TIDMRBD

RNS Number : 6976F

Reabold Resources PLC

12 July 2023

12 July 2023

Reabold Resources plc

("Reabold" or the "Company")

High-grading of North Sea Licences

Reabold Resources plc, the oil & gas investing company with

a diversified portfolio of exploration, appraisal and development

projects , is pleased to provide details of the high-grading

exercise of its North Sea licences, in the context of the Company's

ongoing disciplined approach to capital allocation, which has led

to the prioritisation of the highest potential return assets in the

Board's view. As a reminder, the Northern North Sea basket of

Licences was acquired for GBP0.25 million, effective May 2022, and

the Southern North Sea basket of licences was acquired for c.GBP1

million in January 2023, as part of the Company's acquisition of

Simwell Resources Limited.

Reabold Northern North Sea

The Company is pleased to announce that it has successfully been

granted an extension until July 2025 for licence P2478 (Dunrobin

and Golspie, 36% working interest), which has aggregate gross

unrisked [1] Pmean prospective resources of 201 mmboe (197 Mbbls +

24bcfg) [2] .

In addition, licences P2605 (Laxford and Scourie) P2504 (Oulton

and Oulton West) (both 100% working interest) have been retained as

we continue the farm-out process, prior to a drill or drop decision

by November 2024. These licences have aggregate gross unrisked

Pmean prospective oil resources of 38 Mbbls(3) and aggregate gross

unrisked Pmean prospective gas resources of 148 Bscf(3) , in

addition to 11Mbbls of oil and 15 bcfg 2C contingent resources

(11.1 Mbbls + 3.6 bcfg in Oulton and 11bcfg on block in

Laxford).

Licences P2396 (Curlew-A), P2464 (Quoys and Unst), P2493

(Sandvoe) (all 100% working interest) have been or are due to be

relinquished shortly.

Reabold Southern North Sea

In Reabold's Southern North Sea portfolio, licence P2486 has

been retained as the operator continues the farm-out process, prior

to a drill or drop decision by July 2024.

Shell, the operator of licence P2332, which is adjacent to the

licence containing the Pensacola well, made a decision to

relinquish the licence. Licences P2329 and P2427 have been or are

due to be relinquished shortly.

The work undertaken on all our Southern North Sea licences has

provided the Company with valuable data and added to our

understanding of the Zechstein play, which is fundamental to our

West Newton and Crawberry Hill assets onshore.

Sachin Oza, Co-CEO of Reabold, commented:

"With an abundance of value opportunities within Reabold, the

high-grading of our recently acquired North Sea licence portfolio

is driven by the Board's disciplined financial framework, where the

highest return opportunities have been prioritised. We will look to

farm down these high-graded assets to help fund the de-risking and

value creation process."

For further information, contact:

Reabold Resources plc c/o Camarco

Sachin Oza +44 (0) 20 3757 4980

Stephen Williams

Strand Hanson Limited - Nominated &

Financial Adviser

James Spinney

James Dance

Rob Patrick +44 (0) 20 7409 3494

Stifel Nicolaus Europe Limited - Joint

Broker

Callum Stewart

Simon Mensley +44 (0) 20 7710 7600

Ashton Clanfield

finnCap Ltd - Joint Broker

Christopher Raggett

Barney Hayward +44 (0) 20 7220 0500

Camarco

Billy Clegg

Rebecca Waterworth +44 (0) 20 3757 4980

Notes to Editors

Reabold Resources plc has a diversified portfolio of

exploration, appraisal and development oil & gas projects.

Reabold's strategy is to invest in low-risk, near-term projects

which it considers to have significant valuation uplift potential,

with a clear monetisation plan, where receipt of such proceeds will

be returned to shareholders and re-invested into further growth

projects. This strategy is illustrated by the recent sale of the

undeveloped Victory gas field to Shell, the proceeds of which are

being returned to shareholders and re-invested.

Glossary of Technical Terms

mmboe Million barrels of oil equivalent.

Mbbl Million barrels.

Bcfg Billion cubic feet of gas.

Pmean Reflects a mid-case volume estimate of resource derived

using probabilistic methodology. This is the mean of the

probability distribution for the resource estimates and may be

skewed by resource numbers with relatively low probabilities.

Prospective Resources Those quantities of petroleum estimated,

as of a given date, to be potentially recoverable from undiscovered

accumulations by application of future development projects.

2C Denotes best estimate of Contingent Resources.

Contingent Resources Those quantities of petroleum estimated, as

of a given date, to be potentially recoverable from known

accumulations by application of development projects, but which are

not currently considered to be commercially recoverable owing to

one or more contingencies.

[1] The unrisked aggregation was performed by the Company and

assumes that all prospects at all levels are successful.

[2] Refer to the Company's announcement of 16 February 2023. The

CPR reports oil and gas Prospective Resources. The oil equivalent

value of the gas resources has been estimated by the Company using

a factor of 5.8bcf per mmboe.

(3) Pmean totals are by arithmetic summation (in-house). Refer

to the Company's announcement of 28 April 2023.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUASVROWUBAAR

(END) Dow Jones Newswires

July 12, 2023 02:00 ET (06:00 GMT)

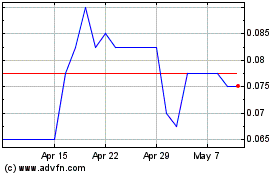

Reabold Resources (LSE:RBD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Reabold Resources (LSE:RBD)

Historical Stock Chart

From Jan 2024 to Jan 2025