We could not find any results for:

Make sure your spelling is correct or try broadening your search.

Prices of goods, commodities and exchange rates are determined on open markets under the control of two forces, supply and demand.

The laws of supply and demand show that:

The value of a nation’s currency, under a floating exchange rate, is determined by the interaction of supply and demand. We will work through some charts and an example to show how these forces work, from a theoretical point of view.

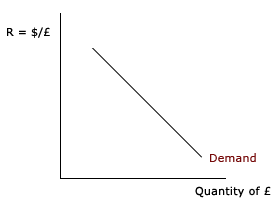

Demand Curve

Figure 1 shows the demand for British pounds in the United States. The curve is a normal downward sloping demand curve, indicating that as the pound depreciates relative to the dollar, the quantity of pounds demanded by Americans increases. Note that we are measuring the price of the pound-the exchange rate-on the vertical axis. Since it is dollars per pound ($/£), it is the price of a pound in terms of dollars and an increase in the exchange rate, R, is a decline in the value of the dollar. In other words, movements up the vertical axis represent an increase in price of the pound, which is equivalent to a fall in the price of the dollar. Similarly, movements down the vertical axis represent a decrease in the price of the pound.

For Americans, British goods are less expensive when the pound is cheaper and the dollar is stronger. At depreciated values for the pound, Americans will switch from American-made or third-party suppliers of goods and services to British suppliers. Before they can purchase goods made in Britain, they must exchange dollars for British pounds. Consequently, the increased demand for British goods is simultaneously an increase in the quantity of British pounds demanded.

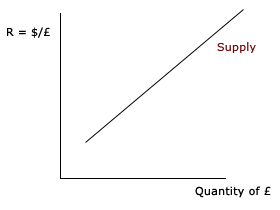

Supply Curve

Figure 2 shows the supply side of the picture. The supply curve slopes up because British firms and consumers are willing to buy a greater quantity of American goods as the dollar becomes cheaper (i.e. they receive more dollars per pound). Before British customers can buy American goods, however, they must first convert pounds into dollars, so the increase in the quantity of American goods demanded is simultaneously an increase in the quantity of foreign currency supplied to the United States.

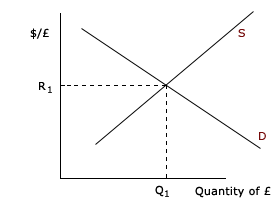

Equilibrium Price

Suppliers and consumers meet at a particular quantity and price at which they are both satisfied. Figure 3 combines the supply and demand curves. The intersection determines the market exchange rate and the quantity of dollars supplied to United States. At the exchange rate R, the demand and supply of British pounds to the United States is Q.

This is known as the equilibrium or the market’s clearing point.

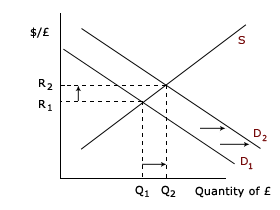

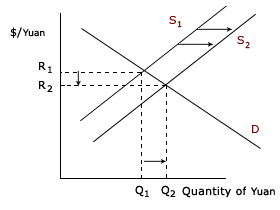

Changes in Demand and Supply

In figure 4, an increase in the US demand for the pound (rightward shift of the demand curve) causes a rise in the exchange rate, an appreciation in the pound, and a depreciation in the dollar. Conversely, a fall in demand would shift the demand curve left and lead to a falling pound and rising dollar. On the supply side, an increase in the supply of pounds to the US market (supply curve shifts right) is illustrated in Figure 5, where a new intersection for supply and demand occurs at a lower exchange rate and an appreciated dollar. A decrease in the supply of pounds shifts the curve leftward, causing the exchange rate to rise and the dollar to depreciate.

Increase in Demand Increase in Supply

When the forces between supply and demand change, the market moves in ways to clear itself through a change in price.

In international finance markets, if many investors are selling a particular currency, they are making it more readily available and increasing its supply. If there is not an equal amount of buyers, or demand, for that currency, its price will go down in order to strike a new balance between supply and demand.

The direction in which the value of a currency is heading can cause cash to flow into or out of that currency. A currency that is appreciating can cause money to flow into its country’s assets as investors and Forex traders want to benefit from buying or taking “long” positions on the currency as the currency’s price rises.

It’s important to note that forex trading carries a high level of risk due to the potential for significant leverage and market volatility. Traders should have a good understanding of the market, risk management techniques, and a solid trading strategy before participating in forex trading.

The information provided in this article is for informational purposes only and should not be construed as financial, investment, or professional advice. The views expressed are those of the author and do not necessarily reflect the opinions or recommendations of any organizations or individuals mentioned. Always consult with a qualified financial advisor or other professionals before making any financial decisions. The author and publisher are not responsible for any actions taken based on the content provided.

.png)

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions