TIDMANP

RNS Number : 2325M

Anpario PLC

13 September 2023

Anpario plc

("Anpario", the "Group"

or the "Company")

Interim results

Anpario plc (AIM:ANP), the independent manufacturer of natural

sustainable animal feed additives for animal health, nutrition and

biosecurity is pleased to announce its unaudited interim results

for the six months to 30 June 2023 ("H1 2023").

Highlights

Financial highlights

- 7% decrease in sales to GBP15.3m (H1 2022: GBP16.5m) as sales

growth in the United States and Australasia was offset by declines

across Asia Pacific, Europe and Latin America.

- Gross profits fell by a lower amount of 3% due to an increase

in gross margins to 43.9% (H1 2022: 41.9%)

- 37% decrease in adjusted EBITDA(1) to GBP1.9m (H1 2022: GBP3.0m)

- 42% decrease in profit before tax to GBP1.4m (H1 2022: GBP2.4m)

- Diluted adjusted earnings per share down 42% to 5.66p (H1 2022: 9.81p)

- 2% increase in interim dividend to 3.20p (H1 2022: 3.15p) per share

- Cash balances, including short-term investments, of GBP7.3m at

30 Jun 2023 (31 Dec 2022: GBP13.6m), after GBP9.1m transferred to

an escrow account ahead of the completion of the tender offer in

July.

Operational highlights

- Sales price increases helped soften the reduction in volumes

and recovered gross margins previously impacted by raw material

price inflation.

- Sales growth of Orego-Stim(R) and pHorce(R) benefiting from

the trend to reduce antibiotic use and demand for anti-viral feed

mitigants.

- Strong growth of sustainably sourced omega 3 supplement brand Optomega(R) Algae.

- Received first ever King's Award for Enterprise for Sustainable Development.

Outlook

- Further improvement of gross margin expected in H2 2023

through an anticipated further reduction in the cost of raw

materials and recovery in sales volumes.

- Benefits of mitigating cost reductions and efficiency

improvements implemented in H1 2023 expected to feed into the

latter part of H2 2023 and more fully realised in 2024.

- Some signs of the recent challenges faced across the global

agriculture industry are beginning to alleviate.

- Regulatory environment continues to move towards natural and

sustainable feed additive solutions giving the Board confidence in

the long-term profitable development of the company.

Matthew Robinson, Chairman, commented:

"In my first statement as Chairman, I would like to thank my

predecessor, Kate Allum, for her two years of service to Anpario

and the significant contribution she made in her leadership and

guidance of the Board.

The Board reports the Group's performance during what has been a

difficult and challenging first half of the year for the global

agricultural industry. Group sales declined by 7% to GBP15.3m

compared to the prior year period of GBP16.5m, as meat protein

producers came under significant margin pressure due to high feed

and overhead costs, weak consumption as consumers reacted to the

effects of increased cost of living and in some regions an

oversupply of poultry, pork and shrimp. These difficulties

inevitably led to a reduction in the use of speciality feed

additives as producers scaled back production and looked to reduce

input costs. Our biggest region, Asia, suffered the most, further

affected by disease outbreaks of avian influenza and African swine

fever (ASF).

The actions taken to recover raw material price inflation helped

to increase gross margins by 2.0% to 43.9% compared to the same

period last year, which would have been higher but for an under

recovery of production overhead costs due to lower volumes. Our

weighted average selling price increased by 25% driven by necessary

price increases and a higher value-add product mix.

Adjusted EBITDA(1) declined by 37% to GBP1.9m compared to the

same period last year of GBP3.0m. Action has already been taken to

reduce overhead costs and the automation investment in the

production facility has improved efficiency at lower volume levels.

The benefit of these actions will be partially felt in the final

quarter and more fully in 2024. The difficult decisions taken would

not have been possible without the efforts and support of our staff

across the globe who have remained resolute throughout difficult

trading conditions and remain focused on implementing our

strategy.

The geographic and product diversity of the Group continues to

serve us well but the synchronised challenges currently impacting

global agriculture and most species are highly unusual. Our

strategy to offer sustainable and environmentally friendly products

which help customers transition away from using antibiotics and

some of the harsher chemical treatments positions Anpario to take

advantage of current and future trends.

The recovery in our markets is taking longer than we anticipated

at the beginning of the year and is also exacerbated by high

inventory levels throughout the industry. However, our sales teams

are focused on offering high value differentiated solutions which

deliver significant benefits to the producer across the four main

species groups of poultry, swine, ruminant and aquaculture. There

are signs that some of these challenges are alleviating for our

customers, not least, the expectation of further falls in animal

feed prices in the second half of this year. The second half has

started at a similar level as the first, but we anticipate that as

conditions in the industry improve and our business development

initiatives prove successful, sales growth will return as the year

progresses and into 2024.

We were pleased to return GBP9m in cash to shareholders by way

of the tender offer. After this corporate action the Group retains

a strong balance sheet and healthy cash balance with which to

deliver on its growth objectives."

Matthew Robinson, Chairman

(1) Adjusted EBITDA represents operating profit for the period

of GBP1.195m (H1 2022: GBP2.313m) adjusted for: share based

payments and associated costs GBP0.120m (H1 2022: GBP0.091m); and

depreciation and amortisation charges of GBP0.590m (H1 2022:

GBP0.604m)

Enquiries:

Anpario plc:

Richard Edwards, CEO +44(0)7776 417 129

Marc Wilson, Group Finance

Director +44(0)1909 537 380

Shore Capital:

(Nominated Adviser and Broker): +44 (0) 20 7408 4090

Stephane Auton Corporate Advisory

David Coaten

Tom Knibbs

Henry Willcocks Corporate Broking

Chief Executive Officer's statement

Overview

Group sales for the six months to 30 June 2023 declined by 7% to

GBP15.3m (H1 2022: GBP16.5m), impacted by the numerous challenges

affecting the global agricultural industry. Brazil and the United

States (US) delivered strong sales growth of 18% and 27%

respectively, reflecting the strength of their home agricultural

and energy markets which enable them to be competitive exporters of

meat protein to the other regions of the world. However, Asia, our

biggest region, accounting for more than a third of Group sales

during the period, experienced sales and volume declines of 18% and

29% respectively.

Our higher value differentiated product brands Orego-Stim(R),

pHorce(R) and Optomega(R) Algae delivered sales growth of 4%, 42%

and 117% respectively, but these performances were offset by

declines of more competitive product areas in organic acids,

mycotoxin binders and antioxidants. Group product volumes declined

by 26% with the biggest impact being in these lower value-added

price sensitive products. Volume declines, however, were tempered

by an increase in weighted average selling price of 25% compared to

the same period last year, which illustrates the extent to which

raw material price inflation has been passed on in selling prices

and the strength of our leading product brands.

Gross profit decreased by 3% to GBP6.7m (H1 2022: GBP6.9m) for

the six months to 30 June 2023, reflecting lower volumes sold.

Encouragingly, gross margins increased from 41.9% to 43.9%,

primarily due to passing on raw material price inflation in prices,

combined with declining raw material and logistics costs during the

period. Historically high inventory levels, which we are now

reducing, means that some of the cost reductions will continue to

work their way through to benefit cost of goods sold, which is also

dependent on production volumes through the factory reflecting the

Company's high operational gearing.

pHorce(R) continues to perform well in the North American swine

market not only as an anti-viral feed mitigant but also improving

the performance and productivity of the animal. In addition,

pHorce(R) is undergoing trials with a significant poultry

integrator where it has already proven to be effective at

controlling salmonella in antibiotic free formulations. Our new

Orego-Stim Forte(R) product for aquaculture, which contains several

natural phytogenic compounds, has proved to be highly effective at

preventing and controlling necrotic enteritis when administered

through the drinking lines for poultry in an easy-to-use

water-soluble form. We have developed a number of product

extensions for Orego-Stim(R) to customise the product for specific

applications tailored to market requirements.

The first half of the year has undoubtedly been the toughest to

navigate where industry specific and geopolitical challenges have

coalesced to make the trading environment very difficult. The 37%

decline in EBITDA(1) to GBP1.9m compared to the same period last

year (H1 2022: GBP3.0m) is disappointing and reflects market

challenging conditions. However, the team's priorities remain on

profitable sales growth but equally it has been necessary to reduce

our overheads to match current trading levels. There are some

positive signs in our markets and with our customers but these are

volatile times and so we remain cautious but optimistic that our

markets are beginning to improve from what was a very testing first

half.

Operational review

Americas

Overall, the segment grew sales by 7% due to increased sales in

Brazil and the United States delivering growth of 18% and 27%

respectively compared to the same period last year. Brazil's

poultry industry was a big beneficiary of export trade, with a 17%

increase in the first quarter of 2023. Whether this level of export

activity continues will depend on how successful the industry is at

limiting the impact of high pathogenicity avian influenza (HPAI)

which has now reached some poultry producing southern states

although it appears to be limited to wild birds and smaller

farms.

The US delivered strong sales and volume growth from both

Orego-Stim(R) and pHorce(R). Orego-Stim(R) had a successful launch

to the young cattle market for inclusion in calf milk delivering

healthier better performing calves, reduced medication costs and

reducing antimicrobial resistance as proven by our research with

the University of Reading and the granting of the UK patent for

this specific claim. We have also combined Orego-Stim(R) and our

mycotoxin binder product to produce a 2-in-1 solution for the US

dairy market and are working with a distributor to the poultry

industry on a water-soluble combination product for preventing and

controlling necrotic enteritis as demonstrated in trial work

undertaken in the US last year.

Historically Argentina has been a consistent market for Anpario

but in recent times the economy has been under increasing strain

with a weak currency, high inflation and central bank currency

controls which have impacted our sales to the country with a

decline of 22% compared to the same period last year.

Sales to the Latin America region declined by 9% and, although

Colombia and Mexico delivered good sales growth with products

including Optomega(R) Algae and pHorce(R), the overall performance

of the region was impacted by a drop in pellet binder sales to

Ecuador.

Asia

The segment, which includes Australasia, China and South-East

Asia accounts for just over one third of Group sales. Sales

declined by 18% in this segment compared to the same period last

year with volumes 29% lower of which two thirds can be attributed

to the Philippines, which has been badly affected by African swine

fever such that pork production is still 23% lower than in the

first quarter of 2021. In addition, producer profit margins have

been squeezed by high feed and overhead costs. The decline in

volumes tended to come from more price sensitive and lower margin

products such as antioxidants where the price of a key raw material

ingredient increased exponentially across Europe due to supply

constraints following Russia's invasion of Ukraine.

The other notable decline in sales performance was Malaysia,

which suffered from high feed prices and a number of outbreaks of

avian influenza. The expectation is that lower feed cost levels,

albeit still historically high, in the second half will support

producers in improving their margins.

Australasia and Indonesia delivered strong sales performances of

18% and 49% respectively compared to the same period last year. The

tough markets in South-East Asia have also been exacerbated by high

inventory levels throughout the supply chain following the rapid

opening up of economies post pandemic; this placed increased

pressure on global logistics prompting feed additive suppliers,

distributors and feed mills to build up inventory only to be

confronted shortly afterwards by a drop in meat protein production

as consumption waned. The unwinding of this situation is taking

longer than expected but is and will continue to improve with

time.

China which accounts for just under 13% of Group sales declined

by 9% due to the difficulties experienced in the swine market

driven by weaker than expected pork consumption, while continuous

herd liquidation added more supply resulting in lower pork prices.

Furthermore, outbreaks of African swine fever in some provinces

have seen short-term disruptions and this uncertainty and months of

losses is forcing smaller producers to exit production. Pork prices

have improved in recent weeks, but it remains to be seen whether

this is sustainable given the weak economy. Our China business is

redirecting its efforts towards the dairy and aquaculture sectors,

with success, which we believe have better growth opportunities in

the medium term and will reduce our dependency on the swine

market.

The Middle East, Africa and India

Despite sales and volumes declining by 4% and 37% respectively

compared to the same period last year, we are encouraged by the

progress the sales team has made in selling our higher value add

products such that the weighted average selling price improved by a

hugely significant 52%. Most of the drop in volumes are attributed

to lower margin mycotoxin and pellet binders, which are often

subject to tender bidding processes leaving little opportunity to

differentiate. In contrast, Optomega(R) Algae has been well

received by customers looking to improve dairy cow fertility. There

was also good growth in Turkey with Genex(R) Poultry which is an

acid-based eubiotic and phytogenic combination.

Sales of Orego-Stim(R) to India increased by 28% as our

long-term partner expanded the market opportunities for the

product. We consider India to be a good opportunity for Anpario's

product range and will be working more closely with our local

partner in the future.

Europe

Overall sales and volumes declined by 8% and 20% respectively

compared to the same period last year. However, the first quarter

of last year had some residual sales from the UK feed hygiene

customer lost due to significant cost inflation in organic acids;

excluding this customer loss, the sales across the segment would

have grown by 3% with volumes declining by a lessor 9%. The

weighted average selling price across the segment increased by 15%

reflecting actions taken to recover raw material cost

inflation.

Pork production across Europe has been in decline over the past

year with a year-on-year decline of 10% in the first four months of

2023 with the UK and Spain, the latter being Europe's largest pig

meat producer, experiencing declines of 17% and 7% respectively.

The contraction in supply has helped to increase pork prices and

with feed prices dropping more efficient producers have returned to

profitability. The improvement in market conditions for producers

means they are more receptive to using speciality feed additives

which is borne out by our improved performance in Spain, Poland and

the Baltic States.

The European poultry market is performing relatively well with a

drop in feed prices helping producer profitability and strong

market conditions for poultry as its value compares favourably with

competing animal proteins such as pork where prices have increased

by 25% since the start of the year. Poultry imports to Europe were

up 10%, mainly from Brazil and Ukraine. Certain countries were

affected by avian influenza outbreaks during the period, but cases

continue to drop in commercial farms. Sales of our leading product

brands are expected to benefit as producer profitability improves

and regulatory tailwinds such as zinc oxide removal from piglet

diets and the trend to reduce antibiotic use continue to take

effect.

Innovation and development

More recently our innovation and development activities have

been undertaken in conjunction with major commercial companies who

are looking for specific solutions to their problems or who want to

remove some of the harsher chemical treatments used in production

and who are also looking for more sustainable and environmentally

friendly approaches.

One example is Orego-Stim(R) Forte recently developed for the

aquaculture market, which combines a number of plant extracts with

our 100% natural oregano essential oil (OEO) to produce a

water-soluble version for use in aquafeed or direct to fish farms.

We are now trialling Orego-Stim(R) Forte with a commercial partner

for use in poultry shed drinking lines to prevent and control

necrotic enteritis. We also have several shrimp trials underway to

support the sales and marketing of the product in the Asia Pacific

and Latin America regions.

In an initiative to reduce packaging, wastage and improve

efficiency in logistics and warehousing we have developed higher

concentrations of our products including Orego-Stim(R) in liquid

form which is available in a number of concentrations to suit the

customer. pHorce(R) is another example being a high strength

acid-based eubiotic, which is only possible due to its unique

mineral carrier system and production process such that it is very

effective in eliminating harmful pathogens and why it is successful

in controlling bacteria such as salmonella infections in the

absence of antibiotics.

In another stride to enhance factory efficiency and manage

demand volatility, we installed a state-of-the-art fully automated

palletiser, representing GBP0.2m capital investment in our

production facility. Automation has been a crucial part of our

strategy and fundamental to responding to growing customer demands

and the continual drive towards sustainable and efficient

operations. This recent investment has improved output capacity and

also halved the level of manual handling in the factory.

Outlook

It is evident that Asia being the largest segment has had an

outsized effect on our performance during the period under review.

However, the reduction in volumes has tended to be in products

characterised as lower value add and more price sensitive. It is

encouraging, therefore, that our higher value differentiated

products exhibited some growth even in difficult markets. The

combination of passing on raw material cost inflation through

selling prices and the recent softening of these input prices has

helped to increase gross margins with further improvement expected

as cheaper raw materials work their way through the system and as

our sales volumes recover. We have taken action to reduce overheads

given the drop in sales; the benefits of which will be partially

felt in the final quarter of this year and more fully in 2024.

Although the second half has started in a similar vein as the

first, there are some positive signs that challenges across the

global agriculture industry are beginning to alleviate although it

is geography dependent. Producer farm margins have begun to improve

as excess supply due to reduced meat protein consumption is

tightening, leading to increased pricing for farmers. In addition,

the cost of animal feed is expected to fall further albeit still at

relatively high levels. The ideal scenario for Anpario is a

balanced supply of meat protein such that producers are profitable,

and the price is affordable for consumers to increase consumption

of meat products. We anticipate markets to be volatile but are

optimistic that the direction of travel will support our business

development initiatives which are gaining traction.

Our leading products consistently demonstrate their resilience

precisely because they deliver the expected return on investment in

our customers' operations. The growth drivers across the meat

protein industry remain intact and the regulatory environment is

continually moving towards natural and sustainable feed additive

solutions, which gives us confidence in the long-term profitable

development of the company.

Richard Edwards

Chief Executive Officer

13 September 2023

Key performance indicators

Financial

H1 2023 H1 2022

Note GBP000 GBP000 change % change

------------------------------------- ----- -------- -------- ------- ---------

Revenue 3 15,273 16,471 -1,198 -7%

Gross profit 6,699 6,900 -201 -3%

Gross margin 43.9% 41.9% +2.0%

Adjusted EBITDA 4 1,905 3,008 -1,103 -37%

Profit before tax 1,364 2,361 -997 -42%

Diluted adjusted earnings per share 6 5.66p 9.81p -4.15p -42%

Interim dividend 3.20p 3.15p +0.05p +2%

Cash and cash equivalents 7,298 13,320 -6,022 -45%

Net assets 43,059 41,973 +1,086 +3%

Financial review

Revenue and gross profits

Revenue for the period fell by 7% to GBP15.3m (H1 2022:

GBP16.5m), on a constant exchange rate basis the fall is similar at

8%. Performance through the second quarter has been stronger in

both sales and gross margin terms. Volumes overall were 26% lower

than the prior year. The more competitive product segments such as

Antioxidants, Binders and some of our Acid-based range contributing

to almost all of this volume decline, and more than all of the

revenue reduction. This is due to a combination of lower demand due

to reduced levels of meat production and price pressures leading

some producers to switch to lower quality and cheaper alternatives.

As animal protein production increases and producers return to

profitability then we expect to see this volume reduction reverse

as our products in this segment are more efficacious, longer

lasting and of a higher quality than the more commoditised

alternatives.

Excluding these more competitive product segments, sales across

other products grew by 11% over the same period last year. These

products including our market leading phytogenic Orego-Stim(TM)

alongside Optomega(TM) Algae and pHorce were able to grow despite

the difficult market context due to their more novel applications,

the result of continuing research and development efforts, and

their higher and more differentiated value add to producers. As a

result of this change in sales mix, and a whole period contribution

of sales price rises previously implemented to offset input cost

inflation, then the average selling price per tonne increased by

25%.

Sales performance was strong in the USA, with revenue up 27%

over the prior period, contributing to an overall geographic

segment increase for the Americas of 7%. This offset a slight

reduction in revenue across MEA and Europe, down 4% and 8%

respectively. However, the largest factor in the overall sales

decline was in Asia, with revenue down GBP1.2m for the region, the

same as the overall Group reduction. Sales in South-East Asia were

down 28% and a smaller decline in sales in China of 9% was almost

fully offset by revenue growth in Australasia, which was up by 18%.

Detailed commentary on the performance of the operating segments is

available in the Chief Executive Officer's Statement.

During the period there was a 3% decrease in gross profit to

GBP6.7m (H1 2022: GBP6.9m), this was lower in percentage terms to

the revenue decline due to a welcome increase in gross margins

43.9% (H1 2022: 41.9%). Whilst some of the factors that have been

negatively impacting our margins have stabilised or improved, there

are still several others limiting the recovery of our gross margins

to their previous levels. Input costs are stabilising and falling

slightly across some raw materials, but they are still at very high

levels compared to where they were historically. Sales price rises

have been implemented fully, but we are still absorbing some margin

pressures to try to mitigate against any further decline in

volumes. We are anticipating that input costs will continue to

gradually fall, which will enable margins to return to more

normalised levels across those product ranges most affected, such

as Acid-based Eubiotics.

The change in sales mix towards products such as Orego-Stim(R)

alongside Optomega(R) Algae and pHorce, away from the higher volume

and comparatively lower contribution products, has meant that the

gross profit per tonne has increased by 31% over the prior period.

Whilst this mix change is helping to increase margins through

higher profitability per tonne, the related reduction in sales

volumes is also reducing margins through the under-recovery of

production costs. The highly automated and low staffing levels

required in production means that we can scale up volumes very

efficiently, however, when volumes are lower there is a largely

fixed operating cost base spread across a reduced level of output.

We have implemented a number of cost reduction measures, including

a reduction in operating hours and other efficiency improvements.

However, the key to reversing the margin reduction impact of this

under-recovery will be through an increase in sales volumes.

Administrative expenses

Administrative expenses were 20% higher at GBP5.5m (H1 2022:

GBP4.6m). This comparative difference is almost fully accounted for

by favourable amounts in the prior year's first half period related

to foreign exchange gains, a release of doubtful debt provisions

that were no longer required and higher than typical levels of

staff capitalisation for research and development. In the first

half of the current year those same items cumulatively represent

expenses of just GBP26,000, but in H1 2022 they represented a net

gain/reduction of administrative costs of GBP0.8m.

Excluding the items mentioned above, core administrative costs

for the first half of last year were GBP5.4m. Against a backdrop of

materially high inflation across the board, most notably in travel

expenditure, then these core administrative costs rose only

slightly in the period by 2% (GBP0.1m) to GBP5.5m. This also

represents a reduction of 4% (GBP0.2m) when compared to the second

half of 2022.

The inflationary pressures and reduced profitability have led to

a greater focus and emphasis on optimising expenditure and

operating more efficiently and the hard work and efforts by staff

in this regard have been greatly appreciated. However, despite

these efforts it has been necessary to implement a restructuring

and redundancy process and we have regrettably needed to reduce

headcount and external resource in several areas of the business to

right-size the operations for the current reduced volumes and

levels of profitability. This process has now concluded and the

related reduction in costs, felt to a small degree through the

first half, should contribute to a decline in comparable

administrative expenses for the second half and give a full year

contribution in 2024.

Foreign exchange

As previously mentioned, hedging contracts are in place to

mitigate the downside-risks related to adverse GBP/USD exchange

rate movements, which represents the principal foreign exchange

risk to the Group. The weighted average forward rate of these

contracts was higher than the spot rate at 30 June 2023 (1.271) and

as such their net fair value represented a liability of GBP0.4m, a

significant decrease from a liability GBP1.3m at 31 December 2022

when the spot rate was lower at 1.210. The majority of this amount

and the movement thereof is deferred in equity in accordance with

cash-flow hedge accounting.

Taxation

Effective from April 2023 UK corporation tax rates increased to

25% from 19%, despite this, the effective tax rate for the period

was similar to last year at 10.6% (H1 2022: 10.5%). Anpario

benefits from R&D tax allowances due to the development work

related to new products and applications. In addition to this,

Anpario benefits from a reduction in the tax charged on the profits

generated by our market leading phytogenic product Orego-Stim(R)

due to the application of the Patent Box scheme which allows

companies to apply a lower rate of corporation tax to profits

attributable to qualifying patents.

Profitability and earnings per share

Resulting from the GBP0.2m reduction in gross profits and

combined with the GBP0.9m increase in administrative costs, of

which GBP0.8m was a credit in the prior period, then adjusted

EBITDA for the period decreased by GBP1.1m to GBP1.9m (H1 2022:

GBP3.0m). Profit before tax decreased by 42% to GBP1.4m (H1 2022:

GBP2.4m). Basic earnings per share decreased 43% to 5.91p (H1 2022:

10.33p) and diluted adjusted earnings per share decreased by a

similar amount of 42% to 5.66p (H1 2022: 9.81p).

Tender offer

As announced in June 2023, Anpario launched a GBP9.0m tender

offer to purchase its own shares at a price of 225p per ordinary

share. Valid tenders were received in respect of 107 per cent of

the total number of share subject to the tender offer and as such

the company purchased the full 4,000,000 ordinary shares. The

actual repurchase and settlement of the transaction occurred in

early July 2023 and as such is not reflected in these financial

statements, other than to show the GBP9.1m held in escrow with a

third-party as a separate line item of the statement of financial

position.

Following the conclusion of the Tender Offer, the 4,000,000

shares repurchased, together a further 440,388 shares that were

already held in Treasury were subsequently cancelled. As this took

place after 30 Jun 2023, the earnings per share calculation in note

6 does not reflect any impact of this transaction. There will be a

partial benefit to FY 2023 as the transaction occurred half-way

through the year, by a way of a reduction in the number of weighted

average shares in issue, however the full year impact will only be

felt through 2024.

Cash flow

Cash generated by operations during the period was GBP2.6m, this

compares to an outflow of cash during the same period last year of

GBP1.1m. Operating cash flows before changes in working capital

were lower as a result of the reduced levels of profitability at

GBP1.6m (H1 2022: GBP3.4m). However, this was more than offset by a

release of working capital of GBP0.9m compared to an absorption of

GBP4.5m over the same prior period.

Included in the release of working capital was a decrease in

inventories of GBP2.1m, with finished goods and raw materials

levels both down equally from the year end as we continued to

reduce the level of raw materials held as part of supply chain

contingencies and also lowering the level of safety stock held in

our subsidiaries to cover logistics concerns. There was a slight

increase in trade receivables of GBP0.2m and a reduction in trade

payables of GBP1.0m, which relates to the payment of raw materials

strategically purchased at the end of the prior year.

The corporation tax debtor at the year end relating to

overpayments and the application of the Patent Box scheme tax

deductions was repaid in the period and as such there was a net

income tax refund of GBP0.7m. This further helped to generate net

cash from operating activities of GBP3.2m during the period (H1

2022: GBP1.5m outflow).

Capital expenditure in the period was GBP0.5m (H1 2022:

GBP1.1m), with only a small investment in an automated palletiser

of GBP0.2m and a reduced level of expenditure on development

projects. The automated palletiser represents the last stage of a

wider programme of CAPEX projects to increase efficiency and

throughput of the production facilities that started in 2016.

Net cash used in financing activities of GBP9.1m primarily

relates to the tender offer, as at 30 June 2023 these amounts were

held in escrow with a third-party ahead of the conclusion of the

tender offer in early July 2023.

As at the year end, cash and cash equivalents as shown on the

statement of financial position and on the cash flow statement

exclude short-term investments which represent cash held in notice

accounts for more than 90 days in order to maximise interest

received. Including these amounts, cash, cash equivalents and

short-term investments declined by GBP6.3m to GBP7.3m (31 December

2022: GBP13.6m). However, this includes the GBP9.1m outflow for the

tender offer, excluding which cash would have increased by

GBP2.9m.

Dividend

The Board has approved an interim dividend of 3.20 pence per

share (H1 2022: 3.15 pence per share), an increase of 2%. This

dividend, payable on 24 November 2023 to shareholders on the

register on 10 November 2023, reflects the Board's continued

confidence in the Group and its ability to generate cash.

Anpario has increased the dividend per share for 16 years since

its maiden dividend in 2007. Despite the current reduced level of

profitability, it is the current intention of the Board to continue

to demonstrate an increase in the dividend per share year on

year.

Marc Wilson

Group Finance Director

13 September 2023

Consolidated statement of comprehensive income

for the six months ended 30 June 2023

six months to six months to year ended

30 June 30 June 31 December

2023 2022 2022

Note GBP000 GBP000 GBP000

---------------------------------------------------------------- ------ -------------- -------------- ------------

Revenue 3 15,273 16,471 33,103

Cost of sales (8,574) (9,571) (18,967)

---------------------------------------------------------------- ------ -------------- -------------- ------------

Gross profit 6,699 6,900 14,136

Administrative expenses (5,504) (4,587) (10,576)

Operating profit 1,195 2,313 3,560

Depreciation and amortisation 590 604 1,225

Adjusting items 4 120 91 423

Adjusted EBITDA 4 1,905 3,008 5,208

---------------------------------------------------------------- ------ -------------- -------------- ------------

Net finance income 5 169 48 121

---------------------------------------------------------------- ------ -------------- -------------- ------------

Profit before tax 1,364 2,361 3,681

Income tax (144) (249) (378)

---------------------------------------------------------------- ------ -------------- -------------- ------------

Profit for the period 1,220 2,112 3,303

---------------------------------------------------------------- ------ -------------- -------------- ------------

Items that may be subsequently reclassified to profit or loss:

Exchange difference on translating foreign operations (185) 423 387

Cashflow hedge movements (net of deferred tax) 477 (967) (902)

Total comprehensive income for the period 1,512 1,568 2,788

---------------------------------------------------------------- ------ -------------- -------------- ------------

Basic earnings per share 6 5.91p 10.33p 16.13p

Diluted earnings per share 6 5.88p 9.60p 15.10p

Adjusted earnings per share 6 5.68p 10.56p 17.81p

Diluted adjusted earnings per share 6 5.66p 9.81p 16.67p

---------------------------------------------------------------- ------ -------------- -------------- ------------

Consolidated statement of financial position

As at 30 June 2023

as at as at as at

30 June 30 June 31 December

2023 2022 2022

Note GBP000 GBP000 GBP000

--------------------------------------------------- ------ --------- -------- ------------

Intangible assets 7 11,390 11,360 11,375

Property, plant and equipment 8 4,827 5,066 4,864

Right of use assets 9 107 52 50

Deferred tax assets 736 1,622 859

Derivative financial instruments 233 26 153

Non-current assets 17,293 18,126 17,301

Inventories 10 7,535 10,426 9,867

Trade and other receivables 7,042 7,323 7,003

Tender offer funds held in escrow 9,144 - -

Derivative financial instruments 5 17 21

Current income tax assets - 120 774

Short-term investments 143 1,809 1,828

Cash and cash equivalents 7,155 11,511 11,739

--------------------------------------------------- ------ --------- -------- ------------

Cash, cash equivalents and short-term investments 7,298 13,320 13,567

Current assets 31,024 31,206 31,232

Total assets 48,317 49,332 48,533

--------------------------------------------------- ------ --------- -------- ------------

Lease liabilities (75) (23) (17)

Derivative financial instruments (562) (1,249) (825)

Deferred tax liabilities (1,701) (2,063) (1,724)

Non-current liabilities (2,338) (3,335) (2,566)

Trade and other payables (2,683) (3,868) (3,983)

Lease liabilities (34) (32) (35)

Derivative financial instruments (102) (124) (638)

Current income tax liabilities (101) - -

Current liabilities (2,920) (4,024) (4,656)

Total liabilities (5,258) (7,359) (7,222)

--------------------------------------------------- ------ --------- -------- ------------

Net assets 43,059 41,973 41,311

--------------------------------------------------- ------ --------- -------- ------------

Called up share capital 5,636 5,448 5,624

Share premium 15,040 11,577 14,934

Other reserves (10,051) (7,261) (10,461)

Retained earnings 32,434 32,209 31,214

Total equity 43,059 41,973 41,311

--------------------------------------------------- ------ --------- -------- ------------

Consolidated statement of changes in equity

for the six months ended 30 June 2023

Called up Share Other Retained Total

share capital premium reserves earnings equity

---------------------------------------------

GBP000 GBP000 GBP000 GBP000 GBP000

--------------------------------------------- --------------- --------- ---------- ---------- --------

Balance at 1 Jan 2022 5,446 11,547 (6,788) 30,097 40,302

--------------------------------------------- --------------- --------- ---------- ---------- --------

Profit for the period - - - 2,112 2,112

Currency translation differences - - 423 - 423

Cash flow hedge reserve - - (967) - (967)

Total comprehensive income for the period - - (544) 2,112 1,568

--------------------------------------------- --------------- --------- ---------- ---------- --------

Issue of share capital 2 30 - - 32

Share-based payment adjustments - - 71 - 71

Transactions with owners 2 30 71 - 103

--------------------------------------------- --------------- --------- ---------- ---------- --------

Balance at 30 Jun 2022 5,448 11,577 (7,261) 32,209 41,973

--------------------------------------------- --------------- --------- ---------- ---------- --------

Profit for the period - - - 1,191 1,191

Currency translation differences - - (36) - (36)

Cash flow hedge reserve - - 65 - 65

Total comprehensive income for the period - - 29 1,191 1,220

--------------------------------------------- --------------- --------- ---------- ---------- --------

Issue of share capital 176 3,357 - - 3,533

Joint-share ownership plan - - (3,270) - (3,270)

Share-based payment adjustments - - 112 - 112

Deferred tax regarding share-based payments - - (71) - (71)

Final dividend relating to 2021 - - - (1,512) (1,512)

Interim dividend relating to 2022 - - - (674) (674)

Transactions with owners 176 3,357 (3,229) (2,186) (1,882)

--------------------------------------------- --------------- --------- ---------- ---------- --------

Balance at 31 Dec 2022 5,624 14,934 (10,461) 31,214 41,311

--------------------------------------------- --------------- --------- ---------- ---------- --------

Profit for the period - - - 1,220 1,220

Currency translation differences - - (185) - (185)

Cash flow hedge reserve - - 477 - 477

Total comprehensive income for the year - - 292 1,220 1,512

--------------------------------------------- --------------- --------- ---------- ---------- --------

Issue of share capital 12 106 - - 118

Share-based payment adjustments - - 110 - 110

Deferred tax regarding share-based payments - - 8 - 8

Transactions with owners 12 106 118 - 236

--------------------------------------------- --------------- --------- ---------- ---------- --------

Balance at 30 Jun 2023 5,636 15,040 (10,051) 32,434 43,059

--------------------------------------------- --------------- --------- ---------- ---------- --------

Consolidated statement of cash flows

for the six months ended 30 June 2023

six months to six months to year ended

30 June 30 June 31 December

2023 2022 2022

Note GBP000 GBP000 GBP000

---------------------------------------------------------- ------ -------------- -------------- ------------

Operating profit for the period 1,195 2,313 3,560

Depreciation, amortisation and impairment 4 590 604 1,225

Loss on disposal of intangible assets 7 - - 45

Loss on disposal of property, plant and equipment 8 - - 1

Share-based payments 110 71 183

Fair value adjustment to derivatives (246) 419 395

Operating cash flows before changes in working capital 1,649 3,407 5,409

Decrease/(increase) in inventories 2,098 (2,137) (1,661)

(Increase)/decrease in trade and other receivables (193) (249) 254

Decrease in trade and other payables (969) (2,125) (2,171)

Changes in working capital 936 (4,511) (3,578)

Cash generated by operations 2,585 (1,104) 1,831

---------------------------------------------------------- ------ -------------- -------------- ------------

Income tax refunded/(paid) 688 (361) (744)

Net cash from operating activities 3,273 (1,465) 1,087

---------------------------------------------------------- ------ -------------- -------------- ------------

Purchases of property, plant and equipment 8 (220) (701) (809)

Payments to acquire intangible assets 7 (313) (395) (731)

Interest received 5 172 49 124

Movement in short-term investments 1,685 (6) (25)

Net cash used in investing activities 1,324 (1,053) (1,441)

Funds placed in escrow for tender offer (9,144) - -

Joint share ownership plan - - (3,270)

Proceeds from issuance of shares 118 32 3,565

Cash payments in relation to lease liabilities (35) (32) (70)

Operating lease interest paid 5 (3) (1) (3)

Dividend paid to Company's shareholders - - (2,186)

Net cash from financing activities (9,064) (1) (1,964)

Net (decrease)/increase in cash and cash equivalents (4,467) (2,519) (2,318)

---------------------------------------------------------- ------ -------------- -------------- ------------

Effect of exchange rate changes (117) 288 315

Cash and cash equivalents at the beginning of the period 11,739 13,742 13,742

Cash and cash equivalents at the end of the period 7,155 11,511 11,739

---------------------------------------------------------- ------ -------------- -------------- ------------

1. General information

Anpario plc ("the Company") and its Subsidiaries (together "the

Group") produce and distribute natural feed additives for animal

health, hygiene and nutrition. Anpario plc is a public company

traded on the Alternative Investment Market ("AIM") of the London

Stock Exchange and is incorporated in the United Kingdom and

registered in England and Wales. The address of its registered

office is Unit 5 Manton Wood Enterprise Park, Worksop,

Nottinghamshire, S80 2RS. The presentation currency of the Group is

pounds sterling.

2. Basis of preparation

The unaudited consolidated financial statements comprise the

accounts of the Company and its subsidiaries drawn up to 30 June

2023.

The Group has presented its financial statements in accordance

with UK adopted International Financial Reporting Standards

("IFRSs").

Full details on the basis of the accounting policies used are

set out in the Group's financial statements for the year ended 31

December 2022, which are available on the Company's website at

www.anpario.com. There are not expected to be any changes to the

accounting policies and the same policies are expected to be

applicable for the year ended 31 December 2023.

This condensed consolidated interim financial information does

not comprise statutory accounts within the meaning of section 434

of the Companies Act 2006. Statutory accounts for the year ended 31

December 2022 were approved by the Board of Directors on 22 March

2023 and delivered to the Registrar of Companies. The report of the

auditors on those accounts was unqualified, did not contain an

emphasis of matter paragraph and did not contain any statement

under section 498 (2) or (3) of the Companies Act 2006.

The consolidated interim financial information for the period

ended 30 June 2023 is neither audited nor reviewed.

3. Operating segments

Management has determined the operating segments based on the

information that is reported internally to the Chief Operating

Decision Maker, the Board of Directors, to make strategic

decisions. The Board considers the business from a geographic

perspective and is organised into four geographical operating

divisions: Americas, Asia, Europe, Middle-East and Africa (MEA) and

Head Office.

All revenues from external customers are derived from the sale

of goods and services in the ordinary course of business to the

agricultural markets and are measured in a manner consistent with

that in the income statement. Inter-segment revenue is charged at

prevailing market prices or in accordance with local transfer

pricing regulations.

Americas Asia Europe MEA Head Office Total

--------------------------------------

for the six months ended 30 Jun 2023 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

-------------------------------------- --------- ------- -------- ------- ------------ --------

Total segmental revenue 4,709 5,356 7,126 1,713 - 18,904

Inter-segment revenue - - (3,631) - - (3,631)

Revenue from external customers 4,709 5,356 3,495 1,713 - 15,273

-------------------------------------- --------- ------- -------- ------- ------------ --------

Depreciation and amortisation (2) (25) (7) (2) (554) (590)

Net finance income - - - - 169 169

Exceptional items - - - - - -

Profit before tax 1,226 1,323 1,136 514 (2,835) 1,364

-------------------------------------- --------- ------- -------- ------- ------------ --------

Americas Asia Europe MEA Head Office Total

--------------------------------------

for the six months ended 30 Jun 2022 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

-------------------------------------- --------- ------- -------- ------- ------------ --------

Total segmental revenue 4,390 6,568 8,967 1,792 - 21,717

Inter-segment revenue - - (5,246) - - (5,246)

Revenue from external customers 4,390 6,568 3,721 1,792 - 16,471

-------------------------------------- --------- ------- -------- ------- ------------ --------

Depreciation and amortisation (2) (27) (6) (2) (567) (604)

Net finance income - - - - 48 48

Exceptional items - - - - - -

-------------------------------------- --------- ------- -------- ------- ------------ --------

Profit before tax 2,162 1,763 1,274 384 (3,222) 2,361

-------------------------------------- --------- ------- -------- ------- ------------ --------

Americas Asia Europe MEA Head Office Total

--------------------------------------

for the year ended 31 Dec 2022 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

-------------------------------------- --------- ------- -------- ------- ------------ --------

Total segmental revenue 9,149 12,617 16,071 3,848 - 41,685

Inter-segment revenue - - (8,582) - - (8,582)

Revenue from external customers 9,149 12,617 7,489 3,848 - 33,103

-------------------------------------- --------- ------- -------- ------- ------------ --------

Depreciation and amortisation (3) (55) (13) (4) (1,150) (1,225)

Net finance income - 1 - - 120 121

Profit before tax 3,301 3,530 2,641 972 (6,763) 3,681

-------------------------------------- --------- ------- -------- ------- ------------ --------

4. Alternative performance measures

In reporting financial information, the Group presents

alternative performance measures (APMs), which are not defined or

specified under the requirements of IFRS. The Group believes that

these APMs, which are not considered to be a substitute for or

superior to IFRS measures, provide depth and understanding to the

users of the financial statements to allow for further assessment

of the underlying performance of the Group.

The Board considers that adjusted EBITDA is the most appropriate

profit measure by which users of the financial statements can

assess the ongoing performance of the Group. EBITDA is a commonly

used measure in which earnings are stated before net finance

income, amortisation and depreciation. The Group makes further

adjustments to remove items that are non-recurring or are not

reflective of the underlying operational performance either due to

their nature or the level of volatility.

six months to six months to year ended

30 June 30 June 31 December

2023 2022 2022

GBP000 GBP000 GBP000

---------------------------------- -------------- -------------- ------------

Operating profit 1,195 2,313 3,560

---------------------------------- -------------- -------------- ------------

Non-recurring acquisition costs - - 210

Share-based payments 120 91 213

Total adjustments 120 91 423

Adjusted operating profit 1,315 2,404 3,983

---------------------------------- -------------- -------------- ------------

Depreciation and amortisation 590 604 1,225

Adjusted EBITDA 1,905 3,008 5,208

---------------------------------- -------------- -------------- ------------

six months to six months to year ended

30 June 30 June 31 December

2023 2022 2022

GBP000 GBP000 GBP000

---------------------------------- -------------- -------------- ------------

Adjusted operating profit 1,315 2,404 3,983

---------------------------------- -------------- -------------- ------------

Income tax expense (144) (249) (378)

Income tax impact of adjustments 2 4 42

Adjusted profit after tax 1,173 2,159 3,647

---------------------------------- -------------- -------------- ------------

5. Net finance income

six months to six months to year ended

30 June 30 June 31 December

2023 2022 2022

GBP000 GBP000 GBP000

------------------------------------------------- -------------- -------------- ------------

Interest receivable on short-term bank deposits 172 49 124

------------------------------------------------- -------------- -------------- ------------

Finance income 172 49 124

Lease interest paid (3) (1) (3)

------------------------------------------------- -------------- -------------- ------------

Finance costs (3) (1) (3)

Net finance income 169 48 121

------------------------------------------------- -------------- -------------- ------------

6. Earnings per share

The calculation of the basic and diluted earnings per share is

based on the following data:

six months to six months to year ended

30 June 30 June 31 December

2023 2022 2022

-------------------------------------------------------- -------------- -------------- ------------

Profit for the year (GBP000's) 1,220 2,112 3,303

--------------------------------------------------------- -------------- -------------- ------------

Weighted average number of shares in issue 20,648,766 20,445,907 20,481,713

--------------------------------------------------------- -------------- -------------- ------------

Number of dilutive shares 90,890 1,553,198 1,392,327

Weighted average number for diluted earnings per share 20,739,656 21,999,105 21,874,040

--------------------------------------------------------- -------------- -------------- ------------

Basic earnings per share 5.91p 10.33p 16.13p

Diluted earnings per share 5.88p 9.60p 15.10p

--------------------------------------------------------- -------------- -------------- ------------

The calculation of the adjusted and diluted adjusted earnings

per share is based on the following data:

six months to six months to year ended

30 June 30 June 31 December

Note 2023 2022 2022

---------------------------------------------------------------- ------ -------------- -------------- ------------

Adjusted profit attributable to owners of the Parent (GBP000's) 4 1,173 2,159 3,647

---------------------------------------------------------------- ------ -------------- -------------- ------------

Weighted average number of shares in issue 20,648,766 20,445,907 20,481,713

---------------------------------------------------------------- ------ -------------- -------------- ------------

Number of dilutive shares 90,890 1,553,198 1,392,327

Weighted average number for diluted earnings per share 20,739,656 21,999,105 21,874,040

---------------------------------------------------------------- ------ -------------- -------------- ------------

Adjusted earnings per share 5.68p 10.56p 17.81p

Diluted adjusted earnings per share 5.66p 9.81p 16.67p

---------------------------------------------------------------- ------ -------------- -------------- ------------

7. Intangible assets

Patents,

Brands and trademarks

developed Customer and Development Software

Goodwill products relationships registrations costs and Licenses Total

-------------------

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------- --------- ------------- -------------- -------------- -------------- -------------- -------

Cost

As at 1 January

2023 5,960 4,766 786 1,924 1,154 943 15,533

Additions - 30 - 103 177 3 313

Reclassifications - 365 - - (365) - -

Disposals - - - - - (2) (2)

As at 30 June 2023 5,960 5,161 786 2,027 966 944 15,844

------------------- --------- ------------- -------------- -------------- -------------- -------------- -------

Accumulated

amortisation

As at 1 January

2023 - 1,318 745 1,263 - 832 4,158

Charge for the

year - 171 4 89 - 34 298

Reclassifications - - - - - - -

Disposals - - - - - (2) (2)

As at 30 June 2023 - 1,489 749 1,352 - 864 4,454

------------------- --------- ------------- -------------- -------------- -------------- -------------- -------

Net book value

As at 1 January

2023 5,960 3,448 41 661 1,154 111 11,375

As at 30 June 2023 5,960 3,672 37 675 966 80 11,390

------------------- --------- ------------- -------------- -------------- -------------- -------------- -------

8. Property, plant and equipment

Land and Fixtures, fittings Assets in the course

buildings Plant and machinery and equipment of construction Total

------------------------------

GBP000 GBP000 GBP000 GBP000 GBP000

------------------------------ ----------- -------------------- ------------------- --------------------- -------

Cost

As at 1 January 2023 2,251 5,017 395 48 7,711

Additions - - 5 215 220

Transfer of assets in

construction - - 9 (9) -

Disposals - (1) (21) - (22)

Foreign exchange - - (4) - (4)

As at 30 June 2023 2,251 5,016 384 254 7,905

------------------------------ ----------- -------------------- ------------------- --------------------- -------

Accumulated depreciation

As at 1 January 2023 350 2,187 310 - 2,847

Charge for the year 25 211 21 - 257

Disposals - (1) (21) - (22)

Foreign exchange - - (4) - (4)

As at 30 June 2023 375 2,397 306 - 3,078

------------------------------ ----------- -------------------- ------------------- --------------------- -------

Net book value

As at 1 January 2023 1,901 2,830 85 48 4,864

As at 30 June 2023 1,876 2,619 78 254 4,827

------------------------------ ----------- -------------------- ------------------- --------------------- -------

9. Right-of-use assets

Land and Plant and Fixtures, fittings

buildings machinery and equipment Total

-----------------------------

GBP000 GBP000 GBP000 GBP000

----------------------------- ----------- ----------- ------------------- -------

Cost

As at 1 January 2023 296 23 3 322

Additions - 11 - 11

Modification to lease terms 85 - - 85

Foreign exchange (23) - - (23)

As at 30 June 2023 358 34 3 395

----------------------------- ----------- ----------- ------------------- -------

Accumulated depreciation

As at 1 January 2023 269 1 2 272

Charge for the year 32 3 - 35

Foreign exchange (19) - - (19)

As at 30 June 2023 282 4 2 288

----------------------------- ----------- ----------- ------------------- -------

Net book value

As at 1 January 2023 27 22 1 50

As at 30 June 2023 76 30 1 107

----------------------------- ----------- ----------- ------------------- -------

10. Inventories

six months to six months to year ended

30 June 30 June 31 December

2023 2022 2022

GBP000 GBP000 GBP000

------------------------------------- -------------- -------------- ------------

Raw materials and consumables 3,476 3,562 4,664

Finished goods and goods for resale 4,059 6,864 5,203

Inventory 7,535 10,426 9,867

------------------------------------- -------------- -------------- ------------

11. Post balance sheet event

In a circular dated 7 June 2023, the Company proposed a tender

offer to shareholders. This exercise was completed on 7 July 2023

and had the effect of reducing cash reserves by approximately

GBP9.1m. All 4,000,000 Ordinary Shares purchased, together with

treasury shares already held of 440,388, were cancelled on 7 July

2023.

There are no other post balance sheet events.

12. Interim results

Copies of this notice are available to the public from the

registered office at Manton Wood Enterprise Park, Worksop,

Nottinghamshire, S80 2RS, and on the Company's website at

www.anpario.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GZGMLGZKGFZZ

(END) Dow Jones Newswires

September 13, 2023 02:00 ET (06:00 GMT)

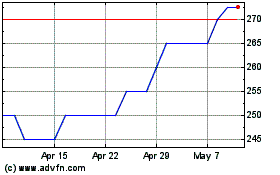

Anpario (LSE:ANP)

Historical Stock Chart

From Oct 2024 to Nov 2024

Anpario (LSE:ANP)

Historical Stock Chart

From Nov 2023 to Nov 2024