Kenmare Resources Kenmare Resources : Conditional Us$100 Million Subscription Agreement As Part Of A Proposed Capital Restruc...

28 April 2016 - 4:01PM

UK Regulatory

TIDMKMR

Kenmare Resources plc ("Kenmare" or "the Company")

28 April, 2016

Conditional US$100 million subscription agreement as part of a proposed

capital restructuring

Kenmare Resources plc (LSE:KMR, ISE:KMR), one of the leading global

producers of titanium minerals and zircon, which operates the Moma

Titanium Minerals Mine (the "Mine" or "Moma") in northern Mozambique, is

pleased to advise that it has entered into a conditional subscription

and relationship agreement with King Ally Holdings Limited ("King Ally"),

a chemicals trading company incorporated in the British Virgin Islands,

in respect of a proposed investment by King Ally in Kenmare. This

proposed investment is in respect of US$100 million and is on the basis

that King Ally would hold not more than 29.9% of the enlarged issued

share capital of the Company following the completion of a capital

restructuring, as described below.

Discussions with Kenmare's lenders in relation to a deleveraging plan

(originally required to have been agreed with lenders by 31 January,

2016) are continuing, and the lenders continue to work with Kenmare on

satisfaction of the pre-conditions necessary for the implementation of

such a deleveraging plan.

As currently envisaged, the deleveraging plan entails a capital

restructuring by, inter alia, an equity fundraising of not less than

US$275 million, of which a significant portion would be used to reduce

debt and the balance would be available to the Company for working

capital purposes. The investment by King Ally would form part of this

US$275 million equity fundraising, together with the proposed US$100

million equity investment by SGRF, a sovereign wealth fund of the

Sultanate of Oman, previously announced by the Company as having been

approved in principle by SGRF and in respect of which discussions are

continuing, and an investment of not less than $75 million which would

be required to be raised from new and existing shareholders in the

Company. As previously announced, it is intended that there will also be

an opportunity for existing shareholders to subscribe in an open offer

on the same terms as under the US$275m equity placing.

Any investment by King Ally and/or any commitment by SGRF, if made, will

be subject to the satisfaction of a range of conditions including, inter

alia, their satisfaction with the form and content of a prospectus to be

prepared by Kenmare, that a final agreement with lenders is entered into

providing for the envisaged capital restructuring and becomes

unconditional, and that not less than, in aggregate, US$275 million is

raised by way of an equity issue, as well as other conditions

conventional for an equity issue of this nature. As of the date of this

announcement, the lenders have not yet agreed to the deleveraging plan.

In addition, implementation of the capital restructuring will require

the approval by Kenmare shareholders of a number of resolutions

(expected to include ordinary resolutions, special resolutions and

resolutions on which only certain independent shareholders can vote) at

an extraordinary general meeting of the Company to be convened.

Accordingly, a significant number of uncertainties remain and there can

be no certainty that the capital restructuring, including the investment

by King Ally, will be completed.

2015 Annual Report

Kenmare intends to issue its annual report and accounts in respect of

the year ended 31 December, 2015 on 29 April, 2016.

Kenmare Resources plc

Michael Carvill, Managing Director

Tel: +353 1 671 0411

Mob: + 353 87 674 0110

Tony McCluskey, Financial Director

Tel: +353 1 671 0411

Mob: + 353 87 674 0346

Jeremy Dibb, Corporate Development and Investor Relations Manager

Tel: +353 1 671 0411

Mob: + 353 87 943 0367

Murray

Joe Heron

Tel: +353 1 498 0300

Mob: +353 87 690 9735

Buchanan

Bobby Morse

Tel: +44 207 466 5000

This announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Kenmare Resources via Globenewswire

HUG#2007633

http://www.kenmareresources.com/

(END) Dow Jones Newswires

April 28, 2016 02:01 ET (06:01 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

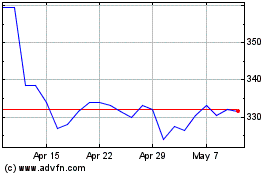

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Jun 2024 to Jul 2024

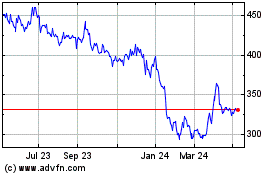

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Jul 2023 to Jul 2024