Crest Nicholson Holdings PLC Revised date for 2024 preliminary results

14 January 2025 - 6:00PM

RNS Regulatory News

RNS Number : 1653T

Crest Nicholson Holdings PLC

14 January 2025

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) No. 596/2014 as it

forms part of domestic law by virtue of the European Union

(Withdrawal) Act 2018

Crest Nicholson Holdings

plc

Revised date for 2024

preliminary results

Crest Nicholson Holdings plc ("Crest

Nicholson" or the "Company"), today announces a revised date for

the publication of its preliminary financial results for the year

ended 31 October 2024.

Following a request from the

Company's auditors for additional time to complete standard

procedures and audit the appropriateness of the fire remediation

provision, the Company will now announce its results on 4 February

2025 and not on 21 January 2025 as previously planned.

The Company has made significant

progress and is nearing completion of its assessment of all

buildings within the scope of the Self Remediation Terms and is

therefore now in a position to account for the expected costs for

all 291 buildings. As a result, the total fire remediation

provision at the FY24 year end is expected to be approximately

£245m - £255m and compares to £145m at HY24 which was in respect of

c.45% of buildings within scope. This is an overall increase in the

future expected cost of remediation of £120m - £130m. In

determining the quantum of the provision, the Company has applied

its experience to date and the most plausible risk scenario to

ensure it accounts for its probable liabilities and maintains a

prudent and responsible approach to fire safety remediation

provisions. The provision does not include any third-party

recoveries or contributions that could offset these costs. The

remediation programme is expected to be completed during FY29,

meeting the obligations of the Government's Remediation

Acceleration Plan, and is intended to be funded from the Company's

cash flow and balance sheet.

In line with the trading update on

20 November 2024, the Company continues to expect adjusted profit

before tax for FY24 to be at the lower end of the guidance range

(£22m - £29m), subject to any final audit adjustments to the

financial results.

With expected fire remediation costs

fully provided for, the Company believes this will provide greater

clarity for the business going forward and allow the new management

team to re-invigorate the business on firmer foundations focused on

its three key priorities: optimising value from the high-quality

land portfolio; building homes of exceptional quality efficiently;

and delivering outstanding service to customers.

For further information, please

contact:

Crest Nicholson

Jenny Matthews, Head of Investor

Relations

+44 (0) 7557 842720

Teneo

James Macey White / Giles Kernick

+44 (0) 207 260 2700

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

NORPKNBBKBKBFDD

Crest Nicholson (LSE:CRST)

Historical Stock Chart

From Dec 2024 to Jan 2025

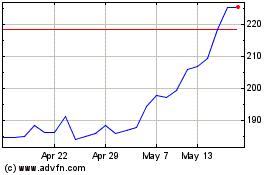

Crest Nicholson (LSE:CRST)

Historical Stock Chart

From Jan 2024 to Jan 2025