, the selling shareholders identified herein (each a “Selling Shareholder” and, collectively, the “Selling

Shareholders”) are offering on a resale basis, up to 306,124,163 shares of common stock, no par value per share (the “common

stock”) of Kraig Biocraft Laboratories, Inc. (the “Company,” “Kraig,” “we,” “our”

or “us”). These shares include: (i) 278,213,449 shares of common stock underlying secured convertible notes pursuant to that

certain securities purchase agreement dated as of January 18, 2022 between the Company and Yorkville (the “2022 Yorkville

Transaction”); (ii) 12,500,000 shares of common stock underlying a warrant issued pursuant to the 2022 Yorkville Transaction;

(iii) 4,285,714 shares underlying a second warrant issued pursuant to the 2022 Yorkville Transaction; (iv) 8,000,000 shares of common stock underlying a warrant issued pursuant to

the transactions contemplated by that certain securities purchase agreement dated as of March 26, 2021 between the Company and Yorkville

(the “2021 Yorkville Transaction”); and (v) 3,125,000 shares of common stock underlying a warrant issued on December 11, 2020. We are not

selling any shares under this prospectus, and we will not receive any proceeds from the sales of shares by the Selling Shareholders.

We will, however, receive the exercise price of the Warrants, if and when such Warrants are exercised for cash by the holders of such

Warrants.

The

shares included in this prospectus may be offered and sold directly by the Selling Shareholders in accordance with one or more of the

methods described in the “Plan of Distribution,” which begins on page 29 of this prospectus. To the extent the Selling

Shareholders decide to sell their shares, we will not control or determine the price at which the shares are sold.

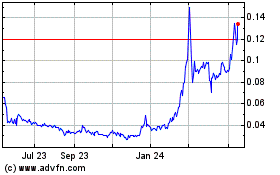

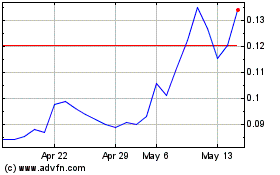

Our

common stock is listed on OTCQB under the symbol “KBLB.” On September 8, 2023, the last reported sale

price of our common stock was $0.0300 per share.

This

offering will terminate on the earlier of (i) the date when all of the shares have been sold pursuant to this prospectus or Rule 144

under the Securities Act of 1933, as amended (the “Securities Act”), and (ii) the date that all of the securities may be

sold pursuant to Rule 144 without volume or manner-of-sale restrictions, unless we terminate it earlier.

Investing

in our securities involves a high degree of risk. You should carefully consider the risk factors described under the heading “Risk

Factors” beginning on page 14 of this prospectus and under similar headings in any amendments or supplements before purchasing

shares of our Common Stock.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is September 1, 2023

Table

of Contents

About

this Prospectus

Pursuant to Rule 429 under the Securities

Act of 1933, as amended (the “Securities Act”), this prospectus is a combined prospectus relating to (a) up to 294,999,163

shares of our Common Stock sought to be registered for resale pursuant hereto (File No. 333-262631) and (b) of up to 11,125,000 shares

of our Common Stock previously registered pursuant to the registration statement on Form S-1 initially filed with the SEC on April 5,

2021 (File No. 333-255041).

We

have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or

in any free writing prospectuses prepared by us or on our behalf or to which we have referred you. We take no responsibility for, and

can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell

only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. We are not making

an offer to sell these securities in any jurisdiction where the offer or sale is not permitted or where the person making the offer or

sale is not qualified to do so or to any person to whom it is not permitted to make such offer or sale. The information contained in

this prospectus is current only as of the date on the front cover of the prospectus. Our business, financial condition, results of operations

and prospects may have changed since that date.

Persons

who come into possession of this prospectus and any applicable free writing prospectus in jurisdictions outside the United States are

required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus and any

such free writing prospectus applicable to that jurisdiction. See “Plan of Distribution” for additional information on these

restrictions.

Industry

and Market Data

Unless

otherwise indicated, information in this prospectus concerning economic conditions, our industry, our markets and our competitive position

is based on a variety of sources, including information from third-party industry analysts and publications and our own estimates and

research. Some of the industry and market data contained in this prospectus are based on third-party industry publications. This information

involves a number of assumptions, estimates and limitations.

The

industry publications, surveys and forecasts and other public information generally indicate or suggest that their information has been

obtained from sources believed to be reliable. None of the third-party industry publications used in this prospectus were prepared on

our behalf. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including

those described in “Risk Factors” in this prospectus. These and other factors could cause results to differ materially from

those expressed in these publications.

Trademarks

This

prospectus contains references to our trademarks and service marks and to those belonging to other entities. Solely for convenience,

trademarks and trade names referred to in this prospectus may appear without the ® or TM symbols, but such references

are not intended to indicate, in any way, that we will not assert, to the fullest extent possible under applicable law, our rights or

the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’

trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by any other companies.

PROSPECTUS

SUMMARY

This

summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider

in making your investment decision. Before investing in our securities, you should carefully read this entire prospectus, including our

financial statements and the related notes and the information set forth under the headings “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus and our consolidated

financial statements and the accompanying notes included in this prospectus. Except as otherwise indicated herein or as the context otherwise

requires, references in this prospectus to “Kraig.” “Kraig Labs,” “the Company,” “we,”

“us,” and “our” refer to Kraig Biocraft Laboratories, Inc. together with its wholly-owned subsidiary Prodigy

Textiles Co., Ltd., a Vietnamese corporation (“Prodigy Textiles”).

Company

Overview

Kraig Biocraft Laboratories, Inc., a Wyoming corporation,

is a corporation organized to develop high strength fibers using recombinant DNA technology for commercial applications in technical

textile. We use genetically engineered silkworms that produce spider silk protein analogs to create our recombinant spider silk. Applications

include performance apparel, workwear, filtration, luxury fashion, flexible composites, medical implants, cosmetics and more. We believe

that we have been a leader in the research and development of commercially scalable and cost-effective spider silk for technical

textile and non-fibrous applications. Our primary proprietary fiber technology includes natural and engineered variants of spider silk

produced in domesticated mulberry silkworms. Our business brings twenty-first century biotechnology to the historical silk industry,

permitting us to introduce materials with innovative properties and claims into an established commercial ecosystem of silkworm rearing,

silk spinning and weaving, and manufacture of garments and other products that can include our specialty fibers and textiles. Specialty

fibers are engineered for specific uses that require exceptional strength, flexibility, heat resistance and/or chemical resistance. The

specialty fiber market is exemplified by two synthetic fiber products that come from petroleum derivatives: (1) aramid fibers; and (2)

ultra-high molecular weight polyethylene fibers. The technical textile industry involves products for both industrial and consumer products,

such as filtration fabrics, medical textiles (e.g., sutures and artificial ligaments), safety and protective clothing and fabrics

used in military and aerospace applications (e.g., high-strength composite materials).

We are using genetic engineering technologies

to develop fibers with greater strength, resiliency and flexibility for use in our target markets, namely the specialty fiber and technical

textile industries. We believe that the genetically engineered protein-based fibers we seek to produce have properties that are in some

ways superior to the materials currently available in the marketplace. Production of our product in commercial quantities holds what

we believe to be potential life-saving ballistic resistant material, which we believe is lighter, thinner, more flexible, and tougher

than steel. Other potential applications for spider silk based recombinant fibers include use as structural material and for any application

in which light weight and high strength are required. We believe that fibers made with recombinant protein-based polymers will make significant

inroads into the specialty fiber and technical textile markets.

Through our technologies, the introduction of

the gene sequence based on those found in native spider silk, results in a germline transformation and is therefore

self-perpetuating. This technology is in essence a protein expression platform which has other potential applications including

diagnostics and pharmaceutical production. Moreover, our technologies are “green” in as much as our fibers and textiles

are derived from nature and do not use any petrochemicals as an input into the fibers.

The Report of Independent Registered Public Accounting

Firm to our financial statements as of December 31, 2021 and as of December 31, 2022 include an explanatory paragraph stating that our

net loss from operations and net capital deficiency at December 31, 2022 raise substantial doubt about our ability to continue as a going

concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Products

Our

products exploit the unique characteristics of spider silk, specifically dragline silk from Nephila clavipes (golden orb-web spider)

and variants thereof. Such fibers possess unique mechanical properties in terms of strength, resilience and flexibility. Through the

use of genetic engineering, we believe that we have produced a variety of unique transgenic silkworm strains that produce recombinant

spider silk. Our recombinant spider silk fibers blend spider silk protein analogs with the native silkworm silk proteins.

This approach allows for the cost-effective and eco-responsible production of spider silk at commercial production levels.

Monster

Silk®

Monster

Silk® was the first recombinant spider silk fiber product we developed. Monster Silk incorporates the natural elasticity of spider

silk to make a silk fiber which is more flexible that conventional silk fibers and textiles. We have produced sample products using Monster

Silk® including knit fabrics, gloves, and shirts in collaboration with textile mills. We expect that Monster Silk® will have

market applications across the traditional textile markets where its increased flexibility will provide increased durability and comfort.

Dragon

SilkTM

Dragon

SilkTM is the next evolution in recombinant spider silk, combining the elasticity of Monster Silk® with additional high

strength elements of native spider silk. Some samples of Dragon SilkTM have demonstrated strength beyond that of native spider

silk. This combination of strength and elasticity results in a silk fiber which is soft and flexible, yet tougher than leading synthetic

fiber available on the market. Based on inquires we have received from end market leaders, we believe that Dragon SilkTM- will

have applications in performance apparel, durable workwear, luxury goods and apparel, and composites.

Other

Products

We

are continuing to develop new recombinant silks and other protein-based fibers and materials using our genetic engineering capabilities.

Our silkworm-based knock-in knock-out development platform has significant advantages over our legacy technology which created

Dragon Silk and Monster Silk. Chief among these is the potential to produce spider silks with greatly increased purity and performance.

Due to the biocompatible and biodegradable properties of silk, we believe that the materials developed using this higher purity process

will create opportunities for products in the medical industry, including sutures, grafts, and implants.

Strengths

We

have developed a method for the production of high-performance bio-degradable, bio-compatible, and ecologically friendly recombinant

spider silk materials to replace the existing global infrastructure for mundane silk manufacturing. This system of operations

utilizes genetically modified silkworms that have been engineered to produce silks based on the proteins and physical characteristics

of native spider silk, a material that has been prized for its physical and chemical properties. By adapting the common silkworm and

the production process for the manufacture of traditional silk, we are able to leverage a global production model which currently processes

more than 150,000 metric tons of silk per year.2 Our technology is a direct drop-in replacement for traditional silk manufacturing,

allowing any silk operation employing our silkworm technology to immediately be converted, without any additional need for capital

investment. We have been granted patent protection in numerous international markets and continue to pursue additional patent protection for our technologies in silk producing and silk consuming countries.

In 2020, we developed a new technology

platform, based on a non-CRISPR Cas9 gene editing knock-in knock-out technology. This is our first knock-in knock-out technology

which we are now using for the development of advanced materials. This system is built on our eco-friendly and cost-effective silkworm production

system, which we believe is more advanced than current competing methods. Knock-in knock-out technology allows for the

targeting of specific locations and genetic traits for modification, addition, and removal. This capability should allow us to

accelerate new product developments and bring products to market more quickly. This capability also allows for genetic trait

modifications that were previously impractical, creating opportunities for products outside of silk fibers and increased flexibility

in production location.

Based on our internal analysis, management believes

that this new platform technology will allow us to outpace and surpass Dragon Silk, a fiber that we developed with our previous tools.

Samples of Dragon Silk have already demonstrated to be tougher than many fibers used in bullet proof vests. We expect that this new approach

will yield materials beyond those capabilities based upon its potential for significantly improved purity.

Strategies

Our approach to disrupting the performance

and technical textile market is to adapt existing silk industry infrastructure and capacity to produce our high-performance silk with

minimal capital investment. Our proprietary recombinant spider silkworms are designed as direct drop-in replacement for existing commercial

silk producing operations. Our genetically engineered silks are produced using the same equipment and processes that traditional silk

uses. In designing our technologies in this manner, we have minimized our need for expansion capital, limiting our direct investment

and contracting with existing secondary fiber processors where the majority of large-scale equipment is needed. Through our subsidiary,

Prodigy Textiles in Vietnam, we have established the relationships necessary to secure these contracted secondary services.

We are actively pursuing relationships

within our targeted end markets to secure product collaborations with key market channel leaders, but no definitive agreements have

been entered into as of the date hereof. We have received numerous unsolicited requests from leading businesses across a range of

attractive end markets requesting materials for applications development, which is most likely due to the unique nature of our

product. This substantial interest in spider silk materials across abroad spectrum of applications for high performance fibers and

textiles, combined with the limited initial production capacity, provides the potential to be selective in choosing the market

channel partners best able to quickly bring our product to market at scale. We are working under non-disclosure agreements to secure

these collaborative development agreements and to establish limited channel exclusivity for firms we believe mirror our culture of

innovation. In January 2021, we entered into a partnership and exclusive purchase agreement with M the Movement by Kings Group,

pursuant to which they committed to purchase up to $40 million worth of product. This partnership will establish a jointly owned

apparel and fashion brand headquarter in Singapore focuses on sales to the ASEAN region. With recent advancements in our

manufacturing capacity, we expect to generate revenues from these relationships in 2023.

Additionally, we are currently focused on

building production capacity in Vietnam. A significant part of that operation is our work to increase the robustness of our silkworms

within the production environment by developing new hybrids We are currently utilizing a mix of direct staffing and contract labor to

support its in-house operations. We are exploring a production expansion model utilizing contract production consistent with the distributed

model used for mundane silk production. We will also consider technology licensing models with companies, regions, or countries where

its silkworms could be produced under exclusive license.

Recent

Developments

In August 2019, we received authorization from

governmental authorities to begin rearing genetically enhanced silkworms at our production facility in Vietnam. In October 2019, the

Company delivered the first batch of these silkworms and began operations. These silkworms served as the basis for the commercial expansion

of our proprietary silk technology. On November 4, 2019, we reported that we had successfully completed rearing the first batch of our

transgenic silkworms at the Quang Nam production factory. Seasonal challenges in late December 2019 slowed production operations and

governmental restrictions imposed due to the global COVID pandemic further delayed our operations in 2020 and 2021. In January of 2021

we received the first shipment of silk from our factory in Vietnam. We believe that we will be able to target metric tons of capacity

of our recombinant spider silk fiber per annum from this factory once it reaches maximum utilization. This capacity will allow us to

address initial demand for our products and materials for various applications in the protective, performance, and luxury textile markets.

In January 2022, we completed production of the

first Dragon Silk yarn produced entirely in Vietnam. The finished yarn was spun from raw recombinant spider silk produced at Prodigy

Textiles. Vietnam produced nearly 1,000 metric tons of mundane silk in 20201. While Prodigy Textiles remains focused on ramping

up the output of recombinant spider silk cocoons. Our supporting vendors will play an essential role in processing that silk into finished

goods for a wide range of consumer markets. When it is in sufficient quantities, we plan to ship Dragon Silk yarn to SpydaSilk Enterprises

in Singapore, a joint venture partially owned by the Company for weaving into fabrics and finished garments. Over the coming months,

Prodigy Textiles will continue its efforts to increase production by focusing on increasing silkworm robustness through cross breeding

and the introduction of hybrids.

Strategic

Partnership

On

November 23, 2020, we entered into a Strategic Partnership Agreement (the “SPA”) with Mthemovement Kings Pte Ltd (“Kings”).

Kings is an eco-friendly luxury streetwear apparel line, part of the Kings Group of Companies and its affiliated companies. On January

25, 2021, the parties exchanged signatures for an amendment to the Agreement, which amended the procedures for termination of the SPA

to only allow for the termination of the SPA by mutual agreement of the Company and Kings following a consultation period of 120 (one

hundred and twenty) calendar days or such period as agreed otherwise between the parties (the “Amendment,” together

with the SPA, the “Agreement”).

Pursuant

to the Agreement, the parties have formed a joint venture to develop and sell the Company’s spider silk fibers under the new innovative

apparel and fashion brand, trade named SpydaSilk™ and potential other trademarks to be announced. All intellectual property related

to SpydaSilk™ will be jointly owned by the Company and Kings. Under the terms of the Agreement, the Company granted the joint venture

and the SpydaSilk Enteprises Pte. Ltd. brand an exclusive geographic license to all the Company’s technologies for the Association

of Southeast Asian Nations, in exchange for a 4-year commitment to purchase up to $32 million of the Company’s raw recombinant

spider silk over the 4-year period. Upon commencement, in consideration for its ownership position in the joint venture, the Company

shall issue 1,000,000 shares of its common stock to Kings.

The

Agreement has a 60-month term, which can be terminated at any time by mutual agreement following a consultation period of 120 days, or

such other period as agreed by the parties. If applicable, the parties will honor their share of committed expenditures of the joint

venture and King will repay the Company any unused brand funds.

Yorkville

Transactions

2022 Yorkville Transaction

On

January 18, 2022, we entered into a securities purchase agreement with YA II PN, LTD., a Cayman Islands exempt company (“Yorkville”),

pursuant to which Yorkville purchased secured convertible debentures (the “Securities Purchase Agreement”) in the aggregate

principal amount of USD$3,000,000 (the “Convertible Debentures”), which are convertible into shares of Common Stock (as converted,

the “Conversion Shares”), of which a secured convertible debenture (the “First Convertible Debenture”) in the

principal amount of $1,500,000 (the “First Convertible Debenture Purchase Price”) shall be issued upon signing the Securities

Purchase Agreement and a secured convertible debenture (the “Second Convertible Debenture,” together with the First Convertible

Debenture, each a “Convertible Debenture” and collectively, the “Convertible Debentures”) in the principal amount

of $1,500,000 (the “Second Convertible Debenture Purchase Price”) shall be issued on or about the date that the Securities

and Exchange Commission declares the registration statement registering the shares of common stock underlying the notes effective (collectively,

the First Convertible Debenture Purchase Price and the Second Convertible Debenture Purchase Price shall collectively be referred to

as the “Purchase Price”) (the “2022 Yorkville Transaction”). These additional funds, together with those from

the previously completed transactions we conducted with Yorkville between December 2020 and March 2021, account for an $8 million total

Yorkville investment; as of November 17, 2022, all debentures to Yorkville pursuant thereto have been satisfied. The Company also

issued Yorkville a warrant to purchase 12,500,000 shares of the Company’s Common Stock, at an initial exercise price of $0.12 per

share and a warrant to purchase 4,285,714 shares of the Company’s Common Stock, at an initial exercise price of $0.14 per share.

The warrants have a term of five (5) years and can be exercised via cashless exercise. If the Company issues or sells securities at a

price less than the applicable warrant exercise price, the exercise price of the applicable warrant shall be reduced to such lower price.

The warrants also have the same ownership cap as set forth in the Convertible Debentures, as described below. The Company is also required

to reserve no less than 300% of the maximum number of shares of Common Stock issuable upon conversion of all the outstanding Convertible

Debentures. Pursuant to the Securities Purchase Agreement, the Company is prohibited from incurring specified indebtedness, liens, except

with the prior written consent from the holders of at least 75% of the then outstanding principal amount of Convertible Debentures.

1

https://inserco.org/en/statistics

Each

Convertible Debenture shall mature thirteen (13) months after the date of issuance, unless extended by the Yorkville, and accrues interest

at the rate of 10% per annum. Principal, interest and any other payments due under the Convertible Debentures shall be paid in cash.

The debenture holder may convert all or part of the Convertible Debentures into shares of common stock at any time after issuance at

a conversion rate equal to 85% of the lowest daily volume weighted average price of the Common Stock during the 10 consecutive trading

days immediately preceding the conversion date or other date of determination. The debenture holder may not convert the Convertible Debenture

if such conversion would result in such holder holding in excess of in excess of 4.99% of the number of shares of Common Stock outstanding

immediately after giving effect to such conversion or receipt of shares as payment of interest, unless waived by the holder with at least

65 days prior notice to the Company (the “Ownership Cap”). The Company also has the option to redeem, in part or in whole,

the outstanding principal and interest under a Convertible Debenture prior to the maturity date. The Company shall pay an amount equal

to the principal and interest amount being redeemed plus a redemption premium equal to 15% of the outstanding principal amount. Standard

events of default are included in the Convertible Debenture, pursuant to which the holder may declare it immediately due and payable.

During an event of default, the interest rate shall increase to 15% per annum until the event of default is cured; the holder also has

the right to convert the Convertible Debenture into shares of common stock during an event of default.

The

Convertible Debentures are secured by all assets of the Company and its subsidiaries subject to (i) that certain amended and restated

security agreement by and between Yorkville, the Company and the Company’s subsidiaries (all such security agreements shall be

referred to as the “Security Agreement”) pursuant to which the Company and its wholly owned subsidiaries agree to provide

Yorkville a security interest in all personal property of the Prodigy Textiles, the Company’s subsidiary organized under the laws

of Vietnam (“Prodigy”), (ii) the amended and restated intellectual property security agreement by and between Yorkville,

the Company and the Company’s subsidiaries referenced therein dated January 18, 2022 (all such security agreements shall be referred

to as the “IP Security Agreement”), pursuant to which the Company and its wholly owned subsidiaries agree to provide Yorkville

a security interest in the intellectual property collateral (as this term is defined in the IP Security Agreement), and (iii) the amended

and restated global guaranty by and between Prodigy, in favor of Yorkville, with respect to all of the Company’s obligations to

Yorkville dated January 18, 2022 (the “Guaranty” and collectively with the Security Agreement and the IP Security Agreement

shall be referred to as the “Security Documents”). Pursuant to the Guaranty, Prodigy guarantees the payment and performance

of all of the Company’s obligations under the Convertible Debentures, Warrants and related transaction documents.

In

connection with the Securities Purchase Agreement, the Company also entered into a Registration Rights Agreement with Yorkville, pursuant

to which the Company agreed to register all of the shares of Common Stock underlying the Convertible Debentures and warrants and with

respect to subsequent Registration Statements, if any, such number of shares of Common Stock as requested by Yorkville not to exceed

300% of the maximum number of shares of Common Stock issuable upon conversion of all Convertible Debentures then outstanding (assuming

for purposes hereof that (x) such Convertible Debentures are convertible at the then current conversion price and (y) any such conversion

shall not take into account any limitations on the conversion of the Convertible Debentures set forth therein, in each case subject to

any cutbacks set forth in the Registration Rights Agreement.

Upon

signing the letter of intent for the 2022 Yorkville Transaction, the Company paid $10,000 to an affiliate of Yorkville, for due

diligence and structuring.

The

Securities Purchase Agreement also contains customary representation and warranties of the Company and the Investor, indemnification

obligations of the Company, termination provisions, and other obligations and rights of the parties.

The

foregoing description of the Securities Purchase Agreement, Convertible Debentures, Warrant, Security Agreement, IP Security Agreement,

Registration Rights Agreement and Guaranty Agreement is qualified by reference to the full text of the forms of Securities Purchase Agreement,

Convertible Debenture and Warrant, which are filed as Exhibits hereto and incorporated herein by reference.

Maxim

Group LLC shall receive a cash placement agent fee of $230,000.

2021

Yorkville Transaction

On

March 25, 2021, we entered into a securities purchase agreement with Yorkville, pursuant to which Yorkville purchased secured convertible

debentures (the “2021 Securities Purchase Agreement”) in the aggregate principal amount of USD$4,000,000 (the “2021

Convertible Debentures”), which are convertible into shares of Common Stock (as converted, the “2021 Conversion Shares”),

of which a secured convertible debenture (the “2021 First Convertible Debenture”) in the principal amount of $500,000 (the

“2021 First Convertible Debenture Purchase Price”) shall be issued within 1 business day following the initial closing, a

secured convertible debenture (the “2021 Second Convertible Debenture”) in the principal amount of $500,000 (the “2021

Second Convertible Debenture Purchase Price”) shall be issued within 1 business day following the satisfaction of conditions for

a second closing and a secured convertible debenture (the “2021 Third Convertible Debenture,” together with the First Convertible

Debenture and the Second Convertible Debenture, each a “2021 Convertible Debenture”) in the principal amount of $3,000,000

(the “2021 Third Convertible Debenture Purchase Price”) shall be issued within 1 business day following satisfaction of conditions

for a third closing (the first closing, second closing and third closing are each referred to as a “2021 Closing” or collectively

as the “2021 Closings) and (collectively, the 2021 First Convertible Debenture Purchase Price, the 2021 Second Convertible Debenture

Purchase Price and the 2021 Third Convertible Debenture Purchase Price shall collectively be referred to as the “2021 Purchase

Price”) (the “2021 Yorkville Transaction,” together with the 2022 Yorkville Transaction, the “Yorkville Transactions”).

Pursuant to the 2021 Securities Purchase Agreement, so long as any portion of the 2021 Convertible Debentures is outstanding, Yorkville

maintains the right of first refusal with the respect to any issuance or sale by the Company of common stock or securities exercisable

into shares of common stock to raise additional capital.

Each

2021 Convertible Debenture shall mature twelve (12) months after the date of issuance and accrues interest at the rate of 10% per annum.

The principal must be paid in cash, but the Company has the right to extend the maturity date by 30 days, during which time interest

will continue to accrue, upon written notice of same to the holder. Interest shall be provided in cash, unless certain conditions as

specified in the 2021 Convertible Debenture are satisfied, in which case the company has the right to pay interest in shares of common

stock at the then applicable conversion price on the trading day immediately prior to the pay date. The debenture holder may convert

each 2021 Convertible Debenture into shares of common stock at any time after issuance at a price equal to 80% of the lowest volume weighted

average price of the Company’s Common Stock during the 10 trading days immediately preceding the date they convert the debenture;

provided, however if the Company’s Common Stock is uplisted to the Nasdaq, the conversion price shall not be less than 20% of the

conversion price used in the first conversion thereunder. The debenture holder may not convert the 2021 Convertible Debenture if such

conversion would result in such holder holding in excess of in excess of 4.99% of the number of shares of Common Stock outstanding immediately

after giving effect to such conversion or receipt of shares as payment of interest, unless waived by the holder with at least 65 days

prior notice to the Company (the “Ownership Cap”). The Company also has the option to redeem, in part or in whole, the outstanding

principal and interest under a Convertible Debenture prior to the maturity date. The Company shall pay an amount equal to the principal

amount being redeemed plus a redemption premium equal to 15% of the outstanding principal amount plus outstanding and accrued interest.

The 2021 Convertible Debenture also provides for certain purchase rights if the Company issues certain securities. Standard events of

default are included in the 2021 Convertible Debenture, pursuant to which the holder may declare it immediately due and payable. During

an event of default, the interest rate shall increase to 15% per annum until the event of default is cured; the holder also has the right

to convert the 2021 Convertible Debenture into shares of common stock during an event of default.

The

2021 Convertible Debentures are secured by all assets of the Company and its subsidiaries subject to (i) that certain security agreement

by and between Yorkville, the Company and the Company’s subsidiaries (all such security agreements shall be referred to as the

“2021 Security Agreement”) pursuant to which the Company and its wholly owned subsidiaries agree to provide Yorkville a security

interest in Pledged Property (as this term is defined in the 2021 Security Agreement), (ii) the intellectual property security agreement

by and between Yorkville, the Company and the Company’s subsidiaries referenced therein dated the date hereof (all such security

agreements shall be referred to as the “2021 IP Security Agreement”) pursuant to which the Company and its wholly owned subsidiaries

agree to provide Yorkville a security interest in the intellectual property collateral (as this term is defined in the IP Security Agreement),

and (iii) the global guaranty by and between Yorkville, the Company and the Company’s subsidiaries dated as of the first Closing

(the “2021 Guaranty” and collectively with the Security Agreement and the IP Security Agreement shall be referred to as the

“2021 Security Documents”). Pursuant to the Guaranty, the Company’s wholly-owned subsidiary, in favor of Yorkville

with respect to all of the Company’s obligations under the 2021 Convertible Debentures, 2021 Warrants and related transaction documents,

agreed to guaranty the payment and performance of all of the Company’s obligations under all such documents.

Contemporaneously

with the first closing, the Company issued Yorkville a warrant (the “2021 Yorkville Warrant”) to purchase 8,000,000

shares of the Company’s Common Stock (the “2021 Warrant Shares”). The Yorkville Warrant has a term of five (5) years

and is initially exercisable at $0.25 per share, subject to adjustment and can be exercise via cashless exercise. If the Company issues

or sells securities at a price less than the exercise price, the exercise price shall be reduced to such lower price. The 2021 Yorkville

Warrant also has the same Ownership Cap as set forth in the 2021 Convertible Debenture.

In

connection with the 2021 Securities Purchase Agreement, the Company also entered into a registration rights agreement with Yorkville,

pursuant to which the Company agreed to register the following shares: 160,875,161 2021 Conversion Shares, all of the 2021 Warrant Shares

issuable pursuant to the 2021 Warrant, 35,750,036 2021 Conversion Shares issuable under the A&R Convertible Debenture (as hereinafter

defined), 3,125,000 shares of Common Stock issuable under the warrant issued by the Company on December 11, 2020 and (ii) with respect

to subsequent registration statements at least such number of shares of Common Stock as shall equal up to 300% of the maximum number

of shares of Common Stock issuable upon conversion of all 2021 Convertible Debenture then outstanding (assuming for purposes hereof that

(x) such Convertible Debenture are convertible at $0.12432 per share, and (y) any such conversion shall not take into account any limitations

on the conversion of the 2021 Convertible Debenture set forth therein, in each case subject to any cutback set forth in the registration

rights agreement and all of the 2021 Warrant Shares issuable upon exercise of the 2021 Warrant.

Upon

signing the letter of intent for the 2021 Yorkville Transaction, the Company paid Yorkville $10,000.

As

part of the 2021 Yorkville Transaction, the parties agreed to amend and restate the $1,000,000, thirteen-month (13), unsecured, 10% convertible

note that was issued on December 11, 2020 to Yorkville (the “A&R Convertible Debenture”). The A&R Convertible

Debenture was issued in exchange for the surrender and cancellation of the debenture issued in December (the “December Debenture”). The A&R Convertible Debenture was fully converted as of October 25, 2021.

When

the Company issued the December Debenture, it also issued a five-year warrant to purchase up to 3,125,000 shares of the Company’s

common stock (the “December Warrant”). We agreed the register the shares of common stock underlying the December Warrant

in this registration statement.

Maxim

received a cash fee equal to eight percent (8.0%) of the gross proceeds received by the Company at each Closing for its services

as placement agent.

On

March 26, 2021, in connection with the initial closing of the 2021 Securities Purchase Agreement, we issued the first 2021 Convertible

Debenture to Yorkville in the principal amount of $500,000.

Following

fulfillment of the requirements in the 2021 Securities Purchase Agreement, on April 6, 2021, we issued the second 2021 Convertible Debenture

to Yorkville in the amount of $500,000.

Following

fulfillment of the requirements in the 2021 Securities Purchase Agreement, on April 22, 2021, we issued the third 2021 Convertible Debenture

to Yorkville in the amount of $3,000,000.

As of the date hereof, all of the 2021 Convertible

Debentures have been fully converted and the related reserves have been removed.

Covid-19

On March 19, 2020, we furloughed non-essential staff

in response to governmental regulations relating to COVID. This decision primarily impacted staff at our fully owned subsidiary, Prodigy

Textiles, in Vietnam and resulted in the temporary closing of silk rearing operations at that facility. As of the date hereof, we have

resumed silk production operations at the factory in Vietnam. The Company supported its furloughed staff and paid their salaries during

all mandatory closures. During the duration of the furlough, the Company’s CEO voluntarily waved the payment or accrual of his

salary. The Company leveraged this forced closure time to improve its production infrastructure based on the lessons learned from its

operations. Following the mandated closures, the Company has enhanced its operations with process automation, moved its production

headquarters to a facility designed for silk production and created a more self-reliant supply chain. We have also established a microbiology

laboratory in the factory for enhanced quality control. Based on lessons learned during Prodigy’s pre-COVID production ramp up,

Management views the in-factory microbiology lab as a critical element to successful large-scale production. The global

COVID pandemic and government regulations associated with the pandemic continue to evolve. Management continues to stockpile critical

inventories and establish alternative supply and vendor chains as a precaution against future pandemics, disasters, or governmental actions.

We will continue to monitor the situation closely, including its potential effect on our plans and timelines.

Summary

of Risk Factors

Risks

Associated with Our Business

As

an OTCQB listed Company, we have limited resources with pressing capital requirements as we attempt to ramp up production. We are mindful

of the challenges involved in achieving growth without compromising our ability to manage our operating risks and comply with rules and

regulations. As we are commercializing a new technology, no one is in a position to know all of the risks, obstacles, and hurdles that

the Company will face as it works to commercialize its new technology. Any investment in our securities involves a high degree of

risk. We are aware of numerous risks associated with our business, including:

| |

● |

Our

ability to continue as a going concern; |

| |

|

|

| |

● |

Our

ability to generate revenues and to become profitable; |

| |

|

|

| |

● |

Our

ability to estimate future expenses; |

| |

|

|

| |

● |

Our

ability to maintain an effective system of internal controls; |

| |

|

|

| |

● |

Our

ability to protect our intellectual property rights and to secure additional rights domestically and internationally; |

| |

|

|

| |

● |

Our

ability to increase the robustness of our silkworms in the production environment; |

| |

|

|

| |

● |

Our

ability to successfully manage our growth domestically and internationally; |

| |

● |

Our

ability to attract and retain the services of key personnel; |

| |

|

|

| |

● |

Our

reliance on independent third-party collaborators to develop and deliver products to market; |

| |

|

|

| |

● |

Our

reliance on key management personnel and future need for highly skilled personnel; |

| |

|

|

| |

● |

Our

ability to successfully develop sales and marketing for our products; |

| |

|

|

| |

● |

Market

acceptance of pricing and performance for products we develop; |

| |

|

|

| |

● |

Our

ability to generate sustainable earnings and net operating profits; |

| |

|

|

| |

● |

Our

ability to adapt to regulatory and technology changes impacting our industry; |

| |

|

|

| |

● |

The

potential for product liability claims regarding our products and the use of genetically modified organisms (“GMO’s”)

in our production system; |

| |

|

|

| |

● |

Actions

taken or omitted to be taken by third parties including our suppliers and competitors, as well as legislative, regulatory, judicial

and other governmental authorities; |

| |

|

|

| |

● |

Competition

in our industry; |

| |

|

|

| |

● |

The

loss of or failure to obtain any license or permit necessary or desirable in the operation of our business; |

| |

|

|

| |

● |

The

availability of additional capital to support development; |

| |

|

|

| |

● |

An

active, liquid, and orderly market for our common stock or Purchase Warrants may not develop; |

| |

|

|

| |

● |

The

Purchase Warrants may not have any value; |

| |

● |

Our

production system is based upon living transgenic organisms; |

| |

|

|

| |

● |

Our

business, operations and plans and timelines could be adversely affected by the effects of health epidemics, including the recent

COVID-19 pandemic; and, |

| |

|

|

| |

● |

Other Factors which are unanticipated by management |

| |

|

|

| |

● |

Numerous

other risks and uncertainties set forth elsewhere

in this prospectus under the section titled “Risk Factors” |

Corporate

Information

Kraig

Biocraft Laboratories, Inc. is a Wyoming corporation. Our Common Stock is quoted on the OTCQB under the ticker symbol “KBLB”.

As of September 1, 2023, there are

1,033,374,219 shares of Common Stock issued and outstanding. Kim Thompson, our founder and Chief Executive Officer, owns approximately

19.51% of our issued and outstanding Common Stock. As of September 1, 2023, there are 2 shares of super voting Series A Preferred

Stock issued and outstanding, all of which are owned by Kim Thompson, which represent approximately 27.91% of all voting rights of our

capital stock (See, “Description of Securities” for additional information about our securities).

Our

principal executive office and mailing address is 2723 South State St., Suite 150, Ann Arbor, Michigan 48104. Our telephone number is

(734) 619-8066. Our corporate website is http://www.kraiglabs.com. The information contained on, or that can be accessed through,

our website is not part of, and is not incorporated by reference into, this prospectus and should not be relied upon with respect to

this offering.

The

Offering

The

following Summary contains general information about this offering. The Summary is not intended to be complete. You should read the full

text and more specific details contained elsewhere in this prospectus.

| Common

Stock offered by the Selling Shareholders |

|

306,124,163

shares of our common stock, which includes:

(i) 278,213,449 shares of common stock underlying secured convertible notes pursuant to that certain securities purchase agreement

dated January 18, 2022 between the Company and Yorkville (the “2022 Yorkville Transaction”); (ii) 12,500,000 shares

of common stock underlying a warrant issued pursuant to the 2022 Yorkville Transaction; (iii) 4,285,714 shares underlying a second

warrant issued pursuant to the 2022 Yorkville Transaction; (iv) 8,000,000 shares of common stock underlying a warrant issued pursuant to the

2021 Yorkville Transaction; and (v)

3,125,000 shares of common stock underlying a warrant issued on December 11, 2020. |

| |

|

|

| Selling

Shareholders |

|

See

“Selling Shareholders” beginning on page 28 |

| |

|

|

| Offering

prices |

|

The

shares offered by this prospectus may be offered and sold at prevailing market prices or such other prices as the Selling Shareholders

may determine. |

| |

|

|

| Common

Stock outstanding prior to completion of this offering (1) |

|

950,905,044 |

| |

|

|

| Common

Stock outstanding after full conversion of the Debentures and exercise of the S1 Warrants (2) |

|

1,257,026,207 |

| |

|

|

| Terms

of the Offering |

|

The

Selling Shareholders will determine when and how they sell the shares offered in this prospectus, as described in “Plan of

Distribution” beginning on page 29. |

| |

|

|

| Use

of Proceeds |

|

We

are not selling any of the shares of common stock being offered by this prospectus and will receive no proceeds from the sale of

the shares by the Selling Shareholders. We will, however, receive the exercise price of the Warrants, if and when such warrants are

exercised for cash by the holders of such warrants. All of the proceeds from the sale of common stock offered by this prospectus

will go to the Selling Shareholders at the time they offer and sell such shares. We will bear all costs associated with registering

the shares of common stock offered by this prospectus. See “Use of Proceeds.” |

| Risk

factors |

|

The

securities offered hereby involve a high degree of risk. You should read “Risk Factors,” and other information included

in this prospectus for a discussion of factors to consider before deciding to invest in our securities. |

| |

|

|

| Market

& Trading Symbol |

|

OTCQB:

KBLB

|

| Transfer

Agent |

|

Olde

Monmouth Stock Transfer Co., Inc |

| (1)

|

The

number of Common Stock to be outstanding before this offering is based on 950,905,044 shares of Common Stock outstanding as

of March 23, 2022, and excludes: |

| |

● |

6,520,000 shares of our

Common Stock issuable upon the exercise of stock options outstanding; |

| |

● |

34,824,320 shares of our

Common Stock underlying any outstanding warrants; and |

| |

● |

0 shares of our Common

Stock issuable upon the conversion of notes and other evidence of indebtedness. |

| (2)

|

The

number of Common Stock to be outstanding after this offering is based on 1,257,026,207 shares of Common Stock outstanding

as of March 23, 2022, and excludes: |

| |

● |

6,520,000 shares of our

Common Stock issuable upon the exercise of stock options outstanding; |

| |

● |

74,160,034 shares of our

Common Stock underlying any outstanding warrants; and |

| |

● |

278,213,449 shares of our

Common Stock issuable upon the conversion of notes and other evidence of indebtedness. |

Except

as otherwise indicated, all information in this prospectus assumes:

| |

● |

no

exercise of 67,335,714 outstanding warrants; |

| |

● |

no

exercise of the S1 Warrants; |

| |

● |

no

exercise of the 6,520,000 shares of our Common Stock issuable upon the exercise of stock options outstanding. |

RISK

FACTORS

An

investment in our securities involves a high degree of risk. You should carefully consider the following risk factors, together with

the other information contained in this prospectus, before you decide to buy any of our securities. Any of the following risks could

cause our business, results of operations and financial condition to suffer materially, causing the market price of our shares of Common

Stock to decline, in which event you may lose part or all of your investment. Additional risks and uncertainties not currently known

to us or that we currently do not deem material may also become important factors that may materially and adversely affect our business.

Risk

Related to Our Company

The

report of the independent registered public accounting firm on our 2022 and 2021 financial statements contains a going

concern qualification.

The report of the independent registered public

accounting firm covering our financial statements for the years ended December 31, 2022 and December 31, 2021 stated that certain factors,

including that we have a working capital and shareholder deficit, raised substantial doubt as to our ability to continue as a going concern. Because we are not yet

producing revenue to sustain our operating costs, we are dependent upon raising capital to continue our business. If we are

unable to raise capital, our ability to continue could remain an ongoing concern.

We

may be unable to generate revenues and may never become profitable.

We

generated $0 and $0, in revenue for the years ended December 31, 2022 and 2021, respectively, and do not currently have

any recurring sources of revenues, making it difficult to predict when we will be profitable. We expect to incur significant research

and development costs for the foreseeable future. We may not be able to successfully market fiber products we produce in the future that

will generate significant revenues. In addition, any revenues that we may generate may be insufficient for us to become profitable.

As

a result of our limited operating history, we may not be able to correctly estimate our future revenues, operating expenses, need for

investment capital, or stability of operations, which could lead to cash shortfalls.

We

have a limited operating history from which to evaluate our business. Our failure to develop additional transgenic silkworms would have

a material adverse effect on our ability to continue operating. Accordingly, our prospects must be considered in light of the risks,

expenses, and difficulties frequently encountered by companies at our stage of development. We may not be successful in addressing such

risks, and the failure to do so could have a material adverse effect on our business, operating results and financial condition.

Because

of this limited operating history and because of the emerging nature of our fiber product we are producing, our historical financial

data is of limited value in estimating future operating expenses. Our budgeted operating expense levels are based in part on our expectations

concerning future revenues. However, our ability to generate any revenues depends largely on the market acceptance of the fibers we develop,

which is difficult to forecast. The failure of our target markets to adopt our products would have a material adverse effect

on our business.

Our

operating results may fluctuate as a result of a number of factors, many of which are outside of our control. For these reasons, comparing

our operating results on a period-to-period basis may not be meaningful, and you should not rely on our past results as any indication

of our future performance. Our quarterly and annual expenses are likely to increase substantially over the next several years depending

upon the level of fiber development activities. Our operating results in future quarters may fall below expectations. Any of these events

could adversely impact our business prospects and make it more difficult to raise additional equity capital at an acceptable price per

share.

If

we lose the services of key management personnel, we may not be able to execute our business strategy effectively.

Our future success depends in a large part upon

the continued service of key senior management personnel. If the Company is unable to hire and retain senior leadership it may be

unable to execute on its business plan. We do not maintain key-person life insurance policies on the Company’s senior

leadership. The loss of the leadership team would materially harm our business.

Our ability to produce our products in a

cost-effective manner will depend on our ability to improve the robustness and tolerance of our silkworm to conditions in the production

environment.

Working with our contract manufacturer in

Vietnam we have identified robustness and acclimation of our silkworm strains to the local climate as the most significant challenges

to production. We are working to overcome these challenges by acclimating our silkworms to the local environment and accelerating the

introduction of our multi-strain hybrids. If we are unable to improve the robustness, including disease and environmental tolerance,

of our silkworms, we may not be able to generate product revenue and may not become profitable.

As

our business grows, we will need to hire highly skilled personnel and, if we are unable to hire, retain, or motivate additional qualified

personnel, we may not be able to grow effectively.

Our

performance will be largely dependent on the talents and efforts of highly skilled individuals. Our future success depends on our continuing

ability to identify, hire, develop, motivate, and retain highly skilled personnel for all areas of our company. Competition in our industry

for qualified employees remains intense as the skills we require in our employees are highly specialized. We compete with companies in

the biotechnology and pharmaceutical industries that seek to retain scientists with genetic engineering experience and expertise. We

expect that over the longer term we will continue to face stiff competition and may not be able to successfully recruit or retain such

personnel. Attracting and retaining qualified personnel will be critical to our success.

Our

management has no previous experience in developing, producing, marketing, or selling recombinant fiber which may have a negative effect

on our ability to develop or sell our products.

Since,

to our knowledge, commercialization of spider silk on a large scale has yet to be accomplished, we are not aware of any candidates with

specific experience in this field. There may be numerous hurdles and obstacles that we are not currently able to foresee.

Our

current management has limited experience in developing, marketing and selling recombinant fiber and the other products that we intend

to develop and market. Additionally, our current management has no formal training in the business of scientific research and development,

which may be critical to our success. The inexperience of our management and lack of experienced workforce may negatively affect our

ability to succeed in developing, marketing and/or distributing our proposed products.

We

may be unprepared for technological changes in our industry, which could result in our products being obsolete or replaced by better

technology.

The

industry in which we participate is subject to rapid business and technological changes. The business, technology, marketing, legal and

regulatory changes that could occur may have a material adverse impact on us. New inventions and product innovations may make our proposed

products obsolete. Potential customers may prefer existing materials to our new technology. New materials may come to market that outperform

our technologies. Other researchers may develop and patent technologies which make our line of research obsolete. We may not have the

financial or technical ability to keep up with our competitors.

If

we experience product recalls, we may incur significant and unexpected costs and damage to our reputation and, therefore, could have

a material adverse effect on our business, financial condition, or results of operations.

We

may be subject to product recalls, withdrawals, or seizures if any of our products are believed to cause injury. A recall, withdrawal,

or seizure of any of our products could materially and adversely affect consumer confidence in our brands and lead to decreased demand

for our products. In addition, a recall, withdrawal, or seizure of any of our products would require significant management attention,

would likely result in substantial and unexpected expenditures and could materially and adversely affect our business, financial condition,

or results of operations.

Our

operations would be negatively affected by any dispute with our collaborating universities or by labor unrest (such as disputes, strikes

or lockouts) between such universities and their academic staff.

We

have signed intellectual property, sponsored research and collaborative research agreements with one or more universities. The continued

cooperation of these universities, as well as the cooperation of other institutions and or universities is essential for the success

of the Company. In the event of a material dispute with one or more of the universities, such a dispute could create a cessation of operations

for a period of time that could be detrimental to our operations and survival. Additionally, a material dispute between any such university

and its employees could create a cessation of operations for a period of time that could be detrimental to our product development.

Our

competitors are larger with greater financial resources than we have and we may face increased competition due to the low barriers of

entry to our industry.

We

compete directly with numerous other companies with similar product lines and/or distribution that have extensive capital, resources,

market share, and brand recognition. There are few barriers to entry on the industry in which we compete, namely the textile, specialty

fabric and technical textile industries. This creates the strong possibility of new competitors emerging, and of others succeeding in

developing the same or similar fibers that we are trying to develop. The effects of this increased competition may be materially adverse

to us and our stockholders.

Our

business, operations and plans and timelines have been adversely affected by health epidemics, including the recent COVID-19 pandemic,

and governmental action relating to the same, on the manufacturing, production and other business activities performed by us or by

third parties with whom we conduct business, including our suppliers, target end market potential collaboration partners, and others.

Our business could be further adversely affected

by health epidemics, or governmental response to the same wherever we have business operations. In addition, health epidemics could cause

significant disruption in the operations of third-party manufacturers, CROs and other third parties upon whom we rely. For example, in

December 2019, a novel strain of coronavirus, SARS-CoV-2, causing a disease referred to as COVID-19, was reported to have surfaced in

Wuhan, China. Since then, COVID-19 has spread to multiple countries worldwide, including the United States. Our headquarters is located

in Michigan and our manufacturing located in Vietnam. The COVID-19 pandemic resulted in the Company furloughing all non-essential personnel

and pausing its production operations. In March 2020, the World Health Organization declared the COVID-19 outbreak a pandemic, and the

U.S. government-imposed travel restrictions on travel between the United States, Europe and certain other countries. Further,

the President of the United States declared the COVID-19 pandemic a national emergency and invoked powers under the Stafford Act, the

legislation that directs federal emergency disaster response, under the Defense Production Act, the legislation that facilitates the

production of goods and services necessary for national security and for other purposes. The state of Michigan imposed its own separate

restrictions on businesses. We have implemented work-from-home policies for some employees. The effects of the executive order and our

work-from-home policies may negatively impact productivity, disrupt our business and delay our timelines, the magnitude of which will

depend, in part, on the length and severity of the restrictions and other limitations on our ability to conduct our business in the ordinary

course. These and similar, and perhaps more severe, disruptions in our operations could negatively impact our business, operating results

and financial condition.

Quarantines, shelter-in-place and similar government

orders, or the expectation that such orders, shutdowns or other restrictions could occur, whether related to COVID-19 or other causes,

could impact our operations or personnel at third-party manufacturing facilities in the United States and other countries,

or the availability or cost of materials, which could disrupt our supply chain or end markets. For example, we may face shortages in

mulberry feed for our silkworms as a result shifting agricultural priorities, or a drop in demand for our finished materials as a result

of an economic downturn. In addition, closures of transportation carriers and modal hubs could materially impact our development and

any future commercialization timelines.

If

our relationships with our suppliers or other vendors are terminated or scaled back as a result of the COVID-19 pandemic or other causes,

we may not be able to enter into arrangements with alternative suppliers or vendors or do so on commercially reasonable terms or

in a timely manner. Switching or adding additional suppliers or vendors involves substantial cost and requires management time and focus.

In addition, there is a natural transition period when a new supplier or vendor commences work. As a result, delays occur, which could

adversely impact our ability to meet our desired clinical development and any future commercialization timelines. Although we carefully

manage our relationships with our suppliers and vendors, there can be no assurance that we will not encounter challenges or delays in

the future or that these delays or challenges will not have an adverse impact on our business, financial condition and prospects. See

“-Risks Related to Our Dependence on Third Parties.”

The spread of COVID-19, which has caused a broad

impact globally, may materially affect us economically. While the potential economic impact brought by the duration of COVID-19 may

be difficult to assess or predict, a widespread pandemic or other crisis or governmental action could result in significant

disruption of global financial markets, reducing our ability to access capital, which could in the future negatively affect our liquidity.

In addition, a recession or market correction resulting from the spread of COVID-19, other pandemics, or governmental action,

could materially affect our business and the value of our common stock.

As stated elsewhere in this registration statement,

governmental travel restrictions impacted our ability to ship eggs to our Vietnam facility and our production is dependent on those

shipments. In October of 2020, with restrictions lifted, we were able to deliver silkworm eggs to the Vietnam facility and production

resumed; in January of 2021 we received the first shipment of silk from our factory in Vietnam. However, given the speed and frequency

of the continuously evolving developments with respect to the pandemic, and the unpredictability of governmental responses,

the Company cannot reasonably estimate the magnitude of the impact to its consolidated results of operations. We have taken every

precaution possible to ensure the safety of our employees. The ultimate impact of the COVID-19 pandemic or a similar health epidemic

is highly uncertain and subject to change. We do not yet know the full extent of potential delays or impacts on our business, our production,

healthcare systems or the global economy as a whole. However, these effects could have a material impact on our operations, and we will

continue to monitor the COVID-19 situation closely. See, “Management’s Discussion and Analysis of Financial Condition and

Results of Operations - Impact of COVID-19 Outbreak.”

Our operations

or those of the third parties upon whom we depend might be affected by the occurrence of a natural disaster, pandemic, war or other catastrophic

event.

We depend on our employees, consultants, and

suppliers, as well as regulatory agencies and other parties, for the continued operation of our business. Despite any precautions we

take for natural disasters or other catastrophic events, these events, including terrorist attacks, wars, pandemics, embargos, sanctions,

trade or supply chain disruptions, hurricanes, fires, floods and ice and snowstorms, could result in significant disruptions to our research

and development, and, ultimately, commercialization of our products. Long-term disruptions in the infrastructure caused by events, such

as natural disasters, the outbreak of war (including expansion of the current armed conflict between Russia and Ukraine or the outbreak

of war in the far East), the escalation of hostilities and acts of terrorism, embargos, sanction, trade disruptions, or other “acts

of God,” particularly involving countries in which we have offices, manufacturing or key supply chain partners, could adversely

affect our businesses. Any natural disaster or catastrophic event affecting us, our suppliers, our customers, regulatory agencies or

other parties with which we are engaged could have a material adverse effect on our operations and financial performance.

We

may not successfully manage any growth that we may experience.

Our

future success will depend upon not only product development, but also on the expansion of our operations and the effective management

of any such growth, which will place a significant strain on our management and on our administrative, operational, and financial resources.

To manage any such growth, we must expand our facilities, augment our operational, financial and management systems, and hire and train

additional qualified personnel. If we are unable to manage our growth effectively, our business would be harmed as our growth could be

adversely affected by such mismanagement.

We

may be unable to maintain an effective system of internal controls and accurately report our financial results or prevent fraud, which

may cause our current and potential stockholders to lose confidence in our financial reporting and adversely impact our business and

our ability to raise additional funds in the future.

Effective

internal controls are necessary for us to provide reliable financial statements and effectively prevent fraud. We have no internal audit

function. As we noted in our annual report on Form 10-K for the year ended December 31, 2021, we reported that our internal control

over financial reporting was not effective for the purposes for which it is intended because we had material weaknesses, as described

below. Though we have

taken some steps to address our material weaknesses in our internal control over financial reporting, including education of management

of disclosure requirements and financial reporting controls, we still have not eliminated the material weakness in our internal controls

over financial reporting. If we cannot provide reliable financial statements or prevent fraud, our operating results and our reputation

could be harmed as a result, causing stockholders and/or prospective investors to lose confidence in management and making it more difficult

for us to raise additional capital in the future.

In

our “Management’s Annual Report on Internal Control Over Financial Reporting” that appeared in our annual report on

Form 10-K for the year ended December 31, 2022, we reported that our internal control over financial reporting was not effective

for the purposes for which it is intended based on a material weakness associated with our lack of qualified resources to perform the

internal audit functions properly, no segregation of duties that results in ineffective controls over financial reporting and lack of

control over related party transactions. As reported in our most recent annual report, we are taking some remediation steps to help address

our material weaknesses in our internal control over financial reporting, but we do not expect to remediate the weaknesses in our internal

controls over financial reporting until the time when we start to commercialize a recombinant fiber (and, therefore, may have sufficient

cash flow for hiring personnel to handle our accounting and reporting functions).

Risks

Related to Our Product and Business

Our

business is based on scientific research which has not demonstrated commercial viability and makes our business highly risky.

We

are engaging in research and development of new recombinant silk fibers. Due to the speculative nature of this scientific research, our

chances of success are uncertain and we cannot guarantee that we will succeed in developing new fibers that deliver performance results

to meet customer requirements or obtain commercial acceptance. An investment in us, therefore, is highly speculative and risky.

The

fibers we develop could expose us to product liability claims, which could have a negative impact on our results of operations.

The

fibers we are seeking to develop may subject us to product liability claims if widely used, including but not limited to design defect,

environmental hazards, quality control, and durability of product. This potential liability is increased by virtue of the fact that our

products in development may be used as protective and safety materials. The fibers and end products we are developing are based on a

GMO and are subject to public opinion, risks, and concerns regarding GMOs. There is tremendous potential liability to any person who

is injured by, or while using, one of our products. As a manufacturer, we may be strictly liable for any damage caused by our products.

This liability might not be covered by insurance, or may exceed any coverage that we may obtain.

Ethical,

legal and social concerns about synthetic biologically engineered products and processes could limit or prevent the use of products or

processes using our technologies, limit consumer acceptance and limit our revenues.

Our

technologies involve the use of genetically engineered (“GE”) products or technologies. Public perception about the safety

and environmental hazards of, and ethical concerns over, GE products and processes could influence public acceptance of our and our collaborators’

technologies, products and processes.

The

subject of GMOs has received negative publicity, which has aroused public debate. This adverse publicity has led to, and could continue

to lead to, greater regulation and trade restrictions on genetically altered products and organisms. Such changes in regulation, or changes

in the interpretation of regulations could negatively impact our ability to produce enhanced fiber and products. Further, there is a

risk that products produced using our technologies could cause adverse health effects or other adverse events, which could also lead

to negative publicity.

There