Investor Day 2024: Clariant well positioned for further growth and profitability improvement

04 November 2024 - 5:00PM

UK Regulatory

Investor Day 2024: Clariant well positioned for further growth and

profitability improvement

AD HOC ANNOUNCEMENT PURSUANT TO ART. 53 LR

- Clariant

committed to creating shareholder value as a top quartile specialty

chemical company

-

Differentiated segment steering and adoption of strategic

mandates to drive above-market growth

- Innovation

arenas to deliver ~ 70 % of profitable growth and

innovation rate expected to

reach ~ 20 % by 2027

- Reinforced

medium-term financial targets, by 2027 at the latest: compound

annual sales growth of 4 – 6 % in local currency,

EBITDA margin of 19 – 21 %, and free cash flow

conversion of around 40 %

- Margin

improvement reinforced by new self-help actions totaling

~ CHF 80 million run-rate savings in full by latest

2027

- Upgraded

2030 non-financial targets, including increased GHG emission

reduction targets in line with

SBTi 1.5°C scenario

“At Clariant, we have built a robust foundation

for profitable growth by streamlining our portfolio, implementing a

customer-centric operating model and enhancing operational

efficiency. Our strategy focuses on innovation-driven growth and

geographic expansion, with our newly defined innovation arenas

expected to drive around 70 % of our growth by 2027. We are

implementing tailored segment strategies across our global

businesses. This approach, combined with ongoing performance

improvement measures, will boost our growth and profitability,

ensuring we meet our medium-term financial targets by 2027 at the

latest. We have also strengthened our commitment to sustainability

by upgrading our non-financial targets, including an increased

reduction in greenhouse gas emissions aligned with a 1.5°C

scenario. Clariant is poised for an exciting future as we execute

our differentiated purpose-led growth strategy. Our goal is clear:

to establish Clariant as a top-quartile specialty chemical company,

delivering value for all our stakeholders,” said Conrad Keijzer,

Chief Executive Officer of Clariant.

MUTTENZ, 4

NOVEMBER 2024

Clariant, a sustainability-focused specialty

chemical company, today hosts an Investor Day in London to provide

an update on its purpose-led strategy to deliver profitable growth.

The company has introduced differentiated segment steering for its

businesses to better align its innovation capabilities with global

megatrends that offer strong, above-market growth opportunities.

These megatrends are categorized into three innovation arenas:

health- and sustainability-conscious consumers and brands, energy

transition, and circularity. Together, they are set to deliver

~ 70 % of profitable growth, with the innovation rate

expected to reach ~ 20 % by 2027.

Clariant’s strong platform for the

future

The new approach builds on the strong platform

Clariant has created for profitable growth since its last Capital

Markets Day (CMD), held in November 2021:

- Clariant has

significantly reshaped its portfolio, which is now specialty

chemicals focused and has an increased consumer exposure. As of

Q3 2024, sales from consumer-facing end markets have increased

to around 44 %, compared to 36 % in 2021;

- Clariant has also

implemented a new, more effective, and customer-focused operating

model. This shift in model has delivered tangible results, with a

significant improvement in both customer and employee Net Promoter

Score. Additionally, simplified processes resulting from the new

model and awareness campaigns have improved Clariant‘s safety

record substantially;

- Clariant has increased its cost

savings target by 60 % since the CMD in 2021 and is on track

to deliver the CHF 175 million target by 2025. Savings of

CHF 162 million, representing > 90 %, have

already been realized from efficiency and rightsizing measures, as

well as from the implementation of the new operating model.

Through self-help actions, Clariant has

therefore been able to demonstrate resilient performance, despite

the challenges faced by the chemical industry in recent years. The

company now holds a strong position to outperform the market in a

stabilizing environment and normalizing trading conditions.

Differentiated segment steering across

Clariant

Clariant aims to seize value-creating

opportunities from key global megatrends that are impacting both

its industry and its customers. These include regional shifts in

the global economy; health, wellness, and sustainability; changing

demographics; digitalization and automation; and decarbonization.

The following examples demonstrate how Clariant is positioning

itself to capitalize on these megatrends:

- Clariant has a

well-balanced global footprint, with ~ 40 % of sales from

APAC and MEA (last twelve months to the end of Q3 2024) and

strong platforms for local sales in key growth regions;

- The Lucas Meyer

Cosmetics acquisition establishes a leadership position in the

highly attractive premium cosmetics ingredients space and is

expected to continue to grow at double-digit rates;

- In the Pharma

segment, Clariant aims to increase its market share through

targeted growth initiatives, expecting high single-digit percentage

CAGR sales growth during the period to 2027;

- Clariant has

deployed GenAI as a strategic enabler across sales, R&D, and

operations, with a customised, in-house AI solution, that is

continously improved;

- The Catalysts business is well

placed to play a crucial role in the emerging hydrogen economy with

a long-term revenue opportunity of more than

CHF 100 million by 2030.

To optimize how Clariant capitalizes on these

global megatrends, the company has categorized them into innovation

arenas and performed a holistic analysis of how its business

segments can serve them. According to this analysis, each segment

has been assigned a strategic mandate, as follows: Boost, Outgrow,

Grow at Market, Turnaround, or Harvest. For Boost segments Clariant

will mobilize resources to rapidly accelerate its market share. For

segments with Outgrow potential, Clariant will leverage its strong

competitive position or scale in attractive markets to drive

growth. For segments which can Grow at Market the company will

secure the long-term market position and therefore ensure sustained

value contribution to the group portfolio. For under-performing

areas, it will Turnaround businesses, aiming to improve

profitability across a growth trajectory and / or cost structure.

And finally, the Harvest category relates to those areas where

Clariant will continue capitalizing on the current asset base,

while focusing on cash flow generation. Each of these mandates has

a tailored strategy that determines the allocation of resources,

reshaping the company-wide innovation process to ensure a

systematic approach.

Boosting innovation

capabilities

While the innovation rate for the last twelve

months, up to the end of Q3 2024, was 17 % (as a

percentage of Group sales from new products in the first five years

of commercialization), Clariant is now expecting to increase the

innovation rate to ~ 20 % by 2027. The new approach to

innovation is leveraging the three innovation arenas:

- Health-

and sustainability-conscious consumers and brands – shifts

in consumer behavior towards sustainability and health-conscious

products are a key driver of Clariant's future growth. For example,

through Lucas Meyer Cosmetics and Clariant’s VitiPure product

lines, the company is expanding high-performance, sustainable

ingredients in cosmetics, personal care, and pharmaceuticals. Its

PFAS-free solutions and sustainable actives also build on this

demand for safer, more environmentally friendly products;

- Energy

transition – Clariant is actively supporting the global

energy transition by providing solutions for biodiesel, sustainable

aviation fuel (SAF) and the hydrogen economy. It is also developing

catalysts for green hydrogen derivatives and other renewable energy

applications, which help to decarbonize hard-to-abate

industries;

-

Circularity – as industries increasingly turn to

renewable and recycled materials, Clariant sees growth potential in

products designed around a circular approach. Clariant offers

solutions such as Licocene® for

recycling applications and recently launched

Hostanox®, a novel natural

antioxidant.

Clariant expects that these three innovation

arenas will deliver around 70 % of its profitable growth by

2027, providing a tangible roadmap to outgrow the chemicals market

by ~ 1.5 % per annum in the medium term.

Profitable growth with medium-term

targets confirmed

For the medium term, Clariant remains committed

to its medium-term targets, to be achieved by 2027 at the latest:

4 – 6 % local currency sales growth;

19 – 21 % reported EBITDA margin; and around

40 % free cash flow conversion.

The top-line medium-term target is underpinned

by tangible growth levers, assuming a market growth of

2 – 4 %. The three innovation arenas are expected to

deliver ~ 1.5 % growth per annum. In addition, the

planned APAC and MEA geographic expansion is expected to deliver

~ 0.5 % growth per annum. Executing on these initiatives

will therefore add an additional 2 % growth per annum for

Clariant, over and above chemical market growth.

Clariant is well-positioned to advance its

guided 2024 reported EBITDA margin of around 16 % to a

medium-term target range of 19 – 21 % by 2027 at the

latest. Top-line growth will drive improved operational leverage on

the back of the reduced cost base and will be strengthened by

margin-enhancing growth from the innovation arenas. Clariant will

also implement incremental cost measures and productivity

improvements. This amounts to total self-help actions of

~ CHF 80 million run-rate savings in full by latest

2027 across all three business units. Overall, Clariant therefore

expects around two-thirds of the margin improvement over 2024 to

2027 to be driven by growth and around one-third to be driven by

self-help measures.

ESG Leadership

Clariant has become a leader in sustainability

within the chemical industry, having upgraded most of its

non-financial targets since the 2021 CMD. The company aims to

remain in the top quartile in terms of employee safety and to

achieve the top quartile in employee engagement (eNPS) by 2030.

Clariant also aims to increase female representation in management

(> 30 %) and have more leaders of national origin

outside of Europe (> 40 %) by 2030.

Since 2019, Clariant has reduced its Scope 1

& 2 carbon footprint by 29 %; and Scope 3.1 by

19 %. The company is currently overdelivering against its

previous 2030 GHG emissions reduction targets, assuming a linear

trend line. Clariant has therefore upgraded its target to a

46 % reduction in Scope 1 & 2 emissions by 2030

(previously 40 %). Furthermore, it is doubling its Scope 3

emissions reduction target from 14 % to 28 %. Clariant

has resubmitted these upgraded targets in line with SBTi 1.5°C

short-term scenario.

Further information

Clariant is holding its Investor Day today,

Monday, 4 November 2024. The presentations of the

in-person event will be available on the Clariant website on the

day from 11.00 a.m. GMT (12.00 p.m. CET). The event will be

recorded and made available on the Clariant website shortly after

its conclusion.

CORPORATE MEDIA RELATIONS

Jochen Dubiel

Phone +41 61 469 63 63

jochen.dubiel@clariant.com

Ellese Caruana

Phone +41 61 469 63 63

ellese.caruana@clariant.com

Luca Lavina

Phone +41 61 469 63 63

luca.lavina@clariant.com

Follow us on X, Facebook, LinkedIn, Instagram. |

INVESTOR RELATIONS

Andreas Schwarzwälder

Phone +41 61 469 63 73

andreas.schwarzwaelder@clariant.com

Thijs Bouwens

Phone +41 61 469 63 73

thijs.bouwens@clariant.com

|

This media release contains certain statements that are neither

reported financial results nor other historical information. This

document also includes forward-looking statements. Because these

forward-looking statements are subject to risks and uncertainties,

actual future results may differ materially from those expressed in

or implied by the statements. Many of these risks and uncertainties

relate to factors that are beyond Clariant’s ability to control or

estimate precisely, such as future market conditions, currency

fluctuations, the behavior of other market participants, the

actions of governmental regulators and other risk factors such as:

the timing and strength of new product offerings; pricing

strategies of competitors; the company’s ability to continue to

receive adequate products from its vendors on acceptable terms, or

at all, and to continue to obtain sufficient financing to meet its

liquidity needs; and changes in the political, social and

regulatory framework in which the Company operates or in economic

or technological trends or conditions, including currency

fluctuations, inflation and consumer confidence, on a global,

regional or national basis. Readers are cautioned not to place

undue reliance on these forward-looking statements, which speak

only as of the date of this document. Clariant does not undertake

any obligation to publicly release any revisions to these

forward-looking statements to reflect events or circumstances after

the date of these materials.

www.clariant.com

Clariant is a focused specialty chemical company led by the

overarching purpose of ‘Greater chemistry – between people and

planet’. By connecting customer focus, innovation, and people the

company creates solutions to foster sustainability in different

industries. On 31 December 2023, Clariant totaled a staff number of

10 481 and recorded sales of CHF 4.377 billion in the fiscal year

for its continuing businesses. As of January 2023, the Group

conducts its business through the three Business Units Care

Chemicals, Catalysts, and Adsorbents & Additives. Clariant is

based in Switzerland. |

- CLARIANT MEDIA RELEASE INVESTOR DAY 2024 EN_20241104

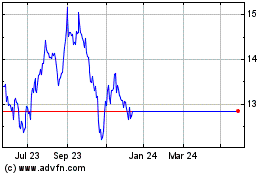

Clariant (LSE:0QJS)

Historical Stock Chart

From Jan 2025 to Mar 2025

Clariant (LSE:0QJS)

Historical Stock Chart

From Feb 2024 to Mar 2025