AssetCo PLC Acquisition of Ocean Dial Asset Management Ltd (2614O)

02 October 2023 - 5:00PM

UK Regulatory

TIDMASTO

RNS Number : 2614O

AssetCo PLC

02 October 2023

2 October 2023

LEI: 213800LFMHKVNTZ7GV45

AssetCo plc

("AssetCo" or the "Company")

Completion of acquisition of Ocean Dial Asset Management

Limited

AssetCo (AIM: ASTO), the agile asset and wealth management

company, is pleased to confirm completion today of its acquisition

of the entire issued share capital of Ocean Dial Asset Management

Limited (the "Acquisition") from Avendus Capital Asset Management

(UK) Limited. This follows confirmation of relevant clearances from

the FCA and Indian regulators.

The initial consideration has been satisfied by the delivery of

1,464,129 ordinary shares of GBP0.01 each in the capital of the

Company ("Ordinary Shares") and GBP2.46m in cash (GBP1.82m net of

cash within the business). Up to a further 1,464,129 Ordinary

Shares may be issued, subject to adjustment, on a deferred basis

until after the calendar year end in accordance with the provisions

of the Sale and Purchase Agreement. As part of the Completion

arrangements, it was agreed to bring forward GBP0.5m of cash which

was to form part of the deferred consideration and to replace this

with the issue of shares rather than the mixtures of cash and

shares originally proposed.

All Consideration shares have and will be issued at an agreed

issue price of 68.3p per share out of Treasury. Following the

transfer for the initial consideration, AssetCo has 6,818,898

ordinary shares remaining in treasury.

The Company announces in accordance with DTR 5.6.1 that, as at 2

October 2023 and following the transfer, the Company's issued share

capital consists of 149,292,970 Ordinary Shares of which 6,818,898

are held in treasury. The total number of voting rights attaching

to the Ordinary Shares is therefore 142,474,072.

The above figure (142,474,072) may be used by shareholders as

the denominator for any calculation pursuant to which they

determine if they are required to notify their interest in, or a

change to their interest in, the Company's Ordinary Shares under

the FCA's Disclosure Guidance and Transparency Rules.

About Ocean Dial Asset Management

Ocean Dial's current business is the management of the assets of

the India Capital Growth Fund Limited, which, as at 22 September

2023, had a net asset value of c.GBP156m generating an annualised

run rate revenue for the manager of GBP1.86m. The Acquisition is

expected to be earnings enhancing for the Group and it is

anticipated that further synergies will be achievable. Ocean Dial

had estimated net assets at completion exceeding GBP0.6m. The fund

has been successfully advised for several years by Gaurav Narain

and his team based in India and UK.

Martin Gilbert, Chairman of AssetCo, commented:

" We are delighted to have completed the acquisition of Ocean

Dial on the timetable originally envisaged and to welcome India

Capital Growth Fund as an important and valued client of our Group.

We are excited about the long-term potential that India offers and

see opportunities to add value by bringing Ocean Dial including

Gaurav and his team together with the other active equity asset

management businesses we are combining under the River and

Mercantile brand."

Gaurav Deepak, Co-Founder and CEO of Avendus Capital (India) added:

"Avendus is delighted to have completed the sale of Ocean Dial

to AssetCo, and we look forward to a long and fruitful future

relationship with Martin and his team."

For further information, please contact:

AssetCo plc Numis Securities Limited

G ary Marshall , CFOO Nominated adviser and joint

Peter McKellar, Deputy Chairman broker

Tel: +44 (0) 7788 338157 Giles Rolls / Charles Farquhar

Tel: +44 (0) 20 7260 1000

Panmure Gordon (UK) Limited H/Advisors Maitland

Joint broker Neil Bennett

Atholl Tweedie Rachel Cohen

Tel: +44 (0) 20 7886 2500 Tel: +44 (0) 20 7379 55151

For further details, visit the website, www.assetco.com

Ticker: AIM: ASTO.L

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQFZMGGZMKGFZM

(END) Dow Jones Newswires

October 02, 2023 02:00 ET (06:00 GMT)

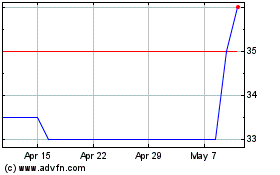

Assetco (LSE:ASTO)

Historical Stock Chart

From Nov 2024 to Dec 2024

Assetco (LSE:ASTO)

Historical Stock Chart

From Dec 2023 to Dec 2024