As

filed with the Securities and Exchange Commission on May 5, 2022

Registration

No. 333-_______

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-3

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PetVivo

Holdings, Inc.

(Exact

Name of Registrant as Specified in Its Charter)

| Nevada |

|

99-0363559

|

(State

or Other Jurisdiction of

Incorporation or Organization) |

|

(I.R.S.

Employer

Identification Number) |

5251

Edina Industrial Blvd., Edina, MN 55439

(Address,

Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

John

Lai

Chief

Executive Officer

5251

Edina Industrial Blvd.

Edina,

MN 55439

(952)

405-6216

(Name,

Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies

to:

Laura

M. Holm, Esq.

Patrick

Pazderka, Esq.

Fox

& Rothschild, LLP

Campbell

Mithun Tower

222

S. Ninth St., Suite 2000

Minneapolis

MN 55402-3338

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If

the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box. ☐

If

any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box. ☒

If

this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer” “smaller reporting company”

and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

Non-accelerated

filer ☐ |

Smaller

reporting company ☒ |

| |

|

|

Emerging

growth company ☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the

Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may

be changed. This prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any

state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 4,

2022

PRELIMINARY PROSPECTUS

PetVivo

Holdings, Inc.

$100,000,000

Common

Stock

Preferred Stock

Debt Securities

Warrants

Rights

Units

We

may offer from time to time shares of our common stock, preferred stock, senior debt securities (which may be convertible into or exchangeable

for common stock), subordinated debt securities (which may be convertible into or exchangeable for common stock), warrants, rights and

units that include any of these securities. The aggregate initial offering price of the securities sold under this prospectus will not

exceed $100,000,000. We will offer the securities in amounts, at prices and on terms to be determined at the time of the offering.

Each

time we sell securities hereunder, we will attach a supplement to this prospectus that contains specific information about the terms

of the offering, including the price at which we are offering the securities to the public. The prospectus supplement may also add, update

or change information contained or incorporated in this prospectus. We may also authorize one or more free writing prospectuses to be

provided to you in connection with these offerings. You should read this prospectus, the information incorporated by reference in this

prospectus, the applicable prospectus supplement and any applicable free writing prospectus carefully before you invest in our securities.

The

securities hereunder may be offered directly by us, through agents designated from time to time by us or to or through underwriters or

dealers. If any agents, dealers or underwriters are involved in the sale of any securities, their names, and any applicable purchase

price, fee, commission or discount arrangement between or among them will be set forth, or will be calculable from the information set

forth, in the applicable prospectus supplement. See the section entitled “About This Prospectus” for more information.

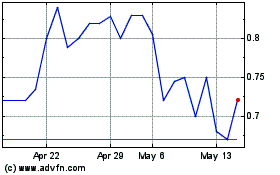

The

aggregate market value of our outstanding common stock held by non-affiliates is $13,922,194 based on 9,988,361 shares of outstanding

common stock, of which 3,163,756 are held by affiliates, and a per share price of $2.04 based on the closing sale price of our common

stock on May 2, 2021. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell our common stock in a public primary

offering with a value exceeding more than one-third of our public float in any 12-month period so long as our public float remains below

$75,000,000. We have not offered any securities pursuant to General Instruction I.B.6. of Form S-3 during the prior 12 calendar month

period that ends on and includes the date of this prospectus

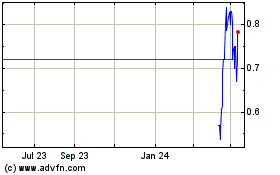

Our

common stock and certain of our outstanding warrants are listed on the NASDAQ Capital Market under the symbols PETV and PETVW, respectively.

Investing

in securities involves certain risks. See “Risk Factors” beginning on page 9 of this prospectus and in the applicable prospectus

supplement, as updated in our future filings made with the Securities and Exchange Commission that are incorporated by reference into

this prospectus. You should carefully read and consider these risk factors before you invest in our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is May __, 2022.

TABLE

OF CONTENTS

The

distribution of this prospectus may be restricted by law in certain jurisdictions. You should inform yourself about and observe any of

these restrictions. If you are in a jurisdiction where offers to sell, or solicitations of offers to purchase, the securities offered

by this document are unlawful, or if you are a person to whom it is unlawful to direct these types of activities, then the offer presented

in this prospectus does not extend to you.

We

have not authorized anyone to give any information or make any representation about us that is different from, or in addition to, that

contained in this prospectus, including in any of the materials that we have incorporated by reference into this prospectus, any accompanying

prospectus supplement, and any free writing prospectus prepared or authorized by us. Therefore, if anyone does give you information of

this sort, you should not rely on it as authorized by us. You should rely only on the information contained or incorporated by reference

in this prospectus and any accompanying prospectus supplement.

You

should not assume that the information contained in this prospectus and any accompanying supplement to this prospectus is accurate on

any date subsequent to the date set forth on the front of the document or that any information we have incorporated by reference is correct

on any date subsequent to the date of the document incorporated by reference, even though this prospectus and any accompanying supplement

to this prospectus is delivered or securities are sold on a later date. Neither the delivery of this prospectus, nor any sale made hereunder,

shall under any circumstances create any implication that there has been no change in our affairs since the date hereof or that the information

incorporated by reference herein is correct as of any time subsequent to the date of such information.

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-3 we filed with the Securities and Exchange Commission, or the SEC, using a

“shelf” registration process. Under this shelf registration process, we may, from time to time, offer and sell any combination

of the securities described in this prospectus in one or more offerings. The aggregate initial offering price of all securities sold

under this prospectus will not exceed $100,000,000.

This

prospectus provides certain general information about the securities that we may offer hereunder. Each time we sell securities, we will

provide a prospectus supplement that will contain specific information about the terms of the offering and the offered securities. We

may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these

offerings. In each prospectus supplement, we will include the following information:

| |

● |

the

number and type of securities that we propose to sell; |

| |

● |

the

public offering price; |

| |

● |

the

names of any underwriters, agents or dealers through or to which the securities will be sold; |

| |

● |

any

compensation of those underwriters, agents or dealers; |

| |

● |

any

additional risk factors applicable to the securities or our business and operations; and |

| |

● |

any

other material information about the offering and sale of the securities. |

In

addition, the prospectus supplement or free writing prospectus may also add, update or change the information contained in this prospectus

or in documents incorporated by reference in this prospectus. The prospectus supplement or free writing prospectus will supersede this

prospectus to the extent it contains information that is different from, or that conflicts with, the information contained in this prospectus

or incorporated by reference in this prospectus. You should read and consider all information contained in this prospectus, any accompanying

prospectus supplement and any free writing prospectus that we have authorized for use in connection with a specific offering, in making

your investment decision. You should also read and consider the information contained in the documents identified under the heading

“Incorporation of Certain Documents by Reference” and “Where You Can Find More Information” in this prospectus.

Unless

the context otherwise requires, the terms “the Company,” “PetVivo,” “we,” “us,” and “our”

in this prospectus each refer to PetVivo Holdings, Inc., our subsidiaries and our consolidated entities.

FORWARD-LOOKING

STATEMENTS

Some

of the statements contained or incorporated by reference in this prospectus may be “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange

Act and may involve material risks, assumptions and uncertainties. Forward-looking statements typically are identified by the use of

terms such as “may,” “will,” “should,” “believe,” “might,” “expect,”

“anticipate,” “intend,” “plan,” “estimate” and similar words, although some forward-looking

statements are expressed differently.

Although

we believe that the expectations reflected in such forward-looking statements are reasonable, these statements are not guarantees of

future performance and involve certain risks and uncertainties that are difficult to predict and which may cause actual outcomes and

results to differ materially from what is expressed or forecasted in such forward-looking statements. These forward-looking statements

speak only as of the date on which they are made and except as required by law, we undertake no obligation to publicly release the results

of any revision or update of these forward-looking statements, whether as a result of new information, future events or otherwise. If

we do update or correct one or more forward-looking statements, you should not conclude that we will make additional updates or corrections

with respect thereto or with respect to other forward-looking statements. A detailed discussion of risks and uncertainties that could

cause actual results and events to differ materially from our forward-looking statements is included in our periodic reports filed with

the SEC and in the “Risk Factors” section of this prospectus.

THE

COMPANY

PetVivo

is a veterinary biotech and biomedical device company headquartered in suburban Minneapolis, Minnesota that is primarily engaged in the

business of commercializing and licensing products in the veterinary market to treat companion animals such as dogs and horses. Most

of our technology was developed for human biomedical applications, and we intend to leverage the investments already expended in their

development to commercialize treatments for pets in a capital and time-efficient way.

Many

of the Company’s products are derived from proprietary biomaterials that simulate a body’s cellular tissue by virtue of their

reliance upon natural protein and carbohydrate compositions which incorporate such “tissue building blocks” as collagen,

elastin and heparin. Since these are naturally-occurring in the body, we believe they have an enhanced biocompatibility with living tissues

compared to synthetic biomaterials such as those based upon alpha-hydroxy polymers (PLA, PLGA and the like) and other “natural”

biomaterials that may lack the multiple proteins incorporated into our biomaterials. These proprietary protein-based biomaterials appear

to mimic the body’s tissue thus allowing integration and tissue repair in long-term implantation in certain applications.

Our

initial product, Kush®, which we rebranded as Spryng™ in the second quarter of our fiscal 2022, is a veterinary

device designed to help reinforce articular cartilage tissue for the treatment and prevention of osteoarthritis and other joint related

afflictions in companion animals. Spryng™ uses an intra-articular injection of non-dissolving, cartilage like patented particles

that are slippery, wet-permeable, durable and resilient to enhance the force cushioning function of the synovial fluid. The particles

mimic natural cartilage in composition, structure and hydration. Multiple joints can be treated simultaneously. Our particles are comprised

of collagen, elastin and heparin, the same components found in natural cartilage. These particles show an effectiveness to augment the

cartilage and enhance the functionality of the joint (e.g. provide cushion or shock-absorbing features to the joint and to provide joint

lubricity).

Osteoarthritis,

a common inflammatory joint disease in both dogs and horses, is a chronic, progressive, degenerative joint disease that is caused by

a loss of synovial fluid and/or the deterioration of joint cartilage. Osteoarthritis affects approximately 14 million dogs and 1 million

horses in the $11 billion companion animal veterinary care and product sales market.

Despite

the market size, veterinary clinics and hospitals have very few treatments and/or drugs for use in treating osteoarthritis in dogs, horses

and other pets. As there is no cure for osteoarthritis, current solutions treat symptoms, but do not manage the cause. The current treatment

for osteoarthritis in dogs generally consists of the use of nonsteroidal anti-inflammatory drugs (or “NSAIDs”) which are

approved to alleviate pain and inflammation but present the potential for side effects relating to gastrointestinal, kidney and liver

damage and do not halt or slow joint degeneration. The Company’s treatment using Spryng™, to our knowledge, has not elicited

any adverse side effects in dogs. Remarkably, Spryng™-treated dogs have shown an increase in activity even after they no longer

are receiving pain medication. Other treatments for osteoarthritis include steroid and/or hyaluronic acid injections, which are used

for treating pain, inflammation and/or joint lubrication, but can be slow acting and/or short lasting.

We

believe Spryng™ is an optimal solution to safely improve joint function in animals for several reasons:

| |

● |

Spryng™

addresses the underlying problem which relate to bones being too close and a lack of synovial fluid. Spryng™ provides a biocompatible

lubricious cushion to the joint, which establishes a barrier between the bones, thereby protecting the remaining cartilage and bone. |

| |

● |

Spryng™

is easily administered with the standard intra-articular injection technique. Multiple joints can be treated simultaneously. |

| |

● |

Case

studies indicate many canines have long-lasting multi-month improvement in lameness after having been treated with Spryng™. |

| |

● |

After

receiving a Spryng™ injection, many canines are able to discontinue the use of NSAID’s, eliminating the risk of negative

side effects. |

| |

● |

Spryng™

is an effective and economical solution for treating osteoarthritis. A single injection of Spryng™ is approximately $600 to

$900 per joint and typically lasts for at least 12 months. |

Historically,

drug sales represent up to 30% of revenues at a typical veterinary practice (Veterinary Practice News). Revenues and margins at veterinary

practices are being eroded because online, big-box and traditional pharmacies have recently started filling veterinary prescriptions.

Veterinary practices are looking for ways to replace lost prescription revenues with safe and effective products. Spryng™ is veterinarian-administered

and should expand practice revenues and margins. We believe that the increased revenues and margins provided by Spryng™ will accelerate

its adoption rate and propel it forward as the standard of care for canine and equine lameness related to or due to synovial joint issues.

Spryng™

is classified as an animal device under the United States Food and Drug Administration (“FDA”) rules and pre-market approval

is not required by the FDA. Spryng™ completed a safety and efficacy study in rabbits in 2007. Since that time, more than 100 horses

and dogs have been successfully treated with Spryng™. We entered into a clinical trial services agreement with Colorado State University

on November 5, 2020. We anticipate this study will be a 12-month study that will be primarily used to expand our distribution outlets

since the large international and national distributors generally require a third-party university study prior to including a product

in their catalog of products. We expect the clinical study to be completed in fiscal 2024.

We

commenced sales Spryng™ in Q2 of fiscal 2022 and plan to increase our commercialization efforts of Spryng™ and other products

developed by us in the United States through the use of in-house marketing personnel who will oversee the efforts of independent distributors

we engage on a regional or national basis. We plan to support our distributors with the use of social media and other methods to educate

and inform key opinion leaders and decision makers at the top distributors and high prescriber veterinarians for companion animals of

the availability and benefits of Spryng™.

We

have established an ISO 7 certified clean room manufacturing facility located in our Minneapolis facility using a patented and scalable

self-assembly production process, which reduces the infrastructure requirements and manufacturing risks to deliver a consistent, high-quality

product while being responsive to volume requirements. While we are not currently manufacturing commercial quantities, we have built

out an ISO 7 certified facility that will be able to handle projected production in units for at least the next five years.

In

addition to Spryng™, we have engaged a strategic partner, Emerald Organic Products, Inc. (“Emerald”), through an exclusive

license agreement, dated July 31, 2019, to allow Emerald to bring our mucoadhesive drug delivery technology to the human nutraceutical

market for the delivery of various active nutraceuticals including cannabidiol (“CBD”), caffeine, and citicoline. Since such

products tout up to a 10-times increase in bioavailability of active agents, we believe that we have an advantage over other delivery

methods in the CBD and nutritional supplement markets. We have agreed that the license to Emerald will include use of PetVivo’s

proprietary technology in the formulation, manufacture and sale of Emerald’s nutritional supplements including its hemp-based CBD

wellness products.

We

also have a pipeline which includes 17 therapeutic devices for both veterinary and human clinical applications. Some such devices may

be regulated by the FDA or other equivalent regulatory agencies, including but not limited to the Center for Veterinary Medicine (“CVM”).

We anticipate growing our product pipeline through the acquisition or in-licensing of additional proprietary products from human medical

device companies specifically for use in pets. In addition to commercializing our own products in strategic market sectors and in view

of the Company’s vast proprietary product pipeline, the Company may establish strategic out-licensing partnerships to provide secondary

revenues.

Risks

Related to Our Business

Our

business, and our ability to execute our business strategy, is subject to a number of risks as more fully described in the section titled

“Risk Factors.” These risks include, among others, the following:

| |

● |

We

have a limited operating history, have not yet generated any material revenues, expect to continue to incur significant research

and development and other expenses, and may never become profitable. |

| |

● |

Our

independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern. |

| |

● |

We

have never generated any material revenue from operations and may need to raise additional capital to achieve our goals. |

| |

● |

We

are substantially dependent on the success of our lead product, Spryng™, and cannot be certain that this product will be successfully

commercialized by us. |

| |

● |

We

have a limited marketing and sales organization, and if our current marketing and sales personnel are insufficient or inadequate,

we may not be able to sell our products in the quantities needed to become commercially successful. |

| |

● |

Our

business will depend significantly on the sufficiency and effectiveness of our marketing and product promotional programs and incentives. |

| |

● |

Our

lead product, Spryng™, will face significant competition in our industry, and our failure to compete effectively may prevent

us from achieving any significant market penetration. |

Corporate

History and Structure

We

were incorporated as Pharmascan Corp. in the State of Nevada on March 31, 2009. On September 21, 2010, we filed a Certificate of Amendment

to our Articles of Incorporation and changed our name to Technologies Scan Corp. On April 1, 2014, we filed a Certificate of Amendment

to our Articles of Incorporation and changed our name to PetVivo Holdings, Inc. On March 11, 2014, our Board of Directors authorized

the execution of a securities exchange agreement dated March 11, 2014 (the “Securities Exchange Agreement”) with PetVivo

Inc., a Minnesota corporation. PetVivo was founded in 2013 by John Lai and John Dolan and engaged in the business of acquiring, in-licensing

and adapting human biomedical technology and products for commercial sale in the veterinary market.

In

accordance with the terms and provisions of the Securities Exchange Agreement, we acquired all of the issued and outstanding shares of

stock of PetVivo and it became our wholly-owned subsidiary. John Lai and John Dolan were controlling shareholders of PetVivo Holdings,

Inc at the time of the securities exchange. In August of 2013, in exchange for 326,250 shares of the Company’s common stock, PetVivo

entered into an exclusive worldwide license for the commercialization of a patented biomaterials technology for the veterinary treatment

of animals having orthopedic joint afflictions (“Technology”). The Technology was developed by Gel-Del Technologies Inc.,

a Minnesota corporation (“Gel-Del”). Gel-Del was a biomaterials development and manufacturing company focused on human and

companion animal applications of its biomaterials technology; our initial product, Spryng™, is derived from the licensed Technology.

Thereafter,

a wholly-owned subsidiary of ours (which was incorporated in Minnesota expressly for this transaction) completed a triangular merger

(the “Merger”) with Gel-Del. Pursuant to the Merger, Gel-Del was the surviving entity and concurrently became our wholly-owned

subsidiary, resulting in our obtaining full ownership of Gel-Del. Our primary reason to effect the Merger was to obtain 100% ownership

and control of Gel-Del and its patented bioscience technology, including ownership of Cosmeta, a subsidiary of Gel-Del. The effective

date for the Merger was April 10, 2017 when the Merger was filed officially with the Secretary of State of Minnesota.

Our

principal executive office is located at 5251 Edina Industrial Blvd., Minneapolis, MN 55439 and our telephone number is (952) 405-6216.

Our website is www.petvivo.com. Information contained in, or that can be accessed through, our website is not incorporated by reference

into this prospectus, and you should not consider information on our website to be part of this prospectus. Our design logo and our other

registered and common law trade names, trademarks and service marks are the property of PetVivo, Inc.

RISK

FACTORS

An

investment in our securities involves a high degree of risk. Before making any investment decision, you should carefully consider the

risk factors set forth below, the information under the caption “Risk Factors” in any applicable prospectus supplement, any

related free writing prospectus that we may authorize to be provided to you and the information under the caption “Risk Factors”

in our Annual Report on Form 10-K for our fiscal year ended March 31, 2021 (“2021 Form 10-K”) and quarterly reports on Form

10-Q that are incorporated by reference into this prospectus, as updated by our subsequent filings under the Securities Exchange Act

of 1934, as amended, or the Exchange Act.

These

risks could materially affect our business, results of operations or financial condition and affect the value of our securities. Additional

risks and uncertainties that are not yet identified may also materially harm our business, operating results and financial condition

and could result in a complete loss of your investment. You could lose all or part of your investment. For more information, see “Where

You Can Find More Information.”

Risks

Related to Our Securities and the Offering

Future

sales or other dilution of our equity could depress the market price of our common stock.

Sales

of our common stock, preferred stock, warrants, rights or convertible debt securities, or any combination of the foregoing, in the public

market, or the perception that such sales could occur, could negatively impact the price of our common stock.

In

addition, the issuance of additional shares of our common stock, securities convertible into or exercisable for our common stock, other

equity-linked securities, including preferred stock, warrants or rights or any combination of these securities pursuant to this prospectus

will dilute the ownership interest of our common shareholders and could depress the market price of our common stock and impair our ability

to raise capital through the sale of additional equity securities.

We

may need to seek additional capital. If this additional financing is obtained through the issuance of equity securities, debt securities

convertible into equity or options, warrants or rights to acquire equity securities, our existing shareholders could experience significant

dilution upon the issuance, conversion or exercise of such securities.

Our

management will have broad discretion over the use of the proceeds we receive from the sale our securities pursuant to this prospectus

and might not apply the proceeds in ways that increase the value of your investment.

Our

management will have broad discretion to use the net proceeds from any offerings under this prospectus, and you will be relying on the

judgment of our management regarding the application of these proceeds. Except as described in any prospectus supplement or in any related

free writing prospectus that we may authorize to be provided to you, the net proceeds received by us from our sale of the securities

described in this prospectus will be added to our general funds and will be used for general corporate purposes. Our management might

not apply the net proceeds from offerings of our securities in ways that increase the value of your investment and might not be able

to yield a significant return, if any, on any investment of such net proceeds. You may not have the opportunity to influence our decisions

on how to use such proceeds.

USE

OF PROCEEDS

Except

as may be stated in the applicable prospectus supplement and any related free writing prospectus that we may authorize to be provided

to you, we intend to use the net proceeds we receive from the sale of the securities offered by this prospectus for general corporate

purposes, which may include, among other things, repayment of debt, repurchases of common stock, capital expenditures, the financing

of possible acquisitions or business expansions, increasing our working capital and the financing of ongoing operating expenses and overhead.

EXECUTIVE

COMPENSATION

The

Company qualifies as a “smaller reporting company” under rules adopted by the SEC. Accordingly, the Company has provided

scaled executive compensation disclosure that satisfies the requirements applicable to the Company in its status as a smaller reporting

company. Under the scaled disclosure obligations, the Company is not required to provide, among other things, a compensation discussion

and analysis or a compensation committee report, and certain other tabular and narrative disclosures relating to executive compensation.

Our

named executive officers (“Named Executive Officers” or “NEO’s”) for fiscal year ended March 31, 2022 (“fiscal

2022”) were as follows:

John

Lai, our Chief Executive Officer and President;

Robert

Folkes, our Chief Financial Officer; and

Randall

Meyer, our Chief Operating Officer.

Certain

information regarding the compensation of our Named Executive Officer for our fiscal years ended March 31, 2021 (“fiscal 2021”)

and March 31, 2022 (“fiscal 2022”) is provided on the following pages.

SUMMARY

COMPENSATION TABLE

The

following table sets forth information regarding the compensation paid to or earned by our Named Executive Officers for fiscal 2021 and

2022.

Name and Principal Position | |

Year | | |

Salary ($) | | |

Bonus ($)(1) | | |

Stock Awards ($)(2) | | |

Non-Equity Incentive Plan Compensation ($) | | |

All Other Compensation ($)(3) | | |

Total ($) | |

John Lai

CEO and President | |

| 2022 2021 | | |

| 202,083 91,668 | | |

| 20,000 0 | | |

| 481,500 148,602 | | |

| —

— | | |

$

| 6,160

| | |

$

$ | 709,743 240,270 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

Robert J. Folkes Chief Financial Officer(4) | |

| 2022 | | |

| 211,250 | | |

| 100,000 | | |

| 173,340 | | |

| — | | |

$ | 3,348 | | |

$ | 487,938 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

Randall Meyer Chief Operating Officer(5) | |

| 2022 | | |

| 128,333 | | |

| 30,000 | | |

| 208,650 | | |

| — | | |

| | | |

$ | 366,983 | |

| (1) |

Amounts

reported represent discretionary bonus payments on amounts earned in fiscal 2022, which will be paid after the Company files its

Annual Report on 10-K for fiscal 2022 with the SEC. |

| |

|

| (2) |

Amounts

shown represent grant date fair value computed in accordance with ASC Topic 718, with respect to restricted stock awards (based on the

closing price of our common stock on the grant date) and stock option awards. Information

regarding the valuation assumptions used in the calculations are included in “Note 15 – Common Stock and Warrants”

of our audited consolidated financial statements included in our 2021 Form 10-K. |

| |

|

| (3) |

Represents

the payment of health insurance premiums by the Company for Mr. Lai and Mr. Folkes. |

| |

|

| (4) |

Mr.

Folkes was appointed to serve as the Company’s Chief Financial Officer on April 14, 2021. |

| |

|

| (5) |

Mr.

Meyer was appointed to serve as the Company’s Chief Operating Officer on September 10, 2021. |

Narrative

Disclosure to the Summary Compensation table

The

following is a discussion of certain terms that we believe are necessary to understand the information disclosed in the Summary Compensation

Table.

Base

Salaries

The

Company’s Named Executive Officers receive a base salary for services rendered to the Company, which is set forth in their respective

employment agreements. The base salary payable to each Named Executive Officer is intended to provide a fixed component of compensation

reflecting the executive’s skill set, experience, role, and responsibilities. From April 1, 2020, through September 8, 2021, Mr.

Lai received a base salary of $100,000 which was increased to $275,000, effective as of September 1, 2022. Mr. Folkes joined the Company

on April 14, 2021, and his initial salary was $190,000 per year, which was increased to $240,000 per year effective as of September 1,

2022. Mr. Meyer joined the Company, as its Chief Operating Officer, on September 1, 2021 and his base salary is $220,000 per year.

Bonuses

In

November 2021, the Company established a bonus plan for its executives and employees, with a performance target based on total revenues.

If the Company achieved the performance target, each employee would receive a bonus equal to a certain percentage of his or her salary.

In December 2021, the Company realized that the performance target would not be achieved because the Company’s ability to

sell its lead product, Spryng™, was limited because it did not have canine and equine studies which distributors and other vendors

needed to review before purchasing the Company’s products. The Compensation Committee determined that the performance target was

unrealistic and not an appropriate target for the Company at this time. The Compensation Committee believed that the executives and other

employees had done exceptional work in transitioning the Company from being a start-up company to a revenue-producing company. As such,

the Compensation Committee awarded discretionary bonuses to the executives and other employees. The Compensation Committee awarded discretionary

bonuses to Mr. Lai, Mr. Folkes, and Mr. Meyers for their services in fiscal 2022 in the amounts of $20,000, $100,000, and $30,000, respectively.

The Company will not make these bonus payments to the Named Executive Officers until its files its 10-K for its fiscal year ended March

31, 2022.

Equity

Compensation

Our

Compensation Committee administers our 2020 Equity Incentive Plan (the “Equity Incentive Plan”) and approves the amount of,

and terms applicable to, grants of stock options, restricted stock units, and other types of equity awards to employees, including the

Named Executive Officers. The Equity Incentive Plan permits the grant of incentive stock options, non-statutory stock options, stock

appreciation rights, restricted stock, restricted stock units (“RSU’s), and stock bonus awards (all such types of awards,

collectively, “equity awards”), although incentive stock options may only be granted to employees.

On

April 14, 2021, the Company granted 54,000 RSU’s to Mr. Folkes pursuant to the terms of his employment agreement. These RSU’s

vest over a three year period, with 10,000 RSU’s vesting on January 1, 2022, 10,000 vesting on January 1, 2023, and 14,000 vesting

on January 1, 2024. Furthermore, these RSU grants are subject to Mr. Folkes remaining employed at the Company.

On

September 9, 2021, the Compensation Committee granted RSU’s to our Named Executive Officers for their exceptional performance in

assisting the Company in closing its public offering in which it raised $11.2 million in gross proceeds and listed its common stock and

warrants on the NASDAQ Capital Market. The Named Executive Officers received the following RSU grants (“November 2021 RSU Grants”):

Mr. Lai – 150,000 RSU’s, Mr. Folkes – 54,000 RSU’s, and Mr. Meyer – 65,000 RSU’s. These RSU’s

vest in three installments, with 1/3 vesting on March 31, 2022, 1/3 vesting on March 31, 2023 and 1/3 vesting on March 31, 2024, based

upon continued employment with the Company.

For

the grant date fair values of the options and RSU’s, please see the Summary Compensation Table above.

Perquisites

We

offer health insurance to our Named Executive Officers on the same basis that these benefits are offered to our other eligible employees.

We offer a 401(k) plan to all eligible employees. The Company also provides other benefits to its Named Executive Officers on the same

basis as provided to all of its employees, including vacation and paid holidays.

OUTSTANDING

EQUITY AWARDS AT FISCAL YEAR END 2022

The

following table sets forth for each Named Executive Officer, information regarding outstanding equity awards as of March 31, 2022. The

option awards and per share amounts for all periods reflect our 1-for-4 reverse stock split, which was effective November 20, 2020. Market

value is based on the closing stock price of $2.04 on March 31, 2022.

| | |

Option Awards | | |

Stock Awards | |

| Name | |

Number of securities underlying unexercised options exercisable (#) | | |

Number of securities underlying unexercised options unexercisable (#) | | |

Option exercise price ($) | | |

Option expiration date | | |

Number of shares or units of stock that have not vested (#) | | |

Market value of shares or units of stock that have not vested ($)(1) | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| John Lai | |

| 75,000 | (1) | |

| 60,000 | (1) | |

| 2.24 | | |

| 10/31/2024 | | |

| 100,000 | (2) | |

$ | 204,000 | |

| | |

| 19,847 | | |

| — | | |

| 1.95 | | |

| 12/31/2024 | | |

| — | | |

| — | |

| | |

| 24,253 | | |

| — | | |

| 1.27 | | |

| 3/31/2025 | | |

| — | | |

| — | |

| | |

| 7,441 | | |

| — | | |

| 1.60 | | |

| 6/30/2025 | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Robert J. Folkes | |

| — | | |

| — | | |

| — | | |

| — | | |

| 60,000 | (3) | |

$ | 122,400 | |

| | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Randall Meyer | |

| 10,547 | | |

| — | | |

| 1.20 | | |

| 1/15/2029 | | |

| 43,333 | (4) | |

$ | 88,399 | |

| | |

| 1,213 | | |

| — | | |

| 1.95 | | |

| 12/31/2024 | | |

| — | | |

| — | |

| | |

| 1,104 | | |

| — | | |

| 1.27 | | |

| 3/31/2025 | | |

| — | | |

| — | |

| | |

| 559 | | |

| — | | |

| 1.60 | | |

| 6/30/2025 | | |

| — | | |

| — | |

| | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| (1) |

Mr.

Lai was granted a warrant to purchase up to 135,000 shares of our common stock at an exercise price of $2.24 per share pursuant to

his employment agreement. The warrants have a five-year term and 90,000 warrants vest quarterly over a three-year term and 45,000

warrants vest based on certain performance conditions; 22,500 of which have expired and 22,500 of which vest if the Company completes

a successful listing on the Exchange and sustains a stock price of at least $16.00 for the thirty consecutive days of trading. |

| |

|

| (2) |

Comprised

of 100,000 unvested shares underlying an RSU award granted on September 9, 2021, which will vest in equal installments on March 31,

2023, and March 31, 2024, subject to the executive’s continued employment with the Company. The RSU’s will vest automatically

if there is a Change of Control (as defined in our Equity Incentive Plan). |

| |

|

| (3) |

Comprised

of 24,000 unvested shares underlying an RSU award granted on April 14, 2021, with 10,000 shares vesting on January 1, 2023, and 14,000

shares vesting on January 1, 2024, and 36,000 unvested shares underlying an RSU award granted on September 9, 2021, which will vest

in equal installments on March 31, 2023, and March 31, 2024, with both RSU awards subject to the executive’s continued employment

with the Company. The RSU’s will vest automatically if there is a change of control (as defined in our Equity Incentive Plan.) |

| |

|

| (4) |

Comprised

of 43,333 unvested shares underlying an RSU award granted on September 9, 2021, which will vest in equal installments on March 31,

2023, and March 31, 2024, subject to the executive’s continued employment with the Company. The RSU’s will vest automatically

if there is a Change of Control ( as defined in our Equity Incentive Plan). |

Executive

Employment Agreements

Prior

Employment Agreements

The

Company entered into an employment agreement (“2019 Agreement”) with John Lai on October 1, 2019, to serve as the Company’s

Chief Executive Officer for a term of 3 years. Mr. Lai’s annual base salary was a minimum of $100,000 or such higher amount, as

determined by the Board. Mr. Lai could be terminated for Cause or without cause upon ten (10) days advance written notice. Mr. Lai was

eligible to receive discretionary bonuses, as determined by the Board, and eligible for all employee benefits provided to executives

of similar tenure. His 2019 Agreement contained customary confidentiality and non-competition provisions which survived for a period

of one year after his employment with the Company was terminated. As discussed below, Mr. Lai’s 2019 Agreement was replaced with

a new employment agreement on November 10, 2021.

The

Company entered into an employment agreement (“April 2021 Agreement”) with Robert Folkes on April 14, 2021, to serve as the

Company’s Chief Financial Officer. The employment

agreement was for a term of approximately two years and nine months and terminated on January 31, 2024. Mr. Folkes’ annual base

salary was $190,000 per year and he was eligible to receive a bonus of up to 50% of his base salary

based upon the achievement of performance goals developed by the Compensation Committee. He could be terminated for cause or without

cause upon ten (10) days advance written notice. His employment agreement contained customary confidentiality

and non-competition provisions which survived for a period of one year after his employment with the Company was terminated. As discussed

below, Mr. Folkes April 2021 Agreement was replaced with a new employment agreement on November 10, 2021

Current

Employment Agreements

Effective

as of November 10, 2021, the Company entered into new employment agreements with Mr. Lai, which replaced his 2019 Agreement, and Mr.

Folkes which replaced his April 2021 Agreement. In addition, the Company entered into a new employment agreement with Randall Meyer to

serve as the Company’s Chief Operating Officer effective as of November 10, 2021. With the exception of salary and severance payments,

the employment agreements are substantially similar.

All

of these employment agreements expire on September 30, 2024. Messrs. Lai, Folkes, and Meyer each have annual base salaries of $275,000,

$240,000 and $220,000, respectively, subject to potential increase or decrease from time to time as determined by the Compensation Committee

of the Board of Directors. The employment agreements also provide for a target annual bonus as determined by the Compensation Committee.

In addition to an annual salary and bonus, the employment agreements provide that the executive officers are entitled to participate

in any equity and/or long-term compensation programs established by the Company for senior executive officers and all of the Company’s

retirement, group life, health, and disability insurance plans and any other employee benefit plans.

The

employment agreements provide for termination of the executive officers at any time by the Company for Cause (as defined in the employment

agreements) or without Cause. If an executive officer is terminated for Cause, he will receive his salary through the termination date

and reimbursement of any unpaid expenses and accrued but unused vacation/paid time off (“Accrued Obligations”). If the executive

officer’s employment is terminated by the Company without Cause, subject to the execution of a release of any and all claims or

potential claims against the Company, the executive officer will be entitled to receive a severance payment, his accrued but unpaid bonus,

if any, and any Accrued Obligations owed through the termination date, in a lump sum payment within 10 days after the termination date.

Mr. Folkes will receive a severance payment equal to 6 months of his base salary. Mr. Lai and Mr. Meyer will each receive a severance

payment equal to 1 month’s base salary. If the executive’s employment is terminated as a result of his death or disability,

he or his estate will receive his compensation through the date of termination, his accrued and unpaid bonus, if any, and Accrued Obligations

through the date of termination.

Each

executive officer is required to agree to non-competition, non-solicitation, and confidentiality obligations. The confidentiality covenants

are perpetual, while the non-compete and non-solicitation covenants apply during the term of the new employment agreements and for 12

months following the executive officer’s termination.

Potential

Payments on Change in Control or Termination without Cause under November RSU Grants

The

employment agreements for Mr. Lai, Mr. Folkes, and Mr. Meyer do not contain any provisions providing for the acceleration of any salary

or bonus payments if there is a change in control. The RSU Grants awarded to Mr. Lai, Mr. Folkes, and Mr. Meyer on September 9, 2021,

and to Mr. Folkes on April 14, 2021 pursuant to our Equity Incentive Plan contain provisions that provide for accelerated vesting of

the RSU’s if there is a change of control of the Company (as such term is defined in the Equity Incentive Plan). In addition, if

Mr. Lai, Mr. Folkes, or Mr. Meyer is terminated without cause, any RSU’s that would have vested on or before the first anniversary

of such termination had the executive remained employed shall be accelerated and deemed to have vested as of the termination date. Any

time-based Restricted Shares that have not vested as described above may not be transferred and will be forfeited on the date the Named

Executive Officer’s employment with the Company terminates.

Director

Compensation

Directors

who are not employees of the Company are paid director’s fees, in cash, stock, or a combination thereof. In fiscal 2022, we did

not pay any cash compensation to our non-employee directors. All compensation was paid with stock and RSU’s, which ½ of

the compensation paid with stock on October 1, 2021, the date of grant, and the remaining RSU’s vesting six months from the date

of grant. In fiscal 2022, our non-employee directors received the following compensation for their services: each non-employee director

received an annual retainer of $40,000; the Chairman received an additional $10,000; each non-employee director serving as a chair of

a standing committee received an additional $5,000 and each non-employee director who served on two or more committee received an additional

$2,500 per year.

The

following table provides information on compensation paid to our non-employee directors for their services as members of our board of

directors during our fiscal year ended March 31, 2022:

| Name of Director | |

Fees paid in cash

($) | | |

Stock awards ($)(1) | | |

Warrant awards ($)(2) | | |

All other compensation ($) | | |

Total ($) | |

| Gregory Cash | |

$ | — | | |

$ | 51,999 | | |

$ | — | | |

$ | 130,000 | (3) | |

$ | 181,999 | |

| David Deming | |

$ | — | | |

$ | 39,901 | | |

$ | — | | |

$ | 120,901 | (3) | |

$ | 120,901 | |

| Joseph Jasper | |

$ | — | | |

$ | 22,499 | | |

$ | — | | |

$ | — | | |

$ | 22,499 | |

| Scott M. Johnson | |

$ | — | | |

$ | 38,899 | | |

$ | — | | |

$ | — | | |

$ | 38,899 | |

| James Martin | |

$ | — | | |

$ | 22,499 | | |

$ | — | | |

$ | — | | |

$ | 22,499 | |

| Dr. David Masters(4) | |

$ | — | | |

$ | 19,999 | | |

$ | — | | |

$ | 77,218 | (3) | |

$ | 97,217 | |

| Robert Rudelius | |

$ | — | | |

$ | 22,499 | | |

$ | — | | |

$ | — | | |

$ | 22,499 | |

| (1) |

The

value in this column reflects the aggregate grant date fair value of the stock award as computed in accordance with ASC Topic 718.

Information regarding the valuation assumptions used in the calculations are included in “Note 15 – Common Stock and

Warrants” to our audited consolidated financial statements included in our 2021 Form 10-K. |

| |

|

| (2) |

The

value in this column reflects the aggregate grant date fair value of the warrants as computed in accordance with ASC Topic 718. Information

regarding the valuation assumptions used in the calculations are included in “Note 15 – Common Stock and Warrants”

to our audited consolidated financial statements included in our 2021 Form 10-K. As of March 31, 2022, the aggregate number of outstanding

warrants held by Mr. Cash was 27,099; for Mr. Deming was 57,354; for Mr. Jasper was 48,225; for Mr. Johnson was 25,376, for Mr. Martin

was 22,500 and for Mr. Rudelius was 44,135. |

| |

|

| (3) |

Represents

consulting fees paid to these directors. |

| |

|

| (4) |

Mr.

Masters was no longer a member of the Board effective as of March 5, 2022. |

DESCRIPTION

OF CAPITAL STOCK

The

following is a summary of our capital stock and certain provisions of our Articles of Incorporation and Bylaws. This summary does not

purport to be complete and is qualified in its entirety by the provisions of our articles of incorporation, as amended, our bylaws, and

applicable provisions of the Nevada Revised Statutes or the NRS.

See

“Where You Can Find More Information” elsewhere in this prospectus for information on where you can obtain copies of our

articles of incorporation and our bylaws, which have been filed with and are publicly available from the SEC.

Our

authorized capital stock consists of 250,000,000 shares of common stock, par value $0.001 per share, and 20,000,000 shares of preferred

stock, par value $0.001 per share.

DESCRIPTION

OF COMMON STOCK

As

of May 4, 2022, there were 9,988,361 shares of our common stock issued outstanding held by approximately 212 stockholders of record.

General

The

following summary of certain provisions of our common stock does not purport to be complete. This description is summarized from, and

is qualified in its entirety by reference to, our amended and restated articles of incorporation, as amended and our bylaws, as amended

to which you should refer and both of which are included as exhibits to the registration statement of which this prospectus is a part.

The summary below is also qualified by provisions of applicable law, including Chapters 78 and 92A of the Nevada Revised Statutes (the

“NRS”), as applicable to corporations.

Voting,

Dividend, and Other Rights. Each outstanding share of common stock entitles the holder to one vote on all matters presented to the

shareholders for a vote. Holders of shares of common stock have no cumulative voting, pre-emptive, subscription, or conversion rights.

All shares of common stock to be issued pursuant to this registration statement will be duly authorized, fully paid and non-assessable.

Our board of directors determines if and when distributions may be paid out of legally available funds to the holders. To date, we have

not declared any dividends with respect to our common stock. Our declaration of any cash dividends in the future will depend on our board

of directors’ determination as to whether, in light of our earnings, financial position, cash requirements and other relevant factors

existing at the time, it appears advisable to do so. We do not anticipate paying cash dividends on the common stock in the foreseeable

future.

Rights

Upon Liquidation. Upon liquidation, subject to the right of any holders of the preferred stock to receive preferential distributions,

each outstanding share of common stock may participate pro rata in the assets remaining after payment of, or adequate provision for,

all our known debts and liabilities.

Majority

Voting. The holders of one-third of the outstanding shares of common stock constitute a quorum at any meeting of the shareholders.

A plurality of the votes cast at a meeting of shareholders elects our directors. The common stock does not have cumulative voting rights.

Therefore, the holders of a majority of the outstanding shares of common stock can elect all of our directors. In general, a majority

of the votes cast at a meeting of shareholders must authorize shareholder actions other than the election of directors. Most amendments

to our articles of incorporation require the vote of the holders of a majority of all outstanding voting shares.

All

issued and outstanding shares of common stock are fully paid and nonassessable. Shares of our common stock that may be offered, from

time to time, under this prospectus will be fully paid and nonassessable.

Transfer

Agent and Registrar

The

transfer agent and registrar for our common stock is Equity Stock Transfer. Equity Stock Transfer’s address is 237 W. 37th Street,

Suite 601, New York, NY 10018 and its telephone number is (212) 575-5757.

Stock

Exchange Listing

Our

common stock is listed for quotation on the Nasdaq Capital Market under the symbol “PETV.”

DESCRIPTION

OF PREFERRED STOCK

As

of May 4, 2022, no shares of preferred stock had been issued or were outstanding.

The

following summary of certain provisions of our preferred stock does not purport to be complete. This description is summarized from,

and is qualified in its entirety by reference to, our amended and restated articles of incorporation and our amended and restated bylaws,

to which you should refer and both of which are included as exhibits to the registration statement of which this prospectus is a part.

The summary below is also qualified by provisions of applicable law, including Chapters 78 and 92A of the NRS as applicable to corporations.

General

Our

board of directors has the authority to issue up to 20,000,000 shares of preferred stock in one or more series and to determine the rights

and preferences of the shares of any such series without stockholder approval. Our board of directors may issue preferred stock in one

or more series and has the authority to fix the designation and powers, rights and preferences and the qualifications, limitations or

restrictions with respect to each class or series of such class without further vote or action by the stockholders, unless action is

required by applicable law or the rules of any stock exchange on which our securities may be listed. The ability of our board of directors

to issue preferred stock without stockholder approval could have the effect of delaying, deferring or preventing a change of control

of us or the removal of existing management. Further, our board of director may authorize the issuance of preferred stock with voting

or conversion rights that could adversely affect the voting power or other rights of the holders of our common stock. Additionally, the

issuance of preferred stock may have the effect of decreasing the market price of our common stock.

We

will file as an exhibit to the registration statement of which this prospectus is a part, or will incorporate by reference from reports

that we file with the SEC, the form of any certificate of designation that describes the terms of the series of preferred stock we are

offering before the issuance of that series of preferred stock. This description will include, but not be limited to, the following:

| |

● |

the

title and stated value; |

| |

● |

the

number of shares we are offering; |

| |

● |

the

liquidation preference per share; |

| |

● |

the

purchase price; |

| |

● |

the

dividend rate, period and payment date and method of calculation for dividends; |

| |

● |

whether

dividends will be cumulative or non-cumulative and, if cumulative, the date from which dividends will accumulate; |

| |

● |

the

provisions for a sinking fund, if any; |

| |

● |

the

provisions for redemption or repurchase, if applicable, and any restrictions on our ability to exercise those redemption and repurchase

rights; |

| |

● |

whether

the preferred stock will be convertible into our common stock, and, if applicable, the conversion price, or how it will be calculated,

and the conversion period; |

| |

● |

whether

the preferred stock will be exchangeable into debt securities, and, if applicable, the exchange price, or how it will be calculated,

and the exchange period; |

| |

● |

voting

rights, if any, of the preferred stock; |

| |

● |

preemptive

rights, if any; |

| |

● |

restrictions

on transfer, sale or other assignment, if any; |

| |

● |

a

discussion of any material United States federal income tax considerations applicable to the preferred stock; |

| |

● |

the

relative ranking and preferences of the preferred stock as to dividend rights and rights if we liquidate, dissolve or wind up our

affairs; |

| |

● |

any

limitations on the issuance of any class or series of preferred stock ranking senior to or on a parity with the series of preferred

stock as to dividend rights and rights if we liquidate, dissolve or wind up our affairs; and |

| |

● |

any

other specific terms, preferences, rights or limitations of, or restrictions on, the preferred stock. |

Transfer

Agent and Registrar

The

transfer agent and registrar for our preferred stock will be set forth in the applicable prospectus supplement.

DESCRIPTION

OF DEBT SECURITIES

General

We

may issue debt securities, in one or more series, as either senior or subordinated debt or as senior or subordinated convertible debt.

When we offer to sell debt securities, we will describe the specific terms of any debt securities offered from time to time in a supplement

to this prospectus, which may supplement or change the terms outlined below. Senior debt securities will be issued under one or more

senior indentures, dated as of a date prior to such issuance, between us and a trustee to be named in a prospectus supplement, as amended

or supplemented from time to time. Any subordinated debt securities will be issued under one or more subordinated indentures, dated as

of a date prior to such issuance, between us and a trustee to be named in a prospectus supplement, as amended or supplemented from time

to time. The indentures will be subject to and governed by the Trust Indenture Act of 1939, as amended.

Before

we issue any debt securities, the form of indentures will be filed with the SEC and incorporated by reference as an exhibit to the registration

statement of which this prospectus is a part or as an exhibit to a current report on Form 8-K. For the complete terms of the debt securities,

you should refer to the applicable prospectus supplement and the form of indentures for those particular debt securities. We encourage

you to read the applicable prospectus supplement and the form of indenture for those particular debt securities before you purchase any

of our debt securities.

We

will describe in the applicable prospectus supplement the terms of the series of debt securities being offered, including:

| |

● |

the

title; |

| |

● |

whether

or not such debt securities are guaranteed; |

| |

● |

the

principal amount being offered, and if a series, the total amount authorized and the total amount outstanding; |

| |

● |

any

limit on the amount that may be issued; |

| |

● |

whether

or not we will issue the series of debt securities in global form, the terms and who the depositary will be; |

| |

● |

the

maturity date; |

| |

● |

the

annual interest rate, which may be fixed or variable, or the method for determining the rate and the date interest will begin to

accrue, the dates interest will be payable and the regular record dates for interest payment dates or the method for determining

such dates; |

| |

● |

whether

or not the debt securities will be secured or unsecured, and the terms of any secured debt; |

| |

● |

the

terms of the subordination of any series of subordinated debt; |

| |

● |

the

place where payments will be payable; |

| |

● |

restrictions

on transfer, sale, or other assignment, if any; |

| |

● |

our

right, if any, to defer payment of interest and the maximum length of any such deferral period; |

| |

● |

the

date, if any, after which, and the price at which, we may, at our option, redeem the series of debt securities pursuant to any optional

or provisional redemption provisions and the terms of those redemption provisions; |

| |

● |

the

date, if any, on which, and the price at which we are obligated, pursuant to any mandatory sinking fund or analogous fund provisions

or otherwise, to redeem, or at the holder’s option to purchase, the series of debt securities and the currency or currency

unit in which the debt securities are payable; |

| |

● |

any

restrictions our ability and/or the ability of our subsidiaries to: |

| |

● |

incur

additional indebtedness; |

| |

● |

issue

additional securities; |

| |

● |

create

liens; |

| |

● |

pay

dividends and make distributions in respect of our capital stock and the capital stock of our subsidiaries; |

| |

● |

redeem

capital stock; |

| |

● |

place

restrictions on our subsidiaries’ ability to pay dividends, make distributions or transfer assets; |

| |

● |

make

investments or other restricted payments; |

| |

● |

sell

or otherwise dispose of assets; |

| |

● |

enter

into sale-leaseback transactions; |

| |

● |

engage

in transactions with stockholders and affiliates; |

| |

● |

issue

or sell stock of our subsidiaries; or |

| |

● |

effect

a consolidation or merger; |

| |

● |

whether

the indenture will require us to maintain any interest coverage, fixed charge, cash flow-based, asset-based or other financial ratios; |

| |

● |

a

discussion of any material United States federal income tax considerations applicable to the debt securities; |

| |

● |

information

describing any book-entry features; |

| |

● |

provisions

for a sinking fund purchase or other analogous fund, if any; |

| |

● |

the

denominations in which we will issue the series of debt securities; |

| |

● |

the

currency of payment of debt securities if other than U.S. dollars and the manner of determining the equivalent amount in U.S. dollars;

and |

| |

● |

any

other specific terms, preferences, rights or limitations of, or restrictions on, the debt securities, including any additional events

of default or covenants provided with respect to the debt securities, and any terms that may be required by us or advisable under

applicable laws or regulations. |

Conversion

or Exchange Rights

We

will set forth in the prospectus supplement the terms on which a series of debt securities may be convertible into or exchangeable for

our common stock or our other securities. We will include provisions as to whether conversion or exchange is mandatory, at the option

of the holder or at our option. We may include provisions pursuant to which the number of shares of our common stock or our other securities

that the holders of the series of debt securities receive would be subject to adjustment.

DESCRIPTION

OF WARRANTS

We

may issue warrants for the purchase of common stock, preferred stock and/or debt securities in one or more series. We may issue warrants

independently or together with common stock, preferred stock and/or debt securities, and the warrants may be attached to or separate

from these securities. While the terms summarized below will apply generally to any warrants that we may offer, we will describe the

particular terms of any series of warrants in more detail in the applicable prospectus supplement. The terms of any warrants offered

under a prospectus supplement may differ from the terms described below.

We

will file as exhibits to the registration statement of which this prospectus is a part, or will incorporate by reference from reports

that we file with the SEC, the form of warrant agreement, including a form of warrant certificate, that describes the terms of the particular

series of warrants we are offering before the issuance of the related series of warrants. The following summaries of material provisions

of the warrants and the warrant agreements are subject to, and qualified in their entirety by reference to, all the provisions of the

warrant agreement and warrant certificate applicable to the particular series of warrants that we may offer under this prospectus. We

urge you to read the applicable prospectus supplements related to the particular series of warrants that we may offer under this prospectus,

as well as any related free writing prospectuses, and the complete warrant agreements and warrant certificates that contain the terms

of the warrants.

General

We

will describe in the applicable prospectus supplement the terms of the series of warrants being offered, including:

| |

● |

the

offering price and aggregate number of warrants offered; |

| |

● |

the

currency for which the warrants may be purchased; |

| |

● |

if

applicable, the designation and terms of the securities with which the warrants are issued and the number of warrants issued with

each such security or each principal amount of such security; |

| |

● |

if

applicable, the date on and after which the warrants and the related securities will be separately transferable; |

| |

● |

in

the case of warrants to purchase debt securities, the principal amount of debt securities purchasable upon exercise of one warrant

and the price at, and currency in which, this principal amount of debt securities may be purchased upon such exercise; |

| |

● |

in

the case of warrants to purchase common stock or preferred stock, the number of shares of common stock or preferred stock, as the

case may be, purchasable upon the exercise of one warrant and the price at which these shares may be purchased upon such exercise; |

| |

● |

the

effect of any merger, consolidation, sale or other disposition of our business on the warrant agreements and the warrants; |

| |

● |

the

terms of any rights to redeem or call the warrants; |

| |

● |

any

provisions for changes to or adjustments in the exercise price or number of securities issuable upon exercise of the warrants; |

| |

● |

the

dates on which the right to exercise the warrants will commence and expire; |

| |

● |

the

manner in which the warrant agreements and warrants may be modified; |

| |

● |

a

discussion of any material or special United States federal income tax consequences of holding or exercising the warrants; |

| |

● |

the

terms of the securities issuable upon exercise of the warrants; and |

| |

● |

any

other specific terms, preferences, rights or limitations of or restrictions on the warrants. |

Before

exercising their warrants, holders of warrants will not have any of the rights of holders of the securities purchasable upon such exercise,

including:

| |

● |

in

the case of warrants to purchase debt securities, the right to receive payments of principal of, or premium, if any, or interest

on, the debt securities purchasable upon exercise or to enforce covenants in the applicable indenture; or |

| |

● |

in

the case of warrants to purchase common stock or preferred stock, the right to receive dividends, if any, or payments upon our liquidation,

dissolution or winding up or to exercise voting rights, if any. |

Exercise

of Warrants

Each

warrant will entitle the holder to purchase the securities that we specify in the applicable prospectus supplement at the exercise price

that we describe in the applicable prospectus supplement. Holders of the warrants may exercise the warrants at any time up to the specified

time on the expiration date that we set forth in the applicable prospectus supplement. After the close of business on the expiration

date, unexercised warrants will become void.

Holders

of the warrants may exercise the warrants by delivering the warrant certificate representing the warrants to be exercised together with

specified information, and paying the required amount to the warrant agent in immediately available funds, as provided in the applicable

prospectus supplement. We will set forth on the reverse side of the warrant certificate and in the applicable prospectus supplement the

information that the holder of the warrant will be required to deliver to the warrant agent.

If

any warrants represented by the warrant certificate are not exercised, we will issue a new warrant certificate for the remaining amount

of warrants. If we so indicate in the applicable prospectus supplement, holders of the warrants may surrender securities as all or part

of the exercise price for warrants.

Outstanding

Warrants

As

of May 4, 2022, we had outstanding warrants that were exercisable to purchase an aggregate of 3,754,484 shares of common stock at a weighted

average exercise price of $4.95 per share that expire between September 2022 and January 2029.

Transfer

Agent and Registrar

The

transfer agent and registrar for any warrants will be set forth in the applicable prospectus supplement.

DESCRIPTION

OF RIGHTS

General

We

may issue rights to purchase our common stock or preferred stock, in one or more series. Rights may be issued independently or together

with any other offered security and may or may not be transferable by the person purchasing or receiving the subscription rights. In

connection with any rights offering to our stockholders, we may enter into a standby underwriting arrangement with one or more underwriters

pursuant to which such underwriters will purchase any offered securities remaining unsubscribed after such rights offering. In connection

with a rights offering to our stockholders, we will distribute certificates evidencing the rights and a prospectus supplement to our

stockholders on the record date that we set for receiving rights in such rights offering. The applicable prospectus supplement or free

writing prospectus will describe the following terms of rights in respect of which this prospectus is being delivered:

| |

● |

the

title of such rights; |

| |

● |

the