true

--05-31

2024

FY

false

0001442492

false

false

2033-06-23

2033-12-31

P5Y

P6Y

0001442492

2023-06-01

2024-05-31

0001442492

2022-11-30

0001442492

2024-09-13

0001442492

2024-05-31

0001442492

2023-05-31

0001442492

2022-06-01

2023-05-31

0001442492

us-gaap:CommonStockMember

2022-05-31

0001442492

us-gaap:PreferredStockMember

2022-05-31

0001442492

us-gaap:AdditionalPaidInCapitalMember

2022-05-31

0001442492

us-gaap:RetainedEarningsMember

2022-05-31

0001442492

2022-05-31

0001442492

us-gaap:CommonStockMember

2023-05-31

0001442492

us-gaap:PreferredStockMember

2023-05-31

0001442492

us-gaap:AdditionalPaidInCapitalMember

2023-05-31

0001442492

us-gaap:RetainedEarningsMember

2023-05-31

0001442492

us-gaap:CommonStockMember

2022-06-01

2023-05-31

0001442492

us-gaap:PreferredStockMember

2022-06-01

2023-05-31

0001442492

us-gaap:AdditionalPaidInCapitalMember

2022-06-01

2023-05-31

0001442492

us-gaap:RetainedEarningsMember

2022-06-01

2023-05-31

0001442492

us-gaap:CommonStockMember

2023-06-01

2024-05-31

0001442492

us-gaap:PreferredStockMember

2023-06-01

2024-05-31

0001442492

us-gaap:AdditionalPaidInCapitalMember

2023-06-01

2024-05-31

0001442492

us-gaap:RetainedEarningsMember

2023-06-01

2024-05-31

0001442492

us-gaap:CommonStockMember

2024-05-31

0001442492

us-gaap:PreferredStockMember

2024-05-31

0001442492

us-gaap:AdditionalPaidInCapitalMember

2024-05-31

0001442492

us-gaap:RetainedEarningsMember

2024-05-31

0001442492

srt:ScenarioPreviouslyReportedMember

2023-05-31

0001442492

srt:RestatementAdjustmentMember

2023-05-31

0001442492

srt:ScenarioPreviouslyReportedMember

lrdc:OlfertMember

2023-05-31

0001442492

srt:RestatementAdjustmentMember

lrdc:OlfertMember

2023-05-31

0001442492

lrdc:OlfertMember

2023-05-31

0001442492

srt:ScenarioPreviouslyReportedMember

lrdc:CatCreekMember

2023-05-31

0001442492

srt:RestatementAdjustmentMember

lrdc:CatCreekMember

2023-05-31

0001442492

lrdc:CatCreekMember

2023-05-31

0001442492

srt:ScenarioPreviouslyReportedMember

2022-06-01

2023-05-31

0001442492

srt:RestatementAdjustmentMember

2022-06-01

2023-05-31

0001442492

srt:ScenarioPreviouslyReportedMember

2022-05-31

0001442492

srt:RestatementAdjustmentMember

2022-05-31

0001442492

srt:ScenarioPreviouslyReportedMember

us-gaap:CommonStockMember

2023-05-30

0001442492

srt:ScenarioPreviouslyReportedMember

us-gaap:PreferredStockMember

2023-05-30

0001442492

srt:ScenarioPreviouslyReportedMember

us-gaap:AdditionalPaidInCapitalMember

2023-05-30

0001442492

srt:ScenarioPreviouslyReportedMember

us-gaap:RetainedEarningsMember

2023-05-30

0001442492

srt:ScenarioPreviouslyReportedMember

2023-05-30

0001442492

srt:RestatementAdjustmentMember

2023-05-30

0001442492

srt:ScenarioPreviouslyReportedMember

us-gaap:CommonStockMember

2023-05-31

2023-05-31

0001442492

srt:ScenarioPreviouslyReportedMember

us-gaap:PreferredStockMember

2023-05-31

2023-05-31

0001442492

srt:ScenarioPreviouslyReportedMember

us-gaap:AdditionalPaidInCapitalMember

2023-05-31

2023-05-31

0001442492

srt:ScenarioPreviouslyReportedMember

us-gaap:RetainedEarningsMember

2023-05-31

2023-05-31

0001442492

srt:ScenarioPreviouslyReportedMember

2023-05-31

2023-05-31

0001442492

srt:ChiefExecutiveOfficerMember

2023-06-01

2024-05-31

0001442492

srt:ChiefExecutiveOfficerMember

2022-06-01

2023-05-31

0001442492

srt:ChiefFinancialOfficerMember

2023-06-01

2024-05-31

0001442492

srt:ChiefFinancialOfficerMember

2022-06-01

2023-05-31

0001442492

srt:ChiefFinancialOfficerMember

2024-05-31

0001442492

srt:ChiefFinancialOfficerMember

2024-05-31

2024-05-31

0001442492

srt:ChiefExecutiveOfficerMember

2024-05-31

0001442492

srt:ChiefExecutiveOfficerMember

2024-05-31

2024-05-31

0001442492

lrdc:Director1Member

2023-06-01

2024-05-31

0001442492

lrdc:Director2Member

2023-06-01

2024-05-31

0001442492

us-gaap:ConvertibleDebtMember

2023-12-29

0001442492

us-gaap:ConvertibleDebtMember

2023-12-29

2023-12-29

0001442492

us-gaap:ConvertibleDebtMember

2023-11-27

0001442492

us-gaap:ConvertibleDebtMember

2023-11-27

2023-11-27

0001442492

us-gaap:ConvertibleDebtMember

2023-09-06

0001442492

us-gaap:ConvertibleDebtMember

2023-09-06

2023-09-06

0001442492

us-gaap:ConvertibleDebtMember

2023-05-31

0001442492

us-gaap:ConvertibleDebtMember

2023-03-01

2023-05-31

0001442492

us-gaap:ConvertibleDebtMember

2023-02-28

0001442492

us-gaap:ConvertibleDebtMember

2022-11-01

2022-11-30

0001442492

us-gaap:ConvertibleDebtMember

2022-10-31

0001442492

us-gaap:ConvertibleDebtMember

2022-10-01

2022-10-31

0001442492

us-gaap:ConvertibleDebtMember

2022-09-06

0001442492

us-gaap:ConvertibleDebtMember

2022-09-06

2022-09-06

0001442492

2023-03-01

2023-04-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

10-K/A

| |

x |

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the fiscal year ended May 31, 2024

or

| |

o |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the transition period from __________ to _________

Commission

file number: 333-153168

| Laredo Oil, Inc. |

| (Exact

name of Registrant as Specified in its Charter) |

| Delaware |

|

26-2435874 |

| (State

or other jurisdiction of |

|

(I.R.S.

Employer |

| incorporation

or organization) |

|

Identification

No.) |

| 2021 Guadalupe Street, Ste. 260; Austin, TX 78705 |

| (Address

of principal executive offices) (Zip Code) |

| |

| (512)

337-1199 |

| (Registrant’s

telephone number, including area code) |

| |

| Securities

registered pursuant to Section 12(b) of the Act: |

| None |

| |

| Securities

registered pursuant to Section 12(g) of the Act: |

| None |

| |

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such

reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit and post such files). Yes x No

o

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“non-accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2

of the Exchange Act.

| Large

accelerated filer |

o |

Accelerated

filer |

o |

| Non-accelerated Filer |

x |

Smaller reporting company |

x |

| |

|

Emerging growth company |

o |

| |

|

|

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12-b of the Act). Yes o No x

On

November 30, 2023, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market

value of the registrant’s outstanding shares of common equity held by non-affiliates of the registrant was $2.1 million, based

upon the closing price of the common stock on that date on the OTC Bulletin Board.

As

of September 13, 2024, there were 73,165,358 shares of the registrant’s common stock outstanding.

Documents

Incorporated by Reference: None.

EXPLANATORY NOTE

The purpose of this amendment on Form 10-K/A to Laredo Oil, Inc.’s Annual Report on Form 10-K for the period ended

May 31, 2024, filed with the Securities and Exchange Commission on September 30, 2024 is solely to furnish the Inline eXtensible Business

Reporting Language (iXBRL) data under Exhibit 101 and 104 to the Form 10-K in accordance with Rule 405 of Regulation S-T.

No other changes

have been made to the Form 10-K. This Amendment No. 1 to the Form 10-K speaks as of the original filing date of the Form 10-K, does not

reflect events that may have occurred subsequent to the original filing date, and does not modify or update in any way disclosures made

in the original Form 10-K.

LAREDO

OIL, INC.

TABLE

OF CONTENTS

EXPLANATORY NOTE

This Annual Report on Form 10-K (this “Form

10-K”) of Laredo Oil, Inc., a Delaware corporation, (the “Company,” “we,” “our,” or “us”) for the year ended

May 31, 2024, includes consolidated comparative financial statements and disclosures for the year ended May 31, 2023 which have been restated

from the Form 10-K previously filed for the year ended May 31, 2023 with the Securities and Exchange Commission (the “SEC”)

on September 23, 2023 (the “2023 Original Filing”).

Reference Note 2 in the accompanying Notes to Financial

Statements for detailed disclosure of items amended by this restatement.

Restatement of the Financial Statement for Fiscal

Year Ended May 31, 2023

This Form 10-K restates the 2023 Original Filing and

related disclosures arising from an impairment analysis during the 2024 audit and the related reaudit of the Company’s fiscal year

2023 financial statements.

The reaudit requirement was authorized by the Company

during the audit engagement for the year ended May 31, 2024. For the year ended May 31, 2024, a new auditing firm was engaged to replace

the previous auditing firm, BF Borgers CPA PC (“Borgers”), who performed the audit in connection with the financial statements

for the fiscal year ended May 31, 2023 included in the 2023 Original Filing.

During the 2024 audit that was in progress, on May

3, 2024 the SEC entered, and the Company became aware of, an order instituting settled administrative and cease-and-desist proceedings

against Borgers, which order includes denying Borgers the privilege of appearing or practicing before the SEC as an accountant. The Company

and its new auditing firm determined that the 2023 audit performed by Borgers should not be included in the 2024 filing, and the Company

expanded its engagement with the new auditing firm to include a reaudit of the 2023 financial statements.

In the course of the 2023 reaudit, procedures were

applied that led the Company and the new auditors to believe sufficient audit procedures were not performed by Borgers when auditing the

2023 financial statements.

For the year ended May 31, 2024, management applied

accounting procedures to examine the need for an impairment adjustment to the carrying value of its unevaluated oil and natural gas properties.

A triggering event related to the evaluation of the economic viability related to the Company’s Olfert 11-4 well on May 31, 2024

was noted. Although negotiation discussions with salt-water disposal well operators in the area have been in progress for over two years,

there was no assurance that access would, in fact, be attained in a timely manner. Additionally, the value of the Company’s Cat

Creek Holdings, LLC (“Cat Creek”) equity method investment was determined to have no continuing value. The conclusion reached

was to impair 100% of the carrying value of the Company’s oil assets associated with the well and the remaining Cat Creek investment

balance as of May 31, 2023. The new auditing firm recommends that this higher impairment is more in line with the standard practices within

the oil and gas exploration industry during periods in which unevaluated oil wells and loss producing investments are recorded.

Given the combined auditing engagement for 2023 with

the audit for 2024, the Company recorded an impairment adjustment as of May 31, 2023 and at May 31, 2024. As a result, our previously

issued 2023 financial statements included in the Original Filing should no longer be relied upon.

Except for the changes relating to this impairment

adjustment for 2023 and changes relating to asset adjustments, no other changes have been made to the consolidated financial statements

for the year ended May 31, 2023. Reference Note 2 to the consolidated financial statements.

References to our website throughout this Form 10-K

are provided for convenience only and the content on our website does not constitute a part of, and shall not be deemed incorporated by

reference into, this filing.

Forward-Looking

Statements

From

time to time, we may provide information, whether orally or in writing, including certain statements in this Annual Report on Form 10-K,

which are deemed to be “forward-looking” within the meaning of the Private Securities Litigation Reform Act of 1995 (the

“Litigation Reform Act”). These forward- looking statements and other information are based on our beliefs as well as assumptions

made by us using information currently available.

The

words “believe,” “plan,” “expect,” “intend,” “anticipate,” “estimate,”

“may,” “will,” “should” and similar expressions are intended to identify forward-looking statements.

Such statements reflect our current views with respect to future events and are subject to certain risks, uncertainties and assumptions.

Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may

vary materially from those described herein as anticipated, believed, estimated, expected or intended or using other similar expressions.

We do not intend to update these forward-looking statements, except as required by law.

In

accordance with the provisions of the Litigation Reform Act, we are making investors aware that such forward-looking statements, because

they relate to future events, are by their very nature subject to many important factors that could cause actual results to differ materially

from those contemplated by the forward-looking statements contained in this Annual Report on Form 10-K, any exhibits to this Annual Report

on Form 10-K and other public statements we make.

PART

I

Item

1. Business

We

are an oil exploration and production company, primarily engaged in acquisition and exploration efforts to find mineral reserves on various

properties. From our inception in March 2008 through October 2009, we were primarily engaged in acquisition and exploration efforts for

mineral properties. Beginning in October 2009, we shifted our focus to locating mature oil fields with the intention of acquiring those

oil fields and recovering stranded oil reserves using enhanced recovery methods. From June 14, 2011 to December 31, 2020, we were a management

services company, managing the acquisition and operation of mature oil fields, focused on the recovery of “stranded” oil

from those mature fields using enhanced oil recovery methods for our then sole customer, Stranded Oil Resources Corporation, or SORC,

a wholly owned subsidiary of Alleghany Corporation, or Alleghany. We performed those services in exchange for a quarterly management

fee and reimbursement from SORC of our employee related expenses. Such fees and reimbursements were effectively all of our revenues prior

to the closing of the Securities Purchase Agreement with Alleghany described below.

On

December 31, 2020, we entered into a Securities Purchase Agreement with Alleghany. Under that agreement, we purchased all of the issued

and outstanding shares of SORC. As consideration for the SORC shares, we paid Alleghany $72,678 in cash and agreed to pay Alleghany a

seven-year royalty of 5.0% of our future revenues and net profits from our oil, gas, gas liquids and all other hydrocarbon operations,

subject to certain adjustments. Currently, SORC is not conducting any ongoing operations.

Prior

to December 31, 2020, while implementing underground gravity drainage, or UGD, projects for Allegheny, we gained specialized know-how

and operational experience in evaluating, acquiring, operating and developing oil and gas properties, as well as expertise in designing,

drilling and producing conventional oil wells. Based upon that know-how, we identified and acquired 45,246 gross acres, and 37,932 net

acres, of mineral property interests in the State of Montana. We began drilling an exploratory well in Montana during May 2022. That

well, named the Olfert 11-4 well, has not yet been completed or put into production. More recently, we are continuing our efforts to

complete the Olfert 11-4 well and begin commercial production. We have also developed relationships with Texakoma Exploration and Production,

LLC, or Texakoma, and Erehwon Oil & Gas, LLC, or Erehwon, designed to develop our acquired mineral property acreage. We also have

raised $2,034,000 from accredited investors pursuant to a participation agreement to fund the development of up to three wells in the

Midfork oil field in Montana. The first well, Reddig 11-21, has been drilled and is in the process of being put into production. We are

continually attempting to raise additional funds to develop our other mineral property interests we have purchased. We also have a 50%

interest in the Cat Creek oil field, located in Montana. Our various projects and relationships are described in more detail below. Our

ability to secure additional funding will determine whether we can achieve any future production for the acreage, and if we can secure

such financing, the pace of field development.

Relationship

with Erehwon Oil & Gas, LLC

In

connection with securing this acreage in Montana, Lustre Oil Company LLC, a wholly owned subsidiary of the Company (“Lustre”),

entered into an Acquisition and Participation Agreement (the “Erehwon APA”) and subsequent amendments with Erehwon Oil &

Gas, LLC (“Erehwon”) to acquire oil and gas interests and drill, complete, re-enter, re-complete, sidetrack, and equip wells

in Valley County, Daniels County and Roosevelt County, Montana. The amended Erehwon APA specifies calculations for royalty interests

and working interests for the first ten well completions and first ten well recompletions and for all additional wells and recompletions

thereafter. Lustre will acquire mineral leases and pay 100% of the costs and the split between Erehwon and Lustre will be 20%/80%. Under

the amended Erehwon APA, Lustre will fund 100% of the construction costs of the first ten wells and first ten completions. Until payout

as defined is attained, the distribution split between Erehwon and Lustre will be 10%/90%, thereafter, 20%/80%. Any additional wells

will be funded 80% by Lustre and 20% by Erehwon.

Royalty

expenses for these wells will consist of a royalty interest to the landowner and an overriding royalty interest of between 3% and 6%

to two individuals who generated the prospects. Those individuals will also receive an amount equal to 5% of the cost of the first ten

new wells we complete and the first ten completed recompletions.

Hell

Creek Crude, LLC Midfork Field Production Well

In December 2023, we entered into a Participation

Agreement, through Hell Creek Crude, LLC, our wholly owned subsidiary (“HCC”), Erehwon, and various accredited investors.

The Participation Agreement provided us with $2,034,000 to acquire certain leases and to drill a development well in the Midfork Field

in Montana. Several of the investors also hold $575,000 of our convertible debt, plus accrued interest of $73,317, which indebtedness

is included as investments under the Participation Agreement.

Until the total of the $2,682,317 in cash, notes and

accrued interest is repaid to the various investors under the terms of the Participation Agreement, the net working interest payments

from the Participation Agreement will be split between the various investors and HCC and Erehwon, collectively on a 90%/10% basis. After

the repayment to the investors, the split between the investors, on one hand, and HCC and Erehwon, on the other hand, will be on a 50%/50%

basis. After the development well is drilled under the Participation Agreement, the investors will have the option to invest in up to

two additional wells in the field.

Olfert

11-4 Montana Well

In

January 2022, we executed a Net Profits Interest Agreement with Erehwon and Olfert No. 11-4 Holdings, LLC, or Olfert Holdings, for the

purpose of funding the first well, named Olfert #11-4, under the Acquisition and Participation Agreement described above. In exchange

for Olfert Holdings’ funding of the development of Olfert #11-4, Olfert Holdings receives 90% of amounts resulting from Olfert

#11-4 prior to “Payout” and 50% after “Payout.” The Net Profits Interest Agreement defines “Payout”

as the point in time when the aggregate of all ‘Net Profits Interest’ payments made to Olfert Holdings under the agreement

equals 105% of the total well development costs.

We

also entered into the Olfert Holdings operating agreement, under which we agreed to make a capital contribution to Olfert Holdings in

the amount of $500,000, out of a total of $1,500,000 of capital to be raised by Olfert Holdings. As of May 31, 2024, we were credited

with a contribution of $59,935 in market value of well development costs, representing a 4.4% interest in Olfert Holdings. Since then,

other investors, including our Chief Financial Officer, assumed and funded our remaining capital commitment under the Olfert Holdings

operating agreement.

As

part of our annual impairment analysis and in conjunction with our annual financial audit, we decided to take an accounting

impairment charge to reduce the asset value of the Olfert 11-4 well to salvage value. Although we still are working to put the well

into production, it has been two years since the well was shut-in pending gaining access to a proximate salt-water disposal well

making the well economically viable. Although the asset carrying value of the well has been reduced, we will continue to complete

the well and bring it into production.

Development

Agreement with Texakoma Exploration and Production, LLC

Effective

July 18, 2023, Lustre and Erehwon entered into an Exploration and Development Agreement (the “Development Agreement”), with

Texakoma. The Development Agreement provides for the exploration and development of the “Lustre Field Prospect” described

in the Development Agreement. Lustre and Erehwon are also parties to an existing Acquisition and Participation Agreement, under which

those parties agreed to acquire certain oil and gas interests, and drill, complete, re-enter, re-complete, sidetrack, and equip wells,

in certain counties in Montana.

Under

the terms of the Development Agreement, Texakoma agreed to pay Lustre and Erehwon, jointly, the following amounts: (i) $175,000 on or before

July 21, 2023; and (ii) another $175,000 upon the “spudding” of the initial test well subject to rig availability. Upon the

spudding of that test well, Lustre and Erehwon were required to deliver to Texakoma a partial assignment of an 85% working interest in

the oil and gas leases covering the first two initial drilling and spacing units. The first payment under the Development Agreement was

paid by Texakoma at the end of August 2023, and the second $175,000 payment on September 29, 2023.

The two test wells were successfully drilled and Texakoma

paid 100% of the costs associated with the drilling and completion of the wells. Lustre and Erehwon jointly, have an undivided 15% working

interest, carried through the tanks, in those two wells. In March 2024, Texakoma exercised its option to participate in the development

of the remainder of the Lustre Field Prospect. By exercising its option, Texakoma agreed to drill eight additional wells, with Lustre

and Erehwon having a 15% working interest carried through the tanks, and to pay Lustre $706,603 spread over four months, for an 85% leasehold

interest in the next eight drill sites and a 50% leasehold interest in the balance of the Lustre Field Prospect acreage. As of May 31,

2024, $377,901 of the contractual amount was settled. The remaining balance was paid as of August 1, 2024. The working and net revenue

interest in any wells drilled subsequent to the first ten wells will be shared by Texakoma and Lustre and Erehwon, jointly, on a 50:50

basis.

Following

the Texakoma transaction, we retain a 100% leasehold interest and full control of an additional 30,556 net mineral acres in northeastern

Montana at the western edge of the Williston Basin.

Competition

Our

operating results are largely impacted by competition from other exploration and production companies in all areas of operation, including

the acquisition of mature fields. Our competitors include large, well-established, companies with substantially more capital resources

than us.

Oil

and Gas Price Volatility

Market

prices for oil and gas declined significantly in the first six months of calendar year 2020, as the combination of the COVID-19 global

pandemic and geopolitical tensions among the world’s energy producers resulted in the simultaneous reduction of demand and increase

in supply of crude oil. Since then, oil and gas prices have recovered and have remained in the $70-80 per barrel range. However, oil

and gas prices still remain volatile.

Operating

Hazards and Uninsured Risks

Oil

and gas drilling activities are subject to many risks, including, but not limited to, the risk that those activities will not produce

commercially viable oil and gas reserves. The cost and timing of drilling, completing and operating wells is often uncertain and drilling

operations may be curtailed, delayed or canceled as a result of numerous factors, including low oil and gas prices, title problems, reservoir

characteristics, weather conditions, equipment failures, delays imposed by project participants, compliance with governmental requirements,

shortages or delays in the delivery of equipment and services and increases in the cost for such equipment and services. Our future oil

recovery activities may not be successful. If so, such failure may have a material adverse effect on our business, financial condition,

results of operations and cash flows.

Our

operations are subject to hazards and risks inherent in drilling for and producing and transporting petroleum products, including fires,

natural disasters, explosions, encountering formations with abnormal pressures, blowouts, craterings, and pipeline ruptures and spills.

Any of these events may result in the loss of hydrocarbons, environmental pollution, personal injury claims and other damage to our properties

and those of others. We maintain insurance against some, but not all, of the risks described above. In particular, the insurance we maintain

does not cover claims relating to failure of title to oil leases, loss of surface equipment at well locations, business interruption,

loss of revenue due to low commodity prices or loss of revenues due to well failure. The occurrence of any such event that is not covered,

or not fully covered, by insurance that we maintain or may acquire, could have a material adverse effect on our operations.

Governmental

Regulation

Oil

and natural gas exploration, production, transportation and marketing activities are subject to extensive laws, rules and regulations

promulgated by federal and state legislatures and agencies, including but not limited to the Mine Safety and Health Administration, or

MSHA, the Federal Energy Regulatory Commission, or FERC, the Environmental Protection Agency, or EPA, the Bureau of Land Management,

BLM, and various other federal or state regulatory agencies. Our failure to comply with any such laws, rules and regulations may result

in substantial penalties, including the delay or prohibition of our operations. The legislative and regulatory burden on the oil industry

described above increases our cost of doing business.

State

regulatory agencies, as well as the federal government when we operate on federal or Indian lands, require permits for drilling operations,

drilling bonds and reports, and impose other requirements relating to the exploration and production of oil and gas. There are also statutes

or regulations addressing conservation matters, including provisions for the unitization or pooling of oil and natural gas properties,

the establishment of maximum rates of production from wells and the regulation of spacing, plugging and abandonment of such wells. In

each jurisdiction, we may need exceptions to some applicable regulations requiring regulatory approval. All of these matters could affect

our operations.

Environmental

Matters

The

oil industry is subject to extensive and changing federal, state and local laws and regulations relating to environmental protection,

including the generation, storage, handling, emission, transportation and discharge of materials into the environment, as well as safety

and health. The recent trend in environmental legislation and regulation is generally toward stricter standards, and this trend is likely

to continue. These laws and regulations may require a permit or other authorization before construction or drilling commences, and for

certain other activities, limit or prohibit access, seismic acquisition, construction, drilling and other activities on certain lands

lying within wilderness and other protected areas, impose substantial liabilities for pollution resulting from its operations, and require

the reclamation of certain lands.

The

permits that are required for oil and gas operations are subject to revocation, modification and renewal by issuing authorities.

Federal

regulations require certain owners or operators of facilities that store or otherwise handle petroleum products to prepare and implement

spill prevention, control countermeasures and response plans relating to the possible discharge of oil into surface waters. The Oil Pollution

Act of 1990, or OPA, contains numerous requirements relating to the prevention of and response to oil spills into waters of the United

States. For onshore and offshore facilities that may affect waters of the United States, the OPA requires the operator to demonstrate

the financial ability to respond to discharges. Regulations are currently being developed under federal and state laws concerning oil

pollution prevention and other matters that may impose additional regulatory burdens on participants in the oil and gas industry. In

addition, the Clean Water Act and analogous state laws require permits to be obtained to authorize discharge into surface waters or to

construct facilities in wetland areas. The Clean Air Act of 1970 and its subsequent amendments impose permit requirements and necessitate

certain restrictions on point source emissions of volatile organic carbons (nitrogen oxides and sulfur dioxide) and particulates with

respect to certain of our operations. The EPA and designated state agencies have in place regulations concerning discharges of storm

water runoff and stationary sources of air emissions. These programs require covered facilities to obtain individual permits, participate

in a covered group or seek coverage under an EPA general permit. A number of agencies, including but not limited to MSHA, the EPA, the

BLM, and similar state commissions, have adopted regulatory guidance in consideration of the operational limitations on oil and gas facilities

and their potential to emit pollutants.

Facilities

Our

principal executive office is located at 2021 Guadalupe Street, Ste. 260, Austin, Texas 78705.

Personnel

As

of May 31, 2024, we had five full-time employees and no part-time employees.

Website

Access

We

make available on our web site our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K,

and all amendments to those reports, as soon as reasonably practicable after we file such reports electronically with the Securities

and Exchange Commission. Information on our website is not included as part of this report.

Item

1A. Risk Factors

Not

Applicable

Item

1B. Unresolved Staff Comments

Not

Applicable

Item

1C. Cybersecurity

We have a range of security

measures that are designed to protect against the unauthorized access to and misappropriation of our information, corruption of data,

intentional or unintentional disclosure of confidential information, or disruption of operations. We have cloud security tools and governance

processes designed to assess, identify, and manage material risks from cybersecurity threats. In addition, we maintain an information

security training program designed to address phishing and email security, password security, data handling security, cloud security,

operational technology security processes, and cyber-incident response and reporting processes.

Our Company is committed to

maintaining the highest standards of cybersecurity to protect our data, intellectual property, and customer information from cyber threats.

As part of this commitment, we leverage a sophisticated cybersecurity framework that integrates the robust capabilities of the Microsoft

cloud ecosystem. We use an outside third-party cloud provider to provide communication and computer services, including email, internet

access and file storage and sharing. Access passwords are changed on a regular basis. All employees have received formal training

on password controls and on email safety procedures. Our policy requires all employees to send any suspicious emails to our

contracted computer expert for evaluation. Access to any sensitive databases is on a limited and need-to-know basis. Should

there be a data breach, the board of directors would be immediately notified. As of the filing date of this report, there has been

no cyber security incident encountered to the best of our knowledge.

The Microsoft cloud ecosystem, including Microsoft

365, Azure, SharePoint Online, Microsoft Defender, and Microsoft InTune, forms the backbone of our cybersecurity infrastructure. These

platforms offer advanced security features such as data encryption in transit and at rest, network security controls, identity and access

management, and threat protection capabilities. Microsoft’s constant investment in cybersecurity research and development ensures

that we benefit from cutting-edge security technologies and practices.

Item

2. Properties

In

May 2022, Lustre began drilling an exploratory well, named Olfert #11-4, in the Lustre oil field located in northeastern Montana. As

of the filing of this report, the Olfert #11-4 well has not been completed and put into production. As a result of the uncertainty surrounding

successful well completion and the availability of future funding to develop our acquired mineral rights, we are not providing disclosures

of proved reserves until we have updated reserve reports. As part of our annual impairment analysis and in conjunction with our annual

financial audit, we decided to take an accounting impairment charge to reduce the asset value of the Olfert #11-4 well to salvage value.

Although we still are working to put the well into production, it has been two years since the well was shut-in in September 2022 pending

gaining access to a proximate salt-water disposal well making the well economically viable. Although the asset carrying value has been

reduced, we plan to complete the well and bring it into production.

As

a result of entering into the Texakoma agreement, we have a 15% net working interest in two wells: Olfert 2-36 and Olfert 3-34, both

located in Valley County, Montana.

Item

3. Legal Proceedings

On

February 4, 2021, Lustre filed a lawsuit captioned Lustre Oil Company LLC and Erehwon Oil & Gas, LLC v. Anadarko Minerals,

Inc. and A&S Mineral Development Co., LLC in the Montana Seventeenth Judicial District Court for Valley County to initiate

a quiet title action confirming Lustre’s rights under certain mineral leases in Valley County, Montana. Lustre is

also seeking damages with respect to actions taken by A&S Mineral Development Co., LLC to improperly produce oil on the property

subject to Lustre’s mineral leases. On January 14, 2022, the District Court granted the defendants’ Motion to Dismiss without

addressing the merits of Lustre’s quiet title action. Lustre appealed the decision to the Montana Supreme Court. On April 6, 2023,

in a unanimous decision, the Montana Supreme Court reversed the District Court’s decision related to Lustre’s quiet title

action and remanded the case to the District Court for further proceedings. On June 1, 2023, Lustre filed a First Amended Complaint with

the District Court reopening the original suit with a different judge. On February 27, 2024, the Company announced that Lustre entered

into a mutually agreeable Settlement Agreement between Lustre, Erehwon Oil & Gas, LLC (“Erehwon”), and A&S Minerals

Development Company, LLC (“ASMD”), (the “Settlement Agreement”). The confidential Settlement Agreement contains

an undisclosed cash amount and settles the quiet title dispute between the parties.

On March 20, 2023, Capex Oilfield

Services, Inc. (“Capex”) filed a lawsuit against Lustre in the Montana Tenth Judicial District Court, Petroleum County, demanding

payment of $377,190, plus interest and collection costs for services provided by Capex to drill the Olfert 11-4 well. On January 29, 2024,

the court issued a Stipulated Judgment and Order in favor of Capex for $354,267.29 plus interest in the amount of $79,224.89 and future

accruing costs and interest of 18% per annum. The same day, Lustre entered into a Payment Arrangement Plan to pay Capex $5,000 per month

until the judgement is satisfied.

On May 18, 2023, Capstar Drilling,

Inc.(“Capstar”) filed a lawsuit against Lustre in the Montana Seventeenth Judicial District Court, Valley County, demanding

payment of $298,050, plus interest and collection costs for services provided by Capstar to drill the Olfert 11-4 well. On July 18, 2024,

the court issued an Order to Adopt Stipulation to Judgment in favor of Capstar in the sum of $276,815 principal balance, plus interest

in the amount of $49,675, plus court costs for a total judgment of $326,650 with post judgment interest of 10% per annum.

On August 29, 2023, Warren Well Service,

Inc. (“Warren Well”) filed a lawsuit against Lustre in the Montana Seventeenth Judicial District Court, Valley County, demanding

payment of $164,235, plus interest and collection costs for services provided by Warren Well to drill the Olfert 11-4 well. A trial date

has been set for November 19, 2024. Lustre intends to negotiate ongoing payment terms with Warren Well prior to that date.

On September 16, 2024, Lustre acquired

three saltwater disposal wells in Valley County, Montana and will attempt to dewater and bring the Olfert 11-4 well into production as

soon as practical and reimburse all unpaid vendors, including Capex, Capstar and Warren Well, from proceeds from such production.

Except as set forth above, the Company

is not currently involved in any other legal proceedings, and it is not aware of any other pending or potential legal actions.

Item

4. Mine Safety Disclosures

Not

Applicable

PART

II

Item

5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

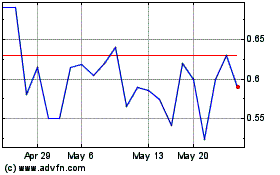

Our

common stock is currently traded under the symbol LRDC on the over-the-counter market and is quoted on the Pink Sheets, which is not

recognized by the Securities and Exchange Commission, or SEC, as a stock exchange for reporting purposes.

Since

our stock began trading on the Pink Sheets on November 5, 2009, there has been a limited trading market for our common stock. The following

table presents the range of high and low bid information for our common equity for each full quarterly period within the two most recent

fiscal years.

Laredo

Oil, Inc. High/Low Market Bid Prices ($)

| |

|

Fiscal

Q1:

Jun 2023 — Aug 2023 |

|

Fiscal

Q2:

Sep 2023 — Nov 2023 |

|

Fiscal

Q3:

Dec 2023 — Feb 2024 |

|

Fiscal

Q4:

Mar 2024 — May 2024 |

| High

Bid |

|

0.091 |

|

0.1301 |

|

0.2725 |

|

0.81 |

| Low

Bid |

|

0.0483 |

|

0.0501 |

|

0.047 |

|

0.191 |

| |

|

|

|

|

|

|

|

|

| |

|

Fiscal

Q1:

Jun 2022 — Aug 2022 |

|

Fiscal

Q2:

Sep 2022 — Nov 2022 |

|

Fiscal

Q3:

Dec 2022 — Feb 2023 |

|

Fiscal

Q4:

Mar 2023 — May 2023 |

| High

Bid |

|

0.229 |

|

0.1711 |

|

0.19 |

|

0.162 |

| Low

Bid |

|

0.1361 |

|

0.081 |

|

0.11 |

|

0.044 |

Over-the-counter

market quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual

transactions.

The

SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally

equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or quoted

on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided

by the exchange or quotation system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver

a standardized risk disclosure document prepared by the SEC, that: (a) contains a description of the nature and level of risk in the

market for penny stocks in both public offerings and secondary trading; (b) contains a description of the broker’s or dealer’s

duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements

of securities laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks

and the significance of the spread between the bid and ask price; (d) contains a toll-free telephone number for inquiries on disciplinary

actions; (e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and (f) contains such

other information and is in such form, including language, type, size and format, as the SEC shall require by rule or regulation. The

broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with: (a) bid and offer quotations

for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which

such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and

(d) monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, the penny

stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a

special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written

acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed

and dated copy of a suitably written statement.

These

disclosure requirements may have the effect of reducing the trading activity in the secondary market for our stock if it becomes subject

to these penny stock rules. Therefore, if our common stock becomes subject to the penny stock rules, stockholders may have difficulty

selling those securities.

Holders

As of September 13, 2024, we had 73,165,358 shares

of common stock issued and outstanding, and there were 25 holders of record and more than 700 beneficial holders of our common stock,

including those who own their shares through their brokers in “street name.”

Dividends

Since

our inception, we have not paid any dividends on our common stock. Our board of directors does not anticipate that it will declare dividends

on our common stock in the foreseeable future.

Item

7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Liquidity

and Capital Resources

Prior

to December 31, 2020, while implementing underground gravity drainage, or UGD, projects for Allegheny, we gained specialized know-how

and operational experience in evaluating, acquiring, operating and developing oil and gas properties, as well as expertise in designing,

drilling and producing conventional oil wells. Based upon that know-how, we identified and acquired 45,246 gross acres, and 37,932 net

acres, of mineral property interests in the State of Montana. We began drilling an exploratory well in Montana during May 2022. That

well, named the Olfert 11-4 well, has not yet been completed or put into production. More recently, we are continuing our efforts to

complete the Olfert 11-4 well and begin commercial production. We have also developed relationships with Texakoma Exploration and Production,

LLC, or Texakoma, and Erehwon Oil & Gas, LLC, or Erehwon, designed to develop our acquired mineral property acreage. We also have

raised $2,034,000 from accredited investors pursuant to a participation agreement to fund the development of up to three wells in the

Midfork oil field in Montana. The first well, Reddig 11-21, has been drilled and is in the process of being put into production. We are

continually attempting to raise additional funds to develop our other mineral property interests we have purchased. We also have a 50%

interest in the Cat Creek oil field, located in Montana. Our various projects and relationships are described in more detail below. Our

ability to secure additional funding will determine whether we can achieve any future production for the acreage, and if we can secure

such financing, the pace of field development.

Development

Agreement with Texakoma Exploration and Production, LLC

The agreement with Texakoma described in Item 1 began

to produce revenue from the test wells in the first calendar quarter of 2024, but pending access to a saltwater disposal well (“SWD”),

neither of the two wells have been put into full production. A third well was drilled by Texakoma in July but also is waiting for SWD

access before being put into production. We expect that during late September, access to SWD will be attained and all drilled wells will

be completed and put into production shortly thereafter. With SWD well access, we expected that Texakoma will continue its drilling program

to complete seven more wells. Texakoma will provide the capital required to drill those additional wells. Once all ten wells are drilled

and producing, we expected that the 15% net working interest held by the Company will generate enough revenue to cover our ongoing operating

expenses. Until we receive adequate funding from the Texakoma agreement described above, any cash needed for operations and oil field

expansion and development will most likely come from the sale of our debt and equity securities.

Hell

Creek Crude, LLC Midfork Field Production Well

In December 2023, we entered into a Participation

Agreement, through Hell Creek Crude, LLC, our wholly owned subsidiary, Erehwon, and various accredited investors. The Participation Agreement

provided us with $2,034,000 of capital to acquire certain leases and to drill the Reddig 11-21 well in the Midfork Field in Montana. Several

of the investors contributed $575,000 of our convertible debt, plus accrued interest of $73,317, which indebtedness was canceled and included

as investments under the Participation Agreement to be repaid from oil sales from the well.

Until the total of the $2,682,317 in cash, notes and

accrued interest is repaid to the various investors under the terms of the Participation Agreement, the net working interest payments

from the Participation Agreement will be split between the various investors and HCC and Erehwon, collectively, on a 90%/10% basis. After

the repayment to the investors, the split between the investors, on one hand, and HCC and Erehwon, on the other hand, will be on a 50%/50%

basis. After the development well is drilled under the Participation Agreement, the investors will have the option to invest in up to

two additional wells in the field.

Olfert

11-4 Montana Well

The Olfert 11-4 was drilled in May 2022 and has not

been completed or put into production. The well encountered what we believe are economic levels of oil but also encountered saltwater

intrusion which requires us to access a proximate SWD well to economically dispose of the saltwater in the well. We are optimistic that

in conjunction with attaining a SWD to support the Reddig 11-21 well in the Midfork Field and the Texakoma wells, the Olfert 11-4 well

will have access to that SWD well to dispose of encountered saltwater and be economical to complete and put into production. As of May

31, 2023, we took a long-term asset impairment loss with respect to our long-term assets, primarily comprised of the Olfert 11-4 assets.

Additional

Acreage North of the Fort Peck Reservation

We

are in the process of raising $7.5 million to drill three exploratory wells by selling units of West Fork Resources, LLC. The purpose

of the package is to prove up portions of our over 30,000 acres of mineral rights located north of the Fort Peck Reservation.

Results

of Operations

Our cash and cash equivalents and restricted cash

at May 31, 2024 was $1,990,189. Our total debt outstanding as of May 31, 2024 was $3,212,828, including (i) $617,934 owed to Alleghany,

which is classified as a current note payable, and (ii) $954,112 pursuant to notes under the Paycheck Protection Program, or PPP, of which

we have classified $887,733 as long-term debt, net of the current portion totaling $66,379, which is classified as a current note payable,

(iii) $288,622 short term convertible notes, net of deferred debt discount, (iv) a $310,061 revolving note classified as short-term, (v)

a $750,000 note payable due to Cali Fields LLC, classified as short-term, and (vi) a $292,099 note payable due to our Chief Financial

Officer, classified as short-term.

Our cash and cash equivalents at May 31, 2023 was

$13,754. Our total debt outstanding as of May 31, 2023 was $3,669,429, including (i) $617,934 owed to Alleghany, which is classified

as a current note payable, and (ii) $986,598 pursuant to notes under the Paycheck Protection Program, or PPP, of which we have classified

$536,974 as long-term debt, net of the current portion totaling $449,624, which is classified as a current note payable, (iii) $839,798

short term convertible notes, net of deferred debt discount, (iv) a $183,000 revolving note classified as short-term, (v) a $750,000

note payable due to Cali Fields LLC, classified as short-term, and (vi) a $292,099 note payable due to our Chief Financial Officer, classified

as short-term.

We recognized revenues and direct costs totaling

$36,482 and $0, respectively through our interest in oil and gas sales for the year ended May 31, 2024. We had no similar revenues

or direct costs during the year ended May 31, 2023 During the years ending May 31, 2024 and 2023, we incurred operating expenses of

$3,426,709 and $7,120,223, respectively. These expenses consisted of general operating expenses incurred in connection with the

day-to-day operation of our business, the preparation and filing of our required public reports and stock option compensation

expense. The decrease in expenses for the year ended May 31, 2024, as compared to the same period in 2023, is primarily attributable

a long-term asset impairment loss which we determined may not be recoverable totaling $4,299,274, recorded during fiscal year ending

May 31, 2023, decreases in other professional fees including public relations and advisory services offset by a $940,940 increase in

stock-based compensation.

During the year ended May 31, 2024, we

recognized other income and expenses of $175,000 related to the sale of drilling equipment, $727,901 offset by $285,412 in direct

lease acquisition costs related to payments required under the Texakoma Development Agreement, and an undisclosed payment related to

a confidential legal settlement. During the year ended May 31, 2023, we recognized other income and expenses comprised of (i) the

$122,682 we received from the Employee Retention Credit established by the CARES Act, and (ii) we recognized a $287,123 impairment

loss on our Cat Creek equity investment in addition to the previous $95,454 equity method loss recorded during the quarters.

Recently

Issued Accounting Pronouncements

Refer

to Note 4 of the Notes to Consolidated financial statements for a discussion of recently issued accounting pronouncements.

Critical

Accounting Policies and Estimates

The

process of preparing consolidated financial statements requires that we make estimates and assumptions that affect the reported amounts

of liabilities and stockholders’ equity/(deficit) at the date of the consolidated financial statements, and the reported amounts

of revenues and expenses during the reporting period. Significant estimates in these consolidated financial statements include estimates

related to purchase price allocation. Changes in the status of certain facts or circumstances could result in a material change to the

estimates used in the preparation of the consolidated financial statements and actual results could differ from the estimates and assumptions.

Going

Concern

These

consolidated financial statements have been prepared on a going concern basis. We have routinely incurred losses since inception, resulting

in an accumulated deficit. We have recently received loans from accredited investors to fund our operations. There is no assurance that

such financing will be available in the future to meet our operating needs. This situation raises substantial doubt about our ability

to continue as a going concern within the one-year period after the issuance date of the consolidated financial statements included in

this report.

Our

management has undertaken steps to improve operations, with the goal of sustaining operations for the next twelve months and beyond.

These steps include an ongoing effort to raise funds through the issuance of debt to fund our well development program and maintain operations.

We have attracted and retained key personnel with significant experience in the industry. At the same time, in an effort to control costs,

we have required a number of our personnel to multi-task and cover a wider range of responsibilities in an effort to restrict the growth

of our headcount. There can be no assurance that we can successfully accomplish these steps and it is uncertain that we will achieve

a profitable level of operations and obtain additional financing. We cannot assure you that any additional financing will be available

to us on satisfactory terms and conditions, if at all.

The

accompanying consolidated financial statements do not include any adjustments to reflect the possible future effects on the recoverability

and classification of assets or the amounts and classifications of liabilities that may result from the possible inability of us to continue

as a going concern.

Off

Balance Sheet Arrangements

We

do not currently have any off-balance sheet arrangements or other such unrecorded obligations, and we have not guaranteed the debt of

any other party.

Item

7A. Quantitative and Qualitative Disclosures About Market Risk

We

are not required to provide the information required by this Item as we are a “smaller reporting company,” as defined in

Rule 229.10(f)(1)

Item

8. Consolidated Financial Statements and Supplementary Data

Our

consolidated financial statements required by this item are included on the pages immediately following the Index to Consolidated Financial

Statements appearing on page F-1.

Item

9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None.

Item

9A. Controls and Procedures

Evaluation

of Disclosure Controls and Procedures

We

maintain disclosure controls and procedures that are designed to ensure that information required to be disclosed in our reports filed

or submitted under the Securities Exchange Act of 1934, as amended, or the Exchange Act, is recorded, processed, summarized and reported

within the time periods specified in the rules and forms of the Securities and Exchange Commission, or the SEC. Our disclosure controls

and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed in our

reports filed under the Exchange Act is accumulated and communicated to management as appropriate to allow timely decisions regarding

required disclosures. There are inherent limitations to the effectiveness of any system of disclosure controls and procedures, including

the possibility of human error and the circumvention or overriding of the controls and procedures. Accordingly, even effective disclosure

controls and procedures can only provide reasonable assurance of achieving their control objectives, and management necessarily is required

to use its judgment in evaluating the cost-benefit relationship of possible controls and procedures.

An evaluation was carried out

under the supervision and with the participation of our management, including our Chief Executive Officer, or CEO, and Chief Financial

Officer, or CFO, of the effectiveness of our disclosure controls and procedures as of the end of the period covered by this report as

defined in Exchange Act Rule 13a-15(e) and Rule 15d-15(e). Based on that evaluation, our CEO and CFO have concluded that, as of the end

of the period covered by this report, our disclosure controls and procedures are not effective in ensuring that information required to

be disclosed in our Exchange Act reports is (1) recorded, processed, summarized and reported in a timely manner, and (2) accumulated and

communicated to our management, including our CEO and CFO, as appropriate, to allow for timely decisions regarding required disclosure

because of a material weakness in our control over financial reporting. A material weakness is a deficiency, or a combination of deficiencies,

in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the Company’s

annual or interim financial statements will not be prevented or detected on a timely basis. Specifically, the Company’s management

has concluded that as of May 31, 2024, we had no full-time employees with the requisite expertise in the key functional areas of finance

and accounting. As a result, there is a lack of proper segregation of duties necessary to ensure that all transactions are accounted for

accurately and in a timely manner. This material weakness resulted in the restatement of the Company’s financial statements for

the fiscal year ended May 31, 2023. In light of this material weakness, we performed additional analysis as deemed necessary to ensure

that our financial statements were prepared in accordance with U.S. generally accepted accounting principles. Accordingly, management

believes that the financial statements included in this Annual Report on Form 10-K presents fairly in all material respects our financial

position, results of operations and cash flows for the periods presented.

Our small size and limited resources have prevented

us from being able to employ sufficient resources to enable us to have an adequate level of supervision and segregation of duties. Further

we have limited specific oil and gas accounting personnel in our accounting department due to our small size, lack of resources and limited

technical accountants on staff. This led to material adjustments to oil and gas investment and asset impairment evaluations. It is difficult

for us to effectively segregate accounting duties and have proper financial reporting, which creates a material weakness in internal controls.

This lack of segregation of duties and limited personnel leads management to conclude that our financial reporting disclosure controls

and procedures are not effective to give reasonable assurance that the information required to be disclosed in reports that we file under

the Exchange Act is recorded, processed, summarized and reported as and when required.

Management’s

Report on Internal Control over Financial Reporting

Our management is responsible for establishing and

maintaining adequate internal controls over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)). Under the

supervision and with the participation of our management, including our CEO and CFO, we conducted an evaluation of the effectiveness

of our internal controls over financial reporting based on the framework in Internal Controls – Integrated Framework issued by

the Committee of Sponsoring Organizations of the Treadway Commission. Based on our evaluation under the framework in Internal Control

– Integrated Framework, our management concluded that our internal controls over financial reporting were not effective as of May

31, 2024 because of a material weakness in our control over financial reporting. Specifically, our management has concluded that our

small size and limited resources have prevented us from being able to employ sufficient resources to enable us to have an adequate level

of supervision and segregation of duties. Further we have limited specific oil and gas accounting personnel in our accounting department

due to our small size, lack of resources and limited technical accountants on staff. This led to material adjustments to oil and gas

investment and asset impairment evaluations. It is difficult for us to effectively segregate accounting duties and have proper financial

reporting, which creates a material weakness in our internal controls over financial reporting.

As we grow, we are working on further improving our

segregation of duties and level of supervision.

This

annual report does not include an attestation report of our registered public accounting firm regarding internal control over financial

reporting. Management’s report was not subject to attestation by our registered public accounting firm pursuant to SEC rules adopted

in conformity with the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010.

Changes

in Internal Control over Financial Reporting

There

were no changes in our internal control over financial reporting (as defined in Exchange Rules 13a-15(f) and 15d-15(f)) that occurred

during the year ended May 31, 2024 that have materially affected, or are reasonably likely to materially affect, our internal control

over financial reporting.

Item

9B. Other Information

None.

PART

III

Item

10. Directors, Executive Officers and Corporate Governance

The

following table sets forth as of August 29, 2024, the name, age, and position of each of our executive officers and directors, and the

term of office of each of our executive officers and directors.

| Name |

|

Age |

|

Position

Held |

|

Term

as Director or Officer

Since |

| Donald

Beckham |

|

64 |

|

Independent

Director |

|

March

1, 2011 |

| Michael

H. Price |

|

76 |

|

Independent

Director |

|

August

3, 2012 |

| Mark

See |

|

63 |

|

Chief

Executive Officer and Chairman |

|

October

16, 2009 |

| Bradley

E. Sparks |

|

77 |

|

Chief

Financial Officer, Treasurer and Director |

|

March

1, 2011 |

| |

|

|

|

|

|

|

Each

of our directors serves for a term of three years, until his successor is elected at our annual stockholders’ meeting, and is qualified,

subject to removal by our stockholders. Each officer serves at the pleasure of the Board of Directors.

Set

forth below is certain biographical information regarding each of our executive officers and directors.

DONALD

BECKHAM has served as a director since March 1, 2011. Since July 2015, he has been a Partner with Copestone Energy Partners, LLC.

In 1993 he founded Beckham Resources, Inc. (“BRI”) which for the past 20 years has been a licensed, bonded and insured operator

in good standing with the Railroad Commission of Texas. Through BRI, Mr. Beckham has drilled and operated fields for his own account.

His expertise is in the acquisition, exploitation, exploration and production enhancement of mature oil and gas fields through which

he has been able to enhance production by compressor optimization, pump design, work-over programs, stimulation techniques and identifying

new pay zones. BRI has operated wells in the following fields: Hull, Liberty, Aransas Pass, McCampbell, Mission River, Garcitas Creek,

Sour Lake, Batson, Barton Ranch and Dayton. Prior to BRI, Mr. Beckham was the chief operations manager for Houston Oil Fields Corporation

(“HOFCO”) where he began his career. There he was responsible for drilling, production and field operations and managed approximately

100 people including engineers, geologists, land men, pumpers, and other contract personnel, as well as state and federal environmental

and regulatory functions. He managed an annual capital budget of approximately $30 million and operated approximately 100 wells. HOFCO

drilled about 20 wells per annum and performed approximately 30 recompletions and work over operations each year. HOFCO owned interests

in about 10 key fields principally in Texas, and company-managed production was approximately 1,000 bpd of crude oil and 10 mm cfd of

natural gas. Fields that he managed were as follows: Manvell, Cold Springs, Shepherd, Turtle Bay, Red Fish Bay, Dickinson, Refugio, Lost

Lake, Liberty and Abbeville. Mr. Beckham is a petroleum engineer and 1984 graduate of Mississippi State University.

MICHAEL

H. PRICE, has served as a director since August 1, 2012 and has over 40 years of senior financial and petroleum experience in the

global oil and gas industry. He has been a principal in Octagon Energy Advisors, a Houston based energy investment advisory firm, from

2002 to the present. The firm advises financial institutions and institutional investors participating in energy investments. Since 2008,

he has been a Managing Director at ING Capital which provides debt financing to domestic exploration and production companies. From 1998

through 2002, Mr. Price was the Chief Financial Officer of Forman Petroleum Corporation. Before that, Mr. Price was Managing Director

at Chase Manhattan Bank for fifteen years where he was in charge of technical support for Chase’s worldwide energy merchant banking

activities. In his early career, he worked as a consulting principal on domestic petroleum engineering and landowner matters, and gained

extensive international experience working with major oil companies in a variety of operating positions. He holds a BS and MS from Illinois

Institute of Technology, an MBA from the University of Chicago, a M.Sc. from the London School of Economics, and a MS in Petroleum Engineering

from Tulane University.

Item

10. Directors, Executive Officers and Corporate Governance - continued

MARK

SEE has been our Chief Executive Officer and Chairman of the Board of Directors since October 16, 2009. He has over 25 years of experience

in tunneling, natural resources and the petroleum industries. He was the founder and founding CEO of Rock Well Petroleum, a private oil

& gas company from January 2005 until December 2008 and worked from then until October 2009 forming Laredo Oil. He was employed with

Albian Sands as the Manager for the Alberta Oil Sands Projects at Fort McMurray, Alberta, Canada, a joint venture between Shell Canada

and Chevron. Mr. See was also President of Oil Recovery Enhancement LLC in Bozeman, Montana, a private oil company. He was selected as

one of the top 25 Engineers in North America by the Engineering News Record for his innovations in the petroleum industry. He

is a member of the Society of Mining Engineers and the Society of Petroleum Engineers.

BRADLEY

E. SPARKS is our Chief Financial Officer and Treasurer and has been a director since March 1, 2011. Before joining us in October

2009, Mr. Sparks was the Chief Executive Officer, President and a Director of Visualant, Inc. Prior to joining Visualant, he was the

Chief Financial Officer of WatchGuard Technologies, Inc. from 2005 to 2006. Before joining WatchGuard, he was the founder and managing

director of Sunburst Growth Ventures, LLC, a private investment firm specializing in emerging-growth companies. Previously, he founded

Pointer Communications and served as Chief Financial Officer for several telecommunications and internet companies, including eSpire

Communications, Inc., Digex, Inc., Omnipoint Corporation, and WAM!NET. He also served as Vice President and Treasurer of MCI Communications

from 1988-1993 and as Vice President and Controller from 1993-1995. Before his tenure at MCI, Mr. Sparks held various financial management

positions at Ryder System, Inc. Mr. Sparks currently serves on the Board of Directors of Comrise. Mr. Sparks graduated from the United

States Military Academy at West Point in 1969 and is a former Army Captain in the Signal Corps. He received a Master of Science in Management

degree from the Sloan School of Management at the Massachusetts Institute of Technology in 1975 and is a licensed CPA in Florida.

To

the knowledge of our management, except as noted below, during the past ten years, no present or former director, executive officer or

person nominated to become a director, or an executive officer of the Company has:

| |

(1) |

filed

a petition under the federal bankruptcy laws or any state insolvency law, nor had a receiver, fiscal agent or similar officer appointed

by the court for the business or property of such person, or any partnership in which he was a general partner at or within two years

before the time of such filings; |

| |

(2) |

was

convicted in a criminal proceeding or named subject of a pending criminal proceeding (excluding traffic violations and other minor

offenses); |

| |

(3) |

was

the subject of any order, judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction,

permanently or temporarily enjoining him from or otherwise limiting, the following activities: |

| |

(i) |

acting

as a futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, floor broker, leverage

transaction merchant, any other person regulated by the Commodity Futures Trading Commission, or an associated person of any of the

foregoing, or as an investment adviser, underwriter, broker or dealer in securities, or as an affiliated person, director or employee

of any investment company, bank, savings and loan association or insurance company, or engaging in or continuing any conduct or practice

in connection with such activity; |

| |

(ii) |

engaging

in any type of business practice; or |

| |

(iii) |

engaging

in any activities in connection with the purchase or sale of any security or commodity or in connection with any violation of federal

or state securities laws or federal commodities laws; |

| |

(4) |

was

the subject of any order, judgment, or decree, not subsequently reversed, suspended, or vacated, of any federal or state authority

barring, suspending or otherwise limiting for more than 60 days the right of such person to engage in any activity described above

under this Item, or to be associated with persons engaged in any such activities; |

| |

(5) |

was

found by a court of competent jurisdiction in a civil action or by the Securities and Exchange Commission to have violated any federal

or state securities law, and the judgment in such civil action or finding by the Securities and Exchange Commission has not been

subsequently reversed, suspended, or vacated; |

Item

10. Directors, Executive Officers and Corporate Governance - continued

| |

(6) |

was

found by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to have violated any

federal commodities law, and the judgment in such civil action or finding by the Commodity Futures Trading Commission has not been

subsequently reversed, suspended or vacated; |

| |

(7) |

was

the subject of, or a party to, any federal or state judicial or administrative order, judgment, decree, or finding, not subsequently

reversed, suspended or vacated, relating to an alleged violation of: |

| |

(i) |

Any

federal or state securities or commodities law or regulation; or |

| |

(ii) |

Any