TIDMDKE

RNS Number : 8793C

Dukemount Capital PLC

16 June 2023

Dukemount Capital Plc

("Dukemount" or "the Company")

Interim Results for the six months ended 31 October 2022

Dukemount Capital Plc (LSE: DKE) is pleased to announce its

unaudited interim results for the six months ended 31 October 2022

("the Interim Report").

For further information, please visit

www.dukemountcapitalplc.com or contact:

Dukemount Capital Plc : Email info@dukemountplc.com

CEO: Paul Gazzard

Non-Exec Director Geoffery Dart

Broker Enquiries:

Peterhouse Capital Limited Tel: +44 (0) 207 469 0930

Lucy Williams/Duncan Vasey

Summary

-- Completed sale of two RTB 11kV energy generation sites

-- Received further funding and existing funding restructured

Operational Developments

On 5 October 2022, the Company announced that HSKB Limited

("HSKB"), in which it held a 50% interest, had completed the sale

of two special purpose companies containing an 11kV gas peaking

facility, ready to build, with full planning permission and grid

access for an aggregate sale price of GBP350,000. The proceeds of

the sale have been used to repay a portion of the sums owing to the

lenders as detailed in the announcement of 15 September 2021.

Further to the disposal of the gas peaking facilities, the

lenders agreed to advance net proceeds of GBP50,000 in aggregate in

addition to restructuring their existing funding arrangement. The

maturity date for the existing debt plus the further advance is to

be 24 months from the date of the Advance (being 10 October 2024).

The proceeds of the further advance have been used to settle

accrued liabilities of the Company.

The board has taken steps to ensure that the financial position

and prospects of the Company are maintained to facilitate a future

reverse takeover transaction. To that end, the board has confirmed

that the directors have released the Company from all accrued but

unpaid emoluments; Chesterfield Capital Limited have confirmed that

the outstanding balance of GBP500,000 due to Chesterfield Capital

Limited will be converted at a price of 0.65p. Such subscription to

settle all balances due from the Company and to be settled by the

issuance of shares at the earlier of (a) the approval of a

prospectus, (b) the direction of the board of the Company and (c)

31 December 2023.

The restructuring and further advance debt is convertible at the

nominal value of 0.1p of the ordinary shares of the Company. The

further advance is subject to a 5% implementation fee. The Company

has settled a 9.5% extension fee of GBP74,575 to the Noteholders in

the form of ordinary shares at the nominal value. Accordingly the

Company issued 74,575,000 ordinary shares in the Company on 12

October 2022 and 28,132,190 ordinary shares on 28 October 2022.

Paul Gazzard commented:

"It has been a tough few months for DKE as we have taken some

hard decisions to dispose of assets no longer able to achieve our

required regulatory goals. However we look forward to continuing to

pursue alternative routes to secure a deal for the Company that can

bring value for shareholders. We look forward to updating the

market with more developments soon as they are delivered."

Interim Management Report

I hereby present the Interim Report for the six months ended 31

October 2022. During the period the Group made a loss of GBP97,108

(six months to 31 October 2021: loss of GBP227,218). These losses

have been contained in the period to a minimum as the board has

taken steps to ensure the financial position and prospects of the

Company are maintained to facilitate a future reverse takeover

transaction .

Outlook

With the support of its funders and professional advisers

Dukemount is optimistic a transaction can be secured to further its

prospects and deliver value to shareholders.

I would like to take the opportunity to thank our shareholders

for their patience and support and the Dukemount team for their

continuing efforts in driving this business forward.

Paul Gazzard

On behalf of the Board

15th June 2023

Responsibility Statement

We confirm that to the best of our knowledge:

-- the Interim Report has been prepared in accordance with

International Accounting Standards 34, Interim Financial Reporting,

as adopted by the EU;

-- gives a true and fair view of the assets, liabilities,

financial position and loss of the Group;

-- the Interim Report includes a fair review of the information

required by DTR 4.2.7R of the Disclosure and Transparency Rules,

being an indication of important events that have occurred during

the first six months of the financial year and their impact on the

set of interim financial statements; and a description of the

principal risks and uncertainties for the remaining six months of

the year; and

-- the Interim Report includes a fair review of the information

required by DTR 4.2.8R of the Disclosure and Transparency Rules,

being the information required on related party transactions.

The Interim Report was approved by the Board of Directors and

the above responsibility statement was signed on its behalf by:

Paul Gazzard

Director

15 June 2023

Consolidated Statement of Comprehensive Income

For the six months ended 31 October 2022

Note Group Group Group

Unaudited Unaudited Audited

31 Oct 2022 31 Oct 2021 30 April 2022

GBP GBP GBP

Continuing operations

Other operating income - - -

Cost of sales - - -

Gross Profit/(Loss) - - -

Other income - 5,033

Administrative expenses (97,108) (227,218) (185,775)

Impairment of goodwill - - (125,101)

Impairment of receivables - - (578,779)

------------- ------------ --------------

Operating loss (97,108) (227,218) (884,622)

------------- ------------ --------------

Interest received - - -

Finance charges - - (242,773)

Loss before taxation (97,108) (227,218) (1,127,395)

Income tax - - -

------------- ------------ --------------

Loss for the year attributable

to equity owners (97,108) (227,218) (1,127,395)

------------- ------------ --------------

Total comprehensive income

for the year attributable

to the equity owners (97,108) (227,218) (1,127,395)

------------- ------------ --------------

Total comprehensive income

for the year attributable

to:

Owners of Dukemount Capital

Plc (97,108) (227,218) (1,176,088)

Non-controlling interests - - 48,693

------------- ------------ --------------

(97,108) (227,218) (1,127,395)

------------- ------------ --------------

Earnings per share attributable

to equity owners

Basic and diluted (pence) 4 (0.00019) (0.00046) (0.0022)

Consolidated Statement of Financial Position

At 31October 2022

Group Group Group

Note Unaudited Unaudited Audited

31 Oct 31 Oct 30 April

2022 2021 2022

GBP GBP GBP

ASSETS

Non current assets:

Intangible assets - - 350,000

------------ ------------ ------------

- 350,000

Current assets:

Trade and other receivables 5 17,299 938,836 38,164

Cash and cash equivalents 28,714 40,864 19,214

Total Current assets 46,013 979,700 57,378

------------ ------------ ------------

Total assets 46,013 979,700 407,378

------------ ------------ ------------

LIABILITIES

Current liabilities:

Trade and other payables 6 1,619,121 1,799,753 1,986,086

Total Current liabilities 1,619,121 1,799,753 1,986,086

------------ ------------ ------------

Total liabilities 1,619,121 1,799,753 1,986,086

------------ ------------ ------------

NET ASSETS (1,573,108) (820,053) (1,578,708)

------------ ------------ ------------

Capital and reserve attributable

to the equity holders of the

Parent

Share capital 616,243 513,535 513,535

Share premium 1,249,305 1,107,783 1,249,305

Share based payments reserve 2,960 2,960 2,960

Retained earnings (3,441,616) (2,444,331) (3,344,508)

------------ ------------ ------------

TOTAL EQUITY (1,573,108) (820,053) (1,578,708)

------------ ------------ ------------

Consolidated Statement of Changes in Equity

For the six months ended 31 October 2022

Share Share Share Retained Total Non Total

capital premium based losses controlling equity

payment interests

reserve

GBP GBP GBP GBP GBP GBP

Balance as at 1

May 2021 481,283 1,115,035 2,960 (2,217,113) (617,835) - (617,835)

------------------------ --------- ---------- --------- ------------ ------------ ------------- ------------

Loss for the period - - - (227,218) (227,218) - (227,218)

--------- ---------- --------- ------------ ------------ ------------- ------------

Total comprehensive

income for the period - - - (227,218) (227,218) - (227,218)

--------- ---------- --------- ------------ ------------ ------------- ------------

Issue of ordinary

shares 32,252 134,270 - - 166,522 - 166,522

Total transactions

with owners 32,252 134,270 - - 166,522 - 166,522

------------------------ --------- ---------- --------- ------------

Balance at 31 October

2021 513,535 1,249,305 2,960 (2,444,331) (678,531) - (678,531)

------------------------ --------- ---------- --------- ------------ ------------ ------------- ------------

Loss for the period - - - (929,543) (929,543) 29,366 (900,177)

--------- ---------- --------- ------------ ------------ ------------- ------------

Total comprehensive

income for the period - - - (929,543) (929,543) 29,366 (900,177)

--------- ---------- --------- ------------ ------------ ------------- ------------

Issue of ordinary - -

shares - - - - -

--------- ---------- --------- ------------ ------------ ------------- ------------

Total transactions - -

with owners - - - - -

Balance as at 30

April 2022 513,535 1,249,305 2,960 (3,373,874) (1,608,074) 29,366 (1,578,708)

Loss for the period - - - (97,108) (97,108) - (97,108)

Total comprehensive

income for the period - - - (97,108) (97,108) - (97,108)

--------- ---------- --------- ------------ ------------ ------------- ------------

Issue of ordinary

shares 102,708 - - - 102,708 - 102,708

Total transactions

with owners 102,708 - - - 102,708 - 102,708

------------------------ --------- ---------- --------- ------------ ------------ ------------- ------------

Balance at 31 October

2022 616,243 1,249,305 2,960 (3,470,982) (1,602,474) 29,366 (1,573,108)

------------------------ --------- ---------- --------- ------------ ------------ ------------- ------------

Consolidated Statement of Cashflows

For the six months ended 31 October 2022

Group Group Group

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

31 Oct 31 Oct 30 April

2022 2021 2022

GBP GBP GBP

Operating activities

Loss before taxation (97,108) (227,218) (1,127,395)

Shares issued in lieu of expenses 74,575 - 30,727

Impairment of goodwill - - 125,101

Impairment of receivables - - 578,779

(Increase)/decrease in trade and other

receivables 20,865 (33,214) (40,627)

(Decrease) / increase in trade and

other payables (38,372) (419,055) (232,722)

----------- ----------- ------------

Net cash used in operating activities 40,040 (679,487) (666,137)

----------- ----------- ------------

Cash Flows from Investing Activities

Investment in JV 350,000 (329,306) (339,306)

----------- ----------- ------------

Net Cash generated from Investing

Activities 350,000 (329,306) (339,306)

----------- ----------- ------------

Cash Flows from Financing Activities

Loans received 50,000 1,000,000 1,000,000

Loans repaid (350,000) - -

Shares issued in lieu of expenses - 25,000 -

Net Cash generated from Financing

Activities (300,000) 1,025,000 1,000,000

----------- ----------- ------------

Increase/(Decrease) in cash and cash

equivalents in period/ year 9,960 16,207 (5,443)

Cash and cash equivalents at beginning

of period / year 19,214 24,657 24,657

Cash and cash equivalents at end

of period / year 29,174 40,864 19,214

----------- ----------- ------------

Notes to the Interim Report

For the six months ended 31 October 2022

1. GENERAL INFORMATION

Dukemount Capital Plc (the "Company") is a company domiciled in

England. The interim report for the six months ended 31 October

2022 comprises the results of the Company and its subsidiaries

(together referred to as the "Group").

2. BASIS OF PREPARATION

The condensed consolidated interim financial statements have

been prepared under the historical cost convention and on a going

concern basis and in accordance with International Financial

Reporting Standards, International Accounting Standards and IFRIC

interpretations endorsed for use in the United Kingdom ("IFRS").

The condensed consolidated interim financial statements contained

in this document do not constitute statutory accounts. In the

opinion of the directors, the condensed consolidated interim

financial statements for this period fairly presents the financial

position, result of operations and cash flows for this period. The

Board of Directors approved this Interim Financial Report on 15

June 2023.

Statement of compliance

The Interim Report includes the consolidated interim financial

statements which have been prepared in accordance with

International Accounting Standard 34 'Interim Financial Reporting'.

The condensed interim financial statements should be read in

conjunction with the annual financial statements for the period

ended 30 April 2022, which have been prepared in accordance with

IFRS endorsed for use in the United Kingdom.

Accounting policies

The condensed consolidated interim financial statements for the

period ended 31 October 2021 have not been audited or reviewed in

accordance with the International Standard on Review Engagements

2410 issued by the Auditing Practices Board. The figures were

prepared using applicable accounting policies and practices

consistent with those adopted in the statutory annual financial

statements for the year ended 30 April 2022. There have been no new

accounting policies adopted since 30 April 2022.

Going concern

The Group has assessed its ability to continue as a going

concern. The Directors, having made due and careful enquiry, are of

the opinion that the Group will have access to adequate working

capital to meet its obligations for the period of at least twelve

months from the date when the condensed interim financial

statements are authorised for issue. The Directors therefore have

made an informed judgement, at the time of approving these

condensed interim financial statements, that there is a reasonable

expectation that the Group, having secured agreement with certain

creditors, existing investors and its broker on a package of

financing measures, has adequate resources to continue in

operational existence for the foreseeable future. Going forward,

the Group will require further funds. The success of securing these

has been identified as a material uncertainty which may cast

significant doubt over the going concern assessment. Whilst

acknowledging this material uncertainty, based upon the expectation

of completing a successful fundraising in the near future, and the

continued support of it investors and broker, the Directors

consider it appropriate to continue to prepare these condensed

interim financial statements for the period ended 31 October 2022

on a going concern basis.

3. RISKS AND UNCERTAINTIES

The Board continually assesses and monitors the key risks of the

business. The key risks that could affect the Group's short and

medium-term performance and the factors that mitigate those risks

have not substantially changed from those set out in the Company's

2022 audited financial statements, a copy of which is available on

the Company's website: http://www.dukemountcapitalplc.com .

4. EARNINGS PER SHARE

The basic loss per share is derived by dividing the loss for the

period attributable to ordinary shareholders by the weighted

average number of shares in issue.

Group Unaudited Group Unaudited Group

31 Oct 2022 31 Oct 2021 Audited

30 April

2022

GBP GBP GBP

Loss for the period (97,108) (227,218) (1,127,395)

Weighted average number of shares

- expressed in thousands 521,695 496,352 504,873

Basic earnings per share - expressed

in pence (0.00019) (0.00046) (0.0022)

5 TRADE AND OTHER RECEIVABLES

Group Unaudited Group Unaudited Group

31 Oct 2022 31 Oct 2021 Audited

30 April

2020

GBP GBP GBP

Trade and other receivables 17,299 377,620 38,164

Amounts recoverable on contracts - 561,216 -

---------------- ---------------- ----------

17,299 938,836 38,164

================ ================ ==========

6. TRADE AND OTHER PAYABLES

Group Unaudited Group Unaudited Group

31 Oct 2022 31 Oct 2021 Audited

30April 2022

GBP GBP GBP

Trade and other payables 721,273 1,681,253 806,296

Other creditors 819,914 - 1,101,250

Accruals 77,934 118,500 78,540

1,619,121 1,799,753 1,986,086

================ ================ ==============

7. APPROVAL OF INTERIM FINANCIAL STATEMENTS

The Condensed interim financial statements were approved by the

Board of Directors on 12 June 2023. A copy can be obtained on the

Company's website at www.dukemountcapitalplc.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SFLFFIEDSEDM

(END) Dow Jones Newswires

June 16, 2023 02:00 ET (06:00 GMT)

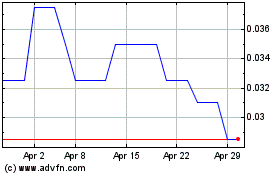

Dukemount Capital (LSE:DKE)

Historical Stock Chart

From Feb 2025 to Mar 2025

Dukemount Capital (LSE:DKE)

Historical Stock Chart

From Mar 2024 to Mar 2025