S4 Capital PLC Issue of Shares

15 November 2024 - 6:00PM

RNS Regulatory News

RNS Number : 3348M

S4 Capital PLC

15 November 2024

15 November 2024

S4 Capital

plc

("S4Capital" or

the "Company")

Issue of

Shares

On 29 July 2020, S4 Capital plc (SFOR.L) announced

a merger with Orca Pacific, a market leading full-service Amazon

agency and boutique consultancy firm based out of Seattle (the

"Transaction"). Pursuant to

the terms of the Transaction, the Company has agreed to issue

13,674 ordinary shares of 25 pence each in the capital of the

Company, credited as fully paid, as deferred consideration to the

sellers (the "Shares").

Applications have been made to the FCA and to the London Stock Exchange

for the Shares to be admitted to the equity shares (transition)

category of the Official List of the FCA and to trading on the

London Stock Exchange's Main Market for listed securities

respectively ("Admission").

It is expected that Admission will become effective at 8.00 a.m.

on 18 November 2024.

Enquiries:

|

S4Capital

|

Tel: +44 (0)20 3793 0003

|

|

Sir Martin

Sorrell (Executive Chairman)

|

|

|

Sodali & Co (PR Adviser

to S4Capital)

|

Tel: +44 (0) 7970 246 725

|

|

Elly Williamson

|

|

|

Pete Lambie

|

|

About S4Capital

Our strategy is to build a purely

digital advertising and marketing services business for global,

multinational, regional, and local clients, and millennial-driven

influencer brands. This will be achieved by integrating leading

businesses in two synchronised practices: Marketing services and

Technology services, along with an emphasis on 'faster, better,

cheaper, more' execution in an always-on consumer-led environment,

with a unitary structure.

The Company now has approximately

7,500 people in 33 countries with approximately 80% of net revenue

across the Americas, 15% across Europe, the Middle East and Africa

and 5% across Asia-Pacific. The longer-term objective is a

geographic split of 60%:20%:20%. At the Group's last full year

results, Content accounted for approximately 60% of net revenue,

Data&Digital Media 25% and Technology Services 15%. The

long-term objective for the practices is a split of

50%:25%:25%.

Sir Martin was CEO of WPP for 33

years, building it from a £1 million 'shell' company in 1985 into

the world's largest advertising and marketing services company,

with a market capitalisation of over £16 billion on the day he

left. Prior to that Sir Martin was Group Financial Director of

Saatchi & Saatchi Company Plc for nine years.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

IOEEAXFLFLPLFFA

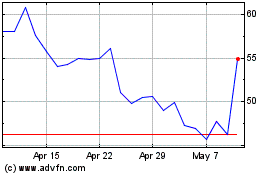

S4 Capital (LSE:SFOR)

Historical Stock Chart

From Feb 2025 to Mar 2025

S4 Capital (LSE:SFOR)

Historical Stock Chart

From Mar 2024 to Mar 2025