TIDMKP2

RNS Number : 8685R

Kore Potash PLC

10 November 2021

10 November 2021

Kore Potash Plc

("Kore Potash" or the "Company")

Kola Optimisation Study Interim Report

Kore Potash, the potash development company with 97%-ownership

of the Kola and DX Potash Projects in the Sintoukola Basin, located

within the Republic of Congo ("RoC"), is pleased to report the

receipt of the Interim Report ("Interim Report") for the

Optimisation Study ("Study") on the Kola Potash Project ("Kola")

from the Summit Consortium ("Consortium").

Highlights:

-- Kola Optimisation Study on track for successful completion in Q1 2022.

-- 53 capital cost reduction opportunities considered to date.

-- Further capital reduction opportunities will be reviewed prior to completion of the Study.

-- The Consortium has reconfirmed it remains on track to present

a financing proposal for the full Kola construction costs in the

first half of 2022.

Brad Sampson, Chief Executive Officer of Kore Potash,

commented:

"We are pleased at the quantum of potential capital cost saving

initiatives being identified in the Interim Report , and that the

process to finance Kola remains on track. We will review the

interim information and proposed changes to the Kola design while

the Consortium continues the Study. There are additional capital

cost reduction opportunities for the Consortium to consider over

the next few months, and we look forward to delivery of the full

Study report in early 2022."

Optimisation Study

On 6(th) of April 2021, Kore Potash announced the signing of a

Memorandum of Understanding (" MoU" ) with the Consortium for the

full financing of the construction of Kola. The agreed process

included the Consortium completing an Optimisation Study on Kola,

and on completion of a successful Study, providing an Engineering,

Procurement and Construction (" EPC ") contract proposal along with

a potential royalty and debt financing proposal for the full

construction costs of Kola.

The Study is being undertaken by the key engineering and

construction partner of the Consortium, SEPCO Electric Power

Construction Corporation (" SEPCO ") and has key goals to add value

to Kola through reducing the capital cost of Kola with a target of

less than US$1.65 billion and shortening the construction schedule

with a target of 40 months.

The Consortium has reported that the Study is on track for

completion and presentation to the Company in Q1 2022.

Interim Report for the Optimisation Study on the Kola Potash

Project

The Consortium has presented a set of documents that

collectively form the Interim Report on the Study to the

Company.

The Interim Report has been provided following their review of

the Definitive Feasibility Study (DFS) of the Kola Potash project

as released in our announcement dated 29 January 2019 entitled

"Kola Definitive Feasibility Study". The Interim Report details the

identified optimisation opportunities and confirms the progress

they have made to date towards reducing the capital cost of

Kola.

The Interim Report details optimisation opportunities that

should substantially reduce the capital cost of Kola compared to

the DFS capital cost once implemented. The potential capital cost

reduction opportunities cover mining, mineral processing,

infrastructure, utilities, and indirect cost areas of Kola.

To this point in the study, 53 capital cost reduction

initiatives have been identified of which 45 have been incorporated

into the optimisation of Kola. The remaining initiatives will be

further considered over the next few months leading to completion

of the Study.

The 53 capital reduction initiatives identified to date are

focused on the following areas:

-- Potential relocation of the processing plant site closer to the Mine site.

-- Mining: 2 initiatives related to alternate sourcing of major

equipment and construction materials.

-- Processing: 8 initiatives related to the optimisation of

processing layouts, major equipment selection and sourcing.

-- Processing wet area: 21 initiatives related to the process

design and major equipment selection.

-- Processing dry areas: 12 initiatives related to the muriate

of potash product produced, processing reagent management and MoP

product storage.

-- Infrastructure: 3 initiatives related to road design and

construction and run of mine overland conveyor belt and product

conveyor belt optimisations.

-- Utilities: 6 initiatives related to electrical transmission,

instrumentation designs and laboratory area cost reductions.

The potential for cost reductions in the marine area has not yet

been assessed and there will be focus on this area during the next

few months.

In the period leading up to the completion of the Study the

remaining optimisation ideas will be assessed along with

opportunities to shorten the construction schedule.

On completion of a successful Study the Consortium has agreed to

provide the Company with an EPC contract proposal with capital cost

that reflects the capital cost achieved in the completed Study.

There is a large amount of information that collectively

constitutes the Interim Report, and the Company is undertaking a

detailed review of all the information and proposed design changes

presented to it by the Consortium. The Company's review of this

Interim Report is expected to take some weeks to complete and will

not impact the timing of completion of the Study in 2022.

Financing Process

The MoU provides for the Consortium to present a royalty and

debt financing proposal for the full construction cost of Kola, and

an EPC contract proposal to the Company following completion of the

Study.

In conjunction with the Interim Report, the Consortium has

advised the Company that it is pleased with the progress to date on

the Study, and that it remains on track to provide the EPC proposal

and the full financing proposal to the Company in the first half of

2022 following completion of a successful Study.

This announcement has been approved for release by the Board of

Kore Potash.

ENDS

For further information, please visit www.korepotash.com or

contact:

Kore Potash Tel: +27 84 603

Brad Sampson - CEO 6238

Tavistock Communications Tel: +44 (0) 20

Jos Simson 7920 3150

Oliver Lamb

Canaccord Genuity - Nomad and Tel: +44 (0) 20

Broker 7523 4600

James Asensio

Henry Fitzgerald-O'Connor

Shore Capital - Joint Broker Tel: +44 (0) 20

Jerry Keen 7408 4050

Toby Gibbs

James Thomas

Questco Corporate Advisory - Tel: +27 (11) 011

JSE Sponsor 9205

Doné Hattingh

Forward-Looking Statements

This release contains certain statements that are

"forward-looking" with respect to the financial condition, results

of operations, projects and business of the Company and certain

plans and objectives of the management of the Company.

Forward-looking statements include those containing words such as:

"anticipate", "believe", "expect," "forecast", "potential",

"intends," "estimate," "will", "plan", "could", "may", "project",

"target", "likely" and similar expressions identify forward-looking

statements. By their very nature forward-looking statements are

subject to known and unknown risks and uncertainties and other

factors which are subject to change without notice and may involve

significant elements of subjective judgement and assumptions as to

future events which may or may not be correct, which may cause the

Company's actual results, performance or achievements, to differ

materially from those expressed or implied in any of our

forward-looking statements, which are not guarantees of future

performance. Neither the Company, nor any other person, gives any

representation, warranty, assurance or guarantee that the

occurrence of the events expressed or implied in any

forward-looking statement will occur. Except as required by law,

and only to the extent so required, none of the Company, its

subsidiaries or its or their directors, officers, employees,

advisors or agents or any other person shall in any way be liable

to any person or body for any loss, claim, demand, damages, costs

or expenses of whatever nature arising in any way out of, or in

connection with, the information contained in this document.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFSUEEUEFSEEF

(END) Dow Jones Newswires

November 10, 2021 02:00 ET (07:00 GMT)

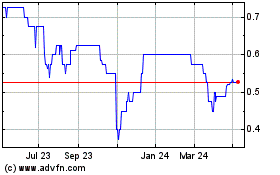

Kore Potash (LSE:KP2)

Historical Stock Chart

From Mar 2024 to Apr 2024

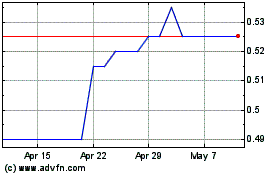

Kore Potash (LSE:KP2)

Historical Stock Chart

From Apr 2023 to Apr 2024