Ashmore Group PLC Trading Statement (9900P)

13 October 2023 - 5:00PM

UK Regulatory

TIDMASHM

RNS Number : 9900P

Ashmore Group PLC

13 October 2023

Ashmore Group plc

13 October 2023

FIRST QUARTER ASSETS UNDER MANAGEMENT STATEMENT

Ashmore Group plc ("Ashmore", "the Group"), the specialist

Emerging Markets asset manager, announces the following update to

its assets under management ("AuM") in respect of the quarter ended

30 September 2023.

Assets under management

Actual Estimated

30 September

30 June 2023 2023 Movement

Theme (US$ billion) (US$ billion) (%)

- External debt 11.0 8.9 -19%

--------------- --------------- ---------

- Local currency 18.8 18.4 -2%

--------------- --------------- ---------

- Corporate

debt 6.5 5.5 -15%

--------------- --------------- ---------

- Blended debt 11.9 11.3 -5%

--------------- --------------- ---------

Fixed income 48.2 44.1 -9%

--------------- --------------- ---------

Equities 6.2 6.0 -3%

--------------- --------------- ---------

Alternatives 1.5 1.6 +7%

--------------- --------------- ---------

Total 55.9 51.7 -8%

--------------- --------------- ---------

Assets under management decreased by US$4.2 billion over the

period, comprising negative investment performance of US$1.3

billion and net outflows of US$2.9 billion.

Net outflows were at a similar level to the prior quarter,

primarily reflecting continuing institutional risk aversion. The

outflows were mainly in the external debt and corporate debt

themes, with smaller net outflows in blended debt and equities.

There were net inflows in the local currency and alternatives

themes.

The combination of weaker China economic data and an expectation

that developed world interest rates will remain high for longer

meant that global capital markets fell over the quarter and the US

dollar rallied. While Emerging Markets indices typically declined

by 2% to 3% over the three months, this was broadly in line with or

marginally better than Developed Markets. As expected in this

environment, Ashmore's main fixed income and equity strategies

modestly underperformed over the three months.

Mark Coombs, Chief Executive Officer, Ashmore Group plc,

commented:

"Emerging Markets were largely rangebound this quarter and

overall delivered slightly negative returns. After three quarters

of positive returns, such a period of consolidation within a longer

recovery cycle is normal, and there continue to be positive

fundamental trends in Emerging Markets. For example, central banks

in many countries are cutting policy rates in response to falling

inflation, which supports the outlook for local bond and equity

markets and provides an opportunity to take advantage of lower

asset prices. Significantly, India will be included in the main

local currency bonds benchmark from mid-2024, illustrating the

positive ongoing reforms in emerging countries and providing

greater investment diversification. Ashmore continues to deliver

longer-term outperformance for clients across a broad range of

strategies and is well-positioned to benefit from further recovery

in Emerging Markets."

Notes

Local currency AuM includes US$6.6 billion of AuM managed in

overlay/liquidity strategies (30 June 2023: US$6.3 billion).

For further information please contact:

Ashmore Group plc

Paul Measday

Investor Relations +44 (0)20 3077 6278

FTI Consulting

Neil Doyle +44 (0)7771 978 220

Kit Dunford +44 (0)7717 417 038

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFSRIFLFLIV

(END) Dow Jones Newswires

October 13, 2023 02:00 ET (06:00 GMT)

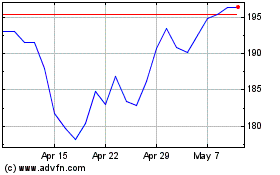

Ashmore (LSE:ASHM)

Historical Stock Chart

From Mar 2025 to Apr 2025

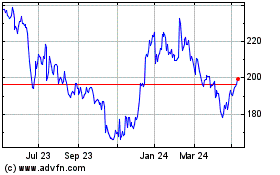

Ashmore (LSE:ASHM)

Historical Stock Chart

From Apr 2024 to Apr 2025