Reabold Resources PLC Conversion of Loan Notes

24 October 2024 - 5:00PM

RNS Regulatory News

RNS Number : 3196J

Reabold Resources PLC

24 October 2024

24 October 2024

Reabold Resources

plc

("Reabold" or the

"Company")

Conversion of Loan

Notes

Reabold Resources plc, the investing

company focussed on developing strategic gas projects for European

energy security, is pleased to announce that, pursuant to a loan

note instrument dated 26 March 2024, and as disclosed in Note 27 of

the Company's 2023 Annual Report and Accounts, it has converted

£510,236.28 of the convertible loan notes, including accrued

interest, into 36 ordinary shares of LNEnergy Limited ("LNEnergy")

at a conversion price of £14,173.23 per share. Following this

conversion, Reabold will hold approximately 29.2% of LNEnergy's

enlarged share capital.

LNEnergy is the manager and owner of

a 20% interest in LNEnergy S.R.L. ("LNEnergy SRL"), the Italian

company which has applied for the Colle Santo gas field concession

(with a 90% interest), and has an option to acquire the remaining

80% interest in LNEnergy SRL on or before 1 February 2025 (the

"Option"), with an exercise price of US$11 million.

The Colle Santo gas field is a

highly material gas resource with an estimated 65Bcf of 2P

reserves1, with two production wells already drilled and

flow-tested, making the field development ready. LNEnergy believes

that the field has the potential to generate an estimated €11-12m

of gross post-tax free cash flow per annum.

1 RPS estimate, September

2022

For further information,

contact:

|

Reabold Resources plc

Sachin Oza

Stephen Williams

|

c/o Camarco

+44 (0) 20 3757 4980

|

|

Cavendish - Broker and Nominated

Adviser

Neil McDonald

Pearl Kellie

|

+44 (0) 20 7220

0500

|

|

Camarco

Billy Clegg

Rebecca Waterworth

Sam Morris

|

+44 (0) 20 3757 4980

|

Notes to Editors

Reabold Resources plc has a

diversified portfolio of exploration, appraisal and development oil

& gas projects. Reabold's strategy is to invest in low-risk,

near-term projects which it considers to have significant valuation

uplift potential, with a clear monetisation plan, where receipt of

such proceeds will be returned to shareholders and re-invested into

further growth projects. This strategy is illustrated by the recent

sale of the undeveloped Victory gas field to Shell, the proceeds of

which are being returned to shareholders and

re-invested.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

CONQKNBKKBDDDKB

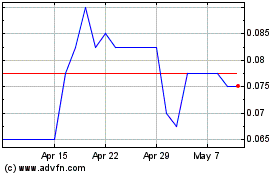

Reabold Resources (LSE:RBD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Reabold Resources (LSE:RBD)

Historical Stock Chart

From Jan 2024 to Jan 2025