TIDMOXB

RNS Number : 0456N

Oxford Biomedica PLC

20 September 2023

The information contained within this announcement is deemed by

the Group to constitute inside information as stipulated under the

Market Abuse Regulation (EU) No. 596/2014 (as it forms part of

domestic law by virtue of the European Union (Withdrawal) Act

2018). Upon the publication of this announcement via the Regulatory

Information Service, this inside information is now considered to

be in the public domain.

Oxford Biomedica and Institut Mérieux enter into exclusive

negotiations with respect to the proposed acquisition by Oxford

Biomedica of ABL Europe from Institut Mérieux as part of pure-play

CDMO transformation

-- The Proposed Transaction, would:

o Provide Oxford Biomedica multi viral vector CDMO capabilities

across multiple sites in EU, US and UK

o Expand Oxford Biomedica's capacity to address increased client

demand

o Reinforce Oxford Biomedica's position as a world leading cell

and gene therapy CDMO providing services in Adenovirus, Lentiviral

vectors, AAVs and with this acquisition, Pox Virus, MVA and

Vaccinia

o Provide new facilities in France to enhance service for

clients with manufacturing capacity and process development in the

EU

-- Terms of the Proposed Transaction would include:

o Consideration of EUR15million, (including the value of

EUR10million of pre-completion cash funding in ABL Europe from

Institut Mérieux), in exchange for Oxford Biomedica shares at an

issue price of not less than 407.4p per share

o Additional EUR20million of committed future funding from

Institut Mérieux to ABL Europe by way of subscription for Oxford

Biomedica shares, with timing at Oxford Biomedica's discretion;

pricing at the 30-day VWAP to the day before the date of this

subscription

o Institut Mérieux to become a major shareholder in Oxford

Biomedica

Oxford, UK - 20 September 2023: Oxford Biomedica plc (LSE:OXB)

("Oxford Biomedica" or "the Company"), a quality and innovation-led

cell and gene therapy CDMO, and Institut Mérieux SA ("Institut

Mérieux") today announce that they have entered into exclusive

negotiations with respect to the proposed acquisition by Oxford

Biomedica of ABL Europe SAS ("ABL Europe"), a pure play European

CDMO with specialised expertise in the development and

manufacturing of solutions for biotechs and biopharma including

viruses for gene therapy, oncolytic viruses and vaccine candidates,

in exchange for Oxford Biomedica ordinary shares (the "Proposed

Transaction").

This Proposed Transaction would form part of Oxford Biomedica's

transformation to be a world-leading quality focused and

innovation-led CDMO in the cell and gene therapy field.

Dr. Frank Mathias, Chief Executive Officer of Oxford Biomedica,

commented: "As part of our transformation into a pure-play CDMO in

2023, this potential acquisition augments our position as a

world-leading quality and innovation-led CDMO in the cell and gene

therapy field. ABL Europe offers the opportunity to gain a

footprint in the EU and free up Oxford Biomedica's capacity to meet

increasing client demand, as well as significantly increasing our

capabilities and flexibility for clients. Our goal is to deliver

excellent client experiences and accelerate the time it takes for

our clients to get their products to market. We are excited about

the possibility of welcoming ABL Europe staff to our group and

Institut Mérieux as a long-term shareholder and turn to 2024 with

great excitement and confidence."

Michel Baguenault, Chief Executive Officer of Institut Mérieux,

said: "Institut Mérieux is delighted with this potential

acquisition to partner with Oxford Biomedica, a CDMO world leader.

We are giving ABL Europe's teams and its French sites new

development prospects and access to innovative technologies that

will enable them to broaden their offering to biopharmaceutical

companies. As a reference shareholder in Oxford Biomedica, and in

keeping with its public health mission, Institut Mérieux intends to

support the company's development in fields of activity that

present major challenges for patients."

Proposed Transaction Rationale

ABL Europe is a European CDMO specialised in viral vector

development and manufacturing, with facilities in Lyon and

Strasbourg. Focused on delivering GMP-compliant viral vectors from

early-stage to market, ABL Europe plays a pivotal role in the

success of client-focused gene and immunotherapy solutions. The

company's service suite includes the production of bulk drug

substances, the precise fill-finish of drug products, robust

process and assay development, bioanalytical testing for product

release, and comprehensive regulatory guidance. ABL Europe

currently works on more than 10 cell and gene therapy programs

spanning disease areas including more than 6 different vector

types.

In line with Oxford Biomedica's strategy to be a world-leading

quality focused and innovation-led CDMO in the cell and gene

therapy field, the Proposed Transaction would, if completed:

-- Together with Oxford Biomedica bring an established

client-focused, quality and innovation led CDMO renowned for its

expertise in viral vector development and manufacturing,

particularly in areas including Pox Virus, MVA, Vaccinia,

Adenovirus and AAVs, further expanding the Company's international

viral vector offering;

-- Increase Oxford Biomedica's capacity in process and

analytical development and early stage manufacturing to enable the

Company's full growth potential and support the overall growth of

the viral vector sector; addresses client needs for process

development arising from increased client demand;

-- Broaden the Company's customer base in Europe in the cell and

gene therapy space and offer cross-selling opportunities with ABL

Europe's existing customer base, forecasted revenues of

c.EUR15million for the year ended 31 December 2023;

-- Expand the Company's international footprint into the

European Union with sites in Lyon and Strasbourg, France, and allow

Oxford Biomedica to achieve European batch release for clients and

significantly improve its business development position with an

enhanced ability for in-market QC release of drug product in the

US, the EU and the UK;

-- Unlock synergies from (i) the utilisation and optimisation of

existing sites and (ii) the combined expertise and know-how of both

companies to further develop cell lines, viral vector and vaccine

platforms, with the addition of over 100 CDMO experts including

scientists, engineers and commercial functions.

Proposed Transaction Terms

Under the Proposed Transaction, Oxford Biomedica would acquire

ABL Europe for a consideration of EUR15million, (including the

value of EUR10million of pre-completion cash funding from Institut

Mérieux in ABL Europe for, amongst other things, development capex)

in exchange for Oxford Biomedica new ordinary shares (the

"Consideration Shares"). The Consideration Shares would be issued

at a price being the higher of (i) 407.4p per share being the

6-month Volume Weighted Average Price ("VWAP") to market close on

19(th) September 2023; and (ii) the VWAP between date of this

announcement and the day before the date of completion of the

Proposed Transaction (the "Completion").

As part of the Proposed Transaction, Institut Mérieux would also

commit to provide Oxford Biomedica with EUR20 million of additional

funding, to cover capex and potential future operating losses in

relation to the proposed acquisition of ABL Europe by means of an

equity subscription (the "Deferred Equity Subscription"). Pursuant

to the Deferred Equity Subscription, Institut Mérieux would provide

the additional funding by the end of Q3 2024, or such earlier date

requested by Oxford Biomedica subject to a 10 business day notice

to Institut Mérieux (the "Deferred Subscription Date"), in exchange

for Oxford Biomedica ordinary shares (the "Deferred Subscription

Shares"). The Deferred Subscription Shares would be issued at a

price being the 30-day VWAP to closing on the day before the

Deferred Subscription Date.

In addition, under the Proposed Transaction, Institut Mérieux

would further build its ownership of Oxford Biomedica by acquiring

up to EUR10million of additional Oxford Biomedica existing ordinary

shares in the market from the date of this announcement to 31 March

2024. Institut Mérieux intends to build its ownership of Oxford

Biomedica shares through purchases in the open market so as to

reach, in aggregate, approximately 10.0 per cent of the Company's

enlarged issued share capital.

Further Information

Under the Proposed Transaction, the Consideration Shares would

be issued on a non pre-emptive basis utilising the exemption under

s565 (1) of the Companies Act 2006 which permits the issue of

shares for non-cash consideration. The Deferred Subscription Shares

would be issued on a non pre-emptive basis utilising the authority

granted at the Group's 2023 AGM which allows Oxford Biomedica to

issue ordinary shares free of pre-emption rights for cash.

Following the entry into definitive documents, applications would

be made for the Consideration Shares and the Deferred Subscription

Shares to be admitted to the premium listing segment of the

Official List of the Financial Conduct Authority and to be admitted

to trading on the main market for listed securities of the London

Stock Exchange plc at the appropriate time.

The signature of definitive documents remains subject to certain

customary conditions, including the completion of a French works

council process by ABL Europe and the completion of due diligence

by Oxford Biomedica. Subject to the entry into definitive

transaction documents, Completion is currently expected to take

place during the fourth quarter of 2023, conditional upon obtaining

certain regulatory approvals. The market will be kept informed of

the progress of discussions between the parties, and a further

announcement will be made in due course, as appropriate.

The Proposed Transaction would be immediately revenue accretive

to Oxford Biomedica. As at 31 December 2022, ABL Europe had

earnings before interest tax and depreciation (EBITDA) of

c.EUR(1.7)m and gross assets of c.EUR23.6m. Further financial

guidance will be provided at Completion.

Currently, the Proposed Transaction would constitute a Class 2

transaction for the purposes of the UK Financial Conduct

Authority's Listing Rules.

-Ends-

Enquiries:

Oxford Biomedica plc:

Sophia Bolhassan, VP, Corporate Affairs and IR - T: +44 (0) 7394

562 425 / E: ir@oxb.com

ICR Consilium:

T: +44 (0)20 3709 5700 / E:

oxfordbiomedica@consilium-comms.com

Mary-Jane Elliott / Matthew Neal / Davide Salvi

Institut Mérieux

Anne de Chiffreville

T:+33(0)6 24 48 36 70 / E:

anne.de.chiffreville@institut-merieux.com

About Oxford Biomedica

Oxford Biomedica (LSE: OXB) is a quality and innovation-led cell

and gene therapy CDMO with a mission to enable its clients to

deliver life changing therapies to patients around the world.

One of the original pioneers in cell and gene therapy, the

Company has more than 25 years of experience in viral vectors; the

driving force behind the majority of gene therapies. The Company

collaborates with some of the world's most innovative

pharmaceutical and biotechnology companies, providing viral vector

development and manufacturing expertise in lentivirus,

adeno-associated virus (AAV) and adenoviral vectors. Oxford

Biomedica's world-class capabilities span from early-stage

development to commercialisation. These capabilities are supported

by robust quality-assurance systems, analytical methods and depth

of regulatory expertise.

Oxford Biomedica, a FTSE4Good constituent, is headquartered in

Oxford, UK. It has locations across Oxfordshire, UK and near

Boston, MA, US. Learn more at www.oxb.com , www.oxbsolutions.com ,

and follow us on LinkedIn and YouTube .

About Institut Mérieux

As an independent family-owned company, Institut Mérieux is

dedicated to the fight against infectious diseases and cancers,

with a global and long-term vision.

Thanks to five companies - bioMérieux, Transgene, ABL, Mérieux

NutriSciences and Mérieux Equity Partners - Institut Mérieux

develops complementary approaches to meet today ' s public health

challenges: from prevention of health risks to innovative disease

treatment, including the key step of diagnosis.

Present in 45 countries, Institut Mérieux employs 22,000 people

around the world and achieves a turnover of 4,3 billion euros.

www.institut-merieux.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCZZGZLKGKGFZG

(END) Dow Jones Newswires

September 20, 2023 02:01 ET (06:01 GMT)

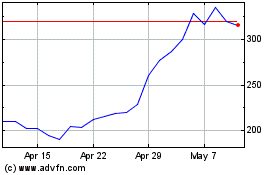

Oxford Biomedica (LSE:OXB)

Historical Stock Chart

From Feb 2025 to Mar 2025

Oxford Biomedica (LSE:OXB)

Historical Stock Chart

From Mar 2024 to Mar 2025