Regal Petroleum PLC Potential Acquisition of Assets in Ukraine (6111U)

26 November 2019 - 6:01PM

UK Regulatory

TIDMRPT

RNS Number : 6111U

Regal Petroleum PLC

26 November 2019

26 November 2019

Regal Petroleum plc

("Regal" or the "Company")

Memorandum of Understanding

for Potential Acquisition of Assets in Ukraine

Regal Petroleum plc (AIM: RPT), the AIM-quoted oil and gas

exploration and production group, is pleased to announce that it

has entered into a Memorandum of Understanding (the "Memorandum")

for the acquisition of PJSC Science and Production Concern

Ukrnaftinvest ("UNI"), which holds the Belolisky and

Alibeysk-Trapivska production licences (the "Licences") in

Ukraine.

The Memorandum is made between (1) the Company and (2) Ms Lidiia

Chernysh and Bolaso Investments Limited (the "Sellers"), who each

own 50% of the issued share capital of UNI. The Memorandum is

non-binding (save in respect of certain provisions) but sets out

proposals for the Company to acquire 100% of the issued share

capital of UNI (the "Acquisition") for a total consideration of up

to $40 million, subject to satisfaction of certain conditions and

contingencies, comprising: (i) $9 million payable on completion;

(ii) $1 million payable on satisfaction of certain conditions; and

(iii) an amount equal to 25% of the net present value (using a 10%

discount rate), payable in cash or, by mutual agreement, ordinary

shares of the Company, of the proved (1P) reserves attributable to

the Licences as assessed by an independent reserves assessor

following completion of a work programme (as set out below),

subject to a cap of $30 million. The Company will pledge a 25%

shareholding interest in UNI in favour of the Sellers as security

for the payment referred to in (iii) above, and in the event that

this payment is not made, the pledged shares will be transferred

back to the Sellers in full settlement. A deposit of $0.5 million

is payable under the Memorandum, which is to be offset against the

first consideration payment at completion, or refundable if the

Acquisition does not proceed. The respective obligations of the

Sellers will be guaranteed by Mr Vladimir Chernysh (in respect of

Ms Lidiia Chernysh) and Mr Leonid Kozachenko (in respect of Bolaso

Investments Limited), who is the ultimate beneficial owner of

Bolaso Investments Limited.

Under the terms of the Memorandum, the Acquisition is

conditional on and subject to completion of the Company's due

diligence enquiries, certain conditions precedent and the parties

entering into detailed transaction documentation, which will

contain terms, conditions, warranties and indemnities which are

customary for this type of transaction.

UNI is a Ukrainian incorporated company, and its audited

financial statements for the year ended 31 December 2018 show that

its net assets as at 31 December 2018 were UAH 178.9 million and

losses after tax for the year ended 31 December 2018 were UAH 0.7

million, with corresponding unaudited figures as at 30 June 2019 of

net assets of UAH 179 million and net profits after tax of UAH 0.2

million.

UNI holds a 100% interest in each of the Licences, which are

located in the Odessa region in south-western Ukraine. Each of the

Licences was granted in August 2004 with a duration of 20 years,

and it is intended that UNI will apply to extend the Licences under

the applicable legislation to enable development of the assets. The

Licences are prospective for oil, as well as gas, and have been the

subject of exploration since the 1980s, with 24 wells having been

drilled on the Licences since then. The Company has undertaken a

detailed review of the available data on the Licences, and has

estimated that there is a substantial Oil Initially In Place volume

of approximately 675 MMboe. The Company and the Sellers are to

agree a work programme to appraise the Licences, which will include

the drilling of up to three wells, subject to satisfactory results

of each well.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

For further information, please contact:

Regal Petroleum plc Tel: 020 3427 3550

Chris Hopkinson, Chairman

Sergii Glazunov, Chief Executive Officer

Bruce Burrows, Finance Director

Strand Hanson Limited Tel: 020 7409 3494

Rory Murphy / Richard Tulloch

Arden Partners plc Tel: 020 7614 5900

Ruari McGirr / Dan Gee-Summons (Corporate

Finance)

Simon Johnson (Corporate Broking)

Citigate Dewe Rogerson Tel: 020 7638 9571

Louise Mason-Rutherford / Nick Hayns

/ Elizabeth Kittle

Dmitry Sazonenko, MSc Geology, MSc Petroleum Engineering, Member

of AAPG, SPE and EAGE, Director of the Company, has reviewed and

approved the technical information contained within this press

release in his capacity as a qualified person, as required under

the AIM Rules.

Definitions

Oil Initially the total volume of oil stored in a reservoir

In Place prior to production

MMboe millions of barrels of oil equivalent

% per cent

$ United States Dollar

UAH Ukrainian Hryvnia

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACQUVUARKRAAUUA

(END) Dow Jones Newswires

November 26, 2019 02:01 ET (07:01 GMT)

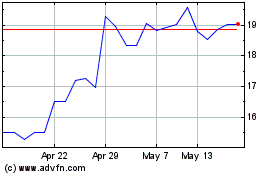

Enwell Energy (LSE:ENW)

Historical Stock Chart

From Feb 2025 to Mar 2025

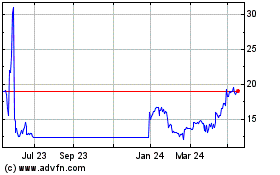

Enwell Energy (LSE:ENW)

Historical Stock Chart

From Mar 2024 to Mar 2025