e-therapeutics Announces Business Updates and Interim Results

01 November 2024 - 12:00AM

UK Regulatory

e-therapeutics Announces Business Updates and Interim Results

LONDON, Oct. 31, 2024 (GLOBE NEWSWIRE) --

e-therapeutics plc, a company integrating computational power and

biological data to discover life-transforming RNAi medicines, today

announced business updates, including its unaudited interim results

for the six months to 31st July 2024.

Ali Mortazavi, CEO, said: “We continue to

make strong and rapid progress towards becoming a clinical-stage

biotech company, as we advance our pipeline of novel GalOmic

therapies, aiming to file our first IND submission in 2025. I am

also excited about the ongoing evolution of HepNet. Our investment

in AWS infrastructure demonstrates our commitment to integrating

cutting-edge technologies across our platform.

To further these efforts, we are thrilled to welcome Dr Lee

Clewley as our Vice President of Applied AI and to announce the

promotion of Dr Natalie Pursell to Vice President of Early-stage

Development.

With a powerful AI-driven platform and a growing GalOmic

pipeline, we continue to be well-equipped to transform the

landscape of RNAi therapeutics as we advance towards clinical

trials.”

GalOmic Pipeline Progress

- ETX-312 for the treatment of

Metabolic Dysfunction-Associated Steatohepatitis (MASH):

ETX-312 continues to progress through IND-enabling studies with an

IND submission anticipated during 2025.

- ETX-148 for the treatment of

Bleeding Disorders: ETX-148 IND-enabling studies

initiated, with an IND submission anticipated during 2026.

- ETX-407 for the treatment of

Dry Age-Related Macular Degeneration: ETX-407 continues to

progress through the initial phase of IND-enabling studies,

following a stage-gated approach to ensure the efficient use of

capital.

- ETX-258 for the treatment of

Heart Failure: This program has completed preclinical

proof-of-concept studies, with selected data due to be presented at

the upcoming American Heart Association Conference.

- ETX-394 for the treatment of

MASH: Our second MASH program continues to advance through

preclinical proof-of-concept studies. ETX-394 targets different

disease biology to ETX-312, silencing another novel and

differentiated target gene.

HepNet Platform Updates

- Infrastructure

Development: We are working with Amazon Web Services (AWS)

to accelerate advancement of our Generative AI capabilities,

leveraging AWS’ global leadership in AI and cloud infrastructure to

enhance the design and scalability of our systems with cutting-edge

large-language model (LLM) technologies via AWS Bedrock.

- Application of Latest

Artificial Intelligence: We continue to leverage the

latest developments in AI to enhance existing processes, including

our target-indication assessment workflow that enables us to

nominate new programs with confidence in biology, developability,

and commercial viability.

Additional Corporate Updates

- Expanding our Leadership

Team

- Dr Natalie Pursell was promoted to

VP, Early-stage Development. Natalie has served as Head of

Preclinical Development at ETX since April 2023, using her

extensive knowledge of preclinical research and oligonucleotide

therapeutics to drive the progress of our GalOmic pipeline. Prior

to this, she held leadership positions at RNA biotech companies

such as Dicerna Pharmaceuticals and Moment Biosciences.

- Addition of Dr Lee Clewley to ETX as

VP, Head of Applied AI and Informatics. Lee specialises in

integrating AI into medicine discovery and delivery processes. Most

recently, Lee was Head of Applied AI at GSK, where he led the

development of a number of innovative projects designed to

accelerate biopharma pipelines.

- Strengthening the

Board: Jeremy Punnett was appointed to the Board of

Directors in July 2024. Jeremy is a fund manager at M&G

Investment Management Ltd and has been involved in numerous private

and public investment transactions, including M&G’s most recent

investment in ETX.

Financial Highlights

- Cash Position: Cash

and cash equivalents were £41.0 million as of 31 July 2024,

including a fundraise of £28.9 million gross in June 2024 (31

January 2024: £20.7 million).

- Operating Loss:

Operating loss was £7.5 million as of 31 July 2024 (H1 2023/24

loss: £7.0 million).

- Research and Development

Expenses: R&D expenditure increased to £5.6 million

for H1 2024/25 (H1 2023/24: £5.3 million), reflecting investment in

industry-leading talent and continued advancement of our

pipeline.

- General and Administrative

Expenses: General and administrative costs rose to £2.0

million (H1 2023/24: £1.8 million) due to increased spend on human

resources to continue the growth of our expert team, alongside

further consultancy costs to support operations and progression of

our pipeline towards the clinic.

- Headcount:

Headcount (excluding Non-Executive Directors) was 39 as of 31 July

2024 (31 January 2024: 38).

About e-therapeutics

plc

e-therapeutics plc ("ETX") uniquely combines

computation and RNAi to discover and develop life-transforming

medicines. ETX's proprietary RNAi chemistry platform,

GalOmic™, enables generation of specific, potent, and durable siRNA

therapeutics for effective silencing of novel gene targets in

hepatocytes. The cutting-edge HepNet™ computational platform allows

ETX to discover better medicines faster through generation of novel

insights and increased automation across all stages of drug

development. HepNet™ encompasses an extensive hepatocyte-specific

knowledgebase and a suite of advanced AI-driven approaches which

enable identification of novel gene targets, rapid

target-indication assessment, and predictive in

silico siRNA design. The Company has specialist expertise

and a robust position in applying computation to biology. Its

computational approaches have been extensively validated through

generation of data from pipeline programs and successful drug

discovery collaborations with biopharma companies, such as Novo

Nordisk, Galapagos NV, and iTeos Therapeutics.

Leveraging the combined capabilities of HepNet™

and GalOmic™, ETX is progressing a therapeutic pipeline of

highly differentiated RNAi candidates across a variety of

therapeutic areas with high unmet need. The Company has generated

positive proof-of-concept data on preclinical assets in metabolic

dysfunction-associated steatohepatitis (MASH), dry age-related

macular degeneration (dry AMD), haemophilia, heart failure, and

cardiometabolic disease, further validating its computationally

enhanced approach to research and development. ETX is currently

progressing its GalOmic™ therapies towards the clinic with its most

developed assets, ETX-312 for MASH, ETX-148 for bleeding disorders,

and ETX-407 for dry AMD, at the IND-enabling stage.

Press Contact

press@etherapeutics.co.uk

Investor Relations Contact

investorrelations@etherapeutics.co.uk

Unaudited Interim Results for the Six

Months to 31st July 2024

|

INCOME STATEMENT FOR THE PERIOD ENDED 31 JULY

2024 |

|

|

6 months

ended

31 July 2024 |

6 months

ended

31 July 2023 |

Year

ended 31

January 2024 |

| |

(unaudited) |

(unaudited) |

(audited) |

| |

£’000 |

£’000 |

£’000 |

| Revenue |

- |

160 |

318 |

| Cost of

sales |

- |

- |

- |

|

Gross profit |

- |

160 |

318 |

| Research and development

expenditure |

(5,554) |

(5,324) |

(10,247) |

|

Administrative expenses |

(1,966) |

(1,806) |

(3,865) |

|

Operating loss |

(7,520) |

(6,970) |

(13,794) |

| Interest income |

277 |

343 |

740 |

|

Interest expense |

(28) |

(4) |

(27) |

|

Loss before tax |

(7,271) |

(6,631) |

(13,081) |

|

Taxation |

1,009 |

1,037 |

1,915 |

|

Loss for the period/year attributable to equity holders of

the Company |

(6,262) |

(5,594) |

(11,166) |

|

Loss per share: basic and diluted |

(0.89)p |

(0.97)p |

(1.91)p |

|

STATEMENT OF COMPREHENSIVE INCOME FOR THE SIX MONTHS ENDED

31 JULY 2024 |

|

|

6 months

ended

31 July 2024 |

6 months

ended

31 July 2023 |

Year ended

31 January

2024 |

| |

(unaudited) |

(unaudited) |

(audited) |

| |

£’000 |

£’000 |

£’000 |

| Loss for the period |

(6,262) |

(5,594) |

(11,166) |

| Other

comprehensive income |

- |

- |

- |

Total comprehensive income for the

period/year attributable to equity

holders of the Company |

(6,262) |

(5,594) |

(11,166) |

|

STATEMENT OF CHANGES IN EQUITY FOR THE PERIOD ENDED 31 JULY

2024 |

|

|

Share

capital |

Share

premium |

Retained

earnings

|

Total |

| |

£’000 |

£’000 |

£’000 |

£’000 |

| As at 31 January 2023 |

582 |

112,613 |

(80,151) |

33,044 |

| Total comprehensive income for

the period |

|

|

|

|

| Loss

for the period |

- |

- |

(5,594) |

(5,594) |

|

Total comprehensive income for the period |

- |

- |

(5,594) |

(5,594) |

| Transactions with owners,

recorded directly in equity |

|

|

|

|

| Issue of ordinary shares |

1 |

21 |

- |

22 |

|

Equity-settled share-based payment transactions |

- |

- |

59 |

59 |

|

Total contributions by and distribution to owners |

1 |

21 |

59 |

81 |

|

As at 31 July 2023 |

583 |

112,634 |

(85,686) |

27,531 |

| Total comprehensive income for

the period |

|

|

|

|

| Loss

for the period |

- |

- |

(5,572) |

(5,572) |

|

Total comprehensive income for the period |

- |

- |

(5,572) |

(5,572) |

| Transactions with owners,

recorded directly in equity |

|

|

|

|

| Issue of ordinary shares |

1 |

14 |

- |

15 |

|

Equity-settled share-based payment transactions |

- |

- |

19 |

19 |

|

Total contributions by and distribution to owners |

1 |

14 |

19 |

34 |

|

As at 31 January 2024 |

584 |

112,648 |

(91,239) |

21,993 |

| Total comprehensive

income for the period |

|

|

|

|

|

Loss for the period |

- |

- |

(6,262) |

(6,262) |

|

Total comprehensive income for the period |

- |

- |

(6,262) |

(6,262) |

| Transactions with

owners, recorded directly in equity |

|

|

|

|

| Issue of ordinary

shares |

193 |

28,714 |

- |

28,907 |

Equity-settled share-based payment

transactions |

- |

- |

25 |

25 |

|

Total contributions by and distribution to

owners |

193 |

28,714 |

25 |

28,932 |

|

As at 31 July 2024 |

777 |

141,362 |

(97,476) |

44,663 |

|

STATEMENT OF FINANCIAL POSITION AS AT 31 JULY

2024 |

|

|

31 July

2024 |

31 July

2023 |

31 January

2024 |

|

|

Note |

(unaudited) |

(unaudited) |

(audited) |

| |

|

£’000 |

£’000 |

£’000 |

| Non-current

assets |

|

|

|

|

| Intangible assets |

|

658 |

301 |

407 |

|

Property, plant and equipment |

|

1,103 |

175 |

988 |

|

|

|

1,761 |

476 |

1,395 |

Current assets |

|

|

|

|

| Tax receivable |

|

2,944 |

2,537 |

1,935 |

| Trade and other

receivables |

|

512 |

302 |

470 |

| Prepayments |

|

419 |

647 |

504 |

| Cash and cash equivalents |

|

41,043 |

24,845 |

20,665 |

|

|

|

44,918 |

28,331 |

23,574 |

|

Total assets |

|

46,679 |

28,807 |

24,969 |

Current liabilities |

|

|

|

|

| Trade and other payables |

|

1,495 |

1,186 |

2,266 |

| Lease Liability |

|

424 |

90 |

393 |

|

Contract liabilities |

|

- |

- |

- |

|

|

|

1,919 |

1,276 |

2,659 |

Non-current liabilities |

|

|

|

|

| Lease

Liability |

|

97 |

- |

317 |

|

Total liabilities |

|

2,016 |

1,276 |

2,976 |

|

|

|

|

|

|

|

Net assets |

|

44,663 |

27,531 |

21,993 |

Equity |

|

|

|

|

| Share capital |

2 |

777 |

583 |

584 |

| Share premium |

|

141,362 |

112,634 |

112,648 |

|

Retained earnings |

|

(97,476) |

(85,686) |

(91,239) |

Total equity attributable to equity

holders of the Company |

|

44,663 |

27,531 |

21,993 |

| CASH FLOW

STATEMENT FOR THE PERIOD ENDED 31

JULY 2024 |

6 months ended

31 July

2024 |

6 months ended

31 July

2023 |

Year ended

31 January

2024 |

|

|

(unaudited) |

(unaudited) |

(audited) |

| |

£’000 |

£’000 |

£’000 |

| Loss for the period/year |

(6,262) |

(5,594) |

(11,166) |

| Adjustments for: |

|

|

|

| Depreciation, amortisation and

impairment |

266 |

271 |

535 |

| Loss on disposal of fixed

assets |

- |

- |

1 |

| Interest income |

(277) |

(343) |

(740) |

| Interest expense |

28 |

4 |

27 |

| Equity-settled share-based

payment expenses |

25 |

59 |

78 |

|

Taxation |

(1,009) |

(1,037) |

(1,935) |

|

Operating cash flows before movements in working

capital |

(7,229) |

(6,640) |

(13,200) |

| (Increase)/Decrease in trade

and other receivables |

43 |

(137) |

(162) |

| Increase/(Decrease) in trade

and other payables |

(771) |

(110) |

965 |

| Tax

received |

- |

- |

1,500 |

|

Net cash from operating activities |

(7,957) |

(6,887) |

(10,897) |

Interest received |

277 |

343 |

740 |

| Interest paid |

(28) |

(4) |

(27) |

| Acquisition of property, plant

and equipment |

(374) |

(5) |

(247) |

| Acquisition of other

intangible assets |

(259) |

(103) |

(234) |

|

Movement in short term investments |

- |

- |

- |

|

Net cash from investing activities |

(384) |

231 |

232 |

Net proceeds from issue of share capital |

28,907 |

22 |

37 |

|

Repayment of lease liability |

(188) |

(210) |

(396) |

|

Net cash from financing activities |

28,719 |

(188) |

(359) |

Net decrease in cash and cash equivalents |

20,378 |

(6,844) |

(11,024) |

| Cash

and cash equivalents at the beginning of the period/year |

20,665 |

31,689 |

31,689 |

|

Cash and cash equivalents at the end of the

period/year |

41,043 |

24,845 |

20,665 |

|

|

|

|

|

Notes

1. Basis

of Preparation

These unaudited interim financial statements do not comprise

statutory accounts as defined within section 434 of the Companies

Act 2006. The Company is a public unquoted limited company; and is

incorporated and domiciled in the United Kingdom. The address of

its registered office is 4 Kingdom Street, Paddington, London, W2

6BD, UK.

Statutory accounts for the year ended 31 January 2024 were

approved by the Board of Directors on 5 June 2024 and delivered to

the Registrar of Companies. The report of the Auditor on the

accounts was unqualified, did not contain an emphasis of matter

paragraph and did not contain any statement under section 498 of

the Companies Act 2006.

While this interim statement, which is neither audited nor

reviewed, has been prepared in accordance with the recognition and

measurement criteria of international accounting standards in

conformity with the requirements of the Companies Act 2006 this

announcement does not in itself contain sufficient information to

comply with IFRS. It does not include all the information required

for the full annual financial statements and should be read in

conjunction with the financial statements as at, and for the year

ended, 31 January 2024. It does not comply with International

Accounting Standard ("IAS") 34 'Interim Financial Reporting'.

The accounting policies applied in preparing these interim

financial statements are the same as those applied in the

preparation of the annual financial statements for the year ended

31 January 2024 (as defined therein) other than standards,

amendments and interpretations which became effective after 1

February 2024.

New standards, amendments and interpretations not adopted in the

current financial year have not been disclosed as they are not

expected to have a material impact on the Company’s financial

statements.

2. Share

Capital

| |

31 July 2024 |

31 July 2023 |

31 January 2024 |

| |

(unaudited) |

(unaudited) |

(audited) |

| In issue - fully

paid |

|

|

Ordinary shares of £0.001 each (number) |

777,074,147 |

582,694,162 |

584,335,487 |

Allotted, called up and fully paid |

|

|

|

|

Ordinary shares of £0.001 each (£'000) |

777 |

583 |

584 |

| |

|

|

|

During the six-month period to 31 July 2024, 192,666,667 new

ordinary shares of 0.1p each were issued following an equity

fundraise of £28.9 million by way of two direct subscription of

funds, managed by M&G Investment Management Limited and Ora

Ventures Limited; £19.65 million and £9.25 million raised

respectively.

In addition, 71,993 new ordinary shares of 0.1p each were issued

at a price of 9.95p each in lieu of fees payable to a non-executive

director in accordance with his service agreement.

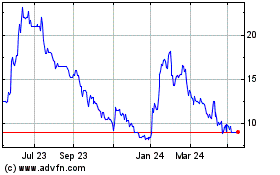

E-therapeutics (LSE:ETX)

Historical Stock Chart

From Dec 2024 to Jan 2025

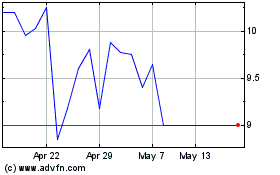

E-therapeutics (LSE:ETX)

Historical Stock Chart

From Jan 2024 to Jan 2025