Last week saw precious metal miners plummet and base metal miners march higher.

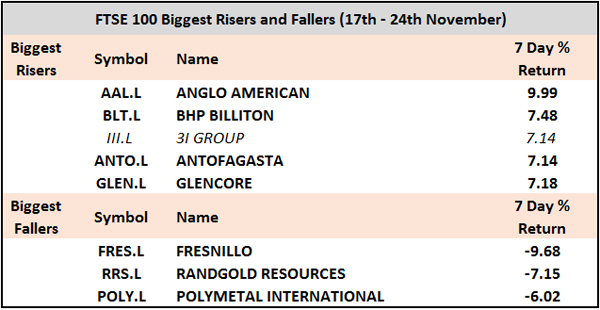

The below table highlights that, over the period 17/11 – 24/11, four of the FTSE 100’s five best performers were base metal miners; conversely the three worst performing stocks were all precious metal peers.

True as at 11:00am 24.11.16

Let’s take a closer look at the mining sector to see how president-elect’s Donald Trump’s reflation plan is having a wildly differing impact on some of the FTSE 100’s biggest and best known companies.

The implications of ‘Trumpflation’

Trump’s plan to bump up US infrastructure spending has resulted in US inflation expectations jumping higher and the yield curve steepening. Yesterday’s FOMC minutes and a highly bullish set of durable goods numbers only served to strengthen investor expectations of a Fed rate rise in December.

Moreover, continued expectations of increasingly hawkish Fed monetary policy going forward has seen the greenback continue to rally sharply higher this week.

Of course a rallying dollar is a headwind for all commodities, however this is where the idiosyncrasies behind the driver of the dollar’s recent rally plays out.

Precious vs. base metals

With precious metals and in particular gold highly sensitive to changes in US yields we have seen gold and silver selloff sharply post the US election. Interestingly, we have seen the exact opposite play out across base metals.

Yes, base metals are historically less sensitive to US yields than their precious metals ‘peers’, however this is not the main reason behind the split. Instead, investors pricing in rising commodity demand on the back of Trump’s proposed increase in infrastructure spending is the key driver.

The below graph shows the relative performance of gold vs copper since the election. Note the relative performance of copper vs. gold is indicative of the relative performance of base vs. precious metals post the US election.

Clearly, the divergence in performance across commodities can explain the recent outperformance of base metal miners vs. their precious metal peers.

Will the trend continue?

Although this is a trend we anticipate will continue to play out going forward, we offer a word of caution.

Most base metal miners are now trading just below their 2016 highs. With many finding resistance at these levels the chance for a retracement or pause for breath is much increased.

Conversely, the speed and ferocity of the selloff in gold and silver has resulted in precious metal miners looking overstretched to the downside.

With this in mind, we are biding our time until we look to again take advantage of the clear split in performance across the mining sector.

Faraday Research offers real time FX and Equity trade signals from qualified analysts. Click here to try us free.

Hot Features

Hot Features