TIDMACT

RNS Number : 5593S

Actual Experience PLC

07 November 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF EU REGULATION 596/2014 (WHICH FORMS PART OF

DOMESTIC UK LAW PURSUANT TO THE EUROPEAN UNION (WITHDRAWAL) ACT

2018) ("UK MAR")). IN ADDITION, MARKET SOUNDINGS (AS DEFINED IN UK

MAR) WERE TAKEN IN RESPECT OF THE PLACING WITH THE RESULT THAT

CERTAIN PERSONS BECAME AWARE OF INSIDE INFORMATION (AS DEFINED IN

UK MAR), AS PERMITTED BY UK MAR. THIS INSIDE INFORMATION IS SET OUT

IN THIS ANNOUNCEMENT. THEREFORE, THOSE PERSONS THAT RECEIVED INSIDE

INFORMATION IN A MARKET SOUNDING ARE NO LONGER IN POSSESSION OF

SUCH INSIDE INFORMATION RELATING TO THE COMPANY AND ITS

SECURITIES.

FOR IMMEDIATE RELEASE

7 November 2023

Actual Experience plc

Company Update, Intention to Appoint Administrators and

Suspension of Trading in Shares

Actual Experience plc (AIM: ACT), the analytics-as-a-service

company (the "Company" and, together with its subsidiary

undertakings, the "Group"), provides the following update regarding

its recent trading performance, financial position, and efforts to

raise further funding.

Introduction

The Company disclosed in its unaudited consolidated interim

results for the six months ended 31 March 2023 (the "Interim

Results", released on 12 June 2023) that, based on its latest "base

case" assessment, and in the absence of cost reductions or

significant commercial progress, the Company was forecast to run

out of cash by December 2023. As part of the Interim Results, the

Company's board of directors (the "Board") also prepared a severe,

but plausible, downside scenario based on significantly more

pessimistic sales forecasts, with corresponding reductions in

controllable costs. In this scenario, the Company was forecast to

run out of cash by November 2023.

Current Trading and Financial Position

During the financial year ended 30 September 2022, the Company

reduced ongoing expenses from GBP680,000 per month to GBP460,000

and expenses have been maintained at this level during the

financial year ended 30 September 2023 ("FY2023"). During FY2023

and subsequently, the Board has been constantly reviewing the

Company's cost profile and organisational structure, however, the

Board also formed the view that the Company had reduced headcount

and its operating cost base to the lowest viable level while still

retaining the ability to deliver commercial objectives regarding

order acquisition and customer support, as well as developing

additional required product features.

Although the Company made commercial progress during FY2023,

securing new revenue contracts and significant sales has taken

longer than expected and, as a result, trading has largely tracked

the severe, but plausible, downside scenario announced in the

Interim Results. This, along with additional costs exploring

strategic options as outlined below, has resulted in a depletion of

the Company's cash reserves and without new funding, the Company

would have inadequate funds to continue trading after late November

2023.

Strategic Options

The Company also announced in the Interim Results that if it

were unable to secure an appropriate combination of new revenue

contracts, cost reductions, and/or further funding, then the

Company may not have sufficient resources to meet its liquidity

requirements over the foreseeable future. As described above and at

the current time, the Company has been unable to secure significant

new revenue contracts or cost reduction and so the Board has been

exploring an equity fundraise to increase the Company's cash

reserves and has been in active discussions with existing and

potential shareholders over the last few months.

On 14 August 2023, the Company submitted a letter to HMRC

seeking advanced assurance under the Income Tax Act 2007 that it is

eligible to issue shares to investors that would benefit from

relief from taxation under the enterprise investment scheme ("EIS")

regime, reflecting the Board's view that receiving advanced

assurance from HMRC provided the greatest chance for a successful

equity fundraise. While exploring an equity fundraise, the Company

has been in discussions with various venture capital trust and EIS

funds along with other potential investors. Despite the Company

submitting information and replying promptly to queries, HMRC have

not, as at the date of this announcement, provided a formal

response regarding the Company's application within HMRC's

published timescales for responding to applications for advanced

assurance.

It is the Board's view that it is now highly uncertain whether

any formal approval regarding its application could be expected

from HMRC within the required timescales, having regard to the

Company's rapidly depleting cash reserves.

Alongside progressing a possible equity fundraise, the Company

has explored other strategic options with the assistance of FRP

Advisory Trading Limited ("FRP Advisory"), including an accelerated

M&A process to seek an acquirer of the Group's business and

assets, and contingency planning. In relation to accelerated

M&A, FRP Advisory contacted a number of potential acquirers on

the Company's behalf, however received no firm indications of

interest in response. The Board therefore terminated this process

due to the lack of interest and the significant ongoing costs

involved.

Having considered the Company's rapidly depleting cash position

and the lack of progress regarding an equity fundraise and the

other strategic options explored, it is the Board's view that it is

unlikely to be able to secure the funding that it requires or

complete an alternative transaction in a timely manner to secure

the Company's future and so is now taking action to protect value

for the Company's creditors and other stakeholders.

The Board has therefore regrettably resolved to file a notice to

appoint administrators to the Company with such appointment

expected to take effect later today.

Resignation of nominated adviser and joint brokers

As a result of the Company's intention to appoint

administrators, Singer Capital Markets Advisory LLP and Turner Pope

Investments (TPI) Ltd have informed the Company of their

resignations as nominated adviser and joint broker and joint broker

to Actual Experience plc respectively, effective immediately on the

release of this announcement. Pursuant to AIM Rule 1, if a

replacement nominated adviser is not appointed within one month of

today's date, the admission of the Ordinary Shares to trading on

AIM will be cancelled. The Company has no current intention of

appointing a replacement nominated adviser.

In light of the above, the Board announces that it has requested

a suspension of trading in the Company's ordinary shares on AIM

with effect from 07.30 a.m. today.

Further announcements will be made in due course .

Enquiries:

Actual Experience plc Tel: +44 (0)207

Iain McCready, CEO 129 1474

Steve Bennetts, CFO

Singer Capital Markets Advisory Tel: +44 (0)207

LLP 496 3000

Shaun Dobson

James Fischer

Turner Pope Investments (TPI) Tel: + 44 (0)203

Ltd 657 0050

James Pope

Andy Thacker

Flagstaff Strategic and Investor Tel: +44 (0)207

Communications 129 1474

Tim Thompson actual@flagstaffcomms.com

Mark Edwards

Andrea Seymour

Anna Probert

The person responsible for arranging release of this

announcement on behalf of the Company is Steve Bennetts, Chief

Financial Officer.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCKQLFBXFLZFBB

(END) Dow Jones Newswires

November 07, 2023 02:00 ET (07:00 GMT)

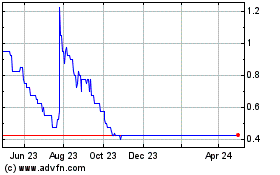

Actual Experience (LSE:ACT)

Historical Stock Chart

From Jan 2025 to Feb 2025

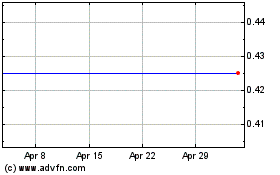

Actual Experience (LSE:ACT)

Historical Stock Chart

From Feb 2024 to Feb 2025