TIDMKDR

[Karelian]

29 November 2023

Karelian Diamond Resources plc

("Karelian" or "the Company")

FINAL RESULTS FOR THE YEAR TO 31 MAY 2023

NOTICE OF ANNUAL GENERAL MEETING

Karelian Diamond Resources plc (AIM: KDR), the diamond exploration company

focused on Finland, announces its Audited Accounts for the year ended 31 May

2023. Details of these can be found below and a full copy of the Annual Results

can be viewed on the Company's website. The period was one of further

significant progress.

Highlights of the period included:

· Compensation to be paid by the Company to local landowners in relation to

the establishment of the Lahtojoki mining concession area, in Finland,

determined and paid.

· High resolution drone based magnetic survey carried out in the Kuhmo region,

Finland. Over 250km were flown with more than twenty kimberlite targets

identified in the area.

· An extensive follow-up programme which includes excavating and drilling on

the potential diamondiferous kimberlite targets has commenced.

· Two additional Mineral Prospecting Licences, adjacent to the existing one,

have been granted in Northern Ireland which will secure the Company's land

position in relation to its exploration programme for Nickel-Copper-Platinum

mineralisation. The total exploration area is now 750km2.

· The exploration programme for Nickel, Copper and PGE in Northern Ireland has

commenced.

Professor Richard Conroy, Chairman of Karelian, said:

"The Company has made excellent progress with the National Land Survey's

procedures regarding the Lahtojoki diamond deposit in Finland now concluded and

the determined compensation paid. New survey work in Finland has identified

additional diamond targets and an excavation and drilling programme on the

targets has begun. In Northern Ireland the Company has been granted new licences

and the exploration programme for Nickel, Copper and PGE has commenced, the

results from which could greatly increase Karelian's potential value and also

diversify the Company's exploration programme."

Annual Report and Accounts for the year to 31 May 2023

The full audited annual report and accounts for the year to 31 May 2023 will be

posted to shareholders today and will be published on the Company's website

(www.kareliandiamondresources.com) shortly. Key elements can also be viewed at

the bottom of this announcement.

Annual General Meeting

The Annual General Meeting of the Company ("AGM") will be held at The Conrad

Dublin Hotel, Earlsfort Terrace, Dublin at 10:30am on 21 December 2023. A copy

of the notice of AGM can be viewed on the Company's website.

Further Information:

Professor Richard Conroy, Chairman +353-1-479-6180

Allenby Capital Limited (Nomad) +44-20-3328-5656

Nick Athanas / Nick Harriss

Peterhouse Capital Limited (Broker) +44-20-7469-0930

Lucy Williams / Duncan Vasey

Lothbury Financial Services +44-20-3290-0707

Michael Padley

Hall Communications +353-1-660-9377

Don Hall

http://www.kareliandiamondresources.com

Chairman's statement

Dear Shareholder,

I have pleasure in presenting the Company's Annual Report and Financial

Statements for the year ended 31 May 2023.

The year was one of significant progress for the Company, both in relation to

its diamond exploration and development programme in Finland and its Nickel,

Copper and Platinum group metals exploration programme in Northern Ireland.

The Lahtojoki Diamond Deposit

A further significant step towards the development of the Lahtojoki diamond

deposit was achieved when the National Land Survey of Finland determined, in

December 2022, the compensation to be paid by the Company to local landowners in

relation to the establishment of the Lahtojoki mining concession area, which has

been approved by TUKES (the Finnish mining authority). The Survey's decision

was announced on 14 December at a public meeting held in the Municipal Hall of

Tuusniemi in Finland and the compensation amounted in total to ?162,815. This

compensation has been paid, bar for two landowners who have appealed the amount

to be paid to them and a small boundary area, entitling the Company to land

possession over the entire mining concession area.

The Lahtojoki diamond mining project comprises a mining concession covering 71

hectares (c.176 acres), including a kimberlite pipe with a surface area of 16

hectares (c.40 acres).

The diamond deposit at Lahtojoki, based on sampling to date, contained high

quality colourless gem diamonds and also coloured diamonds, including pink

diamonds which are highly sought after and can command prices up to 20 times

that of normal coloured diamonds. This is particularly relevant at a time of low

diamond prices.

The development of the diamond mine at Lahtojoki will, I believe, not only bring

significant benefits to the Company, but also to the entire surrounding Kuopio

Kaavi area and when in production is expected to be the first diamond mine in

Europe outside Russia.

Diamond Exploration Programme in Finland

During the year there was significant progress made in the Company's diamond

exploration programme in Finland. This included a detailed high-resolution,

drone based, magnetic survey carried out by Radai Oy over the Company's diamond

exploration licence area in the Kuhmo region, up ice of the green diamond

discovery in till by the Company previously announced. Eighty-two flights

totalling 250km were flown.

Jeremy S. Brett International Consulting Limited ("Brett Consulting") was

retained by the Company to interpret the drone aeromagnetic data generated by

the survey. Mr. Brett is a senior geophysical consultant with over 28 years of

mineral exploration experience in geophysics across a wide variety of ore

deposit settings. He has explored extensively for kimberlites in Africa, North

America and South America.

The geophysical interpretation by Brett Consulting led to the identification of

over twenty kimberlite targets in the area. The targets ranged from 0.5

hectares to 4.7 hectares in size and "with a high ratio of highly ranked

targets" based on their magnetic signature.

The interpretation by Brett Consulting also highlighted potential underlying

structural controls to the emplacement of Kimberlite bodies. This data can be

applied in a wider context to the overall Kuhmo region.

Previous work by the Company on the Kuhmo licence area included kimberlite

indicator mineral sampling, during which the green diamond was discovered.

Further kimberlite indicator mineral sampling in the area encountered highly

anomalous kimberlite indicators, including G9 and G10 garnets, which are known

indicators of diamond prospectivity. Follow-up drilling resulted in the

discovery of a kimberlite dyke, confirming the presence of kimberlites in the

immediate area.

An extensive follow-up programme, which includes excavating and drilling on the

potential diamondiferous kimberlite targets identified by the geophysical

interpretation and indicator till sampling, has commenced. This includes a

pitting programme over a series of more than twenty kimberlite targets which has

been completed, post period.

Exploration for Nickel, Copper and Platinum Group Metals in Northern Ireland

Two additional Mineral Prospecting Licences were granted in October 2023, which

will secure the Company's land position in relation to its exploration programme

for Nickel-Copper-Platinum mineralisation in Northern Ireland.

The licence applications were made following the discovery, on the Company's KDR

-1 licence in Northern Ireland, of indicator minerals, including anomalous

amounts of chromite, forsterite olivine and magmatic massive sulphide indicator

minerals, which are indicative of the possible presence of Nickel-Copper

-Platinum mineralisation.

The licences, KDR-2 and KDR-3, are valid for a period of six years, cover an

area of approximately 500km2 and are adjacent to the Company's existing KDR-1

licence, giving an increased total exploration area of approximately 750km2.

The Nickel-Copper-Platinum exploration targets are based on the mafic and/or

ultramafic dyke-sill complexes in the area which are similar to those that are

known to host the world class Noril'sk Nickel-Copper-Platinum deposit.

Ireland is already a well-established mining area, with a world class zinc mine,

Tara, and other major zinc/lead discoveries in the Lower Carboniferous

limestones, together with a series of significant orogenic gold discoveries in

both Northern Ireland and the Republic of Ireland.

The exploration programme for Nickel, Copper and Platinum Group Metals is an

exciting new development for the Company with positive results from a stream

sediment sampling programme duly announced in October 2023.

Environmental, Social and Governance Issues

Great emphasis is placed by the Company on environmental, social and governance

issues. The Company is committed to high standards of corporate governance and

integrity in all its activities and operations, including rigorous health and

safety compliance, environmental consciousness and the promotion of a culture of

good ethical values and behaviour.

Financials

Theloss after taxation from continuing operations for the financial year ended

31 May 2023 was ?291,467 (31 May 2022: profit of ?13,593) and the net assets of

the Company at 31 May 2023 were ?9,786,074 (31 May 2022: ?9,480,803).

During the year there was a fundraising, debt capitalisation and creditor

conversion totalling £250,000 at 2.5 pence per share together with a convertible

loan of £112,500, convertible at 5 pence per share. Post year end a further

fundraising of £250,000 at 2.5 pence per share was also concluded.

Directors and Staff

I would like to express my very deep appreciation of the support and dedication

of directors, staff, and consultants which has made possible the continued

progress and success which the Company hasachieved.

Outlook

I look forward to continued success for the Company both in diamond exploration

and development in Finland and in nickel, copper and platinum group metals

exploration in Ireland.

Professor Richard Conroy

Chairman

28 November 2023

Extract from the Independent Auditor's Report

The following section is extracted from the Independent Auditor's Report but

shareholders should read in full the Independent Auditor's Report contained in

the Annual Report.

In auditing the financial statements, we have concluded that the directors' use

of the going concern basis of accounting in the preparation of the financial

statements is appropriate.

We draw attention to Note 1 in the financial statements, which indicates that as

at 31 May 2023 the company had net current liabilities of ?1,241,046.

As stated in Note 1, these events or conditions indicate that a material

uncertainty exists that may cast significant doubt on the company's ability to

continue as a going concern. Our opinion is not modified in respect of this

matter.

Our evaluation of the directors' assessment of the company's ability to continue

to adopt the going concern basis of accounting included:

· obtaining an understanding of the company's relevant controls over the

preparation of cash flow forecasts and approval of the projections and

assumptions used in cash flow forecasts to support the going concern assumption;

· assessing the design and determining the implementation of these relevant

controls;

· evaluating directors' plans and their feasibility by agreeing the inputs

used in the cash flow forecast to expenditure commitments and other supporting

documentation;

· challenging the reasonableness of the assumptions applied by the directors

in their going concern assessment;

· obtaining confirmations received by the company from the directors and

former directors evidencing that they will not seek repayment of amounts owed to

them by the company within 12 months of the date of approval of the financial

statements, unless the company has sufficient funds to repay;

· assessing the mechanical accuracy of the cash flow forecast model; and

· assessing the adequacy of the disclosures made in the financial statements.

Statement of profit or loss

as at 31 May 2023

2023 2022

? ?

Continuing operations

Operating expenses (297,386) (369,019)

Movement in fair value of warrants 9,565 389,904

(Loss)/profit before finance costs and taxation (287,821) 20,885

Interest expense (3,646) (7,292)

Net finance costs (3,646) (7,292)

(Loss)/profit before taxation (291,467) 13,593

Income tax expense - -

(Loss)/profit for the financial year (291,467) 13,593

(Loss)/ earnings per share

Basic and diluted (loss)/earnings per share (0.0038) 0.0002

The total (loss)/profit for the financial year is entirely attributable to

equity holders of the Company.

Statement of comprehensive income

as at 31 May 2023

2023 2022

? ?

(Loss)/profit for the financial year (291,467) 13,593

Income recognised in other comprehensive income - -

Total comprehensive (loss)/profit for the financial year (291,467) 13,593

The total comprehensive (loss)/profit for the financial year is entirely

attributable to equity holders of the Company.

Statement of financial position

as at 31 May 2023

31 May 31 May

2023 2022

? ?

Assets

Non-current assets

Intangible assets 11,265,894 10,910,931

Total non-current assets 11,265,894 10,910,931

Current assets

Cash and cash equivalents 116,038 117,868

Other receivables 79,003 60,178

Total current assets 195,041 178,046

Total assets 11,460,935 11,088,977

Equity

Capital and reserves

Share capital presented as equity 3,200,882 3,191,807

Share premium 10,546,844 9,959,181

Share-based payments reserve 450,658 450,658

Retained deficit (4,412,310) (4,120,843)

Total equity 9,786,074 9,480,803

Liabilities

Non-current liabilities

Derivative liability 10,304 146

Convertible loan 119,246 -

Warrant liabilities 109,224 -

Total non-current liabilities 238,774 146

Current liabilities

Trade and other payables 1,436,087 1,441,238

Convertible loan - 166,790

Total current liabilities 1,436,087 1,608,028

Total liabilities 1,664,859 1,608,174

Total equity and liabilities 11,460,935 11,088,977

The financial statements were approved by the Board of Directors on 27 November

2023 and authorised for issue on 28 November 2023.

Statement of changes in equity

for the financial year ended 31 May 2023

Share Share Share-based Retained Total

premium payment

capital reserve deficit equity

? ? ? ? ?

Balance at 1 3,191,807 9,959,181 450,658 (4,120,843) 9,480,803

June 2022

Share issue 9,075 610,824 - - 619,899

Share issue - (23,161) - - (23,161)

costs

Share-based - - - - -

payments

(Loss) for the - - - (291,467) (291,467)

financial year

Balance at 31 3,200,882 10,546,844 450,658 (4,412,310) 9,786,074

May 2023

Balance at 1 3,191,807 9,959,181 450,058 (4,105,780) 9,495,866

June 2021

Share issue - - - (28,656) (28,656)

costs

Profit for the - - - 13,593 13,593

financial year

Balance at 31 3,191,807 9,959,181 450,658 (4,120,843) 9,480,803

May 2022

Statement of cash flows

for the financial year ended 31 May 2023

2023 2022

? ?

Cash flows from operating

activities

(Loss)/profit for the financial (291,467) 13,593

year

Adjustments for:

Movement in fair value of warrants 109,224 (389,904)

Interest expense 3,646 7,292

(178,597) (369,019)

Increase in trade and other 1,361 75,340

payables

(Increase) in other receivables (18,825) (11,872)

Advances/(repayment to) from 119,246 (70,000)

Conroy Gold and Natural Resources

P.L.C.

Net cash used in operating (76,815) (375,550)

activities

Cash flows from investing

activities

Investment in exploration and (354,963) (144,355)

evaluation

Net cash used in investing (354,963) (144,355)

activities

Cash flows from financing

activities

Issue of share capital 453,109 604,651

Share issue costs (23,161) (28,656)

Net cash provided by financing 429,948 575,995

activities

(Decrease)/Increase in cash and (1,830) 56,090

cash equivalents

Cash and cash equivalents at 117,868 61,778

beginning of financial year

Cash and cash equivalents at end 116,038 117,868

of financial year

1 Accounting policies

Reporting entity

Karelian Diamond Resources P.L.C. (the "Company") is a company domiciled in

Ireland. The Company is a public limited company incorporated in Ireland under

registration number 382499. The registered office is located at 3300 Lake Drive,

Citywest Business Campus, Dublin 24, D24 TD21, Ireland.

The principal activity of the Company during the financial year is a mineral

exploration and development company.

Basis of preparation

The financial statements are presented in euro ("?"). The ? is the functional

currency of the Company. The financial statements are prepared under the

historical cost basis except for derivative financial instruments which, if any,

are measured at fair value at each reporting date.

The preparation of financial statements requires the Board of Directors and

management to use judgements, estimates and assumptions that affect the

application of policies and reported amounts of assets, liabilities, income and

expenses. Actual results may differ from those estimates. Estimates and

underlying assumptions are reviewed on an ongoing basis. Revisions to accounting

estimates are recognised in the period in which the estimate is revised and in

any future periods affected. Details of significant judgements are disclosed in

the accounting policies.

The financial statements were authorised for issue by the Board of Directors on

28 November 2023.

Going concern

The Company recorded a loss of ?291,467 (31 May 2022: profit of ?13,593) for the

financial year ended 31 May 2023. The Company had net assets of ?9,786,074 (31

May 2022: ?9,480,803) at that date. The Company had net current liabilities of

?1,241,046 (31 May 2022: net current liabilities of ?1,429,982) at the statement

of financial position date.

The Directors, Professor Richard Conroy, Séamus P. FitzPatrick, Maureen T.A.

Jones, Dr. Sorca Conroy, Brendan McMorrow, Howard Bird and former Director James

P. Jones, have confirmed that they will not seek repayment of amounts owed to

them by the Company of ?1,291,969 (31 May 2022: ?1,106,970) within 12 months of

the date of approval of the financial statements, unless the Company has

sufficient funds to repay.

The Board of Directors have considered carefully the financial position of the

Company and in that context, have prepared and reviewed cash flow forecasts for

the period to 30 November 2024. As set out further in the Chairman's statement,

the Company expects to incur capital expenditure in 2023 and 2024, consistent

with its strategy as an exploration company. The Directors recognise that net

current liabilities of ?1,241,046 (31 May 2022: ?1,429,982) is a material

uncertainty that may cast significant doubt on the Company's ability to continue

as a going concern and, therefore, that it may be unable to realise its assets

and discharge its liabilities in the normal course of business. In reviewing the

proposed work programme for exploration and evaluation assets and, the results

obtained from the exploration programme and the prospects for raising additional

funds as required, the Board of Directors are satisfied that it is appropriate

to prepare the financial statements on a going concern basis.

The financial statements do not include any adjustments to the carrying value

and classification of assets and liabilities that would arise if the Company was

unable to continue as going concern.

Statement of compliance

The Company's financial statements have been prepared in accordance with IFRS as

adopted by the European Union ("EU") and the requirements of the Companies Act

2014.

Recent accounting pronouncements

(i) New and amended standards adopted by the Company

The Company has adopted the following amendments to standards for the first time

for its annual reporting year commencing 1 June 2022:

· IFRS 4 amendments regarding the expiry date of the deferral approach -

Effective date 1 January 2023;

· IAS 8 amendments regarding the definition of accounting estimates -

Effective date 1 January 2023;

· IAS 1 amendments regarding the disclosure of accounting policies -

Effective date 1 January 2023;

· IFRS 17 Insurance contracts - Effective date deferred to 1 January 2023.

· Amendment to IFRS 16 about providing lessees with an extension of one year

to exemption from assessing whether a COVID-19-related rent concession is a

lease modification - Effective date 1 April 2021;

· IFRS 3 amendments updating a reference to the Conceptual Framework -

Effective date 1 January 2022;

· IAS 37 amendments regarding the costs to include when assessing whether a

contract is onerous - Effective date 1 January 2022.

· IFRS 1 amendments resulting from Annual Improvements to IFRS Standards

2018-2020 (subsidiary as a first-time adopter) - Effective date 1 January 2022;

and

· IFRS 9 amendments resulting from Annual Improvements to IFRS Standards

2018-2020 (fees in the `'10 per cent" test for derecognition of financial

liabilities) - Effective date 1 January 2022;

The adoption of the above amendments to standards had no significant impact on

the financial statements of the Company either due to being not applicable or

immaterial.

(ii) New standards and interpretations not yet adopted by the Company

Certain new accounting standards and interpretations have been published that

are not mandatory for 31 May 2023 reporting periods and have not been early

adopted by the Company.

The following new standards and amendments to standards have been issued by the

International Accounting Standards Board but have not yet been endorsed by the

EU, accordingly, none of these standards have been applied in the current

year. The Board of Directors is currently assessing whether these standards once

endorsed by the EU will have any impact on the financial statements of the

Company.

· Amendments to IFRS 10 and IAS 28: Sale or contribution of assets between an

investor and its associate or joint venture - Postponed indefinitely;

· Amendments to IFRS 16 Leases: Lease liability in a sale and leaseback -

Effective date 1 January 2024; and

· Amendments to IAS 1 Presentation of Financial Statements: Classification of

liabilities as current or non-current - Effective date 1 January 2024.

2(Loss)/profit per share

Basic (loss)/profit per

share

2023 2022

? ?

(Loss)/profit for the (291,467) 13,593

year attributable to

equity holders of the

Company

Number of ordinary 68,542,749 68,542,749

shares at start of the

financial year

Number of ordinary 25,950,000

shares issued during

the

financial year

Number of ordinary 94,492,749 68,542,749

shares at end of the

financial year

Weighted average number 76,460,146 68,542,749

of ordinary shares for

the purposes of basic

and diluted loss per

share

Basic and diluted (0.0038) 0.0002

(loss)/profit per

ordinary

share

Diluted (loss)/profit per share

The effect of share options and warrants is anti-dilutive.

3Intangible assets

Exploration

and evaluation

assets

31 May 31 May

Cost 2023 2022

? ?

At 1 June 10,910,931 10,766,576

Expenditure

during the

financial

year:

269,314 10,114

·

Licence and

appraisal

costs

85,649 134,241

·

Other

operating

expenses (Note

2)

At 31 May 11,265,894 10,910,931

Exploration and evaluation assets relate to expenditure incurred in the

development of mineral exploration opportunities. These assets are carried at

historical cost and have been assessed for impairment in particular with regard

to the requirements of IFRS 6: Exploration for and Evaluation of Mineral

Resources relating to remaining licence or claim terms, likelihood of renewal,

likelihood of further expenditure, possible discontinuation of activities as a

result of specific claims and available data which may suggest that the

recoverable value of an exploration and evaluation asset is less than its

carrying amount.

The Board of Directors have considered the proposed work programmes for the

underlying mineral resources. They are satisfied that there are no indications

of impairment.

The Board of Directors note that the realisation of the intangible assets is

dependent on further successful development and ultimate production of the

mineral resources and the availability of sufficient finance to bring the

resources to economic maturity and profitability.

4Cash and cash equivalents

31 May 31 May

2023 2022

? ?

Cash held in bank accounts 116,038 117,868

116,038 117,868

During the year ended 31 May 2022, four new Nordea Bank accounts were opened for

the purpose of holding collateral deposits related to the Finnish licenses. As

at 31 May 2023, a total amount of ?24,500 (31 May 2022: ?24,500) relates to

these collateral deposits and are treated as restricted cash balances.

5Non-current liabilities

Warrant liabilities

During the year ended 31 May 2023, 18,500,000 warrants were issued with a

sterling exercise price and expiry of between 18 and 24 months. No new warrants

were issued in the prior year. The fair value amount at grant date was valued

using the Black Scholes Model and recorded as warrant liabilities. At 31 May

2023, the warrants in issue were fair valued with the movement in fair value

being recorded in the statement of profit or loss . See Note 15 for further

details.

Convertible loan

On 26 May 2023, the Company entered into a convertible loan note agreement for a

total amount of ?129,550 (£112,500) with Conroy Gold and Natural Resources

P.L.C. which is both a shareholder in the company and has a number of other

connections as noted in Note 15. The convertible loan note is unsecured, has a

term of 18 months and attracts interest at a rate of 5% per annum which is

payable on the maturity or conversion of the convertible loan. The conversion

price is 5 pence. The shareholder has the right to seek conversion of the

principal amount outstanding on the convertible loan note and all interest

accrued at any time during the term.

The amount of ?10,304 relates to derivative liability attached to the total

convertible loan note above and the net amount of ?119,246 is recorded as the

value of the convertible loan at 31 May 2023. As the loan note was entered close

to the year end, no interest was accrued due to it being immaterial.

The convertible loan amounted to ?129,550 at 31 May 2023 and is classified as a

non-current liability.

31 May 31 May

2023 2022

? ?

Opening Balance - -

Interest payable - -

Derivative liability 10,304 -

Convertible loan 119,246 -

129,550 -

6 Current liabilities

Trade and other payables

31 May 31 May

2023 2022

? ?

Accrued Directors' remuneration

Fees and other emoluments 1,028,718 843,720

Pension contributions 263,250 263,250

Amount due to related party (see note 14 (b)) 5,023 199,806

Other creditors and accruals 139,096 134,462

1,436,087 1,441,238

As at 31 May 2023, director fees amounting to ?44,167 (31 May 2022: ?34,167) due

to Brendan McMorrow are included in Fees and other emoluments. As at 31 May

2023, an amount of ?NIL (31 May 2022: ?2,500) payable to Brendan McMorrow for

other services rendered by him is included in other creditors and accruals.

It is the Company's practice to agree terms of transactions, including payment

terms with suppliers. It is the Company's policy that payment is made according

to the agreed terms. The carrying value of the trade and other payables

approximates to their fair value.

Convertible loan

On 10 December 2019, the Company entered into a convertible loan note agreement

for a total amount of ?145,829 (£120,000) with one of its shareholders. The

total amount outstanding as at 31 May 2022 including accrued interest was

?166,790. This agreement was varied in December 2022 and the loan note holder

exercised their conversion rights to convert the loan and all accrued interest

(totalling £138,000) into 3,450,000 new ordinary shares in the company on 20

December 2022.

31 May 31 May

2023 2022

? ?

Opening Balance 166,790 159,498

Interest payable 3,646 7,292

Conversion to ordinary equity (170,436) -

- 166,790

7Commitments and contingencies

At 31 May 2023, there were no capital commitments or contingent liabilities (31

May 2022: ?Nil) recognised at the balance sheet date. Should the Company decide

to further develop the Lahtojoki project, an amount of ?40,000 is payable by the

Company to the vendors of the Lahtojoki mining concession.

8Related party transactions

(a)The Company shares office accommodation with Conroy Gold and Natural

Resources P.L.C. which has certain common Directors and shareholders. For the

financial year ended 31 May 2023, Conroy Gold and Natural Resources P.L.C.

incurred costs totalling ?46,178 (31 May 2022: ?100,313) on behalf of the

Company. These costs were recharged to the Company by Conroy Gold and Natural

Resources P.L.C.

These costs are analysed as follows:

2023 2022

? ?

Office salaries 25,558 72,469

Rent and rates 10,145 15,850

Other operating expenses 10,475 11,994

46,178 100,313

(b) At 31 May 2023, the Company owed ?5,023 to Conroy Gold and Natural Resources

P.L.C. (31 May 2022: ?199,806 owed to). Amounts owed to Conroy Gold and Natural

Resources P.L.C. were included within trade and other payables during the

current year. During the financial year ended 31 May 2023, the Company received

?32,500 from (31 May 2022: ?70,000 was paid to) Conroy Gold and Natural

Resources P.L.C. During the financial year ended 31 May 2023, the Company was

charged ?46,178 (31 May 2022: ?100,313) by Conroy Gold and Natural Resources

P.L.C. in respect of the allocation of certain costs as detailed in Note 15(a).

In May 2023, Conroy Gold and Natural Resources P.L.C. converted amounts owing to

it equivalent to ?143,943 (£125,000) into ordinary equity as detailed as part of

the "share issue (b)" detailed in Note 12 and a further ?129,550 (£112,500) into

a convertible loan instrument as detailed in Note 10.

(c) At 31 May 2023, Brendan McMorrow was owed ?44,167 (31 May 2022: ?34,167) in

respect of his services as a director. He invoiced the company an amount of

?9,000 (31 May 2022: ?2,500) during the year for other services rendered of

which ?Nil (31 May 2022: ?2,500) was outstanding at 31 May 2023. These amounts

are included in the trade and other payables balance in the statement of

financial position.

(d) Key management personnel are considered to be the Board of Directors and

other key management. The compensation of all key management personnel during

the year was ?199,824 (2022: ?185,000). Further analysis of remuneration for

each Director of the Company is set out in note 2.

(e) Details of share capital transactions with the Directors are disclosed in

the Directors' Report.

(f) Apart from Directors' remuneration (detailed in Note 2 and Note 4), loans

from two shareholders (who are also Directors which is detailed in Note 12),

convertible loan from a shareholder (which is detailed in Note 11) and share

capital transactions (which are detailed within the Directors' Report), there

have been no contracts or arrangements entered into during the financial year in

which a Director of the Company had a material interest.

9 Post balance sheet events

Post year end the Company announced the completion of a stream sampling

programme in Northern Ireland where subsequent indicator mineral and microprobe

analysis results confirmed the prospectivity of the Company's licence area for

nickel, copper and platinum group metals.

The Company also announced that it has completed a pitting programme over a

series of more than twenty kimberlite target locations in the Kuhmo region of

Finland. The resulting glacial till samples have been sent for kimperlite

indicator mineral testing.

The Company also raised funds of £250,000 in October 2023 (including £100,000

from Board members) with a view to carrying out follow up exploration in

Northern Ireland and to continue its ongoing work in Finland.

There were no further important events to note post year end.

10 Approval of the audited financial statements for the financial year ended

31 May 2023

These audited financial statements were approved by the Board of Directors on 27

November 2023 and authorised for issue on 28 November 2023. A copy of the

audited financial statements will be available on the Company's website

www.kareliandiamondresources.com and will be available from the Company's

registered office at 3300 Lake Drive, Citywest Business Campus, Dublin 24, D24

TD21, Ireland.

This information was brought to you by Cision http://news.cision.com

The following files are available for download:

https://mb.cision.com/Public/22626/3884655/a7d869db350d2f04_org.jpeg 3884655_0.jpeg

END

(END) Dow Jones Newswires

November 29, 2023 02:01 ET (07:01 GMT)

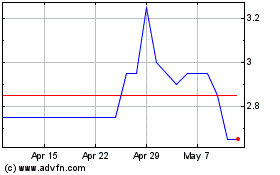

Karelian Diamond Resources (LSE:KDR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Karelian Diamond Resources (LSE:KDR)

Historical Stock Chart

From Dec 2023 to Dec 2024