London open: Stocks in the black; house prices in focus

London stocks rose in early trade on Wednesday as comments from Bank of Japan governor Shinichi Uchida calmed investors, and following the release of better-than-expected UK house price data.

At 0845 BST, the FTSE 100 was up 0.8% at 8,088.91.

Sentiment got a boost after Uchida said the central bank would not lift interest rates when the markets are unstable, in response to this week’s volatility that saw a massive sell-off in equities.

“I believe that the bank needs to maintain monetary easing with the current policy interest rate for the time being, with developments in financial and capital markets at home and abroad being extremely volatile,” Uchida told business leaders in a speech.

He added that the BoJ’s interest rate path would “obviously” change if market volatility affected its economic and price outlook, its view on risks, and the likelihood of durably achieving its 2% inflation target.

“In contrast to the process of policy interest rate hikes in Europe and the United States, Japan’s economy is not in a situation where the bank may fall behind the curve if it does not raise the policy interest rate at a certain pace,” Uchida said.

“Therefore, we won’t raise interest rates when financial markets are unstable,” Uchida said.

Stephen Innes, managing partner at SPI Asset Management, said: “His reassurance acted like a financial security blanket, calming jittery markets and effectively signalling continued protective intervention.”

On home shores, investors were mulling the latest data from Halifax, which showed that house prices rose in July after three flat months.

Prices were up 0.8% on the month, coming in comfortably ahead of expectations for 0.3% growth.

On the year, house prices rose 2.3% in July following a 1.9% increase in June. This marked the highest annual growth rate since January 2024.

The average house price stood at £291,268 compared to £289,042 in June.

Amanda Bryden, head of mortgages at Halifax, said: “Last week’s Bank of England’s Base Rate cut, which follows recent reductions in mortgage rates, is encouraging for those looking to remortgage, purchase a first home or move along the housing ladder. However, affordability constraints and the lack of available properties continue to pose challenges for prospective homeowners.

“Against the backdrop of lower mortgage rates and potential further Base Rate reductions, we anticipate house prices to continue a modest upward trend throughout the remainder of this year.”

In equity markets, banks were among the top performers, with NatWest, Barclays and Lloyds all higher.

TP Icap surged as it announced the launch of a third share buyback programme of £30m and posted a 10% jump in interim adjusted pre-tax profit.

Quilter also racked up strong gains as it reported record first-half adjusted profits.

On the downside, Coca-Cola HBC fizzed lower even as it lifted full-year guidance after a “strong” first half.

WPP was under the cosh as the advertising giant cut its full-year like-for-like revenue growth forecast. The company put this down to pressure in China and in its project-related businesses, as well as an uncertain macro environment.

Glencore lost ground as it posted a drop in half-year profits and said it will keep its coal and carbon steel business.

Hiscox fell as it reported a rise in first-half pre-tax profit despite what it described as “a more active loss environment”.

Legal & General was little changed as the financial services and asset management firm posted interim operating profit that beat analyst forecasts, driven by higher annuity sales.

Top 10 FTSE 100 Risers

| Sponsored by Plus500 |

|

| # | Name | Change Pct | Change | Cur Price | |

|---|---|---|---|---|---|

| 1 |  |

Crh Plc | +4.34% | +260.00 | 6,252.00 |

| 2 |  |

Melrose Industries Plc | +3.51% | +16.90 | 498.80 |

| 3 |  |

Standard Chartered Plc | +3.35% | +23.00 | 710.00 |

| 4 |  |

Ashtead Group Plc | +3.21% | +164.00 | 5,266.00 |

| 5 |  |

Ocado Group Plc | +2.91% | +11.10 | 392.50 |

| 6 |  |

Glencore Plc | +2.56% | +10.05 | 403.20 |

| 7 |  |

Persimmon Plc | +2.00% | +30.00 | 1,531.50 |

| 8 |  |

Vodafone Group Plc | +1.96% | +1.38 | 71.82 |

| 9 |  |

Barclays Plc | +1.95% | +4.05 | 212.25 |

| 10 |  |

Mondi Plc | +1.74% | +25.00 | 1,460.00 |

Top 10 FTSE 100 Fallers

| Sponsored by Plus500 |

|

| # | Name | Change Pct | Change | Cur Price | |

|---|---|---|---|---|---|

| 1 |  |

Hiscox Ltd | -4.45% | -52.00 | 1,117.00 |

| 2 |  |

Wpp Plc | -2.90% | -20.80 | 696.20 |

| 3 |  |

Coca-cola Hbc Ag | -2.55% | -70.00 | 2,670.00 |

| 4 |  |

Intercontinental Hotels Group Plc | -1.48% | -110.00 | 7,300.00 |

| 5 |  |

Sage Group Plc | -0.93% | -9.50 | 1,008.50 |

| 6 |  |

Smith (ds) Plc | -0.76% | -3.40 | 442.00 |

| 7 |  |

Compass Group Plc | -0.64% | -15.00 | 2,321.00 |

| 8 |  |

Legal & General Group Plc | -0.42% | -0.90 | 215.80 |

| 9 |  |

Easyjet Plc | -0.38% | -1.60 | 422.50 |

| 10 |  |

United Utilities Group Plc | -0.35% | -3.50 | 1,008.00 |

US close: Stocks rebound from Monday’s sell-off

Wall Street stocks closed higher on Tuesday as major indices bounced back from heavy losses recorded across global markets a day earlier.

At the close, the Dow Jones Industrial Average was up 0.76% at 38,997.66, while the S&P 500 advanced 1.04% to 5,240.03 and the Nasdaq Composite saw out the session 1.03% firmer at 16,366.85.

The Dow closed 294.39 points higher on Tuesday, reclaiming some of the heavy losses recorded in the previous session.

The blue-chip Dow Jones shed more than 1,000 points on Monday, while the S&P 500 turned in its worst daily performance since 2022, with most market participants viewing the sell-off as being long overdue amidst high valuations and new records, with some analysts also warning that it may not be done just yet either.

Giving sentiment a boost on Tuesday, however, was a rebound in Japanese stocks, with the Nikkei 225 posting its best day since October 2008, surging 10.2%, following the benchmark’s worst day since 1987, in which it closed 12.4% lower.

Comments from San Francisco Federal Reserve president Mary Daly late on Monday were also in focus after she said interest rate reductions were coming later in 2024 as she noted that she still believes the economy is growing, although the labour market was weakening and that less restrictive policy will be appropriate.

“Policy adjustments will be necessary in the coming quarter. How much that needs to be done and when it needs to take place, I think that’s going to depend a lot on the incoming information,” she said. “I see an economy that has momentum, and we want to make sure we keep that.”

In the corporate space, Uber beat Wall Street estimates with its latest set of quarterly results, aided by demand for both its ridesharing and food delivery services, while trade bellwether Caterpillar shares were in the green after the group posted another quarterly profit beat that helped offset revenues that fell short of estimates.

On the macro front, the US trade deficit narrowed in June, pulling back from its highest level in 20 months, according to the Bureau of Economic Analysis, but still came in above market forecasts. The goods and services trade balance was -$73.1bn, $1.9bn less than the revised -$75.0bn in May which was the highest deficit recorded since October 2022, the BEA reported on Tuesday. However, this was still slightly higher than the -$72.4bn consensus estimate.

Exports rose 1.5% or $3.9bn to $265.9bn, driven mainly by increased exports of aircraft and oil and gas, while imports rose 0.6% or $2.0bn to $339.0bn, with large increases in imports of pharmaceuticals.

Wednesday newspaper round-up: Airbnb, Virgin Atlantic, Harland & Wolff

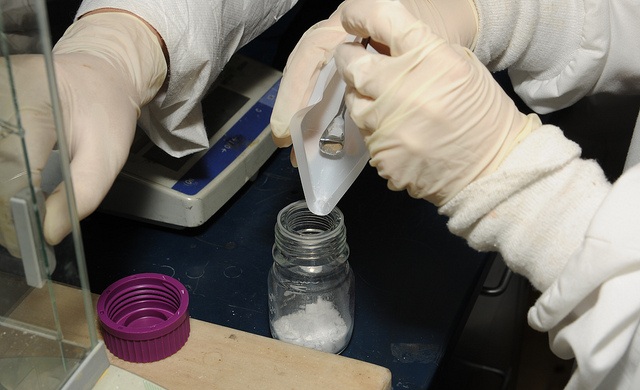

The Royal Mint has unveiled a “pioneering” factory that will recover gold from electronic waste, creating a more sustainable source of the precious metal for the coin manufacturer’s luxury jewellery line. The factory in south Wales, which has been under construction since March 2022, is designed to extract gold from up to 4,000 tonnes a year of circuit boards sourced in the UK from electronics including phones, laptops and TVs. – Guardian

The vacation rental company Airbnb forecast third-quarter revenue below Wall Street estimates on Tuesday and reported a lower second-quarter profit, as it flagged weakening demand from US customers. Shares of the company were down about 12% after the bell. Domestic travel in the United States has been pressured since the start of the year as more Americans grow cautious about travel spending amid growing economic uncertainty. – Guardian

Sir Richard Branson’s Virgin Atlantic has been banned from describing its green jet fuel as “sustainable” after it was accused of “misleading” customers during an advertising campaign. In a ruling on Tuesday, Virgin was found to have breached rules while advertising its first-ever transatlantic service powered by so-called sustainable aviation fuel (SAF). – Telegraph

The Titanic shipbuilder Harland & Wolff has been plunged deeper into crisis after the Falkland Islands withdrew from £120m contract talks. The Belfast-based company had previously been chosen as the preferred candidate to build a new floating dock for the British overseas territory. But on Tuesday it revealed the Falkland Islands government (FIG) had “decided to cease further contractual negotiations”. – Telegraph

The value of Old Master paintings, statues and other objets d’art owned by the FTSE 250 investment trust RIT Capital has inadvertently come to light as a result of their reclassification in its latest accounts. RIT-owned objects housed in Spencer House, a sumptuous palace in the St James’s district of London, where the managers of the trust work, are now believed to be valued at around £3.5 million. – The Times

Hot Features

Hot Features