Reabold Resources PLC Colle Santo Project Enters Operational Phase (3436L)

05 September 2023 - 4:00PM

UK Regulatory

TIDMRBD

RNS Number : 3436L

Reabold Resources PLC

05 September 2023

5 September 2023

Reabold Resources plc

("Reabold" or the "Company")

Colle Santo Project Enters Operational Phase

Reabold Resources plc, the oil & gas investing company with

a diversified portfolio of exploration, appraisal and development

projects , is pleased to provide a further update on developments

in the approvals process for the onshore Colle Santo gas field in

Abruzzo, Italy.

Following a review with the heads of Environment, Energy, and

Mining of the Abruzzo Region, the Abruzzo regional government

confirmed its agreement with, and intention to approve, by decree,

the Early Production Programme for the Colle Santo gas field,

allowing early revenue generation from the Colle Santo project.

The Early Production Programme includes the following:

-- Production of gas for a period of 24 months;

-- Conversion of gas to power for sale to the electricity grid; and

-- Renewal of the Abruzzo Region's earlier 24-month test approval permit.

It is anticipated that the formal decree from the Abruzzo Region

will be provided over the coming months and accordingly, LNEnergy,

has entered the operational phase of development at the Colle Santo

gas field.

Once on stream, the generation of electricity during the Early

Production Programme will be from the use of gas turbines, and the

electricity will be tied into a nearby distribution connection

point enabling revenue generation. Much of the equipment that is

needed for the electricity generation is available locally and can

be provided on a rental basis, minimising the capital required.

In addition to providing valuable accelerated cash flow, the

Early Production Programme and associated monitoring will

facilitate completion of the work required by the VIA Commission

for the granting of the full development concession for the Colle

Santo gas field.

As announced on 9 May 2023 and 12 June 2023, Reabold acquired a

16.2% equity interest in LNEnergy, whose primary asset is an

exclusive option over a 90% interest in the Colle Santo gas field.

The Colle Santo gas field is a highly material gas resource with an

estimated 65Bcf of 2P reserves [1] , with two production wells

already drilled and the field is development ready. LNEnergy

believes that the field has the potential to generate an estimated

EUR11-12m of post-tax free cash flow per annum.

Stephen Williams , Co-CEO of Reabold, commented:

"We are pleased with the speed and efficiency of the regulatory

process in the Abruzzo Region to date and delighted to reach this

stage of the Early Production Programme. We can see a clear pathway

to generating revenue from gas to power in the near-term, and we

believe this news considerably de-risks the granting of the full

concession to LNEnergy and the small scale LNG project. Italy needs

domestic energy supply to keep prices lower. We look forward to

updating shareholders with further progress on the Colle Santo

development."

(1) RPS estimate, September 2022

A further announcement will be made as and when appropriate.

For further information, contact:

Reabold Resources plc c/o Camarco

Sachin Oza +44 (0) 20 3757 4980

Stephen Williams

Strand Hanson Limited - Nominated &

Financial Adviser

James Spinney

James Dance

Rob Patrick +44 (0) 20 7409 3494

Stifel Nicolaus Europe Limited - Joint

Broker

Callum Stewart

Simon Mensley +44 (0) 20 7710 7600

Ashton Clanfield

finnCap Ltd - Joint Broker

Christopher Raggett

Barney Hayward +44 (0) 20 7220 0500

Camarco

Billy Clegg

Rebecca Waterworth

Sam Morris +44 (0) 20 3757 4980

Notes to Editors

Reabold Resources plc has a diversified portfolio of

exploration, appraisal and development oil & gas projects.

Reabold's strategy is to invest in low-risk, near-term projects

which it considers to have significant valuation uplift potential,

with a clear monetisation plan, where receipt of such proceeds will

be returned to shareholders and re-invested into further growth

projects. This strategy is illustrated by the recent sale of the

undeveloped Victory gas field to Shell, the proceeds of which are

being returned to shareholders and re-invested.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUSORROVUKRUR

(END) Dow Jones Newswires

September 05, 2023 02:00 ET (06:00 GMT)

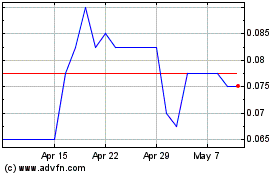

Reabold Resources (LSE:RBD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Reabold Resources (LSE:RBD)

Historical Stock Chart

From Feb 2024 to Feb 2025