Catalysts improvement on track, Care Chemicals and Additives

impacted by macroeconomic challenges – Clariant achieved strong

Operating Cash Flow

AD HOC ANNOUNCEMENT PURSUANT TO ART. 53 LR

- Q2 2023 sales decreased by 7 % in local currency, down

17 % in Swiss francs to CHF 1.084 billion

- Q2 2023 reported EBITDA margin at 16.1 % from 16.6 %

in Q2 2022

- H1 2023 sales decreased by 3 % in local currency,

down 11 % in Swiss francs to

CHF 2.284 billion

- H1 2023 reported EBITDA margin at 15.0 % from 17.0 %

in H1 2022

- H1 2023 Operating Cash Flow at CHF 78 million

compared to CHF - 17 million in H1 2022

- Full Year 2023 Outlook: Full year sales between

CHF 4.55 – 4.65 billion and reported EBITDA

expected between CHF 650 – 700 million

(14.3 % – 15.1 % reported EBITDA margin)

“As indicated in early July, the challenging

economic conditions affected the specialty chemicals sector and

also impacted Clariant’s first-half year results. Our customers

continued to bring their inventories down, and demand was weak in

Care Chemicals and Additives, which impacted our profitability. We

are pleased with our continued improvements in the Catalysts

business, and we achieved further progress in reducing the negative

sunliquid® impact on our results in the second quarter. Our

stronger results in Catalysts partially offset the weaker trading

results in the other business units. We implemented additional

actions to align our cost base to a low volume environment, thereby

increasing our 2025 targeted savings by CHF 10 million to

a revised goal of CHF 170 million. We also continued our

strong focus on cash, resulting in an improved operating cash flow

by almost CHF 100 million compared to last year,” said

Conrad Keijzer, Chief Executive Officer of Clariant.

Business Summary

|

|

Second Quarter |

First Half Year |

|

in CHF million |

2023 |

2022 |

% CHF |

% LC |

2023 |

2022 |

% CHF |

% LC |

|

Sales |

1 084 |

1 301 |

- 17 |

- 7 |

2 284 |

2 563 |

- 11 |

- 3 |

|

EBITDA |

175 |

216 |

- 19 |

|

342 |

436 |

- 22 |

|

|

- margin |

16.1 % |

16.6 % |

|

|

15.0 % |

17.0 % |

|

|

Second Quarter 2023 Group Discussion

MUTTENZ, July 28,

2023

Clariant, a sustainability-focused specialty

chemical company, today announced second quarter 2023 sales of

CHF 1.084 billion, compared to

CHF 1.301 billion in the second quarter of 2022. This

corresponds to a 7 % decrease in local currency and 17 %

lower sales in Swiss francs. Pricing was flat year-on-year, while

volumes decreased by 5 %. Divestments (North American Land Oil

and Quats businesses) as well as the consolidation of the US

Attapulgite business had a net negative scope effect of 2 %.

Currency impacted sales in the quarter by - 10 %. Sales

growth was strong in the Business Unit Catalysts, which partially

compensated for the weakness in the Care Chemicals and

Adsorbents & Additives Business Units.

In the second quarter, local currency sales were

down 10 % in the Europe,

Middle East & Africa region. Care Chemicals and

Adsorbents & Additives sales weakened, while

Catalysts was strong in the Middle East. Sales in the Americas

decreased by 11 %, primarily because the improvement in

Adsorbents & Additives from the integration of the US

Attapulgite business was unable to offset lower Care Chemicals

sales (due in part to the disposal of the North American Land Oil

business). Sales in Asia-Pacific were stable, despite an 8 %

decline in China, as growth in Catalysts balanced out lower prices

and volumes at Care Chemicals and

Adsorbents & Additives.

Care Chemicals sales decreased by 17 % in

local currency in the second quarter of 2023. This development was

primarily driven by a volume decline with lower sales in both

Consumer and Industrial Applications versus a challenging

comparison base. Catalysts sales rose by 30 % in local

currency with growth in all business segments.

Adsorbents & Additives sales decreased by 12 %

in local currency due to weaker demand for Additives in particular,

against a very strong second quarter in 2022.

Group EBITDA decreased by 19 % to

CHF 175 million, and the corresponding 16.1 % margin

was below the 16.6 % reported in the second quarter of the

previous year which included a CHF 22 million gain from

the Scientific Design divestment. Positive profitability impacts

included pricing measures in Catalysts and

Adsorbents & Additives, as well as the preliminary

CHF 62 million gain from the Quats disposal in Care

Chemicals. Performance programs cost savings of approximately

CHF 14 million addressed remnant cost from divested

businesses and contributed positively to offset inflation. However,

these factors did not offset the impact from lower volumes that

negatively affected production utilization in certain businesses,

together with restructuring charges of CHF 18 million,

and a CHF 10 million negative operational impact from

sunliquid®. Inventory devaluation resulting from lower raw material

prices (- 12 %) in the second quarter of 2023 weighed on

the profitability as well.

First Half Year 2023 Group Discussion

In the first half year 2023, sales were

CHF 2.284 billion, compared to

CHF 2.563 billion in the first half year 2022. This

corresponds to a decrease of 3 % in local currency

(- 2 % organic in local currency) and a decrease

of 11 % in Swiss francs. Pricing had a positive impact on

the Group of 4 % while volumes were down 6 %, scope

(arising from divestments and an acquisition) was net

- 1 %, and the currency impact was - 8 %.

In the first half year 2023, sales decreased by

5 % in the Europe, Middle East & Africa

region in local currency, primarily due to weak demand in Germany

(- 18 %). The 3 % sales contraction in the Americas

is largely attributable to an 11 % decline in the US, where

the result was impacted by the divestment of the North American

Land Oil business and force majeure declarations in the first

quarter. Sales in Asia declined by 2 % versus the first half

of 2022, with China reporting a 12 % decrease.

Care Chemicals sales decreased by 9 % in

local currency in the first half year 2023 versus a challenging

comparison base. The prolonged destocking cycle continued to impact

demand in key end markets in Care Chemicals as well as Additives.

In Catalysts, the top line was up by 25 % in local currency,

propelled by Propylene and Syngas & Fuels.

Adsorbents & Additives sales decreased by 8 % in

local currency due to weaker demand for Additives, against a

particularly strong first half year in 2022.

Group EBITDA decreased by 22 % to

CHF 342 million as profitability was negatively impacted

by lower volumes, a CHF - 23 million impact from

sunliquid® (excluding restructuring charges in the second quarter),

the CHF - 11 million fair value adjustment of the

Heubach Group participation in the first quarter, restructuring

charges of CHF 20 million, as well as inventory

devaluation. The disposal of the Quats business in Care Chemicals

contributed a preliminary CHF 62 million gain while

pricing effects overall remained positive. Raw material cost

decreased by 5 %, and the execution of the performance

improvement programs resulted in additional cost savings of

CHF 22 million in the first half year 2023. As a result

of these factors, the EBITDA margin decreased to 15.0 % from

17.0 %.

In the first half year 2023, the total Group net

result was CHF 232 million versus

CHF 386 million in the previous year. The result was

lifted by the strong business performance in Catalysts, the

preliminary CHF 62 million gain from the Quats disposal,

as well as the positive impact on the tax rate from the

reassessment of provisions related to prior years. In the first

half year 2022, the net result had been lifted by the gain on the

disposal of the Pigments Business Unit in discontinued

operations.

Cash generated from operating activities for the

total Group increased significantly to CHF 78 million

from CHF - 17 million in the first half of 2022.

This notable improvement was mainly attributable to the disposals

and Clariant’s active working capital management.

Net debt for the total Group increased to

CHF 908 million versus CHF 750 million recorded

at the end of 2022. This development is largely attributable to

reduced liquidity due to the payment of dividends.

ESG Update – Leading in

Sustainability

Clariant’s Scope 1 and 2 total greenhouse gas

emissions fell to 0.57 million tons in the last twelve months

(July 2022 to June 2023), a decline of 8 % from

0.62 million tons in the full year 2022. The total indirect

greenhouse gas emissions for purchased goods and services (Scope 3)

also decreased by 11 %, from 2.58 million tons in the full

year 2022 to 2.3 million tons in the last twelve months. These

results are to an extent attributable to the lower sales volumes in

the first half year 2023. However, they also demonstrate continued

progress toward reaching the Group’s 2030 emissions reduction

targets.

Clariant has numerous measures in place to

reduce Scope 1 and 2 emissions. Thus far in 2023, Clariant further

reduced the use of coal (50 % versus baseline year 2019). At a

site in Bonthapally, India, steam is generated from sustainable

biomass instead of coal. In addition, sun drying and natural drying

of bentonites at various sites has replaced fossil fuel drying

(coal and oil).

Clariant is committed to drive growth through

sustainability and innovation across the portfolio. The

Adsorbents & Additives Business Unit is improving the

environmental impact of desiccants by adding plastic-free Desi Pak®

ECO moisture adsorbing packets to help manufacturers and

distributors protect sealed packaged goods from moisture damage.

The innovative packets feature bio-based paper made from raw

materials that are sustainably grown and use only water-based inks

and adhesive. To further help customers reduce their own Scope 3

emissions, the sourcing of raw materials has been extended with a

lower environmental impact to include transport packaging.

Outlook – Full Year 2023

From a macroeconomic perspective, Clariant

expects to see no substantial economic recovery in the second half

of 2023, while uncertainties and risks related to the economic

environment remain. For the full year 2023, Clariant expects to

achieve sales between CHF 4.55 – 4.65 billion,

including a net divestments/acquisition impact of around

CHF - 150 million relating to the Quats, North

American Land Oil, and Attapulgite transactions as well as an

expected approximate 5 – 10 % negative FX

translation impact. The full year 2023 reported EBITDA is expected

between CHF 650 – 700 million

(14.3 % – 15.1 % reported EBITDA margin),

including a preliminary CHF 62 million gain from the

Quats divestment and approximately CHF 30 million in

restructuring charges. Clariant expects an increased negative

annualized sunliquid® impact to be counterbalanced by savings

benefits from the restructuring programs and an easing inflationary

environment, given the current economic outlook.

The Group has become a true specialty chemical

company and remains committed toward its 2025 ambition to deliver

profitable sales growth (4 – 6 % CAGR), a Group

EBITDA margin between 19 – 21 %, and a free cash

flow conversion of around 40 %.

Extraction from Key Financial Group

Figures

|

|

Second Quarter |

First Half Year |

|

in CHF million |

2023 |

2022 |

% CHF |

% LC |

2023 |

2022 |

% CHF |

% LC |

|

Sales |

1 084 |

1 301 |

- 17 |

- 7 |

2 284 |

2 563 |

- 11 |

- 3 |

|

EBITDA |

175 |

216 |

- 19 |

|

342 |

436 |

- 22 |

|

|

- margin |

16.1 % |

16.6 % |

|

|

15.0 % |

17.0 % |

|

|

|

EBITDA before exceptional items |

135 |

210 |

- 36 |

|

319 |

448 |

- 29 |

|

|

- margin |

12.5 % |

16.1 % |

|

|

14.0 % |

17.5 % |

|

|

|

EBIT |

|

|

|

|

222 |

290 |

|

|

|

Return on Invested Capital (ROIC) |

|

|

|

|

0.1 % |

10.9 % |

|

|

|

Net result from continuing operations |

|

|

|

|

230 |

189 |

|

|

|

Net result (1) |

|

|

|

|

232 |

386 |

|

|

|

Operating cashflow (1) |

|

|

|

|

78 |

- 17 |

|

|

|

Number of employees (1) |

|

|

|

|

10 690 |

11 148 (3) |

|

|

|

Discontinued operations (2) |

|

|

|

|

|

|

|

|

|

Net result from discontinued operations |

|

|

|

|

2 |

197 |

|

|

- Total Group, including discontinued operations

- Pigments divested on 3 January 2022

- As of 31 December 2022

Q2/H1 2023 Media Release

H1 2023 Financial Review

|

CORPORATE MEDIA RELATIONS Jochen DubielPhone +41 61 469 63

63jochen.dubiel@clariant.com Anne SchäferPhone +41 61 469 63

63anne.schaefer@clariant.com Ellese CaruanaPhone +41 61 469 63

63ellese.caruana@clariant.com Follow us on

Twitter, Facebook, LinkedIn, Instagram. |

INVESTOR RELATIONS Andreas Schwarzwälder Phone +41 61 469

63 73andreas.schwarzwaelder@clariant.com Maria IvekPhone +41

61 469 63 73maria.ivek@clariant.com Thijs BouwensPhone +41 61

469 63 73thijs.bouwens@clariant.com |

|

This media release contains certain statements that are

neither reported financial results nor other historical

information. This document also includes forward-looking

statements. Because these forward-looking statements are subject to

risks and uncertainties, actual future results may differ

materially from those expressed in or implied by the statements.

Many of these risks and uncertainties relate to factors that are

beyond Clariant’s ability to control or estimate precisely, such as

future market conditions, currency fluctuations, the behavior of

other market participants, the actions of governmental regulators

and other risk factors such as: the timing and strength of new

product offerings; pricing strategies of competitors; the Company’s

ability to continue to receive adequate products from its vendors

on acceptable terms, or at all, and to continue to obtain

sufficient financing to meet its liquidity needs; and changes in

the political, social and regulatory framework in which the Company

operates or in economic or technological trends or conditions,

including currency fluctuations, inflation and consumer confidence,

on a global, regional or national basis. Readers are cautioned not

to place undue reliance on these forward-looking statements, which

speak only as of the date of this document. Clariant does not

undertake any obligation to publicly release any revisions to these

forward-looking statements to reflect events or circumstances after

the date of these materials. www.clariant.com Clariant is

a focused specialty chemical company led by the overarching purpose

of ‘Greater chemistry – between people and planet’. By connecting

customer focus, innovation, and people the company creates

solutions to foster sustainability in different industries. On 31

December 2022, Clariant totaled a staff number of 11 148 and

recorded sales of CHF 5.198 billion in the fiscal year

for its continuing businesses. As of January 2023, the Group

conducts its business through the three newly formed Business Units

Care Chemicals, Catalysts, and Adsorbents & Additives. Clariant

is based in Switzerland. |

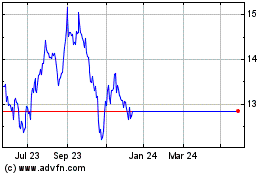

Clariant (LSE:0QJS)

Historical Stock Chart

From Feb 2025 to Mar 2025

Clariant (LSE:0QJS)

Historical Stock Chart

From Mar 2024 to Mar 2025