TIDMCML

RNS Number : 6302V

CML Microsystems PLC

05 December 2023

5 December 2023

CML Microsystems Plc

("CML", the "Company" or the "Group")

Half Year Results

Trading in line with expectations, Acquired MwT business and

amalgamation progressing well

CML Microsystems Plc, which develops mixed-signal, RF and

microwave semiconductors for global communications markets, today

announces its unaudited results for the six months ended 30

September 2023.

Financial Highlights

-- Revenue increased by 5% to GBP10.58m (H1 FY22: GBP10.05m)

-- Profit from operations, excluding the GBP0.30m of external

costs incurred in this half relating to the MwT acquisition,

increased by 9% to GBP1.90m (H1 FY23: GBP1.75m)

-- Diluted EPS decreased to 9.31p (H1 FY22: 11.58p) on higher

tax charge

-- Strong cash balances at period end of GBP20.95m (31 March

2023: net cash of GBP22.26m), a reduction of GBP1.31m after

a GBP1.75m spend on share buybacks and GBP0.9m on dividend

payments

-- Recommended half year dividend of 5p per share (H1 FY23: 5p

per share)

Operational Highlights

-- Post period end, successful completion of MwT acquisition

on 2 October 2023, significantly expanding the Group's product

portfolio and complementing existing R&D capabilities

-- Increasing presence in new and emerging growth sectors driving

growth

-- Board and senior management evolution, with appointment of

Mark McCabe as Chief Operating Officer, Michelle Jones as

Director of Finance and Nathan Zommer soon to be joining as

Non-Executive Director.

Chris Gurry, Managing Director of CML Microsystems Plc,

commented on the results:

"The results achieved for the six months to 30 September 2023

have been robust and the Board expects trading for the full year to

be in line with expectations. CML's sustained revenue growth during

the period, despite the macroenvironment headwinds facing the

sector as a whole, is pleasing and serves to both validate our

strategy and highlight the resilience of our business.

The successful acquisition of MwT in October 2023 marked a

significant milestone for the Group. The resulting expansion of our

product portfolio, and the complementary R&D capabilities that

this acquisition brings, positions CML well to fully capitalise on

the opportunities available in the new and expanding markets in

which we operate.

The future addition of Nathan Zommer as Non-Executive Director,

alongside the promotion of Mark McCabe to the Board as Chief

Operating Officer and Michelle Jones to Director of Finance,

significantly enhances the expertise and experience on the CML

Board while adding notable impetus as we continue on our growth

journey.

The financial and operational progress made during the period

has been pleasing and gives the Board a great deal of confidence as

we continue to deliver value to our shareholders."

Enquiries:

CML Microsystems Plc www.cmlmicroplc.com

Chris Gurry, Group Managing Director Tel: +44 (0) 1621 875 500

Nigel Clark, Executive Chairman

Shore Capital (Nominated Adviser Tel: +44 (0) 20 7408 4090

and Broker)

Toby Gibbs

James Thomas

Lucy Bowden

Fiona Conroy (Corporate Broking)

Alma Strategic Communications Tel: +44 (0)20 3405 0205

Josh Royston

Andy Bryant

Robyn Fisher

Matthew Young

About CML Microsystems PLC

CML develops mixed-signal, RF and microwave semiconductors for

global communications markets. The Group utilises a combination of

outsourced manufacturing and in-house testing with trading

operations in the UK, Asia and USA. CML targets sub-segments within

Communication markets with strong growth profiles and high barriers

to entry. It has secured a diverse, blue chip customer base,

including some of the world's leading commercial and industrial

product manufacturers.

The spread of its customers and diversity of the product range

largely protects the business from the cyclicality usually

associated with the semiconductor industry. Growth in its end

markets is being driven by factors such as the appetite for data to

be transmitted faster and more securely, the upgrading of telecoms

infrastructure around the world and the growing prevalence of

private commercial wireless networks for voice and/or data

communications linked to the industrial internet of things

(IIoT).

The Group is cash-generative, has no debt and is dividend

paying.

Chairman's statement

Introduction

Our relatively recent strategy of concentrating efforts on the

communications semiconductor market and expanding the sub-sectors

addressed continues to serve us well, despite the challenging

macroeconomic conditions. We were very pleased to finally announce

on 2 October 2023 the closing of the acquisition of Microwave

Technology Inc ("MwT") but the unexpected delays in completing the

transaction, due to the associated regulatory processes, means that

amalgamation activities that we hoped to have well underway by now

have only just started.

We are confident the assimilation work will be achieved

successfully but realisation of the benefits will correspondingly

move out beyond our initial expectations. That said, MwT

substantially enlarges the Group's product portfolio, complements

our existing R&D capabilities and expands our system level

understanding, allowing us to better capitalise on the market

opportunities we see.

Results and trading

Despite the global macroeconomic backdrop, the Group's financial

performance for the six months to 30 September 2023 was positive

and generally in line with our expectations. In a reverse of the

comparative period of the prior year, revenue growth was tempered

by the weakening of the average US Dollar rate against Sterling.

The movement in currencies becomes less material at the profit

level since costs below the revenue line are primarily denominated

in other currencies.

Revenue for the first six months increased by 5% to GBP10.58m

(H1 FY22: GBP10.05m). Gross profit increased 4% to GBP7.94m (H1

FY22: GBP7.62m) and profit from operations increased by 9%, before

the GBP0.30m of external costs incurred in this half relating to

the acquisition of MwT. Profit before taxation only marginally

increased to GBP1.87m (H1 FY22: GBP1.83). The tax charge of 22% is

higher than expected but reflects the changes in rules relating to

R&D tax credits and a higher corporation tax rate. The result

is that profit after taxation fell to GBP1.47m (H1 FY22: GBP1.87m),

EBITDA was broadly flat at GBP3.23m (H1 FY23: GBP3.25m) and diluted

EPS was 9.31p (H1 FY23: 11.58p). Cash balances at the end of the

period stood at GBP20.95m (31 March 2023: GBP22.26m), a reduction

of GBP1.31m after a GBP1.75m spend on share buybacks and GBP932k on

dividend payments.

Dividend

The Board is recommending an unchanged half year dividend of

5.0p per share (H1 FY23: 5.0p per share), payable on 12 January

2024 to shareholders on the Register on 22 December 2023, with an

ex-dividend date of 21 December 2023.

Property

Following the sale of the first parcel of land just prior to

commencing the current financial year, building work has commenced

at the Group's Essex Headquarters site, Oval Park, including

relocating the car parks to the rear of the buildings and is

scheduled to be completed before the current year end. The

remaining excess land, circa 15 acres, which was granted planning

permissions in February 2023 was placed on the market early

October.

Further interest in the Group's excess commercial property in

Fareham, Hampshire is currently being explored, following cessation

of the negotiations referenced in the Group's annual report.

Board and senior management

At the time of the Annual General Meeting ("AGM") in August, I

announced my intention to revert to the role of Non-Executive

Chairman once the MwT acquisition had been completed and for this

to coincide with additional appointments. In the last week we have

strengthened the Board with the promotion of Mark McCabe to the

position of Chief Operating Officer and the promotion of Michelle

Jones to the senior management position of Director of Finance.

These actions enhance the Board and leadership team bringing a

diverse set of skills, expertise and experience whilst adding

impetus. With these enhancements in place, I am stepping back to

the position of Non-Executive Chairman with immediate effect.

The formalities of appointing Nathan Zommer as a Non-Executive

Director are expected to be completed in the next couple of weeks

following which an announcement will be made.

Employees

As I indicated at the start of my statement, this is a very

demanding year and we clearly need the support of all employees to

succeed with our ambitions. Throughout our operations globally, we

are fortunate to have a great team of talented, hard-working, and

dedicated employees and the Board thanks them all sincerely.

Prospects and outlook

The business continues to make good progress and has the

appropriate blend of experience, enthusiasm and skills to continue

to achieve its medium-term objectives.

Despite the challenges brought by multiple headwinds facing

businesses in all sectors, we currently expect full year revenues

to be slightly ahead of current market expectations, with the

majority of the growth attributable to the addition of MwT.

Profitability is expected to be in line with current market

expectations, with anticipated costs relating to the incorporation

of MwT likely to temper further growth this year.

Notwithstanding the macroeconomic environment, the Board has

confidence in the strategy being followed and believes the

robustness of our business model and a continued focus on

sustainable growth will deliver a meaningful uplift in performance

beyond the current year.

Nigel Clark

Non-Executive Chairman

5 December 2023

Operational and financial review

Introduction

The Group began the current financial year focused on growth,

supported by relatively resilient end markets, a healthy order book

and an evolving presence in new and emerging growth sectors.

Amidst an inflationary environment, global economic uncertainty

and a backdrop of several industry commentators predicting the

semiconductor market will shrink by double-digit percentage points

in 2023, the delivery of revenue growth through the first six-month

period is a pleasing outcome and serves to highlight the resilience

of our business.

Equally welcome was the completion of the acquisition of

Microwave Technology, Inc ("MwT") on 2 October 2023, ending what

was a protracted process due to US government national security

considerations relating to the technology and skillset the business

possesses. Work is now underway to unlock the global potential of

the MwT product portfolio and to exploit the synergies that

exist.

First half progress has been positive at the revenue level,

although larger than anticipated acquisition costs affected the

underlying growth in operating profitability. Excluding these

one-off costs, profit from operations increased by 9%.

Nevertheless, prior investments in people and products coupled with

the strategy being followed positions CML well to capture

meaningful growth as the enlarged Group moves forward.

Strategy

The Group's vision is to be the first-choice semiconductor

partner to technology innovators, together transforming how the

world communicates.

Our focus is on the definition, development and marketing of

standard semiconductor products that deliver compelling technical

and commercial benefits to our customers. In turn, our customers

utilise these solutions to develop and subsequently market

end-products that are essential for the efficient and reliable

transportation of voice and/or data across a predominantly wireless

medium.

The global communications market is huge, with a myriad of

end-application areas ranging from mobile/cellular networks to

precise positioning systems to short-range remote-control devices.

Within this vast landscape of opportunity, CML is actively

participating in a number of sub-markets that leverage our

strengths and have excellent growth potential on a sustainable

basis. These markets include mission critical communications,

wireless networks and satellite, Industrial Internet of Things

("IIoT") and more recently, broadcast radio. The addressable market

in terms of semiconductor content easily exceeds $1billion.

Continued investment in research and development is essential to

enable CML to take full advantage of the large market opportunity

available. Various new product programmes are underway comprising

mixed-signal complex SoC projects with multi-year engineering

cycles along with more rapid micro/millimetre wave developments.

The blended result is delivering more products to market each year

against what is a relatively stable absolute R&D spend.

Markets and operations

Across the prior full financial year to 31 March 2023, revenues

from Group customers producing voice-centric wireless

communications equipment delivered good growth, with the

contribution from data centric applications slightly weaker due to

some customers having procured inventory in excess of their

end-market needs.

In the first half of the current financial year, across most of

the major customers, the voice equipment manufacturers once again

achieved a solid advance in revenues whereas sales increases from

data applications, such as IIoT, M2M, AMR were more moderate. We

have seen early indications that order intake from this sector is

set to improve but across the next few months, we are nonetheless

taking a cautious stance.

Geographically, performance across the first six months within

Asia was good, with a 7.5% increase in sales revenue. However, the

economic and geo-political situation in parts of the region,

including China and Korea, has the potential to temper growth

prospects. Within China, those customers that are producing

end-products for local consumption have better forecast visibility

than those reliant on exports. We therefore remain mindful of the

backdrop globally and have moderated our expectations for the

second half year period.

The global voice communications markets addressed by the Group

include the Land Mobile Radio/Private Mobile Radio (LMR/PMR)

sector, encompassing high performance mission critical

end-applications through to low-cost digital radio standards for

use in the leisure and retail sector. For data-centric markets,

"smart everything" is driving data throughput increases within

industry verticals such as agriculture, construction, smart

grid/city and marine safety. CML has been a significant player in

these end-application areas for many years and continues to invest

appropriately in growth opportunities.

In recent years, building upon substantial markets knowledge and

"design for manufacturing" capabilities for silicon devices, CML

commenced the development of high-performance Radio Frequency ICs

("RFICs") and Monolithic Microwave ICs ("MMICs") using compound

semiconductor technologies, including GaAs and GaN. The

twelve-month period to 31 March 2023 represented the first full

financial year with availability of a number of new products that

are marketed under CML's SuRF brand and, over time, the flow of

revenue from this expanding portfolio of IC's is expected to

constitute a very sizeable proportion of the Group's total

revenues.

One key R&D initiative outlined at the time of announcing

the FY23 full year results in June 2023, was a low-power radio

receiver solution for Digital Radio Mondiale ("DRM"). DRM is a

digital radio broadcast standard that has been adopted for wide

area broadcasting in China, India and Pakistan and is expected to

be deployed in several other nations. The DRM service provides high

quality stereo audio across long distances and wide areas using

low-cost, low-power infrastructure.

The DRM module was formally announced at the International

Broadcasting Convention (IBC) in Amsterdam in September and is a

complete "antenna to speaker" module, containing all hardware,

software, IP and patent licences required for a radio equipment

manufacturer to easily realise a dual mode (digital and analogue)

DRM capable receiver. The module offers a 60% cost reduction and

80% power reduction over existing DRM technologies in the market.

At IBC, it was announced that the DRM module has been adopted by

leading manufacturer Gospell Digital Radio Technology Co, Ltd for

two new portable radio families.

In support of the broadening product portfolio and expansion

into new sub-markets, we exhibited at a number of trade shows

through the period, including IMS Microwave Week in San Diego,

European Microwave Week in Berlin and the International

Broadcasting Convention (IBC) in Amsterdam.

The multi-year investments in people, products and equipment

have positioned us well to continue to expand the business. The

traditional voice and data centric markets have provided strong

foundations on which to expand into the micro/millimetre wave and,

more latterly, broadcast radio arenas. Within these newer markets

we are at the early stages of a journey to drive the business

forward strongly and sustainably.

Acquisition of Microwave Technology, Inc

On 2 October 2023, immediately following the half year end, we

completed the acquisition of Silicon Valley based semiconductor

company Microwave Technology, Inc. ("MwT"). Founded in 1982, MwT is

a recognised leader in the design, manufacturing and marketing of

GaAs and GaN based MMICs, Discrete Devices, and Hybrid Amplifier

Products for commercial wireless communication, defence, space, and

medical (MRI) applications.

The acquisition expands upon the Group's growing product

portfolio and complements its existing capabilities, providing

essential knowhow and experience in high-frequency system level

understanding, product manufacturing and packaging techniques.

Work is now underway to ensure maximum market exposure for the

product range acquired and investment areas have been identified

that will improve USA-based production capacity and efficiency

positioning the enlarged Group for growth in the years that

follow.

As a Group, CML now has internal final testing capabilities in

the UK, Asia and the Americas, providing the flexibility required

to address regional customer demands as they evolve.

Financial review

Sales revenues for the opening six-month trading period

increased by 5% to GBP10.58m (H1 FY23: GBP10.05m) and include a

currency headwind against the comparable period one year ago.

Re-stated on a constant currency basis, revenues increased by 9%.

Regionally, the improvements came from greater sales into Europe

and the Far East, with the Americas territory posting a decline.

Excess inventory across a handful of customers tempered further

growth following the supply chain dynamics that have been a feature

of the last two years.

Higher sales levels combined with a slight reduction in gross

margin delivered a gross profit of GBP7.94m (H1 FY23: GBP7.62m)

representing an increase of 4%. Given cost of sale pressures, in

part due to supplier raw material price increases that were

experienced across multiple years, maintenance of the gross margin

is a pleasing outcome at this interim stage.

Distribution and administration (D&A) expenses were higher

at GBP6.32m (H1 FY23: GBP5.77m) and whilst an increase over the

previous year was expected, the prolonged process associated with

and leading up to completion of the MwT transaction resulted in

additional costs of GBP0.30m being incurred.

Excluding third-party one-off costs associated with the MwT

acquisition, profit from operations improved by 9% to GBP1.90m (H1

FY23 GBP1.75m). This is a key measure of the Group's performance

over the period under review although under international

accounting standards, the income statement does not highlight these

costs as exceptional, hence the reported figure was lower at

GBP1.61m.

Finance income was noticeably up at GBP0.24m (H1 FY23: GBP0.10m)

and reflected the improved deposit rates being achieved on the

Group's strong cash balances. Finance expenses were negligible.

Adjusted EBITDA came in at GBP3.23m (H1 FY23: GBP3.25m).

Profit before tax was flat at GBP1.87m against GBP1.83m for the

prior year first half.

An income tax charge of GBP0.41m was recorded compared to a

credit of GBP0.04m for the comparable period with the main

contributing factors being lower UK R&D tax credits following

changes to government policy and an increase in the corporation tax

rate from 19% to 25%. The tax charge led to a diluted earnings per

share figure of 9.31p against 11.58p for the prior year.

For some time, the Group has deliberately operated with a raised

level of inventory in keeping with its strategy to help minimise

the impact customers feel from the supply chain dynamics over

recent years. This year is no different and despite the slight drop

in inventory levels to GBP2.19m (H1 FY23: GBP2.30m), expectations

are for this to climb to a higher level over the next 12-18 months

due to an expanded product range along with growth

expectations.

The Group continues to be debt free and had cash balances

amounting to GBP20.95m at 30 September 2023 (31 March 2023: net

cash of GBP22.26m). This follows investments of GBP2.01m in R&D

activities, GBP0.60m in property, plant and equipment and

shareholder returns of GBP2.57m by way of share repurchases (net of

shares issued) and dividend payments. The strong balance sheet

gives us a range of options as we look to win new clients and grow

organically as well as the potential for future acquisitions in the

medium-term.

Chris Gurry

Group Managing Director

5 December 2023

Condensed consolidated income statement

for the six months ended 30 September 2023

Unaudited 6 months end Unaudited 6 months end Audited year end

---------------------------------- ---------------------------------- ----------------------------------

Before Before Before

exceptional Exceptional 30/09/23 exceptional Exceptional 30/09/22 exceptional Exceptional 31/03/23

items items Total items items Total items items Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- ----------- ----------- -------- ----------- ----------- -------- ----------- ----------- --------

Continuing

operations

Revenue 10,575 - 10,575 10,045 - 10,045 20,643 - 20,643

Cost of sales (2,631) - (2,631) (2,423) - (2,423) (5,032) - (5,032)

---------------- ----------- ----------- -------- ----------- ----------- -------- ----------- ----------- --------

Gross profit 7,944 - 7,944 7,622 - 7,622 15,611 - 15,611

Distribution and

administration

costs (6,318) - (6,318) (5,765) - (5,765) (12,644) - (12,644)

Share-based

payments (103) - (103) (137) - (137) (234) - (234)

---------------- ----------- ----------- -------- ----------- ----------- -------- ----------- ----------- --------

1,523 - 1,523 1,720 - 1,720 2,733 - 2,733

Profit on sale

of fixed asset - - - - - - - 2,058 2,058

Other operating

income 85 - 85 30 - 30 199 - 199

---------------- ----------- ----------- -------- ----------- ----------- -------- ----------- ----------- --------

Profit from

operations 1,608 - 1,608 1,750 - 1,750 2,932 2,058 4,990

Other income 50 - 50 4 - 4 18 - 18

Finance income 235 - 235 97 - 97 255 - 255

Finance expense (20) - (20) (21) - (21) (47) - (47)

---------------- ----------- ----------- -------- ----------- ----------- -------- ----------- ----------- --------

Profit before

taxation 1,873 - 1,873 1,830 - 1,830 3,158 2,058 5,216

Income tax

(charge)/credit (406) - (406) 35 - 35 (71) (335) (406)

---------------- ----------- ----------- -------- ----------- ----------- -------- ----------- ----------- --------

Profit after

taxation for

period

attributable to

equity owners

of the parent 1,467 - 1,467 1,865 - 1,865 3,087 1,723 4,810

---------------- ----------- ----------- -------- ----------- ----------- -------- ----------- ----------- --------

All financial

information

presented

relates to

continuing

activities.

Earnings per

share from total

operations

attributable to

the ordinary

equity

holders of the

Company:

---------------- ----------- ----------- -------- ----------- ----------- -------- ----------- ----------- --------

Basic earnings

per share 9.44p 11.72p 30.29p

Diluted earnings

per share 9.31p 11.58p 29.93p

---------------- ----------- ----------- -------- ----------- ----------- -------- ----------- ----------- --------

The following measure is considered an alternative performance

measure, not a generally accepted accounting principle. This ratio

is useful to ensure that the level of borrowings in the business

can be supported by the cash flow in the business. For definition

and reconciliation see note 10.

Adjusted EBITDA 3,230 3,252 5,901

----------------- ----- ----- -----

Condensed consolidated statement of total comprehensive

income

for the six months ended 30 September 2023

Unaudited Unaudited Audited

6 months end 6 months end year end

30/09/23 30/09/22 31/03/23

GBP'000 GBP'000 GBP'000

-------------------------------------------------------------------------------- ------------ ------------ --------

Profit for the period 1,467 1,865 4,810

Other comprehensive income/(expense):

Items that will not be reclassified subsequently to profit or loss:

Re-measurement of benefit obligation - - 1,393

Deferred tax on actuarial gain - - (348)

-------------------------------------------------------------------------------- ------------ ------------ --------

Items reclassified subsequently to profit or loss upon derecognition:

Foreign exchange differences (493) 829 (140)

-------------------------------------------------------------------------------- ------------ ------------ --------

Other comprehensive income for the period net of taxation attributable to the

equity holders

of the parent (493) 829 905

-------------------------------------------------------------------------------- ------------ ------------ --------

Total comprehensive income for the period attributable to the equity holders of

the parent 974 2,694 5,715

-------------------------------------------------------------------------------- ------------ ------------ --------

Condensed consolidated statement of financial position

as at 30 September 2023

Unaudited Unaudited Audited

30/09/23 30/09/22 31/03/23

GBP'000 GBP'000 GBP'000

---------------------------------------------- --------- --------- ---------

Assets

Non-current assets

Goodwill 7,152 7,861 7,429

Other intangible assets 885 1,107 984

Development costs 14,391 12,738 13,801

Property, plant and equipment 6,087 5,479 5,249

Right-of-use assets 910 338 1,022

Deferred tax assets 618 2,605 766

---------------------------------------------- --------- --------- ---------

30,043 30,128 29,251

---------------------------------------------- --------- --------- ---------

Current assets

Property, plant and equipment - held for sale - - 485

Investment properties - held for sale 1,975 1,975 1,975

Inventories 2,187 2,302 2,425

Trade receivables and prepayments 2,881 2,156 2,413

Current tax assets 71 - 1,659

Cash and cash equivalents 14,300 20,005 21,041

Short-term cash deposits 6,646 2,663 1,218

---------------------------------------------- --------- --------- ---------

28,060 29,101 31,216

---------------------------------------------- --------- --------- ---------

Total assets 58,103 59,229 60,467

---------------------------------------------- --------- --------- ---------

Liabilities

Current liabilities

Trade and other payables 2,230 3,665 3,036

Lease liabilities 198 133 210

Current tax liabilities 4 96 78

---------------------------------------------- --------- --------- ---------

2,432 3,894 3,324

---------------------------------------------- --------- --------- ---------

Non-current liabilities

Deferred tax liabilities 4,450 4,103 4,343

Lease liabilities 751 229 842

Retirement benefit obligation 1,204 2,439 1,204

---------------------------------------------- --------- --------- ---------

6,405 6,771 6,389

---------------------------------------------- --------- --------- ---------

Total liabilities 8,837 10,665 9,713

---------------------------------------------- --------- --------- ---------

Net assets 49,266 48,564 50,754

---------------------------------------------- --------- --------- ---------

Capital and reserves attributable to equity owners of the parent

Share capital 796 796 796

Share premium 2,327 2,462 2,462

Capital redemption reserve 8,372 8,372 8,372

Treasury shares - own share reserve (1,822) - (324)

Share-based payments reserve 566 395 488

Foreign exchange reserve 549 2,011 1,042

Retained earnings 38,478 34,528 37,918

----------------------------------------------------------------- ------- ------ ------

Total shareholders' equity 49,266 48,564 50,754

----------------------------------------------------------------- ------- ------ ------

Condensed consolidated cash flow statement

for the six months ended 30 September 2023

Unaudited Unaudited Audited

6 months end 6 months end year end

30/09/23 30/09/22 31/03/23

GBP'000 GBP'000 GBP'000

-------------------------------------------------------------------- ------------ ------------ --------

Operating activities

Profit for the period before taxation 1,873 1,830 5,216

Adjustments for:

Depreciation - on property, plant and equipment 239 219 367

Depreciation - on right-of-use assets 111 142 300

Amortisation of development costs 1,020 831 1,826

Amortisation of intangibles recognised on acquisition and purchased 99 169 224

Profit on disposal of fixed assets - - (2,058)

Employee Retention Credit US - 109 110

Movement in non-cash items (retirement benefit

obligation) 90 90 158

Share-based payments 103 137 234

Finance income (235) (97) (255)

Finance expense 20 21 47

Movement in working capital (1,381) 32 (653)

-------------------------------------------------------------------- ------------ ------------ --------

Cash flows from operating activities 1,939 3,483 5,516

Income tax received/(paid) 1,483 (75) (104)

-------------------------------------------------------------------- ------------ ------------ --------

Net cash flows from operating activities 3,422 3,408 5,412

-------------------------------------------------------------------- ------------ ------------ --------

Investing activities

--------------------------------------------------------------------------- ------- ------- -------

Proceeds from sale of fixed assets - - 2,500

Purchase of property, plant and equipment (597) (88) (932)

Investment in development costs (1,666) (2,291) (4,455)

Investment in intangibles (32) (67) (98)

Repayment/(investment) in fixed term deposits (net) (5,428) 3,295 4,740

Finance income 235 97 255

--------------------------------------------------------------------------- ------- ------- -------

Net cash (outflow)/inflow investing activities (7,488) 946 2,010

--------------------------------------------------------------------------- ------- ------- -------

Financing activities

Lease liability repayments (122) (153) (321)

Issue of ordinary shares (net of expenses) 117 1,118 1,118

Purchase of own shares for treasury (1,750) (4,442) (4,767)

Dividends paid to shareholders (932) (796) (1,589)

Net cash outflow from financing activities (2,687) (4,273) (5,559)

--------------------------------------------------------------------------- ------- ------- -------

(Decrease)/increase in cash, cash equivalents and short-term cash deposits (6,753) 81 1,863

--------------------------------------------------------------------------- ------- ------- -------

Movement in cash and cash equivalents:

At start of period/year 21,041 19,084 19,084

(Decrease)/increase in cash, cash equivalents and short-term cash deposits (6,753) 81 1,863

Effects of exchange rate changes 12 840 94

--------------------------------------------------------------------------- ------- ------- -------

At end of period 14,300 20,005 21,041

--------------------------------------------------------------------------- ------- ------- -------

Cash flows presented exclude sales taxes. Further cash-related

disclosure details are provided in note 7.

Changes in liabilities arising from financing activities relate

to lease liabilities only.

Condensed consolidated statement of changes in equity

for the six months ended 30 September 2023

Capital Share- Foreign

Share Share redemption Treasury based exchange Retained

capital premium reserve shares payments reserve earnings Total

Unaudited GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

At 31 March 2022 865 1,362 8,285 (1,670) 490 1,182 39,339 49,853

--------------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

Profit for period 1,865 1,865

Other comprehensive income net of taxes

Foreign exchange differences 829 829

--------------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

Total comprehensive income for the

period - - - - - 829 1,865 2,694

--------------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

865 1,362 8,285 (1,670) 490 2,011 41,204 52,547

Transactions with owners in their

capacity as owners

Issue of ordinary shares - exercise of

share options 18 1,100 1,118

Purchase of own shares - treasury (4,442) (4,442)

Treasury share cancellation (87) 87 6,112 (6,112) -

Dividend paid (796) (796)

--------------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

Total of transactions with owners in

their capacity as owners (69) 1,100 87 1,670 - - (6,908) (4,120)

--------------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

Share-based payment charge 137 137

Cancellation/transfer of share-based

payments (232) 232 -

--------------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

At 30 September 2022 796 2,462 8,372 - 395 2,011 34,528 48,564

--------------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

Capital Share- Foreign

Share Share redemption Treasury based exchange Retained

capital premium reserve shares payments reserve earnings Total

Unaudited GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

At 30 September 2022 796 2,462 8,372 - 395 2,011 34,528 48,564

Profit for period 2,945 2,945

Other comprehensive income net of taxes

Foreign exchange differences (969) (969)

Re-measurement of defined benefit

obligations 1,393 1,393

Deferred tax on actuarial loss (348) (348)

--------------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

Total comprehensive income for the

period - - - - - (969) 3,990 3,021

--------------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

796 2,462 8,372 - 395 1,042 38,518 51,585

Transactions with owners in their

capacity as owners

Purchase of own shares - treasury (325) (325)

Treasury share cancellation 1 (1) -

Dividend paid (793) (793)

--------------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

Total of transactions with owners in

their capacity as owners - - - (324) - - (794) (1,118)

--------------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

Share-based payment charge 97 97

Deferred tax on share-based payments 190 190

Cancellation/transfer of share-based

payments (4) 4 -

--------------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

At 31 March 2023 796 2,462 8,372 (324) 488 1,042 37,918 50,754

--------------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

Condensed consolidated statement of changes in equity

continued

for the six months ended 30 September 2023

Capital Share- Foreign

Share Share redemption Treasury based exchange Retained

capital premium reserve shares payments reserve earnings Total

Unaudited GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 31 March 2023 796 2,462 8,372 (324) 488 1,042 37,918 50,754

Profit for period 1,467 1,467

Other comprehensive income net of taxes

Foreign exchange differences (493) (493)

--------------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

Total comprehensive income for the

period - - - - - (493) 1,467 974

--------------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

796 2,462 8,372 (324) 488 549 39,385 51,728

Transactions with owners in their

capacity as owners

Issue of treasury shares - exercise of

share options (135) 252 117

Purchase of own shares - treasury (1,750) (1,750)

Dividend paid (932) (932)

--------------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

Total of transactions with owners in

their capacity as owners - (135) - (1,498) - - (932) (2,565)

--------------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

Share-based payments 103 103

Cancellation/transfer of share-based

payments (25) 25 -

--------------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

At 30 September 2023 796 2,327 8,372 (1,822) 566 549 38,478 49,266

--------------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

Notes to the condensed consolidated financial statements

for the six months ended 30 September 2023

1 Segmental analysis

Reported segments and their results, in accordance with IFRS 8,

are based on internal management reporting information that is

regularly reviewed by the Group Managing Director who is the Chief

Operating Decision Maker. The measurement policies the Group uses

for segmental reporting under IFRS 8 are the same as those used in

its financial statements.

The Group is focused for management purposes on one primary

reporting segment, being the semiconductor segment, with similar

economic characteristics, risks and returns and the Directors

therefore consider there to be one single segment, being

semiconductor components for the communications industry.

Geographical segments (by origin)

UK Americas Far East Total

Unaudited GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------- ------- -------- -------- -------

Six months ended 30 September 2023

Revenue to third parties - by origin 2,613 1,243 6,719 10,575

Total assets 44,942 1,512 11,649 58,103

------------------------------------- ------- -------- -------- -------

UK Americas Far East Total

Unaudited GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------- ------- -------- -------- -------

Six months ended 30 September 2022

Revenue to third parties - by origin 2,167 1,622 6,256 10,045

Total assets 44,315 1,043 13,871 59,229

------------------------------------- ------- -------- -------- -------

UK Americas Far East Total

Audited GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------- ------- -------- -------- -------

Year ended 31 March 2023

Revenue to third parties - by origin 5,024 3,413 12,206 20,643

Total assets 47,151 1,575 11,741 60,467

------------------------------------- ------- -------- -------- -------

2 Revenue

The geographical classification of business turnover (by

destination) is as follows

Unaudited Unaudited Audited

6 months end 6 months end year end

30/09/23 30/09/22 31/03/23

GBP'000 GBP'000 GBP'000

--------- ------------ ------------ --------

Europe 2,115 1,634 4,009

Far East 6,660 6,194 12,036

Americas 1,471 1,943 3,910

Other 329 274 688

--------- ------------ ------------ --------

10,575 10,045 20,643

--------- ------------ ------------ --------

The operational classification of business turnover (by market)

is as follows:

Unaudited Unaudited Audited

6 months end 6 months end year end

30/09/23 30/09/22 31/03/23

GBP'000 GBP'000 GBP'000s

----------------------- ------------ ------------ --------

Semiconductor 10,166 9,595 19,551

Design and development 409 450 1,092

----------------------- ------------ ------------ --------

10,575 10,045 20,643

----------------------- ------------ ------------ --------

Semiconductor products, goods and services are transferred at a

point in time whereas design and development revenue is transferred

over the period of the contract on a percentage basis of contract

completion, as detailed in the Group's revenue recognition policy

within its published Annual Report.

The Group does not have any contract assets or liabilities at 30

September 2023 (GBPNil at 31 March 2023) from semiconductors as it

does not fulfil any of its performance obligations in advance of

invoicing to its customer. The Group has contract assets of

GBP242,000 as at 30 September 2023 (GBP363,000 at 31 March 2023)

from design and development and contract liabilities of GBP4,000 as

at 30 September 2023 (GBP17,000 at 31 March 2023) from design and

development. The Group has contractual balances in the form of

trade receivables. See note 20 for disclosure of this in the Annual

Report and Accounts for the year ended 31 March 2023.

The Group expects all contractual costs capitalised or any

outstanding performance obligations will be completed within the

next twelve months.

3 Dividend paid and interim dividend

The Board is declaring an interim dividend of 5p per ordinary

share for the half year ended 30 September 2023, payable on 12

January 2024 to shareholders on the Register on 22 December

2023.

A final dividend of 6p per ordinary share was paid on 18 August

2023 and an interim dividend of 5p per ordinary share was paid on

16 December 2022, totalling 11p per ordinary share paid for the

year ended 31 March 2023 (2022: 9.0p per ordinary share paid for

the year ended 31 March 2022).

4 Income tax expense/(credit)

Unaudited Unaudited

6 months end 6 months Audited

end year end

30/09/23 30/09/22 31/03/23

GBP'000 GBP'000 GBP'000

----------------------------------------------------------------- ------------ --------- ---------

Current tax

UK corporation tax on results of the year (9) (23) (809)

Adjustment in respect of previous years 101 366 (372)

----------------------------------------------------------------- ------------ --------- ---------

92 343 (1,183)

Foreign tax on results of the year 139 192 319

----------------------------------------------------------------- ------------ --------- ---------

Total current tax 231 535 (864)

----------------------------------------------------------------- ------------ --------- ---------

Deferred tax

Deferred tax - origination and reversal of temporary differences 153 (99) 683

Change in deferred tax rate - - 103

Adjustments to deferred tax charge in respect of previous years 22 (471) 484

----------------------------------------------------------------- ------------ --------- ---------

Total deferred tax 175 (570) 1,270

----------------------------------------------------------------- ------------ --------- ---------

Tax expense/(credit) on profit on ordinary activities 406 (35) 406

----------------------------------------------------------------- ------------ --------- ---------

The Directors consider that tax will be payable at varying rates

according to the country of incorporation of its subsidiary

undertakings and have provided on that basis.

The tax charge for the six months ended 30 September 2023 has

been calculated by applying the effective tax rate which is

expected to apply to the Group for the year ending 31 March 2024,

using rates substantially enacted by 30 September 2023.

5 Earnings per share

Unaudited Unaudited

6 months end 6 months end Audited

year end

30/09/23 30/09/22 31/03/23

GBP'000 GBP'000 GBP'000

------------------------------------------------------ ------------ ------------ ---------

Earnings per share from total operations attributable

to the ordinary equity holders of the Company

Basic earnings per share 9.44p 11.72p 30.29p

Diluted earnings per share 9.31p 11.58p 29.93p

------------------------------------------------------ ------------ ------------ ---------

The calculation of basic and diluted earnings per share is based

on the profit attributable to ordinary shareholders divided by the

weighted average number of shares in issue during the year, as

explained below:

Ordinary 5p shares

----------------------

Weighted

average Diluted

number number

----------------------------------- ---------- ----------

Six months ended 30 September 2023 15,546,906 15,765,610

Six months ended 30 September 2022 15,912,744 16,111,674

Year ended 31 March 2023 15,878,401 16,072,444

----------------------------------- ---------- ----------

6 Investment properties

Investment properties were measured at current market valuation.

No depreciation is provided on freehold investment properties or on

long leasehold investment properties. In accordance with IAS 40,

gains and losses arising on revaluation of investment properties

are shown in the income statement. The open market valuation of

investment properties recognised is GBPNil (2023: GBPNil).

Investment properties held for sale is GBP1,975,000 (GBP1,975,000

at 31 March 2023).

The investment property was reclassified on 31 March 2022 as

held for sale as the property became vacant with no prospective

tenant in place and is held based upon the current market valuation

methodology. The property is currently expected to sell within the

next twelve months.

7 Cash, cash equivalents and short-term deposits

Unaudited Unaudited

6 months end 6 months end Audited

30/09/23 30/09/22 year end

31/03/23

GBP'000 GBP'000 GBP'000

------------------------- ------------ ------------ ---------

Cash on deposit 3,016 14,157 13

Cash at bank 11,284 5,848 21,628

------------------------- ------------ ------------ ---------

14,300 20,005 21,041

Short-term cash deposits 6,646 2,663 1,218

------------------------- ------------ ------------ ---------

20,946 22,668 22,259

------------------------- ------------ ------------ ---------

8 Retirement benefit obligations

The Directors have not obtained an actuarial IAS 19 Employee

Benefits Report in respect of the defined benefit pension scheme

for the purpose of this Half Yearly Report.

9 Directors' statement pursuant to the Disclosure and

Transparency Rules

The Directors confirm that, to the best of their knowledge:

-- the condensed set of financial statements have been prepared

in accordance with IAS 34 Interim Financial Reporting; and

-- the Chairman's Statement and Group Managing Director's

Operational and Financial Review include a fair review of the

development and performance of the business and the position of the

Company, and the undertakings included in the consolidation taken

as a whole together with a description of the principal risks and

uncertainties that they face. Full disclosures can be found in

Annual Report and Accounts for year ended 31 March 2023 within

Strategic Report.

The Directors are also responsible for the maintenance and

integrity of the CML Microsystems Plc website. Legislation in the

UK governing the preparation and dissemination of the financial

statements may differ from legislation in other jurisdictions.

The basis of preparation and accounting policies used in

preparation of this Half Year Report have been prepared in

accordance with the same accounting policies set out in the year

ended 31 March 2023 financial statements.

10 Adjusted EBITDA

Adjusted earnings before interest, tax, depreciation and

amortisation ("Adjusted EBITDA") is defined as profit from

operations before all interest, tax, depreciation and amortisation

charges and before share-based payments. The following is a

reconciliation of the Adjusted EBITDA for the three periods

presented:

Unaudited Unaudited

6 months end 6 months Audited

end year end

30/09/23 30/09/22 31/03/23

GBP'000 GBP'000 GBP'000

----------------------------------------------- ------------ --------- ---------

Profit before taxation (earnings) 1,873 1,830 5,216

Adjustments for:

Finance income (235) (97) (255)

Finance expense 20 21 47

Depreciation 239 219 367

Depreciation - right-of-use assets 111 142 300

Amortisation of development costs 1,020 831 1,826

Amortisation of intangibles of purchased and

acquired intangibles recognised on acquisition 99 169 224

Share-based payments 103 137 234

Profit on sale of fixed asset - - (2,058)

----------------------------------------------- ------------ --------- ---------

Adjusted EBITDA 3,230 3,252 5,901

----------------------------------------------- ------------ --------- ---------

11 Events occurring after the reporting period

Acquisition of Microwave Technology, Inc.

Following the announcement on 17 January 2023 that a definitive

agreement had been signed to acquire a Silicon Valley based

semiconductor company Microwave Technology, Inc (MwT) and having

obtained US regulatory clearance, the acquisition completed on 2

October 2023. The Group acquired 100% of the issued share capital

for a total consideration of $13.18m, of which $7.65m is payable in

cash and $5.53m is payable in shares.

Founded in 1982, MwT is a Silicon Valley based company involved

in the design, manufacturing and marketing of GaAs and GaN based

MMICs, Discrete Devices and Hybrid Amplifier Products for

Commercial Wireless Communication, Defence, Space and Medical (MRI)

applications

The financial effects of the transaction have not been included

in the results to 30 September 2023. The operating results and

assets and liabilities of the company will be included from 2

October 2023.

12 General

Other than already stated within the Chairman's Statement and

Group Managing Director's Operational and Financial Review, there

have been no important events during the first six months of the

financial year that have impacted this Half Yearly Report.

There have been no related party transactions or changes in

related party transactions described in the latest Annual Report

that could have a material effect on the financial position or

performance of the Group in the first six months of the financial

year.

The financial information contained in this Half Yearly Report

has been prepared in accordance with UK adopted International

Accounting Standards. This Half Yearly Report does not constitute

statutory accounts as defined by Section 434 of the Companies Act

2006. The financial information for the year ended 31 March 2023 is

based on the statutory accounts for the financial year ended 31

March 2023 that have been filed with the Registrar of Companies and

on which the auditor gave an unqualified audit opinion.

The auditor's report on those accounts did not contain a

statement under Section 498(2) or (3) of the Companies Act 2006.

This Half Yearly Report has not been audited or reviewed by the

Group auditor.

A copy of this Half Yearly Report can be viewed on the Company

website: www.cmlmicroplc.com .

13 Approvals

The Directors approved this Half Yearly Report on 5 December

2023.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DZMGZNDNGFZM

(END) Dow Jones Newswires

December 05, 2023 02:00 ET (07:00 GMT)

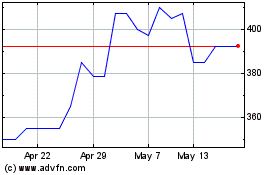

Cml Microsystems (LSE:CML)

Historical Stock Chart

From Dec 2024 to Jan 2025

Cml Microsystems (LSE:CML)

Historical Stock Chart

From Jan 2024 to Jan 2025