Clariant delivers good start to 2024 with improved profitability –

outlook confirmed

AD HOC ANNOUNCEMENT PURSUANT TO ART. 53 LR

- Q1 2024

sales decreased by 6 % organically in local

currencies1 to CHF

1.014 billion against a strong comparison base in Q1 2023, driven

by stabilized volumes and lower pricing

- Q1 2024

EBITDA margin improved to 17.1 % compared to 13.9 % in Q1

2023, driven by performance programs, deflationary raw material and

energy price trends, strong margin in aviation, and reduced

sunliquid®

impact

- Closing of

Lucas Meyer Cosmetics acquisition on 2 April 2024 strengthens

position as a true specialty chemical company and expands

Clariant’s reach into attractive cosmetic ingredients

space

- Confirmed

Outlook 2024 and medium-term targets

“Clariant delivered a good start to the year in the first quarter

of 2024 demonstrating the resilience of our specialty chemicals

portfolio. The improved profitability was driven by our performance

programs and successful margin management in the deflationary

environment. Our topline performance reflected stabilized volumes

and lower pricing against a strong comparison base last year.

Sequentially, we saw limited restocking activities from customers,

although uncertainties about underlying demand remain. The lower

sunliquid® impact and strong margin in our aviation

business positively contributed to profitability. We are on track

to deliver on our 2024 guidance and remain committed toward our

medium-term targets,” said Conrad Keijzer, Chief Executive Officer

of Clariant.

“We recently closed the acquisition of Lucas

Meyer Cosmetics, opening a new chapter for Clariant. I warmly

welcome our new team members, and together we are looking forward

to the growth opportunities that lie ahead. In addition, we

achieved a significant safety milestone recording zero accidents in

the month of March, equating to approximately two million working

hours without accidents across all of our 73 production sites,

offices, laboratories and warehouses worldwide. This achievement is

a direct result of the proactive measures we have implemented to

promote a safe workplace for our employees. We have set the right

trajectory internally as well as externally to deliver on our

targets,” Conrad Keijzer added.

Business Summary

|

|

|

First Quarter |

|

in CHF million |

|

|

|

|

2024 |

2023 |

% CHF |

% LC(1) |

|

Sales |

|

|

|

|

1 014 |

1 200 |

- 16 |

- 11 |

|

EBITDA |

|

|

|

|

173 |

167 |

4 |

|

|

- margin |

|

|

|

|

17.1 % |

13.9 % |

|

|

|

EBITDA before exceptional items |

|

|

|

|

184 |

184 |

0 |

|

|

- margin |

|

|

|

|

18.1 % |

15.3 % |

|

|

|

Sales bridge: |

|

Price - 5 %; Volume - 1 %; Currency - 5 %; Scope

- 5 % |

(1) Excluding

hyperinflation accounting countries Argentina and Türkiye

1 All references to local currency growth, pricing,

volumes, and scope exclude the impact from hyperinflation countries

Argentina and Türkiye. All references to currency include a net

impact from hyperinflation countries Argentina and Türkiye.

First Quarter 2024 Group

Discussion

MUTTENZ, 30

APRIL 2024

Clariant, a sustainability-focused specialty

chemical company, today announced first quarter 2024 sales of

CHF 1.014 billion, down 6 % organically in local

currency1 and 11 % including scope in local

currency (16 % in Swiss francs) versus Q1 2023. Pricing

decreased by 5 % year-on-year and volumes by 1 %. Changes

in scope had a negative impact of 5 % due to the divestments

of the North American Land Oil and Quats businesses.

Care Chemicals sales decreased by 4 %

organically in local currency and 9 % related to scope versus

Q1 2023. Sales in Mining Solutions, Industrial Applications and

Personal & Home Care grew organically while the seasonal

aviation business declined, due to less favorable weather impacting

volume and lower formula-based prices. Sequentially, volumes

increased by 5 % in the first quarter, partially driven by

limited customer restocking from low inventory levels at year-end

2023. Catalysts sales declined modestly by 2 % in local

currency, with growth in Syngas & Fuels and Propylene offset by

Ethylene and Specialties due to the normal project cycle of the

business. Adsorbents & Additives sales decreased by 11 %

in local currency against a high comparison base in Q1 2023 due to

challenges in key end markets for the Additives segments, despite

limited sequential customer restocking activities.

In the first quarter, local currency sales in

the Europe, Middle East, and Africa region were down 16 %

(3 % related to scope) versus Q1 2023, with declines in all

businesses as economic activity in the region remained muted. Sales

in the Americas grew organically by 4 %, driven by stronger volumes

in Care Chemicals and Catalysts. Including scope (- 11 %), sales in

the region declined by 7 % in local currency. Sales in Asia-Pacific

were down 6 % (2 % related to scope) in local currency,

mitigated by organic growth in China of 5 %, driven by Care

Chemicals and Adsorbents and Additives.

Group EBITDA increased by 4 % to

CHF 173 million, with the corresponding margin of

17.1 % significantly above the 13.9 % margin reported in

the first quarter of 2023. Cost savings from performance programs

of approximately CHF 11 million contributed positively to

offset inflation. Lower cost trends in raw materials

(- 12 %) and energy (- 22 %, driven by Europe)

positively supported profitability in all businesses despite lower

pricing. Strong margin in the seasonal aviation business also

positively contributed to profitability. The Group incurred a total

CHF 5 million negative operational impact from the

sunliquid® bioethanol activities, which represented an

improvement against the CHF 13 million negative

operational impact of the prior year. As announced in December

2023, Clariant is ceasing operations at the plant in Romania and is

downsizing related activities of the Business Segment Biofuels

& Derivatives in Germany. The previous year figure was also

negatively impacted by a CHF 11 million one-off fair

value adjustment on the Heubach Group participation. Restructuring

expenses totaled CHF 7 million, mainly related to the

Additives segments. Underlying profitability, as reflected by

EBITDA before exceptional items, of CHF 184 million was

flat year on year and increased sequentially by 17 %,

representing an improved underlying margin of 18.1 % compared

to 15.3 % in the prior year and 14.9 % in the prior

quarter.

1 All references to local currency growth, pricing, volumes,

and scope exclude the impact from hyperinflation countries

Argentina and Türkiye. All references to currency include a net

impact from hyperinflation countries Argentina and Türkiye.

ESG Update – Leading in sustainability

and safety

Clariant’s Scope 1 and 2 total greenhouse gas

emissions fell to 0.52 million tons in the last twelve months

(April 2023 to March 2024), a decline of 4 % from

0.54 million tons in the full year 2023. The total indirect

greenhouse gas emissions for purchased goods and services (Scope 3)

also decreased by 5 %, from 2.28 million tons in the full

year 2023 to 2.16 million tons in the last twelve months.

These results demonstrate continued progress toward reaching the

Group’s 2030 emissions reduction targets.

Clariant achieved a major safety milestone,

recording zero DART (Days Away, Restricted, or Transferred) cases

in March, equating to approximately 2 000 000 working

hours without accidents across all of its 73 production sites,

offices, laboratories, and warehouses worldwide. This achievement

underscores the commitment of all our colleagues to making safety a

top priority every day and is a testament to the effectiveness of

Clariant’s comprehensive safety protocols and initiatives. Clariant

remains steadfast in its commitment to promote a safe and healthy

workplace for all its employees. In the first quarter of 2024, the

DART rate remained unchanged at 0.21, as observed at year-end

2023.

Outlook confirmed

For the full year 2024, Clariant expects to see a

continued easing of the inflationary environment but no significant

economic recovery, with macroeconomic uncertainties and risks

remaining. Clariant therefore reiterates its expectations for low

single-digit sales growth in local currency. Growth in Care

Chemicals, including the impact of the acquisition of Lucas Meyer

Cosmetics, and in Adsorbents & Additives is expected to offset

a temporary slowdown in Catalysts momentum. Reported EBITDA margin

is expected to improve to around 15 %. This includes the

impact of the Lucas Meyer Cosmetics acquisition and a

sunliquid® restructuring/exceptional impact of up to

CHF 30 million. Clariant also expects operational

sunliquid® costs of up to CHF 15 million

related to preparation for the closure or divestment of the Podari

plant. EBITDA margin excluding the operational and exceptional

sunliquid® impacts is expected at around 16 %. Cost

savings benefits from restructuring programs are expected to

deliver CHF 28 million in 2024.

Clariant reiterates its expectation that 2025

will be a year of continued, albeit significant, recovery in

profitability. In 2025, on the basis of an expected 3 – 5 %

improvement in key end market demand, Clariant expects to achieve

EBITDA margin of 17 – 18 %, and free cash flow conversion at

the targeted level of around 40 %. Clariant remains committed

to its medium-term targets as end markets recover and growth

normalizes over the next two to three years. Clariant will adopt an

agile response to the economic environment and remain resolute in

its plans to achieve the medium-term targets. The company is well

positioned to achieve these targets as the accretive impacts of the

Lucas Meyer Cosmetics acquisition and investments in China are

realized. In addition, benefits from increased cost savings are

expected.

Business Discussion

Business Unit Care

Chemicals

|

|

|

First Quarter |

|

in CHF million |

|

|

|

|

2024 |

2023 |

% CHF |

% LC(1) |

|

Sales |

|

|

|

|

581 |

703 |

- 17 |

- 13 |

|

EBITDA |

|

|

|

|

123 |

128 |

- 4 |

|

|

- margin |

|

|

|

|

21.2 % |

18.2 % |

|

|

|

EBITDA before exceptional items |

|

|

|

|

125 |

130 |

- 4 |

|

|

- margin |

|

|

|

|

21.5 % |

18.5 % |

|

|

(1) Excluding

hyperinflation accounting countries Argentina and Türkiye

Sales

In the first quarter of 2024, sales in the

Business Unit Care Chemicals decreased by 4 % organically in

local currency and by 13 % including scope in local currency

(17 % in Swiss francs) versus Q1 2023. Volumes in the first

quarter were up 2 %, supported by limited customer restocking

in Industrial Applications and Personal & Home Care, while

pricing decreased by 6 % compared to Q1 2023, mainly due to

formula-based price adjustments on lower feedstock levels from

previous year. On a sequential basis, sales increased by 4 %

in local currency, driven by a 5 % increase in volumes

(restocking) despite slightly lower pricing.

Organic growth in Mining Solutions, Industrial

Applications, and Personal & Home Care was driven by positive

volumes, while Oil Services was flat when excluding the divestment

impact. Base Chemicals declined due to lower aviation sales, while

in Crop Solutions weak demand and destocking across the entire

supply chain continued.

Care Chemicals sales in Europe, Middle East, and

Africa decreased at a mid-teens percentage rate organically, with

the decrease in pricing slightly more pronounced than volumes. In

the Americas, sales were up by a mid-single-digit percentage rate

organically as volume growth more than offset lower pricing. Sales

in Asia-Pacific increased by a low-single digit percentage rate

organically, mainly attributable to stronger volumes across the

region, and China in particular.

EBITDA Margin

In the first quarter, the EBITDA margin

increased to 21.2 % versus 18.2 % in the same period last

year due to decreasing raw material and energy costs, combined with

successful margin management, the positive impact from performance

programs, and strong profitability in the seasonal businesses. On a

sequential basis, Care Chemicals recorded a 12 % increase in

EBITDA to CHF 123 million, representing an EBITDA margin

of 21.2 % compared to 20.0 % in the prior quarter, driven

by higher volumes (+ 5 %) and the deflationary

environment.

Care Chemicals Insight

With the unveiling of CycloRetin™, a natural

skincare active derived from Prince Ginseng, Clariant provides its

customers in the personal care industry with a new,

high-performing, eco-friendly alternative to traditional retinol.

This follows extensive testing of the benefits of cyclic peptides,

which are known to positively impact the appearance of the skin.

Prince Ginseng was discovered to have outstanding potential to

restart the skin matrix production cycle, improving collagen and

reducing signs of aging, providing comparable efficacy to retinol

and bakuchiol. At the in-cosmetics 2024 trade show, Clariant

showcased two formulations containing CycloRetin™, Firming Mask and

Mask Mist, offering efficient skincare solutions that were well

received by industry representatives.

Business Unit Catalysts

|

|

|

First Quarter |

|

in CHF million |

|

|

|

|

2024 |

2023 |

% CHF |

% LC(1) |

|

Sales |

|

|

|

|

187 |

205 |

- 9 |

- 2 |

|

EBITDA |

|

|

|

|

25 |

13 |

92 |

|

|

- margin |

|

|

|

|

13.4 % |

6.3 % |

|

|

|

EBITDA before exceptional items |

|

|

|

|

24 |

13 |

85 |

|

|

- margin |

|

|

|

|

12.8 % |

6.3 % |

|

|

(1) Excluding

hyperinflation accounting countries Argentina and Türkiye

Sales

In the first quarter of 2024, sales in the

Business Unit Catalysts declined by 2 % in local currency

(9 % in Swiss francs). Volumes declined by 2 % versus Q1

2023 due to the project nature of the business, while pricing was

flat. Sales in Syngas & Fuels grew at a mid-twenties percentage

rate and at a mid-teen percentage rate in Propylene. The remaining

segments declined, with the most pronounced in Ethylene. On a

quarterly sequential basis, sales were down 27 % in local

currency due to the typical seasonality at the start of the year

impacting volumes, while pricing was flat.

Catalysts sales declined at a low-teen

percentage rate in the Europe, Middle East, and Africa region due

to the project cycle of the business, with Europe recording a

decline in sales, while the Middle East and Africa were flat. Sales

in the Americas increased at a mid-sixties percentage rate,

primarily driven by Syngas & Fuels. In Asia-Pacific, the

largest geographic market, sales declined at a low-teen percentage

rate, with a slightly less pronounced decline in China, due to a

normalization of growth projects in comparison to last year.

EBITDA Margin

In the first quarter, the EBITDA margin

increased to 13.4 % from 6.3 % in Q1 2023, mainly due to

a CHF 8 million improvement of the negative operational

impact from sunliquid® and stable pricing in a

deflationary environment. Excluding the sunliquid®

impact, the EBITDA margin was 16.1 %, a 320-basis point

improvement over the 12.9 % recorded in the first quarter of

2023. Sequentially, EBITDA before exceptional items, which allows a

like-for-like comparison by excluding the exceptional items booked

in Q4 2023 related to the sunliquid® decision, decreased

by 41 % to CHF 24 million, representing an underlying

margin of 12.8 % compared to 15.9 % in the prior quarter.

This is the result of the typical seasonal volume patterns in the

first quarter compared to the final quarter of the year, and the

respective impact on operating leverage.

Catalysts Insight

Clariant’s CATOFIN® catalyst,

together with process technology provided by process partner Lummus

Technology, was selected by Huizhou Boeko Materials Co. Ltd for the

dehydrogenation of isobutane at the new plant in Huizhou City,

China. Once complete, this plant will produce 550 000 metric tons

per annum (MTA) of net isobutylene, which will serve as feedstock

for the downstream production of methyl tertiary butyl ether

(MTBE).

The highly efficient CATOFIN has proven to be a

popular choice for China’s chemical industry. Since its commercial

launch in 2017, the catalyst has been selected for 39 new projects

around the world and more than 50 % of these plants are

located in China. The recently opened CATOFIN catalyst plant with

significant production capacity in Jiaxing, Zhejiang Province,

ensures localized production for Clariant’s regional customers as

well as proximity for technical support and services.

Business Unit Adsorbents &

Additives

|

|

|

First Quarter |

|

in CHF million |

|

|

|

|

2024 |

2023 |

% CHF |

% LC(1) |

|

Sales |

|

|

|

|

246 |

292 |

- 16 |

-11 |

|

EBITDA |

|

|

|

|

36 |

54 |

- 33 |

|

|

- margin |

|

|

|

|

14.6 % |

18.5 % |

|

|

|

EBITDA before exceptional items |

|

|

|

|

46 |

55 |

- 16 |

|

|

- margin |

|

|

|

|

18.7 % |

18.8 % |

|

|

(1) Excluding

hyperinflation accounting countries Argentina and Türkiye

Sales

In the first quarter of 2024, sales in the

Business Unit Adsorbents & Additives decreased by 11 %

organically in local currency (16 % in Swiss francs). In the

Adsorbents segments, sales declined by a low single-digit

percentage rate, as positive pricing did not offset lower volumes.

In the Additives segments, sales declined by a high-teens

percentage rate, primarily due to lower volumes with weak demand in

key end markets compared to prior year levels. In the Business

Unit, pricing declined by 4 % against a high comparison base

in Q1 2023. On a quarterly sequential basis, sales in the Business

Unit decreased by 2 % in local currency, equally balanced

between volumes and pricing. Market conditions for the Additives

segments stabilized, and limited customers restocked from low

inventory levels at year-end.

In Europe, Middle East, and Africa, the largest

region, sales decreased by a low-teens percentage rate, as growth

in Adsorbents did not offset lower sales in the Additives segments.

In the Americas, sales declined at a mid-teens percentage rate,

with a more pronounced decline in Additives. While Asia-Pacific

sales were down at mid-single-digit percentage rate, China sales

grew at a low-teens percentage rate due to a positive quarter in

Additives.

EBITDA Margin

In the first quarter, the EBITDA margin

decreased to 14.6 % from 18.5 % in Q1 2023. Profitability

levels were impacted by restructuring charges of

CHF 9 million in Additives and business mix. EBITDA

margin before exceptional items was flat at 18.7 % (vs.

18.8 % in Q1 2023). Sequentially, EBITDA margin before

exceptional items increased by 119 % to

CHF 46 million, representing an underlying margin

improvement from 8.2 % to 18.7 %. The sequential increase

was driven by operating leverage (limited restocking in the

Additives segments) and lower raw material and energy costs, as

well as supported by the structural improvement efforts initiated

during the prior year.

Adsorbents & Additives

Insight

At NPE2024, the largest plastics trade show in

the Americas, Clariant will showcase its latest additive solutions

that deliver on both performance and sustainability to participants

from automotive to packaging and consumer products to construction.

This includes Clariant’s Licocare® RBW Vita waxes, which

are based on renewable bio-based rice bran wax feedstocks and

provide superior performance. This makes them a natural replacement

for traditional coal-based montan waxes for use in engineering

polymers.

Furthermore, the company will present its

AddWorks® line, which is a portfolio of additive

solutions for the plastics industry to address technical challenges

including light, thermal, and process stabilization, as well as the

Exolit® OP range of high-performance, halogen-free flame

retardants. By combining innovation and sustainability criteria,

Clariant provides solutions that are safe and more sustainable by

design, have leading performance, and tackle some of the most

pressing environmental challenges.

Q1 2024 Media Release EN

CORPORATE MEDIA RELATIONS

Jochen Dubiel

Phone +41 61 469 63 63

jochen.dubiel@clariant.com

Ellese Caruana

Phone +41 61 469 63 63

ellese.caruana@clariant.com

Luca Lavina

Phone +41 61 469 63 63

luca.lavina@clariant.com

Follow us on X, Facebook, LinkedIn, Instagram. |

INVESTOR RELATIONS

Andreas Schwarzwälder

Phone +41 61 469 63 73

andreas.schwarzwaelder@clariant.com

Thijs Bouwens

Phone +41 61 469 63 73

thijs.bouwens@clariant.com

|

This media release contains certain statements that are neither

reported financial results nor other historical information. This

document also includes forward-looking statements. Because these

forward-looking statements are subject to risks and uncertainties,

actual future results may differ materially from those expressed in

or implied by the statements. Many of these risks and uncertainties

relate to factors that are beyond Clariant’s ability to control or

estimate precisely, such as future market conditions, currency

fluctuations, the behavior of other market participants, the

actions of governmental regulators and other risk factors such as:

the timing and strength of new product offerings; pricing

strategies of competitors; the company’s ability to continue to

receive adequate products from its vendors on acceptable terms, or

at all, and to continue to obtain sufficient financing to meet its

liquidity needs; and changes in the political, social and

regulatory framework in which the Company operates or in economic

or technological trends or conditions, including currency

fluctuations, inflation and consumer confidence, on a global,

regional or national basis. Readers are cautioned not to place

undue reliance on these forward-looking statements, which speak

only as of the date of this document. Clariant does not undertake

any obligation to publicly release any revisions to these

forward-looking statements to reflect events or circumstances after

the date of these materials.

www.clariant.com

Clariant is a focused specialty chemical company led by the

overarching purpose of ‘Greater chemistry – between people and

planet’. By connecting customer focus, innovation, and people the

company creates solutions to foster sustainability in different

industries. On 31 December 2023, Clariant totaled a staff number of

10 481 and recorded sales of CHF 4.377 billion in the fiscal year

for its continuing businesses. As of January 2023, the Group

conducts its business through the three Business Units Care

Chemicals, Catalysts, and Adsorbents & Additives. Clariant is

based in Switzerland. |

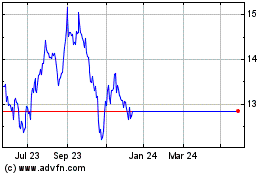

Clariant (LSE:0QJS)

Historical Stock Chart

From Jan 2025 to Mar 2025

Clariant (LSE:0QJS)

Historical Stock Chart

From Feb 2024 to Mar 2025