Reabold Resources PLC Further Investment into LNEnergy (0734M)

12 September 2023 - 4:00PM

UK Regulatory

TIDMRBD

RNS Number : 0734M

Reabold Resources PLC

12 September 2023

12 September 2023

Reabold Resources plc

("Reabold" or the "Company")

Further Investment into LNEnergy to Facilitate Accelerated Work

Programme

Reabold Resources plc, the oil & gas investing company with

a diversified portfolio of exploration, appraisal and development

projects , is pleased to announce that the Company has agreed to

increase its interest in LNEnergy Limited ("LNEnergy") by a further

1.6%, through the subscription of 18 new ordinary shares for a cash

consideration of GBP250,000, at a price of GBP13,889 per share,

funded from existing cash resources (the "Investment"). This takes

Reabold's total shareholding to approximately 17.6% of LNEnergy's

enlarged share capital.

The Company still holds the Second Option, now expiring 29

December 2023, for the Company to acquire, at its sole discretion,

a further 127 new ordinary shares in LNEnergy for cash

consideration of GBP1,800,000, as announced on 9 May 2023. If the

Second Option is exercised, it would result in Reabold holding an

aggregate 26.1 % interest in the enlarged share capital of LNEnergy

for a total cash and equity consideration of GBP4.3 million.

The Investment follows Reabold's acquisition of a 16.2% equity

interest in LNEnergy, as announced on 9 May 2023 and 12 June 2023.

LNEnergy's primary asset is an exclusive option over a 90% interest

in the Colle Santo gas field. The Colle Santo gas field is a highly

material gas resource with an estimated 65Bcf of 2P reserves([1]) ,

with two production wells already drilled and the field development

ready. LNEnergy believes that the field has the potential to

generate an estimated EUR11-12m of gross post-tax free cash flow

per annum.

Reabold has published a competent person's report in relation to

Colle Santo, which can be found here:

www.reabold.com/investors/reports-presentations

The Investment follows the announcement made by the Company on 5

September 2023, which noted that the Colle Santo project had

entered the operational phase after receiving confirmation from the

Abruzzo regional government of its agreement with, and intention to

approve, by decree, the Early Production Programme for the Colle

Santo gas field, which would allow early revenue generation from

the Colle Santo project. Reabold's additional investment provides

increased exposure to this material gas resource, as well as

facilitating the first stages of the accelerated work programme

associated with the Early Production Programme.

Additional Information

As part of the Investment, LNEnergy has agreed to appoint Sachin

Oza, Co-CEO of Reabold, as a board observer. Reabold is entitled to

appoint one person to act as a board observer provided that the

Company is interested in 10% or more of LNEnergy's issued share

capital.

As at 30 September 2022, LNEnergy reported unaudited net assets

of US$746,034. LNEnergy's financial statements for the year ended

30 September 2022 did not include income statement items; however,

its management accounts reported a loss for the year ended 31

December 2022 of US$597,185.

Stephen Williams , Co-CEO of Reabold, commented:

"Following the positive permitting progress on the Colle Santo

gas field announced last week and the subsequent acceleration of

the work programme in Italy, we are delighted to be able to further

increase our interest in LNEnergy. The 65Bcf field is development

ready and is expected to generate significant cash flow once on

stream, whilst providing crucial domestic energy resource for

Italy."

(1) RPS estimate, September 2022

Unless otherwise defined, capitalised terms used in this

announcement have the same meanings as ascribed to them in the

Company's announcement of 9 May 2023 entitled "Investment in

LNEnergy".

This announcement contains inside information for the purposes

of the UK version of the market abuse regulation (EU No. 596/2014)

as it forms part of United Kingdom domestic law by virtue of the

European Union (Withdrawal) Act 2018, as amended.

For further information, contact:

Reabold Resources plc c/o Camarco

Sachin Oza +44 (0) 20 3757 4980

Stephen Williams

Strand Hanson Limited - Nominated &

Financial Adviser

James Spinney

James Dance

Rob Patrick +44 (0) 20 7409 3494

Stifel Nicolaus Europe Limited - Joint

Broker

Callum Stewart

Simon Mensley +44 (0) 20 7710 7600

Ashton Clanfield

finnCap Ltd - Joint Broker

Christopher Raggett

Barney Hayward +44 (0) 20 7220 0500

Camarco

Billy Clegg

Rebecca Waterworth

Sam Morris +44 (0) 20 3757 4980

Notes to Editors

Reabold Resources plc has a diversified portfolio of

exploration, appraisal and development oil & gas projects.

Reabold's strategy is to invest in low-risk, near-term projects

which it considers to have significant valuation uplift potential,

with a clear monetisation plan, where receipt of such proceeds will

be returned to shareholders and re-invested into further growth

projects. This strategy is illustrated by the recent sale of the

undeveloped Victory gas field to Shell, the proceeds of which are

being returned to shareholders and re-invested.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEAKNFFLNDEFA

(END) Dow Jones Newswires

September 12, 2023 02:00 ET (06:00 GMT)

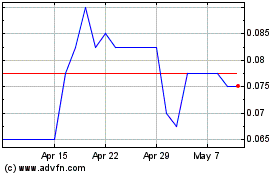

Reabold Resources (LSE:RBD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Reabold Resources (LSE:RBD)

Historical Stock Chart

From Feb 2024 to Feb 2025