false

0001281845

0001281845

2024-03-01

2024-03-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported) March

1, 2024

| UNIQUE

LOGISTICS INTERNATIONAL, INC. |

| (Exact

name of registrant as specified in its charter) |

| Nevada |

|

000-50612 |

|

01-0721929 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

| 154-09 146th Ave, |

|

|

| Jamaica, NY |

|

11434 |

| (Address of principal executive offices) |

|

(Zip code) |

Registrant’s

telephone number, including area code (718)

978-2000

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| None |

|

None |

|

None |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2

of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01

Entry into a Material Definitive Agreement.

The

disclosure set forth below under Item 1.02 of this Current Report on Form 8-K is incorporated by reference herein.

Item 1.02

Termination of a Material Definitive Agreement.

As previously disclosed, on December 18, 2022, Unique Logistics International,

Inc., a Nevada corporation (the “Company”) entered into an Agreement and Plan of Merger by and among Edify Acquisition Corp.,

a Delaware corporation (“Buyer” or “Edify”), Edify Merger Sub, Inc., a Nevada corporation (“Merger Sub”),

and the Company, as amended and supplemented (the “Merger Agreement”).

The Company, Buyer and Merger Sub entered into a mutual termination agreement

dated as of March 1, 2024 (the “Termination Agreement”), pursuant to which they mutually agreed to terminate the Merger Agreement

effective as of such date. The termination of the Merger Agreement was approved by the Company’s Board of Directors. Pursuant to

the Termination Agreement, as of March 1, 2024, the Merger Agreement is of no further force and effect, except for Section 7.04 (No Claim

Against the Trust Account) and Section 9.05 (Confidentiality; Publicity) thereof, which survive the termination of the Merger Agreement

and remain in full force and effect in accordance with their respective terms. No termination penalties were incurred by any party in

connection with the termination of the Merger Agreement.

The

foregoing description of the Merger Agreement and the Termination Agreement does not purport to be complete and is subject to, and qualified

in its entirety by, the full text of the Merger Agreement and the Termination Agreement.

Item

9.01. Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

UNIQUE

LOGISTICS INTERNATIONAL, INC. |

| |

|

| Date:

March 1, 2024 |

By: |

/s/

Sunandan Ray |

| |

|

Sunandan

Ray |

| |

|

Chief

Executive Officer |

Exhibit

10.1

MUTUAL

TERMINATION AGREEMENT

THIS

MUTUAL TERMINATION AGREEMENT (this “Termination Agreement”) is entered into as of March 1, 2024, by and among

Edify Acquisition Corp., a Delaware corporation (“Buyer”), Edify Merger Sub, Inc., a Nevada corporation and

direct, wholly owned subsidiary of Buyer (“Merger Sub”), and Unique Logistics International, Inc., a Nevada

corporation (the “Company”). Buyer, Merger Sub and the Company are collectively referred to herein as the “Parties”

and individually as a “Party.” Capitalized terms used and not otherwise defined herein have the meanings set

forth in Section 1.01 of the Merger Agreement (as defined below).

RECITALS

WHEREAS,

Buyer, Merger Sub and the Company entered into that certain Agreement and Plan of Merger, dated as of December 18, 2022, as amended by

that First Amendment to the Merger Agreement, dated as of July 19, 2023 and that certain Acknowledgement and Waiver Agreement, dated

as of September 18, 2023 (as so amended, the “Merger Agreement”); and

WHEREAS,

the Parties desire to terminate the Merger Agreement in accordance with Section 11.01(a) thereof.

NOW

THEREFORE, in consideration of the mutual agreements contained herein and for good and valuable consideration, the receipt and sufficiency

of which are hereby acknowledged, the Parties agree as follows:

TERMINATION

1. Termination

of Merger Agreement. Pursuant to Section 11.01(a) of the Merger Agreement, Buyer, Merger Sub and the Company hereby agree by

mutual consent to terminate the Merger Agreement effective as of the date hereof, except that Section 7.04 (No Claim Against the Trust

Account) and Section 9.05 (Confidentiality; Publicity) thereof shall survive such termination of the Merger Agreement.

2. Authority.

Each Party hereby represents and warrants to the other Parties that (a) such Party has full corporate power and authority to execute

and deliver this Termination Agreement, (b) the execution and delivery of this Termination Agreement, the termination of the Merger Agreement

and consummation of the other transactions contemplated hereby have been duly and validly approved by the board of directors of such

Party, (c) no other corporate proceedings on the part of such party are necessary to approve this Termination Agreement or the termination

of the Merger Agreement or to consummate the other transactions contemplated hereby and (d) this Termination Agreement has been duly

and validly executed and delivered by such Party and (assuming due authorization, execution and delivery by the other Parties) constitutes

a valid and binding obligation of such Party, enforceable against such Party in accordance with its terms (except in all cases as such

enforceability may be limited by the Enforceability Exceptions).

3. Waiver;

Release.

| a) | Notwithstanding

anything to the contrary in the Merger Agreement, the Company hereby irrevocably and unconditionally

waives all claims or causes of action against Buyer, Merger Sub and their respective Affiliates

and releases Buyer, Merger Sub and their respective Affiliates from any and all obligations,

liabilities, losses or issues of whatsoever kind of nature, in each case, whether in contract

or in tort, in Law or in equity or otherwise, or granted by statute or otherwise, whether

by or through attempted piercing of the corporate, limited partnership or limited liability

company veil or any other theory or doctrine, including alter ego or otherwise, whether accrued

or unaccrued, whether known or unknown, whether asserted or unasserted, whether suspected

or unsuspected, whether disclosed or undisclosed, that have been or could have been, could

now be, or could in the future be based upon, in respect of, arise under, out or by reason

of, be connected with, or relate in any manner to the Merger Agreement or the other Transaction

Agreements, or the negotiation, execution, or performance or non-performance of the Merger

Agreement or the other Transaction Agreements (including any representation or warranty made

in, in connection with, or as an inducement to, the Merger Agreement or the other Transaction

Agreements). |

| b) | Notwithstanding

anything to the contrary in the Merger Agreement, each of Buyer and Merger Sub hereby irrevocably

and unconditionally waive all claims or causes of action against the Company and its Affiliates

and releases the Company and its Affiliates from any and all obligations, liabilities, losses

or issues of whatsoever kind of nature, in each case, whether in contract or in tort, in

Law or in equity or otherwise, or granted by statute or otherwise, whether by or through

attempted piercing of the corporate, limited partnership or limited liability company veil

or any other theory or doctrine, including alter ego or otherwise, whether accrued or unaccrued,

whether known or unknown, whether asserted or unasserted, whether suspected or unsuspected,

whether disclosed or undisclosed, that have been or could have been, could now be, or could

in the future be based upon, in respect of, arise under, out or by reason of, be connected

with, or relate in any manner to the Merger Agreement, or the other Transaction Agreements,

or the negotiation, execution, or performance or non-performance of the Merger Agreement

or the other Transaction Agreements (including any representation or warranty made in, in

connection with, or as an inducement to, the Merger Agreement or the other Transaction Agreements). |

4. Headings.

The headings contained in this Termination Agreement are included for convenience of reference only and shall not affect in any way the

meaning or interpretation of this Termination Agreement.

5. Counterparts.

This Termination Agreement may be executed and delivered (including executed manually or electronically via DocuSign or other similar

services and delivered by facsimile or portable document format (pdf) transmission) in one or more counterparts, and by the different

Parties in separate counterparts, each of which when executed shall be deemed to be an original but all of which taken together shall

constitute one and the same agreement.

6. Amendment.

This Termination Agreement may be amended or modified in whole or in part, only by a duly authorized agreement in writing executed in

the same manner as this Termination Agreement (and by each of the Parties to this Termination Agreement) and that makes reference to

this Termination Agreement.

7. Miscellaneous

Provisions. Sections 1.02 (Construction), 12.02 (Notices), 12.06 (Governing Law), 12.11 (Severability) and 12.12 (Jurisdiction;

Waiver of Trial by Jury) of the Merger Agreement are hereby incorporated by reference into this Termination Agreement, mutatis mutandis.

[Signature

Pages Follow]

IN

WITNESS WHEREOF, Buyer, Merger Sub and the Company have caused this Termination Agreement to be executed as of the date first written

above by their respective officers thereunto duly authorized.

| |

EDIFY

ACQUISITION CORP. |

| |

|

|

| |

By: |

|

| |

Name: |

Morris

Beyda |

| |

Title: |

Chief

Financial Officer |

| |

|

|

| |

EDIFY

MERGER SUB, INC. |

| |

|

|

| |

By: |

|

| |

Name: |

Morris

Beyda |

| |

Title: |

President |

Signature

Page to

Mutual

Termination Agreement

| |

UNIQUE

LOGISTICS INTERNATIONAL, INC. |

| |

|

|

| |

By: |

|

| |

Name: |

Sunandan

Ray |

| |

Title: |

Chief

Executive Officer |

Signature

Page to

Mutual

Termination Agreement

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

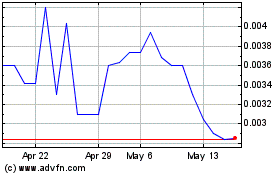

Unique Logistics (PK) (USOTC:UNQL)

Historical Stock Chart

From Feb 2025 to Mar 2025

Unique Logistics (PK) (USOTC:UNQL)

Historical Stock Chart

From Mar 2024 to Mar 2025