TIDMSKG

Smurfit Kappa Group plc

2014 First Quarter Results

2 May 2014: Smurfit Kappa Group plc ('SKG' or 'the Group'), one

of the world's largest integrated manufacturers of paper-based

packaging products, with operations in Europe and the Americas,

today announced results for the 3 months ending 31 March 2014.

2014 First Quarter | Key Financial Performance Measures

EUR m Q12014 Q12013 Change Q4 Change

2013

Revenue EUR1,932 EUR1,889 2% EUR2,033 (5%)

EBITDA before EUR269 EUR241 12% EUR291 (8%)

Exceptional

Items

and Share-based

Payment (1)

EBITDA Margin 13.9% 12.7% - 14.3% -

Operating Profit EUR169 EUR139 21% EUR175 (3%)

before

Exceptional Items

Profit before EUR104 EUR57 81% EUR62 66%

Income Tax

Basic EPS (cent) 28.8 14.4 100% 26.0 11%

Pre-exceptional Basic 30.8 19.8 56% 40.0 (23%)

EPS (cent)

Return on Capital 13.8% 11.7% - 13.1% -

Employed(2)

Free Cash Flow(3) EUR59 (EUR23) - EUR103 (43%)

Net Debt EUR2,640 EUR2,871 (8%) EUR2,621 1%

Net Debt to EBITDA 2.3x 2.8x - 2.4x -

(LTM)

(1) EBITDA before exceptional items and share-based

payment expense is denoted

by EBITDA throughout the remainder of

the management commentary for ease

of reference. A reconciliation of profit

for the period to EBITDA before

exceptional items and share-based payment

expense is set out on page 29.

(2) LTM pre-exceptional operating profit plus share of

associates' profit/average capital employed.

(3) Free cash flow is set out on page 8. The

IFRS cash flow is set out on page 16.

First Quarter Key points

-- Continued EPS growth year-on-year reflecting higher EBITDA and reduced

interest expense

-- Strong Free Cash Flow in the first quarter supporting committed medium

term capital allocation measures

-- Return on Capital Employed of 13.8%

-- Adoption of the Sicad I rate for our Venezuelan operations in the

first quarter

-- S&P upgrade to BB+ rating reflecting significantly improved credit

metrics

-- Proposed final 2013 dividend of 30.75 cent to be paid on 9 May

Performance Review & Outlook

Gary McGann, Smurfit Kappa Group CEO, commented: "In terms of

the first quarter, EBITDA growth of 12% and the sharply increased

EPS year-on-year reflects a strong underlying performance in our

Americas business, price improvements in our European packaging

operations, and materially reduced financing costs as a result of

the completion of the significantly more attractive financing

structure for the Group, most of which has been completed in 2013.

This was offset by a number of factors including downtime in our

kraftliner operations at a net cost of approximately EUR8 million

and a further EUR18 million adverse impact arising mainly from the

negative currency translation adjustment as a result of the Group's

decision to translate its Venezuelan operations at the Sicad I

('Complimentary System of Foreign Currency Acquirement') rate which

was VEF 10.7 per US dollar at the end of the first quarter.

In the quarter under review, the Group reported an improved

year-on-year EBITDA margin of 13.9% and an increasingly strong

Return on Capital Employed of 13.8% further underlining SKG's

progress on achieving optimal returns through continued operating

efficiency and judicious capital investment.

European corrugated packaging demand remains reasonable with

quarter-on-quarter growth in Western Europe partially offset by

lower volumes in Eastern Europe. The first quarter was also

impacted by weakening recovered paper costs and an inventory

build-up from the year-end, resulting in recycled containerboard

price decreases which slowed down corrugated price recovery. SKG is

taking approximately 25,000 tonnes of recycled containerboard

downtime in the second quarter. Despite the current circumstances

SKG's integrated model has underpinned relatively good earnings

development in the quarter.

The Americas business is trending strongly with good earnings

progress across most of the markets. The first quarter has

delivered a strong underlying financial performance as a result of

good demand growth and the successful implementation of price

increases in the majority of countries.

Following a number of years of debt paydown, the company has

achieved its desired leverage range and is now focused on

incremental high return capital projects and accretive acquisitions

while sustaining a progressive dividend policy.

To increase the likelihood of success, additional resources have

been applied to sourcing suitable acquisitions. The combination of

efficient management of our current business and the above

mentioned initiatives will deliver earnings growth momentum. In the

context of the current economic environment, the Group continues to

expect to grow its earnings year-on-year."

About Smurfit Kappa Group

Smurfit Kappa is one of the leading producers of paper-based

packaging in the world, with around 41,000 employees in

approximately 350 production sites across 32 countries and with

revenue of EUR8 billion in 2013.

Innovation, service and pro-activity towards customers, using

sustainable resources, is our primary focus. This focus is enhanced

through being an integrated producer, with our packaging plants

sourcing the major part of their raw materials from our own paper

mills. We are the European leader in paper-based packaging,

operating in 21 countries selling products including corrugated,

containerboard, bag-in-box, solidboard and solidboard packaging. We

have a growing base in Eastern Europe in many of these product

areas. We also have a key position in other product/market segments

including graphicboard, MG paper and sack paper. We are the only

large-scale pan-regional player in the Americas, operating in 11

countries in total in North, Central and South America.

Forward Looking Statements

Some statements in this announcement are forward-looking. They

represent expectations for the Group's business, and involve risks

and uncertainties. These forward-looking statements are based on

current expectations and projections about future events. The Group

believes that current expectations and assumptions with respect to

these forward-looking statements are reasonable. However, because

they involve known and unknown risks, uncertainties and other

factors, which are in some cases beyond the Group's control, actual

results or performance may differ materially from those expressed

or implied by such forward-looking statements.

Contacts

Seamus Murphy FTI Consulting

Smurfit Kappa Group

Tel: +353 1 202 71 80 Tel: +353 1 663 36 80

E-mail: ir@smurfitkappa.com E-mail: smurfitkappa@fticonsulting.com

2014 First Quarter | Performance Overview

The Group has successfully delivered a 2% increase in revenues

and a 12% increase in EBITDA in the first quarter year-on-year.

This performance was driven by steady European volumes,

year-on-year box price increases and a strong underlying

performance in the Americas. While there has been a good start to

the year, the expected macroeconomic uplift in Europe has not yet

happened. In addition, the approximately 40,000 tonnes of technical

downtime in the European kraftliner system and the adoption of the

Sicad I exchange rate for the Group's Venezuelan operations

negatively impacted on results in the first quarter.

The Group delivered steady European box volume progression

during the quarter, with volumes returning to the strong levels

reported in the first quarter of 2013. While SKG has no operations

in Ukraine, volumes in Eastern Europe were negatively affected by

political unrest in that region. However, Eastern Europe comprises

only 8% of Group volumes.

European box price increases of 2% have been achieved

year-on-year following a strong pricing environment for recycled

containerboard in 2013. However, it has proven difficult to

progress further price recovery as the momentum in recycled

containerboard pricing slowed in the quarter.

The Group's primary raw material, Old Corrugated Containers

('OCC'), has seen price decreases of EUR5 per tonne to the end of

April. However, pricing of OCC is expected to increase in the

medium term as slowly recovering global economies bolster demand.

Recycled containerboard pricing will benefit from this upward cost

pressure while inventory levels will reduce as a result of

improving demand. In the year to date recycled containerboard

prices have decreased by approximately EUR25 per tonne.

Following some substitution into high quality recycled

containerboard in 2013 the European kraftliner market has become

more stable. However, at this time conditions are not strong enough

to justify the price increase that was sought in April. Demand is

currently reasonable, supported by the regulatory requirement for

virgin fibre packaging in the food and agriculture sectors, and the

inability of recycled grades to fully match kraftliner in terms of

strength and print quality. Kraftliner remains a fundamental

component of the sustainable fibre system. SKG's strong position as

the European market leader with approximately 1.6 million tonnes of

production per annum provides SKG with a strategic advantage and

offers diversification, security of supply and potential for higher

returns through the cycle.

As noted in its fourth quarter results release the Group has

been assessing the most appropriate rate at which to consolidate

its Venezuelan operations. The Group has concluded that the Sicad I

rate is the most appropriate rate to consolidate its Venezuelan

operations and has adopted that rate as at 31 March 2014. The Sicad

I rate as at 31 March 2014 was VEF 10.7 per US dollar. The

application of the Sicad I rate has resulted in a reduction in the

Group's net assets of approximately EUR172 million and its cash

balances of EUR69 million. During the quarter the underlying

Venezuelan operations continued to operate well with some volume

growth in the business.

The overall Americas segment continues to perform strongly with

average volume growth of 3% year-on-year, which will strengthen as

the year progresses. The Group's Colombian business had a strong

quarter with a 10% increase in corrugated volumes year-on-year and

solid price recovery as the local economy returned to growth. The

Group will complete the acquisition of a local corrugated packaging

business "Corrumed" in the second quarter. Similarly, Mexico's

improving economy drove a 3% increase in SKG's underlying volumes.

In spite of a 23% devaluation of the Argentinian Peso, the Group's

operations in the country performed better year-on-year with

improved cost and price efficiencies. Smurfit Kappa Orange County

('SKOC') reported a 22% increase in EBITDA year-on-year due to

strong volume growth of 7% at improved price levels and the further

flow of integration benefits to the business.

Reflecting SKG's continued focus on cash, the Group's working

capital to sales ratio was 7.3% in the first quarter 2014. This

compares favourably to a quarter one average of 9.3% between 2008

and 2013. The Group's net debt to EBITDA ratio at 2.3 times remains

well within the target range of between two to three times and the

average debt maturity profile at 4.9 years provides security of

funding at historically low rates.

Supported by a robust integrated business model, an increasingly

innovative market offering, an enhanced capital structure and

proven financial discipline, the Group expects to deliver strong

free cash flow generation, which will provide SKG with the capacity

to deliver long-term value for shareholders through 2014 and

beyond.

2014 First Quarter | Financial Performance

At EUR1,932 million, revenue was 2% higher year-on-year in the

first quarter of 2014 with an increase of EUR43 million from

EUR1,889 million in 2013. Underlying revenue increased by EUR139

million compared to the same period last year, with 2014 revenue

including acquisitions of EUR7 million offset by net negative

currency movements and hyperinflation adjustments of EUR103

million.

The Group's first quarter EBITDA of EUR269 million, was EUR28

million higher than the first quarter of 2013, a 12% increase.

Allowing for net currency movements and hyperinflation adjustments

of EUR17 million and the contribution from recent acquisitions, the

underlying year-on-year increase was EUR44 million. The negative

currency movements arose mainly in Venezuela as a result of the

change to the Sicad I rate.

Exceptional charges of EUR9 million in the first quarter's 2014

operating profit related to losses on the translation of

non-Bolivar denominated payables in Venezuela following the change

to the Sicad I rate. Exceptional charges of EUR13 million were

included in the first quarter's 2013 operating profit, EUR12

million of which related to losses on the translation of

non-Bolivar denominated payables following the official devaluation

of the Venezuelan Bolivar in February 2013. The remainder of the

exceptional charges in 2013 related to additional SKOC

reorganisation costs.

The Group's basic EPS increased by 100% in the first quarter of

2014 to 28.8 cent compared to 14.4 cent in 2013. This was primarily

driven by an improved EBITDA performance coupled with lower costs

of financing year-on-year. On a pre-exceptional basis, SKG's EPS

for the first quarter of 2014 increased to 30.8 cent compared to

19.8 cent in the same period in 2013, a 56% increase

year-on-year.

2014 First Quarter | Free Cash Flow

The Group reported a free cash inflow of EUR59 million in the

first quarter of 2014, compared to an outflow of EUR23 million in

the first quarter of 2013. This improvement of EUR82 million was

primarily driven by higher EBITDA, lower cash interest and a lower

working capital outflow in the quarter.

Capital expenditure of EUR66 million in the first quarter of

2014 equated to 71% of depreciation, compared to 76% in the first

quarter of 2013. For the full year 2014, the Group will maintain

its underlying capital expenditure at 100% of depreciation with

additional expenditure of approximately EUR50 million per annum for

three years on short payback projects. As previously announced,

this additional expenditure will provide incremental EBITDA in

excess of EUR70 million per annum exiting 2016.

In the first quarter there was a working capital outflow of

EUR57 million, compared to EUR98 million in the same period of

2013. This reflects the benefits of the Group's consistent focus on

working capital discipline and the development of integrated

inventory and distribution management systems across its global

network of facilities. The Group reported a working capital to

sales ratio of 7.3% in the first quarter of 2014, compared to 9.3%

for the first quarter of 2013.

Cash interest of EUR39 million in the first quarter of 2014 was

EUR15 million lower than the first quarter of 2013, reflecting the

significantly reduced financing costs secured through multiple

refinancing transactions in 2012 and 2013.

Tax payments of EUR26 million in the first quarter of 2014 were

EUR10 million higher than in the same period of 2013 primarily due

to higher cash tax payments in the Americas.

2014 First Quarter | Capital Structure

The Group's first quarter net debt remained largely unchanged

compared with the prior period, rising EUR19 million to EUR2,640

million. This increase is net of the reduction of EUR69 million in

cash balances as a result of the adoption of the Sicad I exchange

rate. It reflects steady operational performance and consistent

cash flow management. The decrease of EUR231 million year-on-year

reflects SKG's significant debt paydown in the last twelve months,

further strengthening the Group's gearing which is now increasingly

robust relative to its peers. At the end of the quarter the Group's

net debt to EBITDA ratio was 2.3 times comfortably within its

objective of remaining within two to three times EBITDA through the

cycle.

On 28 February, S&P upgraded the Group's credit rating to

BB+ from BB. This reflected the Group's consistently strong

operating performance and materially improved credit metrics. The

Group's capital structure is within its stated range and supports

its growth objectives. The Group continues to maintain an active

approach to capital structure management with the objective of

accessing the market at the most opportune times to achieve

long-term interest cost reductions and diversification of

funding.

The Group's average debt maturity profile at the end of March

2014 was 4.9 years, compared to 5.6 years at the end of the first

quarter 2013. In spite of the redemption of the 2017 EUR500 million

bond in November 2013 the Group's cash balances remain strong, with

undrawn credit facilities of approximately EUR482 million and

approximately EUR440 million of cash on its balance sheet at the

end of the first quarter.

Cost Take-out Programme

The Group announced the initiation of a further EUR100 million

cost take-out programme for 2014 as part of its full year results

in February 2014. This programme, as in prior years, is aimed at

tackling inflationary pressures in the business' core cost areas

such as raw materials usage, energy efficiency and labour costs.

Ancillary projects such as facility lay-out, process design and

waste management are also undertaken to identify and minimise

overheads where possible.

In the first quarter of 2014, SKG has delivered EUR32 million of

cost take-out initiatives and is pleased to confirm its full year

expectation of EUR100 million.

2014 First Quarter | Commercial Offering and Innovation

SKG has developed a future-thinking, commercial approach to

innovation, collaborating with customers to create new market

opportunities.

SKG brings its customers the best of its experience, including

excellence and expertise from within the packaging industry but

also fresh perspectives from backgrounds as diverse as aeronautical

engineering and computer game design. The Group has more than 750

designers, hundreds of technical staff, engineers and project

managers across 32 countries, and its comprehensive range of

bespoke Innotools gives its customers direct access to shared

information to inspire new packaging solutions. The Group's

InnoBook contains more than 5,500 of its most successful designs

and is growing daily.

SKG roots its creative innovations in the science and experience

of how packaging behaves in the supply chain and in the

marketplace. Analysing more than 15 million packages globally each

year, the Group provides its customers with unrivalled data to make

informed decisions. SKG's facilities test and evaluate every part

of the packaging lifecycle, integral to its drive to ensure

defect-free production. Within the Group's corrugated operations

all quality feedback is collected and assessed via a fully

integrated application called ZOOM! and boxes are camera-inspected

during production using innovative Vision technology.

SKG uses the science of virtual reality to replicate the shopper

environment and bring new packaging designs to store faster and

more effectively than ever before. The Group's 3D Store Visualiser

allows customers to create a real-life shopper experience, viewing

the proposed designs in a virtual store. Earlier this year the

Group launched an exclusive partnership with "Eyesee", which has

developed unique tracking technology to test hundreds of customers'

visual reactions to new packaging designs online. Within weeks the

Group is able to test new packaging within retail environments

created in the 3D Store Visualiser with representative groups of

shoppers, analysing product appeal, consistency and emotional

response. Combining science and creativity in this way allows SKG

to make it right before making it real, optimising its total

consumer impact before formal launch, and ultimately saving

customers time and money through innovation.

SKG's largest customers are supporting its drive to

revolutionise packaging development within the industry, working

together to create more innovative, sustainable and cost-effective

solutions, to the benefit of their business, their brands and their

customers.

Sustainability

SKG sees sustainability as a key business driver providing

challenges and business opportunities. It is therefore one of its

key platforms for differentiation in a competitive market. In 2013

the Group again broadened its commitment to, and delivered proof

of, its dedication to sustainability by continuing to invest in the

environment, adding measurable long-term commitments to its

existing commitments and by achieving two of its existing long-term

commitments several years ahead of schedule.

The Group's 2014 Sustainability Report will be published in June

2014 and will be available on the Group's website at

www.smurfitkappa.com.

2014 First Quarter | Regional Performance Review

Europe

The Group's European business reported a 12% year-on-year

increase in EBITDA to EUR199 million in the first quarter,

reflecting improved pricing across both containerboard and

corrugated operations. The improved performance is evident in the

segment's EBITDA margin which increased to 13.2% in the first

quarter 2014 from 12.2% in the same period in 2013. This result was

achieved in spite of approximately 40,000 tonnes of maintenance

downtime being taken in the Group's kraftliner operations in the

quarter, with an approximate net impact on EBITDA of EUR8

million.

European corrugated prices increased by 1% during the quarter,

bringing total increases achieved as part of the current corrugated

price recovery initiative to 2%. Following evidence of

containerboard pricing weakness in the first quarter, the

previously stated target of 5% became more difficult to achieve in

spite of steady demand throughout the period.

Following a prolonged period of stability through 2013 European

OCC prices have shown some recent signs of weakening with a

decrease of EUR5 per tonne in April. Chinese demand for imports of

recovered fibre has decreased by 5% year-on-year in the first

quarter of 2014. However, total imports rose by 4% in March

year-on-year and in excess of five million tonnes of containerboard

capacity will be added in China over the course of the year, which

will require incremental imports of recovered fibre due to

insufficient domestic supplies. Demand for OCC in Europe remains

good, and the US is becoming an increasingly large consumer of OCC

with a number of recycled facilities coming on line or being

announced in the last twelve months.

The Group's recycled containerboard operations operated very

well in the first quarter benefiting from strong uptime, stable

recovered paper costs and higher sales prices. However, the

industry began to experience pricing weakness in March and April of

an aggregated EUR25 per tonne. This was due to relatively high

inventory levels caused by increased production at the mills over

the Christmas / New Year period and the impact in the market of the

introduction of new capacity in the first quarter.

In kraftliner, the steady decline in pricing abated in March

2014 when prices stabilised. Demand conditions were not strong

enough to achieve the announced price increase of EUR50 per tonne

from 1 April. However, prices are stable at current levels. The

strong market fundamentals in the grade remain unchanged with

steady demand complemented by a European market structurally short

by over one million tonnes per annum. The recently announced

conversion of Stora Enso's Varkaus mill to kraftliner will not

impact the market until 2016. Despite consistent speculation to the

contrary, US imports to Europe were down by 20% year-on-year for

the last twelve months and this has contributed to the maintenance

of a solid market for the grade in the year to date.

Markets for the Group's European sack paper improved in the

quarter, with volume growth year-on-year. The Group's Machine

Glazed ('MG') paper mill in Spain also experienced good growth, and

SKG is announcing an expansion of its MG capacity in this mill,

replacing a 60,000 tonne containerboard machine with 30,000 tonnes

of new MG capacity, building on its existing leading market

position in this attractive specialty grade. The Group's bag-in-box

operations are also continuing to experience strong volume growth,

and are on track to begin operating a new EUR28 million bag and tap

facility in Spain by the third quarter of 2014 in order to respond

to continuing demand growth.

The Americas

In the first quarter, the Americas underlying performance was

strong with average volume growth of 3% and generally good pricing

dynamics across the region. The segment reported EBITDA of EUR75

million during the period, a 13% increase year-on-year, and macro

environments are improving in the Group's main markets of Colombia,

Mexico and the US. Compared to the fourth quarter 2013, EBITDA has

decreased by 24% primarily due to the adoption of the Sicad I rate

for translation of the Group's Venezuelan operations. This rate is

expected to vary over time in line with the published rate.

The Colombian economy is performing well in 2014 with local

industries regaining competitiveness as the currency weakened

throughout the first quarter. SKG's operations have benefited as a

result, with a 10% improvement in corrugated volumes year-on-year

and solid pricing progression compensating for some price weakness

in the second half of 2013. Furthermore, the country's cost

take-out programme and recent capital expenditure projects are

proceeding to plan, with a threefold increase in cost take-out

year-on-year and key capital projects performing in line with

expectations.

The Argentinian market remains challenging, with a 23%

devaluation in the first quarter impacting earnings while inflation

in the country is having a detrimental impact on consumer spending.

However, against that backdrop the Group's operations are

performing well with cost and pricing efficiencies mitigating the

impact of the devaluation and relatively high inflation.

The Group's Mexican operations delivered a 4% year-on-year

improvement in EBITDA following higher volumes and prices in the

quarter. Underlying corrugated volumes increased by 3% year-on-year

and containerboard pricing is steady at the higher rate achieved in

the fourth quarter 2013. Mexican operations were negatively

impacted by higher energy costs as a result of poor weather

conditions in the US. However, this was offset by a small land sale

and improved cost take-out action.

SKG's underlying Venezuelan operations are performing well in

spite of a continuing difficult operating environment, and

relations with the Government authorities are making some positive

progress. Corrugated volumes have progressed well year-on-year and

cost reduction actions are supporting earnings performance.

SKOC has continued to perform strongly in 2014 with a 22%

year-on-year increase in EBITDA. Corrugated volumes in the Mexican

business improved sharply, up 20% in the period, while the US

business has continued to focus on the "bottom-slicing" of lower

margin sheet and box volumes. The 305,000 ton mill in Forney, Texas

was hindered somewhat by the impact of the extreme cold weather on

operating efficiency in January. However, it benefited from

favourable OCC pricing.

The America's segment provides important geographic diversity to

the Group's operations and remains a key target for acquisitions as

SKG seeks to grow its earnings and exposure to these higher growth

markets.

Summary Cash Flow

Summary cash flows(1) for the first quarter are set out in the

following table.

3 months to 3 months to

31-Mar-14 31-Mar-13

EURm EURm

Pre-exceptional EBITDA 269 241

Exceptional items (9) (13)

Cash interest expense (39) (54)

Working capital change (57) (98)

Current provisions (1) (3)

Capital expenditure (66) (69)

Change in capital creditors 1 7

Tax paid (26) (16)

Sale of fixed assets 2 -

Other (15) (18)

Free cash flow 59 (23)

Share issues 2 3

Purchase of own shares (13) (15)

Purchase of investments - (3)

Dividends (1) -

Net cash inflow/(outflow) 47 (38)

Net debt acquired - (1)

Deferred debt issue costs amortised (2) (9)

Currency translation adjustments (64) (31)

Increase in net debt (19) (79)

(1) The summary cash flow is prepared on a different

basis to the Consolidated Statement of

Cash Flows under IFRS ('IFRS cash flow').

The principal differences are as follows:

(a) The summary cash flow details movements in net debt. The IFRS

cash flow details movements in cash and cash equivalents.

(b) Free cash flow reconciles to cash generated from

operations in the IFRS cash flow as shown below.

(c) The IFRS cash flow has different sub-headings

to those used in the summary cash flow.

3 months to 3 months to

31-Mar-14 31-Mar-13

EURm EURm

Free cash 59 (23)

flow

Add Cash interest 39 54

back:

Capital expenditure (net of change in capital creditors) 65 62

Tax payments 26 16

Less: Sale of fixed assets (2) -

Profit on sale of assets and businesses - non-exceptional (1) (2)

Non-cash financing activities - (1)

Cash generated from 186 106

operations

Capital Resources

The Group's primary sources of liquidity are cash flow from

operations and borrowings under the revolving credit facility. The

Group's primary uses of cash are for funding day to day operations,

capital expenditure, debt service, dividends and other investment

activity including acquisitions.

At 31 March 2014, Smurfit Kappa Treasury Funding Limited had

outstanding US$292.3 million 7.50% senior debentures due 2025. The

Group had outstanding EUR138.4 million and STGGBP60.7 variable

funding notes issued under the EUR250 million accounts receivable

securitisation programme maturing in November 2015, together with

EUR175 million variable funding notes issued under the EUR175

million accounts receivable securitisation programme maturing in

April 2018.

Smurfit Kappa Acquisitions had outstanding EUR200 million 5.125%

senior notes due 2018, US$300 million 4.875% senior notes due 2018,

EUR500 million 7.75% senior notes due 2019, EUR400 million 4.125%

senior notes due 2020 and EUR250 million senior floating rate notes

due 2020. Smurfit Kappa Acquisitions and certain subsidiaries are

also party to a senior credit facility. At 31 March 2014, the

Group's senior credit facility comprised term drawings of EUR700.9

million and US$64.4 million under the amortising Term A facility

maturing in 2018. In addition, as at 31 March 2014, the facility

included a EUR625 million revolving credit facility of which EUR125

million was drawn in revolver loans with a further EUR18 million in

operational facilities including letters of credit drawn under

various ancillary facilities.

The following table provides the range of interest rates as of

31 March 2014 for each of the drawings under the various senior

credit facility term loans.

BORROWING ARRANGEMENT CURRENCY INTEREST RATE

Term A Facility EUR 2.216% - 2.313%

USD 2.154%

Revolving Credit Facility EUR 2.050%

Borrowings under the revolving credit facility are available to

fund the Group's working capital requirements, capital expenditures

and other general corporate purposes.

On 24 July 2013, the Group successfully completed a new

five-year unsecured EUR1,375 million refinancing of its senior

credit facility comprising a EUR750 million term loan with a

current margin of 2.00% and a EUR625 million revolving credit

facility with a current margin of 1.75%. The term loan is repayable

EUR125 million on 24 July 2016, EUR125 million 24 July 2017 with

the balance of EUR500 million repayable on the maturity date. In

connection with the refinancing, the collateral securing the

obligations under the Group's various outstanding senior notes and

debentures was also released and the senior notes and debentures

are therefore now unsecured. The new unsecured senior credit

facility is supported by substantially the same guarantee

arrangements as the old senior credit facility. The existing senior

notes and debentures likewise continue to have substantially

similar guarantee arrangements as supported those instruments prior

to the refinancing.

In addition, on 3 July 2013, the Group put in place a new

five-year trade receivables securitisation programme of up to

EUR175 million utilising the Group's receivables in Austria,

Belgium, Italy and the Netherlands. The programme, which has been

arranged by Rabobank and carries a margin of 1.70%, complements the

Group's existing EUR250 million securitisation programme.

On 4 November 2013, the Group completed the redemption of its

EUR500 million 7.25% senior notes due 2017, utilising cash and

existing credit facilities arranged as part of the senior credit

facility and trade receivables securitisation transactions.

Market Risk and Risk Management Policies

The Group is exposed to the impact of interest rate changes and

foreign currency fluctuations due to its investing and funding

activities and its operations in different foreign currencies.

Interest rate risk exposure is managed by achieving an appropriate

balance of fixed and variable rate funding. As at 31 March 2014,

the Group had fixed an average of 68% of its interest cost on

borrowings over the following twelve months.

The Group's fixed rate debt comprised mainly EUR500 million

7.75% senior notes due 2019, EUR200 million 5.125% senior notes due

2018, US$300 million 4.875% senior notes due 2018 (US$50 million

swapped to floating), EUR400 million 4.125% senior notes due 2020

and US$292.3 million 7.50% senior debentures due 2025. In addition

the Group also had EUR899 million in interest rate swaps with

maturity dates ranging from April 2014 to January 2021.

The Group's earnings are affected by changes in short-term

interest rates as a result of its floating rate borrowings. If

LIBOR interest rates for these borrowings increase by one percent,

the Group's interest expense would increase, and income before

taxes would decrease, by approximately EUR11 million over the

following twelve months. Interest income on the Group's cash

balances would increase by approximately EUR4 million assuming a

one percent increase in interest rates earned on such balances over

the following twelve months.

The Group uses foreign currency borrowings, currency swaps,

options and forward contracts in the management of its foreign

currency exposures.

Principal Risks and Uncertainties

Risk assessment and evaluation is an integral part of the

management process throughout the Group. Risks are identified,

evaluated and appropriate risk management strategies are

implemented at each level.

The key business risks are identified by the senior management

team. The Board in conjunction with senior management identifies

major business risks faced by the Group and determines the

appropriate course of action to manage these risks.

The principal risks and uncertainties faced by the Group were

outlined in its 2013 annual report which is available on its

website www.smurfitkappa.com.

The principal risks and uncertainties remain substantially the

same for the near term except for the following:

-- The Group is exposed to currency exchange rate fluctuations and in

addition, to exchange controls in Venezuela. Currently,

Venezuela

operates a number of alternative exchange mechanisms, the

official

rate (VEF 6.3 per US dollar) ('Official rate'), Sicad I and

Sicad II.

Contrary to general market expectations, in January 2014 the

Government announced that it would not be devaluing the Official

rate

but access to the Official rate would only be available to

certain

priority sectors. Those not in these priority sectors would

access

dollars through the Complimentary System of Foreign Currency

Acquirement ('Sicad'). The Group is awaiting clarification on

whether

it will be part of the priority sector, the non-priority sector

or

both sectors. The most recent Sicad I rate is VEF 10.0 per US

dollar

and it is expected that this rate is likely to vary over time.

As set

out on page 27 the Group has changed the rate at which it

consolidates

its Venezuelan operations ('SKCV') from the Official rate to the

Sicad

I rate as at 31 March 2014 (VEF 10.7 per US dollar). In March

2014 a

new foreign exchange trading platform began operation (Sicad II)

which

permits foreign exchange barter transactions in the private

sector

with the most recent Sicad II rate being VEF 50.0 per US dollar

and

this rate is also likely to vary over time. In this multiple

foreign

exchange rate system there is a risk that the Sicad I rate

will

devalue further resulting in re-measurement of the local

currency

denominated net monetary assets and the local earnings and

increase

the cost of importing goods required to run the business.

-- The Venezuelan government have also announced that companies can only

seek price increases if they have clearance that their margins

are

within certain guidelines. SKCV is operating within these

guidelines.

There is a risk that if SKCV cannot implement price increases in

a

timely manner to cover the cost of its increasing raw material

and

labour costs as a result of inflation and the devaluing currency

it

would have an adverse effect on its results of operations. In

this

volatile environment the Group continues to closely monitor

developments, assess evolving business risks and actively manage

its

investments.

Consolidated Income Statement - First Quarter

3 months to 31-Mar-14 3 months to 31-Mar-13

Unaudited Unaudited

Pre- Exceptional Total Pre- Exceptional Total

exceptional 2014 2014 exceptional 2013 2013

2014 2013

EURm EURm EURm EURm EURm EURm

Revenue 1,932 - 1,932 1,889 - 1,889

Cost of (1,359) - (1,359) (1,363) - (1,363)

sales

Gross 573 - 573 526 - 526

profit

Distribution (152) - (152) (152) - (152)

costs

Administrative (252) - (252) (235) - (235)

expenses

Other - (9) (9) - (13) (13)

operating

expenses

Operating 169 (9) 160 139 (13) 126

profit

Finance (63) - (63) (79) (6) (85)

costs

Finance 2 5 7 10 6 16

income

Profit 108 (4) 104 70 (13) 57

before

income tax

Income tax (38) (24)

expense

Profit for 66 33

the

financial

period

Attributable

to:

Owners 65 33

of the

parent

Non-controlling 1 -

interests

Profit for 66 33

the

financial

period

Earnings

per

share

Basic 28.8 14.4

earnings

per

share -

cent

Diluted 28.6 14.3

earnings

per share

- cent

Consolidated Statement of Comprehensive Income - First

Quarter

3 months to 3 months to

31-Mar-14 31-Mar-13

Unaudited Unaudited

EURm EURm

Profit for the financial period 66 33

Other comprehensive income:

Items that may be subsequently

reclassified to profit or loss

Foreign currency translation adjustments:

- Arising in the period (234) (114)

Effective portion of changes in fair

value of cash flow hedges:

- Movement out of reserve 4 5

- New fair value adjustments into reserve (9) 8

- Movement in deferred tax - (1)

(239) (102)

Items which will not be subsequently

reclassified to profit or loss

Defined benefit pension plans:

- Actuarial (loss)/gain (21) 42

- Movement in deferred tax 3 (9)

(18) 33

Total other comprehensive expense (257) (69)

Total comprehensive expense (191) (36)

for the financial period

Attributable to:

Owners of the parent (166) (20)

Non-controlling interests (25) (16)

Total comprehensive expense (191) (36)

for the financial period

Consolidated Balance Sheet

Restated*

31-Mar-14 31-Mar-13 31-Dec-13

Unaudited Unaudited Audited

EURm EURm EURm

ASSETS

Non-current assets

Property, plant and equipment 2,906 3,041 3,022

Goodwill and intangible assets 2,273 2,321 2,326

Available-for-sale financial assets 27 33 27

Investment in associates 16 17 16

Biological assets 92 120 107

Trade and other receivables 5 5 5

Derivative financial instruments - 1 1

Deferred income tax assets 197 173 203

5,516 5,711 5,707

Current assets

Inventories 707 735 712

Biological assets 9 2 10

Trade and other receivables 1,435 1,524 1,344

Derivative financial instruments 1 10 4

Restricted cash 15 8 8

Cash and cash equivalents 425 502 447

2,592 2,781 2,525

Total assets 8,108 8,492 8,232

EQUITY

Capital and reserves attributable

to the owners of the parent

Equity share capital - - -

Share premium 1,981 1,975 1,979

Other reserves (11) 349 208

Retained earnings 192 (69) 121

Total equity attributable to 2,162 2,255 2,308

the owners of the parent

Non-controlling interests 176 199 199

Total equity 2,338 2,454 2,507

LIABILITIES

Non-current liabilities

Borrowings 3,016 3,214 3,009

Employee benefits 716 681 713

Derivative financial instruments 65 44 59

Deferred income tax liabilities 182 218 214

Non-current income tax liabilities 20 16 17

Provisions for liabilities and charges 41 44 42

Capital grants 11 12 12

Other payables 7 8 9

4,058 4,237 4,075

Current liabilities

Borrowings 64 167 67

Trade and other payables 1,581 1,564 1,525

Current income tax liabilities 20 15 11

Derivative financial instruments 36 39 33

Provisions for liabilities and charges 11 16 14

1,712 1,801 1,650

Total liabilities 5,770 6,038 5,725

Total equity and liabilities 8,108 8,492 8,232

*Details of restatement are set out in Note 15.

Consolidated Statement of Changes in Equity

Attributable to the owners of the parent Non- Total

controlling equity

interests

Equity Share Other Retained Total

share premium reserves earnings

capital

EURm EURm EURm EURm EURm EURm EURm

Unaudited

At - 1,979 208 121 2,308 199 2,507

1 January

2014

Profit for - - - 65 65 1 66

the

financial

period

Other

comprehensive

income

Foreign - - (208) - (208) (26) (234)

currency

translation

adjustments

Defined - - - (18) (18) - (18)

benefit

pension

plans

Effective - - (5) - (5) - (5)

portion

of changes

in

fair value

of cash

flow hedges

Total - - (213) 47 (166) (25) (191)

comprehensive

(expense)/income

for

the

financial

period

Shares - 2 - - 2 - 2

issued

Hyperinflation - - - 24 24 3 27

adjustment

Dividends - - - - - (1) (1)

paid

Share-based - - 7 - 7 - 7

payment

Shares - - (13) - (13) - (13)

acquired

by

SKG

Employee

Trust

At 31 March - 1,981 (11) 192 2,162 176 2,338

2014

At - 1,972 444 (159) 2,257 212 2,469

1 January

2013

Profit for - - - 33 33 - 33

the

financial

period

Other

comprehensive

income

Foreign - - (98) - (98) (16) (114)

currency

translation

adjustments

Defined - - - 33 33 - 33

benefit

pension

plans

Effective - - 12 - 12 - 12

portion

of changes

in

fair value

of cash

flow hedges

Total - - (86) 66 (20) (16) (36)

comprehensive

(expense)/income

for

the

financial

period

Shares - 3 - - 3 - 3

issued

Hyperinflation - - - 24 24 3 27

adjustment

Share-based - - 6 - 6 - 6

payment

Shares - - (15) - (15) - (15)

acquired

by

SKG

Employee

Trust

At 31 March - 1,975 349 (69) 2,255 199 2,454

2013

An analysis

of the

movements

in Other

reserves is

provided

in Note

13.

Consolidated Statement of Cash Flows

3 months to 3 months to

31-Mar-14 31-Mar-13

Unaudited Unaudited

EURm EURm

Cash flows from operating activities

Profit before income tax 104 57

Net finance costs 56 69

Depreciation charge 80 83

Amortisation of intangible assets 7 5

Amortisation of capital grants - (1)

Share-based payment expense 7 6

Profit on purchase/sale of (1) (2)

assets and businesses

Net movement in working capital (57) (99)

Change in biological assets 6 8

Change in employee benefits (17) (23)

and other provisions

Other 1 3

Cash generated from operations 186 106

Interest paid (35) (44)

Income taxes paid:

Overseas corporation tax (net (26) (16)

of tax refunds) paid

Net cash inflow from operating activities 125 46

Cash flows from investing activities

Interest received 1 1

Additions to property, plant and (63) (60)

equipment and biological assets

Additions to intangible assets (2) (2)

(Increase)/decrease in restricted cash (8) 6

Disposal of property, plant and equipment 3 1

Purchase of subsidiaries and - (2)

non-controlling interests

Deferred consideration paid - (2)

Net cash outflow from investing activities (69) (58)

Cash flows from financing activities

Proceeds from issue of new ordinary shares 2 3

Proceeds from bond issuance - 400

Purchase of own shares (13) (15)

Increase in interest-bearing borrowings 4 16

Payment of finance leases (1) (1)

Repayment of borrowings - (310)

Deferred debt issue costs - (6)

Dividends paid to non-controlling interests (1) -

Net cash (outflow)/inflow from (9) 87

financing activities

Increase in cash and cash equivalents 47 75

Reconciliation of opening to closing

cash and cash equivalents

Cash and cash equivalents at 1 January 424 423

Currency translation adjustment (63) (20)

Increase in cash and cash equivalents 47 75

Cash and cash equivalents at 31 March 408 478

An analysis of the Net Movement in Working

Capital is provided in Note 11.

1.General Information

Smurfit Kappa Group plc ('SKG plc' or 'the Company') and its

subsidiaries (together 'SKG' or 'the Group') manufacture,

distribute and sell containerboard, corrugated containers and other

paper-based packaging products such as solidboard and graphicboard.

The Company is a public limited company whose shares are publicly

traded. It is incorporated and tax resident in Ireland. The address

of its registered office is Beech Hill, Clonskeagh, Dublin 4,

Ireland.

2.Basis of Preparation

The consolidated financial statements of the Group are prepared

in accordance with International Financial Reporting Standards

('IFRS') issued by the International Accounting Standards Board

('IASB') and adopted by the European Union ('EU'); and, in

accordance with Irish law.

The financial information presented in this report has been

prepared to comply with the requirement to publish an 'Interim

management statement' for the first quarter, in accordance with the

Transparency Regulations. The Transparency Regulations do not

require Interim management statements to be prepared in accordance

with International Accounting Standard 34 - 'Interim Financial

Information' ('IAS 34'). Accordingly the Group has not prepared

this financial information in accordance with IAS 34.

The financial information has been prepared in accordance with

the Group's accounting policies. Full details of the accounting

policies adopted by the Group are contained in the financial

statements included in the Group's Annual Report for the year ended

31 December 2013 which is available on the Group's website

www.smurfitkappa.com. The accounting policies and methods of

computation and presentation adopted in the preparation of the

Group financial information are consistent with those described and

applied in the Annual Report for the financial year ended 31

December 2013.

There are a number of changes to IFRS issued and effective from

1 January 2014 which include IFRS 10, Consolidated Financial

Statements, IFRS 11, Joint Arrangements, IFRS 12, Disclosure of

Interests in Other Entities,IAS 27, Separate Financial Statements,

and IAS 28, Investments in Associates and Joint Ventures. They do

not have an effect on the condensed interim Group financial

information included in this report.

The condensed interim Group financial information includes all

adjustments that management considers necessary for a fair

presentation of such financial information. All such adjustments

are of a normal recurring nature. Some tables in this report may

not add correctly due to rounding.

The condensed interim Group financial information does not

constitute full group accounts within the meaning of Regulation

40(1) of the European Communities (Companies: Group Accounts)

Regulations, 1992 of Ireland insofar as such group accounts would

have to comply with all of the disclosure and other requirements of

those Regulations. Full Group accounts for the year ended 31

December 2013 will be filed with the Irish Registrar of Companies

in due course. The audit report on those Group accounts was

unqualified.

3.Segmental Analyses

The Group has determined reportable operating segments based on

the manner in which reports are reviewed by the chief operating

decision maker ('CODM'). The CODM is determined to be the executive

management team responsible for assessing performance, allocating

resources and making strategic decisions. The Group has identified

two reportable operating segments: 1) Europe and 2) The

Americas.

The Europe segment is highly integrated. It includes a system of

mills and plants that primarily produces a full line of

containerboard that is converted into corrugated containers. The

Americas segment comprises all forestry, paper, corrugated and

folding carton activities in a number of Latin American countries

and the operations of Smurfit Kappa Orange County ('SKOC').

Inter-segment revenue is not material. No operating segments have

been aggregated for disclosure purposes.

3.Segmental Analyses (continued)

Segment profit is measured based on earnings before interest,

tax, depreciation, amortisation and share-based payment expense

('EBITDA before exceptional items').

3 months to 31-Mar-14 3 months to 31-Mar-13

Europe The Total Europe The Total

Americas Americas

EURm EURm EURm EURm EURm EURm

Revenue and Results

Revenue 1,508 424 1,932 1,457 432 1,889

EBITDA before 199 75 274 177 66 243

exceptional

items

Segment exceptional - (9) (9) - (13) (13)

items

EBITDA after 199 66 265 177 53 230

exceptional

items

Unallocated centre (5) (2)

costs

Share-based payment (7) (6)

expense

Depreciation and (86) (91)

depletion (net)

Amortisation (7) (5)

Finance costs (63) (85)

Finance income 7 16

Profit before 104 57

income tax

Income tax expense (38) (24)

Profit for the 66 33

financial

period

4.Exceptional Items

3 months to 3 months to

The following items are regarded 31-Mar-14 31-Mar-13

as exceptional in nature:

EURm EURm

Currency trading loss on change 9 12

in Venezuelan translation rate

Reorganisation and restructuring costs - 1

Exceptional items included 9 13

in operating profit

Exceptional finance costs - 6

Exceptional finance income (5) (6)

Exceptional items included (5) -

in net finance costs

Exceptional items charged within operating profit in the first

quarter of 2014 amounted to EUR9 million and related to losses on

the translation of non-Bolivar denominated payables following the

Group's decision to translate its Venezuelan operations at the

Sicad I rate. The translation loss reflected the higher cost to its

Venezuelan operations of discharging these payables.

Exceptional finance income in the first quarter of 2014

comprised a gain of EUR5 million in Venezuela on the retranslation

of the US dollar denominated intra-group loans to the Sicad I

rate.

Exceptional items charged within operating profit in the first

quarter of 2013 amounted to EUR13 million, over EUR12 million of

which related to losses on the translation of non-Bolivar

denominated payables following the devaluation of the Venezuelan

Bolivar in February of that year. The translation loss reflected

the higher cost to the Group's Venezuelan operations of discharging

these payables. The remainder of less than EUR1 million was in

respect of SKOC reorganisation and restructuring costs.

Exceptional finance costs in the first quarter of 2013 comprised

an offsetting charge of EUR6 million in respect of the accelerated

amortisation of deferred debt issue costs and a gain of EUR6

million in Venezuela on the value of US dollar denominated

intra-group loans, following the devaluation of the Bolivar. The

accelerated amortisation of deferred debt issue costs arose from

the repayment of part of the senior credit facility.

5.Finance Cost and Income

3 months to 3 months to

31-Mar-14 31-Mar-13

EURm EURm

Finance cost:

Interest payable on bank loans and overdrafts 13 21

Interest payable on other borrowings 29 37

Exceptional finance costs associated - 6

with debt restructuring

Foreign currency translation loss on debt 3 8

Fair value loss on derivatives 1 -

not designated as hedges

Net interest cost on net pension liability 7 7

Net monetary loss - hyperinflation 10 6

Total finance cost 63 85

Finance income:

Other interest receivable (1) (1)

Foreign currency translation gain on debt (1) -

Exceptional foreign currency translation gain (5) (6)

Fair value gain on derivatives - (9)

not designated as hedges

Total finance income (7) (16)

Net finance cost 56 69

6.Income Tax Expense

Income tax expense recognised in the Consolidated Income

Statement

3 months to 3 months to

31-Mar-14 31-Mar-13

EURm EURm

Current tax:

Europe 25 8

The Americas 16 15

41 23

Deferred tax (3) 1

Income tax expense 38 24

Current tax is analysed as follows:

Ireland 2 1

Foreign 39 22

41 23

Income tax recognised in the Consolidated Statement of

Comprehensive Income

3 months to 3 months to

31-Mar-14 31-Mar-13

EURm EURm

Arising on actuarial (loss)/gain (3) 9

on defined benefit plans

Arising on qualifying derivative - 1

cash flow hedges

(3) 10

The EUR14 million increase in the income tax expense compared to

2013 is predominately explained by an increase in earnings and a

change to the geographical mix of those earnings, as well as by a

non-reoccurring tax benefit in Italy in 2013.

There is no income tax expense associated with exceptional items

in 2014, compared to a EUR1 million credit in 2013.

7.Employee Benefits - Defined Benefit Plans

The table below sets out the components of the defined benefit

cost for the period:

3 months to 3 months to

31-Mar-14 31-Mar-13

EURm EURm

Current service cost 12 13

Past service cost 1 -

Net interest cost on net pension liability 7 7

Defined benefit cost 20 20

Included in cost of sales, distribution costs and administrative

expenses is a defined benefit cost of EUR13 million (2013: EUR13

million). Net interest cost on net pension liability of EUR7

million (2013: EUR7 million) is included in finance costs in the

Consolidated Income Statement.

The amounts recognised in the Consolidated Balance Sheet were as

follows:

31-Mar-14 31-Dec-13

EURm EURm

Present value of funded or partially (1,905) (1,851)

funded obligations

Fair value of plan assets 1,677 1,625

Deficit in funded or partially funded plans (228) (226)

Present value of wholly unfunded obligations (488) (487)

Net pension liability (716) (713)

The employee benefits provision has increased from EUR713

million at 31 December 2013 to EUR716 million at 31 March 2014.

8.Earnings Per Share

Basic

Basic earnings per share is calculated by dividing the profit

attributable to the owners of the parent by the weighted average

number of ordinary shares in issue during the period.

3 months to 3 months to

31-Mar-14 31-Mar-13

Profit attributable to the owners 65 33

of the parent (EUR million)

Weighted average number of ordinary 227 228

shares in issue (million)

Basic earnings per share (cent) 28.8 14.4

Diluted

Diluted earnings per share is calculated by adjusting the

weighted average number of ordinary shares outstanding to assume

conversion of all dilutive potential ordinary shares which comprise

convertible shares issued under the management equity plans.

3 months to 3 months to

31-Mar-14 31-Mar-13

Profit attributable to the owners 65 33

of the parent (EUR million)

Weighted average number of ordinary 227 228

shares in issue (million)

Potential dilutive ordinary 2 2

shares assumed (million)

Diluted weighted average ordinary 229 230

shares (million)

Diluted earnings per share (cent) 28.6 14.3

Pre-exceptional

3 months to 3 months to

31-Mar-14 31-Mar-13

Profit attributable to the owners 65 33

of the parent (EUR million)

Exceptional items included in profit before 4 13

income tax (Note 4) (EUR million)

Income tax on exceptional items (EUR million) - (1)

Pre-exceptional profit attributable to 69 45

the owners of the parent (EUR million)

Weighted average number of ordinary 227 228

shares in issue (million)

Pre-exceptional basic earnings 30.8 19.8

per share (cent)

Diluted weighted average ordinary 229 230

shares (million)

Pre-exceptional diluted earnings 30.5 19.6

per share (cent)

9.Dividends

The Board has recommended a final dividend of 30.75 cent per

share for 2013 payable on 9 May 2014 subject to the approval of the

shareholders at the AGM.

10.Property, Plant and Equipment

Land and Plant and Total

buildings equipment

EURm EURm EURm

Three months ended 31 March 2014

Opening net book amount 1,107 1,915 3,022

Reclassifications 4 (7) (3)

Additions 1 59 60

Depreciation charge for the period (12) (68) (80)

Retirements and disposals (2) - (2)

Hyperinflation adjustment 5 3 8

Foreign currency translation adjustment (49) (50) (99)

At 31 March 2014 1,054 1,852 2,906

Year ended 31 December 2013

Opening net book amount 1,125 1,979 3,104

Reclassifications 48 (55) (7)

Additions 8 330 338

Acquisitions - 7 7

Depreciation charge for the year (51) (295) (346)

Impairments (2) (7) (9)

Retirements and disposals (1) (2) (3)

Hyperinflation adjustment 41 43 84

Foreign currency translation adjustment (61) (85) (146)

At 31 December 2013 1,107 1,915 3,022

11.Net Movement in Working Capital

3 months to 3 months to

31-Mar-14 31-Mar-13

EURm EURm

Change in inventories (19) (17)

Change in trade and other receivables (133) (133)

Change in trade and other payables 95 51

Net movement in working capital (57) (99)

12.Analysis of Net Debt

31-Mar-14 31-Dec-13

EURm EURm

Unsecured senior credit facility:

Revolving credit facility(1)- interest 119 119

at relevant interbank rate +1.75%(5)

Facility A term loan(2)- interest at 740 740

relevant interbank rate + 2.00%(5)

US$292.3 million 7.50% senior debentures 217 213

due 2025 (including accrued interest)

Bank loans and overdrafts 58 67

Cash (440) (455)

2015 receivables securitisation 210 203

variable funding notes

2018 receivables securitisation 173 173

variable funding notes

2018 senior notes (including accrued interest)(3) 409 414

EUR500 million 7.75% senior notes due 505 495

2019 (including accrued interest)

EUR400 million 4.125% senior notes due 397 401

2020 (including accrued interest)

EUR250 million senior floating rate notes due 248 247

2020 (including accrued interest)(4)

Net debt before finance leases 2,636 2,617

Finance leases 4 4

Net debt including leases 2,640 2,621

(1) Revolving credit facility ('RCF') of EUR625 million

(available under the unsecured senior

credit facility) to be repaid in 2018. (a)

Revolver loans - EUR125 million, (b) loans

and overdrafts drawn under ancillary facilities-

nil and (c) other operational facilities

including letters of credit drawn under

ancillary facilities - EUR18 million.

(2) Facility A term loan ('Facility A') due to be repaid

in certain instalments from 2016 to 2018.

(3) EUR200 million 5.125% senior notes due 2018 and US$300

million 4.875% senior notes due 2018.

(4) Interest at EURIBOR + 3.5%.

(5) The margins applicable to the unsecured senior

credit facility are determined as follows:

Net debt/EBITDA ratio RCF Facility A

Greater than 3.0 : 1 2.50% 2.75%

3.0 : 1 or less but more than 2.5 : 1 2.00% 2.25%

2.5 : 1 or less but more than 2.0 : 1 1.75% 2.00%

2.0 : 1 or less 1.50% 1.75%

13.Other Reserves

Other reserves included in the Consolidated Statement of Changes

in Equity are comprised of the following:

Reverse Cash flow Foreign Share- Own Available

acquisition hedging currency based shares -for-sale Total

reserve reserve translation payment reserve

reserve reserve

EURm EURm EURm EURm EURm EURm EURm

At 575 (15) (456) 131 (28) 1 208

1 January

2014

Other

comprehensive

income

Foreign - - (208) - - - (208)

currency

translation

adjustments

Effective - (5) - - - - (5)

portion

of changes

in

fair value

of cash

flow hedges

Total - (5) (208) - - - (213)

other

comprehensive

expense

Share-based - - - 7 - - 7

payment

Shares - - - - (13) - (13)

acquired

by

SKG

Employee

Trust

Shares - - - (1) 1 - -

granted

to

participants

of the SKG

Employee

Trust

At 31 March 575 (20) (664) 137 (40) 1 (11)

2014

At 575 (26) (198) 105 (13) 1 444

1 January

2013

Other

comprehensive

income

Foreign - - (98) - - - (98)

currency

translation

adjustments

Effective - 12 - - - - 12

portion

of changes

in

fair value

of cash

flow hedges

Total - 12 (98) - - - (86)

other

comprehensive

income/(expense)

Share-based - - - 6 - - 6

payment

Shares - - - - (15) - (15)

acquired

by

SKG

Employee

Trust

At 31 March 575 (14) (296) 111 (28) 1 349

2013

14.Venezuela

Hyperinflation

As discussed more fully in the 2013 annual report, Venezuela

became hyperinflationary during 2009 when its cumulative inflation

rate for the past three years exceeded 100%. As a result, the Group

applied the hyperinflationary accounting requirements of IAS 29 -

Financial Reporting in Hyperinflationary Economies to its

Venezuelan operations at 31 December 2009 and for all subsequent

accounting periods.

The index used to reflect current values is derived from a

combination of Banco Central de Venezuela's National Consumer Price

Index from its initial publication in December 2007 and the

Consumer Price Index for the metropolitan area of Caracas for

earlier periods. The level of and movement in the price index at

March 2014 and 2013 are as follows:

31-Mar-14 31-Mar-13

Index at period end 548.3 344.1

Movement in period 10.0% 7.9%

As a result of the entries recorded in respect of

hyperinflationary accounting under IFRS, the Consolidated Income

Statement is impacted as follows: Revenue EUR37 million decrease

(2013: EUR8 million decrease), pre-exceptional EBITDA EUR5 million

decrease (2013: EUR4 million decrease) and profit after taxation

EUR18 million decrease (2013: EUR15 million decrease). In 2014, a

net monetary loss of EUR10 million (2013: EUR6 million loss) was

recorded in the Consolidated Income Statement. The impact on the

Group's net assets and its total equity is an increase of EUR13

million (2013: EUR14 million increase).

Exchange Control and Devaluation

As a result of Venezuela operating a number of alternative

currency exchange mechanisms (CENCOEX (formerly known as CADIVI),

Sicad I and Sicad II) the Group has been assessing the appropriate

rate at which to consolidate the results of its Venezuelan

operations. With the introduction of Sicad I and Sicad II,

Venezuela has now become a multiple rate foreign exchange system

with three different official rates. One, the official CENCOEX rate

of VEF 6.3 per US dollar ('Official rate') is a fixed rate for

basic/essential goods. The two remaining rates are variable, Sicad

I for goods excluded from CENCOEX and the Sicad II rate for SMEs

and private individuals.

As a result of the January announcements by the Venezuelan

government that there will be no official devaluation for at least

two years, Sicad I is now intended to offer an alternative currency

exchange mechanism to foreign firms operating in Venezuela.

The Group believes that Sicad I is the more appropriate rate for

accounting and consolidation. On this basis, in accordance with

IFRS, the financial statements of the Group's operations in

Venezuela were translated using the prevailing Sicad I rate of VEF

10.7 per US dollar and the closing euro/US dollar rate of EUR1 /

US$1.38. The change from the Official rate of VEF 6.3 to VEF 10.7

(the rate prevailing at the end of the quarter) reduced the Group's

cash by approximately EUR69 million and its net assets by EUR172

million.

Control

The nationalisation of foreign owned companies or assets by the

Venezuelan government remains a risk. Market value compensation is

either negotiated or arbitrated under applicable laws or treaties

in these cases. However, the amount and timing of such compensation

is necessarily uncertain.

The Group continues to control operations in Venezuela and, as a

result, continues to consolidate all of the results and net assets

of these operations at the period end in accordance with the

requirement of IAS 27.

In 2014, the Group's operations in Venezuela represented

approximately 4% (2013: 5%) of its total assets and 11% (2013: 14%)

of its net assets. In addition, cumulative foreign translation

losses arising on its net investment in these operations amounting

to EUR539 million (2013: EUR330 million) are included in the

foreign exchange translation reserve.

15.Restatement of Prior Periods

IFRS 3, Business Combinations

As required under IFRS 3, Business Combinations, the

Consolidated Balance Sheet at 31 March 2013 has been restated for

final adjustments to the provisional fair values of the SKOC

acquisition on 30 November 2012. The effects on previously reported

financial information are shown in the table below.

Impact on Financial Statements

Previously IFRS 3 Restated

reported Adjustments

EURm EURm EURm

Consolidated Balance Sheet

At 31 March 2013

Non-current assets

Property, plant and equipment 3,013 28 3,041

Goodwill and intangible assets 2,311 10 2,321

Deferred income tax assets 171 2 173

Current assets

Inventories 747 (12) 735

Non-current liabilities

Deferred income tax liabilities 194 24 218

Other payables 7 1 8

Current liabilities

Trade and other payables 1,562 2 1,564

Provisions for liabilities 15 1 16

and charges

Supplementary Financial Information

EBITDA before exceptional items and share-based payment expense

is denoted by EBITDA in the following schedules for ease of

reference.

Reconciliation of Profit to EBITDA

3 months to 3 months to

31-Mar-14 31-Mar-13

EURm EURm

Profit for the financial period 66 33

Income tax expense 38 24

Currency trading loss on change 9 12

in Venezuelan translation rate

Reorganisation and restructuring costs - 1

Net finance costs 56 69

Share-based payment expense 7 6

Depreciation, depletion (net) and amortisation 93 96

EBITDA 269 241

Supplementary

Historical

Financial

Information

EURm Q1, 2013 Q2, 2013 Q3, 2013 Q4, 2013 FY, 2013 Q1, 2014

Group and 3,080 3,285 3,319 3,346 13,030 3,217

third

party

revenue

Third 1,889 2,019 2,016 2,033 7,957 1,932

party

revenue

EBITDA 241 271 303 291 1,107 269

EBITDA 12.7% 13.4% 15.0% 14.3% 13.9% 13.9%

margin

Operating 126 148 195 173 643 160

profit

Profit 57 70 104 62 294 104

before

income tax

Free cash (23) 95 190 103 365 59

flow

Basic 14.4 17.7 24.0 26.0 82.2 28.8

earnings

per

share -

cent

Weighted 228 229 229 229 229 227

average

number

of shares

used

in

EPS

calculation

(million)

Net debt 2,871 2,817 2,630 2,621 2,621 2,640

Net debt 2.84 2.74 2.50 2.37 2.37 2.33

to

EBITDA

(LTM)

This information is provided by Business Wire

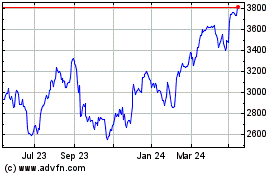

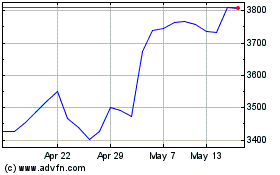

Smurfit Kappa (LSE:SKG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Smurfit Kappa (LSE:SKG)

Historical Stock Chart

From Jul 2023 to Jul 2024