Following the departure of its founder and CEO amidst a record-breaking fine in the cryptocurrency realm, Binance embarks on a new phase of its journey. With Changpeng Zhao replaced by the lesser-known Richard Teng, what lies ahead for Binance investors?

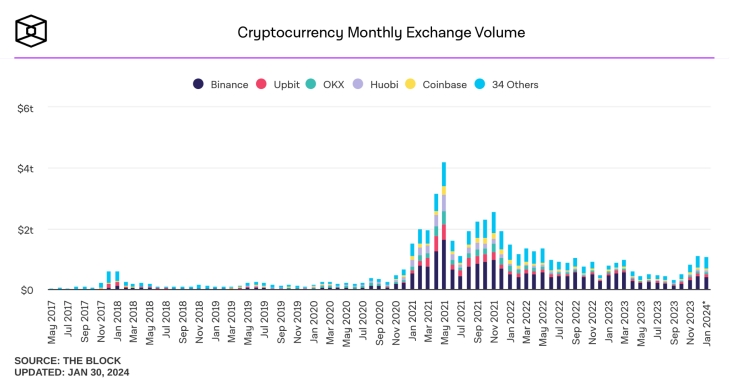

Originating in China during the cryptocurrency boom of 2017, Binance swiftly rose to prominence under the leadership of its ambitious founder, CZ. Within six months of its inception, Binance became the world’s leading cryptocurrency exchange by trading volume, lauded for its user-friendly interface, extensive range of digital assets, and competitive fees.

Evolving from its humble beginnings, Binance has expanded into a comprehensive ecosystem encompassing a public blockchain featuring its native coin (BNB), alongside a myriad of services including digital wallets, a stablecoin, futures trading, an NFT marketplace, and more. CZ’s stewardship propelled him to the ranks of the world’s wealthiest individuals, rivaling figures like Mark Zuckerberg at the peak of his fortune.

However, the departure of CZ marks a significant turning point for Binance, prompted by a tumultuous legal battle with US regulatory authorities.

End of an Era: Turmoil Strikes Binance

In 2019, Binance ventured into the American market to cater to US clientele, unwittingly drawing attention from regulators due to a series of suspicious and unlawful activities.

In June 2023, the SEC levied 13 charges against Binance, its US branch, and CZ himself, alleging a “web of deceitful practices.” Subsequently, in November of the same year, the US Department of Justice (DoJ) unveiled three criminal charges against the company, accusing it of:

1. Conspiring to breach the Bank Secrecy Act (BSA) by neglecting to implement a robust anti-money laundering (AML) program.

2. Operating as an unlicensed money services business.

3. Violating the International Emergency Economic Powers Act (IEEPA) by circumventing sanctions.

CZ admitted guilt to money laundering charges, and Binance agreed to a $4.3 billion settlement—the largest fine ever imposed on a cryptocurrency entity by the US Treasury and FinCEN. Consequently, Binance exited the US market.

Meet Richard Teng: A Financial Veteran Charting Binance’s Compliance Course

Hailing from Singapore, Richard Teng brings over thirty years of financial services and regulatory expertise to Binance, setting the stage for the company’s forthcoming era marked by adherence to regulatory standards.

Born in 1971, Teng is a distinguished graduate of Nanyang Technological University and the University of Western Australia, holding degrees in Accountancy and Applied Finance, respectively.

Assuming the role of CEO at Binance Singapore in August 2021, Teng’s tenure saw him ascend to the position of regional head for Asia, Europe, and MENA by May 2023. His wealth of regulatory knowledge positions him as a prime candidate to steer Binance through its regulatory hurdles. CZ himself lauded Teng’s appointment, citing him as a “highly qualified leader.” However, Teng’s leadership journey commences amidst challenging times for the company.

Despite concerns among investors regarding CZ’s departure, Teng swiftly reassured the crypto community of Binance’s commitment to user-centricity, emphasizing fund security and ease of use. Binance retains its status as the world’s preeminent crypto exchange, and Teng could emerge as the stabilizing force needed to nurture strategic alliances and harmonious rapport with regulators.

Financial Fortitude and Regulatory Compliance at Binance

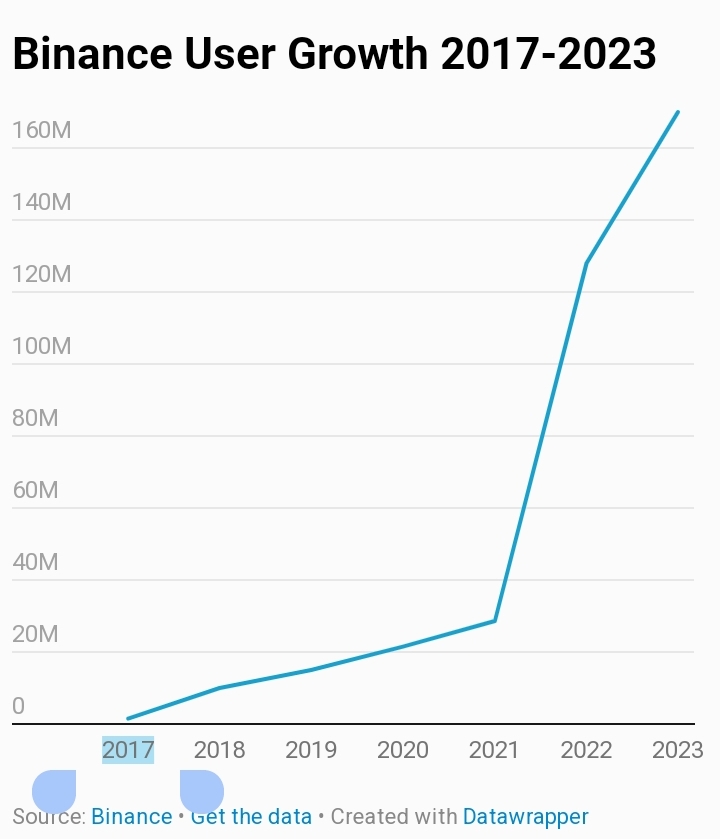

While Binance remains privately held, it offers glimpses into its operations through periodic reports. The latest edition reveals a surge of 40 million new users in 2023, reaching a total of 170 million, marking a 30% increase. The SAFU fund stands at an impressive $1.2 billion, ensuring user asset security. Additionally, Binance asserts full coverage of users’ net balances through its Proof of Reserve report.

Challenges on the Horizon

Teng confronts a formidable array of challenges as Binance pivots towards transparency and regulatory alignment across diverse jurisdictions. Lingering legal skirmishes with the SEC in the US will add complexity to the company’s landscape in 2024. Allegations range from listing unregistered securities to inflating trading volumes and misleading investors, underscoring the urgency for Binance to address regulatory concerns proactively.

Conclusion

Binance stands poised at a pivotal juncture reminiscent of Uber’s transition from Kalanick to Khosrowshahi. With CZ making way for Teng, the company embarks on a new era. Optimistically, akin to Khosrowshahi’s stewardship, Teng could embody the maturity and stability necessary for Binance’s evolution. Teng’s wealth of regulatory expertise, coupled with a global outlook and collaborative ethos, underscores his potential to prioritize user security and regulatory compliance. Moreover, his longstanding tenure within the company suggests a depth of knowledge and established relationships conducive to effective leadership.

Learn from market wizards: Books to take your trading to the next level.

Hot Features

Hot Features