Triple Point Social Housing REIT Net Asset Value and Dividend Declaration (2588H)

23 November 2022 - 6:44PM

UK Regulatory

TIDMSOHO

RNS Number : 2588H

Triple Point Social Housing REIT

23 November 2022

23 November 2022

Triple Point Social Housing REIT plc

(the "Company" or, together with its subsidiaries, the

"Group")

NET ASSET VALUE AND DIVIDEND DECLARATION

The Board of Directors of Triple Point Social Housing REIT plc

(ticker: SOHO) are pleased to announce the Company's unaudited Net

Asset Value ("NAV") as at 30 September 2022 and the declaration of

an interim dividend.

Net Asset Value as at 30 September 2022

The unaudited NAV reflects an independent RICS "Red Book"

valuation of the Group's portfolio (including all property

acquisitions completed) as at 30 September 2022, prepared by Jones

Lang LaSalle Limited ("JLL"), on an individual asset basis (as

required by IFRS).

Net Asset Value

As at 30 As at 30 % change

Sep 2022 Jun 2022

(unaudited) (unaudited)

-------------- -------------- ----------

NAV per Ordinary Share

(pence)* 111.58p 111.80p -0.20 %

-------------- -------------- ----------

* As at 30 September 2022, the EPRA NTA and IFRS NAV for the

Group were the same.

Despite the turbulent market conditions over the three months to

30 September 2022, the Board is pleased to note that the unaudited

NAV per Ordinary Share for the quarter remained stable, reflecting

the long-term, inflation linked income generated by the Group's

properties.

Rental increases for some of the Group's properties drove NAV

gains which were offset by a minor softening in valuation yields,

attributable to two Approved Providers currently in rent arrears

(as noted in the Group's Interim Results for the period to 30 June

2022). The Investment Manager continues to work with these Approved

Providers with the aim of restoring rental payments to historical

levels and agreeing a payment schedule in respect of rental

arrears.

Dividend Declaration

The Board has declared an interim dividend in respect of the

period from 1 July to 30 September 2022 of 1.365 pence per Ordinary

Share, payable on or around 16 December 2022 to holders of Ordinary

Shares on the register on 2 December 2022. The ex-dividend date

will be 1 December 2022.

The dividend will be paid as a Property Income Distribution

("PID").

This dividend is in line with the Company's target annual

dividend of 5.46 pence per Ordinary Share in respect of the

financial year ending 31 December 2022.(1)

Note:

(1) The target dividend is a target only and not a forecast.

There can be no assurance that the target will be met and it should

not be taken as an indication of the Company's expected or actual

future results.

FOR FURTHER INFORMATION ON THE COMPANY, PLEASE CONTACT:

Triple Point Investment Management Tel: 020 7201 8989

LLP

(Investment Manager)

Max Shenkman

Isobel Gunn-Brown

Akur Capital (Joint Financial Adviser) Tel: 020 7493 3631

Tom Frost

Anthony Richardson

Siobhan Sergeant

Stifel (Joint Financial Adviser Tel: 020 7710 7600

and Corporate Broker)

Mark Young

Mark Bloomfield

Rajpal Padam

The Company's LEI is 213800BERVBS2HFTBC58.

Further information on the Company can be found on its website

at www.triplepointreit.com .

NOTES:

The Company invests in primarily newly developed social housing

assets in the UK, with a particular focus on supported housing. The

majority of the assets within the portfolio are subject to

inflation-linked, long-term, Fully Repairing and Insuring ("FRI")

leases with Approved Providers (being Housing Associations, Local

Authorities or other regulated organisations in receipt of direct

payment from local government). The portfolio comprises investments

into properties which are already subject to a lease with an

Approved Provider, as well as forward funding of pre-let

developments but does not include any direct development or

speculative development.

There is increasing political pressure and social need to

increase housing supply across the UK which is creating

opportunities for private sector investors to help deliver this

housing. The Group's ability to provide forward funding for new

developments not only enables the Company to secure fit for

purpose, modern assets for its portfolio but also addresses the

chronic undersupply of suitable supported housing properties in the

UK at sustainable rents as well as delivering returns to

investors.

The Company is a UK Real Estate Investment Trust ("REIT") listed

on the premium segment of the Official List of the UK Financial

Conduct Authority and is a constituent of the FTSE EPRA/NAREIT

index.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DIVBTBATMTTTBIT

(END) Dow Jones Newswires

November 23, 2022 02:00 ET (07:00 GMT)

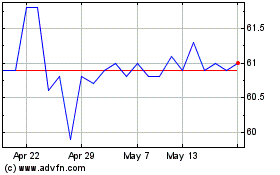

Social Housing Reit (LSE:SOHO)

Historical Stock Chart

From Jan 2025 to Feb 2025

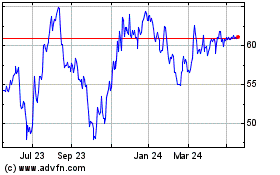

Social Housing Reit (LSE:SOHO)

Historical Stock Chart

From Feb 2024 to Feb 2025