So far, Ethereum staking has attracted $35 billion since December 2020. Liquid Staking Derivatives (LSDs) have low entry barriers; therefore, they represent 30% of the total amount of ETH staked. Liquid Staking began to gain popularity after the launch of the Beacon Chain in December 2020. This was when the Ethereum network switched from the Proof-of-Work consensus mechanism to the Proof-of-Stake consensus Mechanism.

Initially, the requirement for staking was beyond the reach of small-scale crypto investors. For instance, for an investor who wants to run his or her staking node, at least 32 ETH needs to be committed to it for a minimum lockup period of a year. The Liquid Staking Derivatives methods were developed to get past the restrictions, thereby making staking available to everyone.

The recent Shapella upgrade on the Ethereum network also contributed to its growth. This upgrade gives investors the freedom to withdraw their staked ETH at any time. Another thing that boosted the attractiveness of LSDs is the possibility of unlocking the staked assets through the use of liquidity native tokens. The LSDs tokens have their value tied to ETH, and you can further use these tokens for further investment in DeFi projects.

Recommendations for Investors

Investors can use these services to stake ETH, get companion tokens in return, and then sell the tokens back to get the “interest.” For instance, you stake your ETH with Lido and get stETH in return. When you wish to claim prizes, you un-stake your ETH.

Investors can invest in ETH, get companion tokens, and then reinvest the proceeds somewhere else. For instance, you stake your ETH with Lido in exchange for stETH, which you then reinvest in other Web3 products (greater risk = maybe bigger earnings).

Investors may just purchase a project’s token, which is equivalent to investing in the underlying “company.” Simply purchase LDO for the long haul and hold it for Lido.

The Risk Involved in Liquid Staking

• Liquidity risk: It makes it difficult for investors to sell tokens quickly and at favorable prices.

• DeFi Market Risks: Investing in DeFi holds high risk but also high reward possibilities. Potential rewards can be more than 20% of the Annual Percentage Yield. In the same vein, losses mean that investors lost access to the ETH held in the LSD protocol.

• Validator Risk: When a validator has problems, the participants on it will suffer some losses.

• Legal Risk: The legal action of regulatory bodies against crypto projects such as this one can also be a risk for investors.

Lido (LDO)

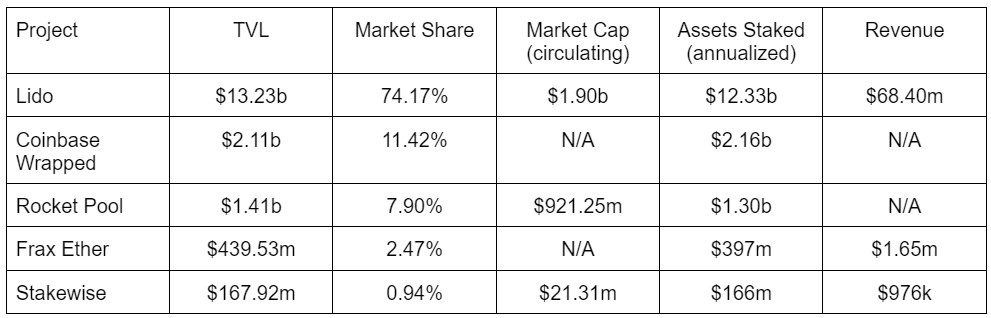

Lido, the first ever non-custodial staking protocol for ETH, was deployed not long after the release of the Beacon Chain. Since then, it has dominated the staking sector, accounting for 29% of the total ETH staking market.

After the Shapella upgrades, Lido has expanded greatly, but that expansion has a cost. The project is getting more and more centralized with its tiny pool of 30 validators. Some believe that this centralization could threaten Ethereum’s decentralized architecture as it increases its market dominance in staked ETH.

Coinbase Wrapped Staked Ether (cbETH)

Coinbase ranks second in the world among the top crypto exchange platforms, but in the USA, it is the leader. Launched in 2012 by Brian Armstrong, it is the first-ever crypto exchange platform. However, its Liquid Staking Services are rather recent—in 2022. This has rapidly increased the number of its users and, as a result, seen some impressive growth.

Being a centralized exchange, it lacks a DAO or governance token. Along with cbETH, Coinbase has also released lsETH, an ERC-20 token that is a liquid staking platform for institutional investors.

Regarding its future, Coinbase is being sued by the SEC, and its future is currently a little hazy. The outcome of the litigation will be crucial to the staking protocol’s prospects.

Rocket Pool (RPL)

Unlike Lido, Rocket Pool has over 2000 validators, and anyone can become one of them. There is an additional measure that has been put in place to protect investors from poorly performing validators.

Rocket Pool is the best option for liquid staking for those who care about decentralization. However, the protocol is limited by its slightly lower returns and comparatively higher fees (15%) compared to other platforms.

Conclusion

Since the inception of Liquid Staking, it has proven attractive to investors; however, there is a lot of regulatory ambiguity due to the new EU MiCA legislation and the SEC’s crackdown on CEXs in the US. Any investment decision should take into serious consideration the possible financial and legal consequences that legislation might have on cryptocurrency (particularly liquid staking schemes).

Learn from market wizards: Books to take your trading to the next level

Hot Features

Hot Features