PART

II — INFORMATION REQUIRED IN OFFERING CIRCULAR

Offering

Circular dated July ----, 2024

Information

contained in this Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be

accepted before the Offering Statement filed with the Commission is qualified. This Offering Circular shall not constitute an offer to

sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation

or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation

to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains

the URL where the Final Offering Circular or the Offering Statement in which such Final Offering Circular was filed may be obtained.

SADDLE

RANCH MEDIA, INC.

$450,000

3,000,000,000

SHARES OF COMMON STOCK

$0.00015

PER SHARE

This

is the public offering of securities of Saddle Ranch Media, Inc., a Utah corporation. We are offering 3,000,000,000 shares of our common

stock, par value $0.0001 (“Common Stock”), at an offering price of $.00015 per share (the “Offered Shares”) by

the Company. This Offering will terminate 180 days from the day the Offering is qualified or the date on which the maximum offering amount

is sold (such earlier date, the “Termination Date”). The minimum purchase requirement per investor is 50,000,000 Offered

Shares ($7,500); however, we can waive the minimum purchase requirement on a case-by-case basis in our sole discretion.

These

securities are speculative securities. Investment in the Company’s stock involves significant risk. You should purchase these securities

only if you can afford a complete loss of your investment. See the “Risk Factors” section on page 4 of this Offering Circular.

This

Offering Circular uses the Offering Circular format.

No

Escrow

The

proceeds of this offering will not be placed into an escrow account. We will offer our Common Stock on a best efforts basis. Upon the

approval of any subscription to this Offering Circular, the Company shall immediately deposit said proceeds into the bank account of

the Company and may dispose of the proceeds in accordance with the Use of Proceeds.

Subscriptions

are irrevocable and the purchase price is non-refundable as expressly stated in this Offering Circular. All proceeds received by the

Company from subscribers for this Offering will be available for use by the Company upon acceptance of subscriptions for the Securities

by the Company.

The

Company, by determination of the Board of Directors, in its sole discretion, may issue the Securities under this Offering for cash, promissory

notes, services, and/or other consideration without notice to subscribers. The aggregate offering price is based on the price at which

the securities are offered for cash. Any portion of the aggregate offering price or aggregate sales attributable to cash received in

a foreign currency will be translated into United States currency at a currency exchange rate in effect on, or at a reasonable time before,

the date of the sale of the securities. If securities are not sold for cash, the aggregate offering price or aggregate sales will be

based on the value of the consideration as established by bona fide sales of that consideration made within a reasonable time, or, in

the absence of sales, on the fair value as determined by an accepted standard. Valuations of non-cash consideration will be reasonable

at the time made.

Sale

of these shares will commence within two calendar days of the qualification date and it will be a continuous Offering pursuant to

Rule 251(d)(3)(i)(F).

This

Offering will be conducted on a “best-efforts” basis, which means our Officers will use their commercially reasonable best

efforts in an attempt to offer and sell the Shares. Our Officers will not receive any commission or any other remuneration for these

sales. In offering the securities on our behalf, the Officers will rely on the safe harbor from broker-dealer registration set out in

Rule 3a4-1 under the Securities Exchange Act of 1934, as amended.

This

Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sales of these

securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful, prior to registration or qualification

under the laws of any such state.

Shares

will be offered on a continuous basis until either (1) the maximum number of Shares are sold; (2) 180 days from the date of qualification

by the Commission, (3) if Company in its sole discretion extends the offering beyond 180 days from the date of qualification by the Commission,

or (4) the Company in its sole discretion withdraws this Offering.

Our

Common Stock is traded in the OTC Markets Pink Open Market under the stock symbol “SRMX.”

Investing

in our Common Stock involves a high degree of risk. See “Risk Factors” beginning on page 4 for a discussion of certain risks

that you should consider in connection with an investment in our Common Stock.

| | |

Per

Share | | |

Total

Maximum | |

| Public Offering Price (1)(2) | |

$ | 0.00015 | | |

$ | 450,000.00 | |

| Underwriting Discounts and Commissions (3) | |

| 0.000 | | |

| 0.00 | |

| Proceeds to Company | |

$ | 0.00015 | | |

$ | 450,000.00 | |

| (1) | We

are offering shares on a continuous basis. See “Distribution – Continuous Offering. |

| (2) | This

is a “best efforts” offering. The proceeds of this offering will not be placed into an escrow account. We will offer our

Common Stock on a best efforts basis. Upon the approval of any subscription to this Offering Circular, the Company shall immediately

deposit said proceeds into the bank account of the Company and may dispose of the proceeds in accordance with the Use of Proceeds. See

“How to Subscribe.” |

| (3) | We

are offering these securities without an underwriter. |

| (4) | Excludes

estimated total offering expenses, will be approximately $10,000 assuming the maximum offering amount is sold. |

Our

Board of Directors used its business judgment in setting a value of $0.00015 per share to the Company as consideration for the stock

to be issued under the Offering. The sales price per share bears no relationship to our book value or any other measure of our current

value or worth.

THE

U.S. SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS

OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES

ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION

THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

The

date of this Offering Circular is July____, 2024

TABLE

OF CONTENTS

We

are offering to sell, and seeking offers to buy, our securities only in jurisdictions where such offers and sales are permitted. You

should rely only on the information contained in this Offering Circular. We have not authorized anyone to provide you with any information

other than the information contained in this Offering Circular. The information contained in this Offering Circular is accurate only

as of its date, regardless of the time of its delivery or of any sale or delivery of our securities. Neither the delivery of this Offering

Circular nor any sale or delivery of our securities shall, under any circumstances, imply that there has been no change in our affairs

since the date of this Offering Circular. This Offering Circular will be updated and made available for delivery to the extent required

by the federal securities laws.

In

this Offering Circular, unless the context indicates otherwise, references to “Saddle Ranch Media”, “SRMX”, “we”,

the “Company”, “our” and “us” refer to the activities of and the assets and liabilities of the business

and operations of Saddle Ranch Media, Inc.

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Some

of the statements under “Summary”, “Risk Factors”, “Management’s Discussion and Analysis of Financial

Condition and Results of Operations”, “Our Business” and elsewhere in this Offering Circular constitute forward-looking

statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events

or trends and similar matters that are not historical facts. In some cases, you can identify forward-looking statements by terms such

as “anticipate”, “believe”, “could”, “estimate”, “expect”, “intend”,

“may”, “plan”, “potential”, “should”, “will” and “would” or the

negatives of these terms or other comparable terminology.

You

should not place undue reliance on forward looking statements. The cautionary statements set forth in this Offering Circular, including

in “Risk Factors” and elsewhere, identify important factors which you should consider in evaluating our forward-looking statements.

These factors include, among other things:

| ● | The

speculative nature of the business we intend to develop; |

| ● | Our

reliance on suppliers and customers; |

| ● | Our

dependence upon external sources for the financing of our operations, particularly given that there are concerns about our ability to

continue as a “going concern;” |

| ● | Our

ability to effectively execute our business plan; |

| ● | Our

ability to manage our expansion, growth and operating expenses; |

| ● | Our

ability to finance our businesses; |

| ● | Our

ability to promote our businesses; |

| ● | Our

ability to compete and succeed in highly competitive and evolving businesses; |

| ● | Our

ability to respond and adapt to changes in technology and customer behavior; and |

| ● | Our

ability to protect our intellectual property and to develop, maintain and enhance strong brands. |

Although

the forward-looking statements in this Offering Circular are based on our beliefs, assumptions and expectations, taking into account

all information currently available to us, we cannot guarantee future transactions, results, performance, achievements or outcomes. No

assurance can be made to any investor by anyone that the expectations reflected in our forward-looking statements will be attained, or

that deviations from them will not be material and adverse. We undertake no obligation, other than as maybe be required by law, to re-issue

this Offering Circular or otherwise make public statements updating our forward-looking statements.

SUMMARY

This

summary highlights selected information contained elsewhere in this Offering Circular. This summary is not complete and does not contain

all the information that you should consider before deciding whether to invest in our Common Stock. You should carefully read the entire

Offering Circular, including the risks associated with an investment in the company discussed in the “Risk Factors” section

of this Offering Circular, before making an investment decision. Some of the statements in this Offering Circular are forward-looking

statements. See the section entitled “Cautionary Statement Regarding Forward-Looking Statements.”

Company

Information

The

Company, sometimes referred to herein as “we,” “us,” “our,” and the “Company” and/or

“Saddle Ranch Media” was incorporated in the State of Utah on October 7, 1988. Our fiscal year-end date is December 31.

Saddle

Ranch Media, Inc. offices are located at 19200 Von Karman Blvd, Ste 425, Irvine, CA 92612. Our telephone number is 949-212-1898 and our

Email address is Max.li@tricascadeinc.com.

We

are focused to become a world-class global *Internet of Things (“IoT”) multi-divisional telecommunications technology company

with four operating divisions: (1) Cloud Managed Services , (2) LTE and IoT Telecom connectivity, (3) Smart home based data transmission

devices and (4) Cellular and WiFi connectivity devices, such as 5G Dongles (see www.tricascade.com)

(*Internet

of Things is defined as: The interconnection via the internet of computing devices embedded in everyday

objects, enabling them to send and receive data, usually through the Cloud).

History

The

Company was originally formed in the State of Utah on October 7, 1988, as Port City Corporation.

In

October 1990, the name of the Company was changed to Interline Resources Corporation (“Interline”) which operated in the

oil and gas industry in east-central Wyoming and eastern Utah. On October 15, 2009, Interline filed a Form 15 terminating its registration

as a 12(g) company and choosing to adopt an alternative-reporting standard for the filing of its subsequent (unaudited) financial reports.

On

November 20, 2014, the Company changed its corporate name to Automated-X, Inc. when the company entered the video kiosk distribution

business through QUICKflickUSA, Inc. On August 15, 2015, the Company entered into a Securities Exchange and Acquisition Agreement with

Saddle Ranch Pictures, Inc. (“SRPI”) wherein the Company acquired SRPI in a cashless exchange of stock. Prior to closing

the SRPI acquisition, the Company approved the transfer of 100% of its ownership in its wholly-owned subsidiary, QUICKflickUSA, Inc.,

to two of the Company’s major shareholders.

The

name of the Company was changed with the state of Utah on September 9, 2015 from Automated-X, Inc. to Saddle Ranch Media, Inc. The Company’s

trading symbol was also changed with FINRA from “AUTX” to “SRMX” effective October 6, 2015. On February 28, 2017

Philip M. Cohen resigned as Chairman and CEO, and in consideration for the Spin-Out of both Saddle Ranch Pictures, Inc and certain digital

programming assets representing the “African American Medical Network” to Mr. Cohen, he surrendered 40,000,000 common shares

back to the Company’s Treasury. Also, on February 28, 2017, Mr. Cohen sold his holding of 1,000,000 “super voting”

Series B preferred shares in a private transaction to The Shamrock Investment Trust, which is in turn controlled by Nadine Peabody, sole

trustee.

The

Company closed on the acquisition of Tri Cascade, Inc. as of April 1, 2017 through a cashless exchange of stock. Since that date the

Company’s subsidiary, Tri Cascade, Inc., has continued its develop in IoT ( “Internet of Things”) technology. Tri Cascade

Inc. was originally founded in May 2010 in California with an R&D and production team located in Taipei, Taiwan. Its focus is primarily

on the convergence of an intelligent energy efficiency eco-system with emerging digital energy home networking technologies. Tri Cascade

Inc. has established strong strategic relationships to advance smart energy to both the home and business markets. With Microsoft as

a business partner, Tri Cascade has a proven history of creating innovative and cutting-edge products. Building on this knowledge base,

Tri Cascade has developed pioneering energy efficiency management products for OEM/ODM, retail, custom integrators, and smart hospitality

providers. Tri Cascade, Inc. has developed and filed for patents* on various proprietary and customized energy management technological

advancements and user interfaces (UI’s) utilizing Microsoft Azure’s Cloud computing system and Microsoft’s Sphere data

security platform. (*see page 30 for list of patents).

Effective

August 9, 2019 Tri Cascade, Inc entered into a 3 year connectivity Provider Service Agreement with a leading Telecom which authorizes

Tri Cascade to obtain certain connectivity services from this telecom, together with powered SIMs, for onward marketing and sales to

End Users through Tri Cascade’s Provider Agents throughout the U.S. Tri Cascade can provide turnkey services to the Telecom’s

IoT partners and/or IoT business customers through IoT onboarding, SIM activation and data transmission, IoT Cloud platform design, device

integration, with the added potential of providing certain manufacturing services with innovative manufacturers based in Taiwan. Tri

Cascade operates side-by-side with the Telecom’s B2B sales team, providing hands-on services to business partners, and expediting

the design and integration IoT platform development, as the new, future, and on-going NB IoT business operation.

Tri

Cascade, Inc., provides leading-edge NB IoT to 5G solutions and innovation, through its various IoT devices and ONENET B2B IoT Onboarding

Platform – certified by Microsoft IoT Sphere under Microsoft’s Azure IoT Hub – for business and infrastructure IoT

operations. Tri Cascade’s Management Team has extensive years of innovation experience in Energy Efficiency Management, Home Automation,

Wireless Networking, and Telecom IoT Connectivity, as well as Cloud Management integration services. Tri Cascade envisions a turnkey

IoT business solution for our business partners since recently we added a complete supply chain of manufacturing operations, with product

development capability, in Taiwan. The Company’s focus is it provide the Smart way of managing indoor and outdoor environment through

the transmission, integration, monitoring and reaction to/from data management utilizing NB IoT technology.

On

December 21, 2017 the Company increased its authorized share capital from 500,000,000 common shares to 2,500,000,000 common shares. (There

was no change to the 3,000,000 authorized Series “B” preferred shares). Then on December 29, 2017 the Board of Directors

approved an Amendment to the Company’s Articles of Incorporation whereby the par value of the Company’s common stock was

reduced from $0.005 to $0.0001.

On

April 20, 2018 through an amendment to its Articles of Incorporation the Company increased its authorized share capital from 2,500,000,000

common shares to 5,000,000,000 common shares (There was no change to the 3,000,000 authorized Series “B” preferred shares)

and on November 23, 2018 through an amendment to its Articles of Incorporation the Company further increased its authorized share capital

from 5,000,000,000 common shares to 7,500,000,000 common shares. (Again, there was no change to the 3,000,000 authorized Series “B”

preferred shares). On September 3, 2019 through an amendment to its Articles of Incorporation the Company further increased its authorized

share capital from 7,500,000,000 common shares to 15,000,000,000 common shares. (Again, there was no change to the 3,000,000 authorized

Series “B” preferred shares). Effective July 8, 2024 the Company additionally increased its authorized share capital from

15,000,000,000 common shares to 17,500,000,000 common shares (with no additional increase to its authorized preferred shares).

Tri

Cascade has closed deals to establish multiple relationships with key nationwide connectivity Providers in order to offer the most price

competitive, complete solutions and best in class service. Building on the certification of the Tritom SBC700 and Tritom GX500c modem

products, Tri Cascade has signed agreements with 2 key partners in the IoT connectivity space to achieve a range of flexibility and options

to offer Tri Cascade customers the right solution and that can be managed on our ONENET platform for IoT connected devices.

During

2022 Tri Cascade signed a joint-partnership agreement for its TRITOM GX550s 5G industrial grade Gateway, with Microsoft Sphere, for product

and production development with New Kinpo Group (“NKG”) , which is a Total Manufacturing Solutions Provider. NKG will be

the key supply chain vendor for Tri Cascade ’s forthcoming 5G business for production. TRITOM GX550s 5G Gateway will provide Microsoft

Sphere data security with 5G network connectivity.

During

2022 the Company partnered with Lighthouse Marketing, based in the Chicago area to act as its national sales and marketing agency. Lighthouse

is a 360 full service agency that has the resources and experience to handle major sales order and marketing transactions with such retail

giants as Home Depot, Best Buy, Loews, etc. Tri Cascade has also added a Teal Communications’ data plan to its data service offering

to support the launch of its VOS 5G dongle (see below). .

In

October, 2022 Tri Cascade, Inc announced the launching of its VOS 5G dongle, the first of its kind in the U.S. 5G USB device, with no

Wi-Fi necessary, that keeps you connected to the internet when and where you need to be — a product that revolutionizes Internet

access and respects Web users’ demands for speed and security. VOS 5G is the ultimate, mobile-tech solution with on-the-go convenience

and off-the-charts capabilities such as efficient large file transfers, downloads, streaming and video conferencing, and much more. The

device has been marketed for online sales through Amazon, Walmart and NewEgg commencing in 2023 and continues to sell to date.

Dividends

The

Company has not declared or paid a cash dividend to stockholders since it was organized and does not intend to pay dividends in the foreseeable

future. The board of directors presently intends to retain any earnings to finance our operations and does not expect to authorize cash

dividends in the foreseeable future. Any payment of cash dividends in the future will depend upon the Company’s earnings, capital

requirements and other factors.

Trading

Market

Our

Common Stock trades in the OTC Markets Pink Sheets under the symbol “SRMX”.

THE

OFFERING

| Issuer: |

|

Saddle

Ranch Media, Inc. |

| |

|

|

| Securities

offered: |

|

A

maximum of 3,000,000,000 shares of our common stock, par value $0.0001 (“Common Stock”) at an offering price of $0.00015

per share (the “Offered Shares”). (See “Distribution.”) |

| |

|

|

| Number

of shares of Common Stock outstanding before the offering |

|

14,019,651,015

issued and outstanding as of March 31, 2024 |

| |

|

|

| Number

of shares of Common Stock to be outstanding after the offering |

|

17,019,651,015

shares, if the maximum amount of Offered Shares are sold |

| |

|

|

| Price

per share: |

|

$0.00015 |

| |

|

|

| Maximum

offering amount: |

|

3,000,000,000

shares at $0.00015 per share, or $450,000 (See “Distribution.”) |

| |

|

|

| Trading

Market: |

|

Our

Common Stock is trading on the OTC Markets Pink Sheets division under the symbol “SRMX.” |

| |

|

|

| Use

of proceeds: |

|

If

we sell all of the shares being offered, our net proceeds (after our estimated offering expenses) will be $440,000. We will use these

net proceeds for product design and development, product inventory for resell, marketing and advertising and for additional working

capital to support corporate operating expenses. |

| |

|

|

| Risk

factors: |

|

Investing

in our Common Stock involves a high degree of risk, including immediate and substantial dilution.

There

is a limited market for our stock.

See

“Risk Factors.” |

RISK

FACTORS

The

following is only a brief summary of the risks involved in investing in our Company. Investment in our Securities involves risks. You

should carefully consider the following risk factors in addition to other information contained in this Disclosure Document. The occurrence

of any of the following risks might cause you to lose all or part of your investment. Some statements in this Document, including statements

in the following risk factors, constitute “Forward-Looking Statements.”

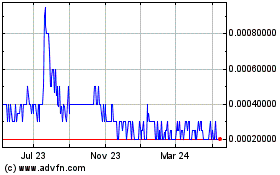

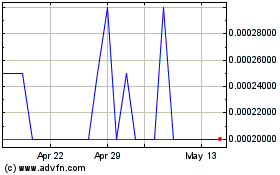

The

price of our common stock may continue to be volatile.

The

trading price of our common stock has been and is likely to remain highly volatile and could be subject to wide fluctuations in response

to various factors, some of which are beyond our control or unrelated to our operating performance. In addition to the factors discussed

in this “Risk Factors” section and elsewhere, these factors include: the operating performance of similar companies; the

overall performance of the equity markets; the announcements by us or our competitors of acquisitions, business plans, or commercial

relationships; threatened or actual litigation; changes in laws or regulations relating to the our business; any major change in our

board of directors or management; publication of research reports or news stories about us, our competitors, or our industry or positive

or negative recommendations or withdrawal of research coverage by securities analysts; large volumes of sales of our shares of common

stock by existing stockholders; and general political and economic conditions.

In

addition, the stock market in general, and the market for development stage companies in particular, has experienced extreme price and

volume fluctuations that have often been unrelated or disproportionate to the operating performance of those companies’ securities.

This litigation, if instituted against us, could result in very substantial costs; divert our management’s attention and resources;

and harm our business, operating results, and financial condition.

There

is doubt about our ability to continue as a going concern.

The

Company is a development stage enterprise, developing various telecommunication devices such as modems, routers and dongles and first

began to sell its products in 2023 through online retail sources such as Amazon, Walmart and NewEgg. The Company had revenues of $134,890

for the 12 months ended December 31, 2023 and revenues of $19,164 for the 3 months ended March 31, 2024, and incurred a net loss of $

641,043] for the 3 months ended March , 2024 and $1,130,887for the year ended December 31, 2023. In addition, the Company has a shareholders’

deficit of $1,473,944 for the period since inception through March 31, 2024. These factors raise substantial doubt about the Company’s

ability to continue as a going concern.

There

can be no assurance that sufficient funds required during this current year or thereafter will be generated from operations or that funds

will be available from external sources, such as debt or equity financings or other potential sources. The lack of additional capital

resulting from the inability to generate cash flow from operations, or to raise capital from external sources would force the Company

to substantially curtail or cease operations and would, therefore, have a material adverse effect on its business. Furthermore, there

can be no assurance that any such required funds, if available, will be available on attractive terms or that they will not have a significant

dilutive effect on the Company’s existing stockholders.

The

Company intends to overcome the circumstances that impact its ability to remain a going concern through a combination of the commencement

of revenues, with interim cash flow deficiencies being addressed through additional equity and debt financing. The Company anticipates

raising additional funds through public or private financing, strategic relationships or other arrangements in the near future to support

its business operations; however, the Company may not have commitments from third parties for a sufficient amount of additional capital.

The Company cannot be certain that any such financing will be available on acceptable terms, or at all, and its failure to raise capital

when needed could limit its ability to continue its operations. The Company’s ability to obtain additional funding will determine

its ability to continue as a going concern. Failure to secure additional financing in a timely manner and on favorable terms would have

a material adverse effect on the Company’s financial performance, results of operations and stock price and require it to curtail

or cease operations, sell off its assets, seek protection from its creditors through bankruptcy proceedings, or otherwise. Furthermore,

additional equity financing may be dilutive to the holders of the Company’s common stock, and debt financing, if available, may

involve restrictive covenants, and strategic relationships, if necessary to raise additional funds, and may require that the Company

relinquish valuable rights.

Risks

Relating to Our Financial Condition

Our

financials are not independently audited, which could result in errors and/or omissions in our financial statements if proper standards

are not applied.

Although

the Company is confident with the accuracy of its accounting practices, we are not required to have our financials audited by an auditor

certified by the Public Company Accounting Oversight Board (“PCAOB”). As such, we do not have a third party reviewing the

accounting. Our accounting staff may also not be up to date with all publications and releases put out by the PCAOB regarding accounting

standards and treatments. This could mean that our unaudited financials may not properly reflect up to date standards and treatments

resulting misstated financials statements.

Our

management has a limited experience operating a public company and are subject to the risks commonly encountered by early-stage companies.

Although

management of Saddle Ranch Media, Inc. has experience in operating small companies, current management has not had to manage expansion

while being a public company. In addition, management has not overseen a company with large growth. Because we have a limited operating

history, our operating prospects should be considered in light of the risks and uncertainties frequently encountered by early-stage companies

in rapidly evolving markets. These risks include:

| ● |

risks

that we may not have sufficient capital to achieve our growth strategy; |

| |

|

| ● |

risks

that we may not develop our product and service offerings in a manner that enables us to be profitable and meet our customers’

requirements; |

| |

|

| ● |

risks

that our growth strategy may not be successful; and |

| |

|

| ● |

risks

that fluctuations in our operating results will be significant relative to our revenues. |

These

risks are described in more detail below. Our future growth will depend substantially on our ability to address these and the other risks

described in this section. If we do not successfully address these risks, our business could be significantly harmed.

We

have limited operational history in an emerging industry, making it difficult to accurately predict and forecast business operations.

As

we have limited operations in our business and have yet to generate significant revenue, it is extremely difficult to make accurate predictions

and forecasts on our finances. This is compounded by the fact that we operate in rapidly transforming industries. There is no guarantee

that our products or services will remain attractive to potential and current users as these industries undergo rapid change, or that

potential customers will utilize our services.

We

have yet to achieve a profit and may not achieve a profit in the near future, if at all.

We

have not yet produced a net profit and may not in the near future, if at all. While we expect our revenue to grow, we have not achieved

profitability and cannot be certain that we will be able to sustain our current growth rate or realize sufficient revenue to achieve

profitability. Further, many of our competitors in the IoT field have a significantly larger user base and revenue stream but have yet

to achieve profitability. Our ability to continue as a going concern may be dependent upon raising capital from financing transactions,

increasing revenue throughout the year and keeping operating expenses below our revenue levels in order to achieve positive cash flows,

none of which can be assured.

We

will require additional capital to support business growth, and this capital might not be available on acceptable terms, if at all.

We

intend to continue to make investments to support our business growth and may require additional funds to respond to business challenges,

including the need to improve our operating infrastructure or acquire complementary businesses and technologies. Accordingly, we will

need to engage in continued equity or debt financings to secure additional funds. If we raise additional funds through future issuances

of equity or convertible debt securities, our existing stockholders could suffer significant dilution, and any new equity securities

we issue could have rights, preferences and privileges superior to those of our common stock. Any debt financing we secure in the future

could involve restrictive covenants relating to our capital raising activities and other financial and operational matters, which may

make it more difficult for us to obtain additional capital and to pursue business opportunities, including potential acquisitions. We

may not be able to obtain additional financing on terms favorable to us, if at all. If we are unable to obtain adequate financing or

financing on terms satisfactory to us when we require it, our ability to continue to support our business growth and to respond to business

challenges could be impaired, and our business may be harmed.

We

are highly dependent on the services of our key executives, the loss of whom could materially harm our business and our strategic direction.

If we lose key management or significant personnel, cannot recruit qualified employees, directors, officers, or other personnel or experience

increases in our compensation costs, our business may materially suffer.

We

are highly dependent on our management, specifically Max Chin Li and Alan Bailey. We have employment agreements in place with these key

employees. If we lose key employees, our business may suffer. Furthermore, our future success will also depend in part on the continued

service of our management personnel and our ability to identify, hire, and retain additional key personnel. We do not carry “key-man”

life insurance on the lives of any of our executives, employees or advisors. We experience intense competition for qualified personnel

and may be unable to attract and retain the personnel necessary for the development of our business. Because of this competition, our

compensation costs may increase significantly.

We

may be unable to manage growth, which may impact our potential profitability.

Successful

implementation of our business strategy requires us to manage our growth. Growth could place an increasing strain on our management and

financial resources. To manage growth effectively, we will need to:

| ● | Establish

definitive business strategies, goals and objectives; |

| ● | Maintain

a system of management controls; and |

| ● | Attract

and retain qualified personnel, as well as develop, train, and manage management-level and other employees. |

If

we fail to manage our growth effectively, our business, financial condition, or operating results could be materially harmed, and our

stock price may decline.

We

operate in a highly competitive environment, and if we are unable to compete with our competitors, our business, financial condition,

results of operations, cash flows and prospects could be materially adversely affected.

We

operate in a highly competitive environment. Our competition includes all other companies that are in the business of the Internet of

Things or other related technologies. A highly competitive environment could materially adversely affect our business, financial condition,

results of operations, cash flows and prospects.

We

may not be able to compete successfully with other established companies offering the same or similar services and, as a result, we may

not achieve our projected revenue and user targets.

If

we are unable to compete successfully with other businesses in our existing market, we may not achieve our projected revenue and/or customer

targets. We compete with both start-up and established technology companies. Compared to our business, some of our competitors, such

as Honeywell, Wyze and Qlsys, have greater financial and other resources, have been in business longer, have greater name recognition

and are better established in retail markets.

Our

lack of adequate D&O insurance may also make it difficult for us to retain and attract talented and skilled directors and officers.

In

the future we may be subject to additional litigation, including potential class action and stockholder derivative actions. Risks associated

with legal liability are difficult to assess and quantify, and their existence and magnitude can remain unknown for significant periods

of time. To date, we have not obtained directors and officers liability (“D&O”) insurance. Without adequate D&O insurance,

the amounts we would pay to indemnify our officers and directors should they be subject to legal action based on their service to the

Company could have a material adverse effect on our financial condition, results of operations and liquidity. Furthermore, our lack of

adequate D&O insurance may make it difficult for us to retain and attract talented and skilled directors and officers, which could

adversely affect our business.

We

expect to incur substantial expenses to meet our reporting obligations as a public company. In addition, failure to maintain adequate

financial and management processes and controls could lead to errors in our financial reporting and could harm our ability to manage

our expenses.

We

estimate that it will cost approximately $50,000 annually to maintain the proper management and financial controls for our filings required

as a public reporting company. In addition, if we do not maintain adequate financial and management personnel, processes, and controls,

we may not be able to accurately report our financial performance on a timely basis, which could cause a decline in our stock price and

adversely affect our ability to raise capital.

Risks

Relating to our Common Stock and Offering

The

Common Stock is thinly traded, so you may be unable to sell at or near ask prices or at all if you need to sell your shares to raise

money or otherwise desire to liquidate your shares.

The

Common Stock has historically been sporadically traded on the OTC Pink Sheets, meaning that the number of persons interested in purchasing

our shares at, or near ask prices at any given time, may be relatively small or non-existent. This situation is attributable to a number

of factors, including the fact that we are a small company which is relatively unknown to stock analysts, stock brokers, institutional

investors and others in the investment community that generate or influence sales volume, and that even if we came to the attention of

such persons, they tend to be risk-averse and would be reluctant to follow an unproven company such as ours or purchase or recommend

the purchase of our shares until such time as we became more seasoned and viable. As a consequence, there may be periods of several days

or more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer, which has a large and steady

volume of trading activity that will generally support continuous sales without an adverse effect on share price. We cannot give you

any assurance that a broader or more active public trading market for our common shares will develop or be sustained, or that current

trading levels will be sustained.

The

market price for the common stock is particularly volatile given our status as a relatively unknown company with a small and thinly traded

public float, limited operating history, and lack of revenue, which could lead to wide fluctuations in our share price. The price at

which you purchase our shares may not be indicative of the price that will prevail in the trading market. You may be unable to sell your

common shares at or above your purchase price, which may result in substantial losses to you.

The

market for our shares of common stock is characterized by significant price volatility when compared to seasoned issuers, and we expect

that our share price will continue to be more volatile than a seasoned issuer for the indefinite future. The volatility in our share

price is attributable to a number of factors. First, as noted above, our shares are sporadically traded. As a consequence of this lack

of liquidity, the trading of relatively small quantities of shares may disproportionately influence the price of those shares in either

direction. The price for our shares could, for example, decline precipitously in the event that a large number of our shares is sold

on the market without commensurate demand, as compared to a seasoned issuer which could better absorb those sales without adverse impact

on its share price. Secondly, we are a speculative investment due to, among other matters, our limited operating history and lack of

revenue or profit to date, and the uncertainty of future market acceptance for our potential products. As a consequence of this enhanced

risk, more risk-averse investors may, under the fear of losing all or most of their investment in the event of negative news or lack

of progress, be more inclined to sell their shares on the market more quickly and at greater discounts than would be the case with the

securities of a seasoned issuer. The following factors may add to the volatility in the price of our shares: actual or anticipated variations

in our quarterly or annual operating results; acceptance of our inventory of games; government regulations, announcements of significant

acquisitions, strategic partnerships or joint ventures; our capital commitments and additions or departures of our key personnel. Many

of these factors are beyond our control and may decrease the market price of our shares regardless of our operating performance. We cannot

make any predictions or projections as to what the prevailing market price for our shares will be at any time, including as to whether

our shares will sustain their current market prices, or as to what effect the sale of shares or the availability of shares for sale at

any time will have on the prevailing market price.

Shareholders

should be aware that, according to SEC Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns of

fraud and abuse. Such patterns include (1) control of the market for the security by one or a few broker-dealers that are often related

to the promoter or issuer; (2) manipulation of prices through prearranged matching of purchases and sales and false and misleading press

releases; (3) boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons;

(4) excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and (5) the wholesale dumping of the same securities

by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of

those prices and with consequent investor losses. Our management is aware of the abuses that have occurred historically in the penny

stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate

in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established

with respect to our securities. The possible occurrence of these patterns or practices could increase the volatility of our share price.

The

market price of our common stock may be volatile and adversely affected by several factors.

The

market price of our common stock could fluctuate significantly in response to various factors and events, including, but not limited

to:

| ● | our

ability to integrate operations, technology, products and services; |

| ● |

our

ability to execute our business plan; |

| |

|

| ● |

operating

results below expectations; |

| ● | our

issuance of additional securities, including debt or equity or a combination thereof; |

| ● | announcements

of technological innovations or new products by us or our competitors; |

| ● | loss

of any strategic relationship; |

| ● | industry

developments, including, without limitation, changes in competition or practices; |

| ● | economic

and other external factors; |

| ● | period-to-period

fluctuations in our financial results; and |

| ● | whether

an active trading market in our common stock develops and is maintained. |

In

addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to the

operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of

our common stock. Issuers using the Alternative Reporting standard for filing financial reports with OTC Markets are often subject to

large volatility unrelated to the fundamentals of the company.

Natural

disasters and geo-political events could adversely affect our business.

Natural

disasters, including hurricanes, cyclones, typhoons, tropical storms, floods, earthquakes and tsunamis, weather conditions, including

winter storms, droughts and tornadoes, whether as a result of climate change or otherwise, and geo-political events, including civil

unrest or terrorist attacks, that affect us, or other service providers, could adversely affect our business.

We

do not expect to pay dividends in the future; any return on investment may be limited to the value of our common stock.

We

have never paid dividends and do not currently anticipate paying cash dividends in the foreseeable future. The payment of dividends on

our common stock will depend on earnings, financial condition and other business and economic factors affecting it at such time as the

board of directors may consider relevant. Our current intention is to apply net earnings, if any, in the foreseeable future to increasing

our capital base and development and marketing efforts. There can be no assurance that the Company will ever have sufficient earnings

to declare and pay dividends to the holders of our common stock, and in any event, a decision to declare and pay dividends is at the

sole discretion of our board of directors. If we do not pay dividends, our common stock may be less valuable because a return on your

investment will only occur if its stock price appreciates.

Our

issuance of additional shares of Common Stock, or options or warrants to purchase those shares, would dilute your proportionate ownership

and voting rights.

We

are entitled under our articles of incorporation to issue up to 17,500,000,000 shares of common stock. We have issued as of March 31,

2024, 14,019,651,015 shares of common stock. In addition, we are authorized under our Articles of Incorporation to issue “blank

check” preferred stock. Our board may generally issue shares of common stock, preferred stock, options, or warrants to purchase

those shares, without further approval by our shareholders based upon such factors as our board of directors may deem relevant at that

time. It is likely that we will be required to issue a large amount of additional securities to raise capital to further our development.

It is also likely that we will issue a large amount of additional securities to directors, officers, employees and consultants as compensatory

grants in connection with their services, both in the form of stand-alone grants or under our stock plans. We cannot give you any assurance

that we will not issue additional shares of common stock, or options or warrants to purchase those shares, under circumstances we may

deem appropriate at the time.

The

elimination of monetary liability against our directors, officers and employees under our Articles of Incorporation and the existence

of indemnification rights to our directors, officers and employees may result in substantial expenditures by our company and may discourage

lawsuits against our directors, officers and employees.

Our

Articles of Incorporation contains provisions that eliminate the liability of our directors for monetary damages to our company and shareholders.

Our bylaws also require us to indemnify our officers and directors. We may also have contractual indemnification obligations under our

agreements with our directors, officers and employees. The foregoing indemnification obligations could result in our company incurring

substantial expenditures to cover the cost of settlement or damage awards against directors, officers and employees that we may be unable

to recoup. These provisions and resulting costs may also discourage our company from bringing a lawsuit against directors, officers and

employees for breaches of their fiduciary duties, and may similarly discourage the filing of derivative litigation by our shareholders

against our directors, officers and employees even though such actions, if successful, might otherwise benefit our company and shareholders.

We

may become involved in securities class action litigation that could divert management’s attention and harm our business.

The

stock market in general, and the shares of early-stage companies in particular, have experienced extreme price and volume fluctuations.

These fluctuations have often been unrelated or disproportionate to the operating performance of the companies involved. If these fluctuations

occur in the future, the market price of our shares could fall regardless of our operating performance. In the past, following periods

of volatility in the market price of a particular company’s securities, securities class action litigation has often been brought

against that company. If the market price or volume of our shares suffers extreme fluctuations, then we may become involved in this type

of litigation, which would be expensive and divert management’s attention and resources from managing our business.

As

a public company, we may also from time to time make forward-looking statements about future operating results and provide some financial

guidance to the public markets. Our management has limited experience as a management team in a public company and as a result, projections

may not be made timely or set at expected performance levels and could materially affect the price of our shares. Any failure to meet

published forward-looking statements that adversely affect the stock price could result in losses to investors, stockholder lawsuits

or other litigation, sanctions or restrictions issued by the SEC.

Our

common stock is currently deemed a “penny stock,” which makes it more difficult for our investors to sell their shares.

The

SEC has adopted Rule 15g-9 which establishes the definition of a “penny stock,” for the purposes relevant to us, as any equity

security that has a market price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock,

unless exempt, the rules require that a broker or dealer approve a person’s account for transactions in penny stocks, and the broker

or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock

to be purchased.

In

order to approve a person’s account for transactions in penny stocks, the broker or dealer must obtain financial information and

investment experience objectives of the person and make a reasonable determination that the transactions in penny stocks are suitable

for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of

transactions in penny stocks.

The

broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to

the penny stock market, which, in highlight form sets forth the basis on which the broker or dealer made the suitability determination,

and that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

Generally,

brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more

difficult for investors to dispose of our common stock if and when such shares are eligible for sale and may cause a decline in the market

value of its stock.

Disclosure

also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading, and about the commissions

payable to both the broker-dealer and the registered representative, current quotations for the securities, and the rights and remedies

available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent

price information for the penny stock held in the account and information on the limited market in penny stock.

As

an issuer of a “penny stock,” the protection provided by the federal securities laws relating to forward-looking statements

does not apply to us.

Although

federal securities laws provide a safe harbor for forward-looking statements made by a public company that files reports under the federal

securities laws, this safe harbor is not available to issuers of penny stocks. As a result, we will not have the benefit of this safe

harbor protection in the event of any legal action based upon a claim that the material provided by us contained a material misstatement

of fact or was misleading in any material respect because of our failure to include any statements necessary to make the statements not

misleading. Such an action could hurt our financial condition.

As

an issuer not required to make reports to the Securities and Exchange Commission under Section 13 or 15(d) of the Securities Exchange

Act of 1934, holders of restricted shares may not be able to sell shares into the open market as Rule 144 exemptions may not apply.

Under

Rule 144 of the Securities Act of 1933, holders of restricted shares may avail themselves of certain exemptions from registration if

the holder and the issuer meet certain requirements. As a company that is not required to file reports under Section 13 or 15(d) of the

Securities Exchange Act, referred to as a non-reporting company, we may not, in the future, meet the requirements for an issuer under

144 that would allow a holder to qualify for Rule 144 exemptions. In such an event, holders of restricted stock would have to utilize

another exemption from registration or rely on a registration statement to be filed by the Company registering the restricted stock.

Securities

analysts may elect not to report on our common stock or may issue negative reports that adversely affect the stock price.

At

this time, no securities analysts provide research coverage of our common stock, and securities analysts may not elect to provide such

coverage in the future. It may remain difficult for our company, with its small market capitalization, to attract independent financial

analysts that will cover our common stock. If securities analysts do not cover our common stock, the lack of research coverage may adversely

affect the stock’s actual and potential market price. The trading market for our common stock may be affected in part by the research

and reports that industry or financial analysts publish about our business. If one or more analysts elect to cover our company and then

downgrade the stock, the stock price would likely decline rapidly. If one or more of these analysts cease coverage of our company, we

could lose visibility in the market, which, in turn, could cause our stock price to decline. This could have a negative effect on the

market price of our common stock.

Because

directors and officers currently and for the foreseeable future will continue to control the Company, it is not likely that you will

be able to elect directors or have any say in the policies of Saddle Ranch Media, Inc.

Our

shareholders are not entitled to cumulative voting rights. Consequently, the election of directors and all other matters requiring shareholder

approval will be decided by majority vote. The directors, officers and affiliates of Saddle Ranch Media, Inc. beneficially own a majority

of our outstanding common stock voting rights . Due to such significant ownership position held by our insiders, new investors may

not be able to affect a change in our business or management, and therefore, shareholders would have no recourse as a result of decisions

made by management.

In

addition, sales of significant amounts of shares held by our directors, officers or affiliates, or the prospect of these sales, could

adversely affect the market price of our common stock. Management’s stock ownership may discourage a potential acquirer from making

a tender offer or otherwise attempting to obtain control of us, which in turn could reduce our stock price or prevent our stockholders

from realizing a premium over our stock price.

Risks

Relating to Our Company and Industry

The

following risks relate to our proposed business and the effects upon us assuming we obtain financing in a sufficient amount.

A

loss of confidence in our security system, or a breach of our security system, may adversely affect us and the value of an investment

in us.

We

will take measures to protect us and our system from unauthorized access, damage or theft; however, it is possible that the security

system may not prevent the improper access to, or damage or theft of our information. A security breach could harm our reputation or

result in the loss of some or all of our information. A resulting perception that our measures do not adequately protect our systems

could result in a loss of current or potential shareholders, reducing demand for our Common Stock and causing our shares to decrease

in value.

Intellectual

property rights claims may adversely affect an investment in us.

We

are not aware of any intellectual property claims that may prevent us from operating our patents; however, third parties may assert intellectual

property claims relating to our operation. Regardless of the merit of an intellectual property or other legal action, any legal expenses

to defend or payments to settle such claims would be extremely expensive. As a result, an intellectual property claim against us could

adversely affect an investment in us.

Our

industry is highly competitive and as an emerging growth company with a new brand we may be at a disadvantage to our competitors.

Our

industry is highly competitive in general. We are an emerging growth company with limited financial resources and our brand has limited

recognition. Our competitors, both established and future unknown competitors, have better brand recognition and, in most cases,

substantially greater financial resources than we have. Our ability to successfully compete in our industry depends on a number of factors,

both within and outside our control. These factors include the following:

| |

● |

our

success in designing and developing new or enhanced products; |

| |

|

|

| |

● |

our

ability to address the changing needs and desires of retailers and consumers; |

| |

|

|

| |

● |

the

pricing, quality, performance, reliability, features, ease of installation and use, and diversity of our products; |

| |

|

|

| |

● |

the

quality of our customer service; |

| |

|

|

| |

● |

product

or technology introductions by our competitors; and |

| |

|

|

| |

● |

the

ability of our contract manufacturing to deliver on time, on price, and with acceptable quality. |

If

we are unable to effectively compete on a continuing basis or unforeseen competitive pressures arise, such inability to compete could

have a material adverse effect on our business, results of operations, and overall financial condition.

Our

products may not achieve market acceptance thereby reducing the chance for success.

We

are only in the early stages of selling our first products, It is unclear whether these product and their features or other unanticipated

events may result in lower sales than anticipated, which could force us to limit our expenditures on research and development, advertising,

and general company requirements for improving and expanding our product offerings. We cannot guarantee consumer demand or interest

in our current or future product offerings, which could have a material adverse effect on our business, results of operations, and overall

financial condition.

If

the market chooses to buy our competitors’ products and services, we may fail.

Although

we believe that our product offerings will be commercially viable, there is no verification by the marketplace that its products will

be accepted by or purchased by customers. If the market chooses to buy our competitors’ products, it may be more difficult for

us to ever become profitable which would substantially harm our business and, possibly, cause it to fail whereby you could lose your

entire investment.

Consumer

trends, seasons fluctuations, and general global economic conditions and outlook may cause unpredictable operating results.

Our

operating results may fluctuate significantly from period to period as a result of a variety of factors, including consumer trends, seasonal

purchasing patterns of customers, competitive pricing, and general economic conditions. There is no assurance that we will be successful

in marketing our product, or that the revenues from the sale of our products will be significant. Consequently, our revenues may

vary significantly by quarter, and our operating results may experience significant fluctuations making it difficult to value our business

and could lead to extreme volatility in our share price.

We

may be unable to protect our proprietary rights.

Our

future success depends in part on our proprietary technology, technical know-how and other intellectual property. We rely on intellectual

property laws, confidentiality procedures and contractual provisions, such as nondisclosure terms, to protect our intellectual property.

Others may independently develop similar technology, duplicate our products, or design around our intellectual property rights. In addition,

unauthorized parties may attempt to copy aspects of our products and technologies or to obtain and use information that we regard as

proprietary. Any of these events could significantly harm our business, financial condition, our patents and our operating

results.

We

also rely on technologies that we acquire from others. We may rely on third parties for further required technologies. We may purchase

a computer’s logic component or other technological devices from outside sources and will need to pay annual fees to enable us

to get updates/upgrades and technical support to the logic portion of the system or device. We may find it necessary or desirable in

the future to obtain licenses or other rights relating to one or more if our products or to current or future technologies. These licenses

or other rights may not be available on commercially reasonable terms or at all. The inability to obtain certain licenses or other rights

or to obtain such licenses or rights on favorable terms, or the need to engage in litigation regarding these matters, could have a material

adverse effect on our business, financial condition and operating results. Moreover, the use of intellectual property licensed from third

parties may limit our ability to protect the proprietary rights in our products.

While

no current lawsuits are filed against us, the possibility exists that a claim of some kind may be made in the future.

While

no current lawsuits are filed against us, the possibility exists that a claim of some kind may be made in the future. We currently have

no plan to purchase liability insurance, which means that the Company would need to fund its own legal fees and costs in any such lawsuit.

We

may depend on contract manufacturers who may not have adequate capacity to fulfill our needs or may not meet our quality and delivery

objectives and timetables.

We

do not own our production lines or manufacturing facilities. We manufacture our products in the United States and Taiwan through

third-party manufacturers . Our reliance on these third-party contract manufacturers involves significant risks, including reduced

control over quality and logistics management, the potential lack of adequate capacity, and discontinuance of the contractors’

assembly processes. Potential financial instability at our contract manufacturers could result in us having to find new suppliers, which

could increase our costs and delay our product and installation deliveries. These contract manufacturers may also choose to discontinue

contracting to build our products for a variety of reasons. Consequently, we may experience delays in the timeliness, quality and adequacy

in product and installation deliveries, any of which could have a material adverse effect on our business, results of operations, and

overall financial condition.

We

have limited experience with our current product offerings, which makes it difficult to predict our future operating results.

The

success of our new product offerings will depend on many factors, including timely and successful research and development, pricing,

market and consumer acceptance of such new products and the product offerings of our competitors. If new product offerings are not successful,

our revenue growth will suffer, and our results of operations may be harmed. Further, we do not have significant experience in these

offerings and cannot be assured that our investments in the development of our offerings will result in increased revenue.

We

will require additional funding to develop and commercialize our services, products, and software. If we are unable to secure additional

financing on acceptable terms, or at all, we may be forced to modify our current business plan or to curtail or cease our planned operations.

We

anticipate incurring significant operating losses and using significant funds for product development and operating activities. Our existing

cash resources are insufficient to finance even our immediate operations. Accordingly, we will need to secure additional sources of capital

to develop our business and product candidates, as planned. We intend to seek substantial additional financing through public and/or

private financing, which may include equity and/or debt financings, and through other arrangements, including collaborative arrangements.

As part of such efforts, we may seek loans from certain of our executive officers, directors and/or current shareholders.

If

we are unable to secure additional financing in the near term, we may be forced to:

| |

● |

curtail

or abandon our existing business plans; |

| |

|

|

| |

● |

default

on any debt obligations; |

| |

|

|

| |

● |

file

for bankruptcy; |

| |

|

|

| |

● |

seek

to sell some or all of our assets; and/or |

| |

|

|

| |

● |

cease

our operations. |

If

we are forced to take any of these steps our common stock may be worthless.

Revenue

derived from large orders could adversely affect our gross margin and could lead to greater variability in our quarterly results.

Large

orders may be more sensitive to changes in the global industrial economy, may be subject to greater discount variability, lower gross

margins, and may contract at a faster pace during an economic downturn compared to smaller orders. To the extent that the amount of our

net sales derived from large orders increases in future periods, either in absolute dollars or as a percentage of our overall business,

our gross margins could decline, and we could experience greater volatility and see a greater negative impact from future downturns in

the global industrial economy. This dynamic may also have an impact on the historical seasonal pattern of our net sales and our results

of operations. These types of orders also make managing inventory levels more difficult as we have in the past and may have to in the

future build large quantities of inventory in anticipation of future demand that may not materialize.

We

intend to make significant investments in new products that may not be successful or achieve expected returns.

We

plan to make significant investments in research, development, and marketing for new and existing products and technologies. These investments

involve a number of risks as the commercial success of such efforts depend on many factors, including our ability to anticipate and respond

to innovation, achieve the desired technological fit, and be effective with our marketing and distribution efforts. If our existing or

potential customers do not perceive our latest product offerings as providing significant new functionality or value, or if we are late

to market with a new product or technology, we may not achieve our expected return on our investments or be able recover the costs expended

to develop new product offerings, which could have a material adverse effect on our operating results. Even if our new products are profitable,

our operating margins for new products may not be as high as the margins we have experienced historically.

Our

success depends on new product introductions and market acceptance of our products.

The

market for our products is characterized by rapid technological change, evolving industry standards, changes in customer needs and frequent

new product introductions, and is therefore highly dependent upon timely product innovation. Our success is dependent on our ability

to successfully develop and introduce new and enhanced products on a timely basis to replace declining revenues from older products,

and on increasing penetration in domestic and international markets. We may experience significant delays between the announcement and

the commercial availability of new products. Any significant delay in releasing new products could have a material adverse effect on

the ultimate success of a product and other related products and could impede continued sales of predecessor products, any of which could

have a material adverse effect on our operating results. There can be no assurance that we will be able to introduce new products in

accordance with announced release dates, that our new products will achieve market acceptance or that any such acceptance will be sustained

for any significant period. Failure of our new products to achieve or sustain market acceptance could have a material adverse effect

on our operating results.

We

may experience component shortages that may adversely affect our business and result of operations.

We

have experienced difficulty in securing certain types of high power connectors for one of our projects and anticipate that supply shortages

of components used in our products, including limited source components, can result in significant additional costs and inefficiencies

in manufacturing. If we are unsuccessful in resolving any such component shortages in a timely manner, we will experience a significant

impact on the timing of revenue, a possible loss of revenue, or an increase in manufacturing costs, any of which would have a material

adverse impact on our operating results.

We

rely on management information systems. interruptions in our information technology systems or cyber-attacks on our systems could adversely

affect our business.

We

rely on the efficient and uninterrupted operation of complex information technology systems and networks to operate our business. We

rely on a primary global center for our management information systems and on multiple systems in branches not covered by our global

center. As with any information system, unforeseen issues may arise that could affect our ability to receive adequate, accurate and timely

financial information, which in turn could inhibit effective and timely decisions. Furthermore, it is possible that our global center

for information systems or our branch operations could experience a complete or partial shutdown. A significant system or network disruption

could be the result of new system implementations, computer viruses, cyber-attacks, security breaches, facility issues or energy blackouts.

Threats to our information technology security can take a variety of forms and individuals or groups of hackers or sophisticated organizations

including state-sponsored organizations, may take steps that pose threats to our customers and our infrastructure. If we were to experience

a shutdown, disruption or attack, it would adversely impact our product shipments and net sales, as order processing and product distribution

are heavily dependent on our management information systems. Such an interruption could also result in a loss of our intellectual property

or the release of sensitive competitive information or partner, customer or employee personal data. Any loss of such information could

harm our competitive position, result in a loss of customer confidence, and cause us to incur significant costs to remedy the damages

caused by the disruptions or security breaches. In addition, changing laws and regulations governing our responsibility to safeguard

private data could result in a significant increase in operating or capital expenditures needed to comply with these new laws or regulations.

Accordingly, our operating results in such periods would be adversely impacted.

We

are continually working to maintain reliable systems to control costs and improve our ability to deliver our products in our markets

worldwide. Our efforts include, but are not limited to the following: firewalls, antivirus protection, patches, log monitors, routine

backups with offsite retention of storage media, system audits, data partitioning and routine password modifications. Our internal information

technology systems environment continues to evolve and our business policies and internal security controls may not keep pace as new

threats emerge. No assurance can be given that our efforts to continue to enhance our systems will be successful.

We

are subject to risks associated with our website.

We

devote significant resources to maintaining our website (www.tricascadeinc.com) as a key marketing, sales and support tool and expect

to continue to do so in the future. Failure to properly maintain our Website may interrupt normal operations, including our ability to

provide quotes, process orders, ship products, provide services and support to our customers, bill and track our customers, fulfill contractual

obligations and otherwise run our business which would have a material adverse effect on our results of operations. We host our Website